Methanol Catalyst Market Outlook:

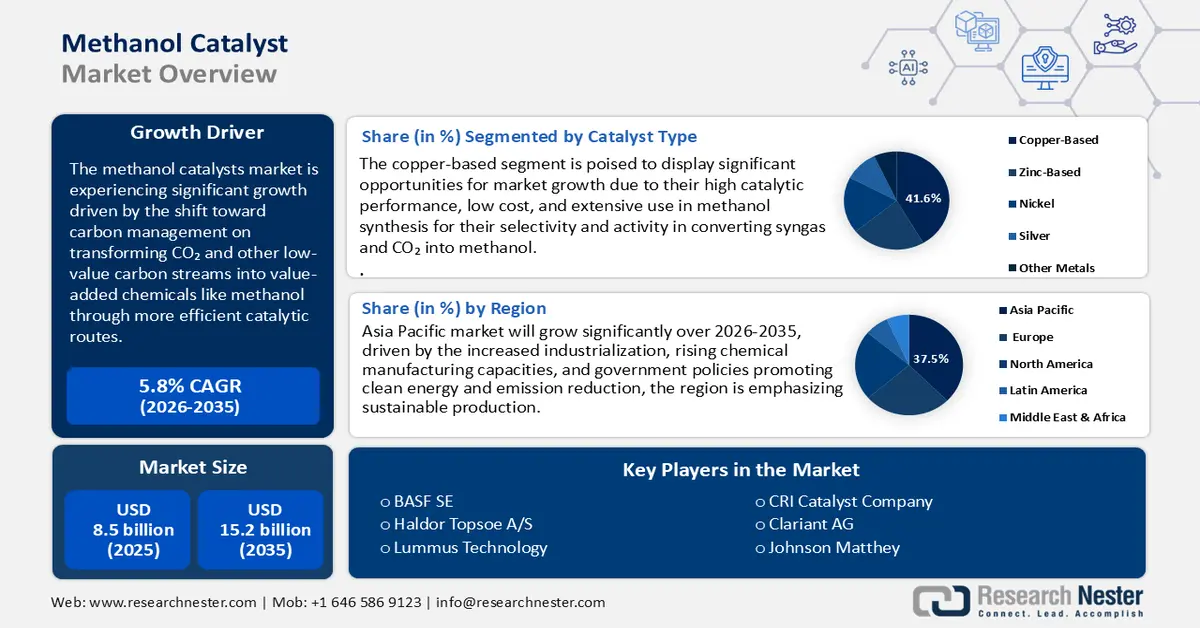

Methanol Catalyst Market size was valued at USD 8.5 billion in 2025 and is projected to reach approximately USD 15.2 billion by the end of 2035, rising at CAGR of 5.8% during the forecast period from 2026 to 2035. In 2026, the industry size of methanol catalyst is assessed at USD 8.7 billion.

The global methanol catalyst market is projected to grow significantly over the forecast years, primarily being driven by the move towards carbon management with the transformation of CO 2 and other low value carbon streams into value added chemicals, such as methanol, via more efficient catalytic routes. The U.S. government research initiatives, including the Carbon Conversion Program of the Department of Energy through NETL, are funding catalyst synthesis, reactors, and activation schemes to facilitate cost-effective CO 2 to methanol and syngas to methanol conversion processes. For example, a DOE-funded modular system to convert methane into methanol directly through photocatalysis focuses on catalysts that selectively react methane to high yield of liquid products; this single project has a funding of USD 1,300,000 (DOE portion) and an equal amount of funding. A second applicable NSF funded project showed a two-catalyst (nickel and cobalt based on nanotubes) system that enhanced conversion efficiency of CO 2 to methanol by approximately 66% relative to current best practices. These efforts demonstrate the support of the government in terms of R&D and deployment, which supports the methanol catalyst market need in catalysts with better performance and stability.

The supply chain, raw materials of methanol catalyst usually consist of nonferrous metals (e.g. copper, zinc, nickel) and their oxides, which are smelted and refined in primary and secondary smelting/refining processes. Based on the data of the U.S. Bureau of Labor Statistics, the Producer Price Index (PPI) of Secondary Smelting, Refining, and Alloying of Nonferrous Metal (except copper and aluminum), including miscellaneous metals (w hich would include most catalyst metal inputs) was about 86.569 in August 2025. Individually, covering greater Metals and Metal Products (all nonferrous castings etc.) the Mid Atlantic PPI indicates monthly values increasing to some 331.86 in June 2025. On trade and manufacturing capacity, as per the U.S. export statistics, the United States imported a total of 5,488 products including 552 most imported products and of all 552 this includes the USD 881 million of supported catalysts (precious metal-based) as its most imported product in 2024. The major suppliers were Canada (USD 534M), Germany (USD 145M), Japan (USD 53.2M) and Mexico (USD 33.8M). Meawhile, in June 2025, the U.S. sent the vast majority of its exports of its supported catalysts to Mexico (USD 51M), India (USD 18.1M), and Belgium (USD 5.61M), where the methanol sectors were developing. Canada and Germany (including imports of USD 52M and USD 11.7M respectively) continued to supply the bulk imports to the U.S. highlighting how much the U.S. depends on high-performance catalyst suppliers. These robust importation and exportation volume indicate the growing domestic demand of effective and lasting catalysts owing to a higher production of methanol in chemical and fuel as well as energy industries. On raw material trade, the EU raw materials strategy documentation and UNCTAD critical minerals trade reports point out that non-EU nations tend to charge export duties or limitations, which has an impact on supplying key metals required in catalysts.

Key Methanol Catalyst Market Insights Summary:

Regional Highlights:

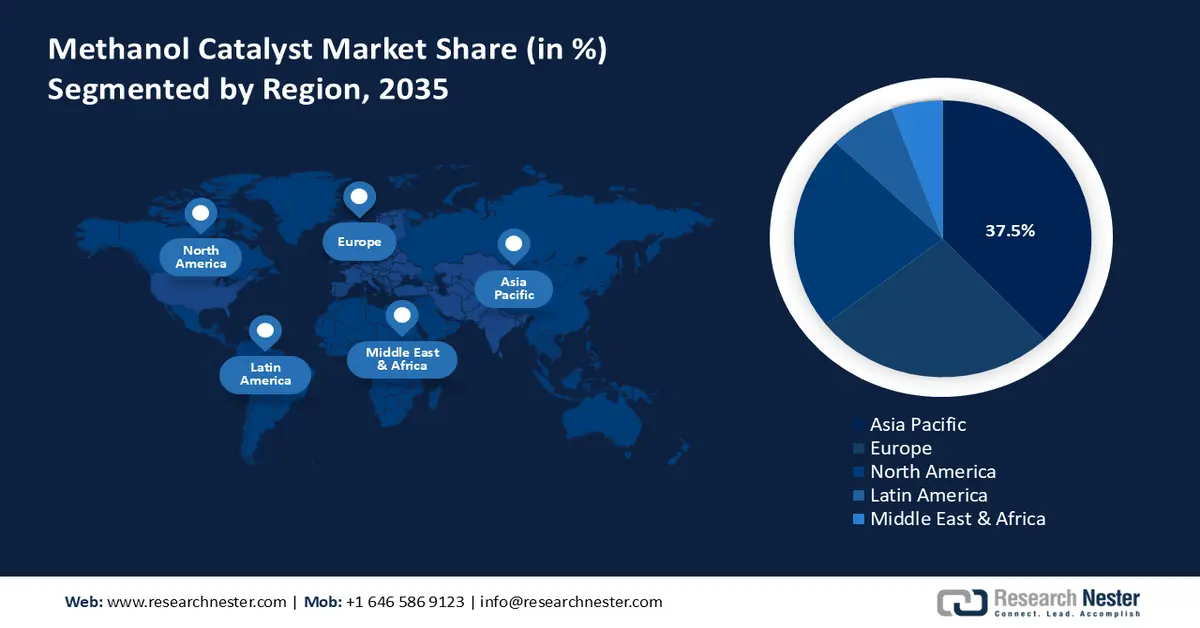

- During 2026–2035, the Asia Pacific methanol catalyst market is forecast to command a 37.5% revenue share, underpinned by accelerated industrialization and rising chemical manufacturing capacities.

- North America is anticipated to capture a 22.5% share between 2026 and 2035, spurred by expanding clean-energy investments and sustainable chemical production initiatives.

Segment Insights:

- By 2035, the copper-based segment in the methanol catalyst market is projected to account for 41.6% of total revenue, bolstered by high catalytic efficiency and cost advantages.

- The thermal activation segment is estimated to secure a 40.8% share by 2035, sustained by its ability to enhance catalyst stability and operational effectiveness.

Key Growth Trends:

- Enhanced applicability of copper-zinc catalysts in green methanol production

- Catalysts supporting Autothermal Reforming (ATR)

Major Challenges:

- High capital investment in cleaner production technologies

- Supply chain shocks to production stability

Key Players: BASF SE (Germany), Haldor Topsoe A/S (Denmark), Lummus Technology (U.S.), CRI Catalyst Company (U.S.), Clariant AG (Switzerland), Johnson Matthey (UK), W. R. Grace & Co. (U.S.), Synfuels China Technology Co., Ltd. (China), Albemarle Corporation (U.S.), KBR, Inc. (U.S.), Sinopec Catalyst Co., Ltd. (China), N.E. Chemcat Corporation (Japan), Mitsubishi Chemical Corporation (Japan), Sumitomo Chemical Co., Ltd. (Japan), Ube Industries, Ltd. (Japan).

Global Methanol Catalyst Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.5 billion

- 2026 Market Size: USD 8.7 billion

- Projected Market Size: USD 15.2 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Vietnam, Mexico, Indonesia

Last updated on : 8 December, 2025

Methanol Catalyst Market - Growth Drivers and Challenges

Growth Drivers

- Enhanced applicability of copper-zinc catalysts in green methanol production: Copper-zinc catalysts play a key role in the green methanol production process, specifically, in the hydrogenation of CO 2 and renewable syngas. The Renewable Energy Directive (RED II) of the European Union establishes that more renewable fuels are required to be used, which promotes the green methanol as a renewable fuel and chemical feedstock. The EU Commission states that at least 32% of all energy consumption should be made of renewable energy by 2030, which further increases the importance of effective catalysts to convert renewable feedstock to methanol. Copper-zinc catalysts are also preferred due to their high activity and selectivity at changing feed conditions, which favor stable methanol production at bio-methanol and CO 2 transformation facilities. The drive towards renewable fuels is likely to put pressure on such catalysts, thereby driving the growth by 2030.

- Catalysts supporting Autothermal Reforming (ATR): Autothermal reforming (ATR) catalysts are catalysts that perform partial oxidation and steam reforming in a unit operation to enