Fluoropolymer Tubing Market Outlook:

Fluoropolymer Tubing Market size was valued at USD 678.6 million in 2025 and is expected to reach USD 1.16 billion by 2035, registering around 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of fluoropolymer tubing is evaluated at USD 712.19 million.

The growth of the market can be attributed to the growing medical industry across the globe. Further, the growing elderly population are also expected to add to the market growth. Many medical applications make use of fluoropolymer components. Surgical device coatings frequently consist of fluoropolymers. For a wide range of applications, PTFE tubing is used by producers of medical devices. It is a preferred material for low friction inner liners of guide catheters used in cardiology and neurology. Further, shrink tubing and vascular access sheaths are made of fluorinated ethylene propylene (FEP). As of 2020, healthcare accounted for over 10% of the nation's GDP in the US.

In addition to these, factors that are believed to fuel the market growth of fluoropolymer tubing include the rising semiconductor industry. The growth can be attributed to the growing consumption of consumer electronics across the globe. FPP fluoropolymer tubing is made to precisely adhere to the stringent purity standards of the semiconductor industry. Further, owing to the flawless surface, superior insulating qualities, and thermal resilience, Parflex fluoropolymer tubing is frequently utilized in semiconductor applications, which is predicted to present the potential for market expansion over the projected period.

Key Fluoropolymer Tubing Market Insights Summary:

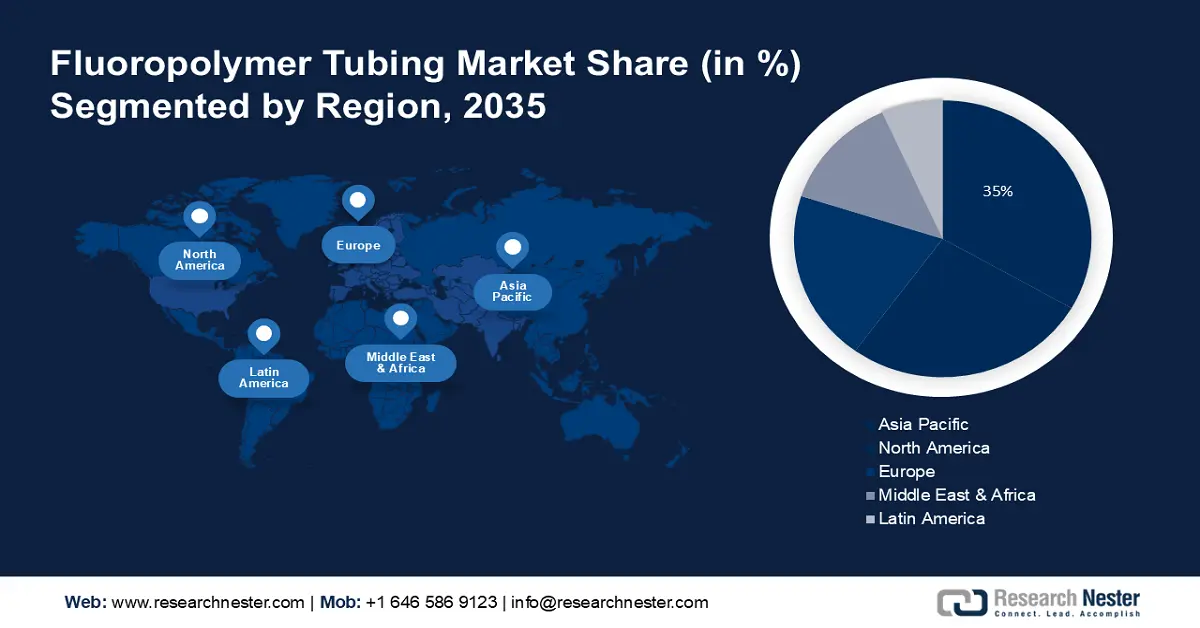

Regional Highlights:

- Asia Pacific fluoropolymer tubing market is poised to capture 35% share by 2035, driven by the increasing automobile industry, higher disposable income, and adoption of electric vehicles in the region.

- North America market will achieve a 24% share by 2035, attributed to the growing aviation sector, with major aircraft manufacturers driving demand for fluoropolymer tubing.

Segment Insights:

- The pipe segment in the fluoropolymer tubing market is expected to secure the largest share by 2035, fueled by increasing demand for chemical-resistant pipes in residential, hospital, and mall infrastructures.

- The fep segment in the fluoropolymer tubing market is expected to achieve a significant share by 2035, driven by the growing use of FEP in fluid transport, electrical insulation, and industrial chemical processes.

Key Growth Trends:

- Surging Demand for Electronics

- Rising Automotive Sector

Major Challenges:

- Exorbitant Cost of Fluoropolymers

- Lack of Ability to Maintain Needed Temperatures Has an Impact on the Quality

Key Players: 3M Company, The Chemours Company, Kureha Corporation, Daikin Industries, Ltd., Honeywell International, Inc., Teleflex Inc., Arkema SA, Asahi Glass Company Limited, Compagnie de Saint-Gobain S.A., Zeus Industrial Products, Inc.

Global Fluoropolymer Tubing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 678.6 million

- 2026 Market Size: USD 712.19 million

- Projected Market Size: USD 1.16 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Mexico

Last updated on : 9 September, 2025

Fluoropolymer Tubing Market - Growth Drivers and Challenges

Growth Drivers

- Surging Demand for Electronics – An increase in the market for electronic devices is the result of more people using telecommuting for work, school, and pleasure, anticipated to drive the market growth. The usage of fluoropolymer tube materials, particularly PTFE, FEP, and PFA, is widespread in electrical and electronic industries. Further, fluoropolymer tubing can provide electrical insulation since it is a great insulator. As of 2021, market for consumer electronics and appliances, including cellphones, washing machines, and smart wearable devices, expanded by over 5% in India.

- Rising Automotive Sector – Rising production of passenger cars, trucks, buses, and other commercial vehicles across the globe is estimated to drive market growth. As of 2021, the global sales of passenger vehicles increased by more than 2, 00,000 units.

- Growing Aviation Industry – On the account of rising middle class population and disposable incomes, the market is expected to expand more in the upcoming years. More than 30% of all aircraft deliveries worldwide are made in the Asia-Pacific region.

- Increasing Industrialization in Developing Countries –In December 2022, India's industrial production climbed over 4% compared to the previous year.

Challenges

- Exorbitant Cost of Fluoropolymers - The increasing concern is associated with the requirement of high investment in production of fluoropolymers tubing is one of the major factors predicted to slow down the market growth. For instance, producing fluoropolymers is a complicated, and costly process, which increases the price of end products such as fluoropolymers tubing.

- Lack of Ability to Maintain Needed Temperatures Has an Impact on the Quality

- Lack of knowledgeable Compounders to Process Fluoropolymer

Fluoropolymer Tubing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 678.6 million |

|

Forecast Year Market Size (2035) |

USD 1.16 billion |

|

Regional Scope |

|

Fluoropolymer Tubing Market Segmentation:

Application Segment Analysis

The global fluoropolymer tubing market is segmented and analyzed for demand and supply by application into film, tube, sheet, pipe, membrane, sealant, roofing, additives, and others. Out of these applications, the pipe segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the increasing demand for pipes in residential sector, hospitals, and malls. For handling reactive and caustic chemicals, PTFE is frequently utilized in hoses, containers, and pipelines. Further, PTFE tubes or pipes are a transparent pipe often known as polytetrafluoroethylene or Teflon. It is non-porous, corrosion-resistant, and perfect for applications involving chemicals and other liquids. For instance, PTFE elbows, tees, reducers, crossings, and spacers are the best options for processing or transferring highly corrosive fluids under challenging circumstances. According to estimates, the demand for water and wastewater pipes in the US is projected to rise by over 2% annually in 2022.

Material Segment Analysis

The global fluoropolymer tubing market is also segmented and analyzed for demand and supply by material into PTFE, PVDF, FEP, PFA, and ETFE. Amongst these segments, the FEP segment is expected to garner a significant share. The growth of the segment can be attributed to the growing applications of FEP. For instance, critical fluid transport tubing applications are seeing an increase in demand for FEP coatings, and the trend towards FEP lab equipment is picking up steam. Owing to their ability to store and transport the corrosive chemicals used in industrial manufacturing processes, FEP coatings are one of the crucial coating materials in the chemical industry. Both as an insulating material for outdoor electrical wires and as a jacketing material for optical fiber cables, fluorinated ethylene propylene (FEP) is employed. In addition to these, it is predicted that heavy use of FEP tubes in the aerospace, automotive, energy, and telecom sectors would fuel market segment growth in the future.

Our in-depth analysis of the global market includes the following segments:

|

By Material |

|

|

By Application |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fluoropolymer Tubing Market Regional Analysis:

APAC Market Insights

The Asian Pacific fluoropolymer tubing market, amongst the market in all the other regions, is projected to hold the largest market share of about 35% by the end of 2035. The growth of the market can be attributed majorly to the increasing automobile industry in the region. For instance, the rise in working people's disposable income has resulted in more demand for vehicles. Further, the market's adoption of electric automobiles, are also anticipated to contribute to the market growth in the region. Further, fluoropolymers are utilized in many different vehicle components, including pillars, rocker panels, bodyside moulding, front and rear bumpers, roofing strips, and mirror housing. For insulation and cabling, fluoropolymers are widely utilized in automotive electrical systems. Temperature resistance is vital to preventing overheating and even fires since wires and cables are also coming into touch with greater temperatures. Parts are sealed by fluoropolymer tubing, which shields them from harmful substances and high temperatures that may impair their functionality. As per estimates, China's automotive sector manufactured over 21 million passenger automobiles in 2021.

North American Market Insights

The North American fluoropolymer tubing market, amongst the market in all the other regions, is projected to hold the second largest share of about 24% during the forecast period. The growth of the market can be attributed majorly to the growing aviation sector in the region. For instance, the market expansion has been aided by the significant presence of major aircraft original equipment manufacturers. Fluoropolymer is necessary for a variety of aviation applications, which will increase demand for the product in the area. Complex wire harnesses, engine compartments, and the whole fuselage of the aircraft's main body can all employ fluoropolymer tubing. Furthermore, fluoropolymer tubing's capacity to withstand wide temperature changes and guard against damage from corrosive chemical fuels is important for the aircraft industry.

Europe Market Insights

Europe region is projected to observe substantial growth through 2035. The growth of the market can be attributed majorly to the increasing auto production in the region. For instance, there has been rapid increase in the production of passenger cars owing to strong domestic demand. Fluoropolymer materials are employed in a number of automotive applications, from tubing to gas sample bags, they increase the durability by lengthening component lives. They are also utilized in the fuel system for the fuel pipe and other components to shield against evaporative vapors. As of 2021, more than 9 million passenger cars were made in the European Union.

Fluoropolymer Tubing Market Players:

- 3M Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The Chemours Company

- Kureha Corporation

- Daikin Industries, Ltd.

- Honeywell International, Inc.

- Teleflex Inc.

- Arkema SA

- Asahi Glass Company Limited

- Compagnie de Saint-Gobain S.A.

- Zeus Industrial Products, Inc.

Recent Developments

-

The Chemours Company introduced an innovative sustainable technique that produces Viton fluoroelastomers that are Advanced Polymer Architecture (APA) grade without the usage of a fluorinated polymerization aid. Further, Viton APA grade fluoroelastomers can be used in a number of industries, including as oil and gas, sophisticated electronics, transportation, and industrial production.

-

Arkema SA planned to invest in expanding its fluoropolymer production capabilities in Changshu by over 30%. This additional investment is made possible by the continued high demand for lithium ion batteries as well as the sizable prospects in the semiconductor, building coatings, and water filtration sectors.

- Report ID: 3879

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fluoropolymer Tubing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.