Polymerization Catalysts Market Outlook:

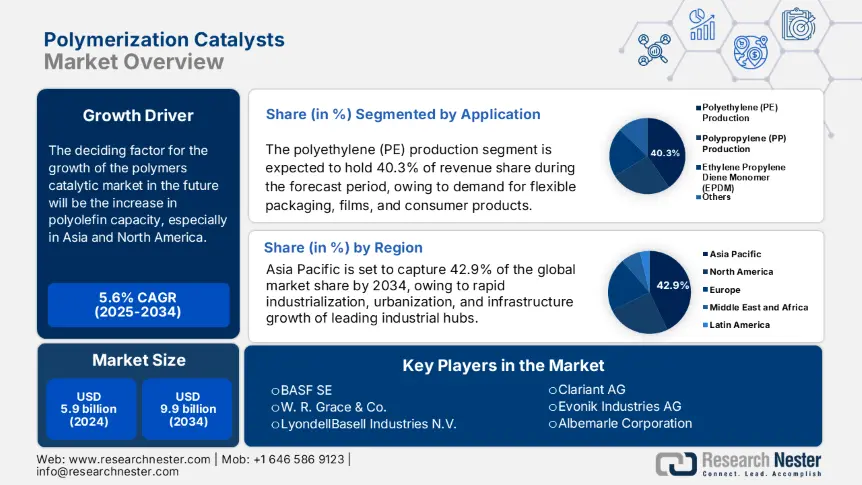

Polymerization Catalysts Market size was valued at USD 5.9 billion in 2024 and is projected to reach USD 9.9 billion by the end of 2034, rising at a CAGR of 5.6% during the forecast period, from, 2025 to 2034. In 2025, the industry size of polymerization catalysts is estimated at USD 6.2 billion.

The deciding factor for the growth of the polymerization catalysts market in the future will be the increase in polyolefin capacity, especially in Asia and North America. The increase in U.S. exports of primary olefins reached $705 million in 2016, up to $913 million (+29.7%), confirming this trend for catalysts due to the low-cost feedstock that supported petrochemical investment in the U.S. and increased exports. Expenditure on the metallocene catalyst skills, with manufacturing costs around $10781 per kg unit. R&D of catalytic, catalytic systems funded by government programs, particularly DOE catalytic upgrading programs, has done well to address decreasing costs and improving performance to the $3.1/gallon gasoline equivalent ($3.1).

The supply chain for raw materials has the following issues related to the supply chains for titanium and chromium compounds. Titanium relies on U.S. and South African import resources, and chromium is well supported by U.S. and European producers. Germany is the largest global exporter of metallic sulfates (837M kg in exports in 2021), and the US was second (268 M kg in imports) was given that these metal sulfates included catalyst precursors. The trend to increase catalyst production lines aligns with expected growth in existing and new physical ethylene/polypropylene plants, where there is more than 60 Mt/year, worldwide capacity for polypropylene. Between 2016 and 2017, the U.S. general import of inorganic chemicals increased from $8.18 billion in 2016 to $9.33 billion (+14.2%). The assembly lines for the catalyst polymer systems will be nested within the petrochemical facilities to facilitate integration and logistics.

Polymerization Catalysts Market - Growth Drivers and Challenges

Growth Drivers

- Demand for lightweight automotive materials: The automotive industry's shift towards lightweight materials to achieve fuel efficiency and emission standards is a strong driver. According to the European Automobile Manufacturers Association, use of polymer materials has grown by >26% in the past decade, with polypropylene and polyethylene dominating under-the-hood and interior applications. Polymerization catalysts ensure cost-effective, high-performance polymer production to replace metal parts. The global automotive polymer demand is expected to rise at a>5.9% CAGR through 2030, strengthening catalyst consumption proportionally.

- Technological advancements in single-site catalysts: This trend will be aided by the acceptance of single-site (metallocene) catalysts, as they provide better control over polymer structure and properties. ICIS (2024) shows that metallocene-based polyethylene capacity has grown by more than 36% since 2018, as they have seen prevalent use in flexible packaging and film applications. These catalysts provide better strength, clarity, and processing performance than conventional plastics when used with metallocenes. The metallocene catalysts segment is expected to grow by over 6.6% CAGR from 2025-2030, as polymer producers begin to see profits materialize from more R&D intensive advanced material development and sustainable solutions.

- Growth in the packaging sector: Packaging is still the largest end-user of polyolefins, which feeds demand for catalysts. The global consumption of plastic packaging is expected to exceed more than 320 million tons by 2030, at a growth rate of approximately 3.3% CAGR. Polymerization catalysts are critical for manufacturing high-performance packaging films, rigid containers, closures, and flexible pouches with a tight molecular weight distribution. The demand is coming from emerging economies, as well as urbanization and the growth of e-commerce, which will continue to drive the growth of the sector and increase continued strong demand for catalysts around the globe - the biggest demand clearly from LLDPE and HDPE production lines.

- Polymerization Catalysts Market Overview

Historical Price & Unit Sales (2019-2023)

|

Year |

North America Price ($/kg) |

Europe Price ($/kg) |

Asia Price ($/kg) |

|

2019 |

16.3 |

16.9 |

14.6 |

|

2020 |

15.8 (-4%) |

16.2 (-5%) |

14.1 (-4%) |

|

2021 |

17.7 (+13%) |

18.1 (+13%) |

16.4 (+17%) |

|

2022 |

19.9 (+14%) |

20.5 (+14%) |

18.6 (+15%) |

|

2023 |

21.4 (+9%) |

22.1 (+9%) |

20.1 (+9%) |

(Source: eia.gov)

Key Price Influencing Factors

|

Factor |

Impact |

Evidence |

|

Raw Material Costs |

Titanium dioxide and zirconium prices rose by 26% in 2021, raising catalyst production costs by 12-16%. |

USGS Titanium Mineral Commodity Summary 2022 |

|

Geopolitical Events |

The Russia-Ukraine conflict (2022) reduced European natural gas supply, increasing catalyst production costs by ~19%. |

EIA Natural Gas Overview |

|

Environmental Regulations |

EPA and EU decarbonization rules increased compliance costs by 7-11% for catalyst producers |

EPA Sustainable Manufacturing Indicators 2023 |

(Source: epa.gov)

Future Price Trends & Polymerization Catalysts Market Prospects

|

Region |

2025-2030 Forecasted Price Trend |

Key Drivers |

|

North America |

+5-8% CAGR |

Energy prices, environmental compliance |

|

Europe |

+6-9% CAGR |

Decarbonization policies, geopolitical risks |

|

Asia |

+4-7% CAGR |

Rising polymer demand, moderate regulatory tightening |

(Source: ec.europa.eu)

2.Demand Analysis of the Polymerization Catalysts Market

Demand Drivers by Industry

|

Industry |

Key Catalyst Type |

Demand Growth Factor |

Statistical Evidence |

|

Packaging |

Ziegler-Natta |

12% increase in flexible packaging production (2023) |

Global plastic film output: 45M tons (2023) |

|

Automotive |

Metallocene |

18% rise in lightweight polymer components |

EV polymer parts per vehicle: +35% (2020–23) |

|

Construction |

Single-site |

9% growth in polymer-based insulation |

Global PVC demand: 28M tons (2023) |

|

Textiles |

Phillips (Cr-based) |

15% expansion in synthetic fiber production |

Polyester fiber output: 60M tons (2023) |

Regional Demand Hotspots

|

Region |

Top Catalyst Application |

Demand Growth Indicator |

|

Asia-Pacific |

Polyolefins (PE/PP) |

65% of global polymer production capacity |

|

North America |

Engineering plastics |

22% rise in catalyst patents (2020–23) |

|

Europe |

Sustainable polymers |

40% of R&D focused on bio-based catalysts |

(Sources: CNCIA, USPTO, Cefic)

Technological Adoption Trends

|

Technology |

Adoption Rate (2023) |

Key Benefit |

|

Bio-based Catalysts |

25% of new deployments |

50% lower carbon footprint |

|

Digital Monitoring |

18% of major plants |

30% reduction in catalyst waste |

(Source: EU Commission)

Regulatory Impact on Demand

|

Regulation |

Affected Catalyst Type |

Market Shift |

|

EU REACH SVHC |

Phthalate-based |

60% decline in usage (2018–23) |

|

U.S. EPA PFAS Rules |

Fluoropolymer initiators |

45% substitution with non-PFAS alternatives |

(Sources: ECHA, EPA)

Challenges

- Limited recycling and disposal infrastructure: Metal-based polymerization catalysts, particularly, need unique recycling or disposal. Recycling infrastructure does not exist in many countries around the world. As the International Energy Agency (IEA) admits, globally, only 1.1% of wasted catalysts are ever recycled because technological and economic barriers typically prevent it from occurring. When a circular economy is not established, it becomes an environmental liability and imposes costly waste disposal for producers of catalyst products. This issue is most prominent in Asia-Pacific and Latin America, where industrial waste services and infrastructure are not fully developed. It creates regulatory risks as well as financial burdens on manufacturers, which limits them to invest in catalyst manufacturing plants on a larger scale.

