Floating Solar PV Market Outlook:

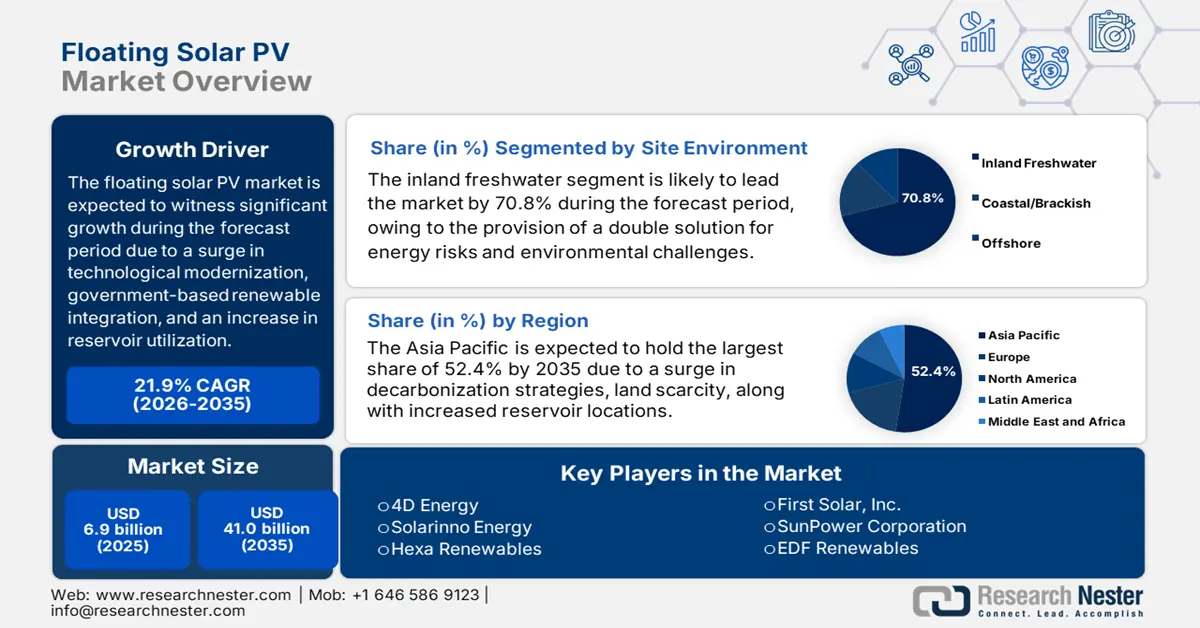

Floating Solar PV Market size was over USD 6.9 billion in 2025 and is estimated to reach USD 41 billion by the end of 2035, expanding at a CAGR of 21.9% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of floating solar PV at USD 8.4 billion.

The international floating solar PV market is continuously growing, which is primarily attributed to technological advancements, government-supported renewable energy policies, reservoir utilization, and land scarcity that tend to reduce expenses and optimize efficiency. According to official statistics published by Cleaner Engineering and Technology in July 2025, covering only 1% of international reservoirs with floating photovoltaics (FPV) can tend to generate 404 GWp of clean energy, which makes them a strong tool in the objective for achieving net-zero emissions, along with a green future. Besides, the Japan-based National Institute of Advanced Industrial Science and Technology (AIST) successfully established the first-ever 20 kW capacity of a FPV plant. In addition, the international FPV capacity has been growing from 1 MW to 2.6 GW, and effectively reached an estimated 5.9 GW as of 2023, thus boosting the market’s exposure.

International FPV Energy Production Yearly Analysis (2009-2025)

|

Year |

Production Capacity (MWh) |

|

2009 |

1.1 |

|

2010 |

1.5 |

|

2011 |

2.2 |

|

2012 |

3.4 |

|

2013 |

5.7 |

|

2014 |

11.0 |

|

2015 |

68.0 |

|

2016 |

169.0 |

|

2017 |

528.0 |

|

2018 |

1,314.0 |

|

2019 |

1,656.0 |

|

2020 |

3,686.0 |

|

2021 |

7,373.0 |

|

2022 |

14,746.0 |

|

2023 |

29,491.0 |

|

2024 |

58,982.0 |

|

2025 |

117,965.0 |

Source: Cleaner Engineering and Technology

Furthermore, rapid expansion in the Asia Pacific, followed by hybridization with hydropower, technological innovation, the presence of utility-scale projects, international solar momentum, and environmental advantages are other drivers fueling the market globally. As per an article published by the IEA Organization in 2026, hydro generated almost 4,500 terawatt-hours of electricity, which is 14% of the international total as of 2024. In addition, over 150 GW of the latest hydro capacity is projected to come online by the end of the decade. Moreover, the electricity generation from this particular source is projected to surge by 7% by 2030. Therefore, the aspect of combining floating solar with hydropower dams is considered a growing trend, thereby maximizing reservoir utilization and ensuring grid stability, thus making it suitable for bolstering the overall market across different regions.

Key Floating Solar PV Market Insights Summary:

Regional Highlights:

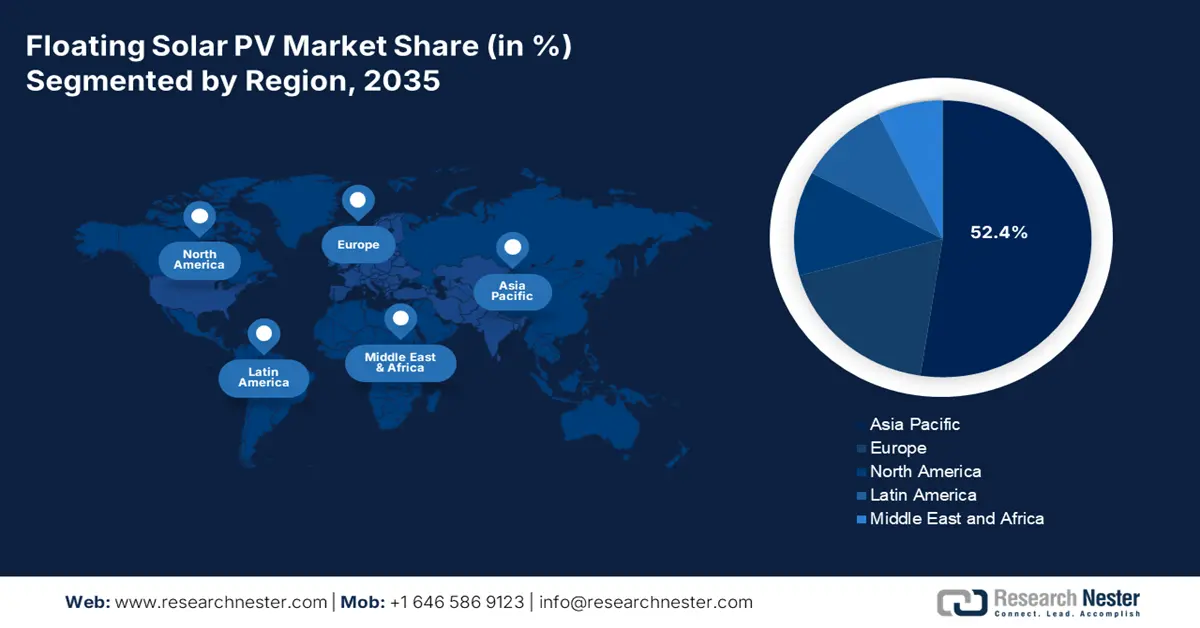

- By 2035, Asia Pacific is projected to command a 52.4% share in the floating solar pv market, reinforced by widespread reservoir co-location, aggressive utility decarbonization targets, and acute land scarcity across major economies.

- During the forecast period 2026–2035, North America is set to register the fastest growth in the market, stimulated by rising industrial electricity demand, water-constrained project siting, and mandated utility decarbonization initiatives.

Segment Insights:

- By the end of the forecast period 2026–2035, the HDPE modular float systems sub-segment within the mounting or structure segment is anticipated to secure the second-highest share in the floating solar pv Market, supported by its durability, cost efficiency, and simplified installation advantages.

- Over the forecast period 2026–2035, the stationary floating PV segment is expected to capture the third-largest share in the market, underpinned by its inherent stability and lower cost structure compared to tracking-based systems.

Key Growth Trends:

- Increased focus on climate objectives

- Surge in industrial demand

Major Challenges:

- Technical and environmental risks

- Regulatory and permitting obstacles

Key Players: Ciel & Terre International (France), Sungrow Power Supply Co., Ltd. (China), Trina Solar Limited (China), Kyocera Corporation (Japan), Sharp Corporation (Japan), Hanwha Q CELLS (South Korea), Waaree Energies Ltd. (India), Vikram Solar Limited (India), Tata Power Solar Systems Ltd. (India), Adtech Systems Co., Ltd. (China), Ocean Sun AS (Norway), Solaris Synergy (Israel), Swimsol GmbH (Austria), 4D Energy (Australia), Solarinno Energy (Malaysia), Hexa Renewables (Malaysia), First Solar, Inc. (U.S.), SunPower Corporation (U.S.), EDF Renewables (France), Lightsource bp (UK)

Global Floating Solar PV Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.9 billion

- 2026 Market Size: USD 8.4 billion

- Projected Market Size: USD 41 billion by 2035

- Growth Forecasts: 21.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (52.4% share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 15 January, 2026

Floating Solar PV Market - Growth Drivers and Challenges

Growth Drivers

- Increased focus on climate objectives: The market readily supports nations’ commitments under the Paris Agreement for extending renewable capacity without additional land utilization. For instance, based on government data published by the PIB Government in November 2024, India’s overall renewable energy capacity has effectively crossed the 200 GW milestone. This outstanding growth readily aligns with the nation’s significant renewable energy target of gaining 500 GW from non-fossil sources by the end of 2030. In addition, the country’s overall renewable energy installed capacity upsurged by 24.2 GW within a year, and successfully reached 203.1 GW in October 2024. This particular growth underscores the nation’s commitment to clean energy, which is positively impacting the market’s growth and demand.

- Surge in industrial demand: Industries, such as manufacturing and chemicals, are increasingly adopting FPV for captive power, along with aligning with decarbonization and ESG mandates. According to the October 2023 Department of Energy article, the U.S. Industrial Efficiency and Decarbonization Office (IEDO) declared the renewed funding, amounting to a USD 40 million investment for 5 years. This investment is poised to uplift research, development, and demonstrations of innovative process technologies to ensure reduced carbon footprint and energy, especially for manufacturing in the process sectors. Besides, DOE also notified a funding opportunity of USD 38 million for developing cross-sector technologies for the overall industrial sector, which, in turn, is skyrocketing the market globally.

- Rise in land scarcity: The floating solar PV market readily addresses land constraints in densely populated locations, especially in Europe and Asia. As per official statistics published by OECD in June 2025, almost 48% of the international land area witnessed nearly a month of extreme drought as of 2023. In addition, across 27 OECD-based member nations, almost 50% of the national territory has witnessed a surge in drought frequency, and meanwhile, in 24 nations, almost 50% of the land has observed an upsurge in drought intensity. Moreover, as of 2023, 37% of international soils experienced significant drying, while less than 6% witnessed an increase in average soil water content. Therefore, based on all these incidents, there is a huge demand for the market across different countries.

Challenges

- Technical and environmental risks: Systems in the floating solar PV market face unique technical hurdles compared to land-based installations. Anchoring and mooring structures must withstand fluctuating water levels, strong currents, and extreme weather events such as typhoons or floods. Offshore projects, in particular, encounter saltwater corrosion, biofouling, and wave-induced mechanical stress, which shorten equipment lifespans and increase maintenance costs. Environmental concerns also arise: large floating arrays can alter aquatic ecosystems by reducing sunlight penetration, affecting oxygen levels, and disrupting biodiversity. In reservoirs utilized for drinking water, regulators worry about contamination risks from float materials or accidental leaks, thereby negatively impacting the market’s growth.

- Regulatory and permitting obstacles: Projects in the market often face lengthy and complex permitting processes due to overlapping jurisdictions between energy regulators, water authorities, and environmental agencies. Unlike land-based solar, which typically requires land-use permits, floating PV must comply with water rights laws, aquatic ecosystem protections, and safety standards for reservoirs or dams. In many countries, water bodies are controlled by multiple agencies, creating bureaucratic delays and uncertainty for developers. For instance, projects on drinking water reservoirs may require additional approvals from public health authorities, while those on hydropower dams must coordinate with energy regulators to avoid operational conflicts.

Floating Solar PV Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

21.9% |

|

Base Year Market Size (2025) |

USD 6.9 billion |

|

Forecast Year Market Size (2035) |

USD 41 billion |

|

Regional Scope |

|

Floating Solar PV Market Segmentation:

Site Environment Segment Analysis

The inland freshwater sub-segment, which is part of the site environment segment, is anticipated to garner the highest share of 70.8% in the market by the end of 2035. The sub-segment’s growth is highly driven by offering a dual solution to pressing environmental and energy challenges, eventually by providing a facility for power generation. This combats land utilization conflicts and ensures suitable efficiency benefits and water conservation. According to official statistics published by UNESCO in February 2024, internationally, agriculture accounts for approximately 70% of freshwater, which is followed by industry with 20%, and domestic utilization with 12%. Besides, groundwater supplies nearly 25% of the overall water that is utilized for irrigation. Therefore, with an increase in the utilization of freshwater, there is a huge growth opportunity for the sub-segment globally.

Mounting/Structure Segment Analysis

By the end of the forecast period, the HDPE modular float systems sub-segment, part of the mounting or structure segment, is projected to hold the second-highest share in the floating solar PV market. The sub-segment’s growth is highly fueled by its durability, cost-effectiveness, and ease of installation. HDPE is resistant to UV radiation, corrosion, and chemical exposure, making it ideal for long-term deployment in diverse water environments such as reservoirs, lakes, and dams. Modular float systems are designed to be lightweight yet strong, enabling rapid assembly and scalability from small pilot projects to large utility-scale installations. Their buoyancy and flexibility allow for stable support of solar panels, even under fluctuating water levels or moderate wave conditions. Additionally, HDPE floats are eco-friendly, as they minimize leaching and are often recyclable, aligning with sustainability goals.

Product Type Segment Analysis

Based on the product type, the stationary floating PV segment in the market is expected to account for the third-largest share during the stipulated timeline. The segment’s development is highly propelled by providing stability and cost efficiency compared to tracking floating PV. Stationary platforms are favored for reservoirs, lakes, and industrial basins where water conditions are relatively calm, reducing the need for complex engineering. Their simplicity translates into lower capital expenditure, faster deployment, and reduced maintenance requirements, making them attractive for utilities and municipalities. Stationary floating PV also benefits from the natural cooling effect of water, which enhances panel efficiency and prolongs lifespan. By reducing evaporation, these systems provide dual benefits for water resource management, particularly in regions facing scarcity.

Our in-depth analysis of the floating solar PV market includes the following segments:

|

Segment |

Subsegments |

|

Site Environment |

|

|

Mounting/Structure |

|

|

Product Type |

|

|

Application |

|

|

Power Purchase Model |

|

|

Capacity |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Floating Solar PV Market - Regional Analysis

APAC Market Insights

The Asia Pacific floating solar PV market is anticipated to garner the highest share of 52.4% by the end of 2035. The market’s upliftment in the region is highly attributed to reservoir co-location, robust utility decarbonization targets, and land scarcity, particularly across Southeast Asia, South Korea, Japan, India, and China. According to an article published by PV Tech Organization in July 2025, A Malaysia-based utility organization, Tenaga Nasional Berhad, has officially unveiled a floating solar pilot project, which is projected to assist in unlocking 2.2 GW of generation capacity. This particular floating solar pilot constitutes a capacity of 100 kW and readily spans an area of 1,085 m2, along with 220 solar PV modules. Additionally, it aims to demonstrate the country’s largest lake, which covers 36,900 hectares, and can readily be utilized for a massive floating solar project.

The floating solar PV market in China is growing significantly due to industrial integration, policy and scale continuity, and the presence of state-owned enterprises significantly commissioning and piloting complex projects. As per official statistics published by the CNESA Organization in July 2025, the completely seawater-driven floating photovoltaic project by Sinopec Qingdao Refining and Chemical Co., Ltd. successfully generated 16.7 million kilowatt-hours of green electricity yearly. This has been extremely suitable for reducing carbon dioxide emissions by 14,000 tons, which is equivalent to planting 750,000 additional trees. This particular project offers a crucial demonstration for promoting floating PV in shallow and coastal sea locations under seawater conditions. Moreover, this readily maximizes the cooling effect of seawater, optimizing the power generation efficiency by 5% to 8%.

The floating solar PV market in Malaysia is also growing, owing to supportive tendering, clear project pipelines, and reservoir hybridization, along with suitable organizational contributions. For instance, in December 2025, Masdar, which is an international clean energy leader, significantly declared its first-ever project in the country, and deliberately signed a power purchase deal to create a 200 MW floating solar photovoltaic project at the Chereh Dam in Pahang State. This particular plant is expected to emerge as the largest floating solar project in the whole of Southeast Asia. Additionally, by occupying an estimated 950 acres, the plant is expected to comprise a generation capacity of over 300 MWp, which is suitable to power the equivalent of more than 100,000 homes. Further, the project valuation is estimated at over RM 850 million (USD 208 million), leading to a huge growth opportunity for the overall market.

North America Market Insights

North America floating solar PV market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by an increase in industrial demand, water-constrained siting, and utility decarbonization mandates. Based on government data published by the NREL Government in January 2025, reservoirs in the U.S. have the capability to host generous floating solar panels and generate almost 1,476 terawatt hours of energy to power an estimated 100 million homes every year. Besides, the 2026 Nature Conservancy Organization article has estimated that it is crucial to increase the renewable energy amount in the U.S. by 400%, develop 1.5 times the present long-lasting power lines to deliver clean energy, and ensure rapid timelines for the newest clean energy projects by 50%, all of which positively impact the market growth.

The floating solar PV market in the U.S. is gaining increased traction due to federal reservoir potential, chemical industry and clean energy funding, EPA green chemistry programs, and industrial decarbonization. As per an article published by the Department of Energy in February 2022, the administrative body issued two notices for providing USD 2.9 billion to bolster the production of innovative batteries. These are extremely essential to rapidly growing clean energy sectors in the near future, including energy storage and electric vehicles. In addition, the Bipartisan Infrastructure Law has allocated almost USD 7 billion to expand the domestic battery supply chain, which comprises recycling and producing minerals without new mining and extraction, along with sourcing materials for localized manufacturing, thereby making it suitable for uplifting the market.

The floating solar PV market in Canada is also developing, owing to provincial clean energy mandates, federal budget support, water utility integration, and sustainability, along with ESG alignment. As per government data put forth by the Government of Canada in August 2025, for the upcoming 5 years, the country’s clean energy gross domestic product (GDP) is expected to reach USD 107 billion, readily driven by USD 58 billion in yearly investments by the end of 2030, eventually leading to over 600,000 employment opportunities. Besides, the electricity sector is continuously transforming and expanding, with 140 GW to 190 GW of additional clean electricity generating capacity predicted to be required by the end of 2050. Moreover, the country’s Clean Electricity Regulations have allocated USD 60 billion to significantly decarbonize the electricity system, which is part of the Clean Economy Plan, thus bolstering the market’s growth.

Clean Electricity Generation in Canada (2024)

|

Source Type |

Generation % |

|

Hydro |

61.6 |

|

Nuclear |

12.9 |

|

Natural Gas |

12.6 |

|

Other Renewables |

8.0 |

|

Coal |

3.8 |

|

Petroleum |

1.1 |

|

Overall Electricity Generation |

639 TWh |

Source: Government of Canada

Europe Market Insights

Europe floating solar PV market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly driven by utility decarbonization targets, reservoir co-location, and land-utilization constraints. According to official statistics published by the Milken Institute Organization in October 2024, the region is considered the second-most crucial region in fueling growth in solar capacity, gradually deriving 15.2% of its electricity capacity from solar. In this regard, 59.9% of the region’s capacity is carbon-free, readily deriving a huge share of electricity from hydropower. Besides, the Netherlands ranks third in the global solar share of electric capacity, accounting for 39.6%. Additionally, the Dutch government offers suitable subsidies for rooftop solar, which has been installed on more than 2.6 million homes in the middle of 2023, thereby denoting a positive outlook for the market.

The floating solar PV market in Germany is gaining increased exposure due to robust clean-tech manufacturing ecosystems, reservoir hybridization with hydropower, and industrial decarbonization. As stated in an article published by Heinrich Böll Stiftung in March 2023, the country’s government has developed the national Climate Action Plan 2050, detailing the goal of achieving a 55% reduction in greenhouse gas emissions by the end of 2030 and almost becoming carbon neutral by the end of 2050. Moreover, it has been projected that 61% to 62% reduction in emissions from the energy industry needs to be gained by 2030. Besides, the objective for the industrial field is to diminish emissions by 49% to 51% by 2030, majorly through energy efficiency measures as well as waste heat recovery for power generation, thus creating an optimistic outlook for the market’s welfare.

The floating solar PV market in the Netherlands is also growing, owing to the rapid adoption of reservoir-based projects, strong water management infrastructure, and acute land constraints. As per a data report published by the Central Joint Organization in July 2024, the GDP per capita amounts to USD 58, along with 451 km of total coastline, 6,500 per km2 of the highest density, and 529 per km2 of average density. In addition, almost 17% of the country’s present land area amounts to 7,000 km2, which has been significantly reclaimed from swamps, lakes, marshes, and seas. Besides, the Delta Programme in the country is deliberately financed with the strong Delta Fund and is grounded under the Delta Act, with the provision of a EUR 27.4 billion budget till 2050. This is suitable for focusing on climate adaptation, water security, and fresh water availability, thus suitable for uplifting the market’s demand.

Key Floating Solar PV Market Players:

- Ciel & Terre International (France)

- Sungrow Power Supply Co., Ltd. (China)

- Trina Solar Limited (China)

- Kyocera Corporation (Japan)

- Sharp Corporation (Japan)

- Hanwha Q CELLS (South Korea)

- Waaree Energies Ltd. (India)

- Vikram Solar Limited (India)

- Tata Power Solar Systems Ltd. (India)

- Adtech Systems Co., Ltd. (China)

- Ocean Sun AS (Norway)

- Solaris Synergy (Israel)

- Swimsol GmbH (Austria)

- 4D Energy (Australia)

- Solarinno Energy (Malaysia)

- Hexa Renewables (Malaysia)

- First Solar, Inc. (U.S.)

- SunPower Corporation (U.S.)

- EDF Renewables (France)

- Lightsource bp (UK)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- Ciel & Terre International is widely recognized as a pioneer in floating solar PV, having developed modular floating platforms deployed across reservoirs worldwide. The company’s patented Hydrelio technology has set industry benchmarks, making it a leader in large-scale installations in Europe and Asia.

- Sungrow Power Supply Co., Ltd. is one of the largest global renewable energy firms and has rapidly expanded into floating solar PV with utility-scale projects. Its integrated solutions, including inverters and floating structures, have positioned it as a dominant player in China’s reservoir-based deployments.

- Trina Solar Limited, a leading solar module manufacturer, has diversified into floating PV by supplying high-efficiency panels for large-scale water-based projects. The company leverages its strong supply chain and research and development capabilities to support China’s rapid floating solar expansion.

- Kyocera Corporation is among the first Japan-based companies to pilot floating solar PV projects, particularly on reservoirs and dams. Its early adoption and collaboration with local governments have helped establish Japan as a key floating solar market.

- Sharp Corporation has contributed to Japan’s floating solar PV sector through advanced solar technologies and partnerships with water utilities. Its focus on high-efficiency modules and sustainable energy solutions supports Japan’s broader renewable energy transition.

Here is a list of key players operating in the global market:

The international market is highly competitive, with Asia-Pacific players dominating due to large-scale reservoir projects in China, India, and Japan. European firms like Ciel & Terre and Ocean Sun lead in modular float innovations, while U.S. companies focus on advanced solar technologies integrated with floating platforms. Strategic initiatives include joint ventures with utilities, government-backed pilot projects, and research and development investments in tracking systems to enhance efficiency. Partnerships with water authorities and chemical industries are expanding, aligning with sustainability mandates. Besides, in August 2025, Black & Veatch successfully delivered first megawatt-scale floating solar PV facility in Philippines. This readily marked a suitable milestone in sustainable mining practices and renewable energy advancement, thus making it suitable for the floating solar PV industry globally.

Corporate Landscape of the Market:

Recent Developments

- In September 2025, Sembcorp Industries significantly achieved the winning bidder by PUB, Singapore’s National Water Agency, to develop an estimated 86 MWp floating solar PV system on Pandan Reservoir.

- In June 2025, Sarawak signed a Memorandum of Understanding (MoU) with China Three Gorges International Ltd (CGTI) and Shanghai Electric Power T&D Group Co. Ltd to readily undertake a floating solar project at the Bakun Hydroelectricity facility.

- In June 2025, NTPC evidently signed a deal with Sustainable Energy for All (SEforALL) to support its transition to clean energy by aligning with net-zero commitments, development priorities, and energy security.

- Report ID: 8349

- Published Date: Jan 15, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Floating Solar PV Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.