Global Market Size, Forecast, and Trend Highlights Over 2025-2037

Temporary Power Market size was over USD 5.7 billion in 2024 and is anticipated to cross USD 18.33 billion by 2037, growing at more than 9.4% CAGR during the forecast period i.e., between 2025-2037. In the year 2025, the industry size of temporary power is estimated at USD 6.16 billion.

The growth of the market can be attributed to the increasing construction and infrastructure activities, and rising number of planned events, triggering a spiraling demand for efficient and faster needs of electricity across the world. Along with these, growing reliance on renewable energy sources coupled with escalating fuel prices, and imposition of strict emission standards globally are expected to auger well for the growth of the temporary power market in the upcoming years. According to the International Energy Agency, the global price of crude oil stood at a value of 0.2 USD per liter in the second quarter of 2020, which increased up to 0.3 USD per liter in the third quarter of the same year. Furthermore, rise in installation of hybrid, mobile and portable types of temporary power systems is projected to offer lucrative opportunities for market growth in the near future.

Temporary Power Sector: Growth Drivers and Challenges

Growth Drivers

- Increasing Construction and Infrastructure Activities Globally

- Rising Number of Planned Events

Challenges

- Expansion of Existing Grid Infrastructure

Temporary Power Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

9.4% |

|

Base Year Market Size (2024) |

USD 5.7 billion |

|

Forecast Year Market Size (2037) |

USD 18.33 billion |

|

Regional Scope |

|

Temporary Power Segmentation

The temporary power market is segmented by end user into utilities, commercial, industrial, and others, out of which, the utilities segment is anticipated to hold the largest share in the market. This can be accounted to the expanding population, along with rapid rate of urbanization and industrialization worldwide. Apart from these, aging power grid infrastructure in developed regions, and lack of electricity supply in developing nations are also predicted to contribute to the market segment’s growth in the future. Additionally, on the basis of power rating, the above 600 kw segment is assessed to acquire the most significant temporary power market share over the forecast period, which can be credited to the rise in demand for power generator with a range of 600 kw and above as these are used in a wide variety of applications ranging from utilities, oil and gas, to mining sectors.

Our in-depth analysis of the global market includes the following segments:

|

Fuel Type |

|

|

Power Rating |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

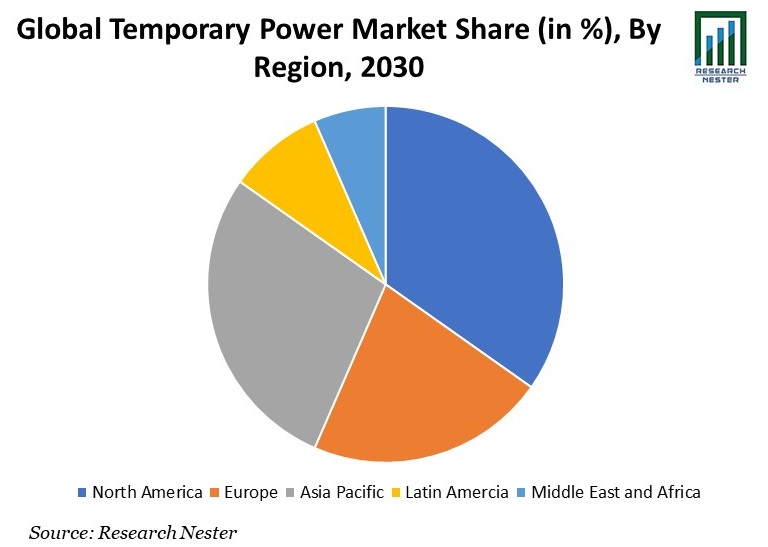

Temporary Power Industry - Regional Synopsis

On the basis of geographical analysis, the temporary power market is segmented into five major regions including North America, Europe, Asia Pacific, Latin America and the Middle East & Africa region. Asia Pacific industry is anticipated to hold largest revenue share by 2037, propelled by presence of poor grid infrastructure and low rate of electrification in the region. In addition, increasing number of planned events, especially in China, is also expected to propel the region’s market growth in the forthcoming years. Moreover, the market in North America is anticipated to grab the largest share during the forecast period ascribing to the intensifying power demand, growing adoption of temporary power in the United States and Canada, and strong presence of prominent temporary power market players in the region. As per the United States Energy Information Administration, in the U.S. total primary energy consumption was equal to almost 92.24 quadrillion Btu, in which the largest share of energy was generated by petroleum, accounting for about 35 percent of the total energy.

Companies Dominating the Temporary Power Landscape

- Cummins Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Aggreko plc

- APR Energy Ltd

- Caterpillar Inc.

- Kohler Co.

- Larson Electronics LLC

- Ashtead Group PLC.

- Speedy Hire PLC.

- United Rentals Inc.

- Hertz Equipment Rental Corporation

Recent Developments

-

May 2021- Kohler Power launched new clean energy line with the launch of KOHLER Power Reserve energy storage systems, which is another milestone in the company’s initiative to support sustainability innovations within the housing industry.

-

March 2021- Aggreko agreed to be taken over by private equity players I Squared Capital and TDR Equity Capital in a cash deal worth USD 2.68 billion.

- Report ID: 3635

- Published Date: Dec 24, 2024

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Temporary Power Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert