Pressure Control Equipment Market Outlook:

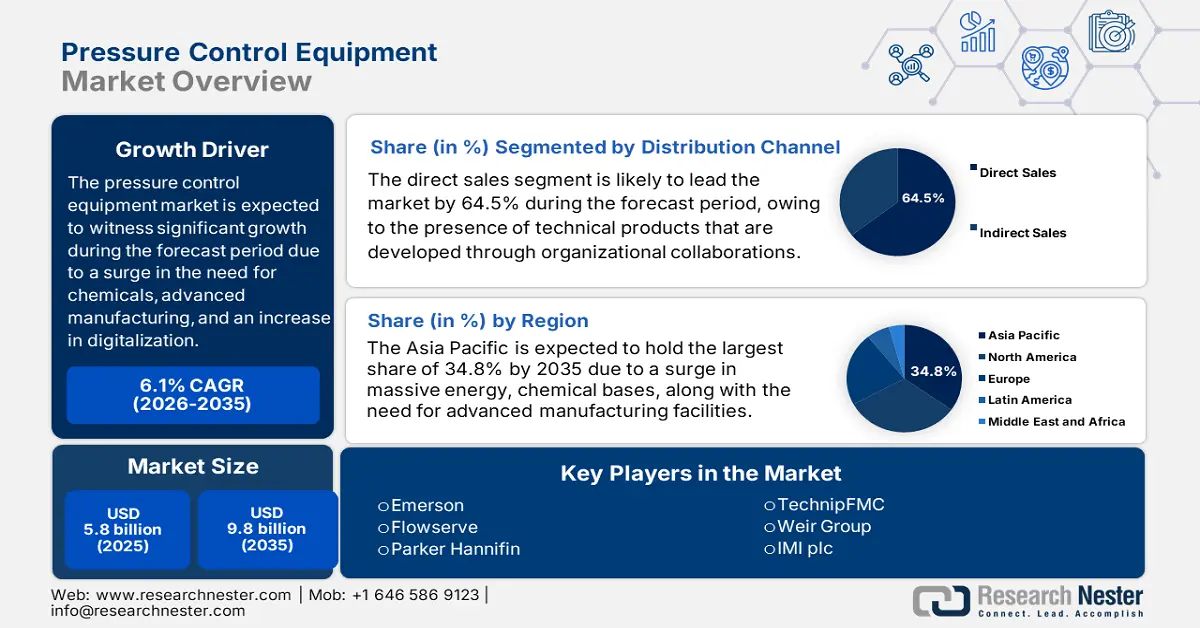

Pressure Control Equipment Market size was over USD 5.8 billion in 2025 and is estimated to reach USD 9.8 billion by the end of 2035, expanding at a CAGR of 6.1% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of pressure control equipment is assessed at USD 6.1 billion.

The worldwide pressure control equipment market is witnessing steady growth and advancement, fueled by advanced manufacturing, a rise in the demand for chemicals, oil and gas, an increase in digitalization, and the presence of stringent safety regulations. According to official statistics published by the International Energy Forum in June 2024, the yearly upstream of oil and gas capital spending is projected to increase by 22% by the end of 2030 to ensure suitable supplies based on the cost and demand inflation. In addition, a generous USD 4.3 trillion investment is expected to be made between 2025 and 2030. Meanwhile, the increasing capital spending requirements are based on the outlook that observes the rising need for oil, rising from 103 million barrels per day as of 2023 to almost 110 million barrels per day by 2030. Besides, there is a continuous demand for oil by different sectors, which is positively impacting the overall market globally.

International Oil Demand Growth by Sector (2021-2024)

|

Year |

Road Transport (mb/d) |

Aviation and Shipping (mb/d) |

Feedstock (mb/d) |

Other Sectors (mb/d) |

|

2021 |

2.9 |

0.8 |

0.7 |

1.0 |

|

2022 |

1.1 |

1.0 |

-0.1 |

0.5 |

|

2023 |

0.1 |

0.9 |

0.6 |

0.2 |

|

2024 |

- |

0.4 |

0.4 |

-0.1 |

Source: IEA Organization

Furthermore, the aspects of Internet of Things (IoT) and digitalization integration, environmental sustainability, an increase in high-pressure systems demand, lifecycle service contracts, and international energy diversification. As per an article published by NLM in April 2023, the world produces 2.0 billion metric tons of municipal solid waste every year, with almost 33% mismanaged in a standard environment. Besides, rapid economic development, population growth, and increased urbanization are projected to cause international waste to increase by 70% in the upcoming 30 years, reaching by the end of 2050, and is poised to generate 3.4 billion metric tons of waste every year. Moreover, nearly 2 billion people are expected to reside in locations without waste collection systems and depend on unmanaged dumpsites or even open burning of waste. Therefore, owing to all these reasons, there is a huge demand for the market to flourish across every country.

Key Pressure Control Equipment Market Insights Summary:

Regional Highlights:

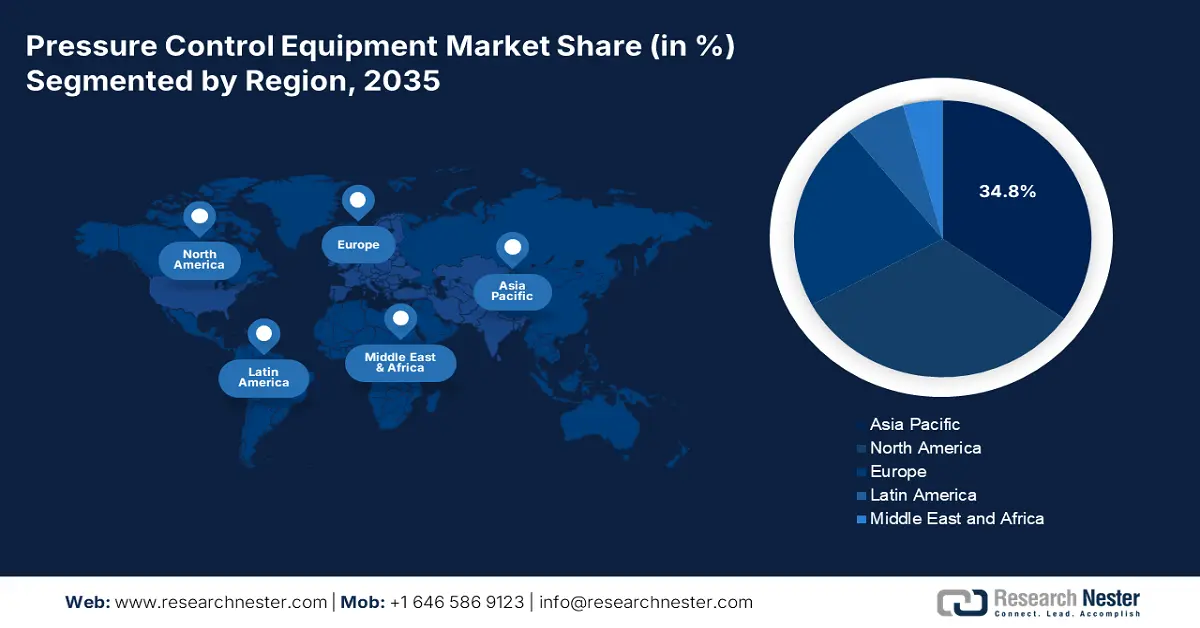

- Asia Pacific in the pressure control equipment market is forecast to command the leading regional position with a 34.8% share by 2035, underpinned by the concentration of large-scale energy, chemical, and advanced manufacturing bases across China, India, Japan, South Korea, and Southeast Asia.

- Europe is projected to register the fastest growth over the forecast period, supported by heavy investment in high-pressure systems, modernization of legacy industrial assets, and enforcement of stringent process safety regulations

Segment Insights:

- The direct sales segment within the pressure control equipment market is projected to dominate the distribution channel landscape by 2035 with a 64.5% share, supported by its strong adoption for highly technical and safety-critical equipment requiring close manufacturer–end-user collaboration.

- The oil and gas end-use industry segment is expected to secure the second-highest share by 2035, underpinned by its critical reliance on pressure control systems to enhance operational safety and efficiency in high-pressure environments.

Key Growth Trends:

- Increase in chemical equipment

- Focus on advanced manufacturing

Major Challenges:

- Increase in capital investment requirements

- Volatility in oil and gas expenses

Key Players: Schlumberger (U.S.), Baker Hughes (U.S.), Halliburton (U.S.), Weatherford International (U.S.), National Oilwell Varco (U.S.), Emerson (U.S.), Flowserve (U.S.), Parker Hannifin (U.S.), TechnipFMC (UK), Weir Group (UK), IMI plc (UK), Samson AG (Germany), KSB (Germany), Yokogawa Electric (Japan), Azbil Corporation (Japan), Fuji Electric (Japan), Hyundai Heavy Industries (South Korea), Doosan Enerbility (South Korea), L&T Valves (India), Unimech Group (Malaysia).

Global Pressure Control Equipment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.8 billion

- 2026 Market Size: USD 6.1 billion

- Projected Market Size: USD 9.8 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34.8% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Poland, Vietnam, Indonesia, Saudi Arabi

Last updated on : 14 January, 2026

Pressure Control Equipment Market - Growth Drivers and Challenges

Growth Drivers

- Increase in chemical equipment: The worldwide presence of agencies has mandated stringent safety and well control standards, thereby boosting the certification for the pressure control equipment market. For instance, as per the October 2025 IBEF Organization, India deliberately accounts for 16% to 18% of the world’s production of dye intermediaries and dyestuffs, and meanwhile, the colorants sector in the country has successfully emerged as a notable player with an international market share of approximately 15%. Therefore, this denotes suitable standards and regulations for developing equipment systems. Moreover, the ongoing supply chain aspect of equipment systems for thoroughly measuring and checking pressure across different industries is yet another factor for fueling the market’s demand globally.

2023 Equipment to Measure or Check Pressure Export and Import

|

Components |

Export (USD) |

Import (USD) |

|

Germany |

2.4 billion |

1.2 billion |

|

U.S. |

1.8 billion |

1.8 billion |

|

China |

1.4 billion |

1.0 billion |

|

Global Trade Valuation |

11.6 billion |

|

|

Global Trade Share |

0.051% |

|

|

Product Complexity |

1.1 |

|

|

Export Growth |

6.9% |

|

Source: OEC

- Focus on advanced manufacturing: The presence of cleanroom and semiconductor sectors demand precise and standardized pressure control for GaAs wafer production and other innovative materials, which is positively impacting the market globally. Based on government data put forth by the PIB Government in January 2026, the semiconductor chip design is considered one of the main value drivers, effectively contributing to 50% of the value addition, 20% to 50% of Bill of Materials expenses, and 30% to 35% of international semiconductor sales through the fabless industry. Besides, as per the January 2026 Semiconductor Organization article, the sales for the worldwide semiconductor sector totaled USD 75.3 billion as of 2025, denoting an increase by 29.8% in comparison to a total of USD 58.0 billion as of 2024, thereby making it suitable for bolstering the market’s exposure.

- Surge in sustainability investments: The existence of administrative programs has readily focused on allocating funds and initiating investments to skyrocket the market internationally. For instance, as per the January 2025 CEFIC Organization data report, the chemical industry in Europe significantly represents nearly EUR 655 billion in turnover, and almost EUR 165 billion in value addition as of 2023. In addition, the industry displays 5% to 7% of the overall industry sales in the country, which is over 1.2 million direct employment opportunities, 3 to 5 times more than indirect employment, and constitutes a dense network of 31,000 organizations, of which 97% are small and medium-sized enterprises (SMEs), thus denoting a huge growth opportunity for the overall market.

Challenges

- Increase in capital investment requirements: Systems in the pressure control equipment market, such as blowout preventers, high‑pressure valves, and control heads, require significant upfront capital for design, manufacturing, and certification. The cost of advanced assemblies is particularly high, limiting adoption among smaller operators and chemical plants with constrained budgets. Beyond procurement, lifecycle costs include inspection, testing, and compliance with international standards, including API, ISO, and OSHA, which further strain financial resources. This challenge is compounded in emerging markets, where companies often prioritize short‑term cost savings over long‑term safety investments. As a result, market penetration is slower in regions with limited access to financing or government subsidies.

- Volatility in oil and gas expenses: The market is closely tied to oil and gas exploration, which is highly sensitive to global price fluctuations. When crude oil prices fall, exploration budgets shrink, leading to deferred investments in drilling rigs, wellheads, and associated pressure control systems. This cyclical nature creates uncertainty for manufacturers, who face uneven demand and unpredictable revenue streams. For example, during oil price downturns, offshore deepwater projects, where high‑pressure equipment is most critical, are often postponed or canceled. Conversely, price spikes can trigger rapid demand surges, straining supply chains and increasing lead times. This volatility complicates strategic planning for both producers and service providers, making it difficult to maintain stable growth trajectories.

Pressure Control Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 5.8 billion |

|

Forecast Year Market Size (2035) |

USD 9.8 billion |

|

Regional Scope |

|

Pressure Control Equipment Market Segmentation:

Distribution Channel Segment Analysis

The direct sales segment, which is part of the distribution channel, is anticipated to hold the largest share of 64.5% in the pressure control equipment market by the end of 2035. The segment’s upliftment is highly driven by its preference, owing to the highly technical nature of products such as blowout preventers, valves, and control heads, which require close collaboration between manufacturers and end-users. Direct engagement ensures that equipment specifications meet stringent safety and operational standards across oil and gas, petrochemicals, and advanced manufacturing. Manufacturers leverage direct sales to provide customized solutions, lifecycle service contracts, and compliance support, which are critical in industries governed by strict regulations. Additionally, direct sales allow companies to build long-term relationships with clients, offering training, certification, and predictive maintenance services.

End use Industry Segment Analysis

Based on the end use industry, the oil and gas segment in the market is projected to account for the second-highest share during the forecast timeline. The segment’s growth is highly fueled by its importance for efficiency, safety, and overcoming catastrophic failures, particularly in high-pressure environments. This is extremely suitable for regulating flow in processing facilities, plants, and wells, utilizing devices such as regulators, relief valves, and choke valves. Government-reported estimates from the IBEF Organization in October 2025 note that India readily exported 64.7 million metric tons of petroleum-based products, which reflected the country’s robust refining capabilities, along with establishing its position as one of the notable players in the international energy markets. Regarding this, the Union Budget has generously provided Rs. 5,597 crore (USD 640.4 million) to the Petroleum and Natural Gas (PNG) Ministry for converting 2 large underground caverns into petroleum storage hubs, thereby proliferating the segment’s growth.

Pressure Rating Segment Analysis

By the end of the stipulated timeline, the high pressure (10,000-20,000 psi) sub-segment, falling under the pressure rating segment, is predicted to garner the third-highest share in the market. The sub-segment’s development is extremely propelled by the increasing prevalence of deepwater drilling, shale gas exploration, and advanced chemical processes that require equipment capable of withstanding extreme operating conditions. Blowout preventers, safety valves, and control heads designed for high-pressure environments are critical to maintaining well integrity and preventing catastrophic failures. Regulatory agencies such as the U.S. Bureau of Safety and Environmental Enforcement (BSEE) and Europe Chemicals Agency (ECHA) mandate rigorous testing and certification for high-pressure assemblies, further boosting demand. In chemical industries, high-pressure systems are essential for petrochemical cracking, industrial gases, and advanced materials, such as gallium arsenide wafers, where precise control under extreme conditions is vital.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Distribution Channel |

|

|

End use Industry |

|

|

Pressure Rating |

|

|

Application |

|

|

Operation Phase |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pressure Control Equipment Market - Regional Analysis

APAC Market Insights

The Asia Pacific pressure control equipment market is anticipated to garner the highest share of 34.8% by the end of 2035. The market’s upliftment in the region is highly propelled by the existence of large-scale energy, advanced manufacturing, and chemical bases in Southeast Asia, South Korea, India, Japan, and China. According to official statistics published by the ITIF Organization in April 2024, China caters to 44% of the international chemical production, along with 46% of capital investment. In addition, the country accounts for 55% of the worldwide capacity for acetic acid, almost 50% of carbon black capacity, and nearly 45% of the international titanium dioxide capacity. In 2022, 46% of the international chemical sector capital investment was significantly located in China, with the country comprising the highest capital investment share, which is 2.8 times more than the U.S., thus making it suitable for bolstering the market’s growth.

The pressure control equipment in China is growing significantly due to the presence of massive petrochemical capacity, semiconductor-based chemical processing, and industrial gases. According to the December 2023 IEA Organization article, there has been a rise in oil utilization within the country, based on which the demand for petrochemical feedstocks, including ethane, liquified petroleum gas (LPG), and naphtha, averaged 1.7 mb/d. Besides, the country has been a long-lasting importer of synthetic fiber and polymer, accounting for nearly 3 mb/d in feedstock, which is 3% of the international oil consumption. Moreover, the aspect of planning regulatory frameworks has encouraged the modernization of legacy assets, along with the integration of certified equipment, while there have been advancements in cleanroom-based processes and materials, thereby suitable for bolstering the market’s exposure.

Regional Petrochemicals Growth Capacity in China (2019-2024)

|

Year |

Growth Capacity (Million Tons Per Year) |

|

2019 |

1.2 |

|

2020 |

5.5 |

|

2021 |

9.3 |

|

2022 |

10.1 |

|

2023 |

8.9 |

|

2024 |

9.3 |

Source: IEA Organization

The pressure control equipment market in India is also growing due to robust compliance with environmental standards and process safety, chemical cluster modernization, and industrial expansion. In addition, governmental strategies to support technology adoption, cleaner processes, and manufacturing are also responsible for boosting the market in the country. As per an article published by the ITA in January 2024, the country’s diversified chemicals sector covers more than 80,000 commercial products, and the industry is valued at USD 220 billion. Additionally, the industry is further projected to grow by 9% to 12% per annum and reach USD 300 billion by the end of 2026. Besides, the specialty chemicals industry is predicted to significantly contribute to overall sector growth and is anticipated to reach USD 40 billion by the same year, thus creating an optimistic outlook for the market’s development.

Europe Market Insights

Europe pressure control equipment market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by generous investment in high-pressure systems across advanced manufacturing, energy, and chemicals, modernizing legacy assets, and the support provided by strict process safety regulation. Based on industry-validated analysis by Europe Environment Agency in March 2023, the regional production, in terms of volume, accounted for 271 million tons, and meanwhile, the consumption was 289 million tons. In addition, the valuation of overall regional chemical sales enhanced by 38% from €363 billion to €499 billion. Besides, in terms of chemical diversity, more than 26,600 chemicals have been registered under the regional REACH legislation, thereby creating a growth opportunity for the overall market.

The pressure control equipment market in Germany is gaining increased traction due to the sustained modernization of process infrastructure, rigorous safety standards, and the presence of a massive chemical base. According to a data report published by the GTAI in October 2024, the country is considered the 4th largest chemical market, with a valuation of EUR 225 billion. Moreover, within 60 years, there has been an increase in by a nominal 5.0% on average every year, thus positively impacting the chemical industry’s upliftment. The country is also highly dominated by small and medium-sized organizations, with a revenue share of 59%. In addition, accounting for a share of 33% as of 2023, the country’s chemical industry has readily consolidated its role with the overall region, thereby making it suitable for bolstering the market.

Yearly Chemical Industry Revenue Analysis for Germany (2013-2023)

|

Year |

Revenue (EUR Billion) |

|

2013 |

165 |

|

2014 |

154 |

|

2015 |

163 |

|

2016 |

160 |

|

2017 |

180 |

|

2018 |

160 |

|

2019 |

166 |

|

2020 |

168 |

|

2021 |

214 |

|

2022 |

242 |

|

2023 |

218 |

Source: GTAI

The pressure control equipment market in Poland is also developing, owing to continuous growth in adjacent manufacturing and chemical industries, regionally aligned environmental compliance, and modernization in industries. Based on government data published by the State Government in 2025, the country’s overall economy increased steadily by 2.9%, due to a well-educated workforce, growing advancements, and a suitable business environment. Besides, the December 2022 Blue Europe article stated that 40% of domestic small and medium enterprises have successfully implemented basic digitalized technology, and it is further projected to reach the regional objective of utilizing artificial intelligence, cloud services, and big data by 75% of organizations in the country. Therefore, owing to such developments, there is a huge growth opportunity for the market.

North America Market Insights

North America pressure control equipment market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly driven by complex operations for chemicals, gas, and oil, along with sustained investment in high-pressure systems, modernizing legacy assets, and the presence of strict process safety standards. Based on government data published by the Biden White House Government in 2023, the President’s 2023 Budget for the Environmental Protection Agency (EPA) deliberately requested USD 11.9 billion as discretionary funding, denoting a USD 2.6 billion or 29% increase from the actual enacted level. This has been suitable for prioritizing environmental compliance, hazardous, and permitting waste programs that indirectly cater to adopting strong pressure control systems in chemical facilities.

The pressure control equipment market in the U.S. is gaining increased exposure due to the presence of programs by the government, the aspect of the federal budget context, as well as advanced instrumentation and materials. Government-related estimates from the 2024 ITA article denote that the country has exported more than USD 494 billion worth of chemicals as of 2022, and is one of the leaders in chemical production, with over 13% of the world’s chemicals deriving from the nation. In addition, the sector’s 14,000 establishments produce more than 70,000 products for which the market’s demand is surging. Besides, in the middle of 2024, the domestic chemical manufacturing sector directly employed more than 902,300 employees, while the overall federal direct investment amounted to USD 766.7 billion as of 2023. Therefore, all these factors contribute to the chemical industry's growth, which in turn positively impacts the market’s upliftment.

The pressure control equipment market in Canada is also growing, owing to the presence of administrative programs, generous budget programs for chemicals, environmental compliance, petrochemical expansion, and cross-border standards alignment. According to official statistics published by Clean Energy Canada Organization in July 2023, the Clean Fuel Regulations have set strict demands on fuel importers and producers for reducing the carbon intensity of transportation fuels by an estimated 15% by the end of 2030. However, this newest regulation successfully came into effect in July 2023, and the new objective is to diminish the carbon intensity by 4%, thus rising to 15% by the end of the same timeline. Besides, the country’s federal government has also unveiled a complementary program, which is the USD 1.5 billion Clean Fuels Fund, intending to support clean production. This deliberately includes hydrogen and biofuels projects, positively impacting and expanding the market’s demand.

Key Pressure Control Equipment Market Players:

- Schlumberger (U.S.)

- Baker Hughes (U.S.)

- Halliburton (U.S.)

- Weatherford International (U.S.)

- National Oilwell Varco (U.S.)

- Emerson (U.S.)

- Flowserve (U.S.)

- Parker Hannifin (U.S.)

- TechnipFMC (UK)

- Weir Group (UK)

- IMI plc (UK)

- Samson AG (Germany)

- KSB (Germany)

- Yokogawa Electric (Japan)

- Azbil Corporation (Japan)

- Fuji Electric (Japan)

- Hyundai Heavy Industries (South Korea)

- Doosan Enerbility (South Korea)

- L&T Valves (India)

- Unimech Group (Malaysia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- Schlumberger is a global leader in oilfield services, offering advanced blowout preventers, valves, and digital monitoring systems. Its strong research and development is focused on automation and predictive maintenance, positioning it as a key innovator in pressure control technologies.

- Baker Hughes provides integrated pressure control solutions, including high‑pressure valves and wellhead systems. The company emphasizes sustainability and digitalization, aligning its equipment with stricter safety and environmental standards worldwide.

- Halliburton’s portfolio includes drilling and completion pressure control equipment designed for both onshore and offshore operations. Its strategic initiatives focus on efficiency, lifecycle management, and compliance with global well control regulations.

- Weatherford International specializes in wellhead systems, control heads, and blowout preventers, serving diverse upstream and chemical applications. The company’s competitive edge lies in its global service network and focus on operational safety.

- National Oilwell Varco manufactures a wide range of pressure control equipment, including adapter flanges, flow trees, and BOPs. Its strength is in large-scale manufacturing and integration with drilling rigs, ensuring reliability in high‑pressure environments.

Here is a list of key players operating in the global market:

The competitive landscape in the market is consolidated at the top, with U.S. multinationals and European engineering leaders leveraging scale, installed base, and service networks. Strategic initiatives include portfolio integration for valves, actuators, digital monitoring, lifecycle service contracts, and compliance-driven upgrades aligned to global safety standards. Players are investing in high‑pressure assemblies, predictive maintenance via sensors, and cleanroom‑compatible solutions for semiconductor‑chemical interfaces. Partnerships with EPCs and national programs support modernization, while merger and acquisition and localization strategies strengthen regional presence across APAC and the Middle East. Besides, in April 2025, Honda R&D Co., Ltd. declared plans to evaluate its high-differential-pressure water electrolysis systems by collaborating with Sierra Space and Tec-Masters. This project is suitable for offering innovative energy storage and supporting human life on the lunar surface, thus driving the pressure control equipment industry’s growth globally.

Corporate Landscape of the Pressure Control Equipment Market:

Recent Developments

- In January 2026, SLB successfully made advancements in its transition in the international land rig industry by finalizing moves that tend to cement its asset-light approach, along with sharpening the focus on advanced and high-value equipment solutions.

- In June 2025, Baker Hughes notified its agreement to develop the newest joint venture with a subsidiary of Cactus Inc., wherein the organization contributed its surface pressure control (SPC) product line.

- In May 2025, SCF Partners significantly announced the sale of Kinetic Pressure Control Ltd. to Scout Surface Solutions LLC. Both companies provided patented and cutting-edge systems and solutions to their consumers for high-value applications, including control systems, pad automation, pressure control, and continuous frac.

- Report ID: 8347

- Published Date: Jan 14, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pressure Control Equipment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.