Pulmonary Function Testing Devices Market Outlook:

Pulmonary Function Testing Devices Market size was valued at USD 3.5 billion in 2025 and is projected to reach USD 6.5 billion by the end of 2035, rising at a CAGR of 7.2% during the forecast period, i.e., 2026‑2035. In 2026, the industry size of pulmonary function testing devices is evaluated at USD 3.7 billion.

The market is growing due to the individuals with chronic pulmonary conditions, such as COPD, are receiving TeleSpirometry testing from VA clinics. As per a report by NLM 2023, in the United States, only 32% of newly diagnosed COPD patients underwent spirometry testing within six months of the diagnosis, despite spirometers being considered easily accessible. The supply chain consisted of materials and components for making medical-grade devices, including remote diagnostic equipment, with federal research grants paying for the integration of low-cost sensors into portable spirometry devices.

The producer and consumer pricing metrics for these devices correspond to the broader categories of medical equipment tracked by the Producer Price Index of the United States Bureau of Labor Statistics in medical and surgical devices. As per a report by WHO 2024, chronic obstructive pulmonary disease (COPD) ranks as the fourth leading cause of death worldwide, accounting for 3.5 million fatalities in 2021, around 5% of all deaths globally. Research investments allow for the development and implementation of handheld pulmonary function technologies through NIH- and NSF-sponsored initiatives. Import-export issues include finding suppliers for special parts and materials needed for the device.

Key Pulmonary Function Testing Devices Market Insights Summary:

Regional Highlights:

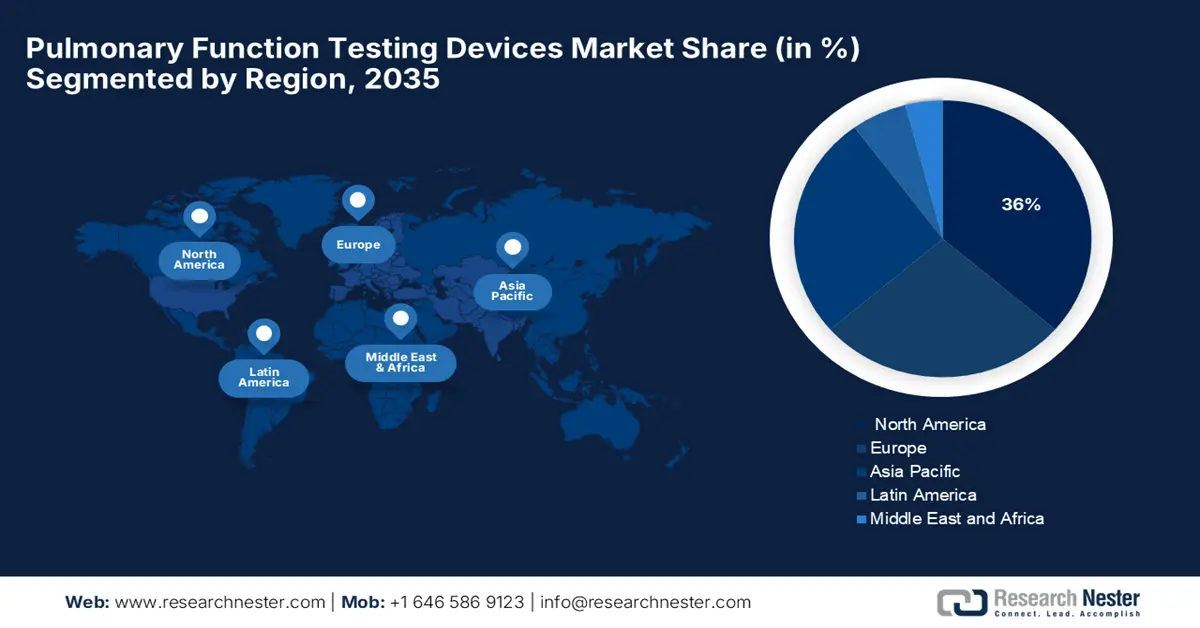

- North America is expected to secure the largest 36% share of the Pulmonary Function Testing Devices Market by 2035, attributed to standardized testing initiatives like the ATS Pulmonary Function Laboratory Registry and increasing demand for compliant diagnostic equipment.

- The APAC region is anticipated to record the fastest growth in the pulmonary function testing devices market through 2026–2035 owing to rising respiratory disease prevalence and supportive government initiatives promoting early diagnosis and accessible respiratory care.

Segment Insights:

- The hospitals & clinics segment is projected to command a 67% share of the Pulmonary Function Testing Devices Market by 2035, propelled by the increasing demand for advanced testing capabilities and stringent infection control measures in high-risk patient care settings.

- The portable or handheld pulmonary function testing devices segment is anticipated to expand significantly through 2026–2035 owing to rising adoption in point-of-care and telemedicine applications enabling decentralized and precise lung function monitoring.

Key Growth Trends:

- Rising demand for diagnostic precision in complex respiratory profiles

- Increasing utilization in risk-specific populations and occupational health

Major Challenges:

- Infection control compliance and cost burden

- Lack of standardized global accreditation

Key Players: MGC Diagnostics Corporation, CareFusion Corporation (BD), Nihon Kohden Corporation, Medisoft (EuroMed), Cosmed, Vyaire Medical, Inc., Schiller AG, Erich Jaeger GmbH & Co. KG, Pulmonx Corporation, Fukuda Sangyo Co., Ltd., Eolane Group, Vitalograph Ltd., NDD Medical Technologies, Bionet Co., Ltd., Intersurgical Pty Ltd.

Global Pulmonary Function Testing Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.5 billion

- 2026 Market Size: USD 3.7 billion

- Projected Market Size: USD 6.5 billion by 2035

- Growth Forecasts: 7.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: APAC

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 2 September, 2025

Pulmonary Function Testing Devices Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand for diagnostic precision in complex respiratory profiles: An advanced panel of pulmonary function tests, including spirometry, lung volumes, and DLCO measurement, is useful to determine whether a person has an obstructive, restrictive, or mixed breathing problem. As per a report by NLM 2023, early diagnosis is emphasized as an essential element of management and must be kept accurate, especially when there is more than 30 mL/year FEV1 decline in non-smokers. This has led to the demand and procurement of multi-functional PFT devices that can carry out all respiratory assessments to effect changes in clinical decisions as early as possible.

- Increasing utilization in risk-specific populations and occupational health: PFTs play a vital role in monitoring patients who are environmentally exposed, after surgical complications, or have undergone pulmonary toxicity. As per a report by NLM 2023, a TLC below 80% of predicted confirms restrictive defects, providing further evidence on the need for capabilities in lung volume measurement. As regulatory guidelines around the world widen, testing facilities increasingly invest in more precise testing systems for the smooth execution of these screening mandates and their compliance in at-risk populations.

- Expansion into home-based and portable monitoring solutions: Rising demand for remote care and decentralized delivery of healthcare constitutes one of the significant growth opportunities for the PFT devices market. Pulmonary testing instruments used by care providers and patients at home, and portable ones such as handheld spirometers and digital analyzers for point-of-care diagnosis outside of hospital walls, are increasingly being adopted. These solutions offer continuous respiratory monitoring, helping patients follow treatment and reducing clinic crowding, while supporting the growth of telehealth services.

PFT Procedures & Their Impact on Pulmonary Function Testing Device Market

|

PFT Procedure |

Clinical Insight |

Market Implication |

|

Spirometry |

Measures FVC, FEV₁, FEV₁/FVC; requires reproducible effort |

Drives demand for ergonomic, user-friendly spirometers with automated quality checks. |

|

Lung Volumes |

Differentiates TLC, FRC, RV using plethysmography or gas dilution |

Creates need for full-range systems—body boxes, dilution modules, or hybrid solutions. |

|

Diffusion Capacity (DLCO) |

Assesses gas exchange; requires hemoglobin/FiO₂ correction |

Increases demand for CO-analyzer integration and advanced calibration features. |

|

Respiratory Pressures (MIP/MEP) |

Measures muscle strength; reproducibility is essential |

Indicates the market for precision manometers with intuitive interfaces and safety features. |

|

Bronchoprovocation (e.g., Methacholine) |

Detects airway hyperresponsiveness; requires repeat spirometry |

Boosts need for aerosol-safe systems with integrated nebulizers and expiratory filters. |

|

Six-Minute Walk Test (6MWT) |

Functional test with minimal equipment; needs oximetry and pacing corridor |

Opens growth in ambulatory/wearable oximeters and remote patient monitoring platforms. |

|

Cardiopulmonary Exercise Testing (CPET) |

Comprehensive assessment of respiratory, cardiac, and metabolic response |

Spurs investment in multi-parameter, connected systems with real-time data analytics. |

Source: NLM, 2023

Challenges

- Infection control compliance and cost burden: Post-pandemic safety protocols require pulmonary function testing labs to adopt high-efficiency filters, PPE, and negative pressure infrastructure. These requirements, unfortunately, bump operational costs up and also curb demand in low-resource settings, thus presenting a tough challenge for manufacturers to scale device use equally in public and private healthcare settings.

- Lack of standardized global accreditation: Without unified international accreditation guidelines for pulmonary function sessions, testing protocols, and equipment standards vary. The procedures in force are not ATS- or ERS-compliant in some regions, which decisively impede interoperability and limit manufacturers' global market entry.

Pulmonary Function Testing Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.2% |

|

Base Year Market Size (2025) |

USD 3.5 billion |

|

Forecast Year Market Size (2035) |

USD 6.5 billion |

|

Regional Scope |

|

Pulmonary Function Testing Devices Market Segmentation:

End user Segment Analysis

Hospitals & clinics are expected to hold the largest share in the end user segment with 67% market share during the forecast period. Hospitals and clinics lead due to their ability to handle vulnerable patient populations, paediatric, geriatric, oncology, and immunocompromised patients with stringent infection control measures. Such centers provide advanced testing (e.g., CPET, bronchial challenges) with trained professionals, PPE standards, and risk-assessed testing that are necessary for high-risk pulmonary diagnosis.

Product Type Segment Analysis

Portable or handheld pulmonary function testing devices lead the market product on the basis of their portability, ease of use, and increasing use at the point-of-care and in decentralized markets. Widely used in telemedicine, family practice clinics, and home monitoring of chronic diseases like asthma and COPD, the hand-held devices provide decentralized diagnosis with clinical-grade precision. In December 2024, electronRx launched purpleDx, an assessment app for cardiopulmonary, as per the medical device standards, enabling CRD patients to detect and monitor digital biomarkers of lung function at home.

Component Segment Analysis

Hardware drives the component charge, spurred by demand for high-performance embedded systems and sensors to provide diagnostic reliability. OEMs and diagnostic solution providers invest in stable hardware platforms to enable advanced spirometry and multi-test integration and meet the reliability and lifecycle performance demands of clinical and homecare installations. In October 2022, AirPhysio announced a partnership with Medsmart and Apollo Hospitals Group in India, intending to improve the quality of life for the citizens.

Our in-depth analysis of the pulmonary function testing devices market includes the following segments:

|

Segment |

Sub-segments |

|

Product Type |

|

|

Test Type |

|

|

Application |

|

|

Component |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pulmonary Function Testing Devices Market - Regional Analysis

North America Market Insight

In North America, the market for pulmonary function testing devices is expected to hold the highest share of 36%. This expansion is due to the extensive support provided by initiatives such as the ATS Pulmonary Function Laboratory Registry and its uniform management manual, which ensure that in case of a shortage of national accreditation, there is consistency with uniform testing protocols, thus generating demand for quality, compliant diagnostic hardware. Furthermore, according to the American Cancer Society in 2025, approximately 226,650 new cases of lung cancer were diagnosed in the U.S., leading to nearly 124,730 deaths.

The U.S. market for pulmonary function testing equipment is growing at a fast pace with the increasing prevalence of lung diseases such as cystic fibrosis, COPD, lung cancer, and asthma. The American Cancer Society 2025 states that lung cancers are most prevalent in people 65 or older, and the average age of diagnosis is 70. The U.S. market is greatly influenced by aggressive R&D spending, with companies investing in artificial intelligence integration, wearable diagnostics, and point-of-care test technology to ride early detection, patient monitoring, and remote care solutions for clinical and home care settings.

Canada pulmonary function testing devices market is aided by Health Canada's robust regulatory environment. According to a report by the Government of Canada 2021, 272 new Class III and 45 new Class IV medical devices were approved in 2021. With 140 investigational test applications for medical devices cleared, based on technology on the respiratory system, Canada continues to promote innovation, safety, and availability of diagnostic solutions in respiratory medicine.

Asia Pacific Market Insight

APAC pulmonary function testing device market is growing and expected to register fastest growth market with a significant market share during the forecast period, owing to increased respiratory diseases and increasing demand for early diagnosis. Government initiatives such as China's Healthy China 2030 and India's National Digital Health Mission encourage early detection and universal access to respiratory care. In addition, regulatory agencies in nations such as India are simplifying medical device approval to make it easier for new products to enter the market more quickly.

China's pulmonary function testing devices market is evolving with the technology of devices such as the Yue Cloud portable spirometer. According to a report by NLM 2022, primary respiratory parameters peak expiratory flow (PEF), maximal expiratory flow at 25%, 50%, and 75% of FVC (MEF25, MEF50, MEF75), and maximal mid-expiratory flow (MMEF), were compared with conventional devices through correlation analyses and Bland-Altman analyses and correlated well. The findings verify the accuracy of the device and the agreement of the automatic interpretation.

India's pulmonary function testing device market is developing, fueled by government-backed screening programs such as ASHA-based initiatives with peak flow meters and portable spirometers. As awareness of COPD rises, the market for pulmonary function testing devices in India is growing, driven by increasing demand for portable diagnostic tool solutions. Demand in the primary care segment is increasing, and there is scope for offering portable diagnostic solutions. Domestic R&D is centered on low-cost rugged devices for rural rollouts.

Europe Market Insight

Europe's market for pulmonary function test equipment is growing and expected to hold a considerable share due to rigid respiratory health requirements and increasing demand for infection-safe diagnosis following COVID-19. Efforts by organizations such as the European Respiratory Society (ERS) have accelerated the uptake of next-generation LFT technology. R&D efforts under coordinated initiatives focus on infection control, sterilization of equipment, and innovative contact-minimized spirometry technologies.

The UK pulmonary function testing equipment market is expanding with the help of government-sponsored respiratory screening requirements and NHS-funded early diagnosis initiatives for asthma and COPD. Industry players are launching digitally interfaced handheld spirometers and AI-assisted diagnostic equipment. Constant focus on R&D and streamlined innovation support schemes, such as the Office for Life Sciences, continue to nurture a nimble and future-proof respiratory diagnostics ecosystem.

Germany pulmonary function testing devices market is based on substantial R&D expenditure, advanced medical facilities, and regulatory capability. Drägerwerk and Geratherm are the leaders in spirometry and lung diagnosis, whereas tele-spirometry and respiratory homecare solutions are rising in prominence. The market is fortified with manufacturing hub benefits, given the very collaborative environment fostered between universities, industry, and medical associations in the country.

Key Pulmonary Function Testing Devices Market Players:

- MGC Diagnostics Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CareFusion Corporation (BD)

- Nihon Kohden Corporation

- Medisoft (EuroMed)

- Cosmed

- Vyaire Medical, Inc.

- Schiller AG

- Erich Jaeger GmbH & Co. KG

- Pulmonx Corporation

- Fukuda Sangyo Co., Ltd.

- Eolane Group

- Vitalograph Ltd.

- NDD Medical Technologies

- Bionet Co., Ltd.

- Intersurgical Pty Ltd.

The pulmonary function testing market is highly competitive, with dominant players focusing on innovation, strategic partnerships, and geographic expansion. Companies invest heavily in R and D to build portable devices easy to use with AI and connectivity features. Mergers and acquisitions are used to consolidate portfolios and increase the market reach, especially in emerging countries. Key players also strive to abide by regulatory standards and customization of products for chronic respiratory diseases to pursue differentiated solutions in an ever-evolving healthcare diagnostics environment.

Here is a list of key players operating in the global market:

Recent Developments

- In March 2024, Philips, being a global leader in the health technology domain, has recently commercialized a new mobile pulmonary function testing device to enhance the access in remote and outpatient locations for lung function testing.

- In January 2023, CAIRE Inc., MGC Diagnostics Corporation, a prominent manufacturer and provider of cardiopulmonary diagnostic equipment, making pulmonary function testing devices among others, has been acquired by CAIRE Inc., a world-renowned name in respiratory care and oxygen therapy.

- Report ID: 8042

- Published Date: Sep 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pulmonary Function Testing Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.