Urethral Dilators Market Outlook:

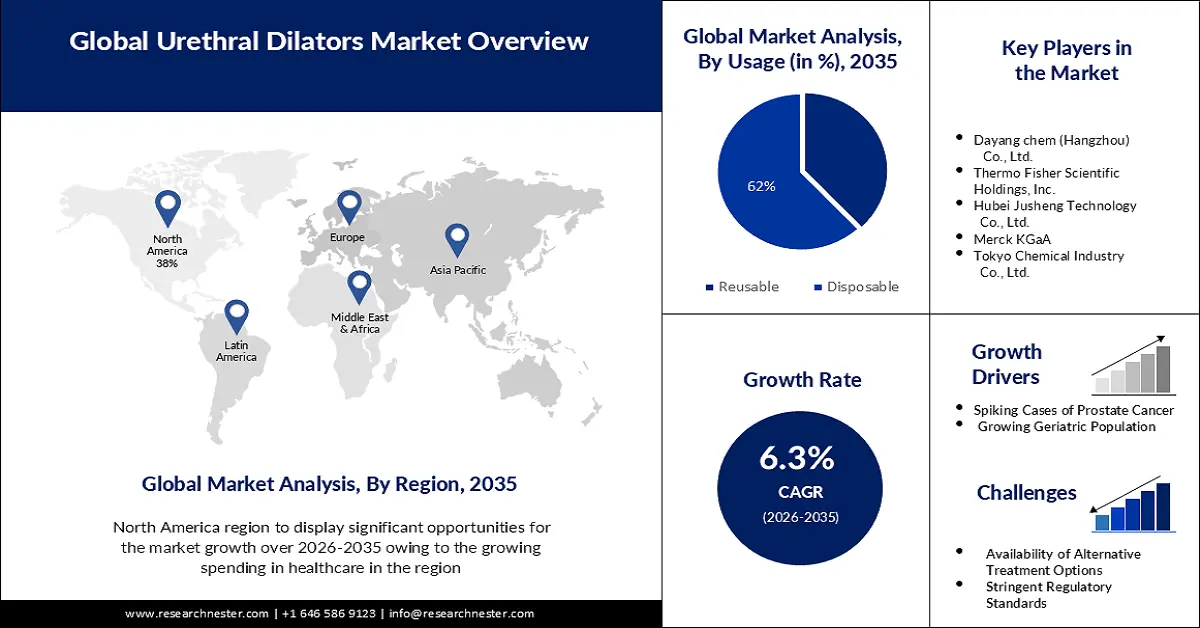

Urethral Dilators Market size was valued at USD 271.54 million in 2025 and is likely to cross USD 500.23 million by 2035, expanding at more than 6.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of urethral dilators is assessed at USD 286.94 million.

The reason behind the growth is impelled by the increasing prevalence of chronic kidney disorders. The prevalence of chronic kidney disease (CKD) has been identified as a major global public health issue, which is majorly caused by stress, and hypertension in all high- and middle-income nations.

Chronic kidney diseases can result in various urological conditions, which involve the use of urethral dilators. Chronic kidney disease (CKD) affects more than 8% of people globally, and millions of people pass away each year because they lack access to effective treatment.

The rising popularity of minimally invasive procedures are believed to fuel the market growth. The popularity of minimally invasive surgery among patients has grown owing to its advantages such as smaller incisions, less discomfort, and shorter hospital stay.

Urethral dilation is a minimally invasive procedure for the treatment of bulbar urethral strictures where a permanent catheter is used to drain the bladder, which offers a faster recovery, and minimal scarring.

Key Urethral Dilators Market Insights Summary:

Regional Insights:

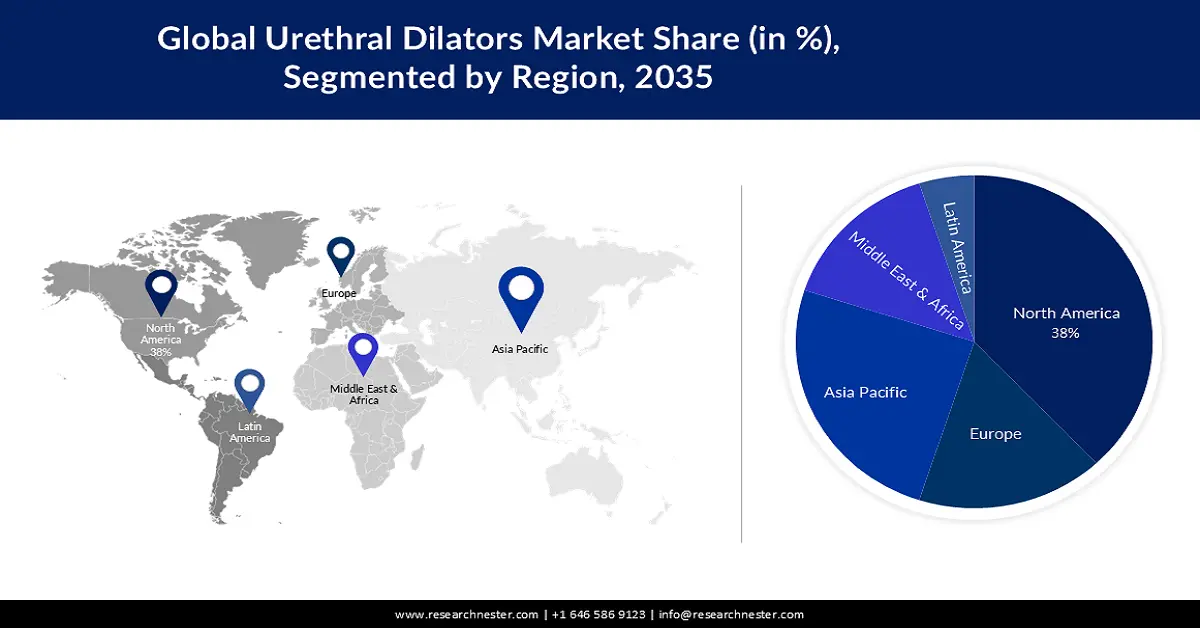

- North America urethral dilators market is forecasted to capture a 38% share by 2035, impelled by growing healthcare expenditure.

- The APAC market is expected to emerge as the second largest during 2026–2035, driven by the surge in medical tourism.

Segment Insights:

- The disposable segment of the urethral dilators market is projected to secure a 62% share by 2035, attributed to its single-use design and safety advantages owing to the benefits offered.

- The urethral stricture segment is anticipated to hold a 51% share during 2026–2035, supported by rising global procedure volumes due to growing surgical procedures.

Key Growth Trends:

- Spiking Cases of Prostate Cancer

- Growing Geriatric Population

Major Challenges:

- Availability of Alternative Treatment Options

- Stringent Regulatory Standards

Key Players: Cook Medical LLC, B. Braun Melsungen AG, Guangzhou Weili Medical Equipment Co. Ltd., Manish Medi Innovation, MED pro Medical BV, Medi Globe Technologies GmbH, Coloplast, SEPLOU Inc., Teleflex Inc., Zhejiang Chuangxiang Medical Technology Co. Ltd, Boston Scientific Corporation.

Global Urethral Dilators Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 271.54 million

- 2026 Market Size: USD 286.94 million

- Projected Market Size: USD 500.23 million by 2035

- Growth Forecasts: 6.3%

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: APAC

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Indonesia, Vietnam, Mexico

Last updated on : 25 November, 2025

Urethral Dilators Market - Growth Drivers and Challenges

Growth Drivers

- Spiking Cases of Prostate Cancer – In some cases, prostate cancer may lead to urethral strictures, which necessitate the use of urology devices including urethral dilators to manage urinary function. For instance, depending on the type of cancer treatment used, there is more than a 5% risk of urethral stricture after prostate cancer therapy. In 2020, there were over 1 million new cases of prostate cancer detected worldwide.

- Growing Geriatric Population- Aged people may have weakened immune systems which can decrease the capacity of the bladder and weaken the pelvic floor muscles. This can lead to several urological disorders, leading to increased demand for urethral dilators. Lately, the number of individuals over 65 across the globe is more than 610 million, or roughly 8% of the population.

Challenges

- Availability of Alternative Treatment Options – There are many other treatment options such as laser therapies, behavioral therapy, medication, surgical options for rUTI management, and endoscopic or percutaneous are easily available for the treatment of urological condition. This, as a result, limits the adoption of urethral dilators.

- Stringent Regulatory Standards

- Lack of Awareness

Urethral Dilators Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 271.54 million |

|

Forecast Year Market Size (2035) |

USD 500.23 million |

|

Regional Scope |

|

Urethral Dilators Market Segmentation:

Usage Segment Analysis

The disposable segment is estimated to gain a robust market share of 62% in the coming years owing to the benefits offered. Disposable urethral dilators are designed for single use with consistent quality standards. They don’t require any sterilization which reduces the risk of cross-contamination between patients. In addition, these dilators are cost-effective as compared to reusable dilators and can be easily disposed of.

Application Segment Analysis

The urethral stricture segment in the urethral dilators market is set to garner a notable share of 51% shortly on the account of growing surgical procedures. Surgical procedures involve the repeated use of catheters which may cause irritation or swelling and scar tissue formation, which can restrict the urethra and cause urine to back up in the urinary tract, resulting in urethral stricture. This can be treated by using the urethral dilation technique where a doctor puts a very little wire into the bladder through the urethra by stretching the urethra's sidewalls. Every year, more than 300 million major surgical procedures are carried out worldwide.

Our in-depth analysis of the global market includes the following segments:

|

Usage |

|

|

Application |

|

|

End-User |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Urethral Dilators Market - Regional Analysis

North American Market Insights

North America industry is predicted to dominate majority revenue share of 38% by 2035 impelled by the growing spending in healthcare. As a result, more efficient and advanced medical technologies including urethral dilators are expected to develop in the region. In addition, availability of more resources would also improve the medical access, which may result in a higher number of surgeries that may require urethral dilators. In 2021, health spending in the US increased by over 2%.

APAC Market Insights

The APAC urethral dilators market is estimated to be the second largest, during the forecast timeframe led by rapidly growing medical tourism. India's medical tourism industry is expanding, since there are many different travel choices available in the country such as its low-cost treatments and state-of-the-art medical facilities. This has significantly increased the demand for urethral dilators as people from different regions visit India and other Asia Pacific countries for urological treatments.

For instance, more than a million individuals from over 75 different countries travel to India each year for medical, wellness, and IVF procedures. As a result, the demand for urethral dilators may rise in the region as more people can access medical facilities for the treatment of urological conditions.

Urethral Dilators Market Players:

- Cook Medical LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- B. Braun Melsungen AG

- Guangzhou Weili Medical Equipment Co. Ltd.

- Manish Medi Innovation

- MED pro Medical BV

- Medi Globe Technologies GmbH

- Coloplast

- SEPLOU Inc.

- Teleflex Inc.

- Zhejiang Chuangxiang Medical Technology Co. Ltd

- Boston Scientific Corporation

Recent Developments

- Coloplast introduced New Catheter, SpeediCath Flex Set with Triple Action Coating Technology, for people living with bladder and urinary problems to enhance their catheterization procedures in a variety of ways, and to lower the risk of urethral injury and urinary tract infections (UTIs).

- Boston Scientific Corporation received approval from the U.S. Food and Drug Administration (FDA) for its POLARx Cryoablation System which uses the POLARx FIT Cryoablation Balloon Catheter, to treat patients with paroxysmal atrial fibrillation (AF).

- Report ID: 5184

- Published Date: Nov 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Urethral Dilators Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.