Biocatalyst Market Outlook:

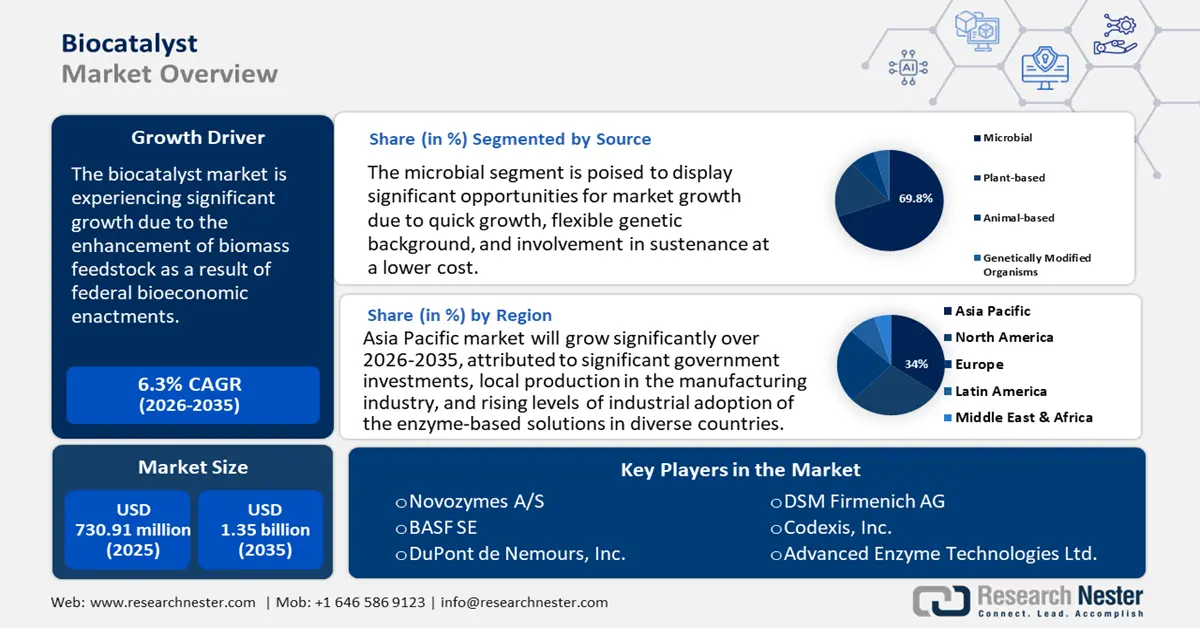

Biocatalyst Market size was valued at USD 730.91 million in 2025 and is projected to reach USD 1.35 billion by the end of 2035, rising at a CAGR of 6.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of biocatalyst is evaluated at USD 776.92 million.

The biocatalyst market is anticipated to grow at a rapid rate, primarily due to the enhancement of biomass feedstock resulting from federal bioeconomic enactments. The current U.S. efforts are aimed at upscaling biomass pre-processing, storage, transportation, and genetic enhancements in order to serve as feedstock to downstream enzyme and microbial biocatalyst production plants. Such investments minimize the fluctuations in the feedstock prices and help maintain constant input magnitudes into production facilities. The Biomass Feedstocks Innovation Program will invest £36 million in the development of sustainable domestic biomass to increase its output. Improved and integrated logistics reduce per-unit costs of production and reduce supply disruptions. As a result, there is an enhanced homogeneity in the manufacturing operations of industrial enzymes. R&D in biomass genetics and supply chain resiliency is already sustained through public funding, which drives more predictable scale-up in enzyme-based manufacturing by reducing operational risk.

The biocatalyst supply ecosystem incorporates the biomass feedstock supply chain, enzyme production, manufacturing scale-up, and international supply of raw materials. The federal program stimulates the use of assembly lines in high biomass areas, which further decentralizes production and lessens the dependency on the importation of special input, either in the form of natural oils or rubber-based compounds. More general categories offer relevant pricing benchmarks, for instance, according to data from the Bureau of Labor Statistics, the PPI for rubber compounds or mixtures rose slightly from 305.673 to 307.049, while rubber products for mechanical use edged up from 146.993 to 147.057. Research, development, and deployment in the area of biotech manufacturing scale-up is supported by public investment mechanisms, which include SBIR grants, corporate R&D agreements, and licensing by federal agencies. A large percentage of biotech and enzyme-related industries have tapped into this federal aid program, and this has propelled the faster fermentation scale, the pilot plant capacity, and the exportability. On trade, biotechnology products are a sizeable fraction of the U.S. exports to its major markets, such as Europe, Canada, and Asia.

Key Biocatalyst Market Insights Summary:

Regional Highlights:

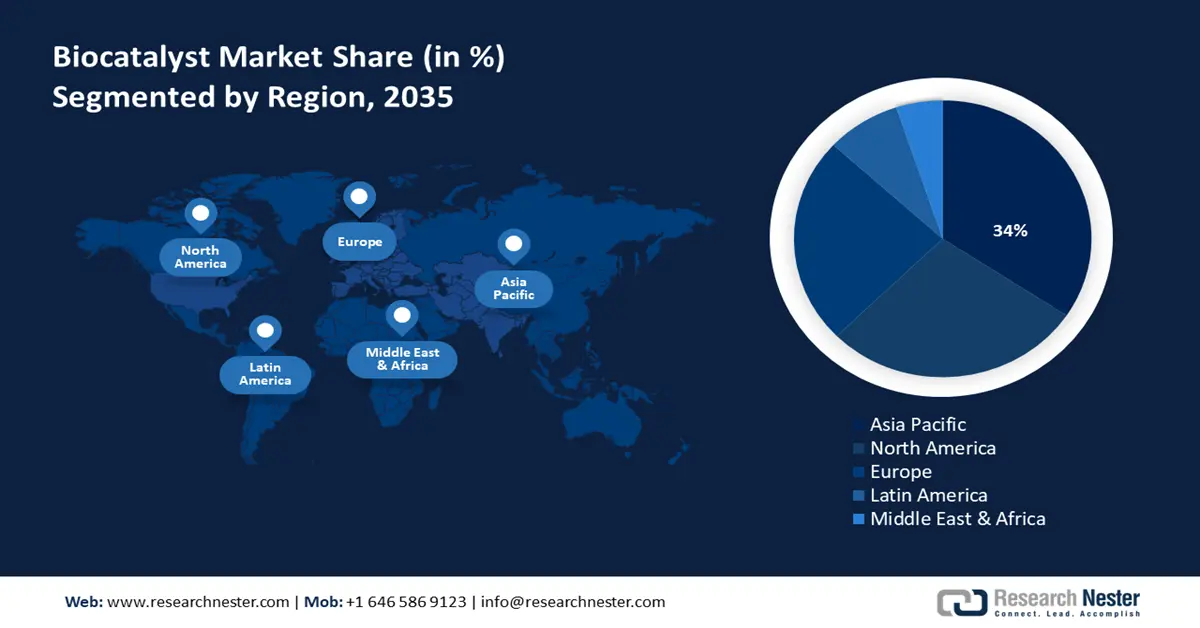

- The Asia Pacific biocatalyst market is projected to dominate with a 34% share by 2035, fueled by extensive government investments, rising industrial adoption, and expansion of enzyme-based manufacturing across China, India, Japan, Malaysia, and South Korea.

- North America is expected to capture a 28% revenue share by 2035, expanding at a CAGR of 6.4% from 2026 to 2035, owing to government-led R&D funding and the promotion of green manufacturing initiatives.

Segment Insights:

- The microbial segment of the Biocatalyst Market is forecasted to account for 69.8% share by 2035, propelled by their rapid growth, genetic adaptability, and cost-effective sustainability.

- The enzymes segment is projected to hold a 64.6% market share by 2035, owing to their high catalytic specificity, cleaner reactions, and growing industrial applications supported by enzyme engineering innovations.

Key Growth Trends:

- Effective improvement in catalytic innovation

- Rising applications in the food and beverage industry

Major Challenges:

- Volatility in raw material pricing

- Infrastructure and scale-up restrictions

Key Players: Novozymes A/S, BASF SE, DuPont de Nemours Inc., DSM-Firmenich AG, Codexis Inc., Advanced Enzyme Technologies Ltd., AB Enzymes GmbH, Chr. Hansen Holding A/S, Biocatalysts Ltd., Roquette Frères, Enzymicals AG.

Global Biocatalyst Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 730.91 million

- 2026 Market Size: USD 776.92 million

- Projected Market Size: USD 1.35 billion by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Malaysia, Brazil, Mexico, Singapore

Last updated on : 11 September, 2025

Biocatalyst Market - Growth Drivers and Challenges

Growth Drivers

- Effective improvement in catalytic innovation: The adoption of biocatalysts can achieve improvements and reaction efficiency with substantial energy saving and reduction of raw materials wastage. Enzyme-based integrating companies have recorded an operating cost reduction due to the conversion rates being optimized, and downstream purification processes are minimized. Fermentation processes produce over 70% byproduct waste due to the limiting toxicity of the fermenting cells or the waste of cell biomass. Enzymatic systems flip this equation, converting a significantly higher percentage of reactants into the target product while generating minimal waste. Leading systems achieve conversion yields that approach 100%, and typically exceed 90% higher than the practical 30% conversion yields generally found in fermentation processes.

- Rising applications in the food and beverage industry: The food and beverage industry uses biocatalysts like proteases, lipases, and amylases for functionality, flavor enhancement, and shelf-life extension of food products, along with producing functional ingredients by conversion via enzymatic reactions, especially in dairy formulations for lactose-free products, sugar reductions, and improving the nutritional value of processed foods. The International Food Information Council (IFIC) stated that two out of three Americans have never had lactose-free milk (64%), lactose-free flavored milk (76%), or any other lactose-free dairy product outside milk (68%). Furthermore, biocatalysts can procure regulatory approvals for their food processing applications, which adds weight to increased use and development in the segment, overall making this a strong driver for growth in the market.

- Rising environmental regulations and waste reduction initiatives: Strict global regulations limit industrial waste and emissions, creating incentives to use biocatalysts. Chemical catalysts often produce environmentally harmful byproducts, while enzymes typically enable cleaner reactions with greater substrate specificity. In 2022, 30% of total U.S. greenhouse gas emissions were associated with direct and indirect industrial greenhouse gas emissions, making it the second largest source of greenhouse gas emissions of all sectors. Direct greenhouse gas emissions from industry were associated with 23% of total U.S. greenhouse gas emissions, making it the third largest source of direct U.S. greenhouse gas emissions, behind the transportation and electric power sectors. Although industries are already under pressure to meet their Environmental, Social, and Governance (ESG) requirements, biocatalysts offer an effective way to reduce their ecological footprint.

1.Agricultural Trade Dynamics

Agricultural product exports drive the biocatalyst market by expanding demand for bio-based processing solutions in food, feed, and biofuel sectors. As global trade in crops and livestock intensifies, producers seek efficient, sustainable methods to enhance product quality and shelf life, often relying on biocatalysts like enzymes for processing, preservation, and nutrient optimization. In biofuel production, exported agricultural residues such as corn stover or sugarcane bagasse serve as feedstock, where biocatalysts accelerate conversion to ethanol and biodiesel. This rising export activity fuels innovation and adoption of biocatalysts across agro-industrial applications, reinforcing their role in global supply chains.

U.S. Agricultural Products Domestic Exports

|

Destination market |

2020 |

2021 |

|

China |

27,010 |

33,721 |

|

Canada |

22,559 |

25,577 |

|

Mexico |

18,163 |

25,292 |

|

Japan |

12,131 |

14,763 |

|

South Korea |

8,104 |

9,734 |

|

Taiwan |

3,273 |

3,860 |

|

Vietnam |

3,490 |

3,671 |

|

Philippines |

3,183 |

3,521 |

|

Colombia |

2,842 |

3,387 |

|

Netherlands |

3,377 |

2,964 |

|

Indonesia |

2,804 |

2,902 |

|

Germany |

1,449 |

2,214 |

|

Egypt |

1,892 |

2,050 |

|

Hong Kong |

2,159 |

1,899 |

|

India |

1,711 |

1,778 |

|

All other destination markets |

37,358 |

41,934 |

|

U.S. domestic exports to all destination markets |

151,504 |

179,265 |

|

Reexports |

5,723 |

6,129 |

|

U.S. total exports |

157,227 |

185,394 |

Source: USITC

2.Trade Dynamics of Enzymes

Trade dynamics of enzymes significantly drive the growth of the biocatalyst market by shaping global supply chains, pricing, and accessibility of key biological inputs. As demand for enzymes rises across industries like food processing, biofuels, and pharmaceuticals, international trade ensures that manufacturers can source specialized enzymes from leading producers such as the U.S., Denmark, and China. Favorable trade agreements and reduced tariffs facilitate cross-border flow, while disruptions like trade wars or regulatory shifts can impact availability and cost, prompting innovation in domestic production and bio-based alternatives. These dynamics influence not only market expansion but also the strategic positioning of enzyme suppliers and biocatalyst manufacturers worldwide.

Export and Import Value of Enzymes in 2023

|

Country |

Export Value (USD) |

Country |

Import Value (USD) |

|

Denmark |

1.65B |

United States |

991M |

|

United States |

1.01B |

Netherlands |

576M |

|

China |

625M |

Germany |

451M |

Source: OEC

Challenges

- Volatility in raw material pricing: The production of biocatalysts depends on agricultural commodities like corn, sugarcane, and lignocellulosic biomass. China's Ministry of Agriculture reports that the average market price of corn increased by 17% between 2020 and 2023, from CNY 2.319 per kilogram to CNY 2.713 per kilogram. This type of volatility has a direct impact on the price at which enzymes are produced and the long-term pricing model. The smaller manufacturers claimed to experience margin compression due to feedstock variability. In Asia, fermentation-grade molasses prices increased between 2021 and 2023. The stability of the supply chain and contractual negotiations in the downstream markets is prevented by such volatilities.

- Infrastructure and scale-up restrictions: The biocatalysts production depends on recapture production systems of production, and highly pure fermentation, not readily available in developing economies. Limited regional infrastructure increases shipping vulnerabilities and delays production. There is no GMP processing unit of enzymes in Africa and Southeast Asia, resulting in limiting their market entry. This deficiency in infrastructure economically slows down the process of localization, which increases the end product price in underserved markets.

Biocatalyst Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 730.91 million |

|

Forecast Year Market Size (2035) |

USD 1.35 billion |

|

Regional Scope |

|

Biocatalyst Market Segmentation:

Source Segment Analysis

The microbial segment in the biocatalyst market is expected to grow at the fastest revenue share of 69.8% during the projected years by 2035, attributed to their quick growth, flexible genetic background, and involvement in sustenance at a lower cost. Many commercial biocatalysts use microbial strains such as Bacillus, Aspergillus, and Escherichia coli. A predictable supply has been stimulated by scalable fermentation infrastructure in North America and Europe. Microorganisms like bacteria, fungi, and yeast produce enzymes widely used in pharmaceuticals, food processing, and biofuels. Their adaptability, rapid growth, and genetic engineering potential further strengthen microbial biocatalysts’ commercial leadership.

Catalyst Type Segment Analysis

The enzymes segment is anticipated to grow substantially over the forecast years, with a biocatalyst market share of 64.6%, driven by their high specificity, faster rates of reactions, and clean output. Widely applied in pharmaceuticals, food and beverages, and biofuels, enzymes offer precise catalytic activity under mild conditions, reducing energy costs and harmful by-products. Continuous innovations in protein engineering and enzyme optimization further enhance their industrial adoption, making them the leading choice over whole-cell, immobilized, and co-factor regenerating biocatalysts.

Type Segment Analysis

The hydrolases segment held the revenue share of 59.5% in 2035, and is estimated to grow at a notable rate, owing to their extensive use in pharmaceutical production, in the processing of food, and in the production of detergents. The detergent, textile, pulp, paper, and starch industries use around 65% of the more than 3000 known enzymes as hydrolases, and nearly 25% of them are used in food processing. Recombinant and cost-effective scalability is supported by the availability of technologies to produce hydrolases.

Our in-depth analysis of the biocatalyst market includes the following segments:

|

Segment |

Subsegment |

|

Type |

|

|

Catalyst Type |

|

|

Source |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Biocatalyst Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is expected to dominate the biocatalyst market with a revenue share of 34% by 2035, and is projected to grow at a steady compound annual growth rate of 7.2% from 2026 to 2035. Such growth is attributed to significant government investments, local production in the manufacturing industry, and rising levels of industrial adoption of the enzyme-based solutions in diverse countries that include China, India, Japan, Malaysia, and South Korea. With government assistance, the domestic chemicals market, which was valued at $220 billion in 2023, is projected to increase to between $400 and 450 billion by 2030, with goals of reaching between $850 and 1,000 billion by 2040. By promoting the Advanced Bio Initiative, which aims to increase the production of enzymes, the Presidential Bio Committee of South Korea has begun the development of the biomanufacturing zone. Over the past decade, the number of chemical companies putting biocatalyst constructions into practice has doubled, and government green investment has been steadily increasing in Malaysia.

China’s biocatalyst market is expected to expand progressively by 2035 as a result of the government's active embrace of bio-based manufacturing techniques, industrial restructuring, and green chemical technologies. The National Development and Reform Commission prioritized circular and green chemical production in the 14th Five-Year Plan. Additionally, in 2024, a breakthrough in catalytic bioconversion was unveiled by the Chinese researchers with the construction of a facility that can produce 1,000 tons of bio-based ethylene glycol annually. This milestone has a direct connection to the nation's carbon-zero goals. Furthermore, in chemical clusters like Jiangsu province, local governments are providing subsidies for low-VOC innovations and green chemical infrastructure.

By 2035, the Indian market is expected to develop at the highest compound annual growth rate of 8.5% in APAC. This growth is attributed to the increased emphasis on bio-based chemicals, favorable state policy, and a robust industrial foundation in the country. India's high reliance on imported feedstock and specialty chemicals is highlighted by its 3.5% share of global chemical value chains and its USD 31 billion chemical trade deficit in 2023. However, by 2040, India will be able to become a global chemical powerhouse with a USD 1 trillion chemical sector and a 12% GVC share due to focused reforms that include a wide range of fiscal and non-fiscal initiatives. The emerging demand, with the support of FICCI and ICC-sponsored initiatives and a number of patents in green chemistry, is expected to establish India as the fastest-growing biocatalyst market by 2035 in the APAC.

North America Market Insights

By 2035, the North American market is expected to grow at a revenue share of 28% and is expected to increase by a 6.4% CAGR between 2026 and 2035, owing to the strong government R&D investment and industrial innovation. Additionally, due to the initiatives to promote clean manufacturing and green purchasing by the DOE and EPA, there has been an increase in the use of biocatalysts in chemical synthesis and biofuel blending. The region has an established enzyme production infrastructure, and the largest facilities are open across Eastern Canada and the Midwest (U.S.). Furthermore, government-industrial collaborations, including strategic partnerships, also help scale up and commercialize processes, such as the Department of Defense (DoD) awarded BioMADE a $87 million, seven-year award in April 2021, and in March 2023, the agency earned a $450 million budget increase.

The U.S. is projected to dominate the North American market during the projected years by 2035, with a calculated CAGR of 6.3% from 2026 to 2035. In a mature market in the future, biomass resources, such as energy crops, can supply about 400 million tons of biomass annually above current needs. The Regional Resource Hubs for Purpose-Grown Energy Crops is one example of a funding announcement that supports the development and demonstration (RD&D) of low-carbon-intensity, purpose-grown energy crops that are essential to advancing a renewable energy economy in order to produce bioproducts and biofuels. Strong demand for biofuels, enzyme-enabled medications, and personal care ingredients has led to a rise over time. Moreover, through the Manufacturing USA (MFG USA) platform, the National Institute of Standards and Technology (NIST) made investments in safety guidelines and the digitization of bio-based manufacturing procedures.

The market in Canada is expected to contribute substantially to the global biocatalyst market by 2035 at a constant CAGR of 5-6% from 2026 to 2035. The enzyme production capacities of the major producers, such as BioVectra and Novozymes Canada in Nova Scotia and Quebec, indicate the growing power of manufactured products within the country. Additionally, through its Clean Growth Program-style investments, the Canadian government has doubled the R&D funding on chemicals, advancing R&D related to green processing by 8-10%, particularly in 2022. Between 2021 and 2023, more than CAD 500 million was spent on clean-tech programs related to industrial sustainability and bio-based chemicals. The Canadian Environmental Protection Act promotes the replacement of hazardous substances with less hazardous materials, which helps in adopting biocatalysts. Regulatory alignment within the country is strong with global green chemistry best practices, which helps in exporting to the U.S. and EU.

Europe Market Insights

In 2035, Europe accounted for the revenue share of 24% and the market is expected to grow with an upward trend over the forecast years by 2035, due to high environmental control and great industrial adoption of enzymes. Enzymes and microbial catalysts are vital to both the biotechnology and pharmaceutical industries to build efficiencies into production. The growing interest and demand for renewable chemicals, combined with new funding and developments emerging from the EU Green Deal, are fast-tracking investment and progress into biocatalyst innovation, and they will continue to provide the backbone of many industries, whether that’s healthcare, food, or specialty chemicals.

Trade Data of Enzymes, Prepared Enzymes in 2023

|

Region / Country |

Trade Value (USD 1,000) |

Quantity (Kg) |

|

European Union |

2,159,096.98 |

|

|

United Kingdom |

106,830.90 |

— |

|

Germany |

567,278.12 |

22,773,100 |

|

France |

420,246.49 |

21,677,700 |

|

Italy |

84,666.15 |

4,549,960 |

|

Spain |

36,989.05 |

2,941,400 |

Source: WITS

Key Biocatalyst Market Players:

- Novozymes A/S

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- DuPont de Nemours, Inc.

- DSM‑Firmenich AG

- Codexis, Inc.

- Advanced Enzyme Technologies Ltd.

- AB Enzymes GmbH

- Chr. Hansen Holding A/S

- Biocatalysts Ltd.

- Roquette Frères

- Enzymicals AG

Novozymes has a commanding 34% market share in the competitive environment due to its significant R&D investments and vast collection of microbial strains. BASF and DuPont are classified as hybrid bio-chemical platforms and are integrated chemical majors in the industrial, pharmaceutical, and agricultural sectors. Codexis also has pharma partnerships in cost‑efficient APIs, and with a proprietary CodeEvolver enzyme engineering platform, which forms the basis of differentiation. Advanced Enzyme Technologies and Amano Enzyme are competent in making enzymes for food and industrial uses regionally at a low cost. DSM- Firmenich focuses on high-margin nutritional and specialty enzyme applications. New entrants such as Biocatalysts Ltd, Chr. Hansen and Synthetic Genomics/LanzaTech concentrate on specialized procedures like CO2 fermentation and PET depolymerization through joint innovation projects.

Top Global Biocatalyst Manufacturers

Recent Developments

- In November 2024, Ecovyst Inc. unveiled AlphaCat, an advanced line of Silicas used in enzyme immobilization in industrial biocatalysis. The launch created a modified silica-based support system that can be customized to enhance the reuse of enzymes and the efficiency of the process. This launch was oriented towards the usage in specialty chemicals, biofuels, and pharmaceuticals. Preliminary client trials showed that enzymes were found to be more stable, and dosing frequency was reduced by 20%, thereby reducing the costs of the whole process. The introduction is a component of the world's tendency in direction towards greener and highly efficient catalyzed reactions in industrial chemicals.

- In July 2024, BASF, together with the University of Graz and the Austrian Centre of Industrial Biotechnology, launched a computer-assisted enzyme optimization model. This model is a predictive tool that permits optimal temperature, solvent concentration, and buffer system in enzyme-catalyzed reactions. The system decreased laboratory scale trial runs by as much as 30% speeding up the process of getting from research to commercial production. It helps process chemists to use fewer resources and have shorter timelines to work with. The tool is being incorporated into the sustainable process development of BASF in the pharma and nutrition business. The technology serves to promote the long-term effort of digitized and eco-efficient chemical production by the company.

- Report ID: 8089

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Biocatalyst Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.