Recycled Glass Market Outlook:

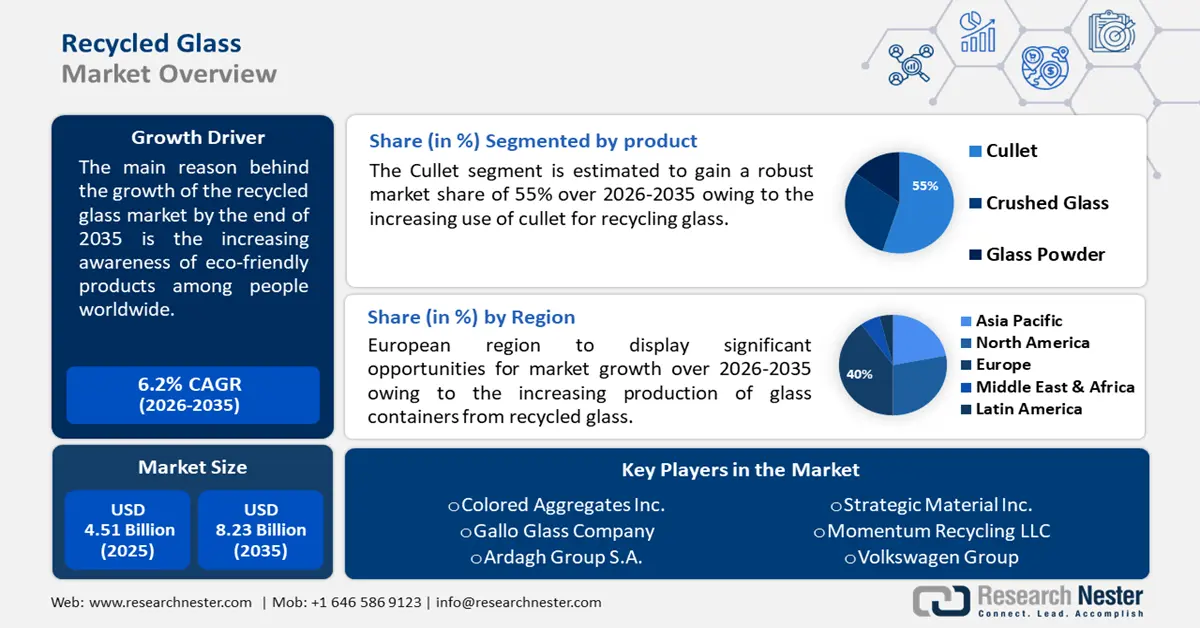

Recycled Glass Market size was over USD 4.51 billion in 2025 and is poised to exceed USD 8.23 billion by 2035, witnessing over 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of recycled glass is estimated at USD 4.76 billion.

The reason behind the growth is the increasing awareness of eco-friendly products among people worldwide. In the 2020 Korea Procter & Gamble (P&G) study, which had 4000 Korean consumers, 82.2% of the participants stated that they would be prepared to buy eco-friendly items; nonetheless, only 25.5% of the respondents made the purchase.

Key Recycled Glass Market Insights Summary:

Regional Highlights:

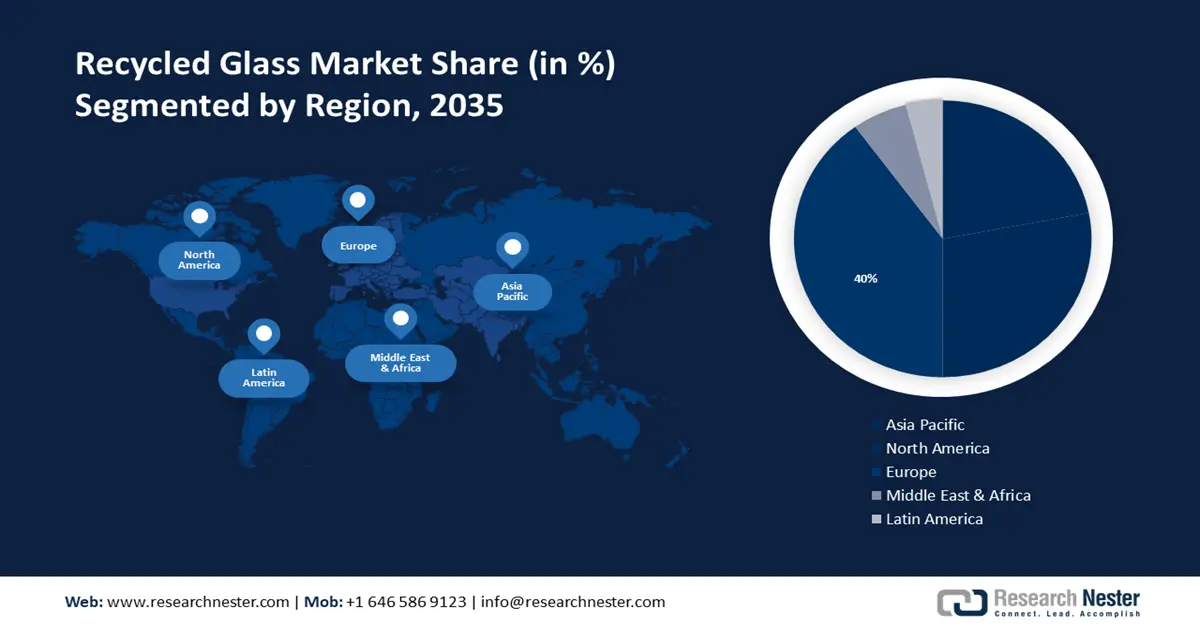

- Europe recycled glass market is anticipated to capture 40% share by 2035, driven by rising production of glass containers from recycled materials and supportive recycling policies.

Segment Insights:

- The cullet segment in the recycled glass market is forecasted to capture a 55% share by 2035, propelled by increased use of cullet in efficient glass recycling processes.

- The bottle & container segment in the recycled glass market is projected to hold a 40% share by 2035, attributed to the expansion of the food and beverages industry and rising demand for glass bottles.

Key Growth Trends:

- Increase in demand for renewable products

- Rising use of glass to manufacture different products

Major Challenges:

- Raw material price fluctuation

- Excessive cost of transportation

Key Players: Strategic Materials Inc., Colored Aggregates Inc., Gallo Glass Company, Ardagh Group S.A., Momentum Recycling LLC, Volkswagen Group, Verallia Packaging SAS, Owens-Illinois Inc., Glass Recycled Surfaces, Vidroporto S.A., Glasrecycling NV, Berryman Glass Recycling, Trivitro Corporation, Consol Glass (Pty) Ltd.

Global Recycled Glass Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.51 billion

- 2026 Market Size: USD 4.76 billion

- Projected Market Size: USD 8.23 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Russia

Last updated on : 17 September, 2025

Recycled Glass Market Growth Drivers and Challenges:

Growth Drivers

- Increase in demand for renewable products - The world recycled glass market for recycled glass is expanding as a result of the fast industrial expansion that is creating trash dumps. Environmental advancements, increased management efforts, and awareness campaigns are further drivers propelling the recycled glass market expansion.

According to IRENA's data, Asia accounted for about half of all new capacity installed in 2022, bringing the total amount of renewable capacity to 1.63 Terawatt (TW) by that year. China made the largest contribution, increasing the additional capacity of the continent by 141 GW. - Rising use of glass to manufacture different products - Glass objects that are thrown away typically wind up in landfill garbage, which can take millions of years to break down. This is one of the main elements that favorably influences the demand for glass recycling globally, along with the growing usage of glass in the creation of various things. The glass forming machines are being sold rigorously due to the rising manufacturing of different products from glass.

In addition, the glass sector is expanding steadily around the globe. Glass bottles and containers are expected to have a 96.4 billion US dollar worldwide market value in 2029, with over 916 billion units forecasted to be sold in that same year. - Rising government initiatives to recycle glasses - one of the issues facing the world today is the growing amount of glass trash, the majority of which is burned in burners and fields, contributing to global warming. Thus, one of the factors contributing to the expansion of the recycled glass market is the rise in government programs to promote the use of recycled glass for effective waste management.

Moreover, in North America of the more than 69 million tons of MSW that were recycled, around 67 percent consisted of paper and paperboard. About 13 percent was made up of metals, while the remaining 4 to 5 percent was made up of glass, plastic, and wood.

Challenges

- Raw material price fluctuation - The recycled glass market may be impacted by the cost and availability of raw materials. Changes in the price of raw materials, such as cullet or crushed recycled glass, can have an impact on the overall cost-effectiveness of producing recycled glass.

- Excessive cost of transportation - Since glass is heavy, moving it over long distances may be costly. High transportation expenses might make glass recycling less profitable, especially if there aren't many processing plants close to them.

Recycled Glass Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 4.51 billion |

|

Forecast Year Market Size (2035) |

USD 8.23 billion |

|

Regional Scope |

|

Recycled Glass Market Segmentation:

Product Segment Analysis

Cullet segment is expected to capture recycled glass market share of over 55% by 2035. The increasing use of cullet for recycling glass will primarily drive this segment's expansion in the recycled glass sector. In order to produce minimal amounts of contaminants, this cullet is treated and filtered using sorting technology based on color. The glass recycling process then makes use of this cullet.

According to the UN Climate Technology Center and Network, the melting process, which creates glass, accounts for more than half of the energy consumed in the glass industry. Energy utilization and CO2 emissions are decreased when recycled glass is added to the raw materials. At now, the global average rate of glass recycling is at around 50%, and it is feasible to achieve higher recycling rates, particularly in areas where recovery rates are relatively low.

Application Segment Analysis

In recycled glass market, bottle and container segment is set to hold revenue share of over 40% by the end of 2035. This expansion will be noticed due to the rising expansion of the food and beverages industry globally and the continuously increasing demand for glass bottles and containers.

Based on statistics from 2019, the trillion-dollar club accounts for almost 78% of the USD 86.31 trillion global Gross Domestic Product GDP, which is contributed by the 16 largest nations. The top five main economies by nominal GDP are the United States, China, Japan, Germany, and India; together, they account for 55% of the global GDP.

Our in-depth analysis of the global recycled glass market includes the following segments:

|

Product |

|

|

Application |

|

|

Source |

|

|

Color |

|

|

End-Use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Recycled Glass Market Regional Analysis:

European Market Insights

Europe industry is estimated to hold largest revenue share of 40% by 2035. Moreover, the European recycled glass industry is projected to increase at a CAGR of almost 7% during the projected period.

The increasing production of glass containers from recycled glass will increase the trend of recycled glass market in this region. According to the European Container Glass Federation (FEVE), FEVE members produced 24.5 million tons and 95.3 billion units of container glass in total in 2022. Food and beverage (F&B) containers accounted for 97% of produced tonnes and 89% of produced units, making up the bulk of this output. However, both the F&B and flaconnage categories saw an increase, with 1.1% in tonnage and 1.9% in units.

Recycled glass is especially in actual demand in the U.K., driven by the government-initiated multiple policies to support recycling in this country. According to the government of the U.K. Waste from Households (WfH) recycling in the UK increased from 44.4% in 2020 to 44.6% in 2021, including Incinerator Bottom Ash Metal (IBAm).

In Italy, recycled glass will encounter massive growth because the country expanded the construction industry and the rising use of recycled glasses in the construction industry. With an annual production value of 168 billion euros, Italy's construction industry ranked third in Europe in absolute terms. Furthermore, a few Italian businesses were included among the biggest construction companies worldwide in 2022.

The recycled glass market will also be huge in Germany due to the increasing use of recycled glass in the automotive and transportation industries. In addition, the automobile scrapping process produces shredding remnants made of plastic, rubber, glass, leftover metals, and other items, including contaminants, that must be disposed of. In 2023, Germany produced 436,000 tons of these shredding wastes, with 138,500 tons—or about one-third—coming from auto bodies.

North American Market Insights

The recycled glass sector in the North America region will notice significant growth through 2035. This growth will be noticed mainly due to rising technological advancement in recycling glasses. Repurposed items, plant-based meals, and sustainably produced goods are just a few examples of how consumers are moving toward eco-friendly and morally-driven enterprises. In North America, there are currently about 3,500 Certified B Corporations, which is twice as many as there were three years ago.

The recycled glass market has expanded in the U.S. as a result of the rising government initiatives to ban plastic use in this region. In terms of the future, the U.S. Interior Department has declared that some public lands and national parks would be free of single-use plastic goods by 2032. This new law will apply to over 480 million acres of federal property.

The Canadian recycled glass’ development mainly lies in increasing concern about the environment amongst people. Canada still has a long way to go before achieving its goal of having net-zero greenhouse gas emissions by the year 2050. These are some of Canada's most urgent environmental problems, ranging from deforestation to pollution of the air and water.

Recycled Glass Market Players:

- Strategic Materials Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Colored Aggregates Inc.

- Gallo Glass Company

- Ardagh Group S.A.

- Momentum Recycling LLC

- Volkswagen Group

- Verallia Packaging SAS

- Owens-Illinois Inc.

- Glass Recycled Surfaces

- Vidroporto S.A.

The recycled glass industry is highly competitive and comparatively fragmented. These sector leaders are diversifying their client base, and in an effort to increase their market share and profitability, many firms are forming strategic alliances and working together with start-up businesses. A few of the key players in the recycled glass market are:

Recent Developments

- VW Group, the German automaker company unveiled a trial program for recycling automobile glass in April 2022. By recycling the broken and shattered glasses, this will assist the carmaker in cutting costs.

- Strategic Materials, Inc. (SMI), the biggest glass recycler in North America, announced today that it has acquired Ripple Glass, located in Kansas City, Missouri. The acquisition will hasten SMI's strategy to improve glass recovery rates throughout North America and strengthen glass collecting initiatives.

- Report ID: 6175

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Recycled Glass Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.