Power Transmission Component Market Outlook:

Power Transmission Component Market size was over USD 81.6 billion in 2025 and is estimated to reach USD 155.1 billion by the end of 2035, expanding at a CAGR of 7.4% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of power transmission component is evaluated at USD 87.6 billion.

The international power transmission component market is playing a critical role in ensuring dependable electricity delivery across residential, commercial, and industrial sectors. Additionally, there has been a rise in the demand for renewable energy sources, infrastructure transmission, and integrating variable generation. According to official statistics published by the IEA Organization in 2025, the international capacity is projected to be more than double by the end of 2030, deliberately increasing by 4,600 GW. In this regard, solar PV caters to nearly 80% of the worldwide increase, which is followed by geothermal, bioenergy, hydropower, and wind. Besides, across 80% of global nations, the renewable power capacity is predicted to increase rapidly between 2025 and 2030. Therefore, with an expected surge in the renewable electricity generation sources, there is a huge growth opportunity for the market globally.

Renewable Electricity Capacity Growth by Technology (2013-2030)

|

Source Type |

2013-2018 (GW) |

2019-2024 (GW) |

2025-2030 (GW) |

|

Solar PV |

438 |

1,622 |

3,546 |

|

Wind |

298 |

566 |

873 |

|

Hydropower |

205 |

138 |

154 |

|

Other |

52 |

48 |

32 |

|

Solar PV Share |

44% |

68% |

77% |

Source: IEA Organization

Furthermore, grid modernization initiatives, renewable energy integration, green and sustainable materials, smart monitoring, digitalization, as well as regional expansion are other drivers uplifting the power transmission component market internationally. Based on official statistics put forward by the IEA Organization in 2026, the Europe Commission expected nearly EUR 584 billion (USD 633 billion) of the overall investments in the regional electricity grid by the end of 2030. Additionally, EUR 170 billion (USD 184 billion) is expected to be allocated for digitalizing technologies, automated grid management, and smart meters for improving metering in the field operations. Likewise, China has planned to expand and modernize its own power grids with USD 442 billion in investments, while India introduced the INR 3.0 trillion (an estimated USD 38 billion) scheme to optimize distribution infrastructure and power distribution organizations, thereby making it suitable for bolstering the overall power transmission component market.

Key Power Transmission Component Market Insights Summary:

Regional Highlights:

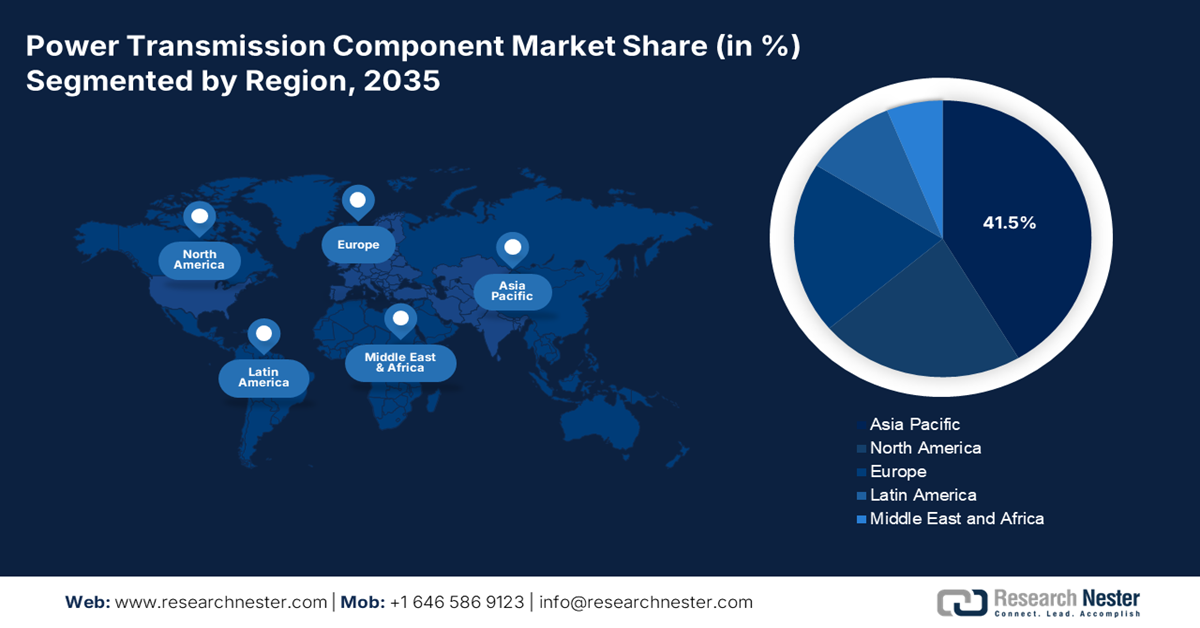

- By 2035, Asia Pacific is projected to command a dominant 41.5% share of the power transmission component market, underpinned by extensive grid modernization, accelerated renewable energy integration, and rapid electrification initiatives across major economies.

- Over the 2026–2035 forecast period, Europe is set to emerge as the fastest-growing region, stimulated by strong momentum in grid modernization, clean-tech manufacturing expansion, and rising foreign direct investment in wind and renewable infrastructure.

Segment Insights:

- By 2035, the >220 kV to ≤440 kV sub-segment within the transformers segment is projected to account for a leading 28.5% share in the power transmission component market, supported by its critical role in enabling long-distance bulk electricity transfer with reduced losses, accelerated by large-scale renewable energy integration into national and regional grids.

- During the 2026–2035 forecast period, the high voltage AC (HVAC) sub-segment under transmission lines and conductors is expected to secure the second-highest share, underpinned by its efficiency in economically transmitting power over moderate to long distances through voltage elevation that minimizes current and transmission losses.

Key Growth Trends:

- Rise in electricity demand

- Surge in government investments

Major Challenges

- Increase of capital expenses and financing gaps

- Supply chain disruptions and raw material volatility

Key Players:General Electric Company (U.S.), Eaton Corporation (U.S.), 3M Company (U.S.), Dow Inc. (U.S.), Siemens AG (Germany), BASF SE (Germany), Schneider Electric SE (France), ABB Ltd. (Switzerland), Arkema S.A. (France), Hitachi Chemical Co., Ltd. (Japan), Mitsubishi Electric Corporation (Japan), Sumitomo Electric Industries, Ltd. (Japan), LG Chem Ltd. (South Korea), Hyundai Electric & Energy Systems Co., Ltd. (South Korea), Tata Chemicals Limited (India), Reliance Industries Limited (India), Petronas Chemicals Group Berhad (Malaysia), Brambles Limited (Australia), Johnson Matthey Plc (UK), Solvay S.A. (Belgium)

Global Power Transmission Component Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 81.6 billion

- 2026 Market Size: USD 87.6 billion

- Projected Market Size: USD 155.1 billion by 2035

- Growth Forecasts: 7.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (41.5% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, France

- Emerging Countries: India, Spain, Canada, South Korea, Italy

Last updated on : 14 January, 2026

Power Transmission Component Market - Growth Drivers and Challenges

Growth Drivers

- Rise in electricity demand: The international electricity consumption is continuing to rise, owing to transport electrification, industrial growth, and urbanization. This has resulted in a direct increase in the need for transmission infrastructure, thus suitable for fueling the power transmission component market globally. According to official statistics published by Oxford Energy Organization in January 2025, projections demonstrate that the electricity consumption, especially in transport, can grow by 10% every year through 2050. Besides, electric vehicles (EVs) cater to 20% of the newest car sales globally, with China significantly leading this transformation. Besides, electrolyzers contributed 5 TWh to the international electricity demand as of 2023, thereby denoting a huge growth opportunity for the market.

- Surge in government investments: The aspect of large-scale funding under initiatives, such as China’s energy transition programs, Europe Green Deal, and the U.S. Infrastructure Investment and Jobs Act, are deliberately escalating transmission upgradation. Based on government data put forward by Invest India Grid in October 2025, India is regarded as one of the synchronized interconnected electricity grids globally, further spanning across 4,63,758 km of transmission lines, along with 11,56,105 MVA of transformation capacity. Additionally, with an outstanding 6.5% yearly growth, the country’s electricity grid is continuously rising. There has been a surge in the inter-regional transmission capacity from 35,950 MW to a standard 1,12,250 MW, thereby aligning with the accelerated electricity demand and generation, which is positively impacting the power transmission component market.

- Focus on technological innovation: Advancements in HVDC systems, GIS/AIS switchgear, and high-voltage transformers are significantly enabling long-distance transmission with minimal losses. Government report published by the PIB Government as of June 2025, the overall power capacity of India reached 476 GW in June 2025, with a drop in power shortages from 4.2% to 0.1% in the same year. In addition, more than 2.8 crore households have been electrified, with a surge in per capita electricity consumption by 45.8%. Besides, non-fossil fuel sources currently contribute 235.7 GW, which is 49% of the overall capacity, comprising 226.9 GW of renewable and 8.8 GW of nuclear. Meanwhile, the electricity generation has also increased from 1,168 billion units (BU) to approximately 1,824 BU between 2024 and 2025, thereby positively catering to the power transmission component market’s welfare.

Challenges

- Increase of capital expenses and financing gaps: One of the most significant challenges for the power transmission component market is the high upfront capital investment required for grid infrastructure projects. Transmission lines, transformers, GIS/AIS switchgear, and HVDC systems demand billions in funding, which can be prohibitive for developing economies. Financing barriers often delay projects, particularly in regions where utilities face liquidity constraints or where regulatory frameworks do not incentivize private investment. Even in advanced economies, securing long-term financing for large-scale transmission corridors is complex due to fluctuating interest rates and competing priorities for government budgets. This challenge is compounded by the need for specialized chemical inputs, such as insulating oils, epoxy resins, and SF6 alternatives, which add to costs due to stringent environmental compliance.

- Supply chain disruptions and raw material volatility: The power transmission component market is heavily dependent on raw materials such as steel, aluminum, copper, polymers, and specialty chemicals. Global supply chain disruptions exacerbated by geopolitical tensions, trade restrictions, and pandemic-related shocks have created volatility in both availability and pricing. For instance, copper prices surged in recent years due to supply shortages, directly impacting conductor and transformer manufacturing costs. Similarly, restrictions on fluorinated gases and polymers have disrupted the supply of insulating materials, forcing companies to seek alternatives at higher costs. These disruptions ripple across the industry, delaying project timelines and increasing procurement risks.

Power Transmission Component Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.4% |

|

Base Year Market Size (2025) |

USD 81.6 billion |

|

Forecast Year Market Size (2035) |

USD 155.1 billion |

|

Regional Scope |

|

Power Transmission Component Market Segmentation:

Transformers Segment Analysis

The >220 kV to ≤440 kV sub-segment, which is part of the transformers segment, is anticipated to garner the highest share of 28.5% in the power transmission component market by the end of 2035. The sub-segment’s upliftment is highly fueled by its importance for long‑distance electricity transmission, enabling bulk power transfer with minimal losses. Their adoption is driven by the expansion of renewable energy projects, particularly wind and solar farms, which require integration into national and regional grids. Governments worldwide are investing in interregional transmission corridors to enhance grid reliability and reduce congestion, further boosting demand for this voltage class. For instance, large‑scale HVDC projects in China and India rely on >220 kV transformers to connect renewable generation with urban load centers, thus creating an optimistic outlook for the sub-segment.

Transmission Lines and Conductors Segment Analysis

Based on the transmission lines and conductors segment, the high voltage AC (HVAC) sub-segment in the power transmission component market is predicted to hold the second-highest share during the forecast period. The sub-segment’s growth is highly driven by its importance for effectively moving electricity over moderate to long distances by enhancing voltage to diminish current. This leads to lowering energy loss and making power delivery economical by utilizing simple and comprehensively available facilities. According to the May 2025 NLM article, AC transmission lines result in a significant enhancement, particularly in the economic performance of the power network, eventually leading to a 10% to 40% optimization in comparison to the network power flow. Therefore, high-voltage systems equipped with AC power electronic power effectively control and regulate the overall transmission network.

Circuit Breakers and Switchgear Segment Analysis

By the end of the stipulated timeline, the gas-insulated switchgear (GIS) segment, part of circuit breakers and switchgear, is expected to hold the third-largest share in the power transmission component market. The segment’s development is highly propelled by its compact design, reliability, and ability to operate in challenging environments. GIS systems use insulating gases to achieve high dielectric strength, allowing them to handle voltages in a smaller footprint compared to air‑insulated switchgear (AIS). This makes GIS particularly suitable for urban areas, offshore wind farms, and industrial facilities where space is limited. The segment’s growth is reinforced by the global push to replace SF6, a potent greenhouse gas, with eco‑friendly alternatives such as g³ gas and dry air systems.

Our in-depth analysis of the power transmission component market includes the following segments:

|

Segment |

Subsegments |

|

Transformers |

|

|

Transmission Lines and Conductors |

|

|

Circuit Breakers and Switchgear |

|

|

Insulators |

|

|

Surge Arrestors |

|

|

Transmission Towers and Structures |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Power Transmission Component Market - Regional Analysis

APAC Market Insights

The Asia Pacific power transmission component market is anticipated to garner the highest share of 41.5% by the end of 2035. The market’s upliftment in the region is highly attributed to large-scale grid upgradation, renewable integration, and rapid electrification. As per official statistics put forward by Energy Tracker Asia in January 2025, the region accounts for 82% of the international coal power and comprises the largest gas expansion plans. In addition, it is the only region in track with the objective of tripling renewable energy capacity by the end of 2030. Moreover, by the end of 2038, South Korea has planned to develop 30 operational nuclear facilities based on its 11th Basic Plan for Supply and Demand of Power. In terms of renewables, the country is poised to extend capacity from 23 GW to 72 GW by 2030, and also develop 115.5 GW of wind and solar power capacity, along with 4GW of biomass and hydropower by 2038, thus creating a growth opportunity for the market.

The power transmission component market in China is growing significantly due to state-driven energy transition, manufacturing depth, and upscaling, along with developing a new energy supply system, accelerating green energy consumption, and modernizing energy governance. According to the 2026 IEA Organization article, the country is expected to account for 40% of international renewable capacity extension by 2040, which is fueled by optimized system integration, enhanced competitiveness, and low curtailment rates for both onshore wind and solar PV. Besides, there has been a rise in the electricity consumption per capita by 557% as of 2023, with energy intensity of the economy accounting for 43%, and renewables constituting 24.2% of the overall domestic power generation. In addition, oil, natural gas, coal, and other sources are readily responsible for bolstering the market’s exposure in the overall country.

Total Energy Supply Analysis in China (2023)

|

Energy Source Type |

Capacity (TJ) |

Share (%) |

|

Coal and Coal Products |

102,535,242.0 |

60.9 |

|

Oil and Oil Products |

30,804,260.0 |

18.3 |

|

Natural Gas |

13,349,463.0 |

3.2 |

|

Nuclear |

4,742,399.0 |

- |

|

Hydropower |

4,430,324.0 |

- |

|

Solar, Wind, and Other Renewables |

7,264,638.0 |

- |

|

Biofuels and Waste |

5,322,049.0 |

- |

Source: IEA Organization

The power transmission component market in India is also growing, owing to policy-based chemical industrial growth, electrification, and industrial expansion. Based on government data published by the IBEF Organization in October 2025, the chemical industry in the country provides a dynamic landscape for growth, with alkali chemicals accounting for almost 73% of the overall production. The industry is estimated at worth Rs. 21,50,750 crore (USD 250 billion) as of 2024, which is further projected to grow to USD 300 billion by the end of 2028, as well as Rs. 86,03,000 crore (USD 1 trillion) by 2040, displaying robust resilience amidst international uncertainties. Besides, the specialty chemical industry was worth USD 64.5 billion as of 2024, and is predicted to increase to USD 92.6 billion with a 3.8% growth rate by the end of 2033, thereby creating a huge growth opportunity for the overall power transmission component market.

Europe Market Insights

Europe power transmission component market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by sustainable and safer chemicals, clean tech manufacturing, and readily prioritizing grid modernization. According to official statistics published by OECD in 2025, small and medium-sized enterprises (SMEs) account for 95% of enterprises, especially in cleantech-based manufacturing industries in Europe. In addition, these regional SMEs cater to only 17% of the export value, based on operating in midstream and upstream segments, including recycling, materials processing, and component production. Besides, the region is considered the most attractive hub for FDI in wind technologies, significantly capturing 25% of international investment since 2023. In this regard, France is the leading destination in the region, achieving 8% of international FDI in wind technology, thereby ensuring power transmission component market expansion.

The power transmission component market in Germany is gaining increased traction due to grid modernization, industrial decarbonization, and ambitious climate targets. Additionally, the country’s legal framework has set a yearly emission budget for industries, thus pushing the market towards cleaner materials and processes. According to official statistics published by Clean Energy Wire Organization in February 2025, the country is focused on reducing greenhouse gas emissions by nearly 65% by the end of 2030, along with 88% by 2040, while aiming for net-negative emissions by 2050. Besides, the land use and forestry (LULUCF) is poised to comprise net-negative emissions by 2030 at minus 25 million carbon dioxide tons. This also includes a target of minus 35 million tons and minus 40 million tons of carbon dioxide by the end of 2040 and 2045, respectively, thereby making it suitable for boosting the market.

The power transmission component market in France is also developing, driven by the French 2030 investment plan and the robust fundamentals of the chemical industry. As stated in the January 2024 IEA Organization article, this particular investment plan has endowed EUR 34 billion, including EUR 30 billion for subsidies and EUR 4 billion for funding schemes, which are projected to be deployed in the upcoming 5 years. Besides, EUR 3.5 billion was allocated, of which EUR 2.8 billion is in grants, and EUR 0.6 billion has been provided for equity investments. In addition, this investment plan offered EUR 8 billion to the energy industry, with €1 billion to create small-scale nuclear reactors, €1.9 billion for developing green hydrogen projects, and €5.6 billion for decarbonizing the industry. Moreover, EUR 4 billion has been allocated to the transport industry for producing 2 million hybrid and electric vehicles, thereby creating an optimistic outlook for the market’s growth.

North America Market Insights

North America power transmission component market is projected to witness considerable growth during the stipulated timeline. The market’s growth in the region is highly fueled by renewable integration, resilience mandates, and grid modernization, with the utility-scale solar and wind requirement for reconducted HVAC corridors, GIS switchgear, and high-voltage transformers. Based on government data published by the EIA Government in November 2024, the yearly spending by major utilities in the U.S. to produce and deliver electricity has increased by 12% from USD 287 billion to USD 320 billion as of 2023. Besides, the expenditure to produce electricity decreased by 24% within the same year, owing to diminished fuel expenses. However, recently, the capital spending on electricity production has surged by 23%, amounting to USD 4.7 billion as of 2023 in comparison to 2022. The majority of this is readily driven by costs associated with constructing the Vogtle nuclear plant, thus suitable for boosting the market’s growth.

The power transmission component market in the U.S. is gaining increased exposure due to reliability mandates, grid modernization, renewable energy integration, chemical industry support for materials, along with safety standards. According to official statistics put forward by the GridWise Alliance Organization in April 2024, the increased demand for renewable Distributed Energy Resources (DERs) is needed to deliberately meet the federal government’s objective of gaining 100% carbon pollution-free electricity by the end of 2035. In addition, the Department of Energy has estimated that the electric grid in the country is required to be more than double by the end of the same year to achieve the federal government’ objective of 100% clean energy. Meanwhile, California has set the goal of load flexibility of 7,000 megawatts by 2030, thus denoting an optimistic outlook for the market’s growth.

The power transmission component market in Canada is also growing due to federal funding, clean energy transition, expansion in renewable and hydropower, cross-border trade, grid reliability, and the presence of safety and sustainability programs. Based on government data proposed by the Government of Canada in 2024, the real gross domestic product (GDP) for the mineral, mining, forestry, and energy sub-sectors significantly accounted for an estimated 11% of the country’s GDP. In addition, this also accounted for 49% of overall exported domestic goods and supported more than 1.7 million indirect and direct employment opportunities. Besides, NRCan, in partnership with international and domestic partners, operated to enhance mineral and energy security in the country, with the aim of protecting supply chains from disruption, thereby creating a positive outlook for the market’s upliftment.

Key Power Transmission Component Market Players:

- General Electric Company (U.S.)

- Eaton Corporation (U.S.)

- 3M Company (U.S.)

- Dow Inc. (U.S.)

- Siemens AG (Germany)

- BASF SE (Germany)

- Schneider Electric SE (France)

- ABB Ltd. (Switzerland)

- Arkema S.A. (France)

- Hitachi Chemical Co., Ltd. (Japan)

- Mitsubishi Electric Corporation (Japan)

- Sumitomo Electric Industries, Ltd. (Japan)

- LG Chem Ltd. (South Korea)

- Hyundai Electric & Energy Systems Co., Ltd. (South Korea)

- Tata Chemicals Limited (India)

- Reliance Industries Limited (India)

- Petronas Chemicals Group Berhad (Malaysia)

- Brambles Limited (Australia)

- Johnson Matthey Plc (UK)

- Solvay S.A. (Belgium)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- General Electric Company remains a global leader in transmission infrastructure, supplying high‑voltage transformers and grid solutions. Its chemical innovations in insulating oils and advanced composites enhance efficiency and reliability across transmission networks.

- Eaton Corporation focuses on power management systems, with strong expertise in switchgear and circuit protection. The company leverages sustainable chemical materials in insulation and coatings to improve safety and reduce environmental impact.

- 3M Company provides specialty chemicals, adhesives, and advanced polymers used in insulators and protective coatings. Its innovations in dielectric materials contribute to the higher performance and durability of transmission components.

- Dow Inc. supplies epoxy resins, silicones, and polymer composites critical for transformers, insulators, and switchgear. The company’s research and development emphasize sustainable chemical processes, aligning with global demand for eco‑friendly transmission materials.

- Siemens AG is a major supplier of transmission systems, integrating GIS/AIS switchgear and HVDC technologies. Its chemical partnerships focus on SF6‑free insulating gases and advanced polymers, supporting Europe’s decarbonization and grid modernization goals.

Here is a list of key players operating in the global power transmission component market:

The international power transmission component market is highly competitive, with multinational corporations leveraging scale, R&D, and regional partnerships to strengthen their positions. U.S. and Europe-based firms dominate through advanced material innovation and sustainability initiatives, while Asia-specific players, particularly from Japan, South Korea, and China, focus on high‑voltage applications and renewable integration. Strategic initiatives include mergers, acquisitions, and collaborations with governments to align with clean energy policies. Companies are investing in eco‑friendly alternatives to SF6, advanced polymers, and digital monitoring solutions. Besides, in June 2025, Talen Energy Corporation notified expanding its current nuclear energy relationship with Amazon to offer carbon-free energy from Talen’s Susquehanna nuclear power plant to Amazon Web Services data centers, thereby making it suitable for boosting the power transmission component market’s growth.

Corporate Landscape of the Power Transmission Component Market:

Recent Developments

- In November 2025, Honda Motor Co., Ltd. unveiled cutting-edge technologies at the Honda Automotive Technology Workshop, particularly for electrified models to be introduced in the upcoming years, suitable for automobile products in North America.

- In October 2025, Larsen & Toubro received large orders for the power transmission and distribution business in Saudi Arabia, as part of the power transmission and distribution for providing grid infrastructure to construct a 380 kV Substation and Transmission Lines.

- In March 2025, Hitachi Energy has been selected to offer a 950-km HDVC transmission system for delivering 6 GW of renewable energy in India, and eventually provide suitable energy for almost 60 million households, with the current 500 GW renewable evacuation milestone in the country.

- Report ID: 8346

- Published Date: Jan 14, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Power Transmission Component Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.