Substation Automation Market Outlook:

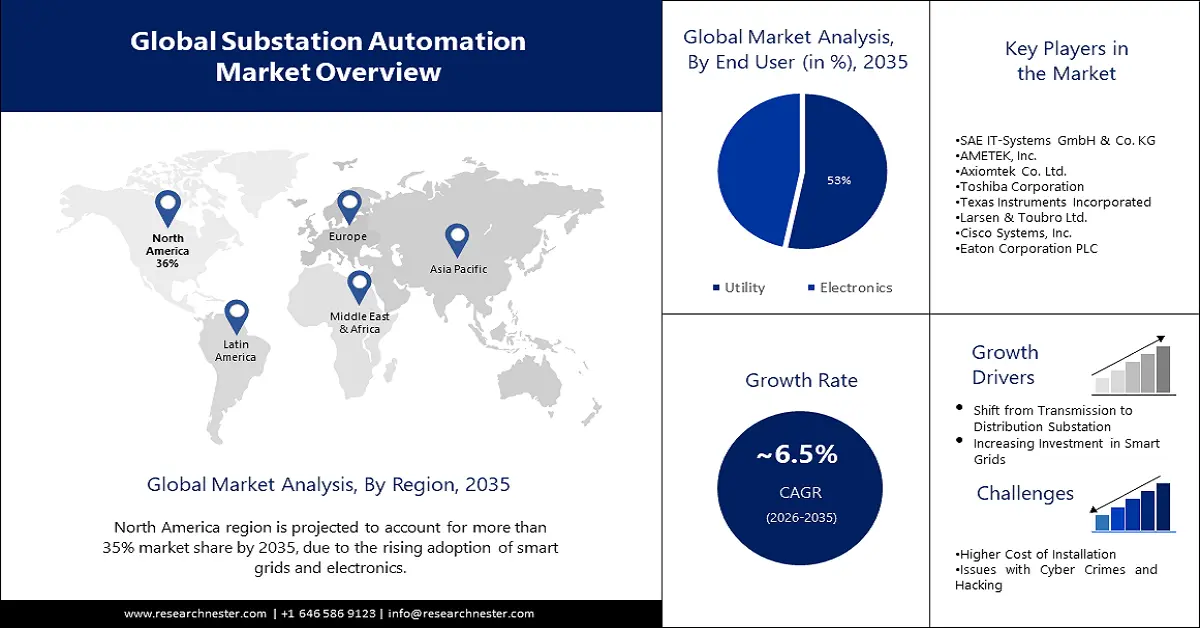

Substation Automation Market size was valued at USD 43.13 billion in 2025 and is set to exceed USD 80.96 billion by 2035, registering over 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of substation automation is estimated at USD 45.65 billion.

The growth of this market is driven by the increasing investment in renewable energy sources to meet energy demands. Currently, solar and wind are the epicenter of power generation with most economies at least generating 20% of their electricity with these two sources. As per a report by International Energy Agency, in 2019 the global share of renewable resources in power generation reached 25%. By 2050, it is anticipated to offer a share of approximately 86% in global power generation.

Moreover, the increasing global population and higher electricity demand are estimated to boost the market expansion in the projected period. Electricity is becoming as crucial in people's daily lives as water and air. As per the research industrial, residential, and commercial domains each account for one-third of total electricity use.

Key Substation Automation Market Insights Summary:

Regional Highlights:

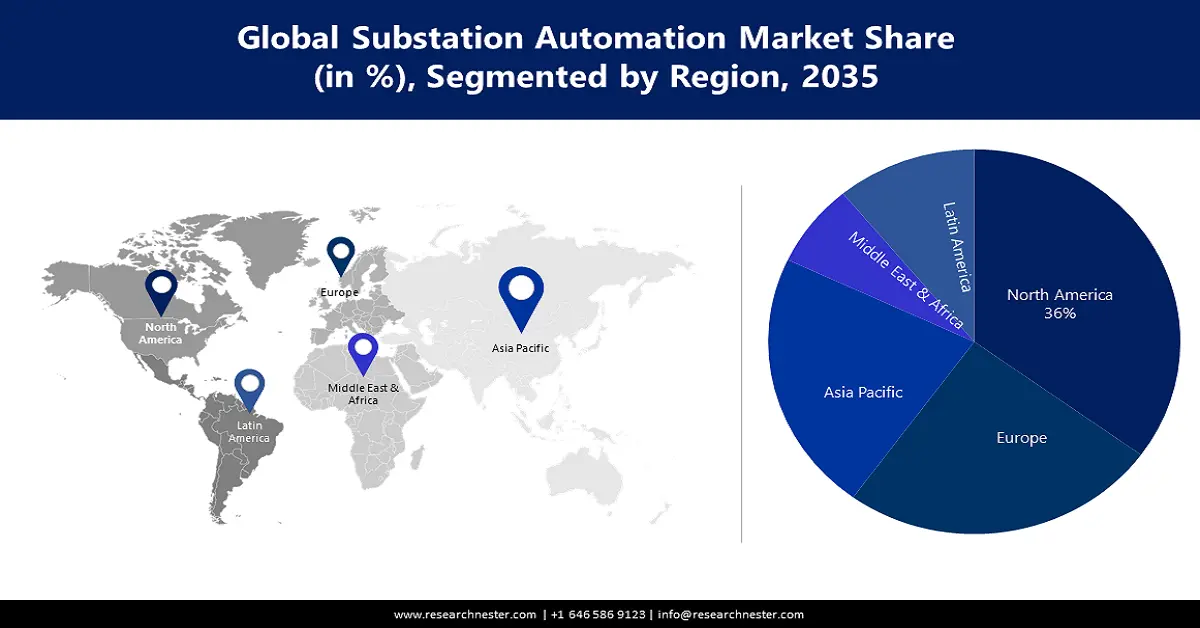

- North America substation automation market is projected to hold more than 35% market share by 2035, impelled by the rising adoption of advanced electronic devices.

- Asia Pacific market is estimated to witness significant growth between 2026-2035, fueled by changing energy infrastructure, rising industrialization, and increasing demand for smart grids and smart electric meters.

Segment Insights:

- The utility segment in the substation automation market is projected to achieve a 53% share by 2035, influenced by rising renewable energy investments and modernization of power systems.

- The new (stage) segment in the substation automation market is forecasted to achieve a substantial share by 2035, driven by the surge in demand for smart grids and power infrastructure upgrades.

Key Growth Trends:

- Increasing Investments in Smart Grids

- Shift from Transmission to Distribution Substation

Major Challenges:

- Higher Cost of Installation

- Issues with Cyber Crimes and Hacking

Key Players: ABB Ltd., SAE IT-Systems GmbH & Co. KG, AMETEK, Inc., Axiomtek Co. Ltd., Toshiba Corporation, Texas Instruments Incorporated, Larsen & Toubro Ltd., Cisco Systems, Inc., Eaton Corporation PLC, General Electric Company.

Global Substation Automation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 43.13 billion

- 2026 Market Size: USD 45.65 billion

- Projected Market Size: USD 80.96 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, India, Japan, Germany

- Emerging Countries: China, India, Japan, South Korea, Malaysia

Last updated on : 9 September, 2025

Substation Automation Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing Investments in Smart Grids – Substation automation aids in reducing maintenance and operational cost along with this it enhances plant productivity with advanced technologies. It performs smart load-shedding functions and interlocking to make sure the reliability, enhanced performance, and security of electrical power networks.Smart grids help to reduce energy losses, increase productivity and dependability, and manage energy demand more cost-effectively and wisely during transmission and distribution. Owing to these benefits major authorities are offering investment in the development of smart grids. In 2018, an investment of USD 949,000 was offered to smart grid projects by Natural Resource Canada.

-

Shift from Transmission to Distribution Substation – To address a variety of utility concerns, including how to reduce operational costs and how to comply with new regulatory requirements, such as NERC-CIP (North American Electric Reliability Corporation - Critical Infrastructure Protection), the migration towards the future transmission and distribution substation is taking place. Over the next ten years, it is predicted by Smart Energy International that Europe will invest USD 23.9 billion in automating or monitoring secondary substations.Utilities in nations like France, Italy, and Spain are anticipated to make the largest investments in machinery and support services to enable substation automation.

-

Demand for Reliable Automation in Substations in Energy and Utility – Increasing demand for electric power in the past few decades has significantly raised the demand for reliable and efficient automation and protection for substations. This factor further is expected to boost the demand in the energy and utility section.

However, substation automation systems are the latest generation system designed in a way keeping in mind the functional needs and they perform functions of protection, automation, and control. These have become significant components in energy consumption systems. Therefore, these factors are projected to boost the demand for automation substations in the energy and utility section.

Challenges

-

Higher Cost of Installation – The growing utilization of advanced technologies such as service-oriented architecture and microprocessors and the increasing requirement to incorporate various IEDs in substations has raised the installation cost of substations automation. This is predicted to hamper the market in the upcoming times.

-

Issues with Cyber Crimes and Hacking

-

Slowdown in Power Generation Sector

Substation Automation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 43.13 billion |

|

Forecast Year Market Size (2035) |

USD 80.96 billion |

|

Regional Scope |

|

Substation Automation Market Segmentation:

Stage Segment Analysis

In substation automation market, new segment is poised to hold substantial share by the end of 2035, increasing need for new power plants and smart grids across numerous industries, as well as the growing need for automation, IED, improved communication technologies, HMIs, and SCADA systems.

As they offer higher operational safety and reliability at low maintenance prices, to propel the power flow, enhance the quality of the power supply, update power infrastructure, and improve electric reliability multiple companies have launched new installation projects. For instance, GE signed an agreement with Botswana Power Corporation for the supply, design, installation, testing, and commissioning of SCADA at the principal grid control center in the BPC main office and backup control center in Francistown in July 2018.

End User Segment Analysis

Utility segment is expected to capture substation automation market share of around 53% by the end of 2035, as a result of increased government measures to modernize power systems and increased investments in renewable energy generation.

However, in the current situation, the demand for substations automation can be seen more in the wind industry due to the joining of government organizations and market players in wind farm projects.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Communication Mode |

|

|

Stage |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Substation Automation Market Regional Analysis:

North American Market Insights

North America region is projected to account for more than 35% market share by 2035, owing to the rising adoption of advanced electronic devices. Moreover, escalating adoption of smart grids in the region is also estimated to boost market growth. For instance, over 90 million smart meters were installed throughout the U.S. in 2020.

APAC Market Insights

The Asia Pacific market for substations automation is estimated to account for lucrative market value between 2026-2035. The expansion of the regional market can be attributed to changing energy infrastructure, which is supported by rising industrialization in developing countries. The growing demand for smart grids and smart electric meters to optimize energy utilization, along with the initiatives to promote the use of renewable is projected to promote market growth in the region.

Substation Automation Market Players:

- ABB Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SAE IT-Systems GmbH & Co. KG

- AMETEK, Inc.

- Axiomtek Co. Ltd.

- Toshiba Corporation

- Texas Instruments Incorporated

- Larsen & Toubro Ltd.

- Cisco Systems, Inc.

- Eaton Corporation PLC

- General Electric Company

Recent Developments

- January 18, 2022: Eaton Corporation PLC launched advanced intelligent power management UPS in the North American market for power protection in IT environments.

- July 20, 2021: ABB Ltd. announced the acquisition of ASTI Group, with the insight to drive the next generation of flexible automation.

- Report ID: 3908

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Substation Automation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.