Textile Market Outlook:

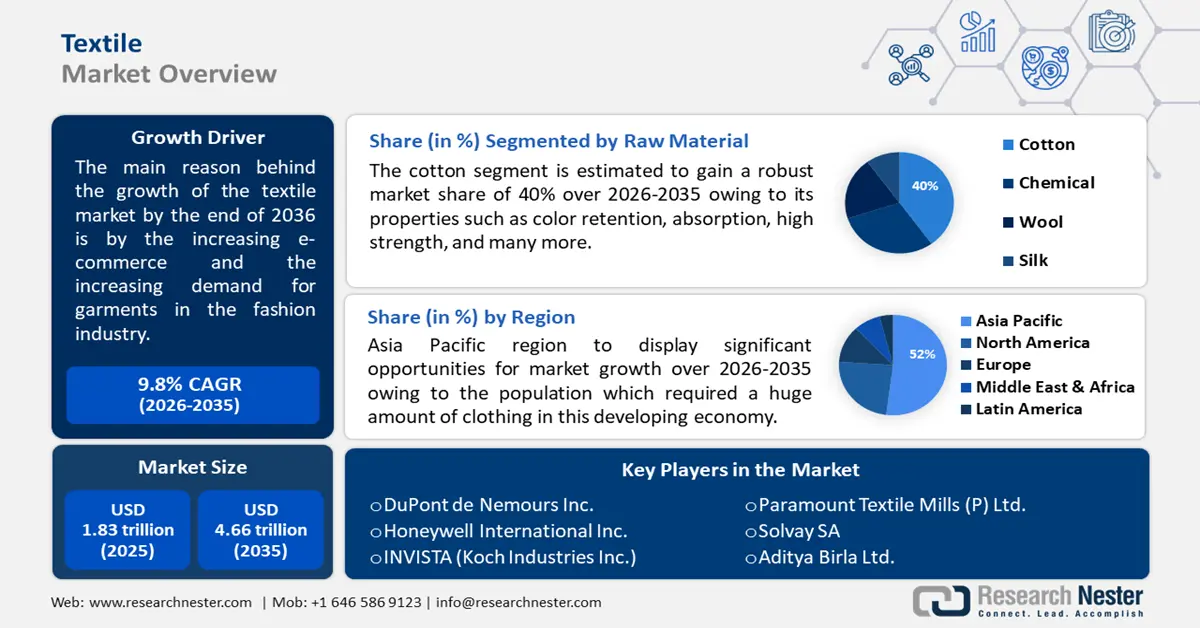

Textile Market size was valued at USD 1.83 trillion in 2025 and is likely to cross USD 4.66 trillion by 2035, registering more than 9.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of textile is assessed at USD 1.99 trillion.

The reason behind this boost is impelled by the increasing e-commerce and the slated demand for garments in the fashion sector. According to a report by Forbes in 2024, more than 59% of the global population now have access to the Internet, and retail e-commerce was propelled to cross about USD 4 trillion in 2021.

Key Textile Market Insights Summary:

Regional Highlights:

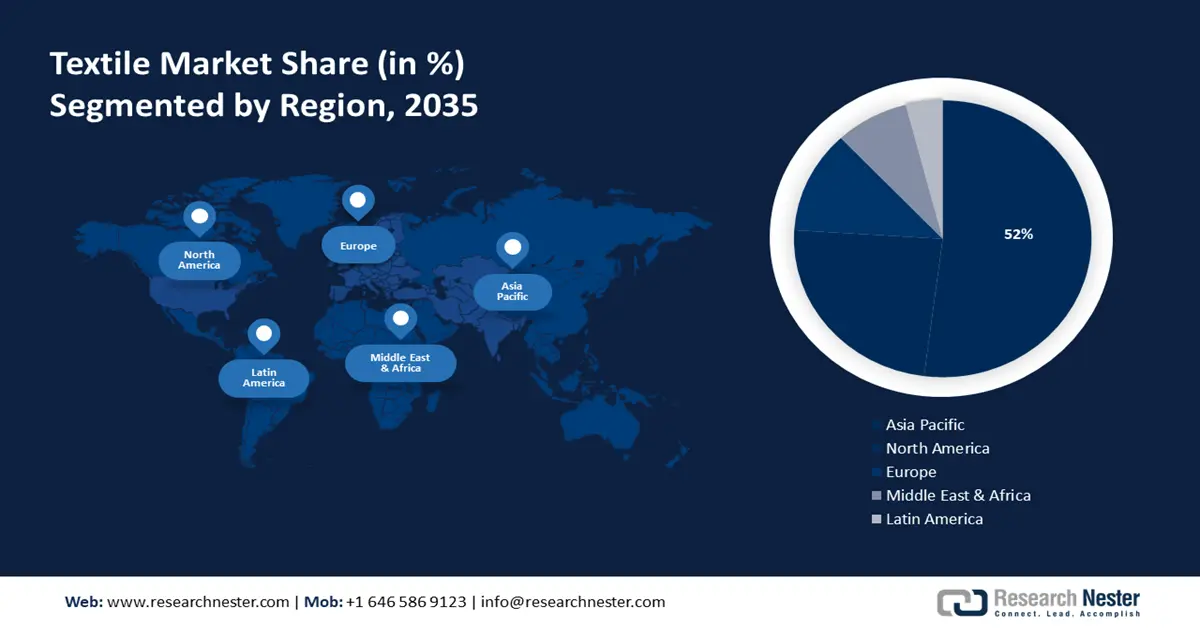

- Asia Pacific textile market will dominate around 52% share by 2035, driven by population surge and demand for apparel.

Segment Insights:

- The cotton segment in the textile market is projected to hold a 40% share by 2035, driven by cotton’s color retention, absorption, high strength, and increasing home furnishing and renovation demand.

- The natural fibers segment in the textile market is projected to exhibit lucrative growth over 2026-2035, driven by its biodegradability, comfort, and breathability, boosting its demand in fashion.

Key Growth Trends:

- Expanding global population

- Ever-changing consumer preference

Major Challenges:

- Growing industrial waste

- Intense competition

Key Players: Dow, DuPont, BSL Limited, China Petroleum & Chemical Corporation, DuPont de Nemours Inc., Honeywell International Inc., INVISTA (Koch Industries Inc.), Paramount Textile Mills (P) Ltd., Solvay SA, Aditya Birla Ltd.

Global Textile Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.83 trillion

- 2026 Market Size: USD 1.99 trillion

- Projected Market Size: USD 4.66 trillion by 2035

- Growth Forecasts: 9.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (52% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, United States, Germany, Japan

- Emerging Countries: China, India, Bangladesh, Vietnam, Indonesia

Last updated on : 17 September, 2025

Textile Market Growth Drivers and Challenges:

Growth Drivers

-

Expanding global population - As the population is constantly increasing, there is a high demand for textiles and clothing such as casual & women's, and fashionable clothing for all age groups due to which purchasing has also increased. According to a report by the UN Trade & Development in 2022, the global population in developing countries increased to 83% in 2022 from 66% in 1950 and is expected to witness an 86% gain by 2050.

-

Ever-changing consumer preference - Consumers now seeks sustainability, and comfort in their fashion choices which has fueled the demand for textiles. There is a surge in functional textiles, organic materials, and eco-friendly fabrics. According to a report by IFOAM in 2024, the global area for organic farming surpassed 96 million hectares in 2022.

- Growing urbanization - Urbanization has been considered one of the major key driving forces for the textile industry owing to the increasing need for textile products such as home textiles, clothing, and many more. According to a report in 2024, about 44% of the world's population lives in cities, about 43% lives in suburbs and towns, and around 13% in rural areas in 2020. Additionally, urbanization has also led to an increasing focus on aesthetics and design, which has created a surge in the market demand for textile solutions that are not only functional but also visually appealing.

- Increase in disposable income- There has been a growth in disposable income which is attributed to the growing need for comfort in residential buildings, healthcare, automobiles, and many more. According to a report, by the Office for National Statistics in 2023, when compared to the gross disposable household income (GDHI) of 2020, it increased by 3.6% in 2021 in the UK. Moreover, there has been growth in residential housing which fuels the demand for this sector.

Challenges

-

Growing industrial waste- One of the primary causes of the increased number of laws and regulations controlling the manufacture of textile items is the availability of uncontrolled industrial waste. This problem is especially common in developing countries that are still undergoing industrialization. One of the biggest factors preventing the business from growing faster is the build-up of improperly handled industrial waste, which can harm the ecosystem nearby.

Intense competition- With a large number of suppliers and manufacturers across the globe, the textile industry is quite competitive. Price pressure and reduced profit margins can result from intense competition, particularly for commoditized textile items.

Textile Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.8% |

|

Base Year Market Size (2025) |

USD 1.83 trillion |

|

Forecast Year Market Size (2035) |

USD 4.66 trillion |

|

Regional Scope |

|

Textile Market Segmentation:

Raw Material

Cotton segment is set to account for textile market share of around 40% by 2035 and impacted by its properties such as color retention, absorption, high strength, and many more. Moreover, the increase in home furnishing shopping, smart furniture, and renovation has also increased the market value for the textile sector globally.

Furthermore, according to a report by USDA Foreign Agricultural Services in 2024, worldwide cotton usage increased from 3.5 million to 116.9 million which is the highest in the last 4 years. In addition, consumers also prefer natural fibers such as cotton, wool, silk, and many more credited to their environmental benefits.

In addition, the textile market has undergone technical advancements that have improved the fabric quality, textures, and knitting, to match the aesthetic demand of the consumers globally.

Product

Natural fibers segment in the textile market is set to grow at a lucrative rate till 2035, owing to its demand in the apparel and fashion industry driven by its qualities such as biodegradability, comfort, breathability, and others, which act as a growth driver for the growing demand for cotton in the textile revenue share.

According to a report in 2022, the apparel industry was expected to increase by 18% of the current prices in 2021. Additionally, nylon is also used in home furnishing on account of its high moisture-absorbing, elastic, and resilience properties which is a better substitute for silk-based products such as flak vests, parachutes, sticking, and many more.

Our in-depth analysis of the global market includes the following segments:

|

Raw Material |

|

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Textile Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is set to hold largest revenue share of 52% by 2035. The landscape's substantial growth in the region is expected due to the surge in population which required a huge amount of clothing, e-commerce apparel, and several related accessories in this developing economy. According to a report in 2024, Asia's population growth rate is the 4th highest with a rate of about 0.66% in 2024.

Attributed to the growth in the fashion sector in Japan, the demand for clothing is also increasing. According to a report by UNIQLO in 2024, store sales increased by more than 18% which includes online sales year on year.

In China there is an easy availability of silk yarn and raw silk as China is the largest producer in the world. According to a report in 2023, China produced about 70% of raw silk and silkworm cocoons globally.

North America Market Insights

The North American region will also encounter a huge influence on the textile market share during the forecast period will account for the second position attributed to the increasing population of this region. According to the UN-Habitat, it is predicted that the urban population in APAC is projected to increase by 50% by 2050.

The growing export of clothing and textiles in the United States is expected to boost the landscape in this region. According to a report in 2022, the export of apparel and textiles in the U.S. increases by 13% every year.

In Cananda, there has been an increase in the construction sector in the residential, commercial, and manufacturing industries. According to a report in 2024, the industrial space in Canada increased t0 4.3% in 2023, which is about 16 million sq. ft of new space.

Textile Market Players:

- Dow

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DuPont

- BSL Limited

- China Petroleum & Chemical Corporation

- DuPont de Nemours Inc.

- Honeywell International Inc.

- INVISTA (Koch Industries Inc.)

- Paramount Textile Mills (P) Ltd.

- Solvay SA

- Aditya Birla Ltd.

Most of these companies are continuously collaborating, expanding, making agreements, and joining ventures for the growth of this revenue share and are estimated to be the major key players in this landscape.

Recent Developments

- Dow- along with Teach For All collaborates to support STEM (Science, Technology, Engineering, and Math) teacher recruitment, professional development, and placement.

- DuPont- will be exhibiting at the 2024 Aircraft Interiors Expo (AIX), in Hamburg, Germany to showcase their long-established solutions for a cleanable, durable, customizable, and safer approach to aircraft interiors.

- Report ID: 6181

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Textile Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.