Radiation Shielding Glass Market Outlook:

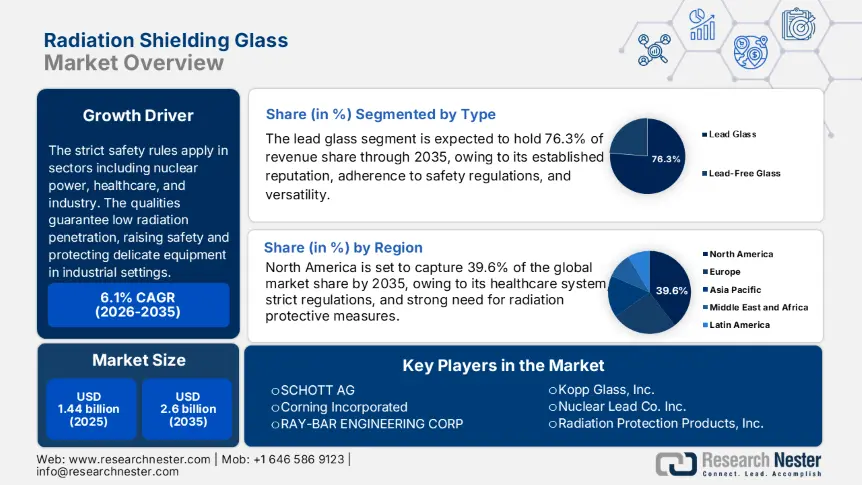

Radiation Shielding Glass Market size was valued at USD 1.44 billion in 2025 and is likely to cross USD 2.6 billion by 2035, registering more than 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of radiation shielding glass is assessed at USD 1.52 billion.

Radiation shielding glass is becoming more and more popular due to strict safety rules in sectors including nuclear power, healthcare, and industry. Due to its composition, which usually includes lead oxide or barium oxide, radiation shielding glass is preferred for its capacity to suppress ionizing radiation, namely X-rays and gamma rays efficiently. Its special qualities guarantee low radiation penetration, raising safety in nuclear power plants, protecting delicate equipment in industrial settings, and lowering exposure risks for staff and patients in medical imaging facilities.

SCHOTT provides a variety of radiation shielding glasses to safeguard individuals in radiation-rich environments. In addition to safeguarding employees using x-ray machines and other medical equipment, these glasses are made to endure the demanding requirements of working in the nuclear industry. RD 30, the only monolithic x-ray protection glass with 0.5 mm Pb (at 6 mm thick or as a 2x3.1 mm laminate), was created especially for use in analogue and digital mammography. It offers a great deal of flexibility as it can be shaped and bent into various shapes. SCHOTT can also provide the glass in the biggest dimensions conceivable for any geometric configuration.

Furthermore, the glass retains its transparency, enabling transparent communication and visual inspection, fusing operational effectiveness with safety. These qualities highlight its widespread acceptance and popularity in a variety of applications where radiation shielding is important.

Key Radiation Shielding Glass Market Insights Summary:

Regional Highlights:

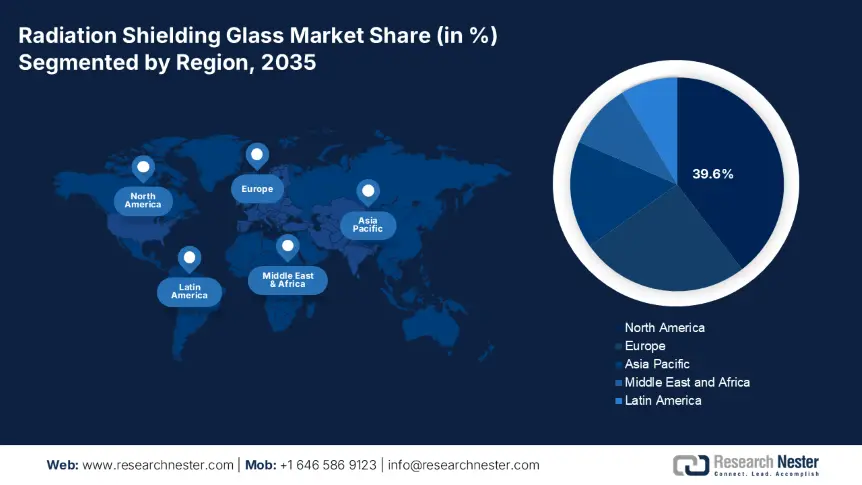

- North America commands a 39.6% share of the Radiation Shielding Glass Market, propelled by healthcare expansion and investment in protective technology, ensuring sustained leadership through 2026–2035.

- The Radiation Shielding Glass Market in Europe is forecasted to maintain a stable CAGR by 2035, driven by ongoing infrastructure projects and safety standards.

Segment Insights:

- The X-Ray Shielding segment is expected to experience significant growth from 2026-2035, fueled by high demand in medical diagnostic imaging and stringent healthcare radiation safety requirements.

- The lead glass segment is projected to secure a 76.3% share by 2035, driven by its superior radiation attenuation properties and widespread industry acceptance.

Key Growth Trends:

- Growing adoption in healthcare settings

- Government regulation of radiation safety

Major Challenges:

- High initial investment

- Limited awareness and education

- Key Players: Pilkington Group Limited, Isolite Corporation, British Glass, glaswerke haller gmbh, Lead Glass Pro, and MarShield Custom Radiation Shielding Products.

Global Radiation Shielding Glass Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.44 billion

- 2026 Market Size: USD 1.52 billion

- Projected Market Size: USD 2.6 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.6% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, China, Germany, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Radiation Shielding Glass Market Growth Drivers and Challenges:

Growth Drivers

-

Growing adoption in healthcare settings: The growing incidence of cancer and other illnesses that need radiation treatment is the main factor driving the growing need for radiation shielding glasses in medical settings. During radiation treatments and medical imaging operations, radiation shielding glasses protect patients and healthcare providers from dangerous radiation exposure. The need for radiation shielding glass in the healthcare sector is increasing due to the expansion of hospitals, clinics, and diagnostic facilities across the globe. Furthermore, the need for radiation shielding glasses that satisfy particular protective criteria and needs is being fueled by developments in medical technology, such as the creation of novel radiation therapy methods and tools.

-

Government regulation of radiation safety: Radiation-shielding glass is becoming increasingly popular across various industries due to strict government requirements and radiation protection standards. Regulations are being put in place by governments all over the world to protect the public and employees from dangerous radiation exposure. Facilities that handle or store radioactive materials are frequently required by these rules to use radiation shielding materials, such as radiation shielding glass. The growing emphasis on radiation safety and compliance is anticipated to keep fueling the need for radiation shielding glass in the nuclear power, construction, and other sectors.

Challenges

-

High initial investment: The high upfront costs of installation and purchase are one of the major barriers to the radiation shielding glass market. Radiation shielding glass is a specialty product that must be made using exacting procedures and the integration of particular materials to satisfy strict performance standards. High-quality radiation shielding glass has comparatively higher production costs than regular glass. Some end users may find the initial cost of purchasing and installing radiation shielding glass to be prohibitive, particularly small healthcare facilities, research labs, or industrial installations with limited funds.

-

Limited awareness and education: There is a lack of knowledge and instruction on the significance of radiation shielding measures in the radiation shielding glass market. In some sectors and applications, there may be a misunderstanding about the possible risks connected with ionizing radiation and the importance of establishing efficient shielding measures. Due to a lack of knowledge, end users may not prioritize the adoption of radiation shielding glass, especially in smaller facilities or industries with less exposure to radiation safety rules. Decision-makers may not completely understand the advantages and requirements of utilizing specialist glass for radiation protection if there are no thorough education and training programs on radiation safety. This can impede market access.

Radiation Shielding Glass Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 1.44 billion |

|

Forecast Year Market Size (2035) |

USD 2.6 billion |

|

Regional Scope |

|

Radiation Shielding Glass Market Segmentation:

Type (Lead Glass and Lead-Free Glass)

The lead glass segment is projected to gain a 76.3% radiation shielding glass market share through 2035. Lead glass is being accepted widely as the industry is relying on it. Lead glass, which is well known for its superior radiation attenuation properties, was important to ensuring safety in environments where protection from ionizing radiation is essential. Its dominance demonstrated how strongly this conventional yet efficient material is preferred in the shielding glass market.

The market share of Lead-Free Glass, on the other hand, was low despite its presence. For safety and environmental reasons, some segments might choose lead-free substitutes. Still, a sizable majority favoured Lead Glass's well-established and shown qualities.

Lead glass has maintained its market dominance in the radiation shielding glass industry due to its established reputation, adherence to safety regulations, and versatility. Lead Glass continues to lead the market as it develops, highlighting its dependability and efficiency in offering crucial radiation protection solutions.

Radiation Type (X-Ray Shielding, Gamma Ray Shielding, and Neutron Shielding)

Based on the radiation type, the X-ray shielding segment is likely to hold a noteworthy radiation shielding glass market share by the end of 2035. In the medical field, radiation shielding glass is crucial for safeguarding both patients and personnel during diagnostic imaging activities. The need for dependable and high-performing radiation shielding solutions is still strong since healthcare regulations continue to place a strong emphasis on radiation safety requirements, which has cemented its leading position in the medical market.

Despite being a significant business segment, Gamma Ray Shielding only holds a minor portion of the radiation shielding glass market. Industries such as radiography, nuclear power, and some medical applications have a significant need for gamma-ray shielding glass. However, due to its widespread application in routine medical procedures and diagnostic imaging, X-ray shielding continued to play a significant role.

Neutron shielding had a smaller market share even though it was crucial in several applications, such as nuclear power plants and research institutions. Neutron shielding requirements are comparatively less common than X-ray shielding, in part due to their specialist nature. The widespread use of X-ray shielding in a variety of sectors, such as healthcare, security, and industrial contexts, is responsible for its dominance.

Our in-depth analysis of the global radiation shielding glass market includes the following segments:

|

Type |

|

|

Radiation Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Radiation Shielding Glass Market Regional Analysis:

North America Market Forecast

North America is expected to lead the radiation shielding glass market with a share of 39.6% during the forecast period. The market growth in the region is due to the healthcare expansion. The region's market is growing due to its healthcare system, strict regulations, and strong need for radiation protective measures. Rising awareness of radiation exposure concerns and increased investment in radiation protective technology.

Investments in safety standards in the U.S. have seen remarkable growth. Corning is a leading global provider of radiation shielding glass products for nuclear, medicinal, and other uses. To supplement its well-known protective glass products, Corning has created a comprehensive radiation protection portfolio with global production capabilities in collaboration with important distributors, equipment manufacturers, and shielding experts worldwide. Corning Med-X Glass offers superior, transparent, and secure X-ray radiation protection for use in technical, medical, and research settings. The X-ray glass offers the best protection against radiation from equipment working in the 80–300 kV range due to its high lead and barium concentration and wide thickness range.

Corning is a global leader in radiation shielding glass, delivering some of the largest glass sizes available (up to 2745 x 1375mm). This enables architects to maximize the diagnostic operators' observation needs by creating viewing windows with a broader field of vision. Most consumer needs can be satisfied by cutting smaller sizes. Safety chamfers are used to polish and grind all cut edges.

Canada's radiation shielding glass market is not far behind, with a focus on nuclear energy and industrial applications, such as those where radiation shielding glass is necessary to maintain safety and adhere to environmental standards. Canada Metal provides a wide range of radiation shielding goods, including partitions and walls, doors, transportable screens and structures, lead bricks, windows and window frames, and more. For radiation shielding, lead is one of the most commonly utilized materials, yet other metals, such as cadmium, also have special qualities and uses.

Canada Metal offers the know-how and capacity to meet any radiation shielding requirement, including lead brick shielding and nuclear shielding, regardless of how complex or specialized the need. Medicine, research, nuclear, aerospace, oil and gas, mining, and defence are just a few of the industries that have relied on Canada Metal for more than a century.

Europe Market Analysis

Europe radiation shielding glass market is expected to experience a stable CAGR during the forecast period. The ongoing infrastructure projects across Europe have increased the demand for radiation shielding glass due to strong environmental and safety standards throughout the continent. Its advancements in glass technology, which emphasize radiation attenuation qualities while following sustainability guidelines, demonstrate the region's dedication to safety and scientific progress in radiation shielding applications.

Germany’s commitment to safety and scientific progress in radiation shielding applications is demonstrated by its advancements in glass technology, which prioritize radiation attenuation properties while adhering to sustainability criteria. SCHOTT offers a selection of radiation shielding glasses to protect people in radiation-rich areas. RD 50 can be supplied as a standard sheet or as a highly tailored panel with cutouts and boreholes. It can then be processed into insulating glass and treated with PVB-film laminates or cast resin. It is more scratch-resistant than acrylic and non-flammable, just as RD 30.

Furthermore, even with relatively thin glass, RD 50 Radiation Shielding Glass provides strong x-ray absorption due to its high density. Due to its unique composition, RD 50 can be used in PET and CT scan facilities. It provides the greatest range of thicknesses for usage in windows, doors, and panoramic glazing for analytical equipment since it is a monolithic x-ray shielding glass.

U.K. commitment to safety from radiation in the nuclear industry. Raybloc (X-ray Protection) Ltd provides nuclear radiation shielding devices such as lead chevrons, heavy lead door sets, heavy lead interior windows, and mobile phones. Effective shielding is one of the most crucial protections against radioactive exposure. Facilities must be equipped with the appropriate shielding materials, such as concrete, lead, or other solid metals, to block and absorb ionizing radiation. Shielding helps create a barrier that protects workers and the environment from the harmful effects of radioactive materials. For shielding materials to be effective, their integrity and upkeep must be guaranteed.

Raybloc protects nuclear facilities from ionizing radiation by employing numerous sheets of lead or lead chevron bricks, depending on the thickness of lead needed to attenuate the radiation. Up to 20 mm of lead (20 mm Pb) can be used in the manufacturing and installation of lead-lined door sets and internal windows if room fixes are necessary.

Key Radiation Shielding Glass Market Players:

- SCHOTT AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Corning Incorporated

- RAY-BAR ENGINEERING CORP

- Kopp Glass, Inc.

- Nuclear Lead Co. Inc.

- Radiation Protection Products, Inc.

- Pilkington Group Limited

- Isolite Corporation

- British Glass

- glaswerke haller gmbh

- Lead Glass Pro

- MarShield Custom Radiation Shielding Products

Key players are investing in research and development to produce high-quality, durable, and flexible radiation shielding glass that meets the evolving needs of industries such as healthcare and the nuclear industry. Leading firms are expanding their market presence through acquisitions and collaborations. Moreover, there is a growing emphasis on safety standards, with manufacturers incorporating safety measures into production and developing in other industries. This approach not only meets regulatory standards but also appeals to safety.

Here are some leading players in the radiation shielding glass market:

Recent Developments

- In April 2024, STERIS announced the completion of an extension that now incorporates X-ray processing at its facility in Chonburi, Thailand. The expansion of the Chonburi I, Thailand plant demonstrates the continued commitment to maintaining patient safety through a technology-neutral service offering that includes radiation and gas processing options, today and in the future.

- In August 2021, SCHOTT launched the RS glass line, which included the RS 520, RS 360, RS 323 G19, RS 253, and RS 253 G18. These series were created especially for safety applications in nuclear energy generation and nuclear waste treatment, and they are tuned for high initial transmission as well as radiation and discharge resistance.

- Report ID: 7657

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Radiation Shielding Glass Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.