Gas Insulated Substation Market Outlook:

Gas Insulated Substation Market size was valued at USD 29.84 billion in 2025 and is set to exceed USD 65.63 billion by 2035, registering over 8.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of gas insulated substation is estimated at USD 32.04 billion.

Gas insulated substations are generally more reliable and efficient than air-insulated substations. Increasing per-hectare land values is also expected to provide lucrative growth opportunities for the market as the gas insulated substation consumes space as compared to its market counterparts. This substation consumes up to 90% less space than a typical power plant this factor is expected to drive the growth of gas insulated substation market in coming years.

Industry players are engaged in research, development, and deployment of market products to capture share for non-SF6 alternatives in HVDC and HVAC systems. As of 2023, the highest voltage non-SF6 gas-insulated switchgear was limited to 450 kV. With planned technologies, high voltage GIS capacity is expected to reach as high as 550 kV over the next few years. The anticipated level of technological advancements will allow phasing out several SF6 systems, but not entirely eliminating its usage as 765 kV systems have no planned alternatives. The U.S. is not exempt from technological innovations in energy and power, with the sector’s infrastructure investment surging from USD 25.1 billion in 2021 and USD 26.7 billion in 2022 to USD 29.1 billion in 2023, marking a 20% growth rate in two years.

The U.S. gas insulated switchgear market was USD 6.7 billion in 2023, representing 23% of all spending on domestic electrical infrastructure and 28% of the global gas insulated substation market. The high-voltage equipment segment accounts for most of this spending, with >75 kV voltage ratings valuing USD 4.8 billion. Of this, USD 2.1 billion was developing non-SF6 systems. According to the U.S. EPA September 2022 report, SF6-free equipment ownership cost is lower than 100% of the overall cost of SF6-based equipment. The O&M and end-of-life costs of vacuum and clean air technology are considered less than SF6-based equipment.

It is expected that lifecycle costs for SF6-free systems, including 145 kV GIS is USD 0 per metric ton of greenhouse gas reduced in metric tons CO2e with a capital cost of USD 33 per ton of GHG for SF6-free equipment. For a 145 kV GIS, an offshore subtraction or wind turbine capital cost is approximately USD 70,000 higher than clean air technology. This eliminates 85 kg of SF6, which is a cost of USD 33/ton CO2e and an equivalent of 2,100 tons of CO2e. An installation of 100 non-SF6 turbines would avoid 252,000 tons of CO2 emissions, driving investments in sustainable market alternatives.

Key Gas-Insulated Substation (GIS) Market Insights Summary:

Regional Highlights:

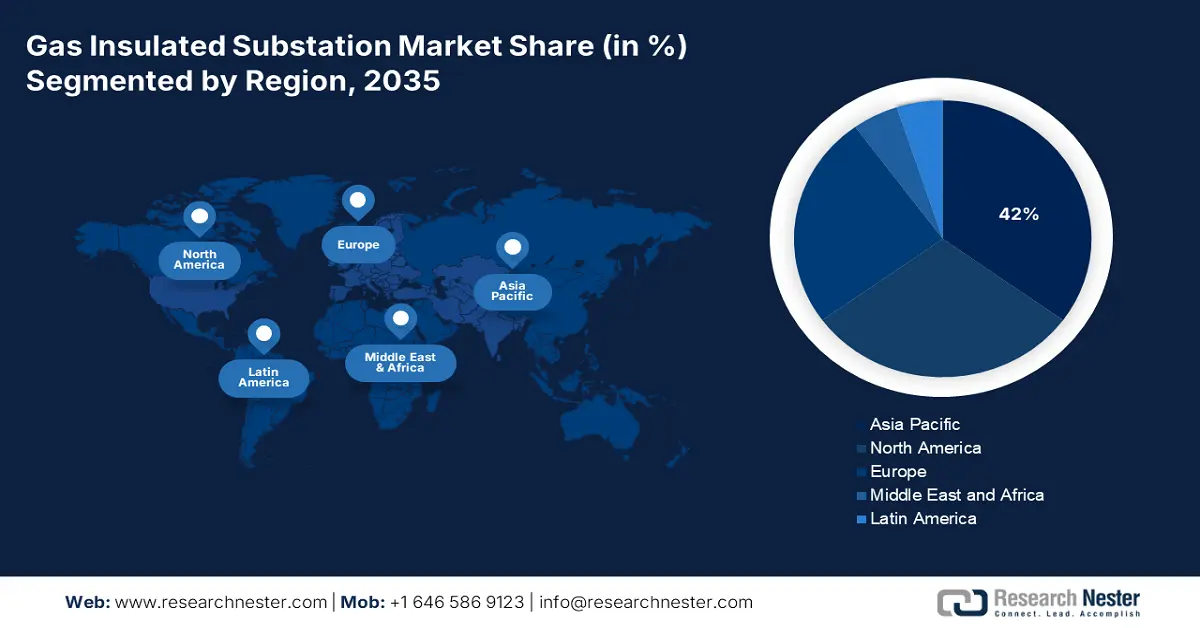

- Asia Pacific gas insulated substation (GIS) market will secure around 42% share by 2035, driven by rapid industrialization and electricity demand in the region.

Segment Insights:

- The outdoor segment in the gas insulated substation market is expected to achieve the largest share by 2035, influenced by dependable operations in high and medium-voltage transmission over long distances.

Key Growth Trends:

- Rising demand for electricity globally

- Rising focus on renewable energy

Major Challenges:

- Shortage of advanced modern infrastructure and high costs

Key Players: General Electric Company, Toshiba Corporation, Hitachi, Ltd., Siemens AG, ABB Ltd., Johnson Controls International plc, Honeywell International Inc., Energate, Inc, Yokogawa Electric Corporation, Schneider Electric.

Global Gas-Insulated Substation (GIS) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 29.84 billion

- 2026 Market Size: USD 32.04 billion

- Projected Market Size: USD 65.63 billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, India, United States, Germany

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 9 September, 2025

Gas Insulated Substation Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for electricity globally: The National Infrastructure Advisory Council (NIAC) transformer lead times have exponentially surged over the past few years, reaching an average of 120 weeks in 2024 from 50 weeks in 2021. Large transformers, including substation power and generator step-up transformers, have operations ranging from 80 to 210 weeks. Driven by the rising electrification across the globe, the demand for transformers has exacerbated supply chain transformation leading to the build-out of renewable electricity generation for largeload end users including data centers. This further resulted in a steep spike in electricity prices for residential and business customers. The producer price index (PPI) crossed 426.800 in December 2024 from 251.800 in March 2020, indicating an 80% increase in electric power and specialty transformer manufacturing costs since the COVID-19 pandemic.

A recent National Renewable Energy Laboratory (NREL) report finds distribution transformer demand in the U.S. is likely to be 160 to 280% higher than 2021 levels by the end of 2050- marking a CAGR of 5.3%. The national lab manages the seven regional transmission operators/independent system operators (ISO) grid interconnection queues and 44 non-ISO balancing areas, representing 95% of U.S. electric generating capacity. To get a sense and context of the massive size of the interconnection queue, American Public Power Association (APPA) disclosed that the total utility-scale capacity installed in the U.S. was 1,277 GW in 2023 and the pending interconnection queue is set to double the installed capacity base during the forecast timeline. - Rising focus on renewable energy: Governments are striving to lower carbon footprint and encourage the usage of renewable energy sources such as wind and solar energy. For the wind farm cluster in the Baltic Sea, Siemens Energy was awarded a contract in 2021 to provide two onshore high-voltage direct currents (HVDC) systems. Gas-insulated switchgear technology will be used in the project, which is anticipated to be finished by 2029, to guarantee dependable and effective power transmission.

The California Air Resources Board (CARB) standardized regulations for limiting GHG emissions from gas-insulated systems and aims to gradually eliminate SF6 GIS purchases. The phaseout provisions in rule amendments were incorporated on January 1, 2022. The first phase of the amendment restrictions began on January 1, 2025, and the final phase is expected to start in January 2033. The initial phaseout is dedicated to lower voltage capacity devices (less than 35 kV) and the last phase applies to higher voltage equipment. Purchases of 245 kV will be prohibited by January 2033, under CARB prohibitions. The proposed regulations are estimated to facilitate cost-effectiveness of USD 33 per metric ton of CO2e from gas insulated switchgear sulfur hexafluoride byproducts.

Challenges

- Shortage of advanced modern infrastructure and high costs: With the focus shifting toward lowering GHG associated with gas insulated substation systems, the gap between demand and supply is increasing owing to the presence of SF6 based equipment. Retrofitting involves high capital costs and is proven to be a market barrier.

Gas Insulated Substation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 29.84 billion |

|

Forecast Year Market Size (2035) |

USD 65.63 billion |

|

Regional Scope |

|

Gas Insulated Substation Market Segmentation:

Installation Segment Analysis

The outdoor segment is anticipated to hold the largest gas insulated substation market share in the forecast period. The outdoor gas insulated substations offer dependable operations in high and medium-voltage transmission over long distances. In November 2024, Siemens introduced its first fluorinated-gas-free GIS system in the U.S. medium-voltage market, called the NXPLUS C 24 - blue, offering a lower CO2 footprint. This aligns with the company’s aim to support grid decarbonization, with arc-resistant design to personnel safety in extreme weather conditions.

Our in-depth analysis of the global gas insulated substation market includes the following segment

|

Voltage Type |

|

|

Installation |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gas Insulated Substation Market Regional Analysis:

APAC Market Insights

The Asia Pacific gas insulated substation market is projected to hold the largest revenue share of 42% by the end of 2035. Rapid industrialization in countries such as China, India, Japan, South Korea, and Southeast Asia has increased the demand for gasoline engines in the region. Gas engines play a crucial role in meeting this demand, particularly in electricity generation, gas-fired power plants, including combined cycle power plants that are increasingly being deployed in the region to provide efficient and reliable electricity. Furthermore, the combination of natural gas reserves, supportive initiatives and environmental policies, renewable energy transition, and infrastructure development has created a favorable environment for the adoption and expansion of gas engines in numerous applications such as mechanical drives, power generation, cogeneration, etc. across the globe.

China gas insulated substation (GIS) market is a key share holder and plays a vital role in raw material exports on the global map. The west region has several hydropower plants and the north west has wind resources. The key end users reside in the southeast regions, requiring high-power transmission and long distances of tens of ±800 kV, ±1,100 kV, and ±500 kV HVDC systems are presently operated in China. The transmission lines provide more than 1000 GW of electricity, connecting the rural northwest to economic southeast areas. The country is home to several large power transformer (LPTs) manufacturers comprising Baoding Tianwei Baobian Electric Co. Ltd. In 2020, the U.S. spent USD 3 billion on power/distribution/specialty transformers imports, of which China accounted for 7%, followed by South Korea. Of USD 108 million import value of insulated copperwinding wire imports in the U.S., 11% came from China and Vietnam, finds the U.S. DOE.

North America Market Insights

North America gas insulated substation market growth trajectory is attributed to Canada’s core manufacturing capabilities. 6% of total U.S. transformer oil imports were from Canada and is among the top LPT producers. LPTs from Canada are 10% less expensive than their counterparts domestically developed in the U.S. Moreover, the growing demand for renewable sources of energy in the region, along with retrofitting of the aging power grids is a significant factor gas insulated substation market expansion in the region.

The domestic manufacturing potential in the United States is promising. Presently, the technologies required to entirely replace SF6 are under development, and by 2027 systems up to 550 kV are anticipated to be deployed by domestic manufacturers. It is critical to recognize rising focus on environmental sustainability would be crippling to the existing SF6-based equipment. The Hitachi, GE, and Siemens companies have the most comprehensive product offerings in the U.S. Hitachi offers production-line interoperability allowing customers to SF6 capacity to non-SF6. The United States, as per the DOE, aims to deploy 30 GW of offshore wind by the end of 2030 and 86 GW by 2050.

Gas Insulated Substation Market Players:

- General Electric Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Toshiba Corporation

- Hitachi, Ltd.

- Siemens AG

- ABB Ltd.

- Johnson Controls International plc

- Honeywell International Inc.

- Energate, Inc

- Yokogawa Electric Corporation

- Schneider Electric

Key players have identified the need for offering government and sustainable-compliant products. They have ramped up investments and strategic partnerships to switch from SF6 to SF6-free systems. The phase out is facilitated by increasing the production capacity of innovative alternatives, product launches, mergers and acquisitions, and geographical expansions. Some of the prominent players operating in the gas insulated substation (GIS) market include:

Recent Developments

- In August 2024, GE Vernova announced to launch of Grid Solutions business that will manufacture, deliver, and commission the world’s 1st 246-kilovolt SF6- free gas insulated substation (GIS) for RTE in France. Grid Solutions will deploy solutions that will support RTE in replacing sulfur hexafluoride.

- In August 2024, Hitachi Energy launched a new technology that will tackle emissions of sulfur hexafluoride or SF6. The equipment can be used in gas-insulated switchgear, dead tank breakers, or live tank breakers.

- Report ID: 4044

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.