Polymer Nanomembrane Market Outlook:

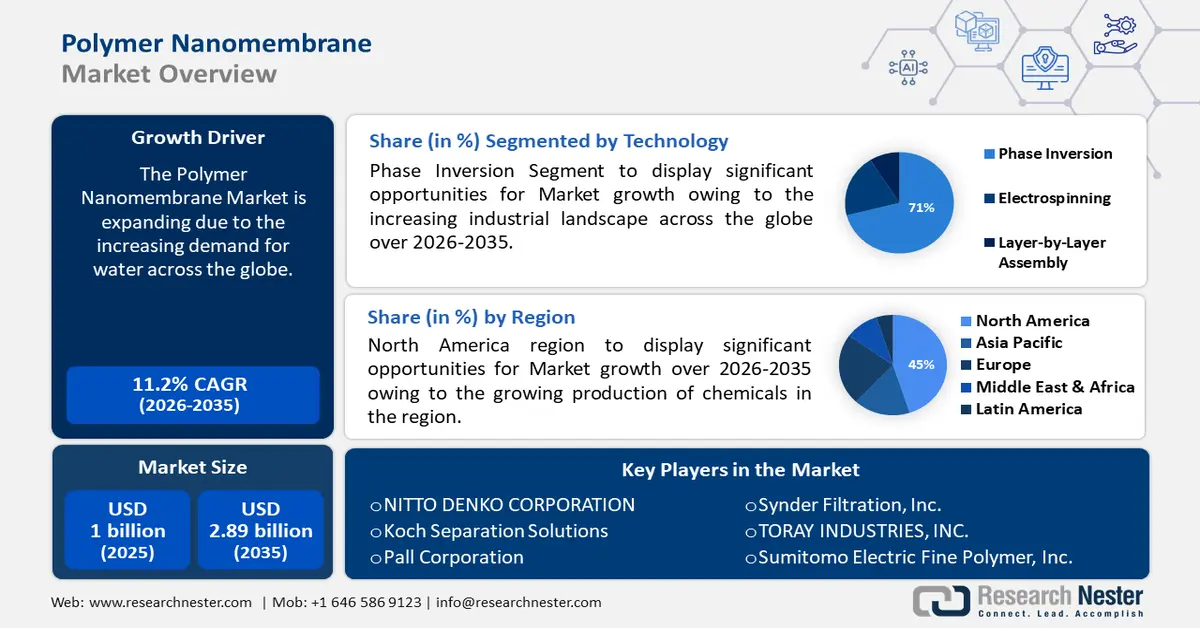

Polymer Nanomembrane Market size was over USD 1 billion in 2025 and is poised to exceed USD 2.89 billion by 2035, growing at over 11.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of polymer nanomembrane is estimated at USD 1.1 billion.

The market size expansion is due to the increasing demand for water globally. Human water use has increased dramatically through a confluence of causes such as economic development, population increase, and others.

Moreover, with rising water use, nanotechnology will likely be used more often, which will augment the polymer nanomembrane market over the projected period.

According to the United Nations, the increasing need for water in both the industrial and home sectors is anticipated to drive a 20–30% increase in global water demand by 2050, compared to the current level of water use.

Key Polymer Nanomembrane Market Insights Summary:

Regional Highlights:

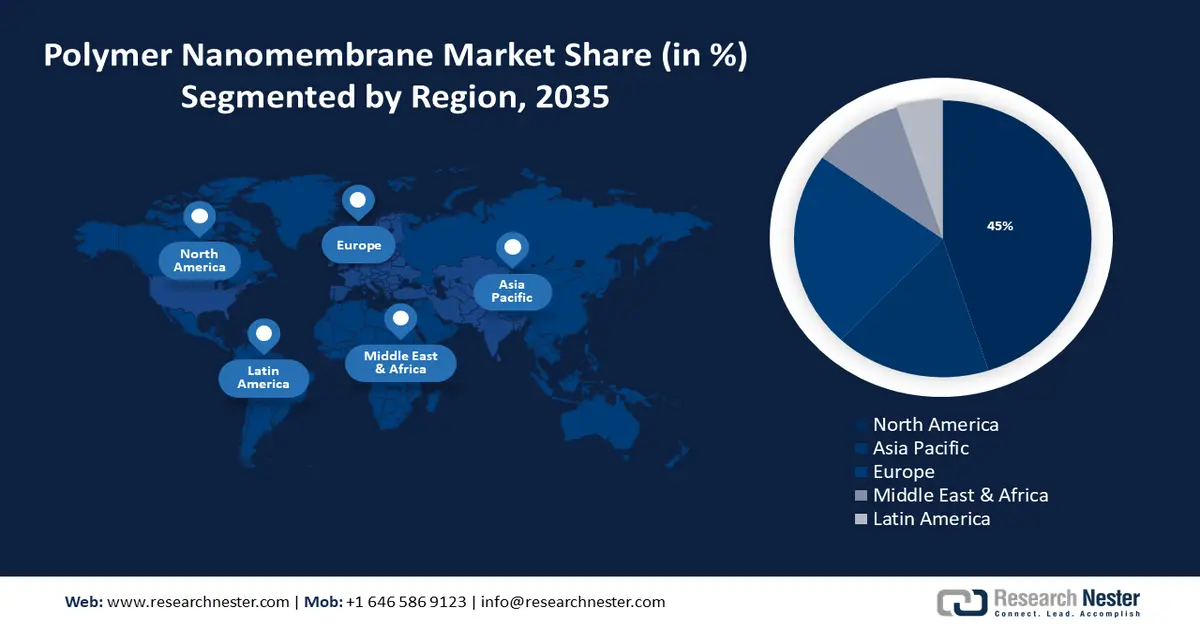

- North America polymer nanomembrane market will dominate around 45% share by 2035, driven by the rising production of chemicals, increasing demand for polymer nanomembranes.

- Europe market will capture the second largest share by 2035, driven by the increasing focus on sustainability, driving demand for polymer nanomembranes.

Segment Insights:

- The phase inversion segment in the polymer nanomembrane market is projected to hold a 71% share by 2035, driven by the increasing industrial landscape across the globe.

- The pan segment in the polymer nanomembrane market is expected to exhibit significant growth over 2026-2035, attributed to the expanding electronics industry.

Key Growth Trends:

- Growing pharmaceutical industry

- Expanding food and beverage industry

Major Challenges:

- Environmental concerns

- Inconsistency in pore size and quality

Key Players: DuPont de Nemours, Inc., Koch Separation Solutions, Sun Capital Partners, Inc., Pall Corporation, Synder Filtration, Inc., Sumitomo Electric Fine Polymer, Inc., Merck kGaA, Argonide Corporation, Danaher Corporation.

Global Polymer Nanomembrane Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1 billion

- 2026 Market Size: USD 1.1 billion

- Projected Market Size: USD 2.89 billion by 2035

- Growth Forecasts: 11.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Polymer Nanomembrane Market Growth Drivers and Challenges:

Growth Drivers

-

Growing pharmaceutical industry - Pharmaceuticals use polymer nanomembranes for the transportation of bioactive substances, tissue engineering, wound care, medication delivery, and medical implants due to their high breathability and controlled permeability.

Global pharmaceutical business is expected to increase by around 6% between 2024 and 2028. - Rising popularity of sports - This is influencing the demand for athleisure apparel, which is expected to boost the demand for polymer nanomembrane as it provides the qualities needed for athleisure apparel since these garments are composed of lightweight, flexible material and are waterproof that can withstand snow, rain, and wind, and allow for better air and water vapor permeability.

The sports industry brought in over USD 402 billion in sales in 2022, and this figure is expected to increase globally in the upcoming years. - Expanding food and beverage industry - To organically concentrate food and beverages while preventing degradation, the food and beverage sector uses polymer nanomembranes, which are also used to produce cheese and sweets, concentrate whey, process sugar, and degumming solutions in edible oil processing.

For instance, the global beverage market would expand by around 10% between 2024 and 2029, reaching a market size of over USD 380 billion by that year.

Challenges

-

Environmental concerns - It is probable that during the manufacturing and disposal processes, nanomaterials may be released into the environment, which may have a possible impact on aquatic ecosystems and species.

Therefore, before polymer nanomembranes are extensively used, in water remediation and to fulfill the objective of ensuring that everyone has access to clean water, it will be imperative to address these obstacles since environmental pollution is a major worry for both industrialized and developing nations these days. - Inconsistency in pore size and quality - can impact the product's quality and complicate the large-scale manufacturing of polymer nanomembranes.

Polymer Nanomembrane Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.2% |

|

Base Year Market Size (2025) |

USD 1 billion |

|

Forecast Year Market Size (2035) |

USD 2.89 billion |

|

Regional Scope |

|

Polymer Nanomembrane Market Segmentation:

Technology Segment Analysis

Phase inversion segment is estimated to hold polymer nanomembrane market share of more than 71% by 2035. The segment growth can be led by the increasing industrial landscape across the globe. Phase inversion refers to the regulated conversion of a liquid phase of a polymer into a solid phase, and is a common process in the production of food, detergents, cosmetics, and pharmaceuticals.

Moreover, it is a popular and effective technique for creating nanoscale polymeric films, which is the method most frequently employed for casting polymeric membranes intended for industrial usage.

As per the UNIDO, a post-pandemic recovery was indicated by a 2.3% gain in industrial sectors worldwide, which included waste management, mining, manufacturing, power, water supply, and other utilities.

Also, the phase inversion procedure makes it possible to precisely manage the membrane's porosity, selectivity, and pore size and has several benefits, including scalability and adaptability, which make it a highly desired way to produce polymer nanomembrane.

The controlled change of a polymer from its liquid phase to its solid phase is known as phase inversion, which is used to prepare polyacrylonitrile (PAN) membranes that combine high flow rates, low-pressure requirements, and outstanding selectivity to assist laboratories in simplifying their filtration setups.

Besides this, electrospinning is a straightforward technique for creating continuous nanofibers of different polymers, polymer blends, and composites of polymers and also creates nanomembranes based on biopolymers by charging and expelling a polymer solution under a high-voltage electric field.

Type Segment Analysis

The PAN segment is set to register a significant market size by 2035. This growth of the segment is encouraged by the expanding electronics industry. polyacrylonitrile (PAN) is utilized as a host polymer electrolyte, which is characterized as a membrane with electron transport capabilities that has been thoroughly studied as a potential material for electrodes in flexible electronics.

For instance, the global consumer electronics market will reach a market size of over USD 117o billion in 2028.

End-Use Industry Segment Analysis

The water & wastewater treatment segment is assessed to generate the maximum CAGR by the end of 2035. The primary driver of the segment's growth is growing cases of contamination in water. When it comes to water and wastewater treatment, polymer nanomembranes provide effective, dependable, and selective solutions, that can effectively remove suspended particles, germs, and other contaminants from water to ensure high-quality drinking water for drinking, industrial uses, and environmental preservation.

According to the World Health Organization (WHO), at least 1.7 billion people worldwide will be using feces-contaminated drinking water in 2022.

Our in-depth analysis of the polymer nanomembrane market includes the following segments:

|

Type |

|

|

End-Use Industry |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polymer Nanomembrane Market Regional Analysis:

North American Market Insights

North America in polymer nanomembrane market is estimated to account for revenue share of around 45% by 2035. The market revenue in the region is credited to the rising production of chemicals. As a result, the demand for polymer nanomembranes may tremendously increase to meet the need for advanced filtration and separation technologies rising from the extensive production of chemicals.

Additionally, the growing research and developments in the US are probable to drive market expansion. For instance, Researchers from Northwestern University in Evanston, USA; Queen Mary University of London; Imperial College London; and the Bielefeld University of Germany have created a new kind of polymer nanomembrane containing coordinated supramolecular macrocycle molecules to show how these small cavities could be arranged and aligned using selectively functionalized macrocycle molecules, crucial for confirming the molecular architecture and providing basic knowledge of these membranes.

As the fourth-largest producer of crude oil and the fifth-largest producer of natural gas worldwide, Canada is a leader in the production of both natural gas and oil, which may augment market demand.

European Market Insights

The Europe region will also encounter tremendous growth for the polymer nanomembrane market in the coming years and will hold the second position owing to the increasing focus on sustainability, leading to a higher demand for polymer nanomembranes which is becoming more and more popular as sustainable materials to solve environmental issues.

By 2030, the European Union hopes to establish a sustainable Europe through the European Green Deal, which addresses issues with pollution, energy, transportation, biodiversity, and climate change.

Italy is a major producer of agricultural products and a major food processor, which may boost the demand for polymer nanomembranes as a variety of polymeric nanoparticles, including chitosan, PVA, lipids, and PLGA, are applied in agriculture to promote plant development and manage pests, and act as pesticide carrier systems.

The need for more pure chemical solutions to clean wafers is growing on account of technical advancements in biotech and electrical devices in Germany, leading to higher demand for polymer nanomembranes, which are considered as cost-effective and mechanically sound than their inorganic equivalents.

Polymer Nanomembrane Market Players:

- DuPont de Nemours, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Koch Separation Solutions

- Sun Capital Partners, Inc.

- Pall Corporation

- Synder Filtration, Inc.

- Sumitomo Electric Fine Polymer, Inc.

- Merck kGaA

- Argonide Corporation

- Danaher Corporation

There are several major companies in the polymer nanomembrane market. To increase their share of the polymer nanomembrane landscape, these major firms are putting out some strategic initiatives.

Recent Developments

- DuPont de Nemours, Inc. a global leader in creating water, shelter, and safety solutions announced the introduction of the new DuPont FilmTec LiNE-XD nanofiltration membrane elements for lithium brine purification by using resources including Salt Lake brine, geothermal brine, and surface and subsurface clay.

High-productivity FilmTec LiNE-XD nanofiltration membrane elements enable greater water and lithium recovery with less energy usage, and in meeting the rising demand for DLE or direct lithium extraction. - Sun Capital Partners, Inc. acquired Koch Separation Solutions to increase its economies of scale and fortify its market position, assist management in carrying out its business plan, spurring expansion, and expanding the company's capacity to assist clients in boosting output while achieving sustainability objectives.

- Report ID: 6061

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polymer Nanomembrane Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.