Hydraulic Tools and Equipment Market Outlook:

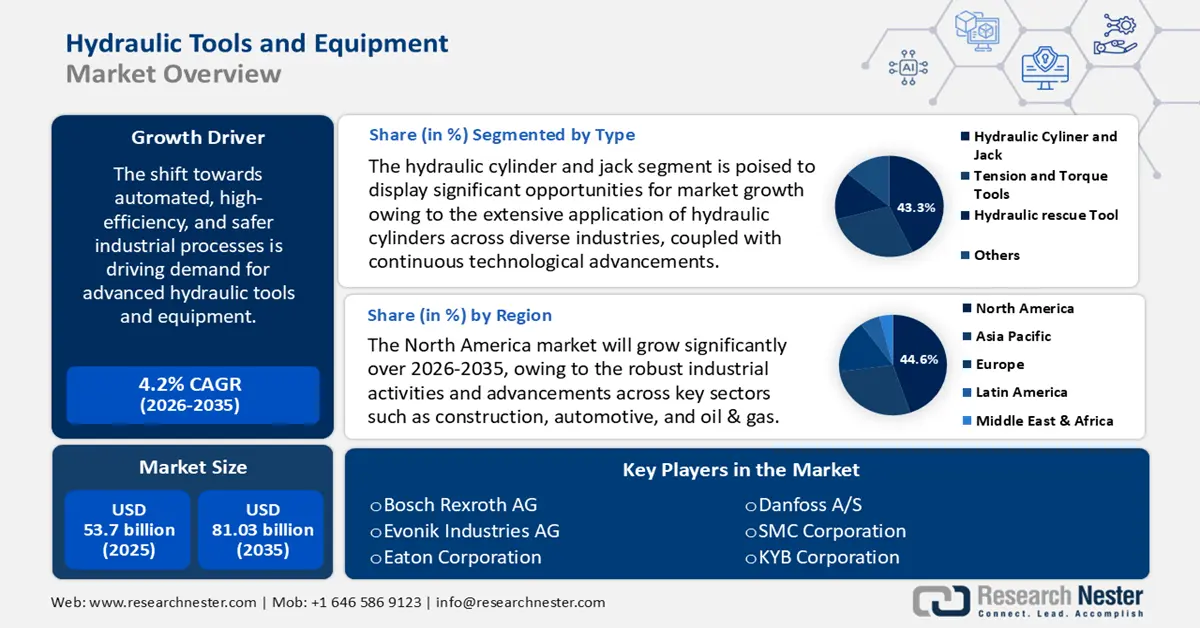

Hydraulic Tools and Equipment Market size was valued at USD 53.7 billion in 2025 and is likely to cross USD 81.03 billion by 2035, registering more than 4.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hydraulic tools and equipment is assessed at USD 55.73 billion.

The shift towards automated, high-efficiency, and safer industrial processes is driving demand for advanced hydraulic tools and equipment. Industrial automation and efficiency needs are key drivers of the hydraulic tools and equipment market since industries are increasingly seeking powerful, precise, and reliable tools to enhance productivity and reduce downtime.

Hydraulic tools provide high force output with minimal effort, making them ideal for tasks like lifting, pressing, cutting, and fastening. Industries aim to reduce manual labor and speed up operations, making hydraulic-powered automation systems crucial. Moreover, integration of IoT and sensors in hydraulic tools allows real-time monitoring of pressure, temperature, and performance, reducing failures and improving maintenance schedules. Predictive maintenance powered by automation ensures optimal tool performance and extends equipment lifespan.

Further, hydraulic presses, cylinders, and pumps enable consistent force application, crucial for precision manufacturing in automotive, aerospace, and metalworking industries. Unlike manual tools, automated hydraulic systems provide repeatability, reducing material wastage and improving quality. Automation reduces worker fatigue and injury risks by replacing physically demanding tasks with hydraulic-powered solutions. Hydraulic tools with automated controls minimize human error and enhance workplace safety compliance.

Key Hydraulic Tools and Equipment Market Insights Summary:

Regional Insights:

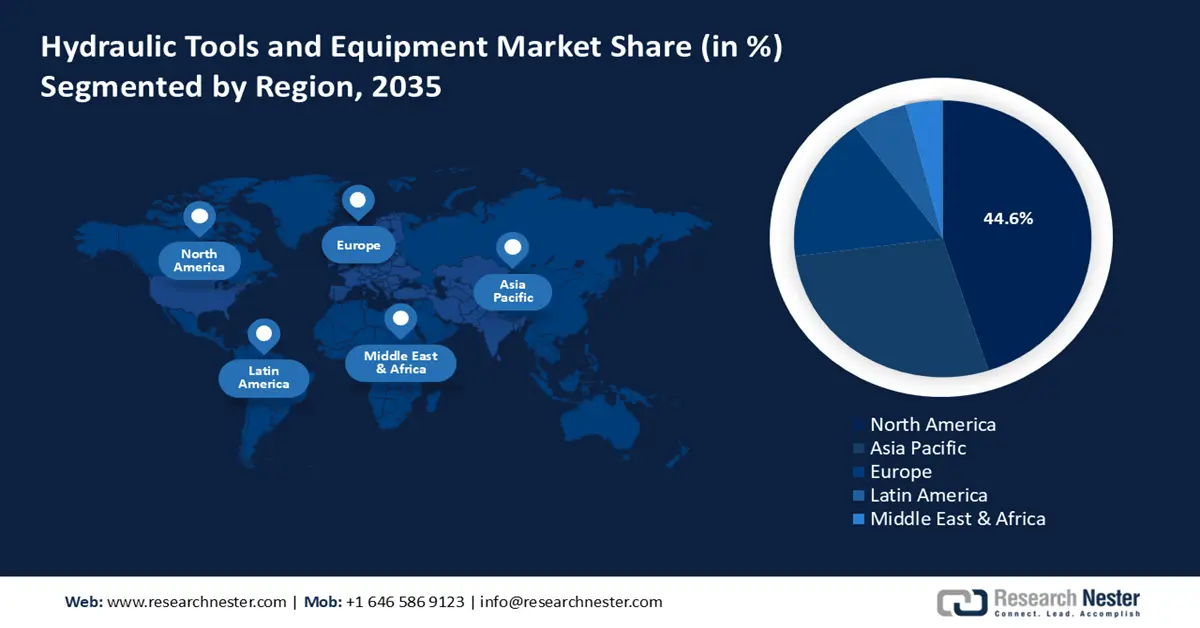

- North America is poised to secure over 44.6% share by 2035 in the hydraulic tools and equipment market, supported by strong industrial momentum and rising automation adoption across key sectors.

- Asia Pacific is projected to record a stable CAGR through 2035 as rapid industrialization and expanding infrastructure projects elevate the demand for hydraulic tools and equipment.

Segment Insights:

- The hydraulic cylinder and jack segment is set to command around 43.3% share by 2035 in the hydraulic tools and equipment market, bolstered by broad industrial utilization and ongoing technological enhancements.

- The pumps segment is expected to gain notable traction by 2035 as its essential role in transforming mechanical energy into hydraulic power sustains demand across major industries.

Key Growth Trends:

- Technological advancements

- Growing demand in the automotive and aerospace industries

Major Challenges:

- Complex maintenance and repairs

- Supply chain disruptions

Key Players: Bosch Rexroth AG, Eaton Corporation, Danfoss A/S, Emerson Electric Co., SMC Corporation, and KYB Corporation.

Global Hydraulic Tools and Equipment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 53.7 billion

- 2026 Market Size: USD 55.73 billion

- Projected Market Size: USD 81.03 billion by 2035

- Growth Forecasts: 4.2%

Key Regional Dynamics:

- Largest Region: North America (44.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Indonesia, Mexico

Last updated on : 3 December, 2025

Hydraulic Tools and Equipment Market - Growth Drivers and Challenges

Growth Drivers

-

Technological advancements: Modern hydraulic systems are becoming more compact while delivering higher power, improving their efficiency for both industrial and mobile applications. Variable displacement pumps and electro-hydraulic systems optimize energy usage and reduce waste. Further, IoT-enabled hydraulic tools offer real-time monitoring, predictive maintenance, and data analytics, reducing downtime and repair costs. Remote diagnostics allow technicians to troubleshoot issues without being physically present, increasing operational uptime.

Additionally, modern hydraulic systems are often modular, allowing for easy integration with different types of equipment or applications. This supports a wide range of industries and increases adoption. This supports a wide range of industries and increases adoption. New designs focus on reducing hydraulic fluid consumption, leakage, and environmental impact. The development of biodegradable hydraulic fluids and energy-efficient systems aligns with global sustainability goals. - Growing demand in the automotive and aerospace industries: Automotive and aerospace manufacturing require tight torque tolerances, accurate fittings, and flawless assembly. Hydraulic tools like torque wrenches, jacks, and cylinders deliver consistent force, essential for critical components. Aircraft and vehicle components are heavy and bulky. Hydraulic lifts, jacks, and hoists are crucial for safe and efficient handling during assembly and maintenance. Technicians in the automotive and aerospace sectors prefer lightweight, ergonomically designed hydraulic tools to reduce fatigue and improve efficiency. Manufacturers are responding with advanced materials and smart tool designs.

Challenges

-

Complex maintenance and repairs: Hydraulic systems require regular inspections, fluid checks, and component replacements like seals, hoses, and valves. When maintenance is delayed or complex, it can lead to unexpected failures, increasing downtime, which is costly in time-sensitive industries like construction, manufacturing, or aerospace. Maintenance and troubleshooting often require specialized knowledge of hydraulic systems. Shortage of trained professionals, especially in developing regions-makes it difficult for businesses to support ongoing use, leading them to prefer simpler alternatives.

- Supply chain disruptions: Hydraulic systems rely on specialized parts like pumps, cylinders, valves, seals, and hoses, many of which are sourced globally. Disruptions in manufacturing hubs cause delays in part availability, halting equipment production and delivery. Supply chain bottlenecks lead to delays in shipping, port congestion, and logistics challenges. Extended lead times make it difficult for end users to plan projects, causing them to seek readily available alternatives like electric or pneumatic tools.

Hydraulic Tools and Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 53.7 billion |

|

Forecast Year Market Size (2035) |

USD 81.03 billion |

|

Regional Scope |

|

Hydraulic Tools and Equipment Market Segmentation:

Type Segment Analysis

Hydraulic cylinder and jack segment is projected to account for hydraulic tools and equipment market share of around 43.3% by 2035. The market growth is due to the extensive application of hydraulic cylinders across diverse industries, coupled with continuous technological advancements, which ensure their continued prominence in the hydraulic tools and equipment market landscape. Double-acting cylinders, which facilitate movement in both directions, hold a significant revenue share. Their versatility makes them suitable for applications in large-scale engines, construction equipment, and industrial machinery. Further, welded cylinders’ robust design is preferred in industries like construction, oil & gas, and material handling, where durability and space efficiency are critical.

Component Segment Analysis

The pumps segment is anticipated to expand at a significant hydraulic tools and equipment market share. Hydraulic pumps are fundamental components in hydraulic systems, responsible for converting mechanical energy into hydraulic energy by moving fluid within the system. This function is crucial for powering various machinery and tools across multiple industries, including construction, agriculture, automotive, and manufacturing.

Further, the integration of smart technologies, such as the Internet of Things (IoT) and smart sensors, into hydraulic pumps has enhanced operational efficiency by enabling real-time monitoring and predictive maintenance. The adoption of Variable Speed Drivers (VSDs) allows for the adjustment of pump rotational speeds, improving energy efficiency and performance, particularly in processes with variable demands.

Our in-depth analysis of the global hydraulic tools and equipment market includes the following segments

|

Type |

|

|

End user |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydraulic Tools and Equipment Market - Regional Analysis

North America Market Insights

North America hydraulic tools and equipment market is set to hold revenue share of over 44.6% by the end of 2035. The market has demonstrated substantial growth driven by robust industrial activities and advancements across key sectors such as construction, automotive, and oil & gas. The expansion of infrastructure projects and the increasing adoption of automation in manufacturing have heightened the demand for hydraulic equipment.

In the U.S., rapid urbanization and increased spending on residential and commercial construction boost the need for hydraulic tools in material handling and construction machinery. Additionally, the adoption of advanced agricultural machinery equipped with hydraulic systems supports growth in the agricultural sector. Companies are prioritizing energy-efficient and environmentally friendly hydraulic technologies to align with sustainability goals. In Canada, the construction and manufacturing sectors are key drivers, with ongoing infrastructure projects and investments boosting demand for hydraulic tools and equipment. Innovations like electric-hydraulic systems and predictive maintenance are enhancing efficiency and reliability, attracting industries seeking improved performance.

APAC Market Insights

Asia Pacific is expected to experience a stable CAGR during the forecast period due to an increase over the next several years. The hydraulic tools and equipment market is experiencing notable growth, driven by rapid industrialization, infrastructure development, and advancements in key sectors such as construction, manufacturing, and agriculture. Countries like China, India, Japan, and South Korea are witnessing significant expansion in manufacturing, construction, mining, and other industries, leading to increased demand for hydraulic equipment.

In China, the hydraulic tools and equipment market is poised for continued expansion, supported by ongoing industrial growth, urbanization, and technological innovations. The emphasis on energy efficiency and sustainability is also expected to drive the development of advanced hydraulic solutions in the region. Further, India’s focus on infrastructure development, such as highways and urban transit systems, accelerates demand for hydraulic systems across various applications.

Hydraulic Tools and Equipment Market Players:

- Parker Hannifin Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bosch Rexroth AG

- Eaton Corporation

- Danfoss A/S

- Emerson Electric Co.

- SMC Corporation

- KYB Corporation

- Atlas Copco AB

- Wipro Enterprises (P) Ltd.

- Stanley Black & Decker, Inc.

- Jiangsu Hengli Hydraulic Co., Ltd.

- Yuci Hydraulics Co., Ltd.

- Husqvarna AB

- Enerpac (Actuant Corporation)

Leading companies are investing in R&D to introduce advanced hydraulic solutions. Firms are engaging in mergers and acquisitions to expand their hydraulic tools and equipment market presence and diversify their product portfolios. These strategies collectively enhance the competitive landscape, drive technological progress, and meet the growing global demand for hydraulic tools and equipment.

Recent Developments

- In September 2024, Power Team, a HYDRAULIC TECHNOLOGIES brand, introduced eSync, a revolutionary portable motion control system. The Power Team eSync portable synchronous system combines digital actuation and digital control. The microprocessor-controlled eSync is a highly accurate solution for lifting or lowering an object within a narrow tolerance. Synchronous lifting reduces undesired stress on the object, while the eSync standard features provide the ultimate in user safety.

- In October 2022, Enerpac introduced the SBL600 gantry as part of its SBL-Super Boom Lift hydraulic gantry li

- ne. This hydraulic gantry has a remarkable top lifting height of 10.6 meters, which is reached using a three-stage telescopic hydraulic cylinder. Notably, the gantry features a folding boom, allowing it to be moved on normal flatbed trucks without the need for additional permits or routing. The rectangular boom design increases both capacity and lifting height, with impressive weight capacities at each stage (674t, 562t, and 416t, respectively). Furthermore, the gantry's structure is designed for easy movement, resulting in cost savings during installation and setup.

- Report ID: 7499

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.