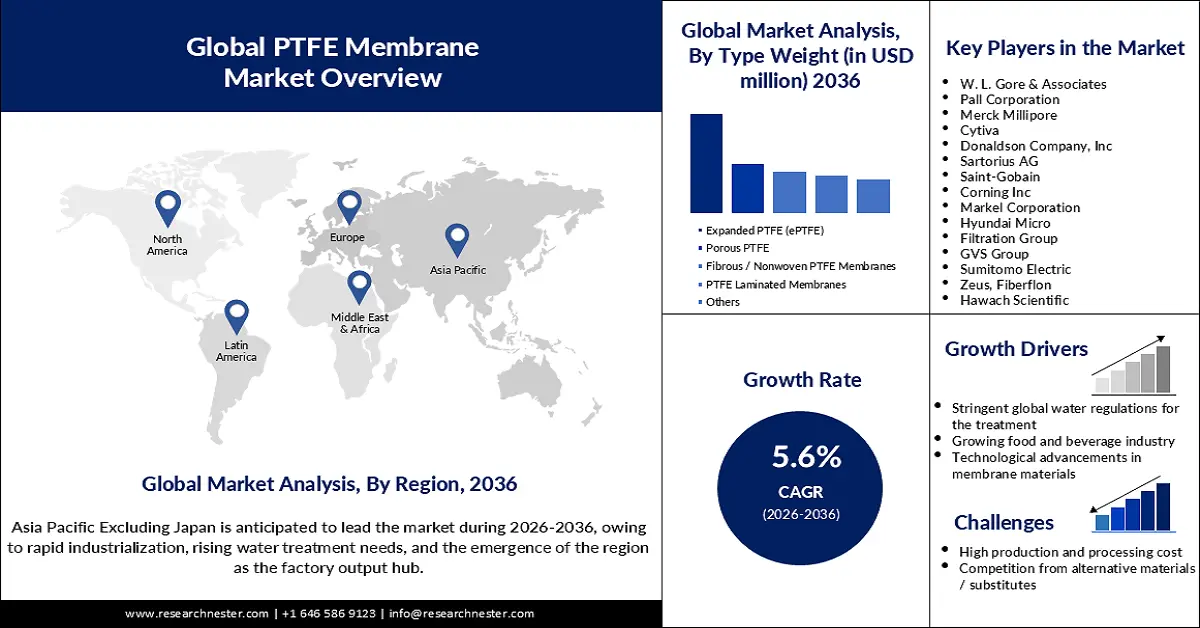

- An Outline of the Global PTFE Membrane Market

- Market Definition & Market Segmentation

- Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

- Type Analysis

- Use Case Analysis

- Analysis of Semiconductor for PTFE Membrane

- Semiconductor Manufacturing Processes

- Application Wise Market Share Analysis

- PTFE Membrane Demand, Value, and Pricing

- Market Dynamics

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Regulatory Framework

- Technological Advancements

- Growth Outlook

- Risk Overview

- Regional Demand

- Root Cause Analysis (RCA)

- Country Analysis

- Price Benchmarking

- Ecosystem Analysis

- Case Study Analysis

- Gaps Analysis

- Future Business Opportunities

- Porter Five Forces

- PESTLE

- Comparative Positioning

- Competitor SWOT Analysis

- Strategic Developments by Competitors in the Industry

- Strategic Recommendations

- Competitive Landscape: Key Players

- Advantec MFS, Inc.

- Cobetter

- Cytiva

- Deefine Filtration

- Donaldson Company, Inc.

- F.I.T Industrial Co.,Ltd.

- GVS S.p.A

- JINYOU

- KAYSER Filtertech

- Meissner Filtration Products, Inc.

- Merck KGaA

- Pall Corporation

- Porex

- Rogers Corporation

- SSI Aeration, Inc.

- Sumitomo Electric Industries, Ltd.

- ZimVie

- Competitive Model: A Detailed Inside View for Investors

- Market Share of Major Companies Profiled, 2024

- Business Profiles of Key Enterprises

- Global PTFE Membrane Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Square Meter), and Compound Annual Growth Rate (CAGR)

- PTFE Membrane Market Segmentation Analysis (2020-2036)

- By Type

- Expanded PTFE (ePTFE), Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Porous PTFE, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Fibrous / Nonwoven PTFE Membranes, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- PTFE Laminated Membranes, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- By Pore Size

- <0.01 μm, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- 0.01 - 1 μm, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- 1 - 5 μm, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Above 5 μm, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- By Application

- Chemical Filtration, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Semiconductor Industry, Market Value (USD Million), Volume (Million Square Meter) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Air / Gas Filtration & Venting, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Battery Separators, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Water & Wastewater Treatment, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Protective Apparel & Medical Barriers, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Others, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

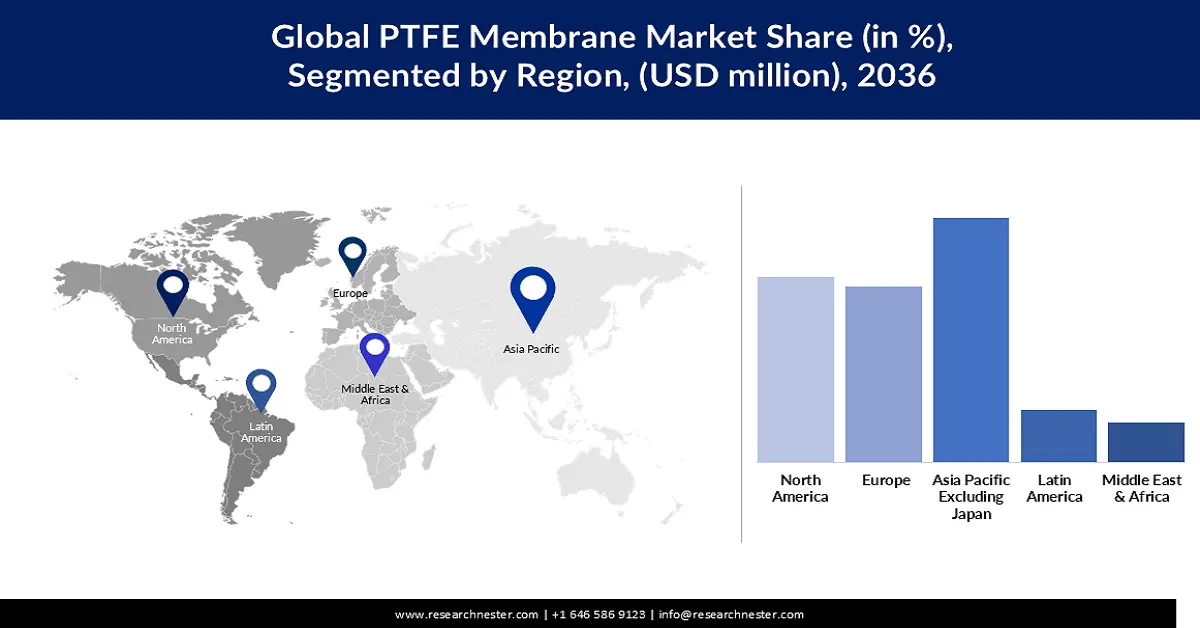

- By Region

- North America, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Europe, Market Value (USD Million), Volume (Million Square Meter) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Asia Pacific Excluding Japan, Market Value (USD Million), Volume (Million Square Meter) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Japan, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Latin America, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Middle East & Africa, Market Value (USD Million), Volume (Million Square Meter) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- By Type

- North America PTFE Membrane Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Square Meter) and Compound Annual Growth Rate (CAGR)

- Analysis of the Regional Market Dynamics

- Top Regional Players

- PTFE Membrane Market Segmentation Analysis (2020-2036)

- By Type

- Expanded PTFE (ePTFE), Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Porous PTFE, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Fibrous / Nonwoven PTFE Membranes, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- PTFE Laminated Membranes, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- By Pore Size

- <0.01 μm, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- 0.01 - 1 μm, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- 1 - 5 μm, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Above 5 μm, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- By Application

- Chemical Filtration, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Semiconductor Industry, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Air / Gas Filtration & Venting, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Battery Separators, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Water & Wastewater Treatment, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Protective Apparel & Medical Barriers, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Others, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- By Country

- US, Market Value (USD Million), Volume (Million Square Meter) and CAGR, 2020-2036F

- Canada, Market Value (USD Million), Volume (Million Square Meter), and CAGR, 2020-2036F

- By Type

- Europe PTFE Membrane Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Square Meter) and Compound Annual Growth Rate (CAGR)

- Analysis of the Regional Market Dynamics

- Top Regional Players

- PTFE Membrane Market Segmentation Analysis (2020-2036)

- By Type

- Expanded PTFE (ePTFE), Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Porous PTFE, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Fibrous / Nonwoven PTFE Membranes, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- PTFE Laminated Membranes, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- By Pore Size

- <0.01 μm, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- 0.01 - 1 μm, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- 1 - 5 μm, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Above 5 μm, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- By Application

- Chemical Filtration, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Semiconductor Industry, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Air / Gas Filtration & Venting, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Battery Separators, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Water & Wastewater Treatment, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Protective Apparel & Medical Barriers, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Others, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- By Country

- UK, Market Value (USD Million), Volume (Million Square Meter) and CAGR, 2020-2036F

- Germany, Market Value (USD Million), Volume (Million Square Meter), and CAGR, 2020-2036F

- France, Market Value (USD Million), Volume (Million Square Meter), and CAGR, 2020-2036F

- Italy, Market Value (USD Million), Volume (Million Square Meter) and CAGR, 2020-2036F

- Spain, Market Value (USD Million), Volume (Million Square Meter) and CAGR, 2020-2036F

- BENELUX, Market Value (USD Million), Volume (Million Square Meter), and CAGR, 2020-2036F

- Russia, Market Value (USD Million), Volume (Million Square Meter), and CAGR, 2020-2036F

- Poland, Market Value (USD Million), Volume (Million Square Meter), and CAGR, 2020-2036F

- Rest of Europe, Market Value (USD Million), Volume (Million Square Meter), and CAGR, 2020-2036F

- By Type

- Asia Pacific Excluding Japan PTFE Membrane Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Square Meter), and Compound Annual Growth Rate (CAGR)

- Analysis of the Regional Market Dynamics

- Top Regional Players

- PTFE Membrane Market Segmentation Analysis (2020-2036)

- By Type

- Expanded PTFE (ePTFE), Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Porous PTFE, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Fibrous / Nonwoven PTFE Membranes, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- PTFE Laminated Membranes, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- By Pore Size

- <0.01 μm, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- 0.01 - 1 μm, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- 1 - 5 μm, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Above 5 μm, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- By Application

- Chemical Filtration, Market Value (USD Million), Volume (Million Square Meter) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Semiconductor Industry, Market Value (USD Million), Volume (Million Square Meter) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Air / Gas Filtration & Venting, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Battery Separators, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Water & Wastewater Treatment, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Protective Apparel & Medical Barriers, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Others, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- By Country

- China, Market Value (USD Million), Volume (Million Square Meter), and CAGR, 2020-2036F

- India, Market Value (USD Million), Volume (Million Square Meter) and CAGR, 2020-2036F

- Indonesia, Market Value (USD Million), Volume (Million Square Meter), and CAGR, 2020-2036F

- South Korea, Market Value (USD Million), Volume (Million Square Meter), and CAGR, 2020-2036F

- Malaysia, Market Value (USD Million), Volume (Million Square Meter), and CAGR, 2020-2036F

- Australia, Market Value (USD Million), Volume (Million Square Meter), and CAGR, 2020-2036F

- Singapore, Market Value (USD Million), Volume (Million Square Meter), and CAGR, 2020-2036F

- Vietnam, Market Value (USD Million), Volume (Million Square Meter), and CAGR, 2020-2036F

- Thailand, Market Value (USD Million), Volume (Million Square Meter), and CAGR, 2020-2036F

- New Zealand, Market Value (USD Million), Volume (Million Square Meter), and CAGR, 2020-2036F

- Rest of Asia Pacific excluding Japan, Market Value (USD Million), Volume (Million Square Meter), and CAGR, 2020-2036F

- By Type

- Japan PTFE Membrane Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Square Meter) and Compound Annual Growth Rate (CAGR)

- Analysis of the Regional Market Dynamics

- Top Regional Players

- PTFE Membrane Market Segmentation Analysis (2020-2036)

- By Type

- Expanded PTFE (ePTFE), Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Porous PTFE, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Fibrous / Nonwoven PTFE Membranes, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- PTFE Laminated Membranes, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- By Pore Size

- <0.01 μm, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- 0.01 - 1 μm, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- 1 - 5 μm, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Above 5 μm, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- By Application

- Chemical Filtration, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Semiconductor Industry, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Air / Gas Filtration & Venting, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Battery Separators, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Water & Wastewater Treatment, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Protective Apparel & Medical Barriers, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Others, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- By Type

- Latin America PTFE Membrane Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Square Meter), and Compound Annual Growth Rate (CAGR)

- Analysis of the Regional Market Dynamics

- Top Regional Players

- PTFE Membrane Market Segmentation Analysis (2020-2036)

- By Type

- Expanded PTFE (ePTFE), Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Porous PTFE, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Fibrous / Nonwoven PTFE Membranes, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- PTFE Laminated Membranes, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- By Pore Size

- <0.01 μm, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- 0.01 - 1 μm, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- 1 - 5 μm, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Above 5 μm, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- By Application

- Chemical Filtration, Market Value (USD Million), Volume (Million Square Meter) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Semiconductor Industry, Market Value (USD Million), Volume (Million Square Meter) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Air / Gas Filtration & Venting, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Battery Separators, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Water & Wastewater Treatment, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Protective Apparel & Medical Barriers, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Others, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- By Country

- Brazil, Market Value (USD Million), Volume (Million Square Meter), and CAGR, 2020-2036F

- Argentina, Market Value (USD Million), Volume (Million Square Meter), and CAGR, 2020-2036F

- Mexico, Market Value (USD Million), Volume (Million Square Meter), and CAGR, 2020-2036F

- Rest of Latin America, Market Value (USD Million), Volume (Million Square Meter), and CAGR, 2020-2036F

- By Type

- Middle East & Africa PTFE Membrane Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Square Meter) and Compound Annual Growth Rate (CAGR)

- Analysis of the Regional Market Dynamics

- Top Regional Players

- PTFE Membrane Market Segmentation Analysis (2020-2036)

- By Type

- Expanded PTFE (ePTFE), Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Porous PTFE, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Fibrous / Nonwoven PTFE Membranes, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- PTFE Laminated Membranes, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- By Pore Size

- <0.01 μm, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- 0.01 - 1 μm, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- 1 - 5 μm, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Above 5 μm, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- By Application

- Chemical Filtration, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Semiconductor Industry, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Air / Gas Filtration & Venting, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Battery Separators, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Water & Wastewater Treatment, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Protective Apparel & Medical Barriers, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Others, Market Value (USD Million), Volume (Million Square Meter), and CAGR & Y-o-Y Growth Trend, 2020-2036F

- By Country

- GCC, Market Value (USD Million), Volume (Million Square Meter) and CAGR, 2020-2036F

- Israel, Market Value (USD Million), Volume (Million Square Meter) and CAGR, 2020-2036F

- South Africa, Market Value (USD Million), Volume (Million Square Meter) and CAGR, 2020-2036F

- Rest of Middle East & Africa, Market Value (USD Million), Volume (Million Square Meter), and CAGR, 2020-2036F

- By Type

- Global Economic Scenario

39.1 World Economic Outlook

40. About Research Nester

40.1. Our Global Clientele

40.2. We Serve Clients Across World

PTFE Membrane Market Outlook:

PTFE Membrane Market size was valued at USD 2.73 billion in 2025 and is projected to reach USD 5.06 billion by the end of 2036, rising at a CAGR of 5.6% during the forecast period, i.e., between 2026-2036. In 2026, the industry size of PTFE membrane is evaluated at USD 2.91 billion.

The global PTFE market is estimated to grow exponentially in the upcoming business years, owing to the strong demand for the fluoropolymer-based material across various industries, including automation, chemical, healthcare, and aerospace. The effective chemical, heat, and low-temperature resistance capacities of the PTFE membrane make it ideal for use in filtration, water treatment, air filtration, and medical, textile, and industrial applications that require high efficiency and resistance to tough conditions. Therefore, the expansion of the end-use industries can accelerate the consumption of the material. As reported by the European Automobile Manufacturers’ Association in September 2025, the global rate of car registrations grew by 5% to 37.4 million units in 2025, led by a surge of 12% in China. Further growth of the automotive sector can boost the use of PTFE membranes in gaskets and seals, mainly.

In addition, stringent regulations encouraging optimal sustainability across different industries globally are also fuelling the market growth. As disclosed by the European Union in April 2023, Annex I to Regulation (EU) 2019/1021 allows for an exemption in the use of PFOA, PFOA-related compounds, and salts derived from PFOA in the production of PTFE required for the production of certain products. In the production of the PTFE membrane, polytetrafluoroethylene is used as the raw material, which does not break down and continues to build up in the environment. Regulations pushing the industry to reduce environmental impact in PTFE membrane production are expected to foster innovation.

Key PTFE Membrane Market Insights Summary:

Regional Highlights:

- By 2036, Asia Pacific is anticipated to command a 43.5% share of the PTFE membrane market, attributed to rapid industrialization.

- North America is projected to hold a 23.0% share by 2036, supported by escalating medical sector demand.

Segment Insights:

- By 2036, the expanded PTFE (ePTFE) segment in the PTFE membrane market is projected to account for a 39.5% share, propelled by growing EV adoption.

- The - 1 μm segment is set to capture a 52.9% share by 2036, underpinned by its strong efficiency and greater flow rates.

Key Growth Trends:

- Stringent global water regulations for the treatment

- Growing food and beverage industry

Major Challenges:

- High production and processing cost

- Competition from alternative materials/substitutes

Key Players: W. L. Gore & Associates (U.S.), Pall Corporation (U.S.), Merck Millipore (Germany), Cytiva (Sweden / U.S.), Donaldson Company, Inc. (U.S.), Sartorius AG (Germany), Saint-Gobain (France), Corning Inc. (U.S.), Markel Corporation (U.S.), Hyundai Micro (South Korea), Filtration Group (U.S.), GVS Group (Italy), Sumitomo Electric (Japan), Zeus, Fiberflon (U.S.), Hawach Scientific (China).

Global PTFE Membrane Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.73 billion

- 2026 Market Size: USD 2.91 billion

- Projected Market Size: USD 5.06 billion by 2036

- Growth Forecasts: 5.6% CAGR (2026-2036)

Key Regional Dynamics:

- Largest Region: Asia Pacific (excluding Japan) (43.5% Share by 2036)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Vietnam, Indonesia, Brazil, Mexico

Last updated on : 5 November, 2025

PTFE Membrane Market - Growth Drivers and Challenges

Growth Drivers

- Stringent global water regulations for the treatment: Governments globally are announcing stringent water treatment regulations, considering the growing wastewater. According to the United Nations in August 2023, wastewater is a rising threat to the environment and human health. The implementation of appropriate policies can result in the use of wastewater as a valuable resource to supply energy to over half a billion people. In September 2025, the U.S. Environmental Protection Agency disclosed that the EU water reuse Regulation (EU) 2020/741 became applicable from June 2023, establishing minimum water quality and requiring proper risk management and monitoring processes to reuse water. As a result, the consumption of the PTFE can increase in plants with a high level of biological contaminants.

- Growing food and beverage industry: The demand for the PTFE membrane is anticipated to increase with the expansion of the food and beverage industry. A report by the German Engineering Federation, published in April 2025, suggests that global sales of packaged food reached 873 million tons in 2024 and are expected to surpass 970 million tons in 2028. The material is widely used in the food and beverage industry for solvent, oil, and aggressive fluid filtration so that the risk of product accumulation can be prevented.

- Technological advancements in membrane materials: Technological advancements in membrane materials, which led to the development of membrane processes, such as nanofiltration, microfiltration, reverse osmosis, ultrafiltration, and electrodialysis, are expected to drive the PTFE market growth significantly. The emergence of these processes increases the attractiveness of the PTFE membrane for its chemical and thermal resistance capabilities in different industrial applications that require high efficiency and compatibility with harsh environmental conditions. For example, the ultrafiltration process, along with PTFE membranes, can be used to remove protozoa, bacteria, and viruses in water treatment.

Challenges

- High production and processing cost: The costs of sourcing PTFE material and performing the process of membrane fabrication are high. This increases production expenses for key players in the market. With further growth of production costs, the key players can be forced to bring hikes in the prices of the PTFE membranes they offer, which can reduce the market affordability of and demand for the production. High investment to produce PTFE membrane is also likely to hinder the emergence of new entrants in the years to come.

- Competition from alternative materials/substitutes: The attractiveness of the PTFE membrane across different industries is likely to deteriorate, owing to the development of a variety of alternatives. Substitute materials such as polypropylene and PVDF membranes are cheaper in the global market, and are expected to influence organizations that are looking for operating cost reduction in the end-use industries for adoption. PCTFE is another emerging alternative to PTFE with more mechanical strength, dimensional stability, and rigidity, capable of resisting low temperatures.

PTFE Membrane Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2036 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 2.73 billion |

|

Forecast Year Market Size (2036) |

USD 5.06 billion |

|

Regional Scope |

|

PTFE Membrane Market Segmentation:

Type Segment Analysis

The expanded PTFE (ePTFE) segment is projected to account for a market share of 39.5% by the end of 2036, owing to the increasing demand for durable sealing solutions, driven by growing EV adoption. According to the India Brand Equity Foundation, BEV production in India is likely to reach 377,000 units in 2025. A report by the International Energy Agency (IEA) stated that global electric vehicle (EV) sales reached 17 million units in 2024, marking a growth of over 25% compared to the previous year. Automotive suppliers globally are scaling up EV production and integrating advanced battery technologies. ePTFE has an outstanding sealing performance, ideal for use in producing sealing solutions. The demand for PTFE is also increasing across industries such as medical, utilities, and chemical processing, where it is used to manufacture implantable medical devices, handle corrosive substances, and support various high-performance applications.

Pore Size Segment Analysis

The - 1 μm segment is estimated to acquire a revenue share of 52.9%, owing to its strong efficiency and greater flow rates while causing less pressure loss at the same time. High-growth sectors, such as the pharmaceutical and medical, are also seeking PTFE membranes with 0.01-1 μm pore size, influencing the dominance of the segment. In the process of ultrafiltration, PTFE membranes with pore sizes ranging between 0.01 to 0.1 μm are likely to be used increasingly to separate particles in drug filtration in the near future. Multiple companies are associated with the production of the PTFE membranes whose pore sizes range from 0.01 to 1 μm.

Application Segment Analysis

The chemical filtration segment is set to acquire a market share of 22.9% from 2026 to 2036. The PTFE membrane filters contain a high level of chemical resistance, which attracts organizations in the chemical processing industry to adopt the material in extracting solvents and acids that cannot be done by using any other type of filter. The process of chemical filtration is performed at a high temperature. The temperature tolerance capacity of the material makes it ideal for use in chemical filtration processes. Industries, such as electronics and pharmaceuticals, that are obligated to ensure high levels of contamination control and purity, are likely to be increasingly dependent on FTPE membranes for chemical filtration.

Our in-depth analysis of the global market includes the following segments:

|

Segments |

Subsegments |

|

Type |

|

|

Pore Size |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

PTFE Membrane Market - Regional Analysis

Asia Pacific Excluding Japan Market Insights

The Asia Pacific, excluding Japan, is expected to emerge as a booming market, acquiring a revenue share of 43.5% by the end of 2036. The region is going through a rapid industrialization and is estimated to do so in the upcoming financial years. As reported by the International Monetary Fund in October 2024, manufacturing is the engine for economic growth in Asia. The region prospers as the source of more than half of the global factory output. This indicates a strong demand for PTFE membranes for industrial filtration. The increasing need for water treatment across the region can also fuel the adoption of the material. As disclosed by the World Bank, East Asia and the Pacific is leading in terms of region with high marine plastic pollution, caused by 11.7 million tons of plastic waste each year.

The PTFE membrane market in China is anticipated to experience a robust expansion, at a 6.2% CAGR throughout the forecast period, owing to the growing demand for the fluoropolymer-based material across the chemical processing and pharmaceutical industries. These industries are highly attracted to PTFE membrane for its chemical resistance, high temperature tolerance, and low surface energy consumption properties for filtration purposes. Thus, the growth of these end-use sectors can result in an increased use of the material in the years to come. A report published by the State Council Information Office (SCIO) in August 2022 suggests that China’s pharmaceutical sector ranks second across the world, accounting for 30% of innovative drugs going through the development and research process.

The industrial and environmental concerns are rising in India, driven by drastic water and soil pollution. As informed in May 2024, 63 of the 100 most polluted cities globally are in India. Around 70% of the surface water is not fit for consumption, and 277 million tons of solid municipal waste are produced each year within the country. To mitigate these environmental issues, the PTFE membrane is likely to gain increasing popularity across various industries. Governments' investment in the expansion of the healthcare infrastructure is also likely to boost the consumption of PTFE membranes for filtration purposes. The presence of a large pool of importers of the PTFE membrane is also likely to fuel the market growth by bolstering trade.

North America Market Insights

The PTFE membrane market in North America is estimated to hold a 23.0% share during the projection timeline, owing to the growing demand for the material in the medical sector. The country’s booming medical sector is also expected to significantly drive the demand for PTFE membranes over the forecast period. As updated by the Centers for Medicare & Medicaid Services in June 2025, the national health expenditure in the U.S. rose 7.5% to USD 4.9 trillion in 2023. Stringent environmental regulations in different countries across the region are also likely to boost innovation in the PTFE membrane production process, since it causes significant environmental hazards.

The U.S. PTFE membrane market is projected to witness a CAGR of 5.2% during the forecast timeline, on account of the rapid expansion of the electronics industry. As reported by the Semiconductor Industry Association in July 2025, exports of chips from the U.S. rose by 13% in 2024 and are estimated to continue to experience a double-digit growth throughout 2025. This is expected to fuel the demand for PTFE membrane as it is crucial for high-purity filtration in the production of semiconductors. The government is pushing all industries toward sustainable practices. The expanding pharmaceutical industry can adopt the material to address its sustainable filtration needs.

Canada is poised to emerge as an expanding PTFE membrane market between 2026 and 2036, attributed to the rising deployment of smart city infrastructure and environmental sensor systems across the country. The government is actively deploying air quality monitoring sensor nodes with the motive of enabling continuous monitoring of air quality and meteorological parameters. This can lead to a rising use of the PTFE membrane as an efficient filter and protective barrier for the filtration of particulate matter. The adoption of the material is also expected to be fuelled within the country with the rapid expansion of the healthcare sector.

Europe Market Insights

The Europe PTFE membrane market is set to experience a CAGR of 4.9% during the projection timeline, owing to the stringent regulations related to environmental sustainability in various industries. This can influence automotive, pharmaceutical, and other end-use industries to adopt PTFE membrane as it is less harmful compared to a range of alternatives used for filtration, especially when they are seeking high-performance filtration solutions. The waterproof and breathable properties of the material can accelerate its popularity in the apparel and footwear industries within the region in the upcoming business years.

Germany is expected to emerge as the fastest-growing PTFE membrane market in the region, owing to the surging need for proper ventilation, driven by rapid industrialization across the country. In August 2025, the International Trade Administration notified that the government of Germany considers advanced manufacturing as a technology area that requires utmost priority. The country has a strong focus on Industry 4.0, precision engineering, machine building, and control systems. This is likely to fuel the integration of the PTFE membrane in ventilation systems to make them smarter, more responsive, and efficient. According to a report by the German Association of the Automotive Industry, released in June 2025, the passenger car production domestically surpassed 363,600 units of volume in May 2025, an increase of 19% compared to May 2024. The rapid expansion of the automotive industry of the country can fuel the consumption of the PTFE membrane in gaskets and seals.

The UK PTFE membrane market is set for a robust expansion during the projection period, on account of the strong emphasis of the government on the development of smart filtration systems. This can fuel the consumption of the material in the near future. The potential end-use industries, such as pharmaceutical, automotive, and healthcare, are growing rapidly, indicating the likelihood of an increase in the demand for the PTFE membrane. Lastly, the presence of large key players involved in the development of production of the material is also influencing stability in the dominance of the UK PTFE membrane market.

Key PTFE Membrane Market Players:

- W. L. Gore & Associates (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pall Corporation (U.S.)

- Merck Millipore (Germany)

- Cytiva (Sweden / U.S.)

- Donaldson Company, Inc. (U.S.)

- Sartorius AG (Germany)

- Saint-Gobain (France)

- Corning Inc. (U.S.)

- Markel Corporation (U.S.)

- Hyundai Micro (South Korea)

- Filtration Group (U.S.)

- GVS Group (Italy)

- Sumitomo Electric (Japan)

- Zeus, Fiberflon (U.S.)

- Hawach Scientific (China)

- W. L. Gore & Associates, a global leader in advanced materials, specializes in high-performance PTFE membranes used in filtration, medical devices, and industrial applications. The company is renowned for its innovative GORE-TEX technology and strong focus on research and development to create durable, chemically resistant membranes.

- Pall Corporation provides filtration, separation, and purification solutions across life sciences, pharmaceuticals, and industrial sectors. Its PTFE membranes are widely adopted in air, gas, and liquid filtration applications, benefiting from Pall’s global network and expertise in high-purity filtration technologies.

- Merck Millipore, a leading supplier in life sciences and laboratory technologies, Merck Millipore manufactures PTFE membranes for applications including biopharmaceutical filtration, chemical processing, and laboratory research. The company emphasizes high chemical resistance and precision performance in its membrane solutions.

- Cytiva, formerly part of GE Healthcare Life Sciences, focuses on bioprocessing and laboratory solutions, providing PTFE membranes for sterile filtration, gas venting, and process optimization. Their products support high-purity applications in pharmaceuticals and biotechnology.

- Donaldson Company is a global filtration and purification company producing PTFE membranes for industrial, air, and liquid filtration systems. The company is known for its robust and high-efficiency membranes that address harsh environments and demanding filtration requirements.

Below is the list of the key players operating in the global PTFE membrane market:

The presence of large key players and the growing demand for PTFE membranes across different industries, including environmental agencies, make the market highly competitive. The association of a large pool of PTFE membrane suppliers is noticed globally, encompassing the emergence of new entrants. This is expected to increase the industry fragmentation in the upcoming financial years. All the key players in the market prioritize research and development optimally. The majority of the PTFE suppliers have expanded globally.

Corporate Landscape of the Global PTFE Membrane Market:

Recent Developments

- In October 2025, Olympus Corporation, a global MedTech leader dedicated to enhancing health, safety, and quality of life, announced an international distribution agreement with the medical products division of U.S.-based W. L. Gore & Associates, Inc. (Gore), a renowned materials science company known for developing innovative products across multiple industries.

- Report ID: 8218

- Published Date: Nov 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

PTFE Membrane Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.