Female Stress Urinary Incontinence Treatment Devices Market Outlook:

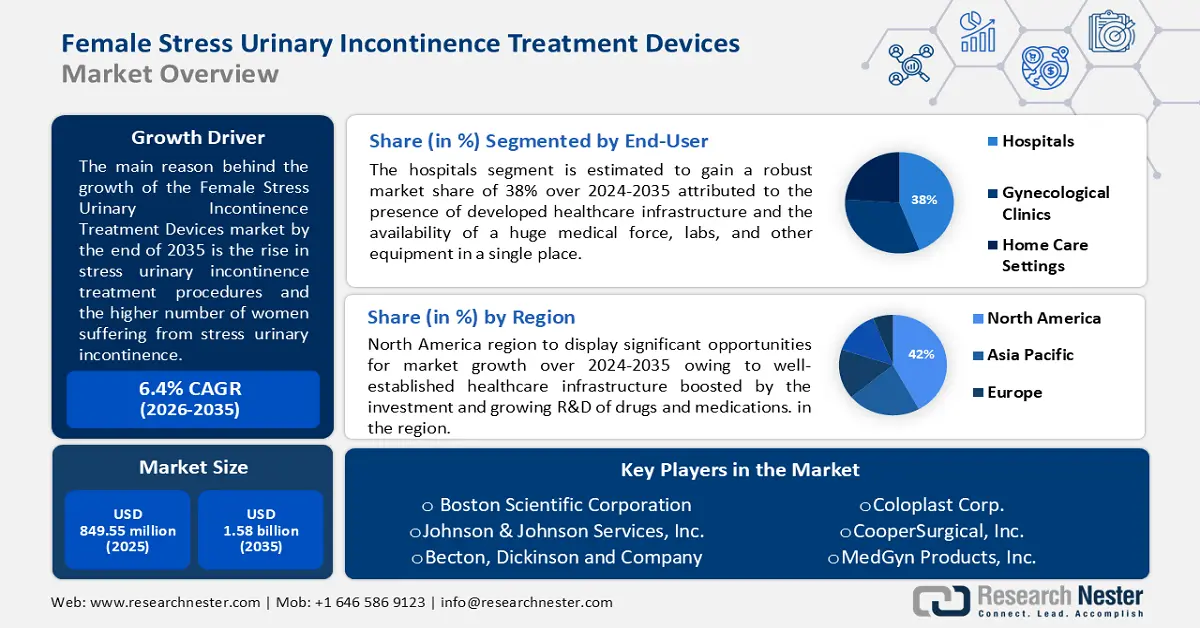

Female Stress Urinary Incontinence Treatment Devices Market size was over USD 849.55 million in 2025 and is projected to reach USD 1.58 billion by 2035, growing at around 6.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of female stress urinary incontinence treatment devices is evaluated at USD 898.48 million.

The rise in the number of stress urinary incontinence treatment procedures and the higher number of women suffering from stress urinary incontinence is estimated to be the primary factor to hike the growth of the market over the forecast period. It was observed in 2019, over 28o,000 stress urinary incontinence procedures are performed per year worldwide. Generally, women develop stress urinary incontinence after giving birth and this disease can be an ignominious act for them. Hence, women suffering from it require stress urinary incontinence treatment procedures to prevent the symptoms and lead a normal life.

The rise of government initiatives to increase awareness of female stress urinary incontinence was predicted to drive the market's growth over the forecast period, among other trends in the global female stress urinary incontinence treatment devices market. For instance, the United States established a "Women's Health Awareness (WHA)" inside the National Institute of Environmental Health Sciences in order to deliver community-based evidence-based health care and boost community health resiliency. For women with stress urinary incontinence, devices such as urethral inserts have been found to be quite beneficial. These are the microscopic plugs that are put into the urethra during specific activities to stop urine flow. As a result, during the anticipated period, these factors are anticipated to boost the market growth.

Key Female Stress Urinary Incontinence Treatment Devices Market Insights Summary:

Regional Highlights:

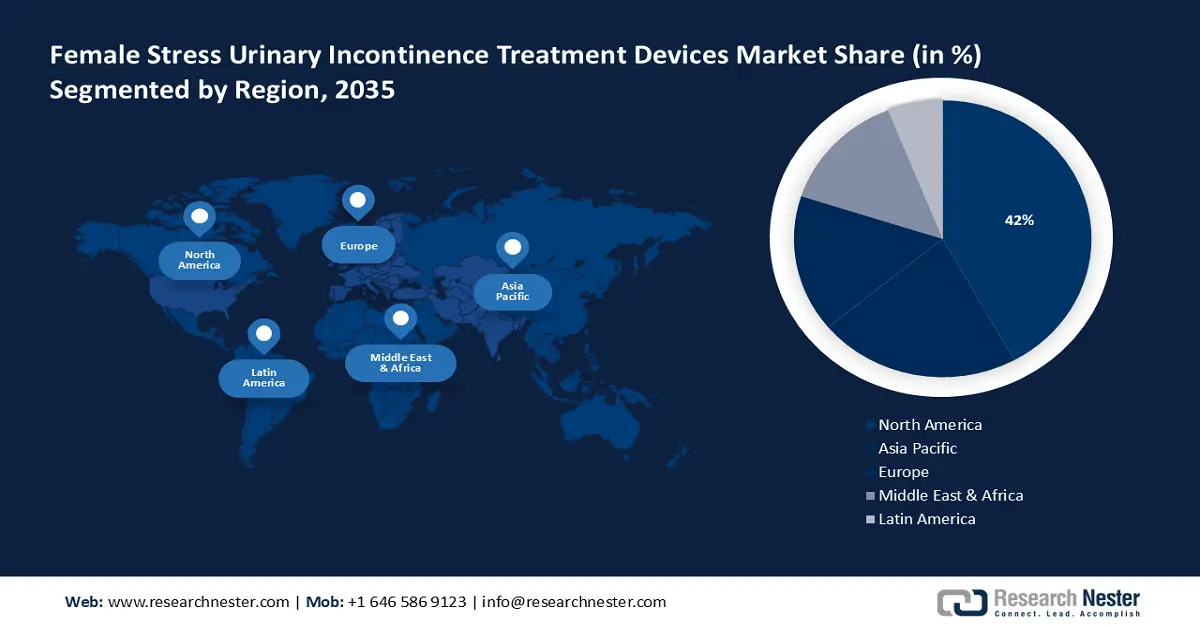

- North America’s female stress urinary incontinence treatment devices market is predicted to capture 42% share by 2035, fueled by robust healthcare infrastructure and SUI prevalence among women.

- Asia Pacific market will secure the second largest share by 2035, attributed to increased urinary incontinence among women and growing awareness of treatment options.

Segment Insights:

- The electrical stimulation devices segment in the female stress urinary incontinence treatment devices market is projected to achieve a 54.40% share by 2035, fueled by ease of use, self-administration, and cost-effectiveness.

- The hospitals segment in the female stress urinary incontinence treatment devices market is forecasted to capture the largest share by 2035, attributed to strong healthcare infrastructure and centralized medical facilities.

Key Growth Trends:

- Increase in Instances of Urinary Incontinence

- Rising Prevalence of Gynecological Disorders

Major Challenges:

- Increase in Instances of Urinary Incontinence

- Rising Prevalence of Gynecological Disorders

Key Players: Boston Scientific Corporation, Johnson & Johnson Services, Inc., Becton, Dickinson and Company, Coloplast Corp., CooperSurgical, Inc., MedGyn Products, Inc., Caldera Medical, Inc, FEG Textiltechnik mbH, Medical Device Business Services, Inc., Renovia Inc.

Global Female Stress Urinary Incontinence Treatment Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 849.55 million

- 2026 Market Size: USD 898.48 million

- Projected Market Size: USD 1.58 billion by 2035

- Growth Forecasts: 6.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 9 September, 2025

Female Stress Urinary Incontinence Treatment Devices Market Growth Drivers and Challenges:

Growth Drivers

-

Increase in Instances of Urinary Incontinence - The incidence of urinary incontinence in women ranged between 10%-65% across the globe while the symptoms of this disease are observed to escalate with age, for instance, nearly 70% of women aged above 65 report urine leakage.

- Urinary incontinence is a condition in which the person losses the control over bladder and people are not much open-minded about this disease. Hence a higher number of women are in the need of proper treatment to cure this condition which is expected to propel the growth of the market over the forecast period.

-

Rising Prevalence of Gynecological Disorders - In India alone, the percentage of women diagnosed with PCOS was estimated to be nearly 9% in 2021 while more than 12% of women in the United States suffer from it.

-

Growing Incidence of Urinary Incontinence Due to Menopause - Each year about 1 million women attain menopause in the U.S.

-

Rise in Incidence of Tuberculosis - As of 2020, the number of tuberculosis cases per 100,000 individuals was estimated to be around 7,174 globally.

-

Increase of Medical Conditions such as Parkinson’s Disease, and Multiple Sclerosis - As the global estimates in 2019, over 8.5 million people have Parkinson’s disease which is further projected to be doubled in 25 years.

Challenges

- Emergence of Neuromodulator for Electric Stimulation of Nerves

- Limitation in Patients with the Fibrotic Urethra

- Poor Procedural Outcomes

- It is not necessary to get rid of stress urinary incontinence after receiving the proper treatment and the patients might have to continue taking the medicines or drugs. Hence, such uncertainty about the treatment is expected to hamper the growth of the market over the forecast period.

Female Stress Urinary Incontinence Treatment Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.4% |

|

Base Year Market Size (2025) |

USD 849.55 million |

|

Forecast Year Market Size (2035) |

USD 1.58 billion |

|

Regional Scope |

|

Female Stress Urinary Incontinence Treatment Devices Market Segmentation:

End-user Segment Analysis

The global female stress urinary incontinence treatment devices market is segmented and analyzed for demand and supply by end-user in hospitals, gynecological clinics, and home care settings. Out of these end users, the hospital segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the presence of developed healthcare infrastructure and the availability of a huge medical force, labs, and other equipment in a single place. The total number of all U.S hospitals was estimated to be about 6,093 in 2022. Whereas, in the type segment, the electrical stimulation devices sub-segment will hold the largest market share of 54.4%, owing to their ease of operation, and cost-effectiveness with the great convenience of being self-administered at home. Furthermore, hospitals are noticed to provide better medical care for women with PCOS. For instance, it has been observed that around 20% of women globally get hospitalized owing to PCOS.

Type Segment Analysis

The global female stress urinary incontinence treatment devices market is also segmented and analyzed for demand and supply by type into the urethral sling, artificial urinary sphincters, electrical stimulation devices, and catheters. Amongst these segments, the urethral sling segment is expected to garner a significant share. A urethral sling is a surgery that is performed to treat to treat stress urinary incontinence. The sling is placed in the urethra to support it and to carry urine from the bladder to discharge it. It is observed that approximately 75% of incontinence cases are completely cured after surgery while many cases don’t even require sling surgery. Hence, such factors are expected to hike the growth of the segment over the forecast period.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Product Type |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Female Stress Urinary Incontinence Treatment Devices Market Regional Analysis:

North American Market Insights

North America industry is likely to dominate majority revenue share of 42% by 2035. The growth of the market can be attributed majorly to the well-established healthcare infrastructure boosted by investment and growing R&D of drugs and medications. The healthcare spending of the U.S. in 2020 was USD 4000 billion. Furthermore, growing cases of stress urinary incontinence in the region owing to several regions backed by the presence of female stress urinary incontinence treatment device manufacturers are expected to expand the market size during the forecast period. Stress urinary incontinence is a disease that requires immediate medical attention. For instance, approximately 22 million American suffer from stress urinary incontinence and around 80% of them are women. Additionally, in every 3 women in the region, 1 of them has faced SUI in her life. Hence, all these factors are estimated to propel the growth of the market over the forecast period.

APAC Market Insights

Furthermore, the Asia Pacific region is anticipated to obtain the second-largest share of the market during the forecast period. The growth of the market is attributed to the increased prevalence of overactive bladder and urinary incontinence among women in urban and rural settings, decreased access to adequate healthcare services, a decreased propensity to seek treatment, growing awareness of the various diagnostic and treatment options, and rising preference for minimally invasive treatments for Urinary Incontinence.

Female Stress Urinary Incontinence Treatment Devices Market Players:

- Boston Scientific Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Johnson & Johnson Services, Inc.

- Becton, Dickinson and Company

- Coloplast Corp.

- CooperSurgical, Inc.

- MedGyn Products, Inc.

- Caldera Medical, Inc

- FEG Textiltechnik mbH

- Medical Device Business Services, Inc.

- Renovia Inc.

Recent Developments

-

Renovia Inc., a leading company in the field of developing digital therapeutics for female pelvic floor disorders informed that Leva, a pelvic health system to treat women in urinary continence received acceptance from researchers supporting its value. It is stated that Leva can provide UI symptom improvement for 12 months and creates real-world data to increase its effectiveness.

-

Boston Scientific Corporation declared that Solyx, a single incision sling system succeeded in the treatment of women with stress urinary incontinence. It is designed to decrease dissection and provide a less complicated procedure.

- Report ID: 4376

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Female Stress Urinary Incontinence Treatment Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.