E-commerce Apparel Market Outlook:

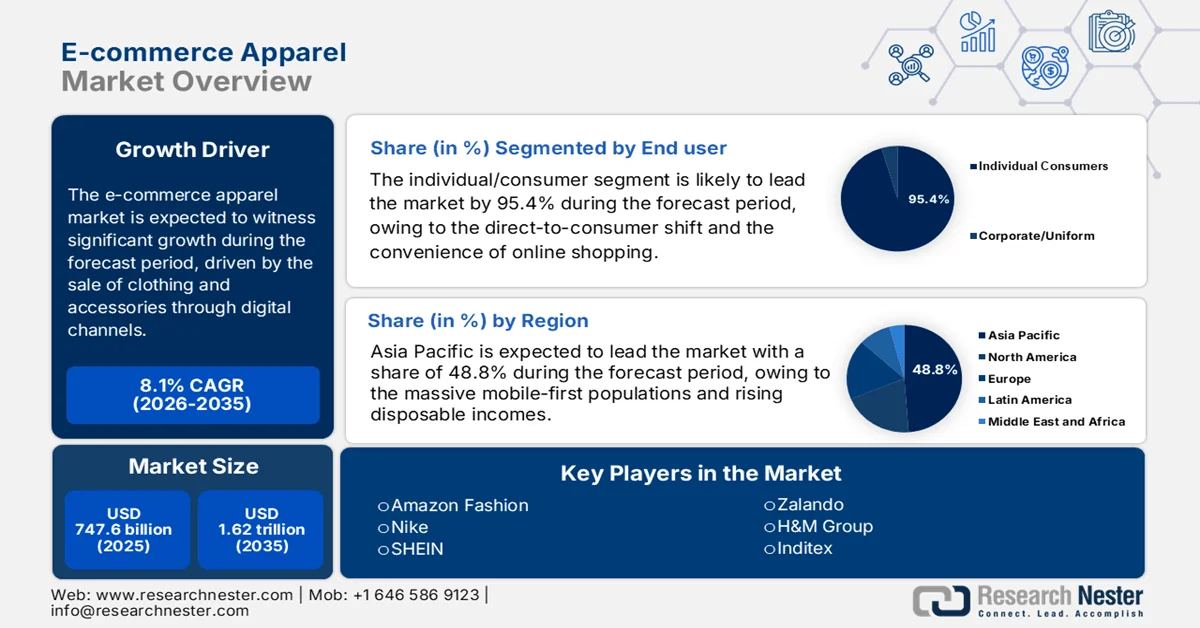

E-commerce Apparel Market size was valued at USD 747.6 billion in 2025 and is projected to reach USD 1.62 trillion by the end of 2035, rising at a CAGR of 8.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of e-commerce apparel is evaluated at USD 808.1 billion.

E-commerce has become a structurally important channel for the apparel sector, reshaping the wholesale-to-retail flows, inventory planning, and cross-border sourcing. The international market represents a fundamental and growing segment of the overall retail economy, characterized by the sale of clothing and accessories through digital channels. This rise is driven by the rising usage of smartphones and the internet by people. According to the U.S. Census Bureau report in February 2024, data from 2023, e-commerce accounted for the 15.6% of the total retail sales, underscoring the sustained channel shift rather than a temporary surge. This transition necessitates that businesses develop robust digital infrastructure, including a logistics payment system, to meet the demand and competitiveness.

Similarly, the UN Trade and Development June 2024 data depicts that the e-commerce sales in 2022 were nearly USD 27 trillion, with the business-to-consumer transactions representing 40% of GDP in the developed countries, a share driven largely by consumer goods such as apparel. The World Trade Organization shows that cross-border e-commerce has lowered the entry barriers for apparel exporters in developing nations, mainly in Asia, by minimizing the reliance on physical retail networks. Besides the integration of advanced technologies for inventory management, personalized customer engagement, and efficient last-mile delivery are now considered baseline requirements for business operations in this space, rather than differentiators. Moreover, the public sector investments in digital trade infrastructure and payments interoperability continue to support the growth in online apparel transactions across the domestic and export-oriented supply chains.

Key E-commerce Apparel Market Insights Summary:

Regional Highlights:

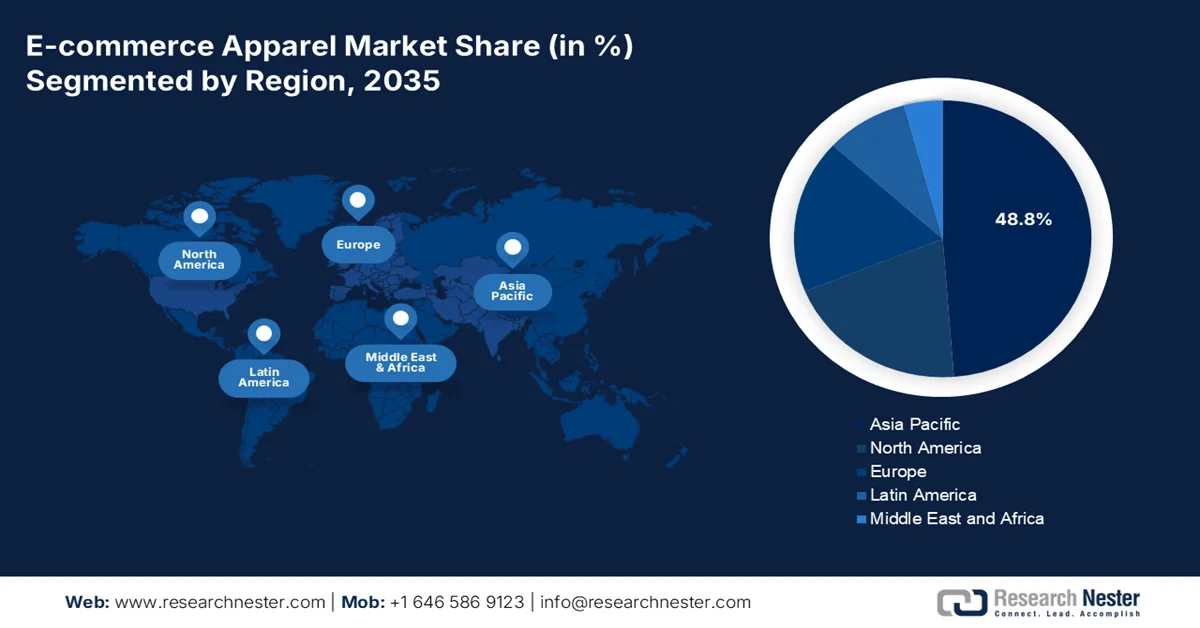

- Asia Pacific is projected to dominate the e-commerce apparel market with a commanding 48.8% regional revenue share by 2035, underpinned by mobile-first demographics and income growth and catalyzed by the rapid proliferation of super app ecosystems integrating commerce, payments, and social media

- North America is expected to be the fastest-growing region, expanding at a 6.5% CAGR during 2026–2035, supported by high digital maturity and consumer spending power and accelerated through advanced last-mile logistics capabilities

Segment Insights:

- Individual Consumer is anticipated to command the e-commerce apparel market by accounting for a dominant 95.4% share by 2035, reinforced by the direct-to-consumer shift, online shopping ease, and personalization initiatives stimulating individual purchasing behavior

- Business-to-Consumer (B2C) Model is forecast to retain the leading share by 2035, strengthened by brand-led digital channels, superior data ownership, and direct customer engagement strategies

Key Growth Trends:

- Government investment in digital infrastructure and broadband expansion

- Expansion of government supported digital payments and financial inclusion

Major Challenges:

- Logistics, fulfillment, and high return rates

- Platform dependency and algorithmic governance

Key Players: Amazon Fashion, Nike, SHEIN, Zalando, H&M Group, Inditex, VF Corporation, Lululemon, Adidas, PVH Corp., Farfetch, ASOS, UNIQLO.

