Beef Liver Market Outlook:

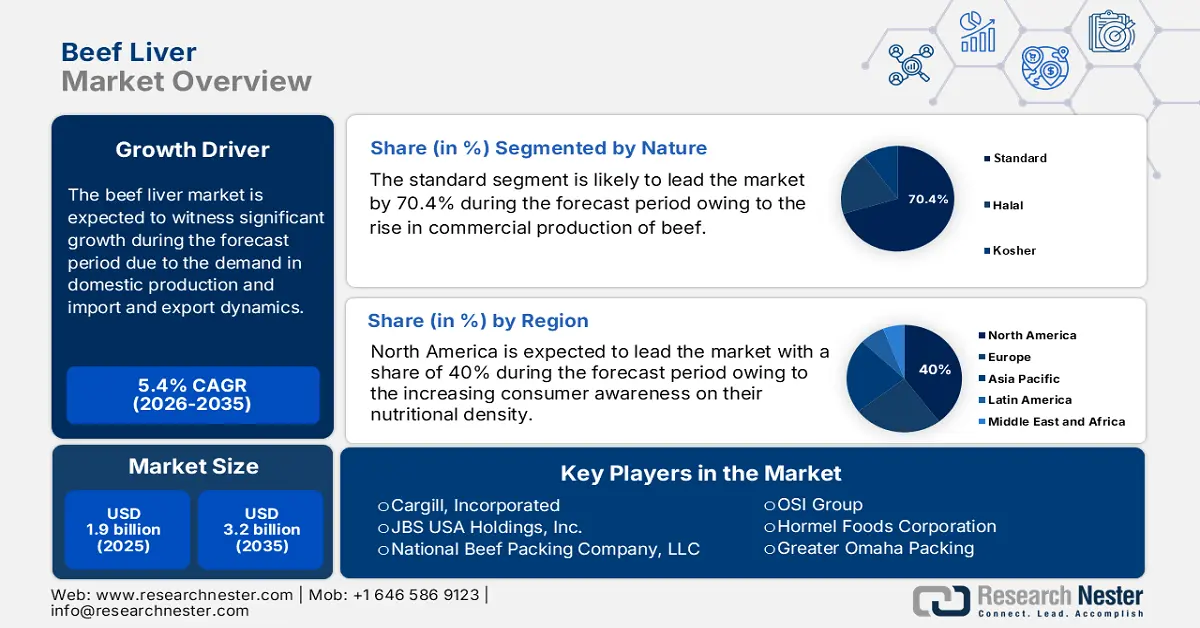

Beef Liver Market size was valued at USD 1.9 billion in 2025 and is projected to reach USD 3.2 billion by the end of 2035, rising at a CAGR of 5.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of beef liver is assessed at USD 2 billion.

The beef liver market is defined by the demand in domestic production and import and export dynamics. According to the American Farm Bureau Federation report of 2025, the U.S. production of beef was 2.16 billion pounds in 2023. The domestic processing factories are located in the Midwest and Texas, where assembly lines combine slaughter, liver removal, and packaging for wholesale sale. These plants comply with USDA Food Safety and Inspection Service (FSIS) regulations for product quality and traceability. The beef liver is the primary organ that is mainly diverted to commercial customers, such as pharmaceutical companies for producing supplements and large food service operators.

On the trade side, the international beef liver trade totalled USD 290 million in 2023, according to the report of the OEC. The U.S., Argentina and Australia are the top exporters of frozen beef liver. The Agricultural Research Service of the USDA studies ways to improve the safety and shelf life of meat foods, such as organ meats, to minimise spoilage and increase marketability. At the same time, the National Institutes of Health continues to fund foundational research on the nutrient bioavailability of compounds like heme iron and vitamin A, which are abundant in the liver.

Key Beef Liver Market Insights Summary:

Regional Highlights:

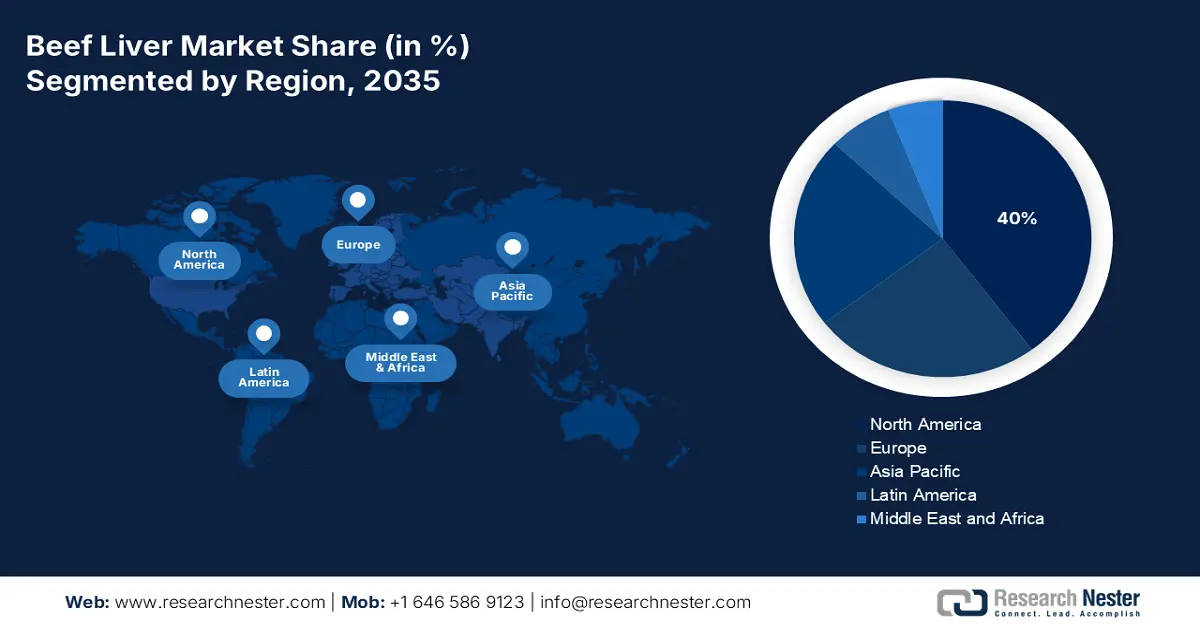

- In the Beef Liver Market, North America is projected to hold a 40% share by 2035, stemming from increasing consumer awareness of the nutritional density of beef liver.

- Asia-Pacific is poised to be the fastest-growing region during 2026–2035, attributed to varying culinary habits, rising disposable incomes, and heightened nutritional deficiency awareness.

Segment Insights:

- In the Beef Liver Market, the standard sub-segment is expected to capture a 70.4% share by 2035, supported by the majority of commercial world production and commerce without religious certification mandates.

- The conventional segment is projected to maintain the largest revenue share by 2035, underpinned by the standard production of traditional cattle farming businesses.

Key Growth Trends:

- Rising prevalence of nutritional disorder

- Growth of the pet food industry

Major Challenges:

- Stringent pathogen and food safety control

- Significant supply chain issue and perishability costs

Key Players: Tyson Foods, Inc., Cargill, Incorporated, JBS USA Holdings, Inc., National Beef Packing Company, LLC, OSI Group, Hormel Foods Corporation, Greater Omaha Packing, Danish Crown A/S, Vion Food Group, ABP Food Group, LDC, Kepak Group, Australian Country Choice, Teys Australia, JBS Australia Pty Ltd, Alliance Group Ltd, Itoham Yonekyu Holdings Inc., Nippon Ham Group, Hanwoo Board, BRF S.A.

Global Beef Liver Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.9 billion

- 2026 Market Size: USD 2 billion

- Projected Market Size: USD 3.2 billion by 2035

- Growth Forecasts: 5.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: USA, China, Brazil, Australia, Germany

- Emerging Countries: India, Vietnam, Indonesia, Mexico, South Korea

Last updated on : 16 October, 2025

Beef Liver Market - Growth Drivers and Challenges

Growth Drivers

- Rising prevalence of nutritional disorder: Anemia is the most common nutritional disorder globally and the WHO in February 2025 has stated that affecting 40% of children and 37% of pregnant women globally. In order to overcome this nutritional deficiency, beef liver is used which is the richest natural source of Vitamin B12 and heme iron. Public health initiatives and growing consumer awareness on these deficiencies which drives the demand for nutrient-dense whole foods.

- Growth of the pet food industry: The pet industry is driving the demand for natural ingredients and high-quality pet food. Beef liver is the major component due to its palatability and high nutrient density. The American Pet Products Association report states that there is a consistent growth in the pet food expenditure. This creates a stable, high-volume trade for manufacturers, allowing them to utilise lower-grade livers that may not meet human consumption standards, thus optimising overall yield and profitability from each carcass.

- Expansion of the dietary supplement sector: The dietary supplement market is expanding rapidly. As per the CDC data in February 2021, 57.6% of people above age 20 use dietary supplements, which is the main driver of the market. Beef livers are processed into powder or capsule form to enhance the nutrients such as iron, Vitamin A, and B12 content. The NIH's Office of Dietary Supplements provides scientific backing for the role of these nutrients, lending credibility to such products. This value-added segment targets people who are more health-conscious and avoid consuming fresh liver, making a significant profit for the manufacturers.

Nutrients in Beef Liver

|

Nutrient |

Percentage |

|

Protein |

19.57 ± 0.16 |

|

Total Fat |

4.50 ± 0.12 |

|

Ash |

1.46 ± 0.04 |

|

Moisture |

71.47 ± 0.08 |

|

Cholesterol |

2.57 ± 0.04 |

|

Calcium |

40.23 ± 0.55 |

|

Copper |

119.47 ± 25.78 |

|

Iron |

51.53 ± 1.45 |

|

Magnesium |

185.67 ± 1.86 |

|

Manganese |

2.60 ± 0.10 |

|

Phosphorous |

3550.00 ± 30.55 |

|

Potassium |

2910.00 ± 26.46 |

|

Sodium |

616.00 ± 10.58 |

|

Zinc |

38.90 ± 2.86 |

Source: NLM September 2024

Challenges

- Stringent pathogen and food safety control: Beef liver has a high risk of contamination with Salmonella and E. coli. Companies need to follow a strict Hazard Analysis and Critical Control Points procedure, which requires a huge investment in testing and sanitation measures. A single recall has the capability to destroy the reputation and finances of a new entrant. For instance, in 2022, the beef items, such as liver, were contaminated with E. coli and resulted in huge cut losses, demonstrating the operational and cost burden of staying compliant in a high-risk category.

- Significant supply chain issue and perishability costs: Beef liver are mostly consumed in a fresh form and has limited shelf life. New companies entering the market must invest heavily in cold chain logistics such as blast freezers and refrigerated transportation to avoid spoilage and wastage. This is the huge challenge to reach the distant market and increases the operational costs. Greater Omaha Packing has succeed by integrating their own processing and cold chain, but this achievement requires huge investment making it a formidable challenge for new suppliers.

Beef Liver Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 1.9 billion |

|

Forecast Year Market Size (2035) |

USD 3.2 billion |

|

Regional Scope |

|

Beef Liver Market Segmentation:

Nature Segment Analysis

The standard sub-segment leads the nature segment and is likely to retain the share value of 70.4% by the year 2035. The segment is driven by the majority of commercial world production and commerce without religious certification mandates. This is a demonstration of the market on the basis of general commercial supply chains. According to the Health and Food Audits and Analysis Programme in 2025, the Directorate-General for Health and Food Safety has planned around 259 controls in 2025 dealing with food safety and welfare compliance for meat products. These audits target the production, slaughter welfare, transport, and safety of mammalian and avian meat products that control the bulk standard segment of the meat market serving the EU and export markets.

Grade Segment Analysis

Conventional leads the segment and is expected to hold the largest revenue share by 2035. The segment is propelled by the standard production of traditional cattle farming businesses and is the most affordable and abundant product. Its supremacy is grounded in the large scale of mainstream cattle farming, as reported by the USDA's Economic Research Service, which summarises the structure of the conventional livestock industry. Also, stable supply chains and built-out processing facilities further support the segment's leadership in the market, providing consistent availability for both export-oriented and domestic demand.

Source Segment Analysis

The dairy cattle are the dominant segment because these animals are a constant and high-volume by-product stream from the dairy sector. Culled dairy cows offer a stable source of offal, such as liver, which is linked to the meat processing value chain. This supply tends to exceed supply from special beef cattle herds. According to the Food and Agriculture Organisation of the United Nations report in 2022, Brazil has increased the import of bovine meat output to higher cattle availability for slaughter by 5.3%. This supply underscores the demand for beef in the international market.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Product Form |

|

|

End use |

|

|

Distribution Channel |

|

|

Grade |

|

|

Source |

|

|

Nature |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Beef Liver Market - Regional Analysis

North America Market Insights

North America is dominating the beef liver market and is projected to hold 40% of the market share by 2035. The market is driven by increasing consumer awareness of their nutritional density, mainly in high iron and vitamin A content. One of the major trends includes the product's growing positioning as a functional food and supplement, often in powdered or encapsulated forms for the health and wellness sector. Demand is also spurred by the paleo and carnivore diets. The industry enjoys a highly developed meat processing sector, which provides an assured by-product supply base. Nevertheless, growth is moderated by issues such as consumer dislike of taste and worry about dietary cholesterol, together with rigorous food safety regulation from the likes of the USDA and CFIA.

The U.S. market is significantly expanding and is led by its use in specialised dietary systems. The U.S. has a rising demand for beef liver and other organ meats among health-conscious demographics. According to the OEC report of 2023, the U.S. exports most frozen beef liver worth USD 92.3 million. A major trend is the conversion of the product into value-added forms; firms are manufacturing freeze-dried liver powders and capsules as a means of breaking taste barriers and targeting the supplement market.

The beef liver market in Canada is driven by the strong domestic production and health-focused consumption. The food inspection agency in Canada strictly inspects the meat safety and labelling to ensure the integrity of the product. According to the April 2025 report of the USDA, Canadian beef production was at 1,326 (1,000 metric tons), which reflects the increased demand of the organs in different industries. Furthermore, the increasing consumer perception of the health benefits of beef liver, like its high iron and vitamin A levels, is slowly increasing its demand in retail and foodservice markets.

Trade Data on Frozen Liver Beef in 2023

|

Country |

Import (USD) |

Export (USD) |

|

U.S. |

360 K |

92.3 million |

|

Canada |

3.4 million |

5.87 million |

Source: OEC 2023

APAC Market Insights

The Asia-Pacific is the fastest-growing region in the beef liver market and is fueled by varying culinary habits, increasing disposable incomes, and heightened nutritional deficiency awareness. India and China consider liver as an affordable source of essential nutrients and overcome the health concerns like anaemia, which affects a significant portion of the population. Key trends include the modernisation of supply chains to improve food safety and the emergence of liver-based dietary supplements. Growth is not even, but rather hampered by religious food restrictions in some markets and competition from other sources of protein.

China is leading the market in the APAC region, as it is the second-largest country in beef production. The market is fueled by the large population and culinary use. Various research programs and studies in China have highlighted the importance of iron-rich foods such as liver to address the nutritional iron deficiency, a condition prevalent in certain demographics. The United States Department of Agriculture Foreign Agricultural Service data in April 2025 depicts that China's beef import market has traditionally concentrated with the top five markets, such as Brazil, Argentina, Uruguay, Australia, New Zealand and the U.S., accounting for nearly 90% of total beef imports in 2024.

The beef liver market in India is very niche and geographically fragmented because of religious restrictions in the cultural diet. Demand still exists in areas with high non-beef-prohibiting populations, where liver is highly regarded as a cheap, dense nutrient food item. According to the USDA report of February 2025, the beef production in India was 4.57 metric million tons in 2024. Its demand is primarily found in states such as Kerala, West Bengal, and the northeast, where the consumption of beef is a part of local culture and added to local diets. Market growth is further driven by the contribution it makes to address the nutritional deficiencies, like anaemia, as reflected in public health information.

Europe Market Insights

Europe market is defined by the demand based on traditional recipes, offset by a long-term trend of declining per capita consumption. The main drivers of the market are the affordability of the product and its high density of nutrients, attractive to price-sensitive consumers and the growing demand for natural sources of iron and vitamins. One key trend is increasing demand for liver from alternative production systems, including organic and grass-fed beef cattle, owing to consumer interest in animal welfare and product origin. The beef liver is also considered an alternative protein source, which changes the eating patterns among the younger population, but it remains a strong sector in the overall meat by-products industry.

UK beef liver demand is supported by the product's status as a low-cost, traditional source of protein, with demand being concentrated in older age groups and lower-income families. The Food Standards Agency (FSA) prescribes strict guidelines on offal production and handling to ensure food safety. The UK is a net importer of bovine offal in general, and figures provided by the Department for Environment, Food & Rural Affairs (DEFRA) point to steady levels of importation to meet domestic demand, particularly from EU member states like Ireland.

Germany is expected to hold the largest revenue share in Europe's beef liver market by 2035. This dominance is due to the country being the largest producer of beef and veal, as Eurostat consistently reports, ensuring a consistent and adequate domestic supply of liver as a by-product of the slaughterhouse. In addition, Germany, being among the major importers of meat and edible meat offal amounting to USD 113 million including products salted, brined, dried, or smoked as well as meat flours or meals, according to the OEC report in 2023 is an important market for beef liver, which indicates robust demand for quality offal products in foodservice as well as industrial uses.

Key Beef Liver Market Players:

- Tyson Foods, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cargill, Incorporated

- JBS USA Holdings, Inc.

- National Beef Packing Company, LLC

- OSI Group

- Hormel Foods Corporation

- Greater Omaha Packing

- Danish Crown A/S

- Vion Food Group

- ABP Food Group

- LDC

- Kepak Group

- Australian Country Choice

- Teys Australia

- JBS Australia Pty Ltd

- Alliance Group Ltd

- Itoham Yonekyu Holdings Inc.

- Nippon Ham Group

- Hanwoo Board

- BRF S.A.

The worldwide beef liver market is fragmented by adding meat processors like Tyson, Cargill, and JBS that utilise vast supply chains for the valorisation of products. Major strategies involve vertical integration to maintain raw material quality and traceability, responding to consumer demand for food safety. Additionally, firms are growing in terms of value-added products like manufacturing frozen, powdered, and encapsulated beef liver for nutraceutical and pet food markets, thereby earning higher margins. Partnerships with health food chains and investment in freeze-drying technology are additional strategic differentiators.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In April 2025, U.S. Meat Export Federation (USMEF) in partnership with the U.S. Department of Agriculture’s Foreign Agricultural Service (USDA FAS) and a Peruvian importer introduced two new red meat products, a liver burger and liver meatballs — formulated using U.S. beef liver and U.S. ham.

- In July 2024, Maev announced the launch of its Human-Grade Freeze-Dried Treats for dogs, made with a single ingredient: 100% USDA-Certified Beef Liver. The launch aims to promote pet wellness through clean, protein-rich nutrition, offering dog owners a high-quality, natural treat option.

- Report ID: 2720

- Published Date: Oct 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Beef Liver Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.