Fiberglass Fabric Market Outlook:

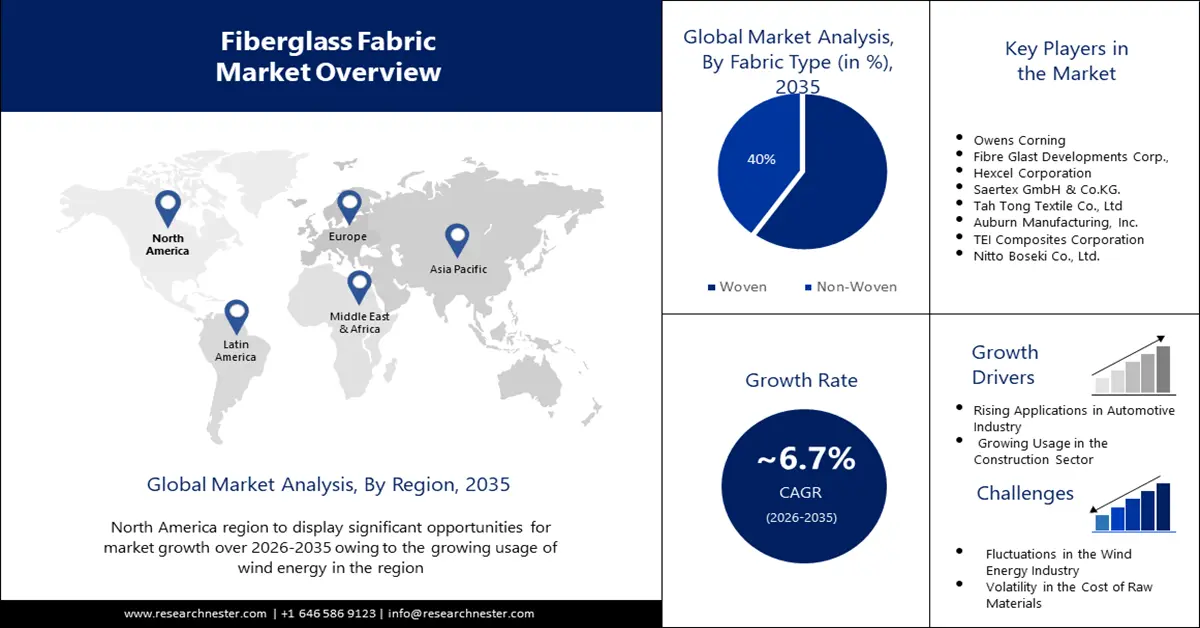

Fiberglass Fabric Market size was over USD 12.12 billion in 2025 and is anticipated to cross USD 23.18 billion by 2035, growing at more than 6.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of fiberglass fabric is assessed at USD 12.85 billion.

The reason behind the growth is impelled by the growing spending textile sector across the globe. According to projections, the global textile industry will expand by around 5% between 2024 and 2028, generating revenue of over USD 210 billion in 2028.

In addition to these, the growing technological advancements in the production procedure are believed to fuel the fiberglass fabric market growth. New products are being developed as a result of technological developments in the fiberglass production process the aim of which is to simplify different processes and products while giving them multiple applications.

Key Fiberglass Fabric Market Insights Summary:

Regional Highlights:

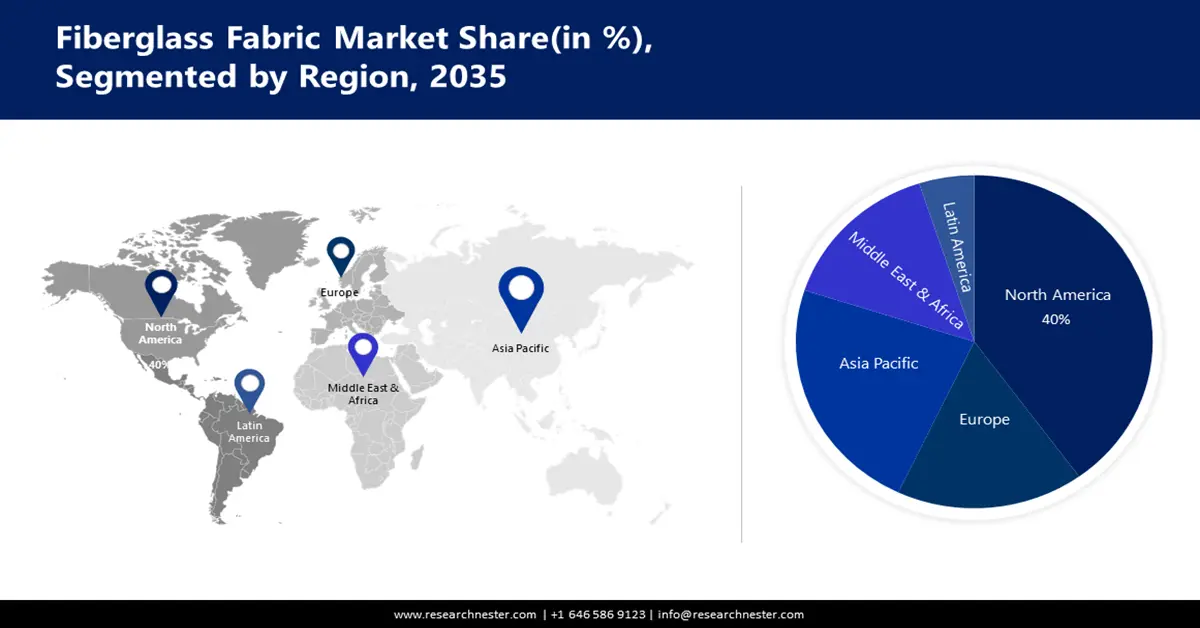

- North America fiberglass fabric market will dominate more than 40% share by 2035, fueled by the growing usage of wind energy and the increasing contribution of wind turbines to the country’s electricity generation.

- Asia Pacific market will hold the second largest share by 2035, driven by increased manufacturing of printed circuit boards and infrastructure development in China and India.

Segment Insights:

- The woven segment in the fiberglass fabric market is expected to hold a 60% share by 2035, driven by the durability and environmental benefits of woven fabrics.

Key Growth Trends:

- Rising applications in automotive industry

- Growing usage in the aerospace sector

Major Challenges:

- Rising applications in automotive industry

- Growing usage in the aerospace sector

Key Players: Dupont, Owens Corning, Fibre Glast Developments Corp., Hexcel Corporation, SAERTEX GmbH & Co.KG., Tah Tong Textile Co., Ltd, Auburn Manufacturing, Inc., TEI Composites Corporation, BGF Industries, Inc., Porcher Industries.

Global Fiberglass Fabric Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.12 billion

- 2026 Market Size: USD 12.85 billion

- Projected Market Size: USD 23.18 billion by 2035

- Growth Forecasts: 6.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 16 September, 2025

Fiberglass Fabric Market Growth Drivers and Challenges:

Growth Drivers

- Rising applications in automotive industry - The market growth is because of its great tensile strength, temperature resistance, and dimensional stability, fiberglass is frequently used in front and rear bumpers, hoods, doors, casings, timing belts, and V-belts. In addition, woven fiberglass fabrics are also used to reinforce automotive components like brake pads and clutch discs in order to preserve the integrity of the composite material in an abrasive and heated environment. Because of this, the need for additional fiberglass fabric to produce different automotive parts will increase with automation, propelling the fiberglass fabric market throughout the foreseen period.

- Growing usage in the aerospace sector - The aerospace industry is the main user of fiberglass fabric for A-, C-, E-, and S-glass, among other types, for a variety of applications involving aircraft insulation, flooring, seating, closets, air ducts, and other interior aircraft components.

The aircraft sector is seeing a surge in the use of fiberglass cloth led by its exceptional fire protection qualities, low weight, high tensile strength, and stiffness. For instance, the Federal Aviation Administration (FAA) estimates that the expansion of air freight activities will result in a total production of commercial aircraft fleet up to 8,270 by the end of 2035. The article goes on to say that the US mainline carrier fleet is expected to grow by 54 aircraft year. - Rising electrical and electronics industry - The fiberglass fabric market's growth is the increased need for high-performance materials across the globe for the manufacture of electronics and luxury items. The growing need for fiberglass for thermal insulation applications, especially in power plants, will lead to an expansion of the fiberglass fabrics sector.

Additionally, the global demand for fiberglass fabrics will rise as a result of government initiatives to support renewable energy and new and future power projects. Furthermore, the fiberglass fabrics market expansion will be aided by the growing need for printed circuit boards worldwide.

Challenges

- Fluctuations in the wind energy industry - Wind farm power fluctuations may have an effect on interconnected-grid stability and operational costs, upsetting the second-to-second balance between the total supply and demand of electricity. Wind turbine blades are typically made of fiberglass, and changes in the wind energy sector directly affect the demand for these blades. This could also have an impact on the cost of fiberglass fibers, which could have an impact on the manufacturers' profitability.

- Changes in the price of raw materials, such silica sand, can cause disruptions in the supply chain.

- Environmental issues related to fiberglass fiber production

Fiberglass Fabric Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 12.12 billion |

|

Forecast Year Market Size (2035) |

USD 23.18 billion |

|

Regional Scope |

|

Fiberglass Fabric Market Segmentation:

Fabric Type

The woven segment in the fiberglass fabric market is slated to gain the largest revenue share of about 60% in the year 2035. The segment growth can be credited to because of its growing popularity and advantages over non-woven fabric. For example, woven materials are more dependable and durable than non-woven fabrics, yet they are also lighter. Weaved fabrics are more environmentally friendly because throughout the production process, they release more oxygen into the atmosphere.

Additionally, woven fabrics require less maintenance, withstand moisture and weather better, and maintain their durability in hazardous environments. Furthermore, woven fabrics are more reasonably priced and accessible than non-woven ones. The International Textile Manufacturers Federation estimates that in 2021, the global cost of woven fabrics would make up 19% of all fabric production expenses.

Furthermore, the Turkish woven fabrics market was estimated to be worth USD1.3 billion in 2021, a 26.1% rise from 2020. Because of the aforementioned advantages over other fabric types, woven fabrics are in high demand, which is anticipated to fuel fiberglass fabric market expansion over the course of the projected period.

Application

The construction segment in the fiberglass fabric market is set to garner a notable share during the forecast timeline propelled by the rise in building activity that is occurring worldwide. The construction landscape uses fiberglass fabric for A-glass, C-glass, E-glass, S-glass, and other types of glass mainly to shield reinforced concrete columns from corrosion and to support their restoration.

They are also employed as a fire prevention medium, wall covering, decorating, and remodeling of walls and ceilings. Because of its exceptional flexural moment capacity, high strength, and corrosion resistance, fiberglass fabric is predicted to become more and more in demand as the global construction industry continues to grow. During the projection period, this is predicted to increase the size of the fiberglass fabric market.

Our in-depth analysis of the market includes the following segments:

|

Application |

|

|

Fiber Type |

|

|

Fabric Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fiberglass Fabric Market Regional Analysis:

North America Market Insights

Fiberglass Fabric market in the North America, amongst the market in all the other regions, is anticipated to hold the largest with a share of about 40% by the end of 2035. The market’s expansion in the region is also expected on account of growing usage of wind energy. The main renewable energy source in the US is wind, a homegrown resource that supports the country's economic expansion.

The amount of wind energy used in the US to produce electricity climbed to over 380 billion kWh in 2021, according to the US Department of Energy. In 2022, wind turbines accounted for around 10.2% of the electricity generated at the utility-scale in the United States.

APAC Market Insights

The APAC region will also encounter huge growth for the fiberglass fabric market till 2035 and will hold the second position owing to the increasing manufacturing of printed circuit boards in this region. The largest manufacturer of printed circuit boards in the world is China since the country supports its PCB sector as part of its Made in China 2025 goal, allocating subsidies to important industries such as electrical transmission and medical equipment.

Moreover, India's building sector is a major force behind the nation's economic growth fueled by the country's increased infrastructure spending, growing need for urban homes, and the rise in commercial development projects. All these factors are expected to fuel the demand for fiberglass fabric market in the region.

Fiberglass Fabric Market Players:

- Dupont

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Owens Corning

- Fibre Glast Developments Corp.,

- Hexcel Corporation

- SAERTEX GmbH & Co.KG.

- Tah Tong Textile Co., Ltd

- Auburn Manufacturing, Inc.

- TEI Composites Corporation

- BGF Industries, Inc.

- Porcher Industries

Recent Developments

- Dupont introduced a new portfolio of patented DuPont Kevlar engineered yarns to offer multi-hazard protection against cut, heat, flame, and electric arc threats, allowing producers to raise the degree of protection without appreciably adding to thickness or weight to aid in increased comfort and dexterity in a range of sectors, including manufacturing, utilities, and the automobile industry.

- Owens Corning together with Pultron Composites announced to production of industry-leading fiberglass rebar to offer better-performing concrete reinforcement materials and more environmentally friendly product options and increase their market opportunities by offering more capacity and superior customer service.

- Report ID: 5644

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fiberglass Fabric Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.