Sheet Metal Market Outlook:

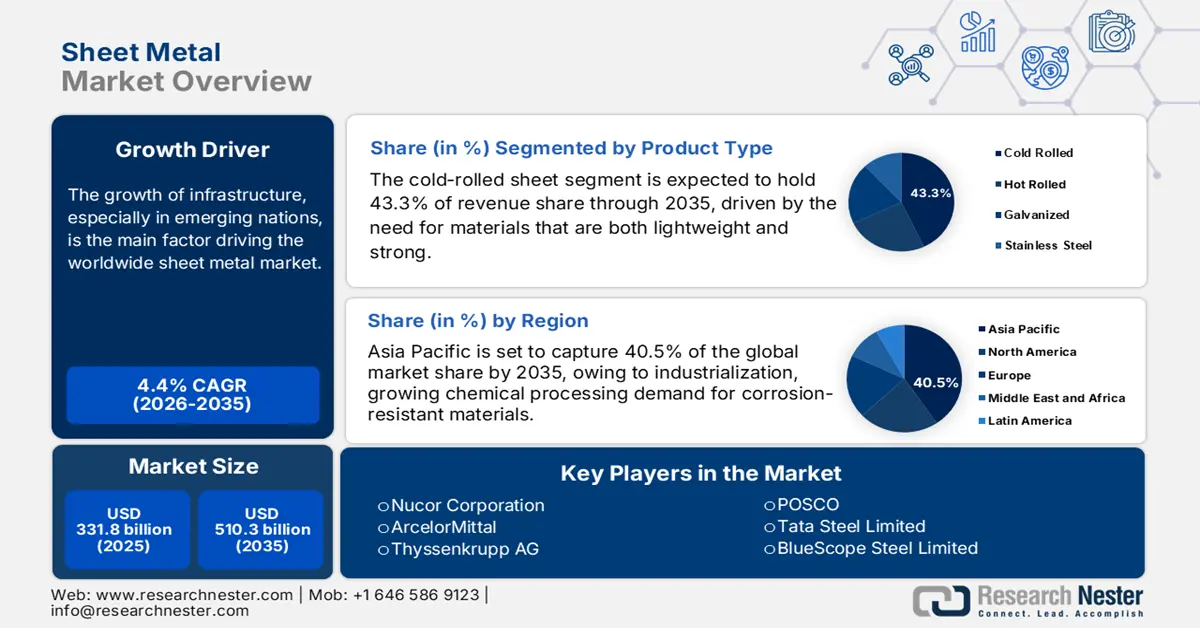

Sheet Metal Market size was estimated at USD 331.8 billion in 2025 and is expected to surpass USD 510.3 billion by the end of 2035, rising at a CAGR of 4.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of sheet metal is estimated at USD 346.4 billion.

The growth of infrastructure, especially in emerging nations, is the main factor driving the worldwide market. The need for sheet metal in the building, transportation, and energy sectors has grown dramatically as a result of government-led programs centered on urbanization and industrialization. The Advanced Manufacturing Office of the U.S. Department of Energy has played a significant role in promoting creative research and development initiatives meant to boost manufacturing productivity and competitiveness in the industrial sector. Further, notable advancements have been made in the supply chain of the sheet metal industry, with large investments going toward increasing production capabilities. TST Fabrication and Machine, for instance, made a $3 million investment to expand its headquarters in Norfolk to produce machine components and sheet metal fabrication for the Navy. In a similar vein, Skilcraft LLC is investing $8.4 million to grow its business in Hebron and increase its ability to manufacture metal components and fabricated parts for the aerospace sector.

Key Sheet Metal Market Insights Summary:

Regional Insights:

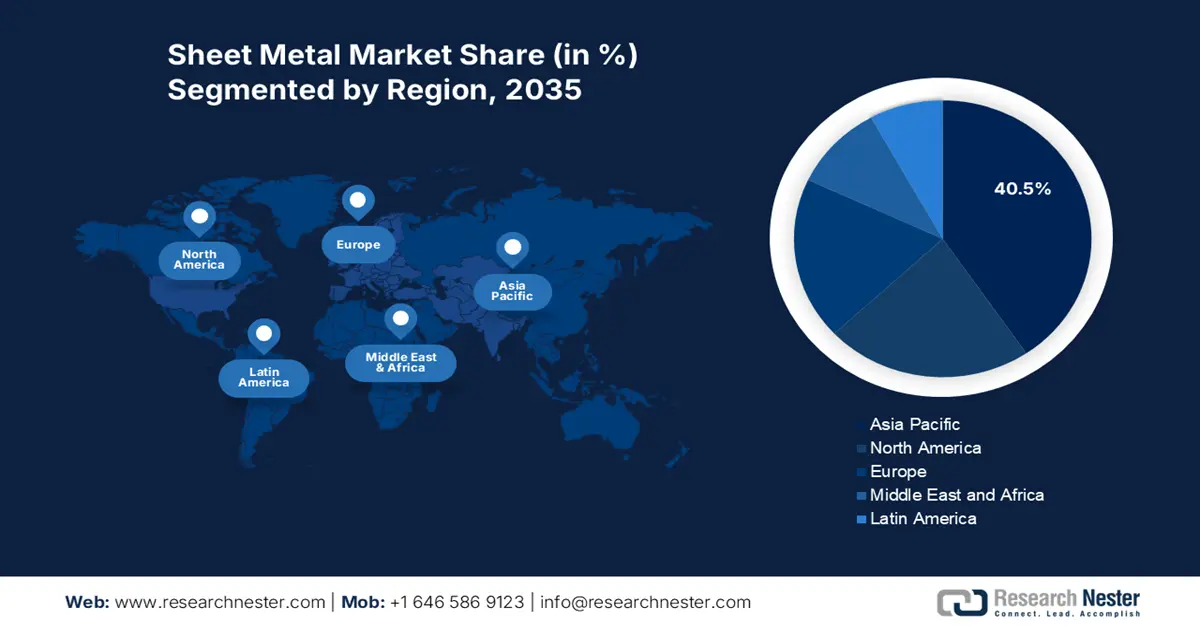

- The Asia Pacific region is expected to hold 40.5% share by 2035 in the Sheet Metal Market, fueled by rapid industrialization, rising demand for corrosion-resistant materials, and strong governmental support for sustainable manufacturing initiatives.

- The North American region is projected to capture 22.5% share by 2035, owing to expanding applications across automotive, aerospace, and construction industries coupled with government-backed energy-efficient fabrication programs.

Segment Insights:

- The cold-rolled sheet metal segment is projected to account for 43.3% share by 2035 in the Sheet Metal Market, propelled by the rising demand for lightweight and high-strength materials in precision automotive and electronics manufacturing.

- The stainless-steel segment is anticipated to capture 39.1% share by 2035, driven by increasing infrastructure development, expanding automotive production, and the growing preference for sustainable and corrosion-resistant materials.

Key Growth Trends:

- Green chemistry and process innovation

- Automotive industry expansion

Major Challenges:

- Fluctuations in raw material prices

- Environmental regulations and sustainability challenges

Key Players: Nucor Corporation,ArcelorMittal,Nippon Steel Corporation,Thyssenkrupp AG,POSCO,Tata Steel Limited,BlueScope Steel Limited,Steel Authority of India Limited (SAIL),U.S. Steel Corporation,JSW Steel,Essar Steel India Limited,Outokumpu Oyj,Malaysian Steel Works (KL) Berhad,Dongkuk Steel Mill Co., Ltd.,JFE Steel Corporation

Global Sheet Metal Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 331.8 billion

- 2026 Market Size: USD 346.4 billion

- Projected Market Size: USD 510.3 billion by 2035

- Growth Forecasts: 4.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: South Korea, Brazil, Indonesia, Mexico, Vietnam

Last updated on : 30 September, 2025

Sheet Metal Market - Growth Drivers and Challenges

Growth Drivers

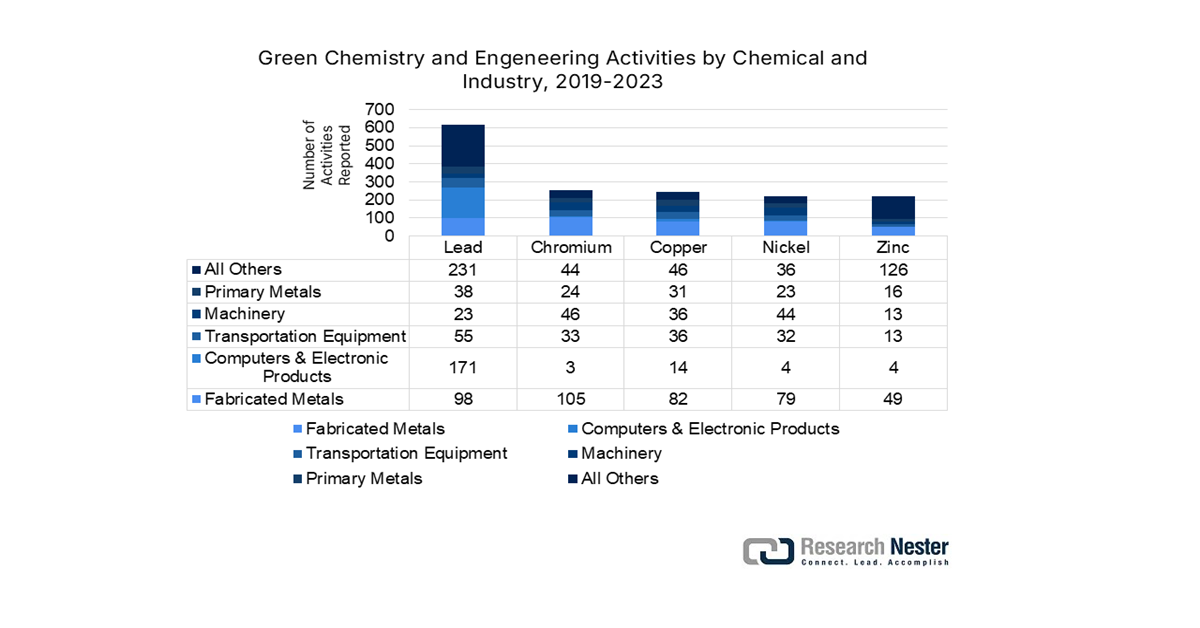

- Green chemistry and process innovation: Innovations play a crucial role in promoting sustainability within the sheet metal industry. The GREENSCOPE tool developed by the U.S. EPA aids in reducing resource consumption and hazardous waste, aligning with the objectives of its Green Chemistry Program. In a similar vein, India’s Ministry of Steel advocates for the implementation of clean technologies and process optimization to decrease energy usage and pollution. By embracing these environmentally friendly principles and innovations, the sheet metal industry can attain reduced emissions and waste, thereby improving its overall environmental performance.

Green chemistry boosts demand for sheet metal by focusing on building more energy-efficient equipment, decreasing waste that needs to be processed, and deploying innovative technologies that require long-lasting, corrosion-resistant materials. Activities include building closed-loop recycling systems that require tanks and pipes, developing novel catalytic reactors, and designing facilities for ambient temperature processing, all of which rely on sheet metal for structure and containment.

Source: epa.gov

- Automotive industry expansion: The automotive industry significantly influences the demand for sheet metal, as demonstrated by Thai Summit Kentucky Corp.'s substantial investment of $131 million aimed at expanding its operations and generating 78 full-time employment opportunities. This expansion bolsters prominent automakers, including Ford, Stellantis, Tesla, and Rivian, highlighting the vital importance of sheet metal parts in the production of vehicles. The lightweight and durable nature of sheet metal is crucial for enhancing fuel efficiency and safety within the fast-changing automotive sector.

- Infrastructure development enhances steel demand: The development of infrastructure serves as a crucial catalyst for the market. In India, the steel demand is anticipated to experience substantial growth over the coming decade, with annual growth rates projected between 5% and 7.3%. This increase is fueled by significant government investments in infrastructure initiatives, including the establishment of industrial corridors and related projects. Prominent states such as Maharashtra, Uttar Pradesh, Gujarat, Karnataka, and Tamil Nadu represented 41% of India's steel consumption in FY23, highlighting the critical role of infrastructure development in stimulating steel demand.

1. Global Sheet Metal Exports & Imports

Hot Rolled Sheet Metal Import/Export Volume (2023)

|

Region |

Import Value (in USD Mn) |

Region |

Export Value (in USD Mn) |

|

China |

145 |

U.S. |

112 |

|

Germany |

87.2 |

Jordan |

45.1 |

|

Japan |

72.1 |

Botswan |

39.8 |

Source: OEC

2. Global Aluminum Production

Aluminum Production (2025)

|

Region |

2025 Sales Volume (Million Units) |

|

China |

3870 |

|

Europe |

596 |

|

Asia-Pacific |

411 |

|

North America |

330 |

|

Africa |

140 |

|

South America |

134 |

Challenges

- Fluctuations in raw material prices: The sheet metal industry is particularly vulnerable to changes in the costs of raw materials such as steel, aluminum, and various alloys. Price fluctuations, influenced by global supply-demand disparities, trade tariffs, and geopolitical issues, can greatly affect manufacturing expenses and profit margins. This uncertainty compels companies to continuously revise their pricing strategies and manage inventory risks, complicating long-term planning.

- Environmental regulations and sustainability challenges: The sheet metal sector faces considerable challenges due to increasingly strict environmental regulations and a heightened focus on sustainability. Adhering to emission standards and waste management regulations often necessitates substantial investments in cleaner technologies and processes. Furthermore, the rising consumer preference for eco-friendly materials drives manufacturers to innovate, which can sometimes result in increased production costs and operational difficulties.

Sheet Metal Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.4% |

|

Base Year Market Size (2025) |

USD 331.8 billion |

|

Forecast Year Market Size (2035) |

USD 510.3 billion |

|

Regional Scope |

|

Sheet Metal Market Segmentation:

Product Type Segment Analysis

Based on the product type, the cold-rolled sheet metal segment is likely to hold a 43.3% share by the end of 2035. The fine finish and tighter tolerances of cold-rolled sheet metal are crucial for precision manufacturing, particularly in the electronics and automotive industries. In these industries, cold-rolled sheets have been driven by the need for materials that are both lightweight and strong. The U.S. Environmental Protection Agency states that cold-rolled steel's superior strength-to-weight ratio makes it a crucial part of the production of energy-efficient cars. The National Institute of Standards and Technology also promotes cold-rolled metal's dominance in the market by highlighting the metal's importance in complex manufacturing processes.

Material Type Segment Analysis

The stainless-steel segment is projected to gain about 39.1% share through 2035. Stainless steel is the industry leader in sheet metal due to its exceptional strength, durability, and resistance to corrosion, which makes it perfect for industrial, construction, and automotive applications. The need for stainless steel sheet metal is further increased by an increase in infrastructure projects and automobile production, particularly in emerging economies. Additionally, the material's recyclability supports global sustainability objectives, which helps it gain market share. Stainless steel is being used more often in long-lasting and energy-efficient constructions, which is helping the industry grow, according to the U.S. Department of Energy. The World Steel Association also emphasizes the global trend toward high-performance steels, of which stainless steel is a major component.

Application Segment Analysis

The automotive sub-segment significantly propels growth in the market, driven by the need for lightweight and durable materials that improve fuel efficiency and safety. Sheet metal, particularly high-strength steel and aluminum alloys, is extensively utilized in car bodies, chassis, and engine components. The rising regulatory pressure to lower vehicle emissions and enhance performance accelerates the adoption of advanced sheet metal solutions, establishing the automotive sector as a crucial revenue contributor in the market.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Material Type |

|

|

Product Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sheet Metal Market - Regional Analysis

Asia Pacific Market Insights

By 2035, it is anticipated that the entire APAC sheet metal market will account for 40.5% of worldwide revenue, with a compound annual growth rate (CAGR) of 4.4% from 2026 to 2035. Strong industrialization, growing chemical processing demand for corrosion-resistant materials, and government-supported environmental initiatives are some of the motivators. To increase sector growth, nations place a lot of emphasis on eco-friendly chemicals, green manufacturing, and revolutionary wafer technologies (GaAs). The adoption of sustainable practices is accelerating in emerging economies, aided by financial incentives and regulatory frameworks.

By 2035, China is predicted to hold the largest revenue share in the APAC sheet metal market, accounting for 18.1% of worldwide sales. Massive industrial output, particularly in the production of chemicals and automobiles, and aggressive government investments in sustainable industrial development are important motivators. The NDRC actively promotes green technology innovation and sustainable practices, with plans to enhance enterprise roles, fiscal support, and international cooperation, aiming for green factories to exceed 40% of manufacturing output by 2030.

India is the world’s second-largest producer of crude steel, and its output has been rising steadily in recent years, reflecting growth in both industrial and infrastructure sectors. The government has set ambitious targets under the National Steel Policy to increase per capita steel consumption significantly, as well as to scale up crude steel production capacity by 2030-31. Domestic demand for finished steel is growing across end-use segments such as automotive, construction, and infrastructure, supported by policy initiatives like the Production Linked Incentive (PLI) scheme for specialty steel. With the rising consumption, India has also become more active in importing and exporting steel products, as well as investing in higher-grade steel and alloys to meet technical specifications required by sheet metal uses. Increased capacity expansions, modernization of steel mills, and regulatory support are enhancing both quality and supply reliability, which in turn reinforce growth in downstream segments like sheet metal fabrication and processing.

North America Market Insights

By 2035, the North American sheet metal market, which includes the United States and Canada, is projected to account for about 22.5% of the global market revenue share, with a compound annual growth rate (CAGR) of 3.9% from 2026 to 2035. The demand for corrosion-resistant and long-lasting materials in the chemical industry, as well as the automotive, aerospace, and construction sectors, is the main driver of the market. The industry is expanding due to advancements in lightweight metals and sophisticated fabrication techniques. Demand is also fueled by government programs that promote environmental sustainability and energy efficiency, particularly in sectors that depend on premium sheet metal components. The U.S. Department of Energy (DOE), for instance, funds advanced manufacturing research, including methods for fabricating sheet metal that use less energy and produce less waste.

Strong government assistance is advantageous to the U.S. chemical industry, which uses sheet metal extensively in infrastructure and equipment. The U.S. Department of Energy's Office of Manufacturing and Energy Supply Chains was allocated $750 million to strengthen critical material supply chains essential for clean energy technologies, including metal production equipment. Additionally, advanced manufacturing methods related to sheet metal fabrication are supported by federal funding, including initiatives run by the National Institute of Standards and Technology (NIST) that encourage environmental compliance and materials science research.

It is anticipated that Canada's sheet metal industry will expand gradually due to rising demand from the chemical, construction, and automotive industries. Canada's share of the worldwide sheet metal market is projected to reach 5.3% by 2035, with a compound annual growth rate (CAGR) of roughly 3.7% during this time frame. Strong manufacturing, a plentiful supply of raw materials, and government backing for green manufacturing projects all benefit the nation.

Europe Market Insights

The European sheet metal market represents 18.3% revenue share, characterized by high-value manufacturing and strict environmental regulations. The primary drivers of growth include the strong automotive industry, the expansion of renewable energy, and the advanced aerospace and defense sectors. The region's significant emphasis on sustainability, highlighted by the European Green Deal, is promoting the adoption of energy-efficient fabrication processes and the use of recycled materials. Furthermore, advancements in automation, laser cutting, and additive manufacturing are improving productivity, enabling manufacturers to counterbalance high labor costs and sustain global competitiveness in the face of economic challenges.

European Union Expanded Sheet Metal by country in 2022

|

Region |

Total Value (1000) USD |

Quantity (Kg) |

|

UK |

12,673.85 |

4,877,710 |

|

China |

6562.42 |

2,951,040 |

|

U.S. |

1,025.76 |

16,362 |

|

Japan |

21.69 |

1,021 |

|

India |

16.80 |

5,049 |

|

Malaysia |

3.67 |

24 |

|

Canada |

1.18 |

1,071 |

|

Indonesia |

0.02 |

2 |

|

Thailand |

0.01 |

1 |

Key Sheet Metal Market Players:

- Nucor Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ArcelorMittal

- Nippon Steel Corporation

- Thyssenkrupp AG

- POSCO

- Tata Steel Limited

- BlueScope Steel Limited

- Steel Authority of India Limited (SAIL)

- U.S. Steel Corporation

- JSW Steel

- Essar Steel India Limited

- Outokumpu Oyj

- Malaysian Steel Works (KL) Berhad

- Dongkuk Steel Mill Co., Ltd.

- JFE Steel Corporation

Leading multinational producers, mostly from the USA, Europe, and Asia, compete fiercely in the worldwide sheet metal chemical industry. To satisfy growing environmental requirements and consumer demand, major manufacturers place a strong emphasis on innovation in corrosion-resistant metals and sustainable manufacturing techniques. Increasing manufacturing capacity, vertical integration, and implementing Industry 4.0 technologies for increased efficiency are examples of strategic initiatives. Businesses like Tata Steel and Nippon Steel make large R&D investments to create specialty sheet metals for use in the chemical sector. Additionally, government-backed incentives in nations like Japan and India encourage greener manufacturing, which affects the competitive dynamics of this sector. Partnerships and acquisitions are also frequently used to expand geographic reach and product portfolios.

Companies Dominating the Sheet Metal Market Landscape:

Recent Developments

- In January 2024, ArcelorMittal introduced a high-performance protective covering sheet metal that was created especially for settings with severe chemicals. This device reduces maintenance expenses by 18% and increases equipment longevity by 30%. ArcelorMittal reported a 12% increase in sales in the chemical industry area in Q1 2024, particularly in North America and Europe, as a result of this introduction.

- Thyssenkrupp's sheet metal chemical production lines saw a 30% decrease in energy use and a 20% increase in yield after using an AI-powered automation system. Many of its plants in Europe have embraced this innovation, which has raised the bar for efficiency.

- Report ID: 4427

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sheet Metal Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.