Protein Hydrolysates Market Outlook:

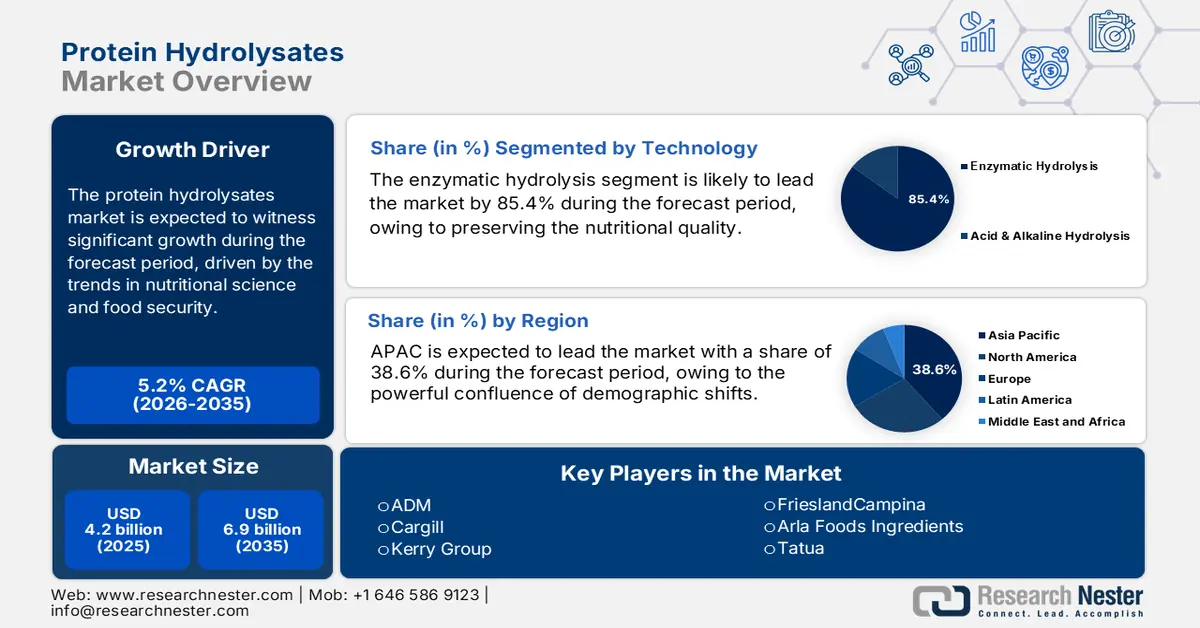

Protein Hydrolysates Market size was valued at USD 4.2 billion in 2025 and is projected to reach USD 6.9 billion by the end of 2035, rising at a CAGR of 5.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of protein hydrolysates is evaluated at USD 4.4 billion.

The protein hydrolysates market is characterized by its integration within broader trends in nutritional science and food security. The demand for protein hydrolysates continues to surge across nutrition, clinical, and specialty food manufacturing, aided by the measurable shifts in public health policies, food safety regulations, and nutrition program budgets. The government data reflects a consistent rise in protein-centric nutrition spending. For example, the U.S. Department of Agriculture's June 2023 report has shown that the federal food assistance expenditure reached USD 183 billion in 2022. This rise in expenditure with programs such as SNAP and WIC is expanding procurement categories for high-value protein ingredients, including specialized hydrolyzed formulation used in infant and medical nutrition. Further, Europe has a high number of dossiers related to protein processing and enzymatic treatments, indicating expanded regulatory activity that aligns with the rising use of hydrolysates in food manufacturing workflows.

Market dynamics are influenced by the regulatory frameworks governing food safety and health claims that vary significantly by region. In the U.S., the Food and Drug Administration oversees ingredient classification, such as Generally Recognized as Safe, a necessary designation for market entry. Globally, the harmonization of standards remains a challenge affecting the supply chain logistics and market access strategies. Production is resource-intensive, requiring controlled enzymatic processes with capital allocation heavily weighted toward R&D and compliance. The World Health Organization’s focus on nutritional interventions in public health, including the guidelines for management of cow’s milk protein allergy in infants, underpins the sustained demand for the specialized market in medical nutrition, creating a stable, high-value segment within the broader protein ingredients landscape.

Key Protein Hydrolysates Market Insights Summary:

Regional Insights:

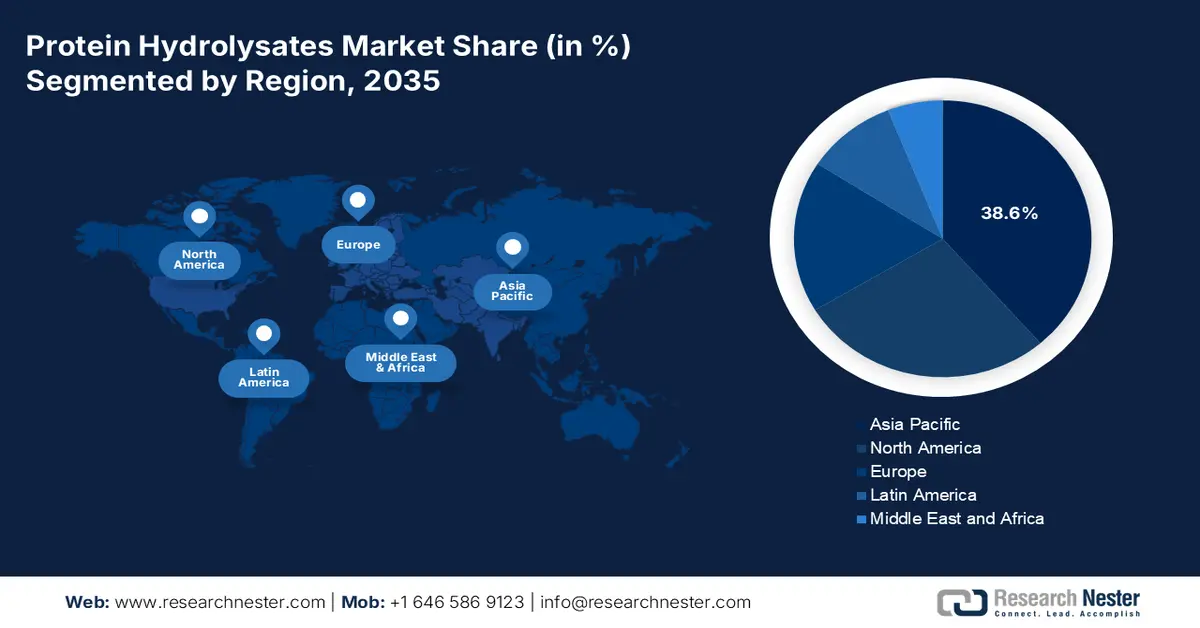

- Asia Pacific is projected to secure a 38.6% share by 2035 in the protein hydrolysates market, supported by surging infant nutrition demand, rising incomes, and expanding health-focused consumers across emerging economies.

- North America is anticipated to accelerate at a 7.5% CAGR during 2026–2035, propelled by advanced healthcare needs and the rising adoption of clinical and sports nutrition solutions.

Segment Insights:

- Enzymatic hydrolysis is expected to command over 85.4% share by 2035 in the protein hydrolysates market, owing to its ability to maintain nutritional integrity and enable targeted bioactive peptide production.

- The powder form is projected to account for the largest share by 2035, underpinned by its superior stability, extended shelf life, and manufacturing versatility.

Key Growth Trends:

- Rising government-funded clinical and metabolic research

- Expansion of FDA and EFSA ingredient approvals

Major Challenges:

- High capital intensity and complex production

- Application-specific formulation challenges

Key Players: Cargill (U.S.), Kerry Group (Ireland, Europe), FrieslandCampina (Netherlands, Europe), Arla Foods Ingredients (Denmark, Europe), Tatua (New Zealand), Glanbia plc (Ireland, Europe), Hilmar Ingredients (U.S.), Ajinomoto Co., Inc. (Japan), Kewpie Corporation (Japan), Hofseth BioCare (Norway, Europe), AMCO Proteins (U.S.), Titan Biotech (India), New Zealand Milk Products (New Zealand), MGP Ingredients (U.S.), Archer Daniels Midland (ADM) - Specialty Ingredients (U.S.), Rousselot (France, Europe), Milk Specialties Global (U.S.), Nutritech (Finland, Europe), BHN (South Korea).

Global Protein Hydrolysates Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.2 billion

- 2026 Market Size: USD 4.4 billion

- Projected Market Size: USD 6.9 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.6% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Australia, Indonesia

Last updated on : 9 December, 2025

Protein Hydrolysates Market - Growth Drivers and Challenges

Growth Drivers

- Rising government-funded clinical and metabolic research: Protein hydrolysates benefit directly from increased federal spending on metabolic health, digestive disorder, and clinical nutrition research. The report from the International Foundation for Gastrointestinal Disorders 2025 shows that the National Institute of Health allocated USD 2.43 billion in 2023 towards the digestive disease research conditions, where hydrolyzed proteins are often recommended due to the improved absorption and reduced allergenicity. The NIH-funded pediatric nutrition and aging studies also highlight the need for easily absorbable proteins in hospital and long-term care settings. Such federally supported research accelerates the adoption of hydrolysates in medical foods, infant formulas, and therapeutic products, hence driving the protein hydrolysates market. Hospitals that participate in government reimbursement programs increasingly prioritize clinically approved protein formulations due to outcome-based care models.

- Expansion of FDA and EFSA ingredient approvals: The demand is reinforced by the regulatory activity in the U.S. and Europe. The U.S. FDA continues to expand the GRAS notices and approves for enzyme-processed proteins used in nutrition, sports formulations, nutraceuticals, and infant care products. Each approval increases the commercialization opportunities across the food and clinical manufacturers. In Europe, EFSA reports an increasing number of scientific dossiers related to protein processing, enzymatic treatments, and safety evaluations, reflecting heightened industry engagement. Regulatory clarity reduces compliance barriers, enabling companies to scale hydrolysate-based formulations across B2B channels. For example, EFSA continues to clear novel food submissions involving hydrolyzed protein sources used in immune support and allergen management applications.

- Public health initiative targeting age related malnutrition: Government-led public health programs, mainly in aging populations, are a primary growth driver in the protein hydrolysates market. In Europe, the importance of nutritional care is emphasized to combat malnutrition among older adults, which affects 390 million adults aged 18 years and older worldwide were underweight, as per the WHO March 2024 report. This data highlights the urgent need for protein supplements, increasing the demand for medical nutrition solutions. On the other hand, the suppliers should align product development and marketing with national nutritional care strategies targeting contracts with healthcare providers and institutions funded by these public health budgets.

Age-Related Malnutrition Mortality Trends

|

Age Group (years) |

Average Annual Percent Change (AAPC) in Malnutrition Mortality Rate |

|

55–64 |

5.64% |

|

65–74 |

5.72% |

|

75–84 |

4.99% |

|

85+ |

5.74% |

Source: NLM October 2025

Challenges

- High capital intensity and complex production: Entering the protein hydrolysates market requires a massive investment, mainly in specialized food-grade fermentation and enzymatic hydrolysis infrastructure alongside robust quality control labs. This creates a significant barrier to entry for new players. Established companies such as Kerry Group reduce this via a continuous CAPEX; they invested a significant amount to expand the capacity and capability, a scale untenable for startups. As a result, the competitive landscape increasingly favors firms with long-term financial strength and vertically integrated manufacturing systems.

- Application-specific formulation challenges: Protein hydrolysates can negatively impact the taste, texture, and stability in the final products. Overcoming these requires an application-specific co-development with customers, a resource-intensive process. Many leading manufacturers provide customized solutions via their robust R&D centers working directly with brands to seamlessly integrate the hydrolysates into sport nutrition products without compromising the sensory attributes, a service requiring significant technical staff and investment. Consequently, this necessity for deep technical partnership inherently limits market entry to only those players with substantial R&D budgets and established customer collaboration frameworks.

Protein Hydrolysates Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 4.2 billion |

|

Forecast Year Market Size (2035) |

USD 6.9 billion |

|

Regional Scope |

|

Protein Hydrolysates Market Segmentation:

Technology Segment Analysis

Enzymatic hydrolysis dominates in the technology segment in the market and is projected to hold over 85.4% of the share value by 2035. This preference stems from its precisely controlled reaction conditions that preserve nutritional quality, minimize the formation of harmful byproducts such as lysinoalanine, and allow for the targeted production of bioactive peptides with specific health benefits. In contrast, acid/alkaline hydrolysis, while faster and cheaper, often degrades sensitive amino acids and creates a bitter taste and high salt content, limiting its use to lower-value applications such as flavor enhancers. The U.S. government actively supports advancements in enzyme technology for sustainable biomanufacturing. Further, various studies have stated that enzymes can reduce the biofuel production costs, which is directly transferable to the cost-effective, high-quality production of protein hydrolysates for the food sector.

Form Segment Analysis

Under the form segment, the powder holds the largest share value by 2035 in the protein hydrolysates market. The dominance is due to its superior stability, extended shelf life, lower shipping costs, and unparalleled versatility in dry mix manufacturing. It is the indispensable format for major end-use industries, including the infant formula, sports nutrition supplements, protein fortified baked goods, and clinical nutrition products. The liquid form is also important for specific ready-to-drink beverages, and certain industrial applications face limitations in stability, transportation economics, and broad formulation compatibility. According to the NLM study, May 2025, 51.9% of women and 82.5% of men reported use of whey protein in powder form. The economic significance of the powdered nutritional products is reflected in trade data.

Degree of Hydrolysis Segment Analysis

Partial hydrolysis is the leading subsegment by degree of hydrolysis as it optimally balances the functionality, taste, and health benefits. This process breaks down the proteins into smaller peptides and amino acids just enough to enhance the digestibility, reduce the allergenicity, and improve the functional properties such as solubility and emulsification while vitally minimizing the bitter flavors related to extensive hydrolysis. It is therefore the preferred choice for mainstream sports nutrition products, general wellness supplements, and hypoallergenic pet foods. Extensive hydrolysis is reserved primarily for specialized clinical and infant formulas where complete allergen removal is mandatory. The importance of controlled protein modification for health is underscored by federal dietary guidance.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Source |

|

|

Form |

|

|

Technology |

|

|

Degree of Hydrolysis |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Protein Hydrolysates Market - Regional Analysis

APAC Market Insights

Asia Pacific is dominating the protein hydrolysates market and is poised to hold the revenue share of 38.6% by 2035. The market is driven by a powerful confluence of demographic shifts, rising disposable incomes, and heightened health awareness. The primary demand driver is the massive and rapidly expanding infant nutrition sector, mainly in China and Southeast Asia, where growing middle-class populations seek premium, scientifically advanced formulas. This is compounded by increasing government focus on public health and malnutrition, as seen in India’s POSHAN Abhiyaan mission. A major trend is the rapid growth of sports nutrition and active lifestyle products among urban populations in countries such as Japan, South Korea and Australia. Further, innovations and investments in plant-based protein hydrolysates cater to regional dietary preferences and sustainability goals, positioning APAC as both the largest consumer and a future innovation hub for alternative protein ingredients.

By 2035, China is expected to lead the market in the APAC and is driven by its massive domestic infant nutrition sector that was reshaped by the 2016 two-child policy. The demand is fueled by a deep consumer preference for premium science-backed formulas with protein hydrolysates, viral for hypoallergenic and specialty products. China has imported over USD 817 million of whey and other milk products, stimulating the demand for protein hydrolysates, as per the OEC 2023 report. Innovation is increasingly focused on domestic dairy self-sufficiency and advanced plant-based sources. Growth is further fueled by the rising health consciousness among a vast middle class, hence expanding applications into adult clinical nutrition, sports nutrition, and functional foods for an aging population.

India represents the highest growth potential market in the region and is propelled by the rising protein awareness, young demographic, and increasing disposable income. The government public health campaigns, such as the POSHAN Abhiyaan, aim to minimize malnutrition and stunting, elevating the focus on the dietary protein quality and accessibility. The report from the Out Reach International, October 2024, depicts that nearly 22% of India’s disease burden is related to malnutrition. This creates a dual demand stream for affordable nutrition solutions for the broader population and for premium sports and wellness products in the urban centers. A key trend is the rapid innovation in the plant-based hydrolysates uses indigenous pulses and legumes, aligning with local dietary patterns and agricultural strengths.

North America Market Insights

North America is the fastest-growing protein hydrolysates market and is expected to grow at a CAGR of 7.5% during the forecast period, 2026 to 2035. The market is defined by a mature, high-value demand driven by advanced healthcare, sports nutrition, and specialized infant formula sectors. The key drivers include a high prevalence of chronic diseases and an aging population necessitating clinical nutrition. The dominant country is the U.S., holding the largest regional share. A prime trend is the shift towards the plant-based and clean-label hydrolysates, aligning with broader consumer demand for sustainable and recognizable ingredients. Innovation focuses on improving taste profiles and bioavailability.

U.S. market is driven by the high consumer health expenditure, a robust sports nutrition industry, and advanced medical nutrition. A prime driver is the integration of protein hydrolysates into clinical and senior nutrition to address the age-related muscle loss, with the NIH indicating the role of dietary protein in healthy aging. Strong FDA regulations for hypoallergenic infant formula create a stable, high-value segment. Market growth is aided by the substantial public and private investment in health. For example, the IFDA data in February 2025 indicates that the U.S. dairy product exports, which are a key source material of hydrolysates, reached USD 8.2 billion in 2024, reflecting the scale of underlying ingredient trade that supports the production capacity and market activity.

Canada is shaped by the strong government-led health and agricultural policies with a distinct focus on sustainable plant-based protein innovation in the protein hydrolysates market. A key driver is Health Canada’s regulatory approvals of protein hydrolysates for use in formulated liquid diets and meal replacements, establishing a reliable institutional demand channel in clinical and elderly care. The national strategies actively promote the plant protein development. For instance, the total production of the field crops, such as the pulses, was 5,284 thousand tones in 2023 to 2024, based on the Agriculture and Agri-Food Canada report in May 2025. This data demonstrates the significant agricultural foundation for the plant-based hydrolysate production and export.

Europe Market Insights

The market in Europe is a mature, innovation-driven sector and is defined by robust regulatory oversight and high demand for specialized nutritional solutions. The primary driver is the rapidly growing aging population. The report from the OECD in November 2024 depicts that the people aged 65 and above in Europe are projected to rise from 21% in 2023 to 29% in 2050. This rise creates a sustained demand for the clinical and elderly nutrition products that utilize easily digestible hydrolysates. The market is highly influenced by the European Food Safety Authority regulations that govern the health claims and the compositional requirements of foods for special medical purposes, including infant formula. The prime trend is the strong shift toward sustainable and plant-based ingredients aligned with the European Green Deal and the EU’s Farm to Fork Strategy that promotes alternative protein sources.

Germany is projected to hold the highest revenue share in Europe’s protein hydrolysate market by 2035. The market is driven by its world-leading healthcare infrastructure and strong manufacturing base for medical nutrition, and a rapidly aging demographic. The country has one of the highest proportions of elderly citizens in eh EU, directly fueling the demand for clinical and geriatric nutrition products. The OEC 2023 report has depicted that Germany has exported USD 720 million worth of whey and other milk products. This data indicates the robust dairy processing capacity that serves as a critical raw material foundation for high-value whey protein hydrolysate production. Growth is further fueled by the high consumer awareness of health and wellness, driving the sports nutrition segment, and significant industry investment in the sustainable production processes for protein ingredients.

Import Data on Whey and Other Milk Products from Germany

|

Country |

Trade Value (USD millions) |

|

Netherlands |

173 |

|

Italy |

45 |

|

Denmark |

69.9 |

|

China |

56 |

|

Japan |

15.9 |

|

U.S. |

17.4 |

Source: OEC 2023

The UK will maintain a leading position in the market and is driven by its advanced life sciences sector and high per capita spending on sports and active nutrition. Post-Brexit, the UK’s Food Standards Agency and Medicines and Healthcare products Regulatory Agency govern its own regulatory pathways for novel foods and medical products, creating a distinct innovation landscape. A major growth factor is the significant government and private investment in sustainable food systems, as outlined in the UK’s National Food Strategy, which promotes the alternative protein development. Further, the UK’s National Health Service spending on clinical nutrition for chronic disease management provides a stable demand base for specialized hydrolysates used in medical foods.

Key Protein Hydrolysates Market Players:

- ADM (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cargill (U.S.)

- Kerry Group (Ireland, Europe)

- FrieslandCampina (Netherlands, Europe)

- Arla Foods Ingredients (Denmark, Europe)

- Tatua (New Zealand)

- Glanbia plc (Ireland, Europe)

- Hilmar Ingredients (U.S.)

- Ajinomoto Co., Inc. (Japan)

- Kewpie Corporation (Japan)

- Hofseth BioCare (Norway, Europe)

- AMCO Proteins (U.S.)

- Titan Biotech (India)

- New Zealand Milk Products (New Zealand)

- MGP Ingredients (U.S.)

- Archer Daniels Midland (ADM) - Specialty Ingredients (U.S.)

- Rousselot (France, Europe)

- Milk Specialties Global (U.S.)

- Nutritech (Finland, Europe)

- BHN (South Korea)

- ADM is a dominant player in the market and uses its massive global agriculture supply chain to produce a wide range of plant-based hydrolysates. Their strategic initiative focuses on vertical integration and significant R&D investment to create specialized clean-label ingredients for sports nutrition, clinical diets, and functional foods, ensuring cost-effective and scalable production.

- Cargil utilizes its unparalleled global network in the protein hydrolysates market to offer diverse solutions from both plant and animal sources. A key strategic initiative is customer-centric innovation, developing application-specific hydrolysates that improve digestibility, reduce bitterness, and enhance texture in everything from infant formula to senior nutrition products. The company's revenue in 2025 was USD 154 billion, and it has invested more than USD 110 million in communities, partnering locally and globally to advance food security.

- Kerry Group holds its strong position in the market by focusing mainly on taste and nutritional technology. Their key initiative is to overcome the inherent flavor challenge of hydrolysates using proprietary enzyme technologies and masking solutions to create palatable high performance protein ingredients for clinical wellness and active lifestyle segments, driving consumer acceptance. The company has earned a revenue of €8,020 million in 2024.

- FrieslandCampina stands out in the protein hydrolysates market via its exclusive focus on dairy-based ingredients, mainly whey and casein hydrolysates. Their strategic initiatives are rooted in using controlled milk streams to ensure the premium quality and consistency, targeting high-value applications in infant nutrition and medical nutrition where superior digestibility and allergen reduction are critical.

- Arla Foods Ingredients is a specialist within the market, renowned for its advanced whey protein hydrolysates such as Lacprodan. Their primary strategic initiative is the deep scientific research and clinical validation to develop highly targeted hydrolysates with proven health benefits, such as the specific peptides for blood pressure management.

Here is a list of key players operating in the global market:

The global protein hydrolysates market is fragmented, with competition intensifying among the multinational agri-food giants who are specialized ingredient suppliers and regional players. Key strategies center on vertical integration to secure raw material capacity expansion in high-growth regions and significant R&D investment to develop cleaner labels, improved functionality, and specialized solutions for infant nutrition, sports, and clinical diets. Further, strategic company acquisitions and partnerships expand the product portfolios and provide access to new geographic markets. For example, in April 2025, Actus Nutrition acquired a protein facility from Foremost Farms USA. On the other hand, sustainability and traceability have emerged as critical differentiators, with top firms investing in environmentally friendly production techniques and publicizing their commitment to responsible sourcing to satisfy changing customer and regulatory demands.

Corporate Landscape of the Protein Hydrolysates Market:

Recent Developments

- In November 2024, Arla Foods Ingredients has announced the launch of a new whey protein hydrolysate with a better taste profile than comparable ingredients for peptide-based medical nutrition.

- In October 2024, FrieslandCampina Ingredients announced that its Hyvital Whey HA 300, a protein hydrolysate specifically developed for infant and follow-on formulas, has received approval for use across the European Union.

- Report ID: 8296

- Published Date: Dec 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Protein Hydrolysates Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.