Schizophrenia Drugs Market Outlook:

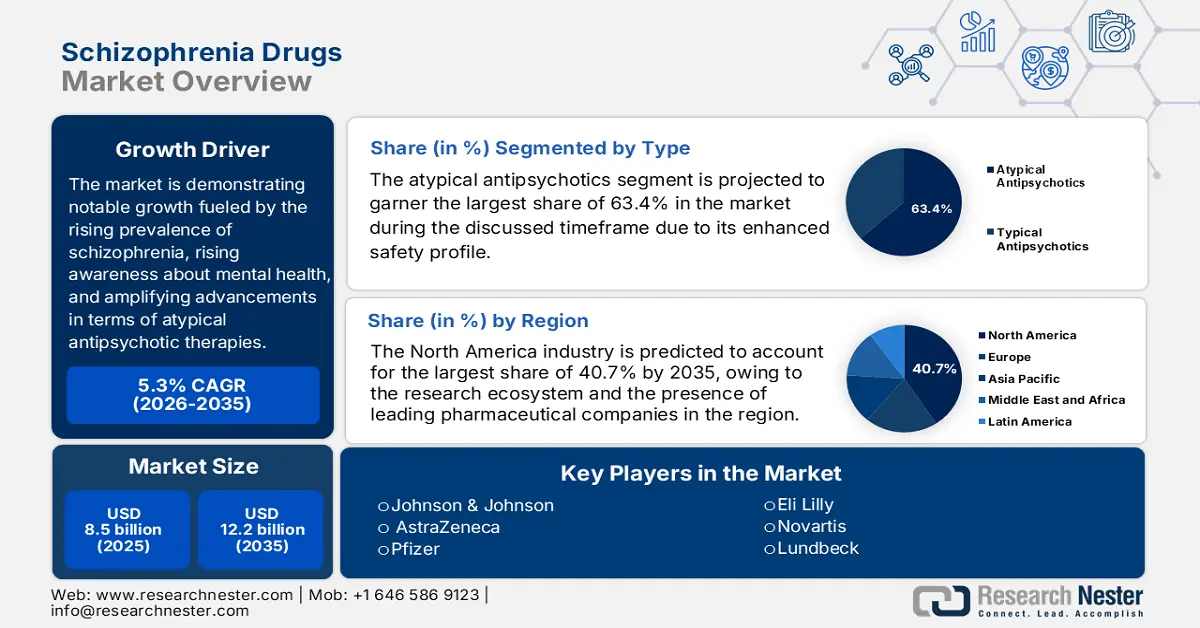

Schizophrenia Drugs Market size was valued at USD 8.5 billion in 2025 and is projected to reach USD 12.2 billion by the end of 2035, rising at a CAGR of 5.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of schizophrenia drugs is estimated at USD 8.7 million.

The worldwide schizophrenia market is demonstrating notable growth, primarily fueled by the rising prevalence of schizophrenia, rising awareness about mental health, and amplifying advancements in terms of atypical antipsychotic therapies. As per an article published by the World Health Organization in January 2022, Schizophrenia affects around 24 million individuals across all nations, or 1 in 300 individuals, with a higher prevalence among adults at 1 in 222. It also underscored that men are highly affected when compared to women, and people affected have a 2 to 3 times increased chance of witnessing death prematurely owing to physical health issues like cardiovascular and metabolic diseases.

Furthermore, the evolving approach of payers towards pricing and reimbursement is also an extremely favorable factor for market expansion. This can be testified by the report from JMCP published in July 2023 that states that a cost-effectiveness study on paliperidone formulations found that long-acting injectables (LAIs) improve patient outcomes. The analysis also underscored that reducing LAI drug prices by 50% to 75% will remarkably enhance the cost-effectiveness, thereby reflecting the pivotal role of payers in adopting value-based pricing strategies.

Key Schizophrenia Drugs Market Insights Summary:

Regional Highlights:

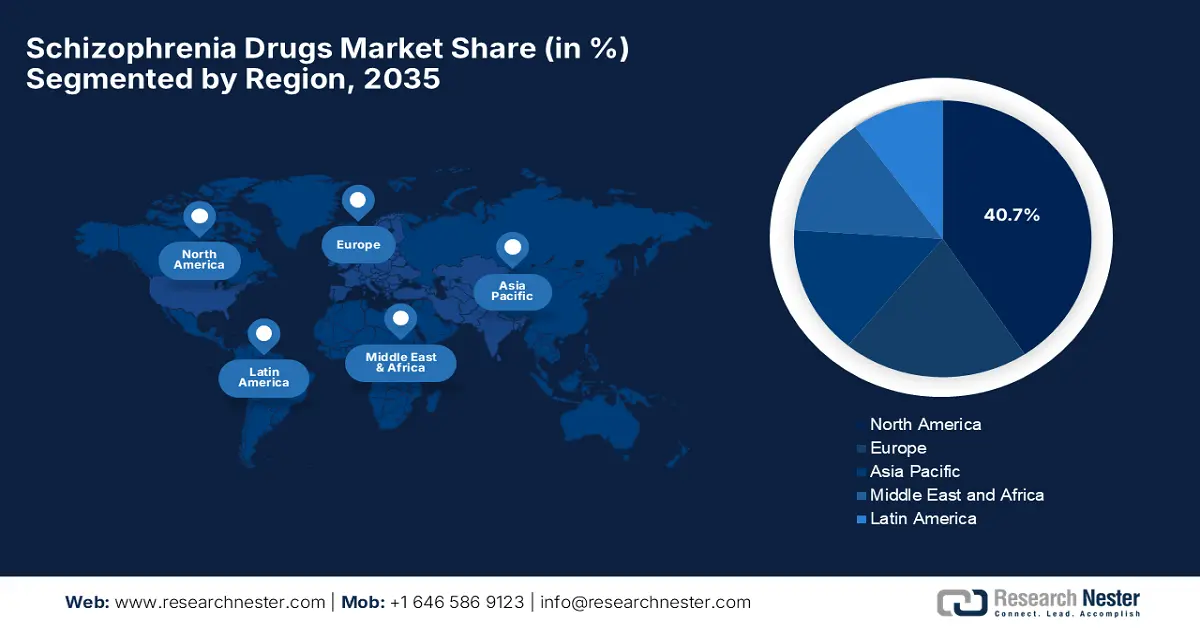

- North America is projected to capture a 40.7% share by 2035 in the schizophrenia drugs market (impelled by advanced healthcare infrastructure, research ecosystem, and presence of leading pharmaceutical companies).

- Asia-Pacific is expected to register the fastest growth by 2035 (owing to increasing healthcare spending, rising diagnosis rates, and adoption of next-generation antipsychotics).

Segment Insights:

- The atypical antipsychotics segment is projected to account for 63.4% share by 2035 in the schizophrenia drugs market (driven by enhanced safety profile and efficacy in managing both positive and negative symptoms of schizophrenia).

- The oral tablets segment is forecasted to hold a 57.6% share by 2034 (propelled by ease of administration, greater patient compliance, and cost-effectiveness).

Key Growth Trends:

- Progressive advancements in drug formulations & delivery technologies

- Rising awareness of early detection

Major Challenges:

- Prolonged approval durations

- Reduced medication compliance

Key Players: Johnson & Johnson (U.S.), AstraZeneca (UK), Pfizer (U.S.), Eli Lilly (U.S.), Novartis (Switzerland), Lundbeck (Denmark), Teva Pharmaceutical (Israel), H. Lundbeck A/S (Denmark), Sun Pharmaceutical (India), Viatris (U.S.), Alkermes (Ireland), Lupin Limited (India), CSL Limited (Australia), JW Pharmaceutical (South Korea), Pharmaniaga (Malaysia).

Global Schizophrenia Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.5 billion

- 2026 Market Size: USD 8.7 million

- Projected Market Size: USD 12.2 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.7% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, Germany, Japan, France, United Kingdom

- Emerging Countries: China, India, Brazil, South Korea, Mexico

Last updated on : 20 August, 2025

Schizophrenia Drugs Market - Growth Drivers and Challenges

Growth Drivers

-

Progressive advancements in drug formulations & delivery technologies: This is a primary fueling factor for the market to expand at a robust pace. The emerging drug formulations, such as novel antipsychotic molecules, readily drive business in this field. For instance, in September 2024, Bristol Myers Squibb announced that the U.S. FDA approved its COBENFY (xanomeline and trospium chloride), which marks the first new class of schizophrenia treatment over the last few decades. The formulation works by targeting M1 and M4 muscarinic receptors, thereby fostering a profitable business environment.

-

Rising awareness of early detection: The escalating mortality rates are remarkably increasing awareness about mental health disorders and accurate detection measures. Besides the evolution of educational campaigns and efforts to reduce stigma are also expanding the reach of schizophrenia drug market. Therefore, IMHO, in November 2023 stated that the government of India introduced Tele MANAS, introduced in 2022, offers 24/7 remote mental health support and has received nearly 400,000 calls. The initiative also includes chatbots and is planned to integrate with eSanjeevani for remote psychiatric consultations, hence a positive market outlook.

-

Strong pipeline and research activities: The market will ultimately benefit from the strong pipeline of novel drug candidates and increasing R&D activities. Both public and private entities are readily putting efforts in terms of clinical trials and investments. For instance, in July 2025, Neumora Therapeutics announced that it had started a Phase 1 clinical trial for NMRA-861, a selective M4 muscarinic receptor modulator for schizophrenia treatment. Preclinical studies showed no convulsions, indicating a favorable safety profile offering new treatment options and improving patient outcomes.

Global Schizophrenia Prevalence by Age Group (2021)

|

Age Group |

Prevalence (%) |

Key Insights |

|

Age-standardized |

0.28% |

Adjusted for global age distribution; baseline for comparisons |

|

All ages |

0.29% |

Slightly higher than age-standardized due to population aging |

|

Ages 70+ |

0.19% |

Lower prevalence likely due to underdiagnosis or comorbidities masking symptoms |

|

Ages 65-69 |

0.31% |

Slight increase vs. 70+, possibly reflecting better diagnosis in younger seniors |

|

Ages 60-64 |

0.38% |

Rising trend as mid-life onset cases persist |

|

Ages 55-59 |

0.44% |

Approaching peak prevalence years |

|

Ages 50-54 |

0.49% |

Near-peak rates; often linked to chronic/late-onset cases |

|

Ages 45-49 |

0.53% |

Peak range: Typical onset age for persistent schizophrenia |

|

Ages 40-44 |

0.56% |

Highest prevalence; aligns with active symptomatic periods |

|

Ages 35-39 |

0.56% |

Matches 40-44 group; prime diagnostic years |

|

Ages 30-34 |

0.53% |

Slight decline but still high; early adulthood onset common |

|

Ages 25-29 |

0.43% |

Drop reflects fewer late-adolescence onset cases |

|

Ages 20-24 |

0.25% |

Sharp decline; schizophrenia is rare in early adulthood |

|

Ages 15-19 |

0.07% |

Very low; early-onset schizophrenia is uncommon |

|

Ages 5-14 |

<0.01% |

Extremely rare; often misdiagnosed as other developmental disorders |

Source: IHME, Global Burden of Disease

Notable Developments in Schizophrenia Drugs

|

Company / Product |

Key Update |

Impact / Significance |

Year |

|

Newron / Evenamide |

Positive Phase II/III trial results; well tolerated |

Potential new option for treatment-resistant schizophrenia |

2024 |

|

Otsuka & Lundbeck / Abilify Maintena |

EC approved a 2-month injectable for maintenance |

Simplifies dosing, supports patient compliance |

2024 |

|

Janssen / INVEGA HAFYERA |

FDA-approved twice-yearly injectable |

Fewer doses per year, better adherence |

2021 |

|

Alkermes / LYBALVI |

FDA-approved oral antipsychotic with less weight gain |

New oral treatment option with improved side effect profile |

2021 |

Source: Company Official Press Releases

Challenges

-

Prolonged approval durations: The market faces a major obstacle due to the stringent regulatory approval processes that ultimately cause a delay to the product’s entry. Besides, the development of new antipsychotic medications requires extensive clinical trials to demonstrate their safety and efficacy, which can be both time and capital-consuming. In this regard, the administrative agencies are further straining manufacturers with their rigorous standards to ensure patient safety, thereby limiting the speed of innovation in this field.

-

Reduced medication compliance: The existence of non-adherence among patients and expensive treatment approaches is the principal challenge for the market. The existing antipsychotic drugs often pose side effects such as weight gain, sedation, and extrapyramidal symptoms that can result in treatment discontinuation or irregular medicine utilization. On the other hand, this complicates the clinical outcomes, thereby increasing relapse rates, making it challenging for pharmaceutical firms to develop drugs that balance efficacy with tolerability.

Schizophrenia Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 8.5 billion |

|

Forecast Year Market Size (2035) |

USD 12.2 billion |

|

Regional Scope |

|

Schizophrenia Drugs Market Segmentation:

Type Segment Analysis

The atypical antipsychotics segment is projected to garner the largest share of 63.4% in the market during the discussed timeframe. The enhanced safety profile and its efficacy in managing both positive and negative symptoms of schizophrenia position this subtype in a dominant position in this field. Therefore, Teva Pharmaceuticals in November 2024 notified that it received positive Phase 3 SOLARIS trial results for TEV-'749, which is a subcutaneous long-acting injectable olanzapine for schizophrenia. The study also showcased remarkable improvements in social functioning and quality of life without any sort of new safety concerns or PDSS events.

Formulation Segment Analysis

In terms of formulation, the oral tablets segment is projected to gain a significant revenue share of 57.6% in the market by the end of 2034. The ease of administration, greater patient compliance, and cost-effectiveness are the key factors reinforcing the segment’s leadership. The Psychiatry Research article published in June 2025 reported that patients described practical aspects of antipsychotic treatment, stating that oral tablets are increasingly preferred owing to the increased privacy compared to long-acting injectables, which may involve frequent hospital visits and embarrassment related to injections, thereby denoting a wider segment scope.

Distribution Channel Segment Analysis

The hospital pharmacy segment is projected to capture a considerable share of 50.7% during the forecast period. The growth in the segment originates from the critical nature of treatment that requires medical guidance, diagnosis, and medication prescription. As evidence, the November 2024 article by the NIH stated that the Si-Care program, which is a pharmacist-led program deliberately showcased, improved medication adherence in schizophrenia patients from 77.38% to 97.57% in a span of four months. Hence, such studies signify the crucial role of pharmacists in supporting medication adherence within hospital and community care settings as well.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Formulation |

|

|

Distribution Channel |

|

|

End user |

|

|

Treatment Line |

|

|

Drug Class |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Schizophrenia Drugs Market - Regional Analysis

North America Market Insights

North America is considered to be the dominating region in the global schizophrenia drugs market, grabbing a share of 40.7% by the end of 2035. The advanced healthcare infrastructure, research ecosystem, and presence of leading pharmaceutical companies are the primary fueling factors in this landscape. In June 2025, Reviva Pharmaceuticals reported positive results from the 1-year Phase 3 RECOVER open-label extension study of brilaroxazine in schizophrenia. The company stated that the drug demonstrated sustained broad-spectrum efficacy across all symptom domains, including negative symptoms, hence a positive market outlook.

U.S. in the schizophrenia drugs market is demonstrating expedited growth on account of growing disease prevalence and significant budget allocations. Besides, the country’s pharmaceutical industry gets huge support from administrative bodies, allowing remarkable funding grants. Therefore, in May 2025, Neurocrine Biosciences stated that it received positive Phase 2 study results for NBI-1117568 in adults with schizophrenia. The investigational oral muscarinic M4 selective orthosteric agonist showed significant symptom improvement and overall severity reduction, hence suitable for standard market growth.

Canada in the schizophrenia drugs market is poised for significant growth, extensively facilitated by the increasing awareness of mental health, advancements in drug development, and rising aging demographics. Therefore, the report by the Schizophrenia Society of Canada (SSC) in February 2023 unveiled that Canada requires urgent mental health parity legislation to improve schizophrenia treatment access. Besides, the country is currently spending USD 50 billion on mental health issues, and there has been a presence of 140 clinics and international evidence that demonstrate enhanced patient outcomes, hence fostering innovation, and expanding the Canada’s market.

Economic Burden of Mental Health Issues in the U.S. 2022

|

Metric |

Value (USD) |

|

Annual per-patient economic burden |

$46,500 |

|

Lifetime costs (diagnosis by age 25) |

Up to $1.85 million |

|

Informal caregiver costs (2020) |

$83.7 billion (unpaid care) + $20.8 billion (additional costs) |

Source: Tufts Medical Center

APAC Market Insights

Asia-Pacific is expected to grow at the fastest rate in the schizophrenia drugs market, supported by increasing healthcare spending and rising diagnosis rates. The region also benefits from both public and private entities that are constantly putting in efforts to enhance access to diagnosis and treatment across its vast geography. Also, there has been an increasing preference for next-generation antipsychotics due to their efficacy, further supported by amplifying research and clinical trials in prominent countries such as Japan, China, and India. Furthermore, the rise of digital health initiatives and telepsychiatry is propelling greater revenue in this field.

China’s market of schizophrenia drugs is reaping advantages from increasing mental health awareness, broader insurance coverage, and strong administrative support to integrate psychiatric care into mainstream health services. In addition, regulatory emphasis on this sector and R&D focus on next-generation therapies also facilitate revenue in this sector. Therefore, in January 2025, Zai Lab Limited made an announcement that the National Medical Products Administration had accepted the New Drug Application for KarXT, a novel treatment for schizophrenia in adults. This has been developed in collaboration with Karuna Therapeutics, which exhibited great results in clinical trials, hence benefiting overall market growth.

India is emerging in the schizophrenia drugs market, readily propelled by the enhanced access to telepsychiatry and the efforts to integrate psychiatric care into the primary healthcare settings. Besides, the country benefits from suitable government schemes that ensure affordability and widespread availability. In this regard, PIB in February 2025 reported that the Ministry of Health is extending its support through initiatives such as the National Mental Health Programme and Ayushman Bharat, which are successfully enhancing care at the community level. It also underscored that the upgrade of 1.73 lakh health centres and the emergence of Tele MANAS highlight a shift toward decentralized, affordable care.

Europe Market Insights

Europe in the schizophrenia drugs market is primarily shaped by its well-established healthcare infrastructure and preceding advancements in neuropsychiatric research. Besides the governments and healthcare providers are increasingly emphasizing early diagnosis to better address the complex needs of patients. In this regard, Laboratorios Farmacéuticos Rovi in April 2024 announced that the U.S. FDA has approved its Risvan (Risperidone ISM) for the treatment of schizophrenia in adults. Hence, such milestones underscore Europe’s growing role in developing next-generation antipsychotics with enhanced adherence.

U.K. holds a strong position in the regional schizophrenia drugs market faciiltated by the widespread access to mental health services through the NHS and rigorous investments in R&D. For instance in June 2025 Monument Therapeutics, revealed that it gained positive topline results from its Phase I clinical trial of MT1988—a fixed-dose combo of two small molecules targeting cognitive impairment associated with schizophrenia. Therefore, this milestone marks a meaningful step toward addressing a critical unmet need in schizophrenia care, thereby stimulating growth in the overall market.

Germany is productively augmenting its leadership in Europe’s schizophrenia drugs market, owing to the robust medical, R&D ecosystem and the rise of personalized psychiatry measures. In this regard, in May 2024, BioMed X Institute, in partnership with Boehringer Ingelheim, announced that it had successfully completed a neuroscience project to observe molecular mechanisms behind white matter deficits in schizophrenia. The data have been acquired by Boehringer Ingelheim to advance research into schizophrenia and related neurological disorders, thereby positing Germany as the dominating player in this landscape.

Schizophrenia Drug Pipeline Overview as per NLM Report 2024

|

Drug Name |

Company |

Mechanism |

Clinical Trial Phase(s) |

|

Ulotaront (SEP-363856) |

Sunovion / Sumitomo Pharma |

TAAR1 & 5-HT1A agonist |

Phase 2/3 |

|

Ralmitaront (RO6889450) |

Roche |

TAAR1 partial agonist |

Phase 2 |

|

KarXT |

Karuna Therapeutics |

M1/M4 muscarinic agonist + anticholinergic |

Phase 3 |

|

Emraclidine (CVL-231) |

Cerevel |

M4 muscarinic positive allosteric modulator |

Phase 2 |

|

Pimavanserin |

ACADIA Pharmaceuticals Inc. |

5-HT2A inverse agonist/antagonist |

Phase 3 |

|

Iclepertin (BI 425809) |

Boehringer Ingelheim Pharma |

GlyT1 inhibitor |

Phase 2/3 |

|

Luvadaxistat (TAK-831) |

Neurocrine Biosciences |

DAAO inhibitor |

Phase 2 |

Source: NIH

Key Schizophrenia Drugs Market Players:

- Johnson & Johnson (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AstraZeneca (UK)

- Pfizer (U.S.)

- Eli Lilly (U.S.)

- Novartis (Switzerland)

- Lundbeck (Denmark)

- Teva Pharmaceutical (Israel)

- H. Lundbeck A/S (Denmark)

- Sun Pharmaceutical (India)

- Viatris (U.S.)

- Alkermes (Ireland)

- Lupin Limited (India)

- CSL Limited (Australia)

- JW Pharmaceutical (South Korea)

- Pharmaniaga (Malaysia)

The global schizophrenia drugs market is displaying an extremely competitive landscape dominated by the U.S. and Europe-based firms such as Johnson & Johnson, AstraZeneca, which are leveraging antipsychotics and long-acting injectables. On the other hand Japan Japan-based players such as Otsuka and Sumitomo Dainippon Pharma are transitioning in terms of digital therapies and next-generation drugs to scale up the business. Generics from Teva and Sun Pharma drive affordability, whereas the mid-sized firms such as Lundbeck, Alkermes target niche solutions. Therefore, the existence of all of these factors remarkably elevates the market growth internationally.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In January 2025, Alembic Pharmaceuticals Limited reported that it received the U.S. FDA acceptance for its ANDA for Brexpiprazole Tablets in doses of 0.25 mg, 0.5 mg, 1 mg, 2 mg, 3 mg, and 4 mg. This antipsychotic is used as adjunctive therapy for major depressive disorder adults and for treating schizophrenia in adults and pediatric patients aged 13 and above.

- In January 2025, Johnson & Johnson finalized the acquisition of Intra-Cellular Therapies, Inc., which is a CNS-focused biopharmaceutical company, for approximately $14.6 billion, i.e. $132 per share. This deal added CAPLYTA (lumateperone) to the firm’s portfolio, which marks the first and only FDA-approved treatment for bipolar I and II depression and schizophrenia in adults.

- Report ID: 8011

- Published Date: Aug 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Schizophrenia Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.