Protective Footwear Market Outlook:

Protective Footwear Market size was valued at USD 5.3 billion in 2025 and is projected to reach USD 8.8 billion by the end of 2035, rising at a CAGR of 5.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of protective footwear is estimated at USD 5.6 billion.

The protective footwear market is highly influenced by regulatory enforcement, workplace safety compliance, and public sector investment in occupational risk mitigation. The government safety agencies continue to redefine the procurement trends by tightening the inspection practices and reinforcing the employer obligations. According to the U.S. Bureau of Labor Statistics data in December 2023, the workplaces recorded 2.8 million nonfatal occupational injuries and illnesses in 2022. Furthermore, more people are involved in foot injuries or falls related to improper protective equipment. This reinforces the mandatory use of safety footwear in industrial settings. The regulatory pressure grew in 2023 and 2024 as the Occupational Safety and Health Administration enhanced the targeted inspections in the high-risk industries such as manufacturing and construction, where safety footwear is a mandated control measure.

Nonfatal Workplace Injuries and Illnesses

|

Year |

Case Counts |

|

2019 |

2,814,000 |

|

2020 |

2,654,700 |

|

2021 |

2,607,900 |

|

2022 |

2,804,200 |

Source: BLS December 2023

Growth trajectories are influenced by the infrastructure investment, industrial output, and evolving safety protocols. For instance, the federal initiatives, such as the U.S. infrastructure investment and jobs act, are projected to stimulate long-term demand in the construction sector, historically accounting for a substantial portion of foot injuries. The National Institute for Occupational Safety and Health emphasizes the role of appropriate footwear in preventing slips, trips, and falls, which is the leading cause of serious work-related injuries and fatalities. The protective footwear market evolution is further shaped by the adoption of consensus performance standards from organizations such as ASTM International that refine the test methods for impact resistance, electrical hazard protection, and slip resistance. This standards development pushes the manufacturers towards continuous product enhancement to meet the high-performance tiers.

Key Protective Footwear Market Insights Summary:

Regional Highlights:

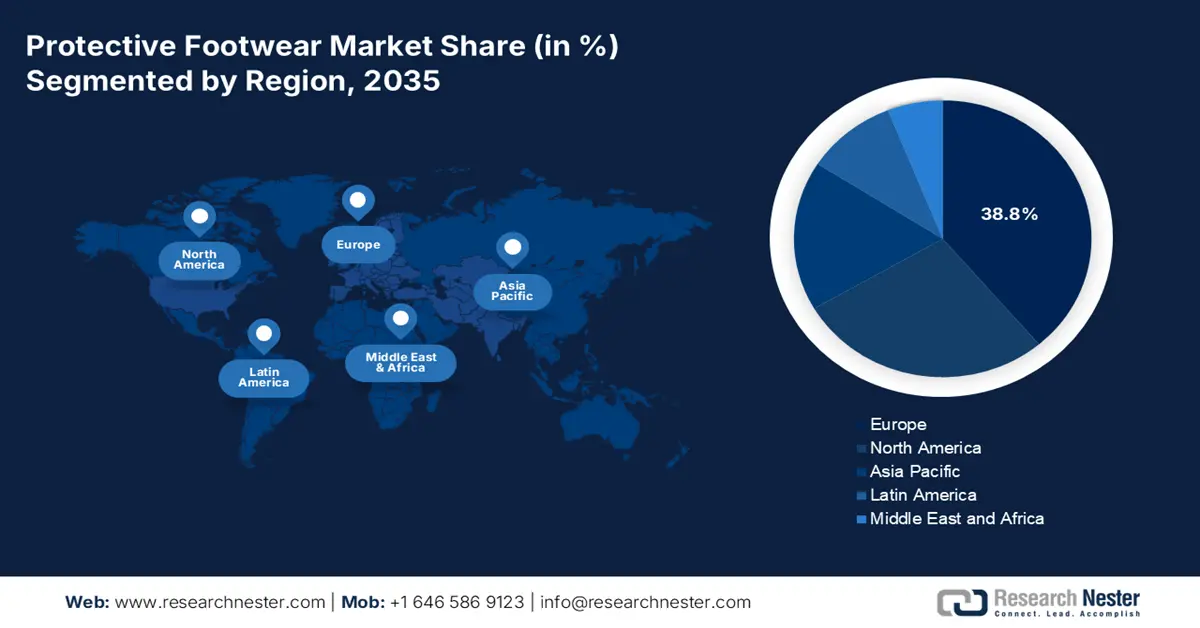

- By 2035, Europe is anticipated to secure a 38.8% share in the protective footwear market, upheld by stringent EU PPE Regulations 216/425 and reinforced through substantial infrastructure funding and a strong cultural commitment to worker welfare, owing to the integration of smart safety technologies and circular manufacturing models.

- Across 2026–2035, Asia Pacific is set to expand rapidly as the fastest-growing region, fueled by accelerated industrialization, large-scale infrastructure programs, and tightening safety compliance standards, propelled by the formalization of workforce protection norms.

Segment Insights:

- By 2035, the online or e-commerce segment in the protective footwear market is projected to command a 60.3% share as organizations transition to centralized digital procurement systems and streamlined safety-related inventory processes, driven by expanding digitalization of industrial supply chains.

- By 2035, the leather footwear segment is expected to retain its leading share as industries prioritize robust protection and ergonomic advancements aligned with rising safety risks, impelled by increasing demand across heavy-duty operational environments.

Key Growth Trends:

- Rising workplace injuries are driving mandatory compliance

- Rise of logistics, warehousing, and e-commerce workforce

Major Challenges:

- Stringent and fragmented regulatory compliance

- Rapid pace of technological integration

Key Players: Honeywell International Inc. (U.S.), 3M (U.S.), COFRA S.r.l. (Italy), Würth Modyf GmbH & Co. KG (Germany), Uvex Group (Germany), Elten GmbH (Germany), Delta Plus Group (France), Bata Industrials (part of Bata Corporation, Switzerland/Global), Ansell Limited (Australia), Jallatte SAS (France), Rahman Group (Bangladesh/Global), Oftenrich Holdings Group Co., Ltd. (Hunan) (China), Viking Footwear AS (Norway), Dunlop Boots (UK), YOTSUGI Co., Ltd. (Jallatte Japan) (Japan), Liberty Shoes Limited (India), MKU Limited (India), Korea Safety Shoes Co., Ltd. (South Korea), Safetyware Group Bhd (Malaysia), Mapa Professional (France).

Global Protective Footwear Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.3 billion

- 2026 Market Size: USD 5.6 billion

- Projected Market Size: USD 8.8 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (38.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: – United States, China, Germany, Japan, United Kingdom

- Emerging Countries: – India, Vietnam, Indonesia, Mexico, Brazil

Last updated on : 9 December, 2025

Protective Footwear Market - Growth Drivers and Challenges

Growth Drivers

- Rising workplace injuries are driving mandatory compliance: Growing workplace injury rates continue to push employers toward certified protective footwear, which is the key driver in the protective footwear market. Various reports have indicated that the risk of non-fatal workplace injuries and illnesses, which involve slips, trips, and falls, requires protective footwear to prevent recurrence. OSHA’s ongoing enforcement programs, including the National Emphasis Program on Warehousing and Distribution Centers, have increased the mandatory PPE inspections, strengthening the adoption in logistics and manufacturing sectors. In the EU, 584,371 accidents occurred at work due to slipping, stumbling, and falling, as per the report from OSHOWIKI in September 2022. This data reinforces the regulatory need for safety footwear across high-risk job functions.

Fatal Occupational Injuries Due to Falls, Slips, and Trips

|

Year |

Total Fatalities from Falls, Slips, Trips |

|

2020 |

805 |

|

2021 |

850 |

|

2022 |

865 |

|

2021 |

885 |

Source: BLS December 2023, NSC 2025

- Rise of logistics, warehousing, and e-commerce workforce: The government labor statistics indicate a strong expansion in warehousing and logistics, which is a high-risk sector requiring safety footwear. The U.S. BLS data in July 2024 depicts that the transportation and warehousing industry employment level increased by over 6.6 million in 2024, driven by the distribution center expansion, supported partly by federal transport infrastructure upgrades. The EU OSHA identifies logistics as a high-incidence sector for foot injuries, slips, falls, and material handling accidents, reinforcing the mandatory safety footwear, driving the protective footwear market. Further, the national agencies report elevated injury rates in warehousing operations. The growth of state-supported logistics hubs, transport corridors, and industrial parks further expands the workforce protected under PPE regulations.

- Technological integration and smart PPE: The convergence of IoT and PPE is creating a new demand segment focused on data-driven safety management. Footwear embedded with sensors can monitor the worker's location, fatigue indicators, slip incidents, and exposure to extreme temperatures. Early state adoption is being piloted by many large firms in oil & gas and logistics. This trend shifts the value proposition from passive protection to active risk analytics, potentially justifying the higher price points. Development is often driven by partnerships among the traditional manufacturers and tech firms, signaling a transformative trend in product development.

Challenges

- Stringent and fragmented regulatory compliance: Manufacturers of the protective footwear market have to manage the complicated web of regional safety requirements, which vary in each country or region. Achieving and maintaining certification for each country market is costly and time-consuming. The non-compliance results in rejected shipments and legal liability. Companies such as Uvex and Honeywell invest heavily in in-house testing labs and compliance teams to manage this. For example, the EU’s PPE Regulation 2016/425 mandates CE marking via rigorous Notified Body assessments, creating a significant barrier to protective footwear market entry.

- Rapid pace of technological integration: The shift towards the smart PPE footwear with embedded sensors for fatigue monitoring, location tracking, or environmental hazard detection requires expertise in electronics and software, far beyond traditional footwear manufacturing. This pushes collaboration or costly R&D. Timberland PRO, in partnership with TwistedPair, has explored connected footwear, illustrating the need for cross-industry alliances to address this innovation roadblock effectively.

Protective Footwear Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 5.3 billion |

|

Forecast Year Market Size (2035) |

USD 8.8 billion |

|

Regional Scope |

|

Protective Footwear Market Segmentation:

Distribution Channel Segment Analysis

The online or e-commerce segment is expected to lead the distribution channel segment in the protective footwear market and is poised to hold the share value of 60.3% by 2035. The segment is driven by the post-pandemic purchasing shifts and superior B2B procurement efficiency. The companies now favor centralized digital platforms for bulk PPE ordering, which streamline inventory management, simplify compliance documentation access, and offer competitive pricing. A key growth driver is the increasing digitalization of industrial supply chains, where integrated e-procurement systems connect safety managers directly with manufacturers. This channel’s dominance reflects a broader trend in industrial goods distribution moving away from purely offline catalogs and direct salesforces towards hybrid digital models. The U.S. Census Bureau reported that e-commerce sales have increased by 5.3% in the second quarter of 2025 from the previous quarter. A part of this rise includes the MRO and safety equipment, such as protective footwear.

Product Type Segment Analysis

Leather footwear remains the dominant product type due to its unparalleled durability, protection from specific hazards such as molten metal and sparks, and significant ergonomic improvements. Modern leather boots are no longer just heavy-duty; they incorporate waterproof breathable membranes and lightweight composite safety toes, enhancing the comfort for extended wear. This makes them the preferred, often mandated choice in heavy industries such as construction, oil and gas, and utilities. Its market leadership is sustained by its association with premium quality and long-term value, justifying higher price points. Government statistics on workplace hazards in these sectors reinforce the demand. For instance, the Bureau of Labor Statistics data in 2023 reported that contact with objects and equipment resulted in 2,569,000 nonfatal injuries requiring days away from work, a risk category where durable leather footwear is a primary defense, strengthening its essential protective footwear market position.

Material Segment Analysis

Polyurethane is set to be the leading material sub-segment primarily due to its optimal balance of lightness, durability, and cost-effectiveness. The PU outsoles and midsoles provide excellent slip resistance, oil resistance, and long-wearing comfort, which are vital for worker compliance in fast-paced environments such as logistics, food processing, and light manufacturing. The material’s versatility allows for injection molding into complex, single-unit designs that are both waterproof and easy to clean. Its growth is propelled by the industry-wide shift towards reducing fatigue and improving all-day wearability without sacrificing protection. The material’s importance is highlighted by regulatory focus on such hazards. The Occupational Safety and Health Administration continues to cite slip, trip, and fall violations as among the most frequent, issuing thousands of citations annually, a main risk that PU footwear is engineered to mitigate.

Our in-depth analysis of the protective footwear market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Material |

|

|

End user |

|

|

Protection |

|

|

Safety Standard |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Protective Footwear Market - Regional Analysis

Europe Market Insights

Europe is dominating the protective footwear market and is expected to hold share of 38.8% by 2035. The market is defined by the strong unified regulations under the EU Personal Protective Equipment Regulations 216/425 that mandate the CE marking and drive continuous product compliance and innovation. The demand is fueled by the mature manufacturing, construction, and automotive industries, but growth is increasingly stimulated by the green energy initiatives and an increased focus on sustainable manufacturing. The key drivers include substantial EU funding for the infrastructure under the Recovery and Resilience Facility and a strong cultural emphasis on worker welfare that pushes the demand beyond minimum standards towards ergonomic and advanced products. The dominant trend is the integration of smart safety technology and the development of circular economy models that manufacturers are investing in footwear made from recycled materials and designed for end-of-life recyclability to meet the ESG targets.

Germany is expected to hold the highest revenue share in the Europe protective footwear market by 2035. The market is driven by its unmatched industrial base, leadership in market manufacturing, and the Energiewende. The shift of renewables necessitates specialized footwear for wind, solar, and hydrogen infrastructure. The growth is supported by the strong German social insurance association regulations and substantial R&D investment in sustainable materials. The report from the DGUV 2023 shows that a total of 783,426 reportable workplace accidents occurred in 2023, due to slips, trips, and falls that directly require certified protective footwear. Further, the German Federal Institute for Occupational Safety and Health actively funds research on ergonomic design and the integration of sensors in the PPE setting, a trends that define the high-value market segment.

Accident Insurance in Industrial and Public Sector

|

Factors |

2022 |

2023 |

|

Reportable accidents at work |

787,412 |

783,426 |

|

per 1,000 full time equivalent employees (FTE) |

18.27 |

18.09 |

|

Reportable commuting accidents |

173,288 |

184,355 |

|

per 1,000 weighted insurance relationships |

3.29 |

3.30 |

|

Accidents at work - new pensions |

10,927 |

10,283 |

|

per 1,000 full time equivalent employees (FTE) |

0.253 |

0.237 |

|

Commuting accidents - new pensions |

3,587 |

3,682 |

|

per 1,000 weighted insurance relationships |

0.068 |

0.066 |

|

Fatal accidents at work |

423 |

381 |

|

Fatal commuting accidents |

248 |

218 |

Source: DGUV 2023

Poland is projected to be the fastest-growing major market and the key revenue holder by 2035. The market is driven by its role as a central European manufacturing hub, benefiting from nearshoring. The massive EU cohesion and recovery funds detailed on the European Commission’s regional policy site are upgrading the national infrastructure and industry, directly boosting the PPE demand. The country’s large industrial workforce and rising safety standards compliance create expansive volume growth. The country has exported over USD 27.7 million of waterproof footwear in 2023, which is highly used in some industries to avoid workplace accidents. National initiatives to modernize the mining and heavy industry further require advanced protective footwear, making Poland a critical growth engine for the regional protective footwear market.

APAC Market Insights

Asia Pacific is the fastest-growing in the protective footwear market and is poised to grow at a CAGR of 7.4% during the forecast period 2026 to 2035. The market is defined by rapid industrialization, expansive infrastructure development, and evolving regulatory frameworks. The key demands include the massive government-led infrastructure projects, such as India’s National Infrastructure Pipeline and China’s Belt and Road Initiative, that employ millions of construction workers requiring certified PPE. The vital trend is the formalization of workforce safety standards. Countries such as India are enforcing new codes, such as the Occupational Safety, Health, and Working Conditions Code 2020, shifting the demand from the non-compliant to standardized footwear. Furthermore, the region's dominance in manufacturing, from electronics in South Korea and Japan to textiles in Vietnam, sustains high-volume B2B procurement.

China’s market is defined by its unparalleled scale as the world’s primary manufacturing hub that generates massive, consistent demand for industrial safety footwear. The growth is structurally aided by the state-led infrastructure megaprojects and the strategic Made in China 2025 initiatives that prioritize advanced manufacturing sectors such as robotics and aerospace, which require high specification personal protective equipment. The vital driver is the increasing regulatory enforcement by the Ministry of Emergency Management that is progressively standardizing safety protocols and cracking down on non compliant low quality products to reduce the high incidence and cracking down on non-compliant low-quality products to minimize the high incidence of workplace accidents. According to the People’s Republic of China data in September 2025, the manufacturing purchasing managers index stood at 49.8 in 2025, indicating a sustained albeit cautious industrial activity that underpins steady PPE procurement.

India represents a dynamic growth in the protective footwear market and is propelled by a transformative regulatory overhaul and unprecedented public infrastructure investment. The formal implementation of the Occupational Safety, Health and Working Conditions Code, 2020 mandates employers to provide PPE, shifting millions of workers from informal, non-compliant footwear to certified products and creating a structured, compliance-driven market. This is supercharged by the government’s National Infrastructure Pipeline valued at over ₹111 lakh crore that fuels the demand across construction, mining, and transportation, based on the India Budget December 2024 report. The key trend is the rapid localization of production, with manufacturers expanding the capacity to meet the Make in India push and raising the domestic demand for the value-engineered products that balance the cost and certified protection.

North America Market Insights

North America in the protective footwear market is witnessing a significant expansion and is defined by high regulatory compliance, advanced product adoption, and stable demand from the mature industries. The growth is driven by the strong OSHA and CSA enforcement infrastructure renewal under acts such as the U.S. Infrastructure Investment and Jobs Act, and a strong shift towards technologically integrated and sustainable footwear. The region leads in premium high specification product demand, with trends focused mainly on the lightweight composite materials, smart PPE for data-driven safety management, and circular economy models. An aging workforce emphasizes ergonomics, pushing manufacturers towards innovation in comfort and injury prevention beyond basic compliance.

The protective footwear market in the U.S. is defined by the regulatory-driven upgrades and technological integration. This is clearly reflected in the trade and demand for the specialized categories, such as waterproof footwear. The key imported and manufactured products of the waterproof footwear include waterproof footwear over the ankle, a metal toe cap, and over-the-knee boots. The demand for these products is highly influenced by the OSHA standards mandating protection in wet environments prevalent in construction, food processing, and utilities. The U.S. is the leading importer of waterproof footwear and imported over USD 135 million in 2023, based on the OEC 2023 report. Further, the regulatory frameworks combined with the need for durable all-weather gear for infrastructure and outdoor work ensure a sustained import and domestic production.

The Canada protective footwear market is heavily influenced by its resource-based economy and extreme climate. The demand is strong in mining, oil & gas, and forestry sectors prioritized under the national Critical Minerals Strategy. The main trend in the protective footwear market is the demand for footwear certified for severe cold and wet conditions with standards developed by the CSA Group. Ergonomics is a major driver, as Workplace Safety and Prevention Services data highlights musculoskeletal disorders as a leading cost driver, surging the adoption of footwear designed for all-day comfort and injury prevention. Alignment with Canada’s 2030 Emissions Reduction Plan is also creating demand for environmentally preferable PPE with manufacturers focusing mainly on durable, repairable designs and circular supply chains to meet corporate and public sector procurement policies.

Key Protective Footwear Market Players:

- Honeywell International Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- 3M (U.S.)

- COFRA S.r.l. (Italy)

- Würth Modyf GmbH & Co. KG (Germany)

- Uvex Group (Germany)

- Elten GmbH (Germany)

- Delta Plus Group (France)

- Bata Industrials (part of Bata Corporation, Switzerland/Global)

- Ansell Limited (Australia)

- Jallatte SAS (France)

- Rahman Group (Bangladesh/Global)

- Oftenrich Holdings Group Co., Ltd. (Hunan) (China)

- Viking Footwear AS (Norway)

- Dunlop Boots (UK)

- YOTSUGI Co., Ltd. (Jallatte Japan) (Japan)

- Liberty Shoes Limited (India)

- MKU Limited (India)

- Korea Safety Shoes Co., Ltd. (South Korea)

- Safetyware Group Bhd (Malaysia)

- Mapa Professional (France)

- Honeywell International Inc. is a dominant player in the protective footwear market and is using its vast industrial safety ecosystem. Its strategy revolves around integrated safety solutions connecting smart footwear with other PPE and workplace hazard monitoring systems. By investing in advanced material science for lighter, stronger toe caps and ergonomic design, the company positions its footwear as a vital node in the market.

- 3M applies its core competency in materials innovation directly to the protective footwear market. Its strategic initiative focuses on sub-brand leadership with products such as 3M rugged comfort safety footwear, emphasizing proprietary technologies in slip resistance, metatarsal protection, and anti-fatigue for quality comfort. In 2024, the company made a net sales of USD 11 billion in the safety and industrial segment.

- COFRA S.r.l., operating under the brands such as the Aktiv and Tecnica, adopts a strategy of vertical specialization and brand diversification within the protective footwear market. It targets specific high-risk sectors with technically advanced certified products while also offering durable value-oriented lines for broader industrial use. COFRA’s control over manufacturing and its focus on European norms and extreme weather conditions solidify its reputation for reliability.

- Wurth Modyf GmbH & Co. KG capitalizes on the unique B2B distribution model of its parent, the Wurth Group. Its strategy in the protective footwear market is centered on the direct integration into the industrial supply chain. By offering a wide range of footwear alongside tools, fasteners, and other MRO supplies via a massive field sales force, the company ensures high availability and brand loyalty.

- Uvex Group implements a strategy of total head-to-toe safety integration within the protective footwear market. It synergizes its footwear with its world-leading eye, face, and head protection lines, promoting unified safety standards and style. Uvex’s initiatives emphasize German engineering for comfort and performance, using extensive research to develop footwear that minimizes worker fatigue and increases compliance. In 2024, the company has witnessed a net sales of m€666 with a rise of 1.7% over the previous year.

Here is a list of key players operating in the global protective footwear market:

The global protective footwear market is very competitive and is dominated by the established players from North America and Europe, known for technological innovation and strict compliance with international safety standards. The main competitive strategies include product diversification beyond basic steel-toe caps into lightweight composite materials, ergonomic design, and footwear with integrated smart sensors for hazard monitoring. Strategic mergers and acquisitions are traditional ways to expand geographical reach and product ranges. For example, in September 2024, the Delta Plus Group, a key participant in the personal protective equipment market, will continue its regional development plan while expanding its position in high-value-added sectors. Further, companies are strengthening direct-to-end-user B2B sales and digital marketing to cater to major industrial sectors such as construction, oil and gas, and manufacturing, where the demand for specialized, comfortable, and high-performance safety footwear is continuously growing.

Corporate Landscape of the Protective Footwear Market:

Recent Developments

- In May 2025, A Canadian footwear brand, Baffin, presents DETOUR (Metatarsal Guard), a unisex safety boot that is designed specifically to offer maximum protection in mining applications and beyond.

- In April 2025, BASF & KPR King Power collaborate to launch a safety footwear made with a recycled polyurethane (PU) solution, Elastopan Loop, incorporating recycled PU materials.

- In February 2025, FootSecure, a leading healthcare start-up specializing in podiatric medicine and wound care has recently launched a custom footwear manufacturing unit in Bangalore, with the support of the Karnataka Institute of Endocrinology & Research.

- Report ID: 8297

- Published Date: Dec 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Protective Footwear Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.