Rigid Endoscopes Market Outlook:

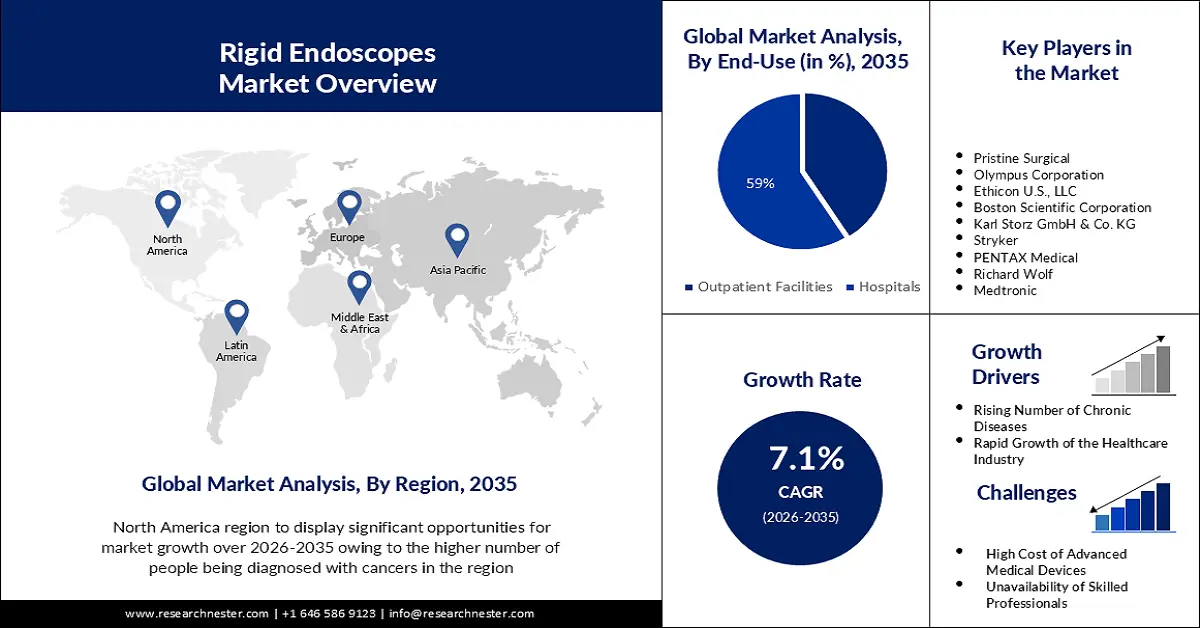

Rigid Endoscopes Market size was over USD 9.09 billion in 2025 and is projected to reach USD 18.05 billion by 2035, witnessing around 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of rigid endoscopes is evaluated at USD 9.67 billion.

The market is growing mainly due to the increasing preference for minimally invasive surgical (MIS) procedures to minimize patient trauma. Every year, over 13 million laparoscopic procedures are performed worldwide. These figures are expected to rise by 1% over the next five years.

The growing demand for early diagnosis through minimally invasive procedures drives the use of rigid endoscopes in the healthcare industry, which includes shorter hospital stays, less pain, and fewer complications among patients. This, in turn, improves patient outcomes and treatment efficiency, thereby aiding market growth.

Key Rigid Endoscopes Market Insights Summary:

Regional Highlights:

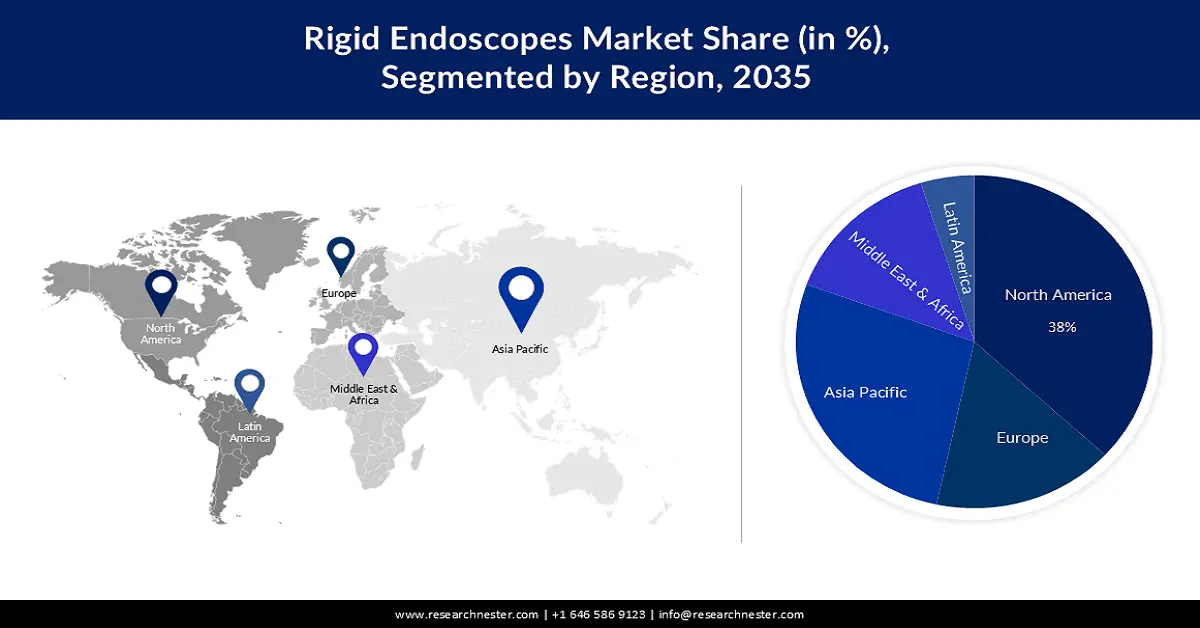

- The North America rigid endoscopes market is projected to capture a 38% share by 2035, driven by increasing awareness of endoscopic surgeries and rising cancer prevalence.

- The Asia Pacific market is expected to secure a 28% share by 2035, driven by growing preference for elective surgeries, increased healthcare spending, and aging population.

Segment Insights:

- The product segment in the rigid endoscopes market is expected to secure a 29% share by 2035, driven by increasing surgeries such as hernia repairs and appendicitis.

Key Growth Trends:

- Increasing Prevalence of Chronic Illnesses

- Rising Cases of Obesity

Major Challenges:

- Limited availability of Skilled Professionals

- High Cost of Advanced Devices

Key Players: Pristine Surgical, Olympus Corporation, Ethicon U.S., LLC, Boston Scientific Corporation, Karl Storz GmbH & Co. KG, Stryker, PENTAX Medical, Richard Wolf, Medtronic.

Global Rigid Endoscopes Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.09 billion

- 2026 Market Size: USD 9.67 billion

- Projected Market Size: USD 18.05 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 20 December, 2024

Rigid Endoscopes Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Prevalence of Chronic Illnesses – Growing chronic illnesses such as cancer and gastrointestinal conditions that necessitate accurate diagnosis and treatment are projected to increase the adoption of rigid endoscopes thereby, driving the rigid endoscopes market growth. The fifth most common cancer in the world is stomach cancer. In 2020, there were over a million new cases of stomach cancer.

- Rising Cases of Obesity – Obesity is associated with a variety of gastrointestinal problems, including gastroesophageal reflux disease, esophageal adenocarcinoma, colorectal polyps, and erosive esophagitis. Furthermore, indigestion caused by lactose intolerance, incorrect diagnosis, and ignorance is pushing patients to test themselves. This has increased the demand for rigid endoscopes, in turn impeding the rigid endoscopes market growth.

- High Expenditure on the Medical Devices Sector – High investments have been made in the medical device industry as a result of the rising global burden brought on by the rise in the prevalence of chronic and acute diseases. These are used to develop smart diagnostic and monitoring medical devices, like rigid endoscopes for therapeutic procedures. In 2022, large medical device companies increased their R&D expenditures from more than USD 1 billion to USD 24 billion.

Challenges

- Limited availability of Skilled Professionals - Healthcare resources in developing and underdeveloped economies are insufficient, resulting in inequitable access to healthcare resources. As a result, there aren't enough qualified healthcare workers.

- High Cost of Advanced Devices

- Rising Excise Tax on Manufacturers

Rigid Endoscopes Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 9.09 billion |

|

Forecast Year Market Size (2035) |

USD 18.05 billion |

|

Regional Scope |

|

Rigid Endoscopes Market Segmentation:

Product Segment Analysis

The product segment is estimated to hold around 29% share of the global rigid endoscopes market by the end of 2035 as a result of the increasing rate of surgeries conducted such as hernias, appendicitis, hysterectomy, endometriosis, cholecystitis, and others. Almost 10% of the population in the United States develops some type of hernia during life and more than 1 million abdominal hernia laparoscopic repairs are performed each year.

End-Use Segment Analysis

The hospitals sub-segment is expected to gain a prominent share of the rigid endoscopes market by 2035 because hospitals employ skilled surgeons, and most patients choose to have endoscope-related surgeries there. Endoscopic surgery patients make up a sizable portion of hospital patients, which is anticipated to support the segment growth.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Rigid Endoscopes Market Regional Analysis:

North American Market Insights

North America industry is predicted to dominate majority revenue share of 38% by 2035, as a result of the increasing awareness about endoscopic surgeries for the diagnosis and treatment of various acute and chronic diseases. In the coming years, the region is also expected to present lucrative growth opportunities for market expansion due to rising cancer tumor prevalence, strong healthcare infrastructure, and the availability of prominent key players. According to the American Cancer Society, more than 1.8 million new cases of cancer were identified in the U.S. in 2021.

APAC Market Insights

The rigid endoscopes market in Asia Pacific will register a revenue share of more than 28% by the end of 2035. The market is expanding as a result of the region's growing preference for elective endoscopic surgeries, increased healthcare spending, and a rapidly growing geriatric population. According to the World Health Organization, the proportion of people aged 60 years and above in the South East Asia region was 9.5% in 2017, and it is expected to rise to 13.2% and 19.8% by 2030 and 2050, respectively.

Rigid Endoscopes Market Players:

- Pristine Surgical

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Olympus Corporation

- Ethicon U.S., LLC

- Boston Scientific Corporation

- Karl Storz GmbH & Co. KG

- Stryker

- PENTAX Medical

- Richard Wolf

- Medtronic

Recent Developments

Pristine Surgical has finally been granted 510(k) clearance for its Summit 4K single-use surgical arthroscope from the US FDA. This latest version is estimated to improve the safety, consistency, and efficiency of arthroscopic procedures.

Olympus Corporation has announced its decisive decision to acquire Quest Photonic Devices B.V. This acquisition is projected to strengthen the company’s surgical endoscopy capabilities.

- Report ID: 5082

- Published Date: Dec 20, 2024

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Rigid Endoscopes Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.