Membrane Separation Technology Market Outlook:

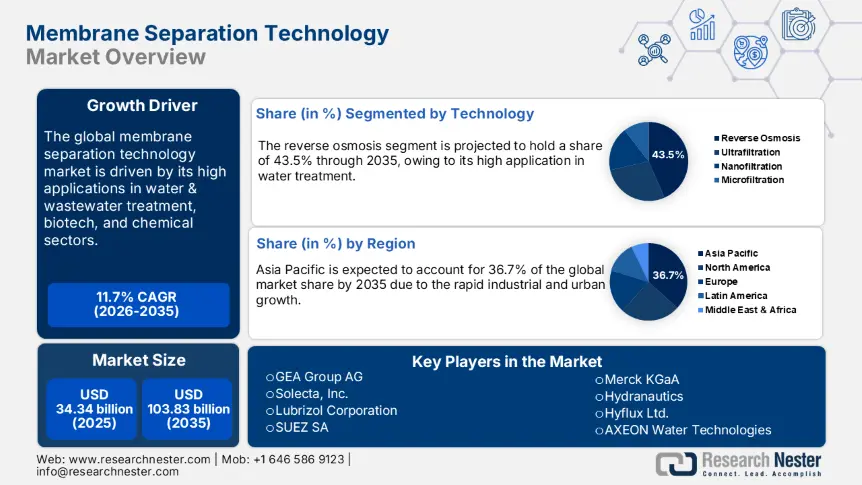

Membrane Separation Technology Market size was over USD 34.34 billion in 2025 and is anticipated to cross USD 103.83 billion by 2035, witnessing more than 11.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of membrane separation technology is assessed at USD 37.96 billion.

The rise in infrastructure development activities, both ongoing and planned around the globe, is set to create a profitable environment for leading companies. The industrial and urban growth is directly fueling the consumption of chemicals, minerals, and metals. Concentration and purification of chemicals, metal recovery, and plating processes are widely propelling the application of membrane separation technologies. The report by the World Business Council for Sustainable Development (WBCSD) underscores that the global chemical sector is a USD 4.0 trillion business, employing over 20 million individuals.

According to the World Economic Forum (WEF), around 100,6 billion tonnes of materials are consumed by the world each year. Out of which 3.2 billion are metals. An estimated 220,000 tonnes of rare earth elements are being extracted by miners, and 60% of these are from China. The global underground mining market is projected to hold significant revenue share durign the forecast period. The supportive government policies and public-private investments are booming the metal mining trade and directly fueling the application of membrane separating technologies

Key Membrane Separation Technology Market Insights Summary:

Regional Highlights:

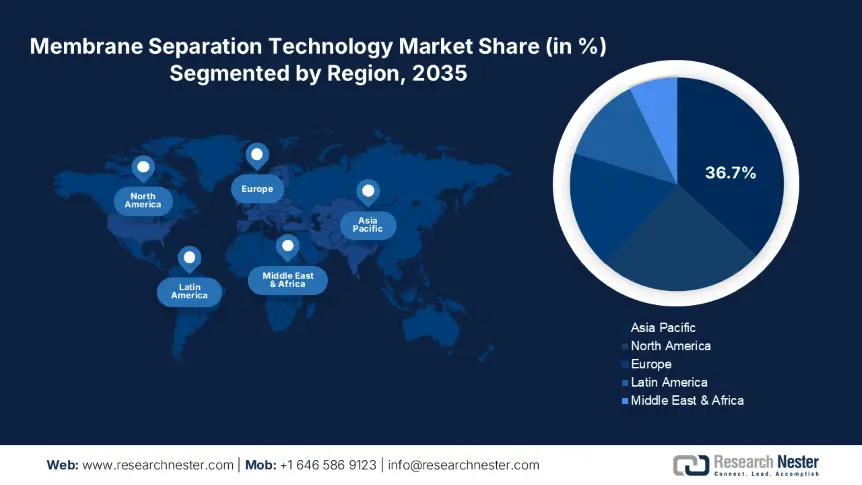

- Asia Pacific dominates the Membrane Separation Technology Market with a 36.7% share, driven by expanding investments in water and wastewater treatment plans, fostering strong growth through 2026–2035.

- North America's Membrane Separation Technology Market is expected to grow rapidly by 2035, driven by the strong presence of key market players.

Segment Insights:

- The Reverse Osmosis segment is anticipated to achieve 43.5% market share by 2035, propelled by the need for clean water and water scarcity boosting demand across various sectors.

- The Water & Wastewater Treatment segment is projected to achieve a 47.10% share by 2035, propelled by water scarcity issues fueling demand for treatment plants.

Key Growth Trends:

- Pharma and biotech sectors are revenue boosters

- Increasing application in the food and beverage sector

Major Challenges:

- Capital-intensive business

- Lack of expertise and awareness

Key Players: GEA Group AG, Solecta, Inc., Lubrizol Corporation, SUEZ SA, and Pentair.

Global Membrane Separation Technology Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 34.34 billion

- 2026 Market Size: USD 37.96 billion

- Projected Market Size: USD 103.83 billion by 2035

- Growth Forecasts: 11.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36.7% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, Japan, South Korea, India, Brazil

Last updated on : 12 August, 2025

Membrane Separation Technology Market Growth Drivers and Challenges:

Growth Drivers:

- Pharma and biotech sectors are revenue boosters: The pharmaceutical and biotech companies are boosting the revenues of membrane separation technology manufacturers. The advanced membrane technologies are enhancing the isolation and purification of active pharmaceutical ingredients. The increasing investments in pharma and biotech innovations are likely to augment the sales of membrane separation technologies.

- Increasing application in the food and beverage sector: The food and beverage processing facilities are increasingly employing advanced separation solutions, which are opening lucrative doors for membrane separation technology companies. Juice clarification, milk processing, and beer & wine production are boosting the application of membrane separation technologies. The report by the UN Trade and Development (UNCTAD) reveals that in the past 20 years, the developed countries have consistently imported processed food and captured over 48.0% of the share, while developing regions represent 35.0% of the share.

Challenges:

- Capital-intensive business: The development of membrane separation technologies requires high capital for initial setup and associated equipment. This becomes cost-prohibitive for smaller operators, leading to fewer market entries. The budget constraint companies often hesitate to invest in advanced membrane separation technologies, which directly limits their sales growth. Strategic collaborations and public-private funding are expected to aid membrane separation technology market players in overcoming this issue.

- Lack of expertise and awareness: The limited awareness in developing regions is directly affecting the sales of the latest membrane separation technologies. The unavailability of a skilled workforce also hinders its adoption rates and increases the training costs for the companies. However, the larger companies are focusing on expanding their production facilities in the high-potential economies to earn high profits from untapped opportunities.

Membrane Separation Technology Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.7% |

|

Base Year Market Size (2025) |

USD 34.34 billion |

|

Forecast Year Market Size (2035) |

USD 103.83 billion |

|

Regional Scope |

|

Membrane Separation Technology Market Segmentation:

Technology (Microfiltration, Ultrafiltration, Nanofiltration, Reverse Osmosis)

The reverse osmosis segment is expected to capture 43.5% of the global membrane separation technology market share by 2035. The need for clean water for various applications and water scarcity is boosting the demand for reverse osmosis technologies. The sectors, such as food processing, pharma, chemical, and biotech, which are highly dependent on water for the manufacturing process, are augmenting the sales of reverse osmosis technologies. The consistent demand for fresh water for various applications is poised to offer lucrative gains to reverse osmosis technology producers in the years ahead.

Application (Water & Wastewater Treatment, Industry Processing, Food & Beverage Processing, Pharmaceutical & Medical, Others)

The water & wastewater treatment segment is projected to account for 47.1% of the global membrane separation technology market share through 2035. The water scarcity issues in developing regions, particularly Africa, are fueling the demand for membrane separation technologies in water and wastewater treatment. For instance, the United Nations International Children's Emergency Fund (UNICEF) states that around 4 billion or nearly 2/3rd of the global population is witnessing severe water scarcity issues. To combat these issues, many governments are investing in water and wastewater treatment plants, which is directly boosting the demand for membrane separation solutions. Apart from these, the increasing need for fresh water in several manufacturing applications is also boosting the sales of membrane separation technologies.

Our in-depth analysis of the global market includes the following segments:

|

Technology |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Membrane Separation Technology Market Regional Analysis:

APAC Market Forecast

The Asia Pacific membrane separation technology market is foreseen to account for 36.7% of the global revenue share through 2035. The expanding investments in water and wastewater treatment plans are boosting the sales of membrane separation technologies. The swift industrialization and urbanization are promoting the demand for innovative membrane separation systems in various industries such as metal and mining, pharma, and manufacturing. China and India are likely to offer lucrative gains in the coming years to membrane separation technology producers owing to the strong presence of end use industries. Japan and South Korea are estimated to lead the membrane separation technology sales through innovations.

China’s strong manufacturing base and chemical sector are augmenting the sales of membrane separation technologies. The European Chemical Industry Council (Cefic) study highlights that China is the leading producer of chemicals across the world. The country holds nearly 43.0% of the total share and drives the majority of global investments. Innovations in petrochemicals, polymers, specialized chemicals, and consumer chemicals are likely to propel the demand for membrane separation systems during the foreseeable period.

The robust mining activities in India are likely to increase the application of membrane separation technologies in the coming years. The report by the India Brand Equity Foundation (IBEF) highlights that there are around 2036 active mines in the country. Also, under the PLI scheme, many companies are investing in mining projects, creating high-earning opportunities for membrane separation technology manufacturers. The lucrative investments in the pharma and biotech fields are also set to increase the sales of membrane separation technologies. IBEF also estimates that in 2024, the bio economy of the country was calculated at USD 130.0 billion.

North America Market Statistics

The North America membrane separation technology market is expected to increase at the fastest pace between 2026 to 2035. The strong presence of key market players is driving high sales of membrane separation technologies in the region. The increasing investments in pharma and biotech innovations are expected to fuel the demand for separation systems. The dominance in the food processing sector is set to double the revenues of membrane separation technology manufacturers in the coming years. The U.S. and Canada bot are expected to drive the overall market growth.

The infrastructure upgrade activities are likely to increase the demand for membrane separation technologies in the U.S. The increasing investment in water and wastewater treatment plants is increasing the demand for membrane separation solutions. The Regional Environmental Sewer Conveyance Upgrade Program (RESCU) project of California is focusing on advancements in wastewater treatment. The growing population in the Silicon Valley is fueling a high demand for fresh water. This factor is set to augment the revenues of membrane separation system manufacturers in the coming years.

Canada’s swiftly expanding biotech and pharma sector is propelling the sales of membrane separation technologies. High investments in biopharm research and development activities are increasing the adoption of advanced membrane separation systems. The country is the 8th largest market for pharmaceuticals and accounts for over 2.2% of the global share. The booming manufacturing sector and increasing employment rates are also contributing to the overall membrane separation technology market growth.

Key Membrane Separation Technology Market Players:

- GEA Group AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Solecta, Inc.

- Lubrizol Corporation

- SUEZ SA

- Pentair plc

- Merck KGaA

- Hydranautics

- Hyflux Ltd.

- AXEON Water Technologies

- Koch Membrane Systems Inc.

- HUBER SE

- Pall Corporation

- 3M Company

- Corning Incorporated

- DuPont de Nemours Inc

The leading companies in the membrane separation technology business are employing various inorganic and organic marketing strategies such as new product launches, technological innovations, partnerships & collaborations, mergers & acquisitions, and regional expansions to increase their revenue shares. The top companies are entering into strategic partnerships and collaborations with other players to introduce innovative solutions and maximize their membrane separation technology market reach. Industry giants are also targeting untapped markets to earn higher gains are boost their dominance.

Some of the key players include:

Recent Developments

- In February 2024, GEA Group AG announced its intention to invest around USD 20.0 million in a technology center for alternative proteins in the U.S. The company, with its technologies and experts, is scaling new food for industrial production to meet the country’s increasing demand.

- In February 2023, Solecta, Inc. and Lubrizol Corporation entered into a new partnership for the development and commercialization of novel membrane solutions. These solutions are anticipated to enhance productivity and drive greater efficiencies in the global separations sector.

- Report ID: 7604

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.