Superconducting Materials Market Outlook:

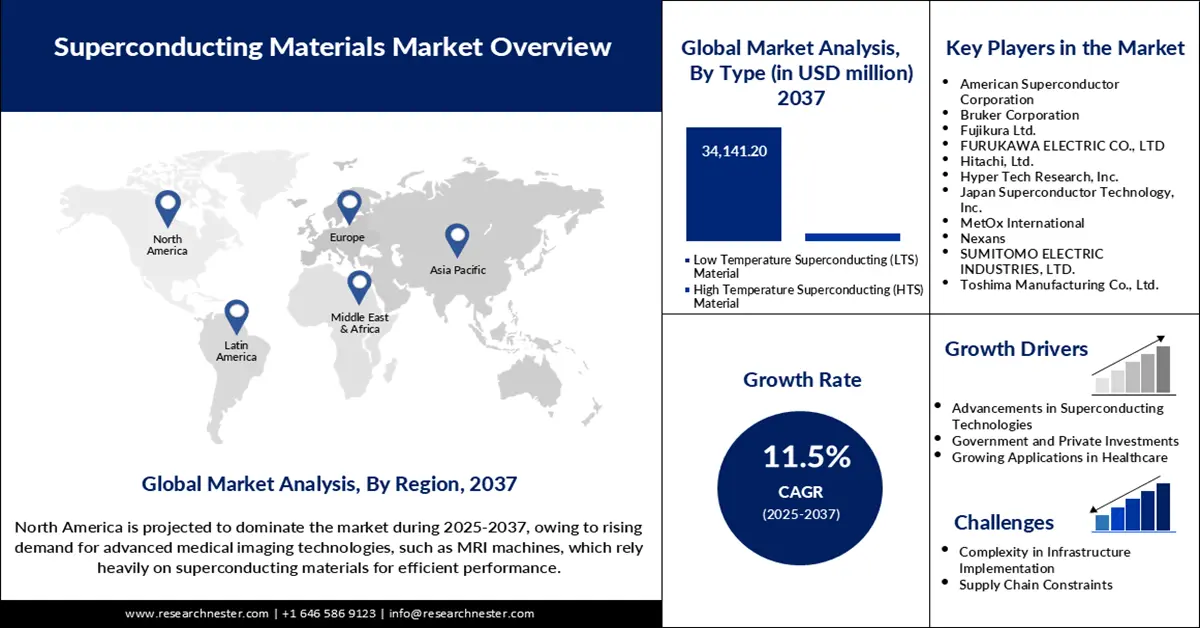

Superconducting Materials Market size was valued at USD 9.1 billion in 2024 and is projected to reach a valuation of USD 36.8 billion by the end of 2037, rising at a CAGR of 11.5% during the forecast period, i.e., 2025-2037. In 2025, the industry size of superconducting materials is assessed at USD 9.9 billion.

The superconducting materials market is anticipated to garner rapid expansion as countries strive to upgrade grid technology, quantum computing, and MRI systems. Recent breakthroughs are bringing superconductivity closer to room temperature, opening up possibilities in industrial applications. In February 2025, the researchers at Stanford University and SLAC National Accelerator Laboratory achieved superconductivity in semiconductors at ambient pressure, which was a significant advancement toward scalability. This enables the fast development of miniaturized, low-cost superconducting devices in different parts of the world. In addition, government investment in fusion, cryogenic infrastructure, and research institutes is increasing. The integration of material science with the help of artificial intelligence modeling is speeding up the discovery cycles. With superconducting materials becoming more accessible, the market is ready to adopt this technology across several sectors.

Advancements in healthcare imaging technology, quantum computing, and clean energy are some of the areas that are fueling the demand for high-performance superconductors. As the MRI systems become more environmentally friendly, manufacturers have shifted focus towards helium-free solutions. In August 2023, Siemens Healthineers introduced a next-generation MRI system that incorporates dry superconducting magnets, which reduced helium consumption by 95%. Meanwhile, governments are also being proactive, for example, the European Union increased its funding in May 2024 to deploy HTS in fusion reactors. Other regional programs like the SuperMat program in the U.S. DOE and superconducting accelerator tests in Japan are also advancing innovation. Altogether, these partnerships are developing a strong base for collaboration between the public and private sectors. This has led to the development of a diverse superconducting ecosystem around the globe with high levels of commercial viability.

Superconducting Materials Market - Growth Drivers and Challenges

Growth Drivers

- Increased utilization of sustainable medical imaging technologies: Magnetic Resonance Imaging (MRI) systems that do not use helium are becoming more popular in hospitals due to the reduction of operating expenses and environmental conservation. In August 2023, Midea Healthcare introduced new superconducting MRI units that do not require helium at all. This caters for more affordable diagnostic procedures without a compromise on the quality of the images produced. The demand is particularly high in the developed countries where the healthcare system’s modernization is a major concern. With the advancement in magnet technology, superconductors are finding a place in clinical applications. This healthcare push drives demand for global superconducting material consumption.

- Increased utilization of sustainable medical imaging technologies: Magnetic Resonance Imaging (MRI) systems that do not use helium are becoming more popular in hospitals due to the reduction of operating expenses and environmental conservation. In August 2023, Midea Healthcare introduced new superconducting MRI units that do not require helium at all. This caters for more affordable diagnostic procedures without a compromise on the quality of the images produced. The demand is particularly high in the developed countries where the healthcare system’s modernization is a major concern. With the advancement in magnet technology, superconductors are finding a place in clinical applications. This healthcare push drives demand for global superconducting material consumption.

- Energy sector transition towards high-efficiency grid components: Superconducting cables help to minimize the losses and increase the reliability of power distribution in urban areas. In September 2024, South Korea’s KERI developed a 154 kV-class superconducting cable that operated with no loss over a 1-kilometer length. This real-world validation enables nationwide grid upgrades and opens new markets in Asia. Superconducting technology is being increasingly adopted by energy providers as part of the grid upgrade plans. This is in line with the net-zero goals and electricity efficiency policies. This reinforces the long-term demand for HTS materials in power applications.

Challenges

- Complexity of ambient-pressure superconductors: While superconductivity above 30 K has been recently attained through various innovations, the problem of reproducibility and scalability is still a challenge. In October 2024, Tsinghua University released data on an ambient superconductor based on FeSe, but the commercialization is still in the distant future. The problem of scaling such materials for mass production is both scientific and economic. It is important for industry players to have a way of ensuring that the pace at which new research is conducted is aligned with manufacturing realities. This may be offset by regulatory support for pilot-scale projects. As a result, the use of cryogenic setups remains restricted and not easily accessible to a wide population.

- Critical raw materials supply chain vulnerability through geopolitical considerations: Some superconductors are based on rare earths or high-purity metals that originate from politically sensitive locations. Thus, most countries are still vulnerable to external shocks. Without diversified sourcing and recycling strategies, pricing and project continuity could be affected by supply chain risks. These challenges call for synergy between public and private efforts. Strategic stockpiling and investment in domestic refining capabilities can help to mitigate geopolitical risks in the supply chain. In addition, the search for new superconductor materials that can eliminate dependence on limited raw materials is equally important.

Superconducting Materials Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Period |

2025-2037 |

|

CAGR |

11.5% |

|

Base Year Market Size (2024) |

USD 9.1 billion |

|

Forecast Year Market Size (2037) |

USD 36.8 billion |

|

Regional Scope |

|

Superconducting Materials Market Segmentation:

Type Segment Analysis

Low Temperature Superconducting (LTS) is anticipated to dominate the market with a 92.3% market share by 2037. These materials provide high current density and have already found applications in MRI machines, particle accelerators, and quantum computing systems. In June 2023, Lawrence Berkeley Lab improved Nb3Sn strand uniformity through vapor deposition, allowing precision manufacturing of high-field magnets. LTS materials are still used as a main type of material owing to their stability and the existing cryogenic storage. Their repeatability in critical applications makes them favored by industries. This position guarantees the prolongation of its dominance even with the changes that HTS innovations bring about.

Application Segment Analysis

The healthcare and medical sector is projected to lead the application landscape and have a 49% market share through 2037. MRI systems are the largest consumer of superconducting magnets commercially, and the development is growing at a rapid pace. In August 2023, Siemens Healthineers launched a new helium-free superconducting MRI with increased resolution. Healthcare facilities are now buying affordable diagnostic tools as health systems are being transformed. The need for non-invasive, fast, and precise imaging is increasing at an unprecedented rate across the world. Superconducting materials enable this transition, and this trend is set to cement their position in next-gen diagnostics.

Our in-depth analysis of the superconducting materials market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Superconducting Materials Market - Regional Analysis

North America Market Insights

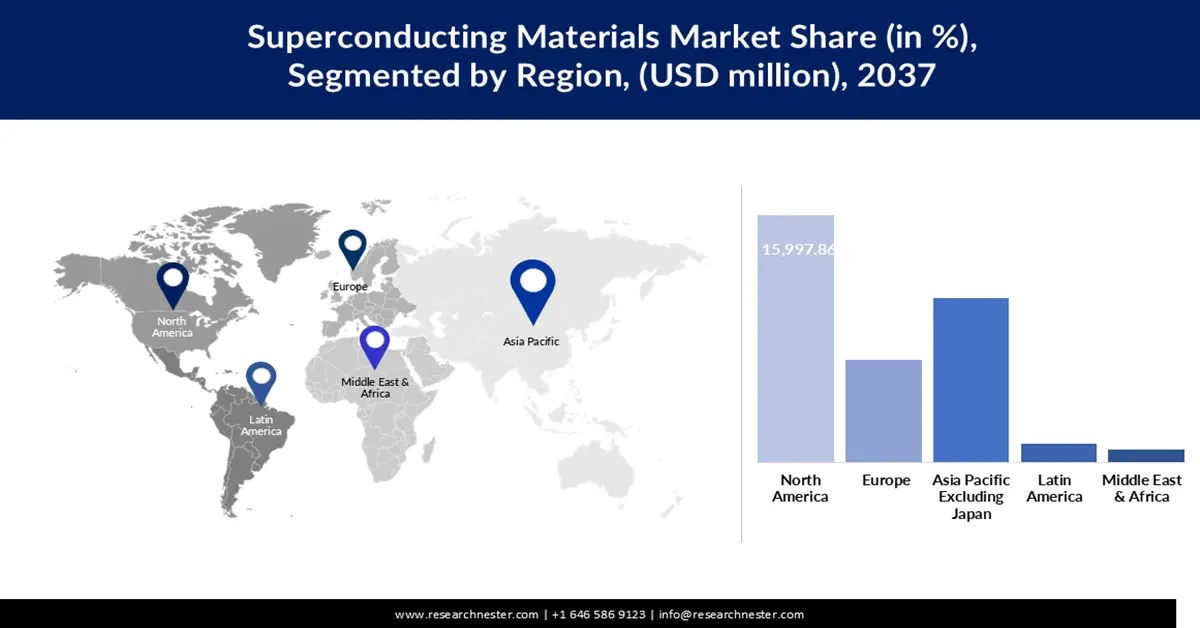

North America is expected to be the largest market for superconducting materials with a 43.4% share during the forecast period. The region is well endowed with research facilities, especially in the U.S., and has access to considerable government funding. In March 2024, the US DOE introduced SuperMat to support the automation of superconducting tape production, indicating policy-level support. These measures promote the advance of HTS materials to the commercial level. Domestic innovation is mainly spearheaded by institutions such as SLAC, Fermilab, and national laboratories. Demand in healthcare, defense, and power segments is expected to maintain an upward trend.

The U.S. is leading the regional growth in a combination of academic research and industrial implementation. In February 2025, researchers at Stanford University achieved superconductivity in semiconductors at room temperature, removing the need for high-pressure systems. This discovery will pave the way for the normal use of electronics and quantum devices. Domestic companies such as IBM, Hyper Tech, and Applied Materials are among the companies currently funding quantum and fusion projects. Modern warfare and even space exploration incorporate superconducting technologies for their accurate and energy-efficient nature. Such applications support sustainable development in the long term.

Canada is also coming up as a significant participant through its growing health care facilities and quantum research and development centers. Some of the institutions that are currently involved in superconducting research include TRIUMF and Universite de Sherbrooke. The Canadian government has also been supporting quantum innovation through the country’s AI and clean-tech policies. Canada actively engaged in joint projects in the framework of the U.S.-Canada Energy Transition plan in March 2024. These efforts enhance the compatibility of modernization of the grid solutions. With increased focus on cross-border research, Canada is likely to consolidate its position even further.

APEJ Market Insights

APEJ is anticipated to garner expansion at a CAGR of 12.6% from 2025 to 2037, owing to increasing electrification policies and infrastructural development. Currently, China, India, and South Korea are leading the way in terms of funding for fusion, grid upgrade, and quantum research. Korea Electric Research Institute (KERI) conducted a test of a 154 kV high-temperature superconductor cable in September 2024 and successfully produced a zero-loss result. The emphasis on urban energy resilience in the region is driving up the pace of adoption. Local production capabilities are also developing rapidly.

China continues to dominate with large-scale government-backed industrial deployments and research institutes. In May 2024, the State Grid Corporation of China gave its approval to the deployment of HTS cable in Jiangsu province with the goal of decreasing line loss to 30%. Companies such as IBM are getting ambient superconductors from universities like Tsinghua, reducing system-level cooling costs. The focus on localization and industrialization makes it possible for China to quickly commercialize its advancements. Additionally, it will also expand its contribution as a superconducting manufacturing base based on strategic policies and investment.

India is not far behind in terms of domestic innovation as well as partnerships across the globe. In September 2024, researchers at IISc Bangalore successfully synthesized indium-based superconductors on flexible substrates. These innovations are associated with electronics integration and wearable applications. Government-based programs like the National Superconductivity Mission are being launched. There are applications of HTS in defense and transport under current development. Further, India’s involvement in international fusion partnerships adds to its credibility. Local startups are also working with superconductor recycling and material optimization.

Key Superconducting Materials Market Players:

- American Superconductor Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bruker Corporation

- Fujikura Ltd.

- FURUKAWA ELECTRIC CO., LTD

- Hitachi, Ltd.

- Hyper Tech Research, Inc.

- Japan Superconductor Technology, Inc.

- MetOx International

- Nexans

- SUMITOMO ELECTRIC INDUSTRIES, LTD.

- Toshima Manufacturing Co., Ltd.

The superconducting materials market is saturated, and competitiveness is high due to continuous research and development of new products. Some of the leading companies in the industry are American Superconductor Corporation, Bruker Corporation, Fujikura Ltd., Hitachi Ltd., Hyper Tech Research, Japan Superconductor Technology Inc., Sumitomo Electric, MetOx, and Nexans. Manufacturing footprints and product portfolios of companies are increasing at a rapid pace. This landscape consists of startups that focus on manufacturing HTS tapes and diagnosing these tapes. There is also a growing trend of research institutes partnering with corporates in their research activities.

A significant milestone was achieved in March 2025 when Fujikura delivered HTS tapes to Commonwealth Fusion Systems in the U.S., aimed at advancing fusion energy across the world. Likewise, in November 2023, Hyper Tech Research increased the manufacturing of MgB2 wires for grid-level applications. These moves show a further evolution of the commercialization of HTS technologies. Competition is anticipated to be fierce among those firms that can provide reliability, scale, and customization.

Here are some leading companies in the superconducting materials market:

Recent Developments

- In February 2025, The Kavli Foundation, Klaus Tschira Foundation, and Kevin Wells launched a multi-million-dollar project to design novel superconductors based on quantum geometry. The initiative brings together an international team of scientists. It uses AI to predict unique material structures. This marks a bold step in advancing high-efficiency superconducting materials.

- In July 2024, Helix Inc. received U.S. DoD funding to develop HTS-based drone propulsion systems. The project targets reduced power loss and quieter operation. Field trials are scheduled in early 2025. It marks the military’s exploration of superconducting mobility applications.

- In June 2024, Toshima Manufacturing launched GdBaCuO and SmBaCuO superconductors for electronics and energy. These are high-phase HTS materials. The expansion strengthens Japan’s manufacturing edge in cryogenic materials. It supports industries including aerospace and IoT systems.

- In May 2024, Cryomech launched the PT415-RM cryocooler targeted at HTS applications under 50K. The system delivers 1.5 W of cooling with low vibration design. It supports mobile or field-deployed HTS systems. The launch expands cryogenic access for emerging markets.

- Report ID: 7682

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Superconducting Materials Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert