Protein Supplements Market Outlook:

Protein Supplements Market size was valued at USD 7.7 billion in 2025 and is projected to reach USD 16.7 billion by the end of 2035, rising at a CAGR of 8.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of protein supplements is estimated at USD 8.3 billion.

The global protein supplements market is actively expanding due to the rising concern about health and wellness. The market is defined by the steady demand driven by demographic and health trends. According to the OEC data in 2023, the global trade of Whey reached USD 3.53 billion. Whey is the vital ingredient for whey protein powder, bars, and beverages, which fall under the protein supplement category. Over the past five years, the category has shown a growth rate of 2.19%. On the other hand, the World Health Organization has reported the vital role of protein intake in addressing the age-related muscle loss among the elderly population globally. As a result, there is a steady demand for protein components in consumer and clinical nutrition applications, which affects product development and marketing tactics for producers of finished goods and suppliers of ingredients.

Trade Flow of Whey in 2023

|

Country |

Export (USD million) |

Import (USD million) |

|

Germany |

554 |

179 |

|

U.S. |

573 |

59.7 |

|

Australia |

84.1 |

27.2 |

|

China |

4.15 |

780 |

|

France |

381 |

136 |

Source: OEC 2023

The international trade policies and agricultural output are the vital factors shaping the market dynamics. The U.S. Department of Agriculture provides evidence on the production of key raw materials, such as dairy and soy, that are the primary sources for protein isolates and concentrates. Trade data from organizations like the World Trade Organization (WTO) indicates that cross-border flows of these ingredients are substantial, forming a global supply chain for manufacturers. Regulatory harmonization remains a complex factor, as entities like the European Food Safety Authority (EFSA) manage health claim approvals, which can impact product positioning and market access across different regions. In order to retain compliance and marketability in this regulatory climate, firms must maintain strict quality control and justification for their product claims.

Key Protein Supplements Market Insights Summary:

Regional Highlights:

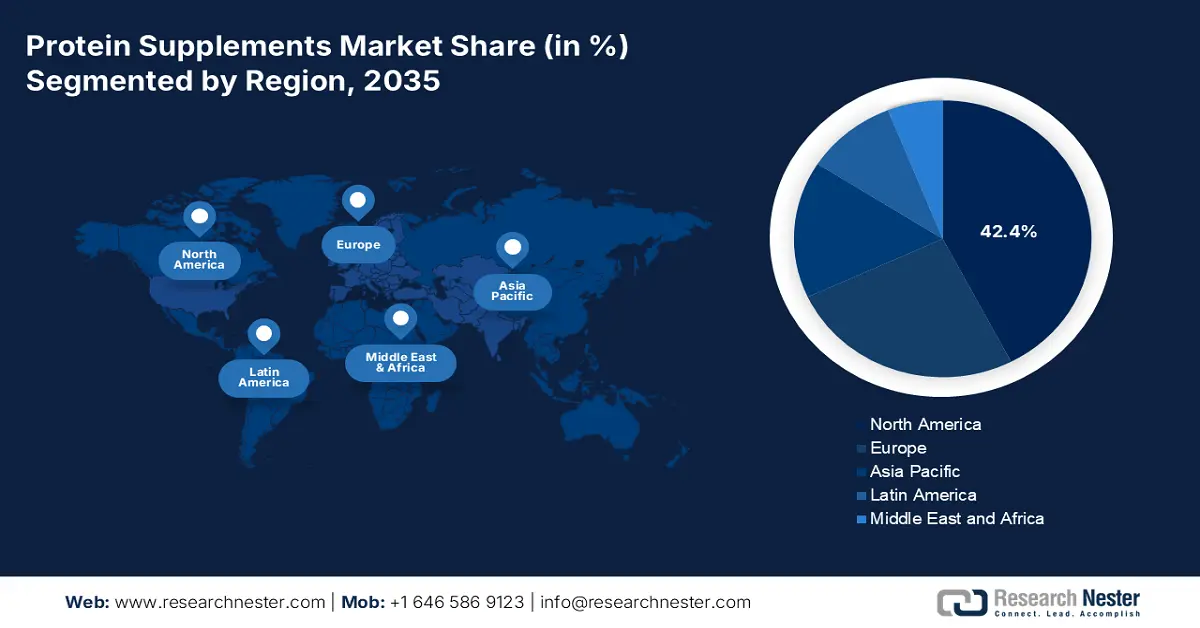

- North America is predicted to command a 42.4% share of the protein supplements market by 2035, propelled by rising health awareness and robust retail and digital distribution.

- Asia Pacific is set to expand at an 11.2% CAGR from 2026–2035, attributable to urbanization and growing fitness consciousness.

Segment Insights:

- By 2035, the animal-based segment is projected to secure a 58.6% share in the protein supplements market owing to superior protein quality and rapid adoption rates.

- The powder segment is anticipated to retain a leading share through 2035, stemming from its cost-effectiveness, high protein concentration, and versatility.

Key Growth Trends:

- Rising aging population and sarcopenia management

- Growth of e-commerce as a primary distribution channel

Major Challenges:

- Growth of e-commerce as a primary distribution channel

- Supply chain integrity and adulteration risks

Key Players: Glanbia plc (Ireland), The Hut Group (THG) (UK), Abbott Laboratories (USA), AMCO Proteins (USA), NOW Foods (USA), Iovate Health Sciences International (Canada), BellRing Brands (Premier Protein) (USA), Post Holdings (PowerBar, Dymatize) (USA), Danone S.A. (Nutricia) (France), Nestlé S.A. (Optifast) (Switzerland), MuscleTech (Iovate) (Canada), Kerry Group (Ireland), Arla Foods Ingredients (Denmark), GlaxoSmithKline (GSK) (Horlicks) (UK), Meiji Co., Ltd. (Japan), MHN Foods Inc. (South Korea), HealthKart (India), Myprotein (The Hut Group) (UK), Vital Strength (Australia), BRANDS World (Malaysia).

Global Protein Supplements Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.7 billion

- 2026 Market Size: USD 8.3 billion

- Projected Market Size: USD 16.7 billion by 2035

- Growth Forecasts: 8.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Germany, United Kingdom

- Emerging Countries: Brazil, Indonesia, South Korea, Mexico, Australia

Last updated on : 13 November, 2025

Protein Supplements Market - Growth Drivers and Challenges

Growth Drivers

- Rising aging population and sarcopenia management: The elderly population is the main driver for the market growth. These demographic populations opt for medical and clinical nutrition for their health and wellness. According to the Government of India data in May 2025, the total senior citizens in India aged above 60 is 10.38 crore, among which males and females are 5.11 crore and 5.27 crore, respectively. This demographic is at a high risk for sarcopenia, which is known as age-related muscle loss, both in strength and mass. To overcome this, protein supplements are taken as a dietary strategy for its management. This creates a sustained demand for protein ingredients in products targeting elderly nutrition, driving innovation in formats suitable for this demographic, such as easy-to-consume medical shakes and high-protein functional foods.

- Growth of e-commerce as a primary distribution channel: The shift to online shopping, accelerated by recent global events, has made e-commerce a major driver of market access and consumer reach. E-commerce retail sales have consistently and significantly increased year over year, according to government data, such as that from the U.S. Census Bureau. For protein supplement brands, this channel reduces barriers to the startup or entry-level business, hence allowing them to have direct consumer relationships and facilitating the rise of digitally-native vertical brands. It also provides a platform for detailed product information and customer reviews, which are crucial for purchase decisions in this category.

- Rising fitness consciousness and sports participation: Increased participation in fitness activities and amateur sports drives the market in the sports nutrition segment. Data from organizations such as Sport England shows consistent public engagement in physical activity. These active consumers represent a core market for protein powders, bars, and ready-to-drink shakes aimed at muscle recovery and performance. This expansion of the consumer base is directly reflected in recent product launches, where companies are formulating targeted solutions for specific athletic demographics and needs, moving beyond one-size-fits-all offerings. The trend goes beyond traditional bodybuilding to include runners, team sport players, and casual gym-goers. This expands the consumer base and demands a wider variety of products to suit varying activity levels and tastes.

Recent Protein Supplement Product Launches

|

Company |

Product Name/Brand |

Launch Year |

Product Description / Focus |

|

Vitaco Health |

ATHENA Sports Nutrition |

2024 |

Protein powders, supplements, and bars designed specifically for female athletes, with targeted nutrients like iron, calcium, collagen, electrolytes, and protein |

|

Glanbia / Isopure |

Whey Protein and Collagen UK Launch |

2025 |

Whey protein isolate and collagen products, focused on simple, high-quality ingredients, launched in UK market post US success |

|

Danone |

Oikos Protein Shake |

2025 |

Protein shake under the Oikos yogurt brand emphasizing clean-label and allergen-free |

Source: Vitaco Health, Glanbia, Oikos

Challenges

- Price transparency and international reference pricing: Governments are using International Reference Pricing for pharmaceuticals to create indirect pricing pressures for medical-adjacent products such as supplements. While not directly regulated, benchmarked drug prices set a cost expectation for payers and consumers alike. The WHO supports IRP in order to keep healthcare costs managed. This environment challenges the ability of the manufacturer to price premium, high-quality supplements profitably in some markets because they are compared to lower-cost comparators, which can limit the availability of specialized products and create a barrier for patients who need them.

- Supply chain integrity and adulteration risks: The FDA’s tainted supplements database lists products with undeclared pharmaceutical ingredients. This persistent issue, documented in an FDA warning, minimizes trust and increases regulatory scrutiny for the startup companies in the market. Further, manufacturers invest heavily in strong third-party testing and supply chain audits, including certified NSF International, to ensure the product purity. These costs raise the barrier to entry and final product price, making it harder for legitimate companies to compete and for patients to access safe, affordable options.

Protein Supplements Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.1% |

|

Base Year Market Size (2025) |

USD 7.7 billion |

|

Forecast Year Market Size (2035) |

USD 16.7 billion |

|

Regional Scope |

|

Protein Supplements Market Segmentation:

Source Segment Analysis

Animal-based leads the segment and is expected to hold the share value of 58.6% by 2035. Its superior protein quality and rapid adoption rates are key drivers for the market growth and are vital for muscle protein synthesis. To justify this, the NLM study in September 2024 has provided an evidence that states beef liver is rich in protein content, further strengthening the dominance of animal-based sources in the market. Based on the research the percentage of protein content in beef liver is 19.57 ± 0.16. This high biological value supports its efficacy in sports nutrition and clinical dietary interventions. Further, rising innovation in whey protein isolates and hydrolysates enhances the functionality and absorption. Furthermore, the seamless supply chain and strong consumer behavior solidify the animal-based protein market position against the plant-based alternatives.

Application Segment Analysis

Powder is dominating the segment and is poised to hold a significant share during the forecast period. The segment is fueled by various factors such as cost-effectiveness, high protein concentration per serving, and versatility. Consumers customize their serving either in powder or food or beverage form, which is the key advantage over the pre-formulated products. The WHO data depict the importance of flexible nutritional formats for managing dietary needs. This versatility, combined with lower manufacturing and shipping costs compared to RTD formats, secures its leading share, mainly for bodybuilders and regular gym-goers.

Form Segment Analysis

Sports nutrition continues to dominate the segment and is rooted in several lifestyle patterns. A significant age group of people shift towards fitness and body conditioning, mainly among the urban population, sustaining the market demand. The segment is further reinforced by the mainstream adoption of athletic dietary practices by everyday consumers, not just professional athletes. The NIH study in April 2024 states that 66% of U.S. college students take dietary supplements in any form. Further, marketing strategies specifically target the wellness-driven consumers, highlighting the lean muscle maintenance and workout recovery. The widespread retail presence of these products from the specialized health shops ensures consistent accessibility to the customers. Moreover, continuous product innovation, for example, the development of fast-absorbing formulations and flavor variety, keeps the segment dynamic and responsive to changing consumer preferences, setting its position at the forefront of the protein supplements market.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Source |

|

|

Form |

|

|

Distribution Channel |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Protein Supplements Market - Regional Analysis

North America Market Insights

North America is predicted to hold the highest market share of 42.4% by 2035. The leadership is driven by the increased awareness of health-conscious and widespread retail and digital distribution. the demand for transparent sourcing and clean label, with the rise of plant-based and collagen fortified products, and personalized nutrition using DNA-based recommendations. To encourage dairy producers to produce more high-protein products, Arla Foods Ingredients started a new high-protein dairy promotion in September 2024. The Go High in Protein campaign showcases the Arla Foods Ingredients Nutrilac, which is a ProteinBoost range of patented microparticulated whey proteins that are rich in essential amino acids. The market is highly competitive, with innovation focused on sustainable packaging and products targeting specific demographics, such as protein for seniors to combat age-related muscle loss.

The U.S. market is defined by the strong shift to transparently sourced products and scientifically advanced formulations. The key trend is the integration of protein supplements into medical nutrition for the elderly population to address issues related to sarcopenia. The National Institute of Health recognizes the role of protein in the muscle loss with age. The NLM study in December 2021 depicts that the protein supplements market accounted for USD 2,069.3 million in 2021. Further, the study states that a dosage of 20 to 25 g/day of whey protein provides the desired benefits, while amounts greater than 40 g/day may lead to adverse side effects on the body. Beyond the typical bodybuilding demographics, innovations in sustainable packaging and products with professionally researched components reach the general health and wellness market.

The Canada market is experiencing steady growth and is influenced by stringent regulatory oversight and is rising focus on preventive healthcare measures. The most dominant trend is the rising consumer demand for the certified Health Canada’s Natural Product Number that guarantees efficiency, safety, and quality. According to the NLM study released in May 2025, nearly 51.9% of girls and young women and 82.5% of boys and young men reported use of whey protein in powder or shake form. The study also depicts that muscle-building supplements are highly used by male demographics due to the muscular sociocultural male body ideal. Market growth is also fueled by increasing sports participation and a multicultural demographic seeking products tailored to specific dietary needs and health goals, all within a tightly regulated environment.

APAC Market Insights

Asia Pacific is the fastest-growing contributor in the protein supplements market and is expected to grow at a CAGR of 11.2% during the forecast period, 2026 to 2035. The market is driven by urbanization and a rapidly expanding health and fitness consciousness. Western lifestyle, rising population in gym culture are the key drivers driving the sustainable growth. The market is further defined by the significant adoption of e-commerce platforms, which are the primary channel for the discovery and purchase of supplementary products. This digital adoption is particularly witnessed among the youth population, as these people are heavily influenced by fitness influencers on social media.

India is growing exponentially and is driven by the young population, having rising concerns about their health and the rapid expansion of organized retail and e-commerce. According to the IBEF report released in October 2025, the protein supplements market in India reached Rs. 7,461 crores in 2024. The growth is highly witnessed in metros and high-potential cities such as Indore, Lucknow, and Surat, where packet-related protein powder supplements are picking up momentum. This economic empowerment is directly impacting on the higher spending on health and nutrition, reflecting on the market expansion. As awareness rises on diverse forms of supplement products via social media, wellness influencers and health apps shift their marketing strategy, hence raising the demand for these protein supplements towards regular nourishment.

Japan protein supplements market is shaped by its super-aging society, with the demand highly focused on the products that address health and sarcopenia among the elderly population. Functional foods and drinks enhanced with collagen and soy protein are hot trends in sports nutrition, even if whey protein is still widely used. The Ministry of Health, Labour and Welfare's focus on healthy life expectancy highlights elderly demographic driver. In September 2023, the World Economic Forum report depicts that 1/3rd of the population aged 65 in the total populace. This demographic reality creates a sustained and growing demand for protein supplements as a crucial tool for preventive healthcare and maintaining mobility among seniors.

Europe Market Insights

The Europe market is mature and is growing steadily, shaped by the strong regulatory frameworks and rising consumer focus on health and wellness. Rising aging population seeks products that overcome sarcopenia, a strong shift towards plant-based nutrition, and high participation in sports and fitness activities are the market growth drivers. The market is highly competitive, with innovation centered on clean-label formulations, personalized nutrition, and products with verified health claims approved by the European Food Safety Authority (EFSA). The government is spending on supplements and creating a supportive environment..

Germany is identified as a strong player in the protein supplements market in Europe. Large health-conscious population and strong regulatory trust in products compliant with the German Food Code are the key drivers for the sustained market growth. The Destatis data from December 2022 indicate that nearly 4 million people in Germany are aged 67 and above, driving the market towards plant-based protein to mitigate age-related muscle loss. On the other hand, the government has allocated €38 million to promote alternative proteins, as per the Proveg International data from November 2023. This investment further surges the innovation and product development in the plant-based protein sector, highlighting the growing demand.

The UK market is fueled by the rising gym membership rates and a pervasive fitness culture amplified by social media. The market is defined by the intense innovation in flavour profiles and convenient formats such as ready-to-drink shakes. The UK’s Office for National Statistics consumer spending on recreation and culture, which includes gym memberships and associated nutrition, has shown consistent growth. The mainstreaming of protein supplements from athletes to general wellness consumers is a major trend, fueled by effective direct-to-consumer brand presence and sophisticated digital marketing. This is accompanied by rising consumer interest in collagen-based beauty supplements and sustainably sourced ingredients, keeping the market dynamic and diverse.

Key Protein Supplements Market Players:

- Glanbia plc (Ireland)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The Hut Group (THG) (UK)

- Abbott Laboratories (USA)

- AMCO Proteins (USA)

- NOW Foods (USA)

- Iovate Health Sciences International (Canada)

- BellRing Brands (Premier Protein) (USA)

- Post Holdings (PowerBar, Dymatize) (USA)

- Danone S.A. (Nutricia) (France)

- Nestlé S.A. (Optifast) (Switzerland)

- MuscleTech (Iovate) (Canada)

- Kerry Group (Ireland)

- Arla Foods Ingredients (Denmark)

- GlaxoSmithKline (GSK) (Horlicks) (UK)

- Meiji Co., Ltd. (Japan)

- MHN Foods Inc. (South Korea)

- HealthKart (India)

- Myprotein (The Hut Group) (UK)

- Vital Strength (Australia)

- BRANDS World (Malaysia)

- Glanbia plc is the dominating player in the protein supplements market by operating across the entire value chain from ingredient manufacturing to consumer brands such as Optimum Nutrition. The company uses deep market data and consumer insights to drive innovation in whey protein and plant-based alternatives. The total profit earned by Glanbia plc in 2024 is USD 164.7 million.

- The Hut Group leverages its vast e-commerce and brand management platform and focuses on the direct-to-consumer sales of protein supplements. The company uses data data-driven approach to analyze real-time sales and consumer behavior and reshape the development, pricing, and marketing of the product. This model allows the company to quickly adapt the fitness trends and personalize the customer experience, hence driving significant global brand loyalty and market penetration.

- Abbott Laboratories uses its clinical expertise in the medical nutrition segment for the manufacture of protein supplements. With brands such as Ensure and Glucerna, Abbott utilizes clinical trial data to develop specialized nutritional products that addresses muscle health and specific metabolic needs. The worldwide sales of the company's product reached USD 42 billion, which includes the protein supplement products.

- AMCO Proteins is a significant player in the protein supplements market and focuses on manufacturing high-purity protein components in the B2B ingredient sector. The company uses rigorous analytical data to ensure the product consistency, solubility, and technical support for the customers. AMCO enables manufacturers to innovate and differentiate their products, making it a critical behind-the-scenes innovator in the market.

- Now Foods is a dominant player in the protein supplements market and is driven by its quality, transparency, and affordability. The company aims to conduct a robust in-house testing of data and consumer demand trends to offer a wide array of products, including whey isolate, pea protein, and egg white powders.

Here is a list of key players operating in the global market:

The global protein supplements market is very competitive and is defined by the presence of ingredient suppliers such as Glanbia and finished product brands. Organizations are following strategic acquisitions to expand their market share and product portfolios. Firms are relying on plant-based and clean-label products to meet the consumer demand for transparency and sustainability. For example, Nestlé Health Science completed the final acquisition of Vital Proteins in February 2022. The ultimate aim of this acquisition is to expand the brand geographically and scale in R&D, and innovate on new products. Further, companies are highly investing in personalized nutrition and using digital marketing strategies to build brand loyalty. The competition is intensifying as established brands face pressure from agile online-native companies and private-label offerings.

Corporate Landscape of the Protein Supplements Market:

Recent Developments

- In March 2025, GNC launched GNC Pro Performance, which is 100% Whey + Nitro Surge, a groundbreaking protein supplement that is designed to enhance performance and support cardiovascular health.

- In February 2025, Vivici introduced a nature-equivalent whey protein, Vivitein, from fermentation. The fermentation is rich in amino acids and free from lactose, cholesterol, hormones, and antibiotics, and transforms the market for sustainable and superior dairy proteins.

- In October 2024, REBBL launches innovative 26g protein shakes with upcycled barley protein, leading the charge in sustainable RTD beverages. It is available in three classic flavors: chocolate, vanilla, and cookies & crème.

- Report ID: 8236

- Published Date: Nov 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Protein Supplements Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.