Hydraulic Solenoid Valve Market Outlook:

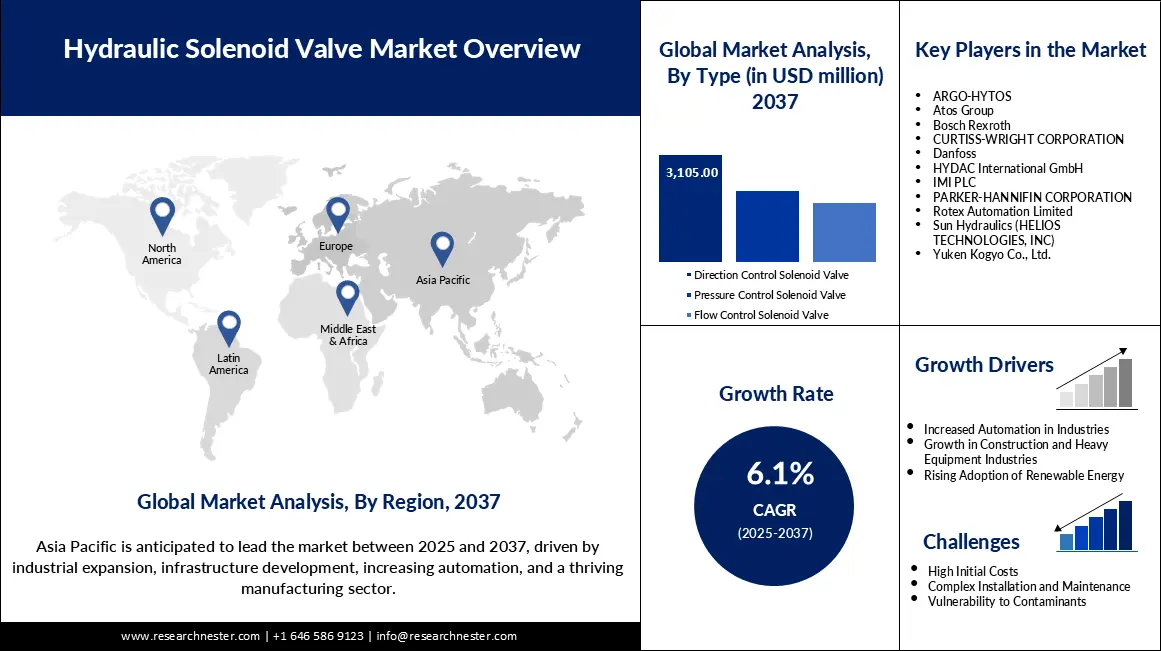

Hydraulic Solenoid Valve Market size was valued at USD 3.2 billion in 2024 and is projected to reach a valuation of USD 6.9 billion by 2037, rising at a CAGR of 6.1% during the forecast period, i.e., 2025-2037. In 2025, the industry size of hydraulic solenoid valve is evaluated at USD 3.4 billion.

The hydraulic solenoid valve market is advancing rapidly as automation and digitalization reshape industrial processes worldwide. Producers are focusing on integrating smart diagnostics and real-time monitoring to improve reliability and efficiency. Parker Hannifin launched its DFplus Generation IV proportional valves, featuring improved electronics and real-time diagnostics, in May 2024, strengthening Parker's smart industrial actuation leadership. The sector is also experiencing a shift towards sustainable and energy-efficient technology, and industries are trying to minimize their ecological footprint. Governments are putting stricter regulations and standards in place, compelling businesses to innovate and adapt. According to the U.S. Department of Commerce, the hydraulic equipment industry is projected to expand to USD 14 billion worth of revenues by 2026, indicating robust demand for advanced fluid control systems.

One of the major opportunities for the sector is the adoption of automation and Industry 4.0 practices, particularly in manufacturing, automotive, and infrastructure development. Companies are employing digital technologies and embedding IoT to enable predictive maintenance and minimize downtime. In April 2024, Bosch Rexroth displayed factory automation systems at Hannover Messe, including hydraulic valves for hydrogen infrastructure and customized actuators for energy-efficient flow control. This is a trend in which leading manufacturers are taking on the role of clean-tech innovators and enabling the world's transition towards smart, connected operations. With automation on the rise in all industries, demand for precise and reliable hydraulic solenoid valves is estimated to increase rapidly.

Hydraulic Solenoid Valve Market - Growth Drivers and Challenges

Growth Drivers

- Global drive towards sustainability: The drive towards sustainability and compliance mandates in industrial processes is among the primary drivers of growth. In March 2024, the U.S. EPA implemented stricter emission control requirements for hydraulic valves targeting low-leakage as well as energy-saving hydraulic valves in industrial and HVAC processes. Producers who commit to green designs and compliant technologies are achieving a strategic benefit, as market access increasingly depends on compliance with evolving standards. Use of such regulations not only generates innovation but also opens up access to green procurement programs and new markets.

- Smart infrastructure demand: Another major driver is expanding demand for smart infrastructure and city development, especially in emerging hydraulic solenoid valve markets. In May 2024, India expanded its subsidies under its Smart Cities Mission to cover hydraulic solenoid valves in water infrastructure and HVAC plans. This has significantly boosted regional demand for compliant leak-free valves and encouraged manufacturers to create solutions tailored to smart city applications. With governments investing heavily in infrastructure renewal, the market can expect sustained growth, particularly in Asia and the Middle East.

Challenges

- Regulatory compliance challenges: One of the key issues for the industry is the increasing complexity of compliance with chemical makeup and environmental safety legislation. The U.S. reformulated TSCA regulations in February 2024 that affected the chemical makeup of hydraulic valves, banning very high concern chemicals such as phthalates and fluoropolymers. Compliance is expensive in terms of materials sourcing and requires investment in reformulation and testing but is required for sale to the market and avoidance of federal fines. Conquering these shifting standards is a serious obstacle for smaller producers.

- Limiting safety standards to restrain market growth: The second challenge is raising electronic and material safety standards in dominant hydraulic solenoid valve markets. In July 2024, the EU tightened RoHS conformity checks of electrical solenoids, imposing more stringent prohibitions on lead, mercury, and flame retardants in valve electronics. This has forced businesses to re-engineer products to qualify for entry into the EU market, pushing the globe towards sustainable materials and increased R&D expenditure. The need to continually change to support the entry of new legislation raises the cost and complexity of product development cycles.

Hydraulic Solenoid Valve Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

6.1% |

|

Base Year Market Size (2024) |

USD 3.2 billion |

|

Forecast Year Market Size (2037) |

USD 6.9 billion |

|

Regional Scope |

|

Hydraulic Solenoid Valve Market Segmentation:

Type Segment Analysis

The direction control solenoid valve segment is anticipated to maintain a hydraulic solenoid valve market share of 45% during the forecast period based on its critical role in managing the flow direction of fluids in industrial and automatic systems. The valves are favored because of their accuracy and high-speed response, making them the core component in automobile manufacturing and process automation. In March 2024, Atos released its TID series proportional valves from Shanghai, created to facilitate high-speed hydraulic control in space-efficient applications, and ATEX and IECEx zone-certified. The innovation is accelerating application in mining and offshore industries as well as solidifying the segment's leadership. With rising complexity in manufacturing environments, direction control solenoid valves remain the preferred choice for demanding, sensitive fluid management.

Application Segment Analysis

The construction equipment control is slated to secure a 34% hydraulic solenoid valve market share by 2037, which emphasizes the sector's reliance on advanced hydraulic solutions for heavy-duty machines. Expansion results from global infrastructure expenditure and demand for solid, leak-proof valves in harsh construction conditions. In March 2024, HYDAC highlighted mobile hydraulics' integration into its Business Innovation Group by combining electrohydraulics with environmentally friendly motion control to meet the green mobility needs of construction fleets. This method leverages regional networks in Latin America and APAC, further stimulating segment growth. Intelligent construction equipment, boosting adoption with real-time diagnostics and remote monitoring, also fuels demand for innovative solenoid valves.

Our in-depth analysis of the global hydraulic solenoid valve market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Application |

|

|

Pressure Rating |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

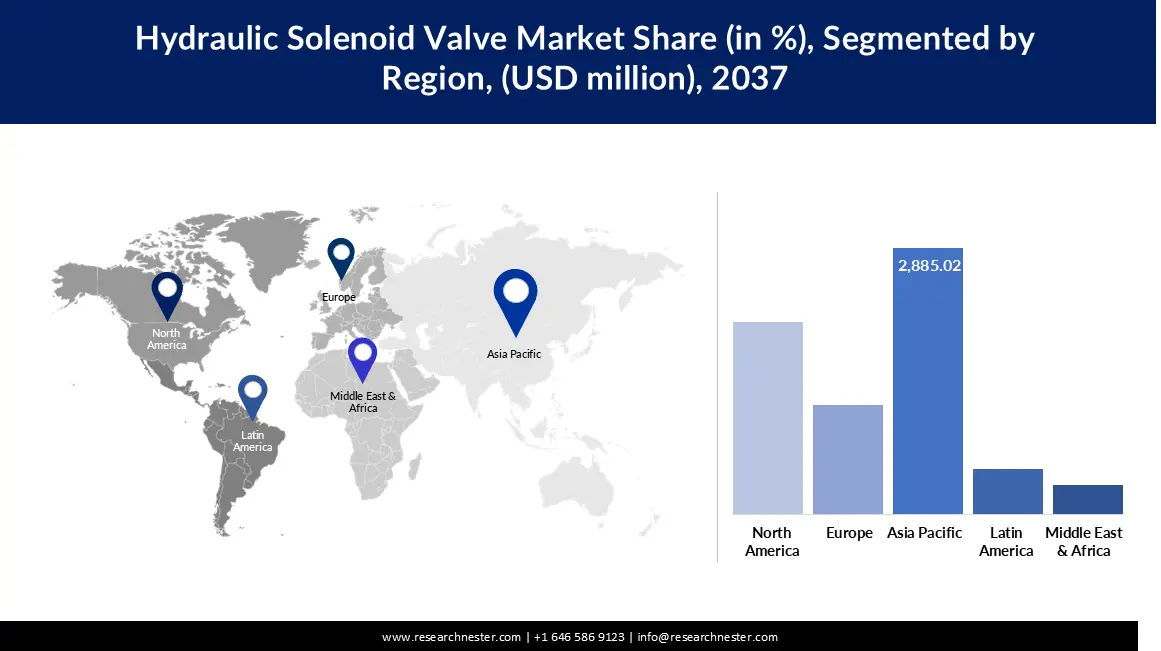

Hydraulic Solenoid Valve Market - Regional Analysis

APAC Market Insights

The hydraulic solenoid valve market in Asia Pacific is estimated to account for 41.4% of the market during the forecast period. Industrialization, urbanization, and government support for smart infrastructure projects are increasing demand for advanced hydraulic solutions. In April 2024, the ISO 1219-1 standard attained wider implementation in Asia, which enhanced cross-border system schematic compatibility and reduced the frequency of manufacturing errors. This has enabled solenoid valve manufacturers to achieve higher worldwide integration and shorter production cycles.

China hydraulic solenoid valve market is expanding at a stable rate as a result of high local demand, export growth, and robust policy support for the equipment manufacturing sector. In January 2024, China expanded the CCC certificate scope to new hydraulic solenoid categories, with mandatory electrical safety, EMC, and endurance testing. Business enterprises that keep up with these regulations will be capable of accessing China's vast industrial base, and CCC certification is now essential for valve exporters targeting Asia. The policy shift is prompting manufacturers to develop product lines and make investments in conformity to remain competitive.

India hydraulic solenoid valve market is expanding on the strength of government support for infrastructure and smart cities, and industrial initiatives. India expanded subsidies under its Smart Cities Mission in May 2024, including hydraulic solenoid valves for water and HVAC applications. The policy shift has significantly surged demand for leak-free, compliant valves for local schemes. The sector is also benefiting from a growing base of local manufacturers and growing requirements for automation by sectors. In June 2024, HYDAC introduced smart diagnostic valves in India with sensors integrated into them for predictive maintenance that reduces downtime for the industrial process. As the nation continues to develop its infrastructure and maintain sustainable development, the hydraulic solenoid valve market will continue its rapid growth trajectory.

