Solar PV Module Market Outlook:

Solar PV Module Market size was over USD 81.4 billion in 2025 and is estimated to reach USD 222.1 billion by the end of 2035, expanding at a CAGR of 11.8% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of solar PV module is evaluated at USD 91 billion.

The international solar PV module market is significantly entering into a transformative phase, readily shaped by evolving energy approaches, a shift in investment priorities, and technological breakthroughs. According to official statistics published by the IEA Organization in February 2025, there has been an increase in solar PV generation by a record, accounting for 320 TWh, denoting a rise by 25$ as of 2023 and reaching more than 1,600 TWh. This demonstrates the highest absolute generation growth of overall renewable technologies as of 2023. Besides, China is continuing to lead in solar PV capacity, with 260 GW added in 2023, and meanwhile, there has been a surge in PV additions by 70% and, reaching a record 32 GW. Therefore, solar PV technology is the fastest-growing share of electricity generation, which is positively impacting the market’s growth across different locations.

Renewable Electricity Generation Share Analysis by Technology (2020-2030)

|

Year |

Share % |

|

2020 |

3.1 |

|

2021 |

3.6 |

|

2022 |

4.4 |

|

2023 |

5.4 |

|

2024 |

6.8 |

|

2025 |

8.3 |

|

2026 |

9.8 |

|

2027 |

11.4 |

|

2028 |

12.9 |

|

2029 |

14.5 |

|

2030 |

16.1 |

Source: IEA Organization

Furthermore, the hybrid energy systems integration, expansion in floating solar, corporate renewable procurement, and artificial intelligence and digitalization in PV operations are trends that are also bolstering the solar PV module market globally. As per an article published by Energy Conversion and Management: X in January 2026, the international installed capacities of renewables, including hydropower, marine, geothermal, biogas, wind, and solar has reached nearly 4,448.1 GW. Of this, solar energy systems account for 1,600 GW, 1,021 GW for wind energy, and 150 GW to 363 GW for the worldwide cumulative battery energy storage capacity. This continuous growth in the renewable energy industry effectively reflects an international transition towards sustainable and renewable energy technologies, thereby enhancing the market’s exposure globally.

Key Solar PV Module Market Insights Summary:

Regional Highlights:

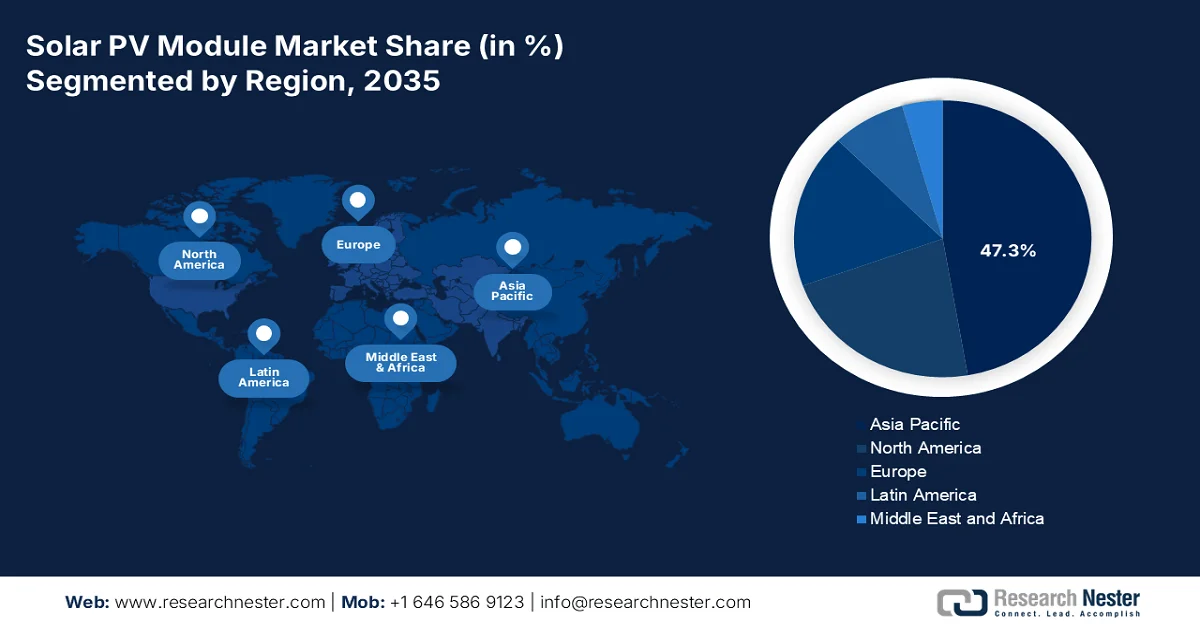

- Asia Pacific is projected to command a leading 47.3% share by 2035 in the solar pv module market, underpinned by accelerating demand for high-efficiency energy systems and robust government-led clean energy investments.

- Europe is expected to register the fastest growth in the forecast period toward 2035, supported by stringent decarbonization goals, solar–hydrogen integration initiatives, and expanding subsidies for rooftop installations.

Segment Insights:

- The ground-mounted segment under the mounting type is forecast to account for a dominant 53.7% share by 2035 in the solar pv module market, strengthened by its critical role in maximizing energy yield and enabling efficient, flexible, large-scale renewable power generation.

- The utility-scale ground-mounted sub-segment is projected to secure the second-largest share during 2026–2035, bolstered by economies of scale and its capability to deliver grid-connected electricity at commercial volumes.

Key Growth Trends:

- Decline in electricity expenses

- Rise in green financing

Major Challenges:

- Supply chain vulnerabilities

- Grid integration and storage limitations

Key Players: LONGi Green Energy Technology Co., Ltd. (China), JinkoSolar Holding Co., Ltd. (China), Trina Solar Co., Ltd. (China), Canadian Solar Inc. (Canada), First Solar, Inc. (U.S.), SunPower Corporation (U.S.), Hanwha Q CELLS Co., Ltd. (South Korea), JA Solar Technology Co., Ltd. (China), Risen Energy Co., Ltd. (China), GCL System Integration Technology Co., Ltd. (China), REC Solar Holdings AS (Norway), Sharp Corporation (Japan), Panasonic Corporation (Japan), Kyocera Corporation (Japan), Tata Power Solar Systems Ltd. (India), Vikram Solar Limited (India), Waaree Energies Ltd. (India), Seraphim Solar System Co., Ltd. (China), Tindo Solar Pty Ltd. (Australia), Solarvest Holdings Berhad (Malaysia).

Global Solar PV Module Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 81.4 billion

- 2026 Market Size: USD 91 billion

- Projected Market Size: USD 222.1 billion by 2035

- Growth Forecasts: 11.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47.3% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: China, United States, India, Germany, Japan

- Emerging Countries: Vietnam, Brazil, Australia, Spain, South Korea

Last updated on : 6 February, 2026

Solar PV Module Market - Growth Drivers and Challenges

Growth Drivers

- Decline in electricity expenses: The aspect of ongoing optimization in manufacturing economies and efficiency of scale has made the solar PV module market more evolving, which is driving the implementation across both emerging and developed economies. According to official statistics published by the IEF Organization in January 2024, the international energy generation from solar PV panels, which readily convert sunlight into electricity, increased by 270 TWh, thereby marking a 26% surge. Presently, solar PVs are almost 24.5% efficient, with recent innovations in technology deliberately indicating a future rise by more than 30% in the upcoming decade. Besides, there has been a reduction in PV module expenses by 99%, with support from economies of scale, thus proliferating the market’s expansion.

- Rise in green financing: The rise in green bonds, ESG-based financing, and climate funds is effectively channeling unprecedented capital into projects of the solar PV module market. As per an article published by the IBEF Organization in March 2025, based on the Paris Agreement, India is projected to focus on lowering its carbon intensity by 33% to 35% by the end of 2030. In addition, the country has also aimed to generate 50% of its electricity from renewable energy sources by the same year, along with other ambitious objectives that are related to green energy production, sustainable agriculture, and carbon reduction. Besides, there is the demand for USD 2.5 trillion (INR 162.5 lakh crore) or USD 170 billion (an estimated INR 11 lakh crore) every year to meet National Determined Contributions (NDCs), which is suitable for uplifting the solar PV module market.

- Innovations in material and energy chemicals: Advancements in the solar PV module solar PV module market are readily fueling sustainability and efficiency benefits, making the industry more attractive for long-lasting investment. Based on government estimates published by the Department of Energy in October 2024, the U.S. has installed an estimated 14.1 GWh of energy storage in the electric grid as of 2024. In addition, thin-film PV demonstrated nearly 3% of the international PV deployment throughout 2023, significantly accounting for over 17% of domestic PV deployments within this duration. Besides, an estimated 45% of battery capacity, as well as 26% of utility-scale PV capacity are hybrid energy storage system projects, thus fueling the market’s demand worldwide.

Challenges

- Supply chain vulnerabilities: The solar PV module market is highly dependent on a complex global supply chain, particularly for raw materials such as polysilicon, silver, and Gallium Arsenide wafers. Disruptions caused by geopolitical tensions, trade tariffs, and logistical bottlenecks can significantly impact module availability and pricing. For example, the concentration of polysilicon production in China creates a risk of supply shocks if export restrictions or energy shortages occur. Additionally, shipping delays and rising freight costs have increased the overall cost of solar projects worldwide. These vulnerabilities hinder scalability, especially in emerging markets where affordability is critical. To mitigate this, companies are exploring vertical integration and regional manufacturing hubs, but such initiatives require substantial investment and time.

- Grid integration and storage limitations: While the solar PV module market generates clean electricity, integrating this power into existing grids remains a significant challenge. Solar energy is intermittent, with generation dependent on sunlight availability, leading to fluctuations in supply. Many grids, particularly in developing countries, lack the infrastructure to handle variable renewable inputs. This results in curtailment, where excess solar energy cannot be utilized effectively. Furthermore, large-scale storage solutions such as lithium-ion batteries remain expensive and limited in deployment. Besides, without adequate storage, solar power cannot provide reliable baseload energy, restricting its role in national energy systems.

Solar PV Module Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.8% |

|

Base Year Market Size (2025) |

USD 81.4 billion |

|

Forecast Year Market Size (2035) |

USD 222.1 billion |

|

Regional Scope |

|

Solar PV Module Market Segmentation:

Mounting Type Segment Analysis

The ground-mounted segment, part of the mounting type, is projected to garner the largest share of 53.7% in the solar PV module market by the end of 2035. The segment’s upliftment is primarily attributed to its importance for increasing energy yield and ensuring efficient, flexible, and large-scale renewable energy generation. According to official statistics published by the SEIA Organization in January 2025, the U.S.-based solar sector has readily installed 10.8 GW of direct current as of 2025. Additionally, solar accounts for 69% of the latest electricity-generating capacity addition to the domestic grid in the same year. Besides, Texas has effectively installed the majority of the solar capacity, with 92% more than Florida, with utility-scale projects significantly dominating installations in both states, thereby making it suitable for boosting the segment globally.

Installation Segment Analysis

Based on the installation segment, the utility-scale ground-mounted sub-segment is anticipated to grab the second-largest share in the solar PV module market during the forecast period. The sub-segment’s growth is highly driven by the aspect of comprising large solar farms connected directly to national grids, delivering electricity at scale. Their dominance stems from economies of scale, which reduce the levelized cost of electricity (LCOE) compared to smaller installations. Governments across regions, including the U.S., China, and India, have prioritized utility-scale solar farms to meet renewable energy targets, often supported by subsidies, tax incentives, and long-term power purchase agreements (PPAs). Technological advancements such as bifacial modules, single-axis trackers, and AI-driven monitoring systems have further enhanced the efficiency and reliability of ground-mounted projects.

Size Segment Analysis

By the end of the stipulated timeline, the large (>500 W) modules segment as part of the size is expected to hold the third-largest share in the solar PV module market. The segment’s development is highly propelled by the demand for higher efficiency and reduced balance-of-system costs. These modules, often based on advanced monocrystalline or bifacial technologies, deliver greater power output per panel, enabling developers to maximize energy yield while minimizing land and installation requirements. Utility-scale projects are the primary adopters, as large modules significantly lower installation costs by reducing the number of panels, wiring, and mounting structures needed. Manufacturers such as LONGi, JinkoSolar, and Trina Solar are leading innovation in this segment, thereby bolstering the segment’s exposure globally.

Our in-depth analysis of the solar PV module market includes the following segments:

|

Segment |

Subsegments |

|

Mounting Type |

|

|

Installation |

|

|

Size |

|

|

Technology |

|

|

Efficiency |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Solar PV Module Market - Regional Analysis

APAC Market Insights

The Asia Pacific solar PV module market is anticipated to garner the highest share of 47.3% by the end of 2035. The market’s upliftment in the region is highly attributed to a rise in the need for high-efficiency energy, chemical industry advancements, and strong government expenditure. According to official statistics published by the UNDP Organization in March 2025, the overall region is home to 60% of the global population and heavily relies on fossil fuels for 85% of its energy demands, accounting for almost half of the international carbon dioxide emissions. Besides, the ambitious dual carbon objectives in China have the potential to shift not only the nation, but the total region. Besides, as per the June 2025 World Economic Forum article, the energy transition has gained speed, with renewable energy sources are home to 75% of the international coal power, thus stimulating the solar PV module market in the overall region.

The presence of massive government spending, industrial adoption, the carbon neutrality goal by 2050, and domestic organizations integrating sustainable energy processes are responsible for boosting the solar PV module market in China. Based on government estimates published by the ITA in September 2025, the deployment of battery energy storage systems is rapidly growing, with an overall storage capacity quadrupling to 31.4 GW as of 2023. Besides, in terms of pumped hydro storage, the deployed energy storage in the country has successfully reached 58.6 million kW by the end of 2024. Besides, as per the September 2025 Ember Energy Organization data report, 84% of clean generation growth has been led by solar and wind due to the country’s electricity demand growth in 2024, thereby denoting an optimistic outlook for the market’s growth in the overall country.

The solar PV module market in India is significantly growing, owing to governmental investment in water-specific PV technology, large and small-scale businesses implementing green energy processes, and the presence of strong funding programs. As per an article published by the PIB Government in December 2025, the country’s solar capacity has surged to 129 GW as of 2025, with non-fossil power crossing 50% of the nation’s 500 GW capacity. Besides, almost 24 lakh households have integrated rooftop solar in December 2025 under the government, with an installation capacity of 7 GW of clean energy, as well as ₹ 13,464.6 crore subsidy. Moreover, the PM-KUSUM facilitated almost 9.2 lakh standalone solar pumps, suitable for bolstering clean energy utilization in agriculture, thus denoting a positive impact for the market’s expansion in the country.

Europe Market Insights

Europe solar PV module market is expected to emerge as the fastest-growing region during the projected timeline. The market’s development in the region is highly propelled by regional decarbonization targets, integration of solar with hydrogen production, and subsidies for rooftop solar. According to official statistics published by Europe Commission in January 2026, rooftop solar photovoltaics can tend to supply nearly 40% of regional electricity by the end of 2050. This provides an open accessibility, along with high resolution basis for targeted and precise energy planning. Besides, the rooftops in the region’s 271 million buildings can host almost 2.3 TWp of solar PV capacity and also generate an estimated 2,750 TWh of electricity every year with present PV technology. Moreover, the PV technology has witnessed energy communication efficiency from 18% to 22% as of 2025, which is positively impacting the solar PV module market in the region.

The adoption of robust renewable energy, the provision of feed-in tariffs and subsidies for utility-scale and rooftop solar, as well as an increase in the demand for green energy solutions, are responsible for bolstering the solar PV module market in Germany. As per an article published by the Europe Investment Bank (EIB) in February 2024, the regional Climate Bank Group has increased its financing signed for projects in the country to €8.6 billion. Additionally, 65% of overall domestic financing as of 2023 has been committed for projects deliberately contributing to climate, while 30% are readily dedicated to advanced technologies. Therefore, with this, the EIB Group significantly remained on its growth path for its domestic operations, along with an additional investment, amounting to €5.5 billion, thus proliferating the market’s development in the country.

The solar PV module market in Spain is gaining increased traction, owing to abundant solar resources, solar-based utility programs, rooftop adoption in urban centers, and the integration with battery storage systems. As per an article published by the Global Solar Council Organization in February 2023, the majority of solar energy associations in the country already comprises 770 organizations, and in 2022, there were 2,507 MW of solar energy for self-consumption. This denotes a 108% rise over the previous year, readily accounting for 1,203 MW capacity. Besides, the country already comprises 5,249 MW of cumulative installed power for self-consumption. Meanwhile, in terms of distribution by sectors, the majority of this particular new power, 47%, has been successfully installed in the industrial sector. This is followed by 32% in the residential sector, 20% in commercial, and the remaining 1% in isolated self-consumption.

North America Market Insights

North America solar PV module market is projected to witness considerable growth by the end of the stipulated duration. The market’s growth in the region is highly fueled by the presence of large-scale utility projects, corporate ESG commitments, and federal clean energy programs. According to official statistics published by the Department of Energy in May 2023, an increase in the decarbonization of the power industry is a severe strategy for meeting the U.S.’s climate objectives of diminishing economic greenhouse gases by 50% to 52% by the end of 2030. Therefore, identifying the notable role of the industry in total decarbonization and other suitable advantages, the U.S. constitutes an objective of 100% carbon pollution-free electricity by the end of 2035. Thus, based on these futuristic goals, there is a huge growth opportunity for the market in the overall region.

The presence of federal clean energy mandates, advanced manufacturing support, EPA green chemistry strategies, and corporate ESG commitments are factors driving the solar PV module market in the U.S. As per an article published by the SEIA Organization in December 2025, the solar industry in the country installed 11.7 GW of direct current of capacity in 2025, denoting a 20% surge from 2024, along with a 49% surge from the third quarter of 2025. Besides, the industry also accounted for 58% of all the latest electricity-generating capacity in addition to the country’s grid throughout 2025, with over 30 GW installed. Additionally, the country also added 4.7 GW of solar module manufacturing capacity, thereby bringing the overall capacity to 60.1 GW. Therefore, with all these capacity developments, the market is continuously growing in the country.

State-Based Solar PV Installation Ranking Analysis in the U.S. (2025)

|

State |

Rank |

Installations (mwdc) |

||||

|

2023 |

2024 |

Q1 to Q3 2025 |

2023 |

2024 |

Q1 to Q3 2025 |

|

|

Texas |

1 |

1 |

1 |

11,993 |

10,842 |

7,414 |

|

California |

2 |

2 |

2 |

6,567 |

4,869 |

3,764 |

|

Indiana |

15 |

10 |

3 |

679 |

1,631 |

2,273 |

Source: SEIA Organization

The solar PV module market in Canada is also growing significantly, owing to the provision of federal funding for clean energy, provincial and net-metering incentives, climate policy and sustainability alignment, and cross-border collaboration. As stated in an article published by Invest Canada in 2025, there are 215 clean technology, energy, and forestry projects in the country, totaling USD 194.2 billion in investment. Besides, USD 60 billion in federal clean electricity support has been allocated in the Government of Canada’s Powering a Domestic Future strategy. The government’s action means that domestic green energy projects are estimated to increase in valuation by over 50% in the total lifetime. Moreover, the electricity industry is 80% non-emitting, with the power deriving from sources, including nuclear, wind, solar, and hydro, thus suitable for the market’s growth.

Key Solar PV Module Market Players:

- LONGi Green Energy Technology Co., Ltd. (China)

- JinkoSolar Holding Co., Ltd. (China)

- Trina Solar Co., Ltd. (China)

- Canadian Solar Inc. (Canada)

- First Solar, Inc. (U.S.)

- SunPower Corporation (U.S.)

- Hanwha Q CELLS Co., Ltd. (South Korea)

- JA Solar Technology Co., Ltd. (China)

- Risen Energy Co., Ltd. (China)

- GCL System Integration Technology Co., Ltd. (China)

- REC Solar Holdings AS (Norway)

- Sharp Corporation (Japan)

- Panasonic Corporation (Japan)

- Kyocera Corporation (Japan)

- Tata Power Solar Systems Ltd. (India)

- Vikram Solar Limited (India)

- Waaree Energies Ltd. (India)

- Seraphim Solar System Co., Ltd. (China)

- Tindo Solar Pty Ltd. (Australia)

- Solarvest Holdings Berhad (Malaysia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- LONGi Green Energy Technology Co., Ltd. is the world’s largest solar module manufacturer, holding the leading market share globally. The company specializes in high-efficiency monocrystalline modules and continues to expand production capacity to meet surging demand in utility-scale projects.

- JinkoSolar Holding Co., Ltd. is a top-tier global supplier known for its diversified product portfolio and strong presence in both residential and utility-scale markets. It has consistently ranked among the largest exporters of solar modules, with a focus on innovation in bifacial and high-efficiency technologies.

- Trina Solar Co., Ltd. is a pioneer in smart solar solutions, combining PV modules with energy storage and system integration. The company is recognized for its leadership in utility-scale projects and has expanded aggressively into global markets, particularly in Europe and Asia.

- Canadian Solar Inc. is one of the largest non-China-based solar manufacturers, with a strong presence in North America and Europe. The company integrates manufacturing with project development, giving it a competitive edge in utility-scale solar farms and long-term power purchase agreements.

- First Solar, Inc. is unique in its focus on thin-film cadmium telluride (CdTe) technology, offering cost-effective alternatives to crystalline silicon modules. It is a leader in the U.S. market, supported by strong government incentives and a robust pipeline of utility-scale projects.

Here is a list of key players operating in the global solar PV module market:

The international solar PV module market is highly competitive, dominated by China-specific manufacturers such as LONGi, JinkoSolar, and Trina Solar, which collectively hold over the majority of global share. U.S. players, such as First Solar and SunPower, focus on advanced technologies, while Europe and Japan-based firms emphasize quality and innovation. Indian companies, including Tata Power Solar and Vikram Solar, are expanding rapidly with government-backed initiatives. Besides, in January 2025, Waaree Energies Ltd announced that it has received an order for a major renewable power project of 150 MW for supplying solar modules from a well-known customer engaged in operating, owning, and developing renewable power projects in India, thereby denoting a huge growth opportunity for the solar PV module industry globally.

Corporate Landscape of the Solar PV Module Market:

Recent Developments

- In January 2026, Vikram Solar Limited declared a tactical transition to a fully G12R-based module portfolio, significantly reinforcing its commitment to cutting-edge solar technology, thus denoting its benchmarks with 100% portfolio transition.

- In June 2025, Saatvik Solar Industries Private Limited unveiled the integrated 4.8 GW solar cell, along with 4.0 GW module manufacturing infrastructure, which is poised to be set up on the land sub-leased from Tata Steel Special Economic Zone Limited out of total of 57 acres located on National Highway – 16 in Odisha.

- In May 2025, ReNew Energy Global Plc has effectively secured an INR 8,700 million (USD 100 million) investment from British International Investment, which is the UK’s development finance institution and impact investor, for accelerating the growth of its solar manufacturing business in India.

- Report ID: 8385

- Published Date: Feb 06, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Solar PV Module Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.