Conductive Textiles Market Outlook:

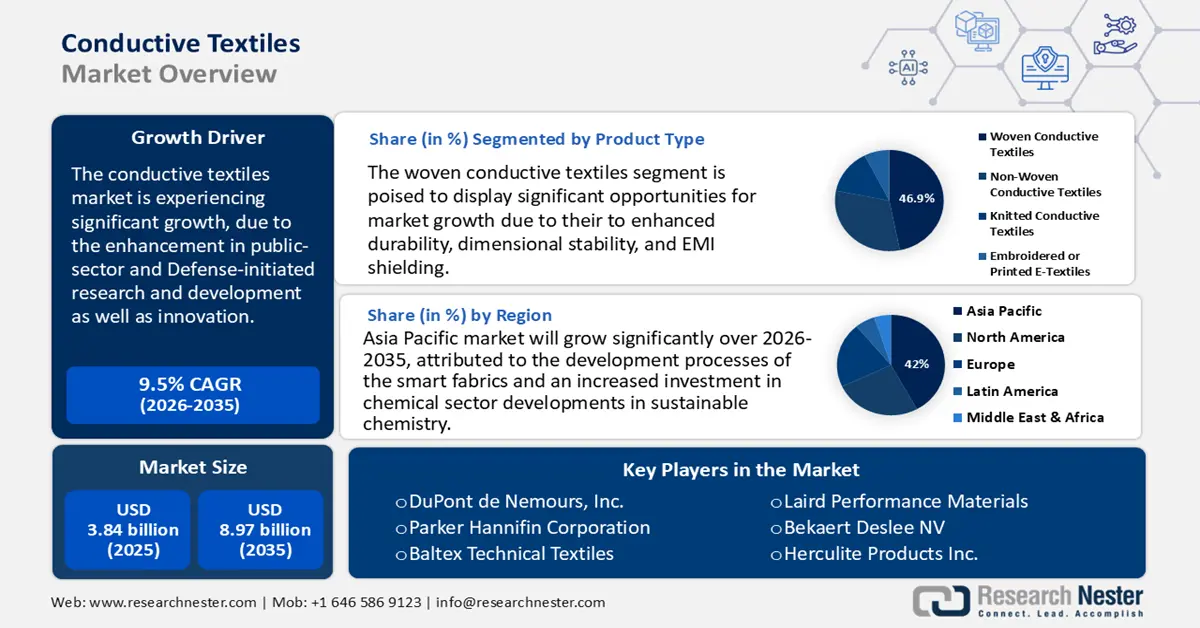

Conductive Textiles Market size was valued at USD 3.84 billion in 2025 and is projected to reach USD 8.97 billion by the end of 2035, rising at a CAGR of 9.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of conductive textiles is assessed at USD 3.99 billion.

The conductive textiles market is projected to grow with an upward trend, primarily driven by the enhancement in public-sector and defense-initiated research and development, as well as innovation. The Advanced Functional Fabrics of America (AFFOA) set up PPE testing infrastructure and down-selected and facilitated six contracts totaling more than $10 million for regional PPE companies. Constant innovation in conductive fabrics has been supported by such government-backed programs and used across healthcare, defense, and industrial monitoring. In India, the Mega Integrated Textile Region and Apparel (PM-MITRA) parks were started by the government with an outlay of 4,445 crore, to cluster all the spinning, weaving, processing, and finishing units. Such publicly funded infrastructure enhances the efficiency and scaling of the domestic supply chains to support superior fabric production, including conductive textiles. The convergence of multi-million-dollar state-driven textile plans and innovation centres is indicative of the increasing awareness of conductive textiles as a significant area of national industrial policy. Such projects build up localized manufacturing ecosystems and also enhance the technological, addressing both the public procurement and the industrial needs of the private sector.

The data indicated by the government further demonstrates ongoing growth in the area of textiles and technical fabrics trade, integral to the supply chains. Between 2020 and 2021, the value of domestic textile and clothing product exports from the United States increased by $2.7 billion, or 18.5%, to $17.4 billion. In addition, bilateral trade in fibers, yarns, and fabrics is monitored by the USDA Economic Research Service, showing significant cross-border movement of raw materials such as polyester and nylon, blended into fibers with a high degree of conductive properties, used to make fabrics. This movement sustains global assembly shops and textile finishing centers, especially in countries having in-built infrastructure like India and the U.S. Trade statistics indicate that there is an increase in transactional activity, which implies an upward shift in demand and the movement of costs. Ongoing substantial investments in textile industrial parks, which include infrastructural facilities such as logistics and utility networks, support the capacity building to both local and export markets. R&D and production expansion directed by the Government, streamlined customs procedures, and trade liberalization further contribute to the enhanced competitiveness of conductive textiles in the global supply and demand cycles.

Key Conductive Textiles Market Insights Summary:

Regional Insights:

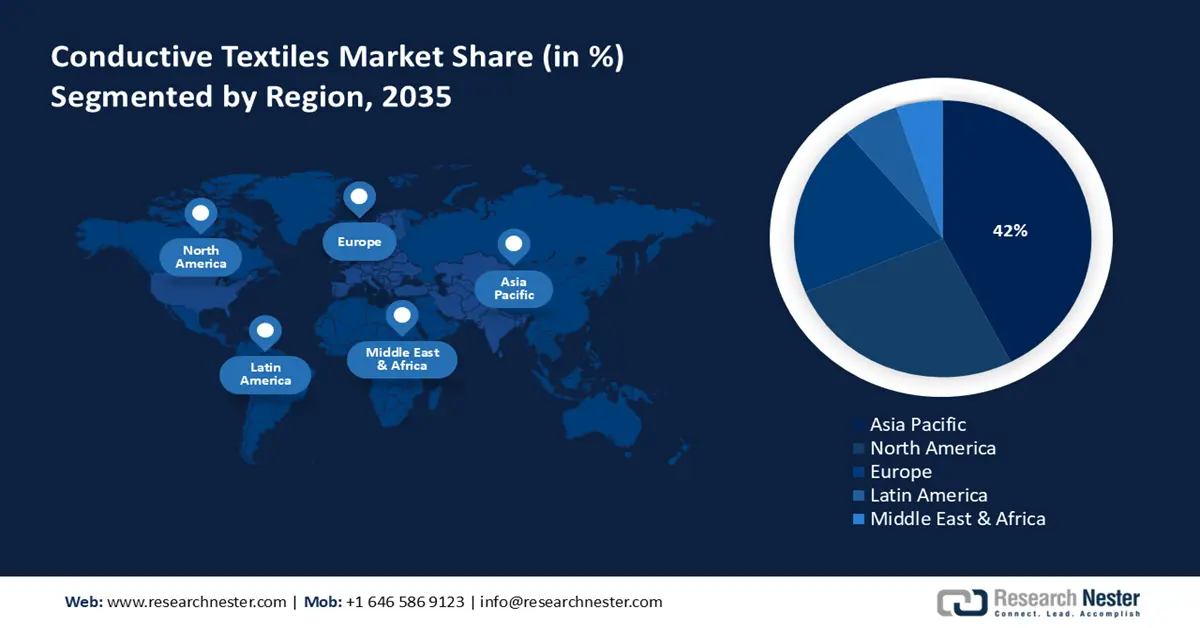

- The Asia Pacific region is anticipated to command a dominant 42% revenue share in the Conductive Textiles Market by 2035, fueled by advancements in smart fabric development and heightened investments in sustainable chemical processing.

- North America is projected to capture a 26% revenue share by 2035, supported by rapid industrialization and increased government investment in advanced material innovation.

Segment Insights:

- Woven conductive textiles segment in the Conductive Textiles Market is projected to account for a significant 46.9% share by 2034, propelled by enhanced durability, dimensional stability, and EMI shielding.

- The nylon segment is anticipated to hold a 41.8% revenue share by 2034, driven by its superior flexibility, tensile strength, and adaptability to multiple coating technologies.

Key Growth Trends:

- Green chemicals market dynamics

- European Green Deal industrial strategy

Major Challenges:

- Tariff escalation and access limits of the market

- OECD divergence and inconsistent lab practices

Key Players: DuPont de Nemours, Inc., Parker Hannifin Corporation, Baltex Technical Textiles, Laird Performance Materials (DuPont), Bekaert Deslee NV, Herculite Products Inc., Swicofil AG, Kolon Glotech, Inc., Asahi Kasei Corporation, SRF Limited, Texchem Resources Berhad, Toray Industries, Inc., Mitsufuji Corporation.

Global Conductive Textiles Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.84 billion

- 2026 Market Size: USD 3.99 billion

- Projected Market Size: USD 8.97 billion by 2035

- Growth Forecasts: 9.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 11 September, 2025

Conductive Textiles Market - Growth Drivers and Challenges

Growth Drivers

- Green chemicals market dynamics: The increase in the use of bio-based solvents, conductive polymers, and environmentally friendly additives is transforming the chemical inputs into conductive textiles. Additionally, there is a shift towards sustainable formulation in manufacturers due to growing environmental compliance needs and consumer preferences to have green alternatives, resulting in the increased development of low-emitting and biodegradable coatings in the application of conductive textiles in various sectors such as healthcare and defense.

- European Green Deal industrial strategy: The European Green Deal and the circular economy action plan call for a process that reduces carbon emissions in chemicals used in the textiles industry. Green investment by 2030 is projected to reach about 350 billion Euros annually to support sustainable businesses. The focus of the directive is on lowering harmful chemical use, increasing the use of recycled and renewable materials in production cycles. With the EU’s new regulations in effect, conductive textile manufacturers must pay particular attention to low-carbon coatings and energy-efficient synthesis methods, along with the costs, to comply with the regulations most cost-effectively.

- Catalytic innovation & chemical recycling: Innovations and developments in catalyst technology have allowed greener synthesis in conductive agents and metal-based coatings, an increase in the reaction yield, and to minimize the energy consumption. These advancements reduce operational expenses and enable the transition to a closed-loop chemical production. High-value conductive polymers that are recycled through catalytic depolymerization and chemical recycling help in reducing the dependency on raw materials. This consequently provides the producers with economic, as well as sustainability benefits on their lines of conductive textiles.

Trade Data in the High Tenacity Yarn of Nylon or Other Polyamides

High tenacity yarn of nylon or other polyamides is playing a crucial role in driving the conductive textile market. Its excellent strength, durability, and abrasion resistance make it an ideal base material for integrating conductive fibers or coatings. The yarn’s flexibility allows for easy blending with metals, carbon, or conductive polymers, enabling the production of lightweight and high-performance conductive fabrics. These properties support growing demand in wearable electronics, smart textiles, defense, aerospace, and automotive applications, where both mechanical robustness and reliable conductivity are critical.

Top Exporters of High Tenacity Yarn of Nylon or Other Polyamides in 2023

|

Reporter (Exporting Country/Entity) |

Export Value (USD thousands) |

Quantity (Kg) |

|

China |

452,122.84 |

114,133,000 |

|

Netherlands |

363,097.52 |

19,218,100 |

|

European Union |

308,733.66 |

- |

|

United States |

202,432.10 |

16,777,500 |

|

Korea, Rep. |

200,904.69 |

10,469,100 |

|

Japan |

166,597.16 |

27,513,700 |

|

Canada |

152,326.62 |

27,889,900 |

|

Vietnam |

104,246.51 |

20,183,000 |

|

Turkey |

95,178.30 |

17,611,300 |

|

Belgium |

93,882.41 |

3,429,660 |

Sources: WITS

Challenges

- Tariff escalation and access limits of the market: In 2025, the U.S. has set high tariffs up to 10% additional tariff against imports from China. This has had a serious influence on the supply chain in Asia to North America, on conductive textile sharp increase in the input costs. Several Asian manufacturers have come out of the American market, leading to a decrease in competitive supplies. The U.S. faced a decline in chemical imports by 10.5% in 2024, particularly in specialized materials that apply conductive textiles. The decreased flexibility in the supply chain has prompted North American buyers to switch to more extensive domestic alternatives. Such tariffs have established a long-term pressure on the pricing of conductive textile chemical integration in both the electronics and the medical textile applications.

- OECD divergence and inconsistent lab practices: Within the OECD Mutual Acceptance of Data (MAD) system, only 37 countries are officially enrolled, and the recognition of regulatory controls on the use of data to accept data in chemical tests remains fragmented. Failure to comply with the requirements of GLP in emerging economies results in repeated toxicity or performance trials, adding approximately 23 weeks to the time of approval and extra costs in validation costs. The non-OECD laboratories produce conductive textile chemistry that is rejected or slowed down in high-value markets such as the EU and the U.S. For instance, with the non-alignment to OECD GLP standards in 2022, submissions of more than 159 Southeast Asia chemicals had to be resubmitted. This deviation is a hindrance to both global trade as well as the research and development cooperation in the conductive textiles area.

Conductive Textiles Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.5% |

|

Base Year Market Size (2025) |

USD 3.84 billion |

|

Forecast Year Market Size (2035) |

USD 8.97 billion |

|

Regional Scope |

|

Conductive Textiles Market Segmentation:

Product Type Analysis

Woven conductive textiles are projected to rise at a significant share of 46.9% during the projected years, attributed to enhanced durability, dimensional stability, and EMI shielding. These fabrics are mainly utilized in military uniforms, industrial work clothes, and also in advanced medical attire. Structured weave enables these fibers to be applied precisely as conductive fibers, and they can perform in high-load and high-wear applications. Demand is also backed by global defense modernization schemes and industry safety regulations. The woven textiles are projected to rise to a CAGR of 5.3% from 2025-2034, with the Asia-Pacific being the production leader with more than 38% of the total output in 2024.

Fabric Type Analysis

Nylon segment is expected to grow at a steady pace with the revenue share of 41.8%, over the forecast years, owing to its superior flexibility, robust tensile strength, and hence can be coated with a variety of technologies. The segment has a good demand in sportswear, healthcare monitoring fabric, and military equipment. The nylon-made conductive textiles are highly washable and reusable, crucial for the business. Global manufacturing of nylon conductive cloth was more than 1.5 million m in 2023. The major consumption is in North America and Europe, and the major production is in the Asia-Pacific. The conductive textiles based on nylon are expected to expand annually by a compound growth rate of 4.8% by 2034.

Conductive Material Analysis

The metal-coated fiber segment held the revenue share of is expected to attain a revenue share of 34.6% in 2024, and is likely to grow substantially by 2034. This growth is driven by its conductivity, biocompatibility, and antimicrobial use, especially in medical, defense, and textile applications related to sensors. In 2023, over 58% of metal-coated fiber was used as Silver-coated fabrics alone. Adoption of these fibers has been enhanced due to increased demand for wearable biosensors, smart clothes, and personal protective devices. The segment is predicted to expand at a CAGR of 5.4% from 2025-2034 due to its strong R&D in silver-based nanocoating.

Our in-depth analysis of the conductive textiles market includes the following segment

| Segment | Subsegment |

|

Fabric Type |

|

|

Conductive Material |

|

|

Product Type |

|

|

End use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Conductive Textiles Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific region is expected to hold the dominant position in the conductive textiles market, growing at a revenue share of 42% during the projected years by 2035. The regional markets are highly concentrated in China, Japan, India, Malaysia, and South Korea, where the development processes of the smart fabrics and an increased investment in chemical sector developments in sustainable chemistry are established. In addition, the automotive, industrial safety, medical wearable, and electronics sectors are the key factors driving this growth. An important part of India's industrial and economic environment is the chemicals sector. The industry is expected to grow rapidly, reaching between $400 and 450 billion by 2030 and between $850 and 1,000 billion by 2040, from a market size of about $220 billion in 2023. In addition, new government initiatives like Malaysia Green Transition are speeding up the chemical processing sector's decarbonization to double the share of renewable energy in the electrical balance by 2035.

China is expected to dominate the APAC conductive textiles market by 2034 due to its large-scale manufacturing of chemicals and the modernization of industries that are being boosted by the government. Between 2018 and 2024, the country spent more than USD 299 billion on industrial modernization through the Made in China 2025 scheme. The chemical plants have saved 604,400 tons of coal equivalent yearly and reduction of 15.6 million tons in the volume of CO2 emissions as a result of energy-efficiency retrofits. By 2023, more than 1.1 million companies had sustainable processes for chemicals. High demand for smart fabrics in electronics and the automobile industries is reinforcing domestic market and export capacities. Investment and trade routes have been developing specialty chemicals as well as promoting China into the global supply chain.

The conductive textiles market in India is on the rise due to strong textile exports, rising defense spending, and the increase in the uptake of smart wearables. Government support for domestic manufacturing and innovation through Make in India and Production-Linked Incentive (PLI) schemes for technical textiles provides additional momentum to the conductive textiles market. Key growth areas include healthcare applications, especially in relation to patient monitoring and smart clothing.

India’s Textiles Trade in 2023

|

Exporting Country |

Value (USD) |

Importing Country |

Value (USD) |

|

United States |

9.71B |

China |

4.95B |

|

Bangladesh |

2.64B |

Bangladesh |

1.13B |

|

Germany |

2.03B |

Vietnam |

484M |

|

United Kingdom |

1.82B |

United States |

462M |

|

United Arab Emirates |

1.68B |

Indonesia |

292M |

Source: OEC

North America Market Insights

The conductive textiles market in North America is projected to grow at a revenue share of 26% by 2035 due to the expanding industrialization and the increasing investment in the development of new materials by the government. The notable level of investments in R&D and government funding for advanced materials enables more competitiveness in the market. The dominant presence of key players in North America and fiber-based textile manufacturing infrastructure further enhances market opportunities, as this region is a global leader in the development of conductive textiles.

The U.S. conductive textiles market already benefits from high demand as it pertains to defense, aerospace, healthcare, and sportswear uses. In the case of the U.S. market, strong government funding for prototypes for advanced defense wearable capabilities, alongside the rapid growth of smart fabrics in the consumer electronics market, supports market growth. U.S. exports of textiles and apparel grew by $2.7 billion (18.5%) to $17.4 billion in 2021. Apparel, fibers and yarns, miscellaneous textile products, and fabrics fueled the growth in the U.S. exported textiles and apparel sector. The two largest product groups exported were fabrics ($5.5 billion) and fibers and yarns ($4.0 billion), which accounted for more than one-half of all U.S. textile and apparel exports. The largest export destination markets for U.S. textiles and apparel were Mexico, Canada, and Honduras, which accounted for 57.2% of all U.S. textile and apparel exports in 2021.

Canada’s conductive textiles market is predicted to grow at a compound annual growth rate of 6.1% from 2025 to 2034, with market shares of about USD 1.3 billion by the end of the forecast period. The country has automotive and military industries to support demand, as well as the increasing pressure toward wearable protective gear in industrial workplaces. The government of Canada also invested USD 1.8 billion in clean technologies in 2023, which indirectly promoted smart textile development. The manufacturing is on a small scale; however, the gap is filled by imports from the U.S and Asia. The production of conductive fiber technologies on a pilot scale has also been promoted by national tax credits and R&D support through the Canada Clean Growth Program.

Europe Market Insights

The market in Europe is estimated to hold 21% market share due to its growing control of environmental laws, increased use of smart fabrics, and heavy industrial innovativeness. Increasing funding for medical textiles and e-textiles will increase their usage in the healthcare and fitness markets. Additionally, pro-active European Union public policies to promote the use of sustainable materials in textiles or the digitalization of textiles will support innovative activity. Europe is taking important steps in increasing connectivity between universities, start-ups, and legacy textile manufacturers, for greater collaborative innovation to develop multi-functional, lightweight, and sustainable conductive textiles.

Multiple or cabled yarn of polyesters Trade in 2023

|

Region/Country |

Export Value (USD thousands) |

Quantity (kg) |

|

United Kingdom |

554.84 |

24,261 |

|

Germany |

13,676.84 |

814,127 |

|

France |

1,153.70 |

95,846 |

|

Italy |

8,942.80 |

1,187,690 |

|

Spain |

2,748.13 |

605,599 |

Source: WITS

Key Conductive Textiles Market Players:

- DuPont de Nemours, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Parker Hannifin Corporation

- Baltex Technical Textiles

- Laird Performance Materials (DuPont)

- Bekaert Deslee NV

- Herculite Products Inc.

- Swicofil AG

- Kolon Glotech, Inc.

- Asahi Kasei Corporation

- SRF Limited

- Texchem Resources Berhad

- Toray Industries, Inc.

- Mitsufuji Corporation

The global market is characterized by the concentration of more than 41% of global revenue, generated by Japanese and American companies. Japanese firms like Toray, Seiren, and Teijin Frontier rule with their endurance in research and development, vertical design, and well-patented IP in the smart textile and electro-conductive fiber domain. Companies like DuPont and Laird are U.S.-based companies that have become larger-scale due to manufacturing and acquisitions in the wearable technology and defense industries. European firms work on eco-design as well as high-performance niche-oriented applications. India and Malaysia are cost-effective and growing in production due to trade agreements and increasing local buying. The current trends of global strategies include low-carbon processes, multi-functionality, and the level of compliance with REACH and EPA requirements.

Top Global Manufacturers in the Conductive Textiles Market

Recent Developments

- In September 2024, DOMO Chemicals unveiled its sustainable polyamide product line that was certified as environmentally friendly at the Fakuma 2024 trade fair and was tailored to conductive and thermal-management coating textiles. Circularity and low-carbon applications have been quickly embraced by the product line applied across European functional textile centers. In Q4 2024, the company has shown a market share growth of functional textiles by 16%, due to the thriving demand for sustainable conductive coatings. The launch links to the European decarbonization guidelines and the expanded B2B sustainability requirements.

- In June 2024, Asahi Kasei launched a proprietary high-ionic conductive electrolyte aimed at enhancing the conductivity and flexibility of textile-integrated electronics. Such a development is specifically intended for wearable sensor functions in the field of medicine. The launch resulted in a quarter-on-quarter increase of 12.5% in healthcare-related sales at the company, due to the rapid adoption of smart medical textiles. The product further enhances Asahi Kasei's strength in electro-conductive fabrics as the pool of demand for flexible biosensors continues to rise across the globe.

- Report ID: 8090

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Conductive Textiles Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.