Functional Apparel Market Outlook:

Functional Apparel Market size was valued at USD 452.8 billion in 2025 and is projected to reach USD 850.1 billion by the end of 2035, rising at a CAGR of 6.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of functional apparel is evaluated at USD 482.2 billion.

The functional apparel market is strongly shaped by institutional procurement, workforce safety mandates, and public sector spending on health defense and infrastructure. In the U.S., the federal and state agencies are the major buyers of performance-driven garments used by the military personnel, healthcare workers, emergency responders, and industrial labor forces. The U.S. military demand illustrates this stability. The Defense Logistics Agency procurement indicates a sustained uniform purchasing under the long-term contracts. The report from the DLA April 2025 depicts that the supply chain acts as anchor customers, supplying more than 8,000 items ranging from combat and service uniforms to footwear, undergarments, body armor, and fire-retardant workwear for all service branches and emergency responders. This activity material in value terms during 2024 DLA Troop Support C&T obligation about 1.88 billion dollars across key NAICS categories. This data highlights the scale of the institutional demand for performance-oriented garments.

DLA Troop Support Clothing & Textiles (2024)

|

NAICS Code |

NAICS Description |

NAICS Dollars Obligated (USD) |

|

– |

Grand Total DLA Troop Support Clothing & Textiles FY24 |

1,878,048,895 |

|

315210 |

Cut and Sew Apparel Contractors |

624,305,296 |

|

315990 |

Apparel Accessories and Other Apparel Manufacturing |

273,362,258 |

|

315220 |

Men's and Boys' Cut and Sew Apparel Manufacturing |

165,238,079 |

|

314910 |

Textile Bag and Canvas Mills |

139,673,116 |

|

315250 |

Cut and Sew Apparel Manufacturing (Except Contractors) |

101,003,795 |

|

316210 |

Footwear Manufacturing |

100,647,870 |

|

339999 |

All Other Miscellaneous Manufacturing |

67,036,548 |

|

314999 |

All Other Miscellaneous Textile Product Mills |

49,346,946 |

|

339113 |

Surgical Appliance and Supplies Manufacturing |

43,130,204 |

|

711510 |

Independent Artists, Writers, and Performers |

43,111,646 |

Source: DLA April 2025

Further, the public sustainability policy and industrial standards are further reshaping the procurement criteria for the functional apparel suppliers. The U.S. Environmental Protection Agency highlights that the textile sector is among the most resource-intensive manufacturing industries, pushing the federal buyers to prioritize durability, reusability, and reduce the lifecycle waste in the apparel contracts. At a global level, the International Labor Organization report in July 2024 indicates that over 17.3% of workers are exposed to heat stress, reinforcing the long term institutional demand for performance-enhancing garments in both developed and emerging economies. Moreover, the WHO continues to emphasize the domestic manufacturing capacity for protective apparel as part of the national health security strategies.

Key Functional Apparel Market Insights Summary:

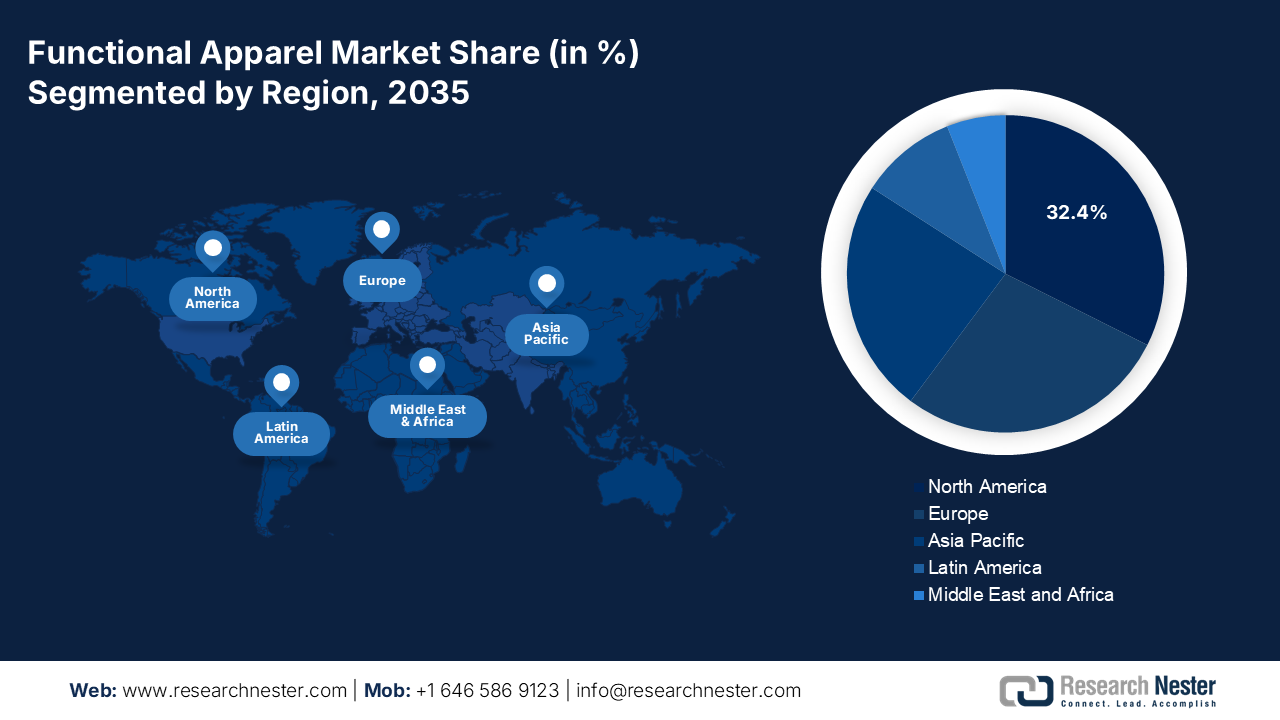

Regional Highlights:

- North America is projected to command a 32.4% share by 2035 in the functional apparel market, underpinned by high consumer spending, entrenched sports culture, and stringent workplace safety regulations.

- Asia Pacific is anticipated to expand at a CAGR of 7.4% during 2026–2035, supported by a growing middle-class base and rising participation in fitness and outdoor activities.

Segment Insights:

- The online/e-commerce sub segment is expected to capture a 55.4% share by 2035 in the functional apparel market, strengthened by the convenience of direct-to-consumer models offering higher margins and richer first-party data.

- The women’s sub segment holds the largest share over 2026–2035, influenced by rising female participation in athletics and sustained wellness-driven demand.

Key Growth Trends:

- Defense and military uniform procurement

- Aging demographics and healthcare workforce needs

Major Challenges:

- Complex supply chain and sourcing

- Consumer education and adoption hurdles

Key Players: VF Corporation, Nike, Inc., Columbia Sportswear Company, Under Armour, Inc., adidas AG, PUMA SE, Mammut Sports Group AG, Helly Hansen, Decathlon S.A., Salomon Group, ASICS Corporation, Mizuno Corporation, Goldwin Inc., Lululemon Athletica Inc., ANTA Sports Products Ltd., Li Ning Company Ltd., Kolon Sport, Toray Industries, Inc., Skora, Wildcraft

Global Functional Apparel Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 452.8 billion

- 2026 Market Size: USD 482.2 billion

- Projected Market Size: USD 850.1 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Vietnam, Indonesia, Brazil, Mexico

Last updated on : 19 December, 2025

Functional Apparel Market - Growth Drivers and Challenges

Growth Drivers

- Defense and military uniform procurement: The government defense budgets remain one of the most stable demand anchors for functional apparel market. The U.S. military procurement via the Defense Logistics Agency shows a sustained purchasing of the flame resistant weather adaptive nad performance uniforms. Further the DLA Troop Support for the clothing and textiles covering the uniforms, protective gear, and footwear. The multi-year contracts, such as the five-year flame resistance uniform program, are initiated to ensure the predictable volume demand and supplier capacity utilization. The NATO countries mirror this trend with the rising defense allocations linked to the readiness and modernization programs. The functional performance requirements, thermal regulations, durability, and compliance with the military standards drive the continuous replacement cycles. The report from the IISS in February 2025 has shown that the defense spending exceeded USD 2.46 trillion, with uniforms classified as essential consumable items. This positions defense procurement as a long-term structural driver rather than a cyclical one.

Defense Spending by Top 5 NATO Members Including Uniforms (2008 to 2024)

|

Country |

Defense Budget (USD billion) |

|

U.S. |

752 |

|

UK |

73.9 |

|

Germany |

67.4 |

|

France |

54.5 |

|

Italy |

30 |

Source: IISS February 2025

- Aging demographics and healthcare workforce needs: The demographic shifts towards the older population in developed nations drive the demand in two ways: increased need for functional adaptive clothing for seniors and a growing professional healthcare workforce requiring functional medical scrubs and uniforms. The government health agencies, such as the Administration for the community living in the U.S., address the needs of an aging population that includes the apparel solutions. Further, the expanding on the healthcare sector, a major employer, requires durable antimicrobial and comfortable uniforms, a demand reflected in the procurement contracts from the public hospital systems.

- Climate exposure, heat stress, and environmental conditions: Rising exposure to extreme heat, cold, and weather volatility is driving the institutional adoption of the climate adaptive apparel. The International Labor Organization in 2024 estimates that 231 million full-time workers are exposed to excessive heat, reducing productivity and increasing injury risk. Government labor agencies increasingly recognize heat stress as an occupational hazard, promoting the updated guidance and employer obligations. In the U.S., the hottest year has seen a demand for breathable moisture-managing workwear. The public employers of municipal services, utilities, and transport authorities are early adopters of the adaptive uniforms. The functional apparel addressing the thermal regulations and UV exposure is now treated as a preventive investment rather than optional equipment.

Challenges

- Complex supply chain and sourcing: Functional apparel market relies on the specialized often technical material and trims that are not commoditized. The new entrants struggle to secure a reliable cost-effective supplier at scale. the Ministry of Supply, a DTC brand has tackled this by developing its own temperature responsive suit fabric in house and then partnering closely with a limited number of specialized manufacturers to control the quality and production flow a complex and time intensive supply chain build out.

- Consumer education and adoption hurdles: Explaining the superior value of the technical features examples the phase change material, specific breathability metrics over the basic apparel requires significant marketing. The key players in the functional apparel market uses its funds and athlete led expectations to tangibly demonstrate product performance in extreme conditions building narrative driven credibility that justifies the premium pricing more effectively than the technical specs alone.

Functional Apparel Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 452.8 billion |

|

Forecast Year Market Size (2035) |

USD 850.1 billion |

|

Regional Scope |

|

Functional Apparel Market Segmentation:

Distribution Channel Segment Analysis

The online/e-commerce sub segment is dominating the distribution channel segment in the functional apparel market and is poised to hold the share value of 55.4% by 2035. The segment is driven by the convenience of the direct-to-consumer models that offer brands higher margins and valuable first-party data alongside robust omnichannel integration, such as the BOPIS. The shift is stimulated post-pandemic as consumers became accustomed to digital discovery and purchasing of specialized goods. This trend is supported by the strong government data. The report from the U.S. Census Bureau in August 2023 depicts that the total e-commerce sales in the second quarter of 2023 reached USD 277.6 billion, reflecting a YoY increase and a consistent quarterly growth pattern. This secular trend solidifies online as the primary platform for the high consideration purchase of the technical performance wear.

End user Segment Analysis

The women’s sub segment is the leading end user in the functional apparel market and holds the largest share value during the forecast period, 2026 to 2035. The segment is driven by the powerful socio-cultural and economic forces. The growth is fueled by the increasing female participation in athletics, sustained wellness trends, and significant brand investment in designing performance apparel specially for female biomechanics, moving beyond mere aesthetics. The demand spans sportswear, outdoor gear, and premium athleisure. The government statistics underscores this economic impact. The data from the IJNRD in 2024 has reported that 30.2% of women prefer to buy garments online. Further, rising female workforce participation and digital commerce adoption are reinforcing the spending power and access, promoting the brands and public health programs to aid the function-led women's apparel through targeted wellness initiatives and inclusive design standards.

Material Segment Analysis

Polyester remains the top subsegment in the material segment in the functional apparel market due to its unbeatable combination of performance, durability, and cost-effectiveness. Its engineered fibers excel in essential functional properties such as moisture-wicking, quick drying, and shape retention, making it the foundational fabric for most sportswear and activewear. While the sustainability concerns are driving the innovation in recycled variants, the virgin polyester supply from China's dominance persists. The government trade data illustrates this material scale. The report from the USITC in August 2024 has indicated that Indonesia has imported polyester staple fiber worth USD 126 million in 2023, highlighting the critical and embedded role in the global apparel manufacturing.

Our in-depth analysis of the functional apparel market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Material |

|

|

Technology |

|

|

End user |

|

|

Distribution Channel |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Functional Apparel Market - Regional Analysis

North America Market Insights

North America is dominating the functional apparel market and is poised to hold the market share of 32.4% by 2035. The market is driven by high consumer spending, a strong sports culture, and strong workplace safety regulations. The key trends include the dominance of e-commerce demand for sustainable and technical fabrics and the blurring of lines between performance and lifestyle wear. The functional apparel market is defined by innovation with significant R&D in smart procurement, which provides a stable B2B demand stream for protective and high-performance gear. Canada’s federal support for the outdoor recreation and cold climate industries further accelerates the demand for specialized apparel. The region's advanced retail logistics and high digital penetration further solidify its leading position, creating a mature ecosystem for both product innovation and consumer access.

The U.S. functional apparel market is defined by robust innovation and regulatory-driven demand. A key trend is the integration of smart textile technologies supported by the federal R&D funding via institutes such as the AFFOA. The demand is structurally supported by the mandatory occupational safety standards from the OSHA, ensuring a consistent B2B procurement of the protective apparel across industries such as utilities and construction. Further, a substantial and consistent department of defense spending on soldier clothing and individual equipment, as detailed in the annual budget documents, creates a high value performance-oriented procurement channel. On the other hand, the polyester staple fiber woven fabrics are a core input material used in functional apparel such as workwear, military uniforms, healthcare garments, sportswear, and protective clothing. According to the OEC report in 2023 U.S. has imported USD 7.34 million of woven fabric polyester staple fibers, making it relevant for supply-chain, trade, and demand-side functional apparel market analysis.

The functional apparel market in Canada is shaped by the climate and a strong outdoor recreation system. The demand is driven by the need for advanced technical apparel for the harsh winter conditions and activities such as skiing, hiking, and camping, supported by the federal investments in the parks and recreational infrastructure via Parks Canada. Further, the wool apparel, cotton or man-made fibre apparel, fabrics, and spun yarn represent the raw materials and intermediate inputs used in the production of the functional apparel, such as workwear, protective clothing, uniforms, and performance garments. The report from Global Affairs Canada in December 2025 depicts that 364,515 SME units of wool apparel are imported from Mexico, representing 52% utilization of the negotiated import level, compared with 40% in the previous year, indicating rising inbound reliance on specialty wool garments used in cold-weather workwear and uniforms.

Import Apparel Utilization Data

|

Unit |

Product Description |

Negotiated Level |

Utilization (Year to Date) |

Current Year (%) |

Previous Year (%) |

|

SME |

Wool Apparel (Import) |

700,000 |

364,515 |

52% |

40% |

|

SME |

Cotton or Man-Made Fiber Apparel (Import) |

20,000,000 |

755,369 |

4% |

11% |

|

SME |

Cotton or Man-Made Fiber Fabrics and Made-Up Goods (Import) |

15,000,000 |

0 |

0% |

0% |

|

KGM |

Cotton or Man Made Fiber Spun Yarn (Import) |

1,000,000 |

10,082 |

1% |

3% |

Source: Global Affairs Canada December 2025

APAC Market Insights

Asia Pacific is the fastest growing functional apparel market and is expected to grow at a CAGR of 7.4% during the forecast period 2026 to 2035. The market is driven by the expanding middle class population and increasing participation in fitness and outdoor activities. The key growth include the heightened health awarness post pandemic and a strong government initiatives promoting sports. The functional apparel market is defined by a powerful manufacturing ecosystem enabling innovaiton and competitive pricing. A dominant trend is the seamless integration of the e-commerce and socal commerce platforms with th edigital first brands and the live shopping revolutionizing retail. Furhter the athleisure into everyday wear and a growing emphasis on the sustainable and technically advanced materials are shaping the consumer preferences. The region is further driven by the mass market expansion and increasing formal workplace adoption of the functional business causual wear.

The functional apparel market in China is propelled by the massive domestic demand, government led fitness campaigns, and the rise of the Guochao nationalism, favoring local brands such as the ANTA and Li Ning. The state is actively promoting the sports industry as a strategic economic pillar. The report from the State Council Information Office in December 2025 has predicted that the national per capita consumption expenditure on sports and recreation grew by 11.1% in 2024, reflecting the sustained investment in active lifestyles. This growth is further fueled by the country’s dominant position as the global textile manufacturing hub, enabling rapid innovation and scaling of technical fabrics. The market is defined by a highly integrated digital ecosystem, where e-commerce and social commerce platforms like Tmall and Douyin are primary sales and discovery channels, driving both mass-market and premium segments.

Japan’s market is mature and advanced in the functional apparel market and is driven by technological innovation, a premiumization trend, and the needs of an aging demographic seeking health-focused apparel. The demand is underpinned by a deep-rooted outdoor culture and a society with a high discretionary spending on quality and specialized gear. The government initiatives promoting sports across all age groups support a steady demand. According to JSPIN statistics from August 2023, 72.9% of individuals participated in sports and other physical activities in 2022. This stable, engaged user base aids a high-value market for technical outdoor wear, smart textiles, and advanced functional materials from domestic leaders like Goldwin and Descente.

Europe Market Insights

The functional apparelmarket in Europe is expanding rapidly and is defined by the high consumer spending power, a strong outdoor sports culture, and robust regulatory frameworks. The key drivers include the deep integration of sustainability into the product design, driven by the Eu’s Green Deal and Circular Economy Action Plan that pushes for eco-friendly materials and production. The market also benefits from the innovation in smart textiles and technical fabrics, aided by initiatives such as the European Smart Textiles Alliance. There is a strong demand for the premium versatile apparel that links performance and every data lifestyle wear. The growth is further supported by the digitalization, with e-commerce being a dominant sales channel, and by rising health consciousness post pandemic that has sustained demand for the activewear.

Germany’s functional apparel market is the largest in Europe and is driven by the consumer purchasing power, a deep-seated appreciation for the technical quality, and a widespread organized sports culture via clubs. The demand is consistently strong for th ehigh performance outdoor cycling and fitness apparel. The sustainability s a vital purchasing factor stimulated by the government policies promoting a circular economy. A key statistic highlighting the robust consumer economy underpinning this functional apparel market is the growth in the retail trade in sports equipment games and toys. The report from the Federal Ministry for the Environment, Climate Action, Nature Conservation, and Nuclear Safety in January 2023 states that Germany has witnessed 53 million tourists in National Parks annually, which directly supports demand for functional apparel, including outdoor jackets, thermal wear, moisture-management clothing, hiking apparel, and weather-resistant garments.

The functional apparel market in the UK is defined by a powerful blend of globally influential fashion, a strong outdoor heritage, and the pervasive athleisure trend. The demand is driven by the high participation in running, gym fitness, and hiking, aided by the public health campaigns and digital fitness platforms. The government’s role is significant for example, Sport England data in April 2024 depicts that the Uniting the Movement strategy invests over £250 million of public and lottery funding to tackle the inequities in sports participation, directly stimulating the demand for sportswear. A clear market indicator is the sustained growth in online sales, with non store retailing sector seeing an increase in sales volume as reported by the Office for the National Statistics, underscoring the critical digital channel for functional apparel.

Key Functional Apparel Market Players:

- VF Corporation (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nike, Inc. (U.S.)

- Columbia Sportswear Company (U.S.)

- Under Armour, Inc. (U.S.)

- adidas AG (Germany)

- PUMA SE (Germany)

- Mammut Sports Group AG (Switzerland)

- Helly Hansen (Norway)

- Decathlon S.A. (France)

- Salomon Group (France)

- ASICS Corporation (Japan)

- Mizuno Corporation (Japan)

- Goldwin Inc. (Japan)

- Lululemon Athletica Inc. (Canada)

- ANTA Sports Products Ltd. (China)

- Li Ning Company Ltd. (China)

- Kolon Sport (South Korea)

- Toray Industries, Inc. (Japan)

- Skora (Australia)

- Wildcraft (India)

- VF Corporation is a global giant in the functional apparel market and is strategically driving the growth via its portfolio of powerful outdoor and activity-based brands such as The North Face and Smartwool. Its key initiative involves leveraging the consumer data from its DTC channels to inform the design of the technically advanced apparel for the specific environments, from alpine climbing to urban exploration, while heavily investing in sustainable materials to meet the functional apparel market demands. As per the annual report in 2025, the operating income of the company has increased by 18%.

- Nike, Inc dominates the functional apparel market via a relentless focus on performance innovation and digital integration. The company's strategic initiatives include developing proprietary technical fabrics such as the Dri-FIT and AeroSwift, and embedding connectivity via its Nike Fit Technology. This transforms apparel into a data-gathering platform linking physical performance to the digital ecosystem to enhance the athlete training and consumer engagement. The annual report 2024 states that the company has earned revenue of USD 51.4 billion in 2024.

- Columbia Sportswear Company competes in the core functional apparel market by specializing in accessible technology-driven outdoor gear. The company's strategic advancement is based on patenting and scaling its proprietary Omni Heat thermal reflective and Omni Tech waterproof technologies across the mass market price points. This democratizes a high performance features, making functional apparel for harsh weather conditions available to a broad consumer base.

- Under Armour Inc has carved a distinct niche in the functional apparel market by emphasizing athletic performance and moisture management with its UA Tech fabric suite. Its key strategic initiative is the creation of the connected fitness ecosystem, such as the MapMyRun platform, where the data from the wearable devices can be synced with a user’s functional apparel regimen to provide holistic health and performance analytics.

- Adidas AG is a leading innovator in the functional apparel market, strategically merging sport performance with sustainability. Its initiatives are highlighted by the partnerships with the material science firms to develop high-tech fabrics such as Primegreen and by integrating wearable sensor technology, such as its partnership with NURVV, directly into the apparel and footwear to provide real-time biomechanical feedback to athletes.

Here is a list of key players operating in the global functional apparel market:

The global functional apparel market is intensely competitive and is dominated by the established U.S. and EU sportswear giants alongside specialist Japan and emerging players from Asia. The key strategies revolve around the technological innovation in fabrics and sustainability, with heavy investment in R&D often via partnerships with the material scientists, such as Toray. The direct-to-consumer channels and digital marketing are vital for brand building and margin growth. Further, the strategic acquisitions allow the key players to enter the niche segments while regional players leverage local market expertise and cost advantages to solidify their positions. For example, in July 2022, Essity, a hygiene and health company, announced the acquisition of Modibodi, which is a leading leakproof apparel company in Australia, New Zealand, and the UK. The aim of the acquisition is that Essity will strengthen its position in leakproof apparel, the fastest growing product segment in intimate hygiene, which includes feminine care and incontinence products.

Corporate Landscape of the Functional Apparel Market:

Recent Developments

- In February 2025, Polygiene Group is expanding its portfolio with the introduction of Polygiene StayCool, which is an innovative cooling technology for textiles. This expansion complements the company’s existing offering in odor control and responds to the strong market demand for functional textiles with enhanced comfort.

- In November 2024, UNIQLO, the Japanese global apparel retailer has announced the opening of its largest store in Mumbai at Phoenix Palladium Mall and Pacific Mall Tagore Garden. Both stores will provide a complete range of LifeWear: high-quality, thoughtfully designed, and functional clothing that is designed to make everyone's life better.

- In September 2024, JCPenney announced the Jamey Perry for JCPenney, a new limited-time collaboration featuring fashionable and functional apparel for women using wheelchairs. The exclusive collection is launched during the Fashion Revolution show during the New York Fashion Week.

- Report ID: 2727

- Published Date: Dec 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Functional Apparel Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.