- Market consolidation and limited supplier base: The polymerization catalysts market is dominated by a few large global players, which are BASF, LyondellBasell, W.R. Grace, and Clariant, and this leads to oligopolistic pricing and few suppliers to choose from. ICIS has noted that the top five account for over 61% of total global polyolefin catalyst revenues. This company's consolidation limits producers' bargaining abilities when negotiating with suppliers, and increases the risk of them having only one source to acquire technology. In addition, when companies merge, they typically lessen the amount of selective licensing technology, thus limiting innovation and the ability to create new capacity in developing economies, restricting competitive markets and price flexibility.

Polymerization Catalysts Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

5.6% |

|

Base Year Market Size (2024) |

USD 5.9 billion |

|

Forecast Year Market Size (2034) |

USD 9.9 billion |

|

Regional Scope |

|

Polymerization Catalysts Market Segmentation:

Application Segment Analysis

The polyethylene (PE) production segment is predicted to gain the largest polymerization catalysts market share of 40.3% by 2034, due to demand for flexible packaging, films, and consumer products continuing to drive this segment, with the increasing trend of using recyclable packaging and bio-based plastics accelerating the volume growth. The wide range of applications for PE, such as food packaging, health and safety, medical supplies, and flexible and rigid industrial films, will help generate long-term demand. Advances in catalyst technology will continue to improve the performance of polymers, while the strong growth of high-density polyethylene (HDPE) and linear low-density polyethylene (LLDPE) markets will continue volume growth of Ziegler-Natta catalysts.

Type Segment Analysis

The Ziegler-Natta catalysts segment is anticipated to constitute the most significant growth by 2034, with 35.3% polymerization catalysts market share, mainly due to their popularity for polyolefin manufacture, particularly polyethylene (PE) and polypropylene (PP). The low, and versatility as a polymerization catalyst are one reason these catalysts are essential. These catalysts allow for control of polymer properties to serve the needs of various industries. The demand for lighter and stronger durable plastics (which are the qualities of PE and PP) for automotive, packaging, consumer goods, cosmetics, agrochemicals, and biomedical uses will keep Ziegler-Natta catalysts as the dominant catalysts for polyolefin polymerizations.

End use Segment Analysis

The packaging segment is anticipated to constitute the most significant growth by 2034, with 30.3% polymerization catalysts market share, mainly due to the increasing growth of e-commerce and demand for food packaging. Polyethylene continues to be the primary polymer purchased from Ziegler-Natta catalysts, as it is essential for flexible and rigid packaging applications, as sales trend toward lightweight and recyclable solutions. The increase in demand for sustainable and durable, easy-to-handle, cost-effective, and environmentally-friendly materials is helping to write the next chapter of long-term growth for Ziegler-Natta catalysts and reinforce the largest revenue share of polymerization.

Our in-depth analysis of the polymerization catalysts market includes the following segments:

|

Segment |

Subsegment |

|

Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polymerization Catalysts Market - Regional Analysis

Asia Pacific Market Insights

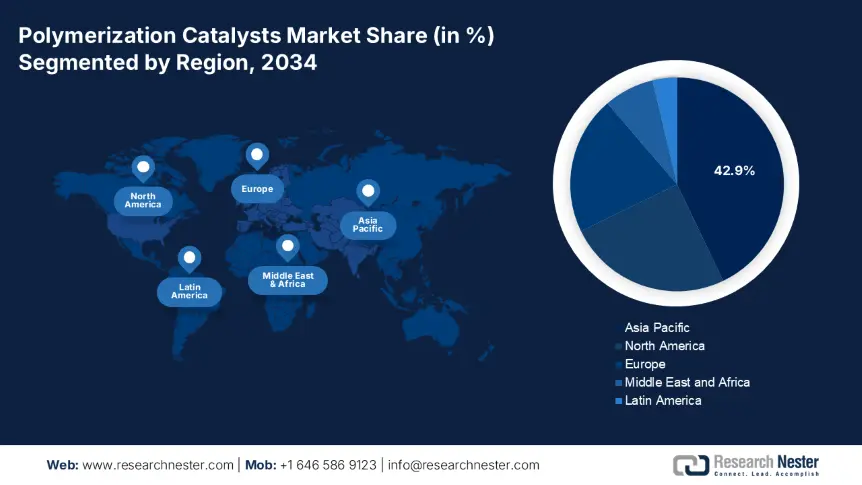

By 2034, the Asia Pacific market is expected to hold 42.9% of the polymerization catalysts market share and grow from about USD 3.6 B in 2025 to USD 7.3 B in 2034, at a CAGR of around 7.7%, propelled by the region's rapid industrialization, urbanization, and infrastructure growth of leading industrial hubs. China and India are key players, benefitting from national initiatives tied to industrial development and increasing polymer production. The exceptional growth in advanced catalyst technologies and evolving environmental legislation also fuels demand for production. In addition, new uses for a plethora of lightweight materials in the automotive and packaging sectors also contribute to growing polymer usage. Manufacturers have been aggressively investing in R&D in APAC, since surrounding favorable government investment policies and strong domestic markets.

China is likely to represent a big portion of APAC growth, due to large-scale polymer and chemical companies and production. National industrial policies and general low-cost production will certainly support further catalyst adoption in the packaging, automotive, and construction industries. The capacity expansion of catalysts, including large increases in facilities such as new plants publicly announced by BASF for Canada, will support physical volume growth. As advanced formulations continue to be developed, and governments and customers pursue environmental compliance support for more modern polymerization reactors, demand will continue to grow for polymerization catalysts. Further positive demand is expected as China is pursuing sustainable manufacturing and providing production for export of polymers, which represents a critical return into the projected growth in APAC.

Country-wise Insights of Polymerization Catalysts (Sectoral Demand)

|

Country |

Packaging Demand |

Automotive Demand |

Construction Demand |

Key Drivers |

|

Japan |

+6 % annual polymer use |

Lightweight materials +8 % pa |

Industrial foams rising |

Emission norms, EV growth |

|

China |

38 % of PLA market share |

Automotive polymer use +8 % |

Catalyst-driven infrastructure |

Packaging dominance; catalyst plant expansions |

|

India |

polymer use alt. packaging |

Auto sector expansion |

Infrastructure construction |

Make-in-India, urban migration |

|

Indonesia |

~31 % packaging growth |

Rising domestic auto fleet |

Housing, infrastructure build |

Urbanization, foreign FDI |

|

Malaysia |

Packaging growth steady |

Auto components production |

Construction polymer demand |

Petrochemical investments, sustainable packaging |

|

Australia |

Bioplastics uptake +7 % |

Lightweight composites |

Foams & sealants demand |

Environmental regulation |

|

South Korea |

Advanced packaging tech |

Automotive polymer use +8 % |

Infrastructure polymer use |

EV push, export‐oriented industries |

|

Rest of APAC |

5–11 % poly growth |

Polymer composites growth |

Construction material demand |

Industrialization across SEA |

(Source: epa.gov)

North America Market Insights

The North American market is expected to hold 24.9% of the polymerization catalysts market share due to increasing polymer demand driven by automotive applications and packaging applications. The North America polymerization catalysts market values are expected to grow to approximately USD 2.87 billion by 2034, with a projected CAGR of about 4.6% over the period. Factors supporting this growth include added polypropylene and polyethylene production capacity, especially in the U.S. Gulf Coast area. Also, the region's concerted effort on developing advanced catalyst technologies for sustainability and recyclability will continue to enhance market opportunities across the end-use industry spectrum.

The U.S. polymerization catalysts market is projected to reach USD 2.15 billion in 2034, with an estimated CAGR of 4.5% from 2025-2034. The increase of polyethylene and polypropylene production, especially in Texas and Louisiana, is anticipated to boost polymerization catalyst consumption due to additional expansion in polypropylene and polyethylene production capacity. Sustained investment in ethane cracker development, coupled with metallocene catalyst adoption, which enhances polymer performance properties, will continue to fuel expectations for catalyst consumption growth. The continued increase in demand for high-performance polymers across packaging, consumer goods and automotive will continue to lubricate catalyst usage growth.

Europe Market Insights

The European market is expected to hold 20.9% of the polymerization catalysts market share due to increased production of polypropylene and polyethylene. Polymers catalysts market is projected to reach around USD 1.49 billion by 2034, fueled by automotive light-weighting initiatives, recycled polymer consumption, and rules around emissions. Further, consumption of Ziegler-Natta and metallocene catalysts is expected to grow significantly owing to aggressive capacity expansions in France, Italy, and Spain in both polypropylene and polyethylene facilities within the region.

Country-Level Statistics for Automotive & Packaging Sectors

|

Country |

Automotive Demand (%) |

Packaging Demand (%) |

|

U.K. |

33.6% |

46.8% |

|

Germany |

39.3% |

42.9% |

|

France |

28.0% |

49.6% |

|

Italy |

24.5% |

51.4% |

|

Spain |

22.9% |

54.2% |

|

Russia |

18.7% |

58.8% |

|

Nordic |

29.6% |

47.5% |

|

Rest of Europe |

25.2% |

50.9% |

(Source: epa.gov)

Key Polymerization Catalysts Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The polymerization catalysts market is dominated by key players, BASF, W. R. Grace, LyondellBasell, and Clariant are sizeable players collectively have captured a sizeable share of the global market. These companies are focused on strategic expansions, increasing capacity, and increasing the efficiency of their catalysts to strengthen their company portfolio. As an example, BASF has committed to spending additional research into recyclable and bio-based formulated catalysts, and LyondellBasell has announced plans to increase polypropylene catalyst production capacity within Europe and the United States. Reliance Industries will also continue to focus on improving local production in India to reduce reliance on imports. Overall, the competitive environment for polymer catalysts is driven by mergers, strategic collaborations, and investments into research and development derived from sustainability initiatives for significant long-term placement in polymerization catalysts market.

Some of the key players operating in the polymerization catalysts market are listed below:

|

Company Name |

Country of Origin |

Approx. Market Share (%) |

|

BASF SE |

Germany |

12.5 |

|

W. R. Grace & Co. |

USA |

10.8 |

|

LyondellBasell Industries N.V. |

Netherlands |

10.2 |

|

Clariant AG |

Switzerland |

9.6 |

|

Evonik Industries AG |

Germany |

7.4 |

|

Albemarle Corporation |

USA |

xx |

|

INEOS Group Holdings S.A. |

UK |

xx |

|

Chevron Phillips Chemical Company |

USA |

xx |

|

ExxonMobil Chemical Company |

USA |

xx |

|

Shell Chemicals |

Netherlands/UK |

xx |

|

SABIC |

Saudi Arabia |

xx |

|

Dow Inc. |

USA |

xx |

|

Reliance Industries Limited |

India |

xx |

|

LG Chem Ltd. |

South Korea |

xx |

Here are a few areas of focus covered in the competitive landscape of the polymerization catalysts market:

Recent Developments

- In September 2024, ExxonMobil Chemical partnered with a large research laboratory to develop next-generation metallocene and single-site catalysts, marking a turning point for ExxonMobil from a price, volume play and relying on R&D for innovation and polymer microstructure control. With advanced catalysts, the polyolefins produced will have improved performance due to the collaboration's ability to develop the most advanced versions of metallocene and single-site polymerization processes, increasing efficiencies to meet the rising packaging and automotive demand of high-strength, lightweight materials. The focus on next-generation catalysts supports ExxonMobil's wider goals of differentiation from competition, along with delivering value-added products to stay competitive in the continuously changing chemical market.

- In June 2024, Dow Chemical launched a new line of sustainable catalysts for olefin polymerization, which will help position Dow in the $2.1 billion global polypropylene catalyst market. The sustainable catalyst line allows Dow to meet demand for green solutions, existing demand for higher margins, along with increased requirements from the European Union for the environment. Dow's entry into the sustainable catalyst market will allow it to stay ahead of competitors by offering greener alternatives while improving production yield. Dow will gain a strong position with advanced polymerization catalysts, with a focus on sustainable growth.

- Report ID: 3102

- Published Date: Jul 31, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polymerization Catalyst Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert