Power System Simulator Market Outlook:

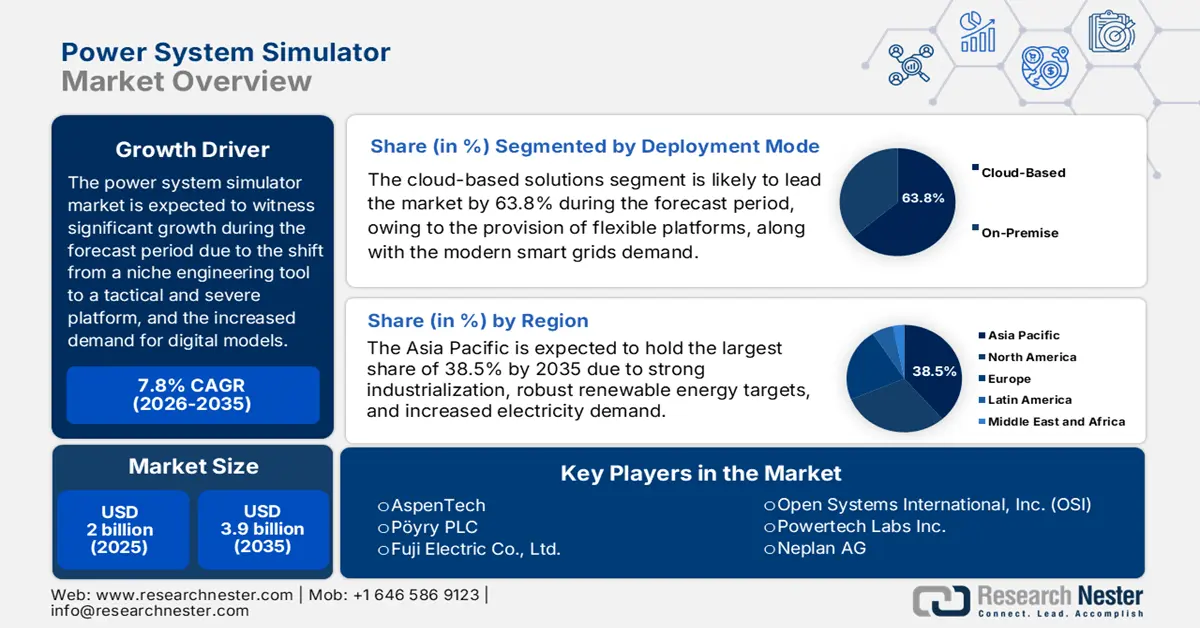

Power System Simulator Market size was over USD 2 billion in 2025 and is estimated to reach USD 3.9 billion by the end of 2035, expanding at a CAGR of 7.8% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of power system simulator is evaluated at USD 2.1 billion.

The international power system simulator market is currently experiencing a paradigm transition, evolving from a niche engineering tool into a strategic and critical platform that underpins the global energy shift. In addition, there is a huge demand for high-fidelity and digitalized models to ensure efficiency, security, and stability, which is also driving the market’s growth and expansion across different nations. According to an article published by the UNDP Organization in February 2025, fossil fuels continue to offer 80% of the global energy supply by releasing planet-warming gases, including methane and carbon dioxide, in the overall process. Besides, the present energy system is one of the major drivers of worldwide climate change, accounting for almost 75% of overall greenhouse gas emissions. Therefore, with the presence of the energy supply and continuous climatic modifications, there is a huge demand for the power system simulator market.

Furthermore, the shift to digital twin and cloud-driven SaaS platforms, integration of machine learning and artificial intelligence, real-time simulation, OT and IT convergence, growth of distributed energy resources (DER) and microgrid modeling, as well as emphasis on open data and interoperability models. As per a data report published by the IBEF Organization in January 2025, the SaaS sector in India is continuing to record a strong growth rate, accounting for approximately 30% on a year-over-year (YoY) basis. Besides, as stated in the August 2024 ICRIER Organization report, the international public cloud industry is projected to grow at a 24% rate, rising from USD 351.4 billion to USD 669.2 billion globally as of 2023. In addition, the SaaS technology accounted for almost 62% of the international revenue, which is followed by 20% in the case of IaaS and 18% for PaaS, thus bolstering the power system simulator market’s demand.

Key Power System Simulator Market Insights Summary:

Regional Highlights:

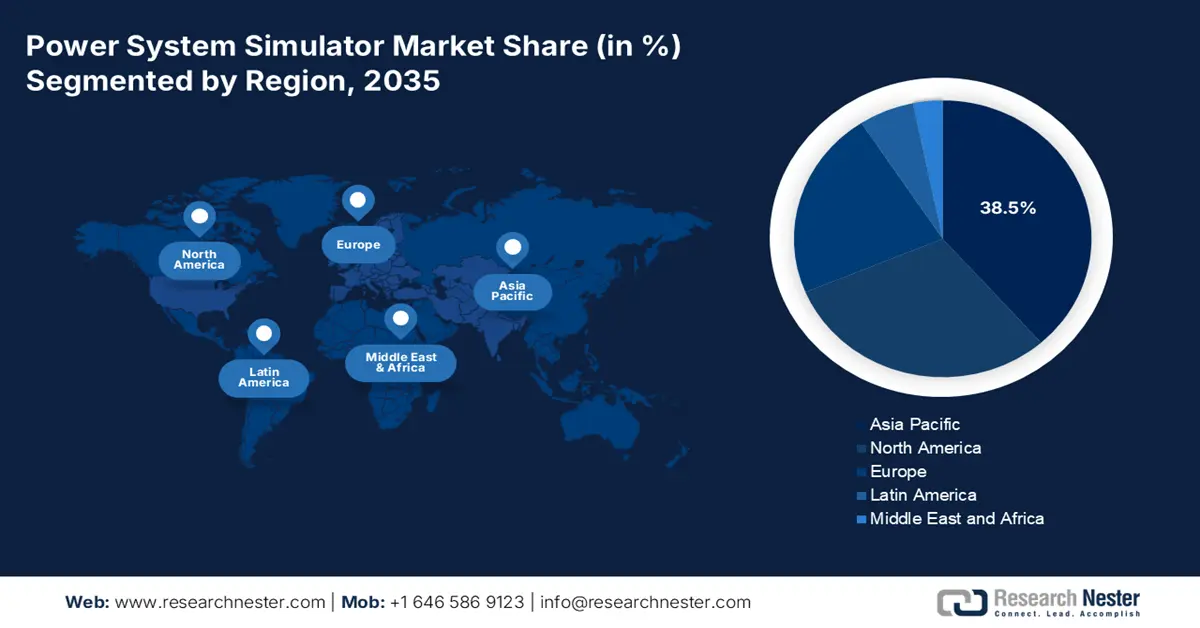

- By 2035, the Asia Pacific region in the power system simulator market is anticipated to command a 38.5% share, spurred by rapid industrial modernization, expanding renewable capacity, and accelerating electricity demand.

- Europe is projected to be the fastest-growing region by 2035, underpinned by escalating regulatory complexity and large-scale energy transition initiatives led by major grid-investment mandates.

Segment Insights:

- By 2035, the cloud-based solutions segment is projected to capture a 63.8% share in the power system simulator market, propelled by its scalable, cost-efficient architectures that meet the rising computational requirements of modern smart grids.

- The software and solutions segment is expected to hold the second-largest share by 2035, encouraged by the shift toward recurring software models and the adoption of digital-twin platforms enriched with advanced analytics.

Key Growth Trends:

- Escalating renewable energy integration

- Electrification of industry and transport

Major Challenges:

- Increased cost and demonstrable ROI for innovative features

- Acute shortage of specialized engineering talent

Key Players: Schneider Electric SE (France), Siemens AG (Germany), ETAP / Operation Technology, Inc. (U.S.), General Electric Company (U.S.), ABB Ltd. (Switzerland), Eaton Corporation plc (Ireland), Emerson Electric Co. (U.S.), RTDS Technologies Inc. (Canada), PowerWorld Corporation (U.S.), Nexant, Inc. (U.S.), DIgSILENT GmbH (Germany) (a part of Siemens), Open Systems International, Inc. (OSI) (U.S.), Powertech Labs Inc. (Canada), Neplan AG (Switzerland), Electrocon International Inc. (U.S.), CYME International (Canada) (a part of Eaton), AspenTech (U.S.), Pöyry PLC (Finland) (part of AFRY), Fuji Electric Co., Ltd. (Japan), Mitsubishi Electric Corporation (Japan).

Global Power System Simulator Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2 billion

- 2026 Market Size: USD 2.1 billion

- Projected Market Size: USD 3.9 billion by 2035

- Growth Forecasts: 7.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.5% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Saudi Arabia, Australia

Last updated on : 9 December, 2025

Power System Simulator Market - Growth Drivers and Challenges

Growth Drivers

- Escalating renewable energy integration: The huge influx of intermittent solar and wind generation has created complicated power quality and grid stability risks, which have mandated innovative dynamic and transient stability studies for safe grid operation. According to an article published by the IRENA Organization in 2025, the overall international renewable power generation capacity is expected to triple by the end of 2030, with the intention of reaching over 11,000 GW under IRENA’s 1.5-degree Celsius scenario. In addition, this also takes into consideration wind power and solar photovoltaic for nearly 90% of renewable energy capacity additions. Moreover, energy efficiency optimization also needs to double by the same year to remain intact on the 1.5-degree pathway, thereby boosting the power system simulator market globally.

- Electrification of industry and transport: The rapid integration of electric vehicles, along with the transition to electric arc furnaces and hydrogen electrolyzers in aggressive sectors, is placing localized and unprecedented demand on distribution grids. This has necessitated detailed load forecasting and infrastructure planning simulations, which have created a positive impact on the power system simulator market’s growth. As per an article published the IEA Organization in July 2023, the overall electricity share in finalized energy consumption is expected to increase the net net-zero emissions by the end of 2050 from 20% as of 2022 to more than 27% by the end of 2030. Furthermore, the ongoing electrical power accessories supply chain is also contributing a positive influence, which is catering to uplift the power system simulator market internationally.

2023 Electrical Power Accessories Export and Import

|

Countries |

Export (USD) |

Import (USD) |

|

Germany |

7.1 billion |

3.4 billion |

|

China |

6 billion |

- |

|

U.S. |

5.1 billion |

4.6 billion |

|

Mexico |

- |

4.2 billion |

|

Global Trade Valuation |

42.7 billion |

|

|

Global Trade Share |

0.1% |

|

|

Product Complexity |

0.7 |

|

|

Export Growth |

1.8% |

|

Source: OEC

- Increased focus on cybersecurity and grid resilience: The rise in cyber and physical threats, along with critical weather events, are readily compelling utilities to utilize simulators for vulnerability assessment. This leads to contingency planning and the creation of strong defense approaches for severe infrastructure, which are suitable for driving the power system simulator market. According to a data report published by the IEA Organization, in 2025, electricity utilization is expected to grow by 20% in the upcoming decade. Besides, reaching national objectives also caters to adding or refurbishing an overall of more than 80 million kilometers of grids by the end of 2040. Moreover, to cater to national climate targets, grid investment demands are expected to almost double by the end of 2030 to more than USD 600 billion per year, thus proliferating the power system simulator market’s growth.

Average Yearly Investment in Grids and Renewables by Regional Grouping (2016-2050)

|

Year |

Distribution of Advanced Economies (USD) |

Distribution EMDEs (USD) |

Renewables Advanced Economies (USD) |

Renewables EMDEs (USD) |

|

2016-2022 |

155 billion |

162 billion |

195 billion |

195 billion |

|

2023-2030 |

225 billion |

263 billion |

358 billion |

323 billion |

|

2031-2040 |

381 billion |

393 billion |

308 billion |

449 billion |

|

2041-2050 |

409 billion |

462 billion |

254 billion |

490 billion |

Source: IEA Organization

Challenges

- Increased cost and demonstrable ROI for innovative features: An increase in the upfront and ongoing expense of progressive simulation platforms, along with the difficulty in quantifying a clear return on investment (ROI), represents a major adoption barrier in the power system simulator market. While basic load flow software is commonplace, the licenses and specialized computing hardware needed for real-time simulation, high-fidelity electromagnetic transient (EMT) analysis, and cloud-based digital twin platforms represent a suitable capital expenditure. Therefore, justifying this particular expense needs proving that the software will combat expensive blackouts, improve capital deferral, and escalate interconnection studies, thus creating difficulty in attributing directly to the tool.

- Acute shortage of specialized engineering talent: The power system simulator market is critically restricted by an acute limitation of specialized power systems engineers with the expertise to develop, calibrate, and interpret complicated simulation models. Besides, this particular talent gap readily operates at different levels, including limitations in seasoned Ph.D.-based engineers, understanding the in-depth physics of modernized grids with power electronics, and the absence of mid-career professionals' proficiency in the newest software tools, along with a pipeline that frequently emphasizes theoretical concepts over practical and software-based modeling skills. This leads to organizations owning strong simulation tools but lacking the staff to utilize them to their complete potential.

Power System Simulator Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.8% |

|

Base Year Market Size (2025) |

USD 2 billion |

|

Forecast Year Market Size (2035) |

USD 3.9 billion |

|

Regional Scope |

|

Power System Simulator Market Segmentation:

Deployment Mode Segment Analysis

The cloud-based solutions segment, which is part of the deployment mode, is anticipated to garner the largest share of 63.8% in the power system simulating market by the end of 2035. The segment’s upliftment is highly attributed to its provision of flexible platforms, cost-effective, high-performance, which tend to handle the complicated computational demand for modernized smart grids. According to an article published by Energy Reports in November 2023, it has been predicted that by the end of 2030, 20% of the electricity in the U.S. will be derived from wind energy. Besides, the international second-life battery capacity is projected to reach an estimated 953 GW hours by the same year, which is readily possible through cloud computing. Therefore, the cloud computing technology is readily utilized to effectively manage power and various types of batteries, thereby proliferating the segment’s growth and development.

Offering Segment Analysis

Based on offering, the software and solutions segment is expected to cater to the second-largest share in the power system simulating power market during the forecast period. The segment’s growth is highly propelled by the fundamental transition from perpetual licenses for static and desktop-based engineering tools to recurring revenue models for dynamic and cloud-based software platforms. Besides, the value proposition has evolved from offering a single-point calculation tool to providing an integrated digital twin, which is a living virtual model of the physical grid continuously updated with real-time data from IoT sensors, SCADA, and GIS systems. This frequency is fueled by the demand for innovative analytics in grid modernization, wherein artificial intelligence (AI) and machine learning modules are currently embedded within software suites to perform predictive maintenance, optimize renewable energy dispatch, and automate complex stability studies.

End user Segment Analysis

By the end of 2035, the transmission and distribution (T&D) utilities sub-segment, part of the end user segment, is expected to account for the third-largest share in the power system simulator market. The sub-segment’s development is extremely propelled by its importance as the primary steward of grid reliability and faces unprecedented technical and regulatory pressures that make innovative simulation both beneficial and essential. Besides, the ultimate challenge is the increased integration of remote renewable generation, such as offshore wind farms and large-scale solar parks, requiring exhaustive stability studies to ensure the newest resources for destabilizing the interconnected system. Besides, in the case of distribution utilities, the revolution is at the grid edge, highly fueled by the proliferation of Distributed Energy Resources (DERs). This includes rooftop solar, home batteries, and electric vehicle charging clusters, thus boosting the segment’s growth.

Our in-depth analysis of the power system simulator market includes the following segments:

|

Segment |

Subsegments |

|

Deployment Mode |

|

|

Offering |

|

|

End user |

|

|

Grid Type |

|

|

Application |

|

|

Module |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Power System Simulator Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the power system simulator market is anticipated to garner the largest share of 38.5% by the end of 2035. The market’s upliftment in the region is primarily attributed to the heavy industrial modernization, strong renewable energy targets, and a huge demand growth for electricity. In addition, the presence of national net-zero commitments, such as India’s 2070 target and China’s 2060 objectives, has mandated unprecedented renewable integration into often-strained grids, smart power infrastructure, and rapid urbanization that demands reliability. According to an article published by the IEA Organization in September 2025, there has been a surge in the electricity demand in the overall region by over 7% as of 2024, which is almost double the international average, and is expected to further double by the end of 2050. Moreover, Southeast Asia specifically comprises approximately 20 terawatts of wind potential and untapped solar power, which is equivalent to almost 55 times the overall region’s present power capacity.

China in the power system simulator market is growing significantly due to the state-driven pace and sheer scale of its energy transition, which is encapsulated in the National Development and Reform Commission (NDRC)'s 14th Five-Year Plan for Modern Energy System. As per an article published by Climate Cooperation China in June 2022, the NDRC plan has set a 2025 target for the successful renewable electricity production of 33%, along with 18% for non-hydro renewable energy, in comparison to 28.8% of the renewable share and 11.4% for non-hydro in past years. In addition, the share of solar and wind electricity is further expected to increase by 1.4% by the end of 2030, making up almost 26% of the total power consumption. Therefore, this is rapid that the 13th FYP period, wherein the combined share of solar and wind, which grew from 5% to 10%, thus bolstering the power system simulator market’s demand.

India in the power system simulator market is also growing, owing to the acute grid modernization and explosive renewable energy ambitious needs. According to an article published by the Minister of Power in September 2023, the country’s government is set to gain 50% of the cumulative electric power installed electric power capacity from non-fossil fuel-driven energy resources by the end of 2030. Based on this target, transmission schemes are constituted for integrating 66.5 GW of renewable generation across different states, such as Tamil Nadu, Andhra Pradesh, Karnataka, Madhya Pradesh, Maharashtra, Gujarat, and Rajasthan. Besides, almost 33.3 GW of renewable generation is projected to be integrated into the ISTS grid, primarily through margins at different existing construction. Moreover, the continuous power transmission parts import and export from the country is also fueling the power system simulator market.

Power Transmission Parts Import and Export from India (2023)

|

Countries |

Import (USD) |

Export (USD) |

|

China |

130 million |

- |

|

Germany |

102 million |

64.2 million |

|

U.S. |

27.3 million |

138 million |

|

Italy |

23.2 million |

43.8 million |

|

South Korea |

7.1 million |

- |

|

UK |

- |

14.4 million |

|

Canada |

- |

14.1 million |

Source: OEC

Europe Market Insights

Europe in the power system simulator market is expected to emerge as the fastest-growing region during the forecast period. The market’s development is highly propelled by the complicated administrative landscape, which is gradually driving the sophisticated demand. In addition, the Europe Green Deal, along with the REPowerEU Plan, has mandated an increase and secure transition from fossil fuels. According to an article published by the Strategic Energy Europe in July 2025, the Europe Commission estimated that €584 billion is projected to be provided for grid investment by the end of 2030, while the Europe Court of Auditors projects that will be offered between €1.99 trillion and €2.29 trillion by the end of 2050. Besides, as per an article published by the UK Government in February 2024, the Net Zero Hydrogen Fund (NZHF), which is worth £240 million, is extremely suitable for deployment and development of the newest low-carbon hydrogen production to diminish lifetime expenses and de-risk investments.

Germany in the power system simulator market is gaining increased traction, owing to the unparalleled investment in hydrogen infrastructure and the presence of the massive energy transition industrial base. As per a report published by the U.S.-Germany Climate and Energy Partnership in June 2023, it is expected to increase the 2030 domestic electrolysis capacity target from 5 GW to almost 10 GW. This is possible by establishing diverse hydrogen supply, establishing sustainability standards, combating newest dependencies, and emerging as the technological partner for exporting nations. Besides, the 95 TWh to 130 TWh hydrogen demand has been targeted to be achieved by 2030, out of which 50% 70% are required to be met by imports from international nations, thereby denoting an optimistic outlook for the overall market’s growth as well as expansion in the country.

Spain in the power system simulator market is also developing due to the strong renewable energy rollout and corresponding grid modernization strategies. As per an article published by the ITA in July 2024, there has been a rise in temperatures, accounting for 3.5 degrees Celsius, as well as 2.7 degrees Celsius in minimum temperatures, particularly in the country’s main cities. Besides, the domestic Climate Change and Energy Transition Law has aimed for a 100% renewable electricity system, outlining the country’s long-lasting objective of gaining a decarbonized economy and climate neutrality by the end of 2050. In addition, 2030 targets comprise a 32% reduction in greenhouse gas emissions, leading to achieving 42% of renewable energy in finalized consumption, along with 74% of renewable electricity generation, thus proliferating the power system simulator market’s exposure.

North America Market Insights

North America in the power system simulator market is projected to witness considerable growth by the end of the stipulated period. The market’s growth in the region is highly driven by investment tailwinds, as well as the presence of the unparalleled regulatory system. For instance, according to an article published by the U.S. Department of Energy (DOE) in December 2024, the administrative body’s Office of Electricity (OE) declared the selection of 9 projects, which received USD 20 million through the Flexible Innovative Transformer Technologies (FITT) funding opportunity. The purpose is to make advancements in key components for assisting in modernizing the overall region’s grid. OE also notified that 8 projects of the Silicon Carbide (SiC) Packaging Prize Phase 1 to achieve USD 50,000 each. Besides, the overall USD 2.2 million funding is considered part of the America-Made Challenges Program, which fosters collaboration between the region’s innovators and entrepreneurs.

The U.S. in the power system simulator market is gaining increased exposure, owing to clean energy strategies, federal budget allocation, along with the presence of specific programs for driving the simulator demand. As per an article published by the World Resources Institute in March 2024, the U.S. Department of Energy (DOE) notified almost USD 6 billion of projects to effectively catalyze greenhouse gas reductions, particularly in energy-intensive heavy industries. In addition, the administrative body’s Office of Clean Energy Demonstrations (OCED) announced 33 commercial-scale projects across 20 states in the country, to significantly demonstrate the commercial and technical viability of decarbonization technologies. Therefore, with such investments and project availability, there is a huge growth opportunity as well as increased demand for the power system simulator market.

Canada in the power system simulator market is also growing due to the industrial decarbonization and electrification of resource industries, interprovincial transmission, national grid modernization, processing capacity, critical minerals strategy, hydrogen economy development, and the adoption of cybersecurity and CSA/NEE standards. As stated in the November 2024 Office of the Auditor General of Canada report, the federal budget generously allocated almost USD 3.8 billion for more than 8 years. The objective is to support the successful implementation of the Canada Critical Minerals Strategy. The strategy’s vision focuses on increasing the supply of sourced critical minerals and providing support in developing value chains of global and domestic critical minerals for a digitalized and green economy, thus bolstering the power system simulator market’s growth.

Key Power System Simulator Market Players:

- Schneider Electric SE (France)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens AG (Germany)

- ETAP / Operation Technology, Inc. (U.S.)

- General Electric Company (U.S.)

- ABB Ltd. (Switzerland)

- Eaton Corporation plc (Ireland)

- Emerson Electric Co. (U.S.)

- RTDS Technologies Inc. (Canada)

- PowerWorld Corporation (U.S.)

- Nexant, Inc. (U.S.)

- DIgSILENT GmbH (Germany) (a part of Siemens)

- Open Systems International, Inc. (OSI) (U.S.)

- Powertech Labs Inc. (Canada)

- Neplan AG (Switzerland)

- Electrocon International Inc. (U.S.)

- CYME International (Canada) (a part of Eaton)

- AspenTech (U.S.)

- Pöyry PLC (Finland) (part of AFRY)

- Fuji Electric Co., Ltd. (Japan)

- Mitsubishi Electric Corporation (Japan)

- Schneider Electric SE is regarded as the global leader in energy management and automation, with its EcoStruxure Power platform integrating innovative power system simulation for design, operation, and real-time control of electrical distribution networks. The organization's tactical acquisitions, such as ETAP, have solidified its dominance in offering wide-ranging and model-based digital twins for grid and industrial power system analysis. Besides, as per its 2024 annual report, the organization generated €38 billion in revenue, based on a 12% organic rise in energy management.

- Siemens AG has acquired DIgSILENT PowerFactory software and provides an in-depth integrated suite for power system simulation. Additionally, the company is renowned for its high-fidelity modeling of transmission grids, renewable integration, and large-scale industrial plants. Its approach focuses on developing a seamless digital thread from planning to operation, positioning its tools as critical for grid modernization and the energy transition.

- ETAP / Operation Technology, Inc. is widely recognized as the ultimate industry standard for electrical power system modeling and simulation software. Besides, the company provides an exceptionally comprehensive, all-in-one platform for design, analysis, real-time monitoring, and predictive simulation. Its in-depth arc flash, protection coordination, and renewable energy integration modeling make it indispensable for engineering consultants, utilities, and large-scale industrial facilities worldwide.

- General Electric Company’s grid solutions business offers sophisticated power system simulation software, preferably its PSLF and Positive Sequence Load Flow tools, which are increasingly utilized by major utilities for transmission planning, stability studies, and the integration of large-scale generation assets. The organization has leveraged its deep legacy in power generation equipment to deliver simulations with a high degree of accuracy for complex grid dynamics.

- ABB Ltd. is one of the key players in the power system simulation through its portfolio of electrification and automation solutions, including software, such as the ABB Ability Electrical Distribution Control System, which utilizes simulation for optimal grid management and resilience. The organization's strength remains in integrating simulation directly with its market-leading hardware to provide closed-loop and vendor-optimized solutions for utilities and industries.

Here is a list of key players operating in the global power system simulator market:

The worldwide power system simulator market is highly consolidated, with the presence of leaders, such as ETAP, Siemens, and Schneider Electric, collectively accounting for a dominating share. In addition, the competitive landscape is effectively defined by a tactical transition from selling standalone software to providing integrated digital twin platforms and cloud-based SaaS models. Moreover, notable players are strongly pursuing acquisitions to expand capability stacks and developing partnerships with cloud hyperscalers, including AWS and Microsoft Azure, to uplift scalability and analytics. Besides, in September 2024, the Energy Council of South Africa deliberately signed a Memorandum of Understanding (MoU) with Energy Exemplar for launching the Energy Data and Modelling South Africa (EDMSA). This creates the opportunity to develop and open engagement platform in South Africa for energy system data and modelling., thus proliferating the power system simulator market globally.

Corporate Landscape of the Power System Simulator Market:

Recent Developments

- In December 2025, Toshiba Energy Systems & Solutions Corporation has readily commercialized a standard gas-insulated busbar, which has completely diminished the utilization of sulfur hexafluoride (SF6), which is a highly potent greenhouse gas, and instead utilizes natural-origin gases.

- In July 2024, Rolls-Royce SMR has effectively enlisted GSE Solutions to create a standardized power station simulator since it continues to mature the Small Modular Reactor (SMR) design technology and also remains on track to significantly complete step 2 of the Generic Design Assessment.

- In January 2024, Gamma Technologies declared the development of an innovative methods team, known as GammaTech Engineering, along with acquiring Powertech Engineering S.r.l to enable industry innovators to deploy and develop innovative methods for complicated systems.

- Report ID: 8295

- Published Date: Dec 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Power System Simulator Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.