Hydraulic Bolt Tensioner Market Outlook:

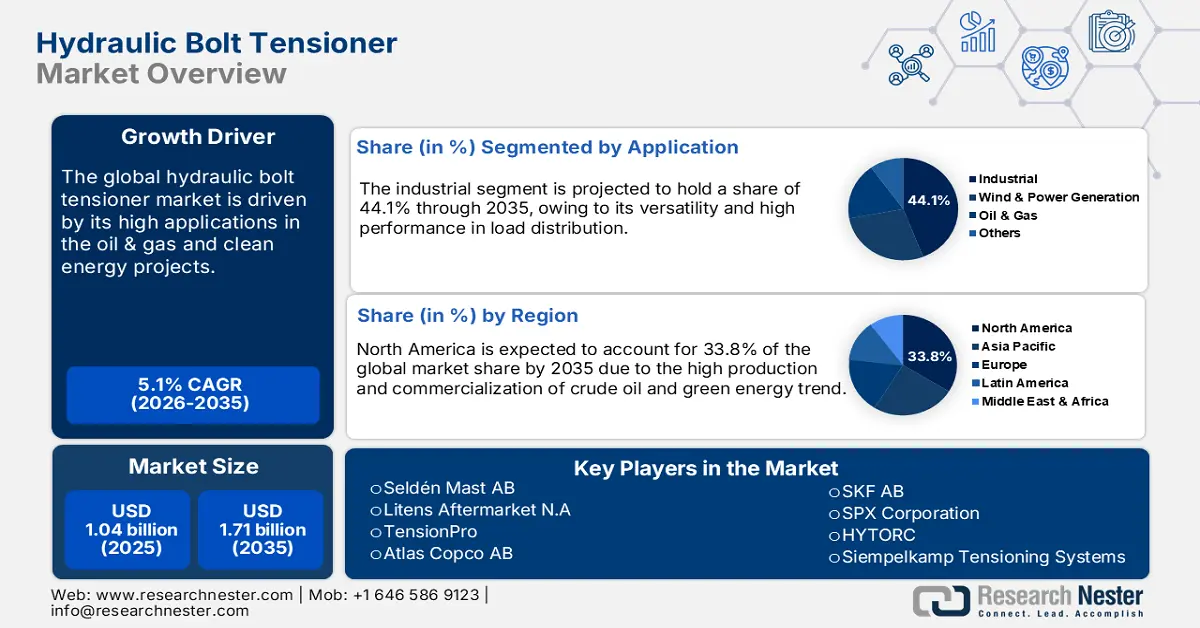

Hydraulic Bolt Tensioner Market size was valued at USD 1.04 billion in 2025 and is expected to reach USD 1.71 billion by 2035, registering around 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hydraulic bolt tensioner is evaluated at USD 1.09 billion.

The rising investments in renewable energy projects are creating significant earning opportunities for hydraulic bolt tensioner manufacturers. Innovative hydraulic bolt tensioners are being widely demanded by the wind energy sector as specialized bolting solutions for turbine assembly and maintenance. The swift rise in wind energy capacity is set to boost the pocket gains of hydraulic bolt tensioner producers. The World Wind Energy Association (WWEA) estimates that the wind energy farms contribute 10.0% to the global power. Around 123 GW of new capacity was added during June 2023 to 2024, driving the total capacity to 1,1 Terawatt.

The International Energy Agency (IEA) states that the total investments in wind energy amounted to USD 180.0 billion in 2023, a rise of 20%. The supportive government policies, clean energy goals, and increasing competitiveness are propelling investments in wind energy. The rise in public-private investments is also driving the importance of wind power production. The offshore technologies are dominating the wind power capacity and account for 93.0% of the total share. China leads the wind energy capacity additions, followed by the European Union and the U.S. The net-zero emission scenario is expected to drive the global wind power capacity to 2,731 GW by 2030.

Key Hydraulic Bolt Tensioner Market Insights Summary:

Regional Highlights:

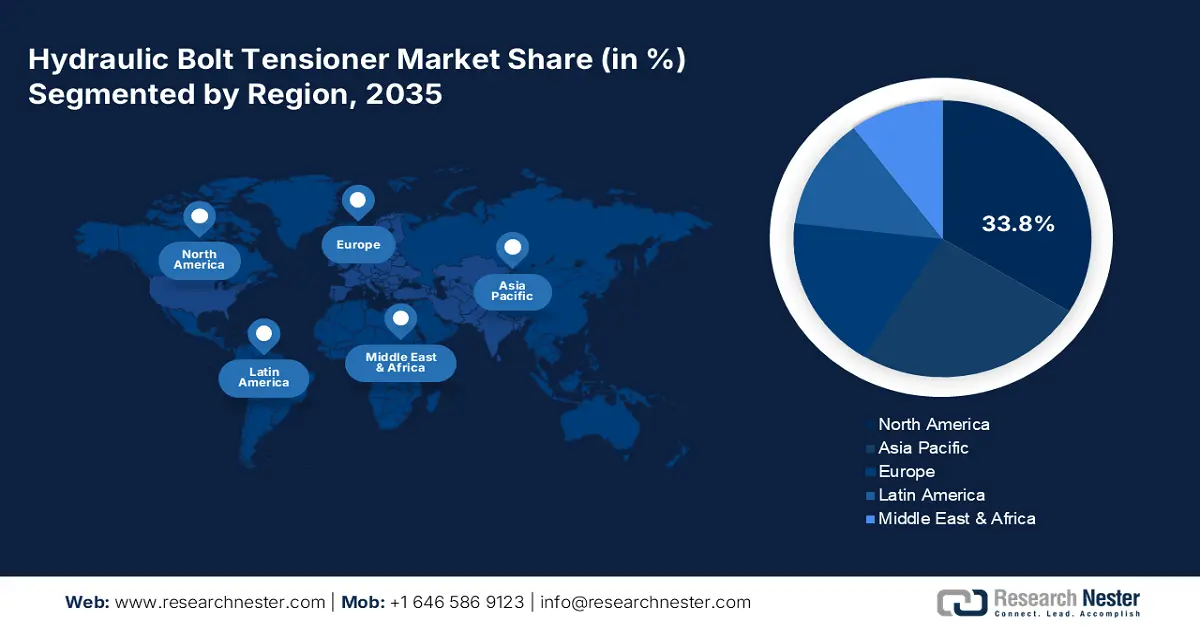

- North America holds a 33.8% share of the Hydraulic Bolt Tensioner Market, propelled by oil & gas industry dominance and growing electric vehicle registrations, driving growth through 2026–2035.

- The Asia Pacific region is projected to experience high growth in the Hydraulic Bolt Tensioner Market from 2026 to 2035, driven by industrial growth, clean energy investments, and booming automotive sector.

Segment Insights:

- The Industrial segment of the Hydraulic Bolt Tensioner Market is expected to achieve a 44.10% share from 2026 to 2035, fueled by rising construction and infrastructure development activities.

Key Growth Trends:

- Rising subsea applications

- High use in automobile manufacturing and maintenance

Major Challenges:

- High capital investment

- Product recalls challenge long-term returns

- Key Players: Seldén Mast AB, Litens Aftermarket N.A, TensionPro, Atlas Copco AB, and SKF AB.

Global Hydraulic Bolt Tensioner Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.04 billion

- 2026 Market Size: USD 1.09 billion

- Projected Market Size: USD 1.71 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Hydraulic Bolt Tensioner Market Growth Drivers and Challenges:

Growth Drivers

- Rising subsea applications: The growing offshore oil and gas exploration activities are anticipated to propel the sales of high-performance hydraulic bolt tensioners. The need for automation to reduce human errors is fueling a high demand for lightweight and compact hydraulic bolt tensioners. Considering these consumers' demands, manufacturers are more focused on the development of innovative hydraulic bolt tensioners. In July 2024, TensionPro introduced advanced and versatile hydraulic tensioners, particularly for subsea applications. This SUB series is widely used for tightening compact and common-sized flanges.

- High use in automobile manufacturing and maintenance: The robust expansion of the global automotive sector represents high sales of hydraulic bolt tensioners. The increasing popularity and adoption of electric vehicles are projected to drive the applications of innovative high-performance hydraulic bolt tensioners in the years ahead. In January 2025, Suzuki Motor Corporation unveiled 3 new vehicle models. Namely, the all-new e-ACCESS, ACCESS, and GIXXER SF250. The electric version of ACCESS uses an auto-tensioner to reduce maintenance. Such developments in the EV segment are foreseen to amplify the sales of tensioners.

Challenges

- High capital investment: The high investment requirement is expected to hamper the market entry of new hydraulic bolt tensioners to some extent in the coming years. The new and small-scale companies are often deterred from the latest hydraulic bolt tensioner market trends and opportunities owing to low budgets. To overcome these challenges, many small companies are entering into strategic collaborations with industry giants to earn lucrative gains. Joint ventures are likely to boost the market reach of the companies and aid them in maximizing their revenue shares.

- Product recalls challenge long-term returns: The production of hydraulic bolt tensioners is a complex process and is integrated with various other manufacturing technologies. The improper development or minor faults often result in product recalls. This directly hinders the goodwill and hydraulic bolt tensioner market shares of the company for the long term. The employment of advanced manufacturing technologies integrated with digital technologies such as predictive analysis, artificial intelligence, big data analytics, and machine learning is likely to aid in overcoming this drawback.

Hydraulic Bolt Tensioner Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 1.04 billion |

|

Forecast Year Market Size (2035) |

USD 1.71 billion |

|

Regional Scope |

|

Hydraulic Bolt Tensioner Market Segmentation:

Type (Topside Bolt Tensioners, Sub-Sea Bolt Tensioners, Wind Bolt Tensioners)

The topside bolt tensioners are highly sought-after products owing to their controlled bolt tensioning, accuracy, versatility, and reduced workplace accidents. Oil and gas, power generation, and other industrial businesses are propelling the trade of topside bolt tensioners. Furthermore, to earn high hydraulic bolt tensioner market shares, leading companies are investing in research and development activities and introducing topside bolt tensioners with the latest versions. For instance, in June 2024, TensionPro revealed the launch of its latest HTR range of hydraulic tensioners. These solutions are designed for topside applications, particularly in the offshore oil and gas sectors. Thus, new product launches are anticipated to boost the revenues of topside bolt tensioner manufacturers in the coming years.

Application (Oil & Gas, Wind & Power Generation, Industrial, Others)

The industrial segment is poised to capture 44.1% of the global hydraulic bolt tensioner market share by 2035. The hydraulic bolt tensioners are vital components in industrial applications owing to their ability to ensure accurate and uniform load distribution across a joint. The swift rise in construction and infrastructure development activities around the globe is fueling the use of industrial hydraulic bolt tensioning systems. They are also widely demanded in heavy machine applications and in maintaining rolling mills, presses, and furnaces.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydraulic Bolt Tensioner Market Regional Analysis:

North America Market Forecast

The North America hydraulic bolt tensioner market is estimated to account for 33.8% of the global revenue share through 2035. The dominance of the oil and gas industry is fueling the sales of hydraulic bolt tensioners. The increasing need for innovative solutions is propelling investments in the R&D of hydraulic bolt tensioners. The growing registrations of electric vehicles are also anticipated to drive the sales of hydraulic bolt tensioners in both the U.S. and Canada. Furthermore, the clean energy trend is likely to double he revenues of hydraulic bolt tensioner manufacturers in the years ahead.

The U.S.'s advancing oil and gas exploration activities are projected to propel the installation of hydraulic bolt tensioners. The onshore and offshore investments are creating a lucrative environment for hydraulic bolt tensioner manufacturers in the country. The U.S. Energy Information Administration (EIA) states that the country’s natural gas demand is increasing by 4% to 116 billion Bcf/d in 2025. The rising export trade and residential and commercial consumption are also contributing to the overall demand.

The expanding renewable energy capacity of Canada is directly fueling the demand for hydraulic bolt tensioners. The leadership in green power production is estimated to offer a healthy growth for the sales of hydraulic bolt tensioners in the country. The Canadian Renewable Energy Association estimates that the solar, wind, and storage capacity of the country increased by 46.0% between 2019 to 2024, with nearly 5 GW added by new wind. The total wind installed capacity of the country is around 18 GW.

Asia Pacific Market Statistics

The Asia Pacific hydraulic bolt tensioner market is projected to expand at a high pace between 2026 to 2035. The region’s robust industrial growth is contributing significantly to the sales of hydraulic bolt tensioners. The public-private investments in the clean energy projects, the booming automotive sector, and domestic hydrocarbon production are opening profitable doors for hydraulic bolt tensioner manufacturers. Investments in China and India are set to double the profits of key market players in the years ahead. Whereas Japan and South Korea are likely to lead the innovations in the hydraulic bolt tensioners.

China’s increasing dominance in the automotive sector, especially EVs, is forecast to increase the demand for hydraulic bolt tensioners. The know-how strategy is benefiting the hydraulic bolt tensioner manufacturers to earn lucrative gains. The IEA report underscores that the battery electric vehicle sales in the country stood at 6.4 million units and plug-in hybrid electric vehicle sales totaled 4.9 million units in 2024. The booming registrations of electric vehicles are directly augmenting the installation of hydraulic bolt tensioners in the country.

The high oil demand and increasing focus on domestic production are driving the attention of hydraulic bolt tensioner companies to invest in India. Supportive government policies and positive foreign direct investments are increasing the hydraulic bolt tensioner trade activities. The India Brand Equity Foundation (IBEF) projects that the country’s refining capacity is likely to reach 309.5 MMTPA by 2028. The consumption of petroleum products totaled 4.44 million barrels per day in 2023, and the LNG imports stood at 28,300 million metric tonnes in 2024. Furthermore, the same source states that nearly USD 640.5 million was allocated to the petroleum and natural gas ministry for phase II of the Indian Strategic Petroleum Reserves Ltd (ISPRL) project in the Union Budget 2025-26.

Key Hydraulic Bolt Tensioner Market Players:

- Seldén Mast AB

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Litens Aftermarket N.A

- TensionPro

- Atlas Copco AB

- SKF AB

- SPX Corporation

- HYTORC

- Siempelkamp Tensioning Systems

- WREN HYDRAULICS

- Pilgrim International

- Nord-Lock Group

- Hi-Force

- SCHAAF GmbH

- Beck Industries

- FPT – Fluid Power Technology.

- Hydraulics Technology Inc.

- TorcUp Inc.

- ITH bolting technology

- Powermaster Engineers Pvt Ltd.

- Technofast Industries Pty Ltd

The top companies in the hydraulic bolt tensioner sector are employing several organic and inorganic strategies such as technological innovations, new product launches, collaborations & partnerships, mergers & acquisitions, and regional expansions to earn high profits. The continuous investments in new product innovations are anticipated to boost he revenue growth of the hydraulic bolt tensioner market players. Technological collaborations and strategic partnerships with high-tech companies are likely to lead to the development of next-gen hydraulic bolt tensioners. Furthermore, the regional expansion tactics are poised to help key players earn high profits from untapped opportunities.

Some of the key players include:

Recent Developments

- In February 2025, Seldén Mast AB revealed the introduction of the Halyard Tensioner 32 solution. This system is perfect for sails, including furling mainsails and headsails used on a jib furling system, which are permanently hoisted.

- In August 2024, Litens Aftermarket N.A announced the development of a new line of hybrid tensioners, the Alpha Hybrid Tensioner and Hybrid V-Tensioner. These tensioners are manufactured for mild hybrid applications and are available in Litens’ new hybrid tensioner kits.

- Report ID: 7594

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hydraulic Bolt Tensioner Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.