North America Market Insights

North America hydraulic solenoid valve market is anticipated to advance at a CAGR of 6% from 2025 to 2037, fueled by the robust industrial foundation and heavy adoption of automation technology. Strong regulatory control and high priority on energy efficiency prevail in the region, as a consequence of which compliant and high-performance hydraulic solenoid valves are in strong demand. The U.S. Commerce Department indicates steady expansion in the hydraulic equipment market, capturing ongoing investment in manufacturing and infrastructure construction. The market encourages innovation and challenges makers to develop advanced, competitive products.

The U.S. hydraulic solenoid valve market is rising on the back of strict emission regulations and a trend toward green manufacturing. In March 2024, the U.S. EPA introduced new emission control rules on energy-efficient and low-leakage hydraulic valves in industrial and HVAC applications. Those players investing in green in eco-designs and digital monitoring are realizing it pays, as market access can now be restricted with non-compliance. The U.S. market is also witnessing increased investments in smart automation and IoT-based valve systems, which are pushing growth upwards.

Canada hydraulic solenoid valve market is developing consistently with the industrialization and adoption of advanced automation technologies. The market is likely to increase at a healthy rate, headed by stainless steel valves, owing to its consistency in extreme conditions and its performance. The industries in the energy sector, water management sectors, and the manufacturing sector are embracing solenoid valves for their consistency and precise control over fluid. The expansion in smart infrastructure and process automation is also fueling demand, propelling Canada to become a key player in the North America market.

Key Hydraulic Solenoid Valve Market Players:

- FEMA Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hyvair

- Taon Hydraulic

- Magnetbau Schramme GmbH & Co. KG

- Sun Hydraulics

- NACHI AMERICA

- Airtac International Group

- MAGNET-SCHULTZ GmbH & Co. KG

- Ningbo Zhenhai Finotek Machinery

- Houston Hydraulic

- Parker Hannifin Corporation

- Bosch Rexroth AG

- Danfoss Power Solutions

- Moog Inc.

- Valcor Engineering Corp.

The hydraulic solenoid valve market is highly competitive with key suppliers such as FEMA Corporation, Hyvair, Taon Hydraulic, Magnetbau Schramme GmbH & Co. KG, Sun Hydraulics, NACHI AMERICA, Airtac International Group, MAGNET-SCHULTZ GmbH & Co. KG, Ningbo Zhenhai Finotek Machinery, Houston Hydraulic, Parker Hannifin Corporation, Bosch Rexroth AG, Danfoss Power Solutions, Moog Inc., and Valcor Engineering Corp. These companies leverage extensive global networks, advanced R&D capabilities, and broad product portfolios to maintain their market positions.

The industry is marked by continuous innovation, strategic partnerships, and a focus on sustainability and compliance. A notable recent development is the July 2024 relocation of IMI’s valve operations to a new 105,000 sq ft. plant in Dorset, UK. This facility supports high-integrity solenoids for industrial use, boosting productivity and reducing lead times under the One IMI model. The move consolidates IMI’s global supply capability and reflects the industry’s focus on operational efficiency and rapid response to customer needs. Such strategic investments and facility upgrades are intensifying competition and driving advancements in product quality and service delivery across the market.

Here are some leading companies in the hydraulic solenoid valve market:

Recent Developments

- In February 2025, Bosch Rexroth and HydraForce revealed compact hydraulic valve solutions at bauma 2025. The collaboration targets OEM construction firms with miniaturized, durable assemblies. The launch enhances mobile machine precision. Their focus is on growth through sustainability and performance.

- In November 2024, Eaton Hydraulics integrated solenoid controls into mobile lift systems. The system improves lift response times in heavy-duty off-highway equipment. It aligns with battery-electric machine initiatives. Eaton boosts its OEM portfolio amid rising electrification.

- In October 2024, Danfoss introduced the KBFRG4-5 industrial hydraulic valve. The IP67-rated design supports 350 bar pressure and offers rapid actuation. It's suited for harsh industrial environments. The product supports energy-efficient fluid control in automation.

- In February 2024, Rotex Automation scaled valve production for electric forklifts. The upgrade supports integration with EV battery cooling and powertrain systems. The valves deliver fast switching and low energy loss. Rotex targets Asia Pacific OEM partnerships.

- Report ID: 7783

- Published Date: Jun 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hydraulic Solenoid Valve Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert