Compressed Air Treatment Equipment Market Outlook:

Compressed Air Treatment Equipment Market size was over USD 9.44 billion in 2025 and is anticipated to cross USD 17.07 billion by 2035, growing at more than 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of compressed air treatment equipment is assessed at USD 9.96 billion.

The expansion is attributed to the world's increasing industrialization, which is driving up demand for compressed air solutions in several sectors, such as manufacturing, automation, and construction. As per a report in 2023, a 9% increase from 2018 sees 66% of firms either utilizing automation or showing interest in doing so. Compressed air powers pneumatic tools, control systems, and machinery, which are employed in several industrial operations. The growing demand for trustworthy and efficient compressed air solutions to assist with industrial processes is boosting market expansion even further.

Compared to other power sources, air compressors are typically less expensive and require less maintenance. Since they require an electrical source, hydraulic pump, diesel or gasoline engine, power take-off (PTO), and air compressor to operate, they also require less physical labor. They are therefore a fantastic choice for companies trying to cut expenses and lessen their environmental effect. through lowering the total weight of the equipment required for GVM and trailers on trucks. while simultaneously reducing the amount of actual space that larger pieces of equipment occupy. Therefore, these benefits of air compressors are propelling the market growth.

Key Compressed Air Treatment Equipment Market Insights Summary:

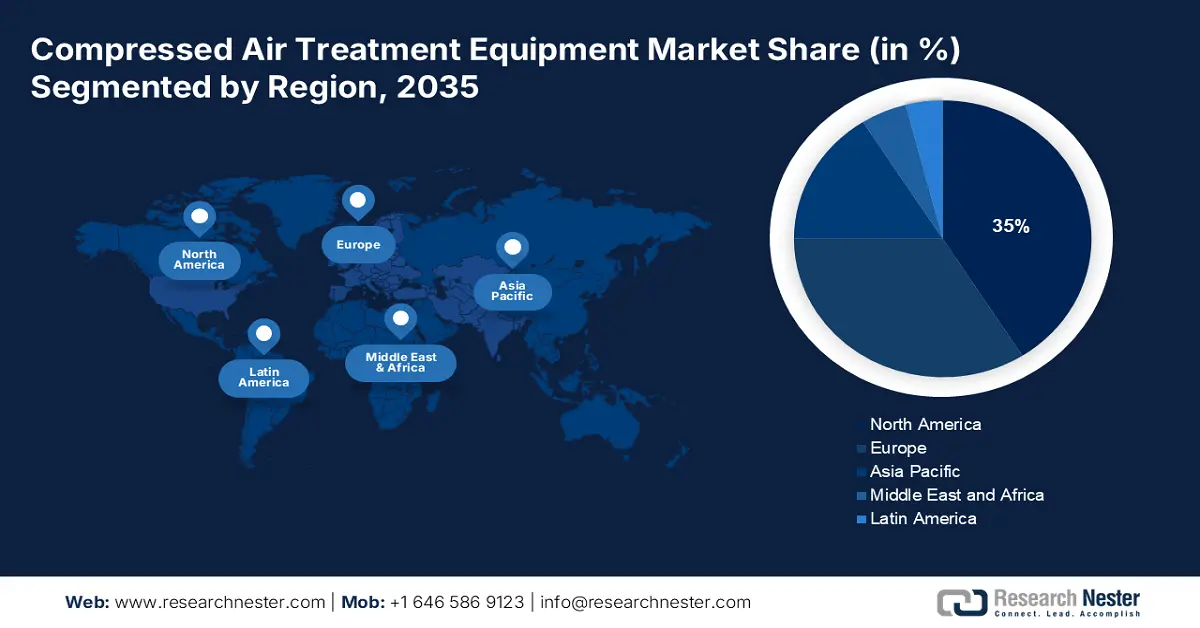

Regional Highlights:

- The North America compressed air treatment equipment market will dominate around 35% share by 2035, attributed to rising industrial activity and energy-efficient solution needs.

- The Asia Pacific market will secure 29% share by 2035, driven by the expansion of industrial facilities and infrastructure investment.

Segment Insights:

- The compressor segment in the compressed air treatment equipment market is expected to achieve significant growth through 2035, driven by the increasing demand for compressors in manufacturing and energy sectors.

- The manufacturing segment in the compressed air treatment equipment market is witnessing significant growth through 2035, driven by the rising demand for automation and pneumatic tools.

Key Growth Trends:

- Surge in the Adoption of Industry 4.0 Technologies

- Increased Shift Towards Rental Services

Major Challenges:

- Higher Energy Consumption

- Environmental Impacts due to the Air Compressors may Hamper the Market Growth

Key Players: Equipment Limited, ZF Friedrichshafen AG, Atlas Copco AB, Ingersoll Rand Inc., Kaeser Kompressoren SE, Quincy Compressor, Campbell Hausfeld, Powerex Inc., FS-ELLIOTT CO., LLC, Beko Technologies.

Global Compressed Air Treatment Equipment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.44 billion

- 2026 Market Size: USD 9.96 billion

- Projected Market Size: USD 17.07 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 16 September, 2025

Compressed Air Treatment Equipment Market Growth Drivers and Challenges:

Growth Drivers

- Surge in the Adoption of Industry 4.0 Technologies - The market is experiencing a rise in the integration of Industry 4.0 technologies, such as the usage of IoT in smart compressors for predictive maintenance and real-time monitoring. According to a survey, in Industry 4.0 at the top of the list is the Internet of Things (IoT), which almost 72% of respondents agreed would have the greatest influence on Industry 4.0 technology in their company. Furthermore, as a result of the ongoing emphasis on energy economy, complex control systems and variable-speed drives are being developed. Manufacturers are being compelled to create oil-free compressors and ecologically friendly refrigeration systems due to the increasing significance of sustainable practices. Compact and modular designs are becoming more and more common due to their flexibility and ability to maximize space.

- Increased Shift Towards Rental Services - There is a discernible shift away from ownership and toward rental services, which provide firms with more affordable options.

By placing a strong emphasis on remote accessibility and user-friendly interfaces, manufacturers are enhancing the usefulness of compressed air systems. When everything is said and done, these patterns show how committed the sector is to efficiency, robustness, and adaptability to shifting consumer demands and environmental concerns. The maintenance costs associated with new machine purchases are a major deterrent for some businesses choosing to rent industrial air compressors instead. - Increasing Adoption of Electric Compressors - Electric compressors, which provide better performance and environmental advantages, have become a crucial answer. Modern electric compressors provide the same power output as diesel compressors of a similar capacity, but they also have the advantage of operating more quietly and typically having a cheaper total cost of ownership. Additionally, more flexible, electric compressors can be used indoors or after hours. Electric compressors of today and tomorrow are built to withstand the demanding conditions seen on many construction sites, which makes them a perfect option for achieving sustainability goals without compromising the performance and dependability that are essential for an air compressor.

Challenges

- Higher Energy Consumption - High energy use during compression raises operating costs, which affects a business's ability to remain financially viable overall. The high-power needs of Compressed Air Treatment Equipment become a turnoff as enterprises value sustainability and energy efficiency more and more. This problem forces companies to look for other ways to solve their problems, which slows down the widespread use of Compressed Air Treatment Equipment and highlights the market's need for more energy-efficient products.

- Environmental Impacts due to the Air Compressors may Hamper the Market Growth

- Need for Regular Maintenance may Impede the compressed air treatment equipment market growth

Compressed Air Treatment Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 9.44 billion |

|

Forecast Year Market Size (2035) |

USD 17.07 billion |

|

Regional Scope |

|

Compressed Air Treatment Equipment Market Segmentation:

Component Segment Analysis

Compressor segment for compressed air treatment equipment market is expected to hold a share of 46% during the forecast period. The increasing demand for compressor components across a range of sectors is expected to drive considerable growth in the compressor component industry. In order to provide the required pressure for uses like manufacturing, building, and energy production, compressors are essential.

The demand for compressed air is only going to expand due to global manufacturing activities, infrastructure expansion, and industrialization. For instance, the amount of public and private money from the United States for a global effort to develop infrastructure in underdeveloped countries goes above and beyond the USD 30 billion estimate that was made public in May. China's Belt and Road Initiative, which is celebrating its tenth anniversary this year, is rivaled by the Partnership for Global Infrastructure and Investment, or PGI. By 2027, additional G7 members aim to raise USD 400 billion. Further supporting the projected growth is the development of compressor technology, which is centered on sustainability and energy efficiency as organizations look for more dependable and ecologically friendly ways to meet their compressed air needs.

End-use Segment Analysis

Manufacturing segment of compressed air treatment equipment market is expected to hold a share of 30% during the projected period. The market is witnessing a notable surge in the manufacturing sector owing to various factors, including the increasing demand for automation and pneumatic tools in production procedures. These systems provide stable and efficient power for a variety of applications, which increases productivity in manufacturing operations. Energy-efficient solutions are a focus for industries as well, and modern compressed air treatment equipment usually incorporates state-of-the-art technologies to optimize energy consumption. Due to tightening quality requirements and an increasing emphasis on precision manufacturing, the market is growing.

Our in-depth analysis of the global market includes the following segments

|

Component |

|

|

End-use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Compressed Air Treatment Equipment Market Regional Analysis:

North American Market Insights

North American compressed air treatment equipment market is expected to hold a share of 35% during the forecast period. The rise in industrial activity, the expansion of infrastructure, and the need for energy-efficient solutions are all attributed to the growth. Growth in the market is being driven by the region's growing manufacturing sector as well as higher investments in oil and gas projects. For instance, in North America, 523 oil & gas projects are scheduled to start production between 2022 and 2026. Of the anticipated oil & gas projects, 295 are midstream projects, accounting for more than 56% of the total. Furthermore, strict regulations that promote energy efficiency and the use of cutting-edge technologies also contribute to the market's growth. Significant expansion in the compressed air treatment equipment market in North America is being driven by the emphasis on automation and smart manufacturing practices, which in turn fuels the demand for dependable compressed air equipment.

APAC Market Insights

Compressed Air Treatment Equipment market in Asia Pacific is poised to hold a share of 29% by the end of 2035. The expansion of industrial facilities and infrastructure investment in China, India, and Japan is expected to drive a large increase in the compressed air equipment market in the Asia Pacific region in the coming years. Additionally, a rise in the number of production units utilizing contemporary automation technologies is probably going to increase product sales. Because top manufacturers are readily available, compressed air treatment equipment has had a significant impact on the regional food & beverage industry.

Compressed Air Treatment Equipment Market Players:

- Equipment Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ZF Friedrichshafen AG

- Atlas Copco AB

- Ingersoll Rand Inc.

- Kaeser Kompressoren SE

- Quincy Compressor

- Campbell Hausfeld

- Powerex Inc.

- FS-ELLIOTT CO., LLC

- Beko Technologies

Recent Developments

- February 2024 - One of the top producers of air compressors worldwide, ELGi Equipments Limited, parent company of ELGi North America (ELGi), will exhibit at the world's largest equipment rental trade exhibition, the American Rental Association's annual trade show (ARA exhibition 2024). At booth #5957, ELGi will demonstrate its cutting-edge mobile compressed air solutions. The Ernest N. Morial Convention Center in New Orleans, Louisiana, will host the event from February 18–21. Three portable compressed air solutions—the ELGi D90KA, ELGi D185T4F, and ELGi D300T4F—that are focused on dependability, silent operation, durability, and fuel efficiency will be on display by ELGi.

- April 2023 - The world debut of a significant next-generation eMobility product has been unveiled by ZF's Commercial Vehicle Solutions (CVS) division, as part of the company's latest push to decarbonize the commercial vehicle industry. Air is forced into the fuel cell by a new compressor, allowing a chemical reaction to occur that produces energy. Additionally, ZF has said that it has an exclusive development agreement with the product sector of the Liebherr Group that deals with aerospace and transportation. ZF will be the only company to supply commercial vehicles with the cutting-edge fuel cell air compressor systems that the partners will create for their separate client bases.

- Report ID: 5945

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Compressed Air Treatment Equipment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.