Global E-commerce Apparel Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 747.6 billion

- 2026 Market Size: USD 808.1 billion

- Projected Market Size: USD 1.62 trillion by 2035

- Growth Forecasts: 8.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48.8% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, Indonesia, Vietnam, Brazil, Mexico

Last updated on : 6 February, 2026

E-commerce Apparel Market - Growth Drivers and Challenges

Growth Drivers

-

Government investment in digital infrastructure and broadband expansion: Public investment in digital infrastructure is a primary driver of market demand by expanding addressable online consumer bases. The government continues to allocate substantial budgets toward broadband access, mainly in the rural and underserved regions, directly increasing online retail participation. The Political Economy of Communication 2024 data indicates that the largest investment in broadband accessibility reached USD 65 billion, mainly in broadband deployment in low-income nations to increase the digital retail penetration, mainly for apparel, which relies on visual browsing and frequent repeat purchases. Moreover, the manufacturers and distributors for apparel, the investments translate into sustained growth in online order volumes, wider geographic reach, and greater demand predictability.

- Expansion of government supported digital payments and financial inclusion: The government-led financial inclusion initiatives are stimulating the market demand by enabling secure digital transactions at scale. The apparel is highly sensitive to payment accessibility due to high transaction frequency and return cycles. According to the World Bank Group June 2022, nearly 76% of the adults globally had a digital transaction account in 2021, supported by public payment infrastructure and regulatory reforms. Further, India experiences a rapid growth in UPI transactions, directly supporting the online retail growth, including apparel. For the B2B apparel sellers, this driver improves the conversion rates by lowering cash on delivery dependence and enables scalable direct-to-consumer and marketplace-led sales models across the emerging and developed markets.

Region Wise Digital Payment Usage

|

Region |

Percentage |

|

East Asia & Pacific (China) |

82% |

|

East Asia & Pacific (ex-China) |

23% |

|

Europe & Central Asia (ECA) |

75% |

|

Latin America & Caribbean (LAC) |

40% |

|

South Asia (SA) |

34% |

|

Sub-Saharan Africa (SSA) |

15% used mobile money for savings; 75% used non-P2P payments |

Source: UNCTAD June 2022

- Government backed SME digitalization programs in apparel manufacturing: The public funding programs supporting SME digitization are expanding the supplier base for e-commerce apparel. Government’s view apparel as a high employment sector suitable for digital export enablement. The World Bank and UNIDO support digital transformation programs for textile SMEs, enabling participation in online B2C and B2B platforms. In India, the Ministry of MSME funds digital onboarding and e-commerce integration for apparel units under national competitiveness schemes. These initiatives increase the online product availability and sourcing diversity. For global buyers and marketplaces, this expands supplier choice while lowering procurement risk. Apparel brands benefit from faster vendor onboarding and diversified sourcing through government-enabled digital ecosystems.

Challenges

- Logistics, fulfillment, and high return rates: Efficient low-cost logistics are non-negotiable, yet reverse logistics for high return rates cripple profitability. Apparel has high return rates compared to other categories. Zalando talked about this by investing a huge amount in logistics tech, including AI for size recommendations to reduce returns. Now suppliers must build similar systems or partner with other companies, adding complexity and cost, which is a significant barrier to achieving the positive unit economics from the outset.

- Platform dependency and algorithmic governance: Relying on Amazon, Filpkart and Tmall creates vulnerability. These platforms control visibility via opaque algorithms and can launch competing private labels. Amazon’s Amazon Essentials directly competes with its suppliers. Further, the platform fee structures often take a percentage of the sale compress margins. A seller report indicated that the Amazon sellers cite rising fees as their top challenge, forcing brands to balance the platform sale with direct channel investment.

E-commerce Apparel Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.1% |

|

Base Year Market Size (2025) |

USD 747.6 billion |

|

Forecast Year Market Size (2035) |

USD 1.62 trillion |

|

Regional Scope |

|

E-commerce Apparel Market Segmentation:

End user Segment Analysis

The individual consumer sub-segment is dominating and is expected to hold the share value of 95.4% by 2035 in market. The segment is driven by the direct-to-consumer shift, the convenience of online shopping, and personalized marketing. The key trend is the rise of the individual consumer as both a buyer and a reseller, fueled by the platforms that blend the traditional B2C and C2C models. The data from the FRED in January 2026 highlights this penetration, reporting that in September 2025, the retail sales of clothing and clothing accessories stores reached USD 23,889 million. This is driven by individual purchases, demonstrating the segment’s massive and sustained scale. This growth is further accelerated by the integration of social commerce features, turning everyday social media browsing into direct purchasing opportunities.

Business Model Segment Analysis

The business-to-consumer model is leading the business model segment in the e-commerce apparel market and is poised to hold the largest share value. This includes transactions from the established brands, pure play e-tailers, and traditional retailers selling directly online. The model’s strength lies in brand control, data collection, and the ability to create seamless omnichannel experiences. Its growth is fueled by the brands bypassing wholesale intermediaries to build direct relationships, as seen with Nike’s DTC focus. The report from the International Trade Commission shows that the digital B2C transactions in consumer goods have seen compound annual growth, with the value of B2C e-commerce imports consistently rising YoY, reflecting the model’s central role in global trade and consumer access.

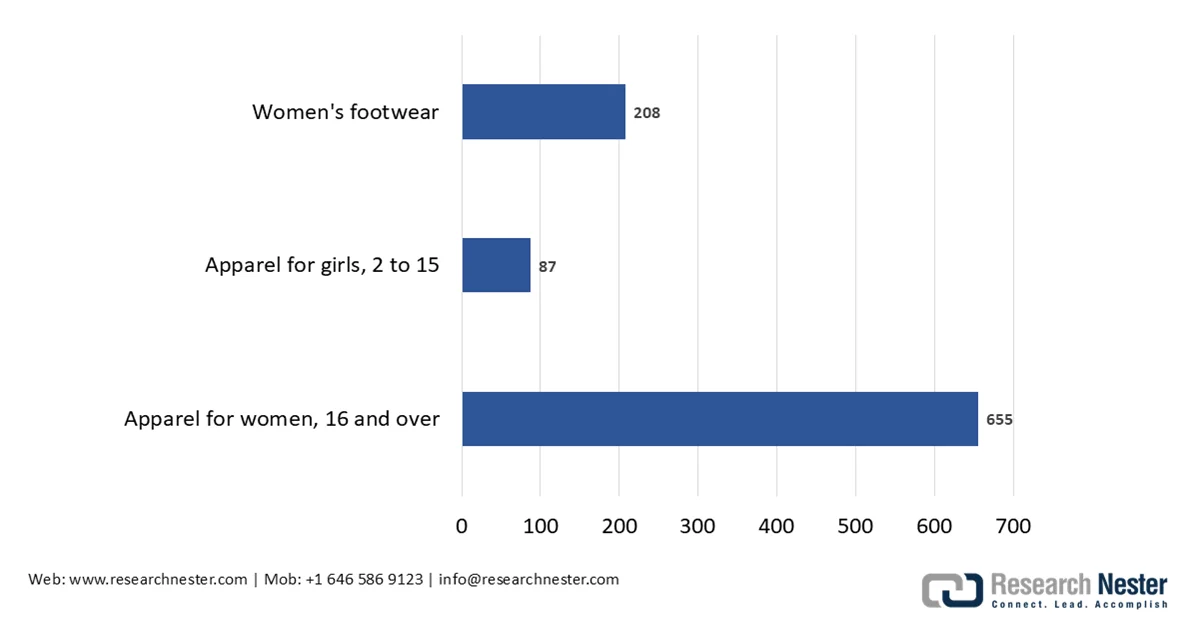

Consumer Gender Segment Analysis

The women's apparel sub-segment is the largest by consumer gender, consistently holding the largest share value in the market. This leadership is driven by the higher purchase frequency, greater engagement with the fashion trends, and a broader product variety encompassing formal, casual, and activewear. The segment is also at the forefront of sustainability and social commerce trends. Supporting this, the report from the U.S. Bureau of Labor Statistics Consumer Expenditure Surveys shows that average annual expenditures on apparel and other services by women have consistently exceeded those for men and children. For instance, the data from the U.S. Bureau of Labor Statistics in February indicates that the spending on women's apparel averaged USD 655, while that on men was USD 406. This underscores the segment’s commercial primacy.

Average Annual Expenditures for Apparel, 2025 (USD)

Source: BLS February 2025

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Consumer Gender |

|

|

Price Point |

|

|

Business Model |

|

|

Platform |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

E-commerce Apparel Market - Regional Analysis

APAC Market Insights

The Asia Pacific e-commerce apparel market is the largest and dominating, expected to hold the regional revenue share of 48.8% by 2035. The leadership is due to the massive mobile-first populations, rising disposable incomes, and continuous digital infrastructure investment. The key growth drivers include the proliferation of super app ecosystems that integrate social media, payments, and shopping, and government-led digitalization initiatives. Further, the major trends are the intense competition between the vertical specialists and horizontal marketplaces, the rapid adoption of live stream commerce, and a growing, nascent consumer focus on sustainability. The region also features stark contrasts between hyper-mature markets such as Japan and South Korea, and the high-growth emerging economies such as India and Indonesia, requiring highly localized strategies for product mix logistics and pricing.

India e-commerce apparel market is expanding rapidly and is supported by rising digital adoption, government-backed payment infrastructure, and improving connectivity. According to the IBEF February 2024 data, India had over 800 million internet users in 2023, creating a large online consumer base for apparel purchases. The digital payments are the critical enabler, the report from the PIB January 2025 data shows that the UPI processed more than 16.73 billion transactions in December 2024, reinforcing the consumer confidence in online retail. On the supply side, the PIB April 2025 data reports that India’s Textile and apparel sector contributed around 2.3% of GDP and employed over 45 million people, supporting both the domestic and online channels. Government initiatives and logistics-focused infrastructure spending continue to improve the last-mile delivery positioning India as a high-growth market for e-commerce apparel.

UPI Transactions in 2024

|

Month |

Transaction in Millions |

|

May |

14,036 |

|

June |

13,885 |

|

July |

14,436 |

|

August |

14,963 |

|

September |

15,042 |

|

October |

16,585 |

|

November |

15,482 |

|

December |

16,730 |

Source: PIB January 2025

The high interest penetration, reliable digital payments, and a strong domestic retail base are driving a steady growth in the Japan e-commerce apparel market. According to the August 2023 data, Japan’s B2C e-commerce market reached nearly JPY 227,449 in 2022, with apparel and fashion among the leading product categories. Moreover, the report from the World Bank Group 2023 shows that nearly 87% of people in 2023 had internet access, enabling a broad participation in online shopping. Despite inflationary pressures, consumer spending on online retail has remained stable, supported by efficient logistics and trusted payment systems. besides the METI also highlights continued policy support for digital commerce and cross-border e-commerce under Japan’s digital transformation initiatives, reinforcing the position as a mature and resilient market in Japan.

North America Market Insights

The North America e-commerce apparel market is the fastest-growing and is expected to grow at a CAGR of 6.5% during the forecast period 2026 to 2035. The market in this region is defined by the high digital maturity and consumer spending power. The growth is driven by mobile-first shopping, advanced last-mile logistics, and the dominance of integrated omnichannel retail. The key trends include the rapid expansion of social commerce platforms as direct sales channels and a strong consumer shift towards sustainable and circular fashion models, such as resale and rental. The market consolidation is ongoing with major players acquiring the DTC brands to capture niche segments. The region faces headwinds from inflation impacting discretionary spending and heightened regulatory scrutiny on data privacy and environmental claims, which increase compliance costs for all market participants.

The e-commerce apparel market in the U.S. continues to expand and is supported by measurable growth in the online retail penetration, consumer spending, and public investment. Further, the usage of e-commerce has strengthened the demand for apparel sold via online channels. Moreover, the NLM study in August 2022 indicates the U.S. e-commerce sales grew by 25%, rising from USD 516 billion to USD 644 billion, increasing the retail sales from 11.1% 5o 14.2%, with continued growth estimated at USD 875 billion by 2022. Besides, the apparel remains a key beneficiary of this shift due to high online purchase frequency. On the supply side, the U.S. textile and apparel industry provides critical manufacturing support employing over 500,000 workers and generating USD 64.8 billion in shipments in 2023, while exporting over USD 29 billion in textile-related products, according to the International Trade Administration in July 2022. Strategic reshoring process automation and niche manufacturing are aligning domestic production with growing e-commerce apparel demand.

The market continues to grow steadily in Canada, supported by rising online retail penetration, digital connectivity, and cross-border trade integration. According to the Government of Canada in February 2024, the online retail sales account for USD 63.7 billion out of USD 815.5 billion in total spending in 2022. Despite the inflation reaching 6.8% in 2022, the online retail activity remained resilient, supported by the consumer preference for convenience and price comparison. Moreover, the International Trade Administration July 2025 data, e-commerce represented a 6.1% of the total retail sales in Canada, with online totaling to USD 2.14 billion for the month, and fashion emerged as the leading category accounting for 23.3% of online sales. Additionally, the e-commerce infrastructure continues to create favorable conditions for sustained apparel e-commerce expansion and cross-border sales growth in Canada e-commerce apparel.

Europe Market Insights

The e-commerce apparel market in Europe is a mature and growing defined by the stringent consumer protection regulations and a high demand for sustainable and circular fashion. The market growth is driven by the advanced digital payment adoption, omnichannel retail integration, and increasing cross-border online shopping within the EU’s single market. Besides, the key trends include the rapid expansion of resale and rental platforms, compliance with new EU-wide regulations such as the Digital Services Act and the Ecodesign for sustainable products regulations, and a consumer shift towards quality and durability over fast fashion. Despite economic pressures on discretionary spending, the convenience of online channels and the embedded nature of digital shopping continue to expand the market steadily.

The Germany e-commerce apparel market continues to expand on the back of strong digital adoption, stable consumer spending, and supportive regulatory frameworks. According to the NLM study in August 2022, the online retail sales increased by 29% from USD 127 billion to USD 141 billion, with clothing and footwear ranking among the top online purchase categories. Moreover, the data from the Garbe Industrial in December 2023 indicates that more than 83% of the people have purchased online, reflecting high digital maturity and trust in online transactions. Despite inflationary pressures across Europe Germanys online retail demand remained resilient, supported by widespread broadband access and secure digital payment systems. Additionally, EU-backed initiatives under the Digital Single Market continue to facilitate cross-border e-commerce, reinforcing Germany’s role as a key growth market for e-commerce apparel in Europe.

High online shopping penetration and mature digital infrastructure are driving the growth for UK market. According to the Office of National Statistics data in January 2026, the online retail sales in December 2025 accounted for 29.3%, remaining structurally higher than the pre-pandemic levels despite normalization in store-based shopping. Moreover, apparel is a key online category, with ONS data showing that clothing retailers consistently record one of the highest proportions of internet sales within the non-food retail sector. Besides, the Office for National Statistics report in April 2021 indicates that in 2021, nearly 92% of the adults in the UK had used the internet, enabling a sustained demand for online apparel purchases. Continued investment in logistics, widespread digital payment adoption, and strong consumer familiarity with e-commerce platforms support steady growth in the UK market.

Internet Sales Percentage Month wise (2025)

|

Month |

Percentage |

|

January |

26.9 |

|

February |

25.9 |

|

March |

26.6 |

|

April |

26.1 |

|

May |

26.1 |

|

June |

26.4 |

|

July |

26.5 |

|

August |

26 |

|

September |

27.2 |

|

October |

27.9 |

|

November |

32.3 |

|

December |

29.3 |

Source: ONS January 2026

Key E-commerce Apparel Market Players:

- Amazon Fashion (U.S.)

- Nike (U.S.)

- SHEIN (China)

- Zalando (Germany)

- H&M Group (Sweden)

- Inditex (Spain)

- VF Corporation (U.S.)

- Lululemon (Canada)

- Adidas (Germany)

- PVH Corp. (U.S.)

- Farfetch (UK)

- ASOS (UK)

- UNIQLO (Japan)

- Rakuten (Japan)

- Myntra (Flipkart) (India)

- Reliance (Ajio) (India)

- Coupang (South Korea)

- Musinsa (South Korea)

- Cotton On Group (Australia)

- PG Mall (Malaysia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amazon Fashion is the dominating player in the market. Its key initiatives include using its vast customer data for the hyper personalized recommendations, investing in private label brands to capture higher margins, and integrating apparel seamlessly into its Prime ecosystem to ensure loyalty via convenience and fast delivery.

- Nike has aggressively transformed its position in the e-commerce apparel market via a strategic direct-to-consumer shift. Key initiatives include heavy investment in its Nike app and SNKRS platform for exclusive releases, using data from these digital touchpoints to drive product innovation, and creating member-focused experiences that blend training content with commerce to build a community beyond transactional relationships.

- SHEIN has also leader in the global e-commerce apparel market with its ultra-fast fashion on-demand manufacturing model. Its core strategy utilizes real-time data from user engagement and search trends to instantly inform design and micro production, minimizing waste and inventory risk. This agile data-centric supply chain allows for an immense volume of new trend-responsive styles at highly competitive price points. According to the 2024 ESG report, the company has over 5,300 artists and designers from more than 20 countries to make the creations available for all customers worldwide.

- Zalando is a leading platform in Europe in the market, evolving from a retailer to a connected fashion ecosystem. Its strategic initiatives focus on deepening partnerships with the brand partners via logistics and marketing services, expanding its Zalando fulfillment solution, and investing in augmented reality try-on features and size advice technology to reduce the return rates and enhance the online shopping experience.

- H&M Group is a competitive e-commerce apparel market player and leads by stimulating its digital integration and circular economy focus. The key initiatives include merging its online and offline stock for seamless omnichannel services, such as buy online, pick up in store, investing heavily in its member program for personalized loyalty, and pioneering garment collection and recycling programs via its brands to address sustainability demands. In 2024, the company made a net sale of SEK 234 billion.

Here is a list of key players operating in the global market:

The global e-commerce apparel market is highly competitive and is defined by the blend of established fast fashion players, traditional retailers with robust online transitions, and innovative direct-to-consumer brands. The key players compete on hyper-localization, supply chain speed, and sustainability initiatives. Strategies such as using AI for personalized shopping, expanding into omnichannel experiences, and investing in exclusive brand portfolios to drive customer loyalty. The dominance of vertical integrators such as Shein and Zalando challenges the traditional players to stimulate digital transformation and agile manufacturing to capture market share in this rapidly consolidating space. Further top players' mergers and acquisitions are expanding the market, for example, in July 2025, Zalando and ABOUT YOU completed the transaction and teamed up to lead the way in European fashion and lifestyle e-commerce.

Corporate Landscape of the E-commerce Apparel Market:

Recent Developments

- In December 2025, Gildan announced that it has acquired HanesBrands to strengthen its leadership in responsibly made apparel and bring together two companies with a shared commitment to quality, innovation, and industry-leading environmental, social, and governance practices.

- In June 2025, the New York-origin luxury fashion brand Rizvol has officially launched in India, emphasizing timeless design, quiet luxury, and global craftsmanship.

- In August 2024, Chanel launched its e-commerce site in India for fragrance, Beauty, and Eyewear, expanding reach beyond metros further partnered with retailers in India, such as Nykaa, to offer its beauty and fragrance lines online and in select Nykaa Luxe stores.

- Report ID: 5966

- Published Date: Feb 06, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

E-commerce Apparel Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.