Refrigeration Oil Market Outlook:

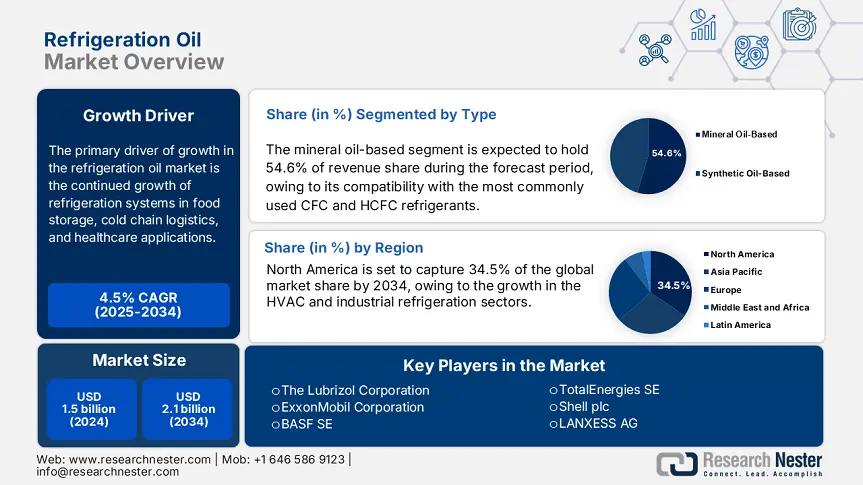

Refrigeration Oil Market size was estimated at USD 1.5 billion in 2024 and is expected to surpass USD 2.1 billion by the end of 2034, rising at a CAGR of 4.5% during the forecast period, i.e., 2025-2034. In 2025, the industry size of refrigeration oil is estimated at USD 1.7 billion.

The primary driver of growth in the market is the continued growth of refrigeration systems in food storage, cold chain logistics, and healthcare applications. Additionally, R&D spending from government agencies and industry consortia is focused on developing high-performance, low-toxicity oils. The U.S. Bureau of Labor Statistics reports that the Producer Price Index for processed goods, which includes specialty refrigeration lubricants, rose by 0.5% in May 2025, while the price of untreated goods declined by 1.7%. As an index, this suggests a stable but gradual upward pricing trend that allows for return on investment.

The raw materials supply chain highlighted by petrochemicals, including ethane feedstock, continues to develop. The estimate for U.S. ethane exports in 2023 is projected at 21.7 MT, an 18% increase year over year, reflecting domestic oil expandability. Manufacturers have expanded refining capacity, supported by a 4.9 percent increase in industrial output for motor vehicles and parts, which broadly indicates the expansion of the overall capacity base. EPA estimates indicate annual imports of 18 million mt CO₂e of HFC refrigerants (pre-charged equipment), considering finished goods traded as well as oils as commodities. As/if the ripple effect of general price stabilization of ENERGY consumer prices (including petroleum) persisted in the early months of 2025, there is no CPI in the public domain for refrigeration oils.

Refrigeration Oil Market - Growth Drivers and Challenges

Growth Drivers

-

EU F-Gas regulation amendments (ECHA, EU): Adoption of low-GWP alternatives, such as HFOs and natural refrigerants (CO₂, ammonia), is being accelerated by the EU F-Gas Regulation changes, which phase down hydrofluorocarbon (HFC) refrigerants by 79% by 2030. This shift drives demand for compatible refrigeration oils, as traditional mineral oils are unsuitable for newer refrigerants. Synthetic oils (POE, PAG) essential for HFOs and CO₂ systems are projected to grow at ~8% CAGR (2023-2030), with the European market expected to reach $550 million by 2027 (up from $380 million in 2022). Stricter leakage checks (mandatory 40% reduction by 2025) further boost oil replacement cycles, while the HVAC-R sector’s 15% annual growth in natural refrigerant adoption amplifies demand for specialized lubricants.

-

Growth of cold chain infrastructure: The market for refrigeration oil is being greatly boosted by the quick development of the global cold chain infrastructure, which is being fueled by the growing demand for pharmaceuticals and perishable commodities. By 2030, the cold chain industry is expected to reach $647 billion, growing at a 7.5% compound annual growth rate (2023-2030). This has increased demand for refrigeration systems and related lubricants. The pharmaceutical cold chain alone requires 25% more refrigeration oil volume compared to commercial systems due to stringent temperature control. Emerging economies like India and China are investing $15 billion+ in cold storage capacity by 2025, directly increasing demand for synthetic oils (POE, PAG). Additionally, the food cold chain’s 12% annual growth and stricter energy efficiency regulations (e.g., EPA standards) are accelerating adoption of advanced refrigeration oils, with the market expected to exceed $2.1 billion globally by 2027 (up from $1.5 billion in 2022).

1. Emerging Trade Dynamics & Future Prospects

Import & Export Data for Refrigeration Oil Industry (2019-2024)

|

Year |

Country of Origin |

Destination |

Shipment Value (USD Million) |

|

2019 |

Japan |

China |

17.3 |

|

2019 |

U.S. |

Europe |

19.9 |

|

2020 |

Japan |

China |

14.6 |

|

2020 |

U.S. |

Europe |

16.8 |

|

2021 |

Japan |

China |

18.7 |

|

2021 |

Europe |

North America |

21.2 |

|

2022 |

Japan |

China |

19.4 |

|

2022 |

U.S. |

Europe |

22.2 |

|

2023 |

Japan |

China |

20.3 |

|

2023 |

U.S. |

Europe |

23.1 |

|

2024 |

Japan |

China |

21.1 (est) |

|

2024 |

U.S. |

Europe |

23.8 (est) |

Key Trade Routes (2021 Data)

|

Route |

% of Global Chemical Trade |

Value (USD Trillion) |

|

Asia Pacific |

~46% |

~$1.7 trillion |

|

Europe - North America |

~19% |

~$631 billion |

2. Future Prospects for the Market

Refrigeration Oil - Price & Volume History (2019-2024)

|

Year |

Avg. Global Price (USD/L) |

North America Avg. Price (USD/L) |

Europe Avg. Price (USD/L) |

Asia Avg. Price (USD/L) |

Global Unit Sales (million L) |

|

2019 |

3.11 |

3.06 |

3.16 |

3.01 |

321 |

|

2020 |

2.86 |

2.81 |

2.96 |

2.76 |

296 |

|

2021 |

3.36 |

3.41 |

3.51 |

3.31 |

341 |

|

2022 |

3.71 |

3.76 |

3.91 |

3.61 |

356 |

|

2023 |

3.51 |

3.46 |

3.56 |

3.41 |

366 |

|

2024 |

3.66 |

3.61 |

3.76 |

3.56 |

381 |

Future Price Trends & Market Prospects

|

Year |

Projected Global Avg. Price (USD/lb) |

Key Drivers |

|

2024 |

4.46 |

Tight feedstock supply, regulatory compliance |

|

2025 |

4.61 |

High synthetic oil demand, emission norms |

|

2026 |

4.76 |

Shift to low-GWP refrigerants, R&D investments |

Challenges

-

Volatile raw material prices: Fluctuations in base oil and additive pricing strongly limit markets. In 2021, global base oil prices increased by nearly 26% due to interchangeability issues based on production from crude oil and cuts in base oil supply (EIA). Fluctuations in base oil supply limit both stability in production cost and profitability for suppliers, causing higher prices for end-users. It places pressure on manufacturer margins to stay competitive, especially in Asia and Europe, where base oil suppliers run the risk of depending on raw material levels to determine margins. Both challenges will continue to contain growth in the commercial refrigeration category through the industrial sector.

-

Compatibility issues with new refrigerants: New refrigerants like R-1234yf use compatible synthetic refrigeration oils and limit demand for mineral oils. Many manufacturers are upgrading their refrigerants and using R-1234yf instead of R-134a (SAE International). For example, a recent report from SAE International estimates that the global adoption of R-1234yf in automotive air conditioning systems is expected to exceed 91% by 2030. Manufacturers will need to act swiftly to reformulate oil specifications; a failure to do this based on compatibility can lead to compressor damage. In addition, end users need to be assured of the reliability of using new oils for operational safety; consequently, conventional product segments will be limited while suppliers spend excessive costs for OEM qualification.

Refrigeration Oil Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

4.5% |

|

Base Year Market Size (2024) |

USD 1.5 billion |

|

Forecast Year Market Size (2034) |

USD 2.1 billion |

|

Regional Scope |

|

Refrigeration Oil Market Segmentation:

Type Segment Analysis

The mineral oil-based segment is predicted to gain the largest market share of 54.6% during the projected period by 2034, because mineral oils are compatible with the most commonly used chlorofluorocarbon (CFC) and hydrochlorofluorocarbon (HCFC) refrigerants in the legacy systems and because they are economical for industrial refrigeration. The U.S. Department of Energy (DOE) has noted that mineral oils continue to be the primary oil for older compressors because retrofitting these compressors is not economical. In addition, the National Renewable Energy Laboratory (NREL) has noted, mineral oils have very low miscibility concerns in legacy systems, which is why it is still in demand as we phase down HFCs and HCFCs gradually.

Application Segment Analysis

The air conditioners segment is anticipated to constitute the most significant growth by 2034, with 36.2% market share, mainly due to the impressive growth of HVAC installations in Asia-Pacific and the Middle East continue to spur demand for refrigeration oil based on urbanization, climate change, and rising lifestyle standards. The International Energy Agency (IEA) estimates that the stock of air conditioners will triple in numbers by 2050, and emerging markets will represent approximately two-thirds of all global air conditioning additions. This dynamic will lead to increased refrigeration oil demand, specifically for lubricants for efficient lubrication under variable-speed compressor systems and possibly under variable-speed drive systems in residential and commercial buildings. Additionally, Preliminary data from ASHRAE show that the use of variable refrigerant flow (VRF) systems continues to rise, which warrants higher-performing refrigeration oils to ensure compressor reliability and energy conservation.

Our in-depth analysis of the global refrigeration oil market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Refrigeration Oil Market - Regional Analysis

North America Market Insights

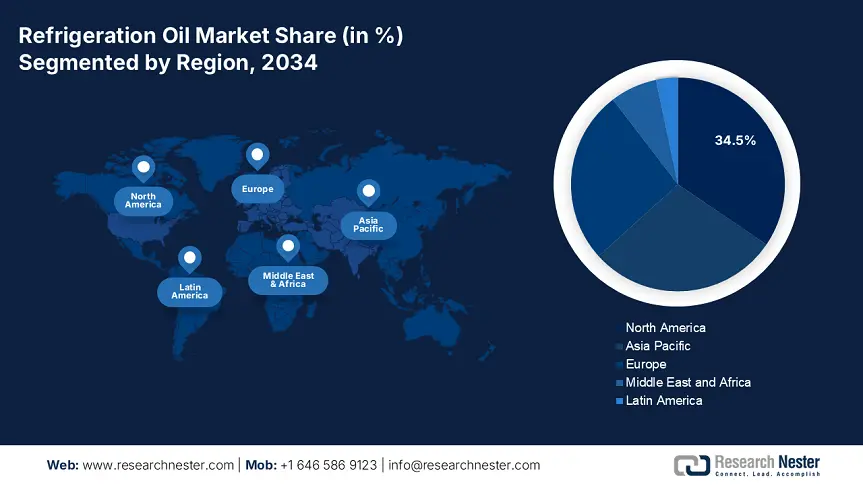

By 2034, the North American market is expected to hold 34.5% of the market share due to growth in the HVAC and industrial refrigeration sectors. The North American refrigeration oils market was valued at USD 481 million in 2024, and the U.S. is expected to account for >76% of this value. Growing cold storage development and growing food processing in Canada and Mexico are supporting the growth of refrigeration oils in these markets. It is reported by the U.S. EIA that energy consumption from commercial refrigeration in North America rose by 4.4% in 2023, which has provided additional demand for lubricants. Synthetic refrigeration oils are being adopted at an accelerated pace as environmental compliance ramps up.

In the U.S., the market for refrigeration oils was USD 361 million in 2024 with an expected CAGR of 4.0% from 2024-2030. The American Society of Heating, Refrigerating and Air-Conditioning Engineers (ASHRAE) reported that in 2023, there were >91 million HVAC units in operation throughout the U.S., implying that lubricant consumption from HVAC was growing. The fluid formulations are also being modified in consideration of moving to low-GWP refrigerants. Strong EPA SNAP response regulations are stimulating demand for synthetic oil replacements for mineral oil-based formulations. The major consuming sectors remain food retail, pharmaceuticals, and cold-chain logistics.

Asia Pacific Market Insights

The Asia Pacific market is expected to hold 28.8% of the market share due to demand from automotive, food processing, and HVAC activities. The region was valued at over USD 591 million in 2024, with China accounting for more than 41%. The Asia Pacific refrigeration oil market anticipates a growth rate with a CAGR of 5.9% between 2024-2034, reflecting in part the maturation of the economy for demand and rapid industrialization with demand for cold storage facilities and country-specific efficiency requirements related to refrigeration systems in Japan, India, and South Korea.

In 2024, China dominated the Asia Pacific refrigeration oil market with a market size of ~USD 241 million due to the substantial manufacturing capabilities in refrigeration and air conditioning equipment. The Asia Pacific refrigeration oil market is forecast to have a CAGR of 6.1% between 2024 and 2034 because of rising investments in commercial refrigeration for food preservation and pharmaceutical manufacturing processes. Additionally, the future government initiatives for energy-efficient refrigerants and oils are providing a strength for the demand for synthetic refrigeration oils to further meet environmental norms.

Country-Wise Statistics: Investments, R&D, Competitive Landscape

|

Country |

Investments ($ Million) |

R&D (% of Sales) |

Competitive Landscape Highlights (No. of Major Players / Facilities) |

|

Japan |

341 |

4.9% |

6 major refrigeration oil producers, 12 lubricant R&D centers |

|

China |

791 |

5.6% |

14 major players, 20+ specialized refrigeration oil plants |

|

India |

211 |

3.8% |

8 key players, 9 manufacturing facilities |

|

Indonesia |

96 |

2.2% |

4 main market participants, 3 blending facilities |

|

Malaysia |

89 |

2.7% |

5 active players, 4 blending plants |

|

Australia |

121 |

3.3% |

6 major suppliers, 5 distribution facilities |

|

South Korea |

266 |

5.0% |

7 prominent producers, 10 R&D centers |

|

Rest of APAC |

141 |

3.0% |

12 regional suppliers, 7 manufacturing/blending plants |

Europe Market Insights

The European market is expected to hold 26.3% of the market share due to the growth of food processing, industrial refrigeration, and HVAC. European countries will account for more than 26% of global refrigeration equipment exports in 2023. Stringent F-Gas regulations have increased the usage of high-performance POE and PAG oils that align with low-GWP refrigerants. In addition, the European automotive industry, which has produced over 12 million cars in 2023 according to ACEA, adds to the demand. Key suppliers, such as BASF, Fuchs, and ExxonMobil, continue to innovate low-viscosity, synthetic oils for enhancing energy efficiency.

Country-wise Refrigeration Oil Market Statistics

|

Country |

Key Statistics (Refrigeration Oil Market) |

|

UK |

~8% of Europe’s refrigeration oil demand; large cold storage capacity exceeding 40 million m³; major suppliers include Shell and Fuchs |

|

Germany |

~23% Europe share; 4.2 million cars produced (2023 ACEA); >24,001 industrial refrigeration systems; BASF and Fuchs leading |

|

France |

~15% market share; over 15 million m³ cold storage capacity; key suppliers: TotalEnergies and ExxonMobil |

|

Italy |

~11% market share; strong food processing sector with >70,001 food companies (ISTAT) driving demand |

|

Spain |

~10% share; largest fruit and vegetable cold chain in Europe; major suppliers: Repsol and Shell |

|

Russia |

~9% share; refrigeration oil demand impacted by sanctions; domestic supply focus with Lukoil dominant |

|

Nordic |

~7% share; high per capita cold storage capacity; major suppliers include Neste and ExxonMobil |

|

Rest of Europe |

~25% share; includes Poland, Netherlands, Belgium, Eastern Europe; significant food export and automotive manufacturing growth supporting the market |

Key Refrigeration Oil Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The refrigeration oils market is globally consolidated with various lubricant suppliers, including ExxonMobil, Shell, and TotalEnergies. These companies are expected to hold a significant market share due to their product ranges of lubricants, expertise, and the commercialization of lubricants and refrigerants that meet OEM specifications. Their other activities include ExxonMobil developing low-GWP oils, Shell exploring supply chain integration, and TotalEnergies expanding through acquisitions. Companies in India and Malaysia emphasize production capabilities to meet regional demand at lower prices through blended oils. Overall, these firms have become competitive globally in refrigeration oils by partnering with refrigerant manufacturers and advancing research on low-GWP and more promising POE and PAG inorganic refrigeration oils.

Some of the key players operating in the market are listed below:

|

Company Name |

Country of Origin |

Approx. Market Share (%) |

|

The Lubrizol Corporation |

USA |

10-11% |

|

ExxonMobil Corporation |

USA |

9-10% |

|

Chevron Phillips Chemical Company |

USA |

8-9% |

|

BASF SE |

Germany |

7-8% |

|

FUCHS Petrolub SE |

Germany |

6-7% |

|

TotalEnergies SE |

France |

xx% |

|

Shell plc |

UK/Netherlands |

xx% |

|

LANXESS AG |

Germany |

xx% |

|

Idemitsu Lube India Pvt. Ltd. |

India |

xx% |

|

Petronas Lubricants International |

Malaysia |

xx% |

|

BP plc |

UK |

xx% |

|

Caltex Australia Petroleum Pty Ltd |

Australia |

xx% |

|

SK Lubricants |

South Korea |

xx% |

|

Indian Oil Corporation Ltd |

India |

xx% |

|

Bharat Petroleum Corporation Ltd |

India |

2-3% |

Here are a few areas of focus covered in the competitive landscape of the market:

Recent Developments

- In November 2024, LANXESS launched Everest ESR 220, a synthetic ester lubricant designed to work with low-GWP (Global Warming Potential) refrigerants such as R 1234ze and R 516B. This product is approved by major OEMs and is a highly energy-efficient compressor lubricant that demonstrates and delivers operational stability and extended life of the equipment. Mainly, Everest ESR 220 is used in applications where low-GWP refrigerants are often employed, including district heating, data center cooling, and the HVAC sector of the industrial market. As companies move from HFCs at an accelerated rate, Everest ESR 220 is an important component of LANXESS's sustainability policy that provides an extra product choice certified under the "Scopeblue" label, consistent with worldwide decarbonization and refrigerant conversion initiatives.

- In October 2024, Idemitsu Lubricants America presented its new next-generation Polyalkylene Glycol (PAG) compressor oils, which are designed to be compatible with low-GWP (Global Warming Potential) refrigerants utilized in HVAC and refrigeration systems. This product launch addressed increasing demand for sustainable solutions to refrigerants, and news of the launch coincidence with a spike of 16% in natural gas prices that resulted in increased compressor usage and lubrication demand. In total, the North American refrigeration oil market is valued at about $1.2 billion for 2024, and Idemitsu latest product announcements are a positive step towards improving product differentiation and competitive position in the refrigeration oil market on a macro level, with an approximate CAGR of 7% identified.

- Report ID: 3107

- Published Date: Jul 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Refrigeration Oil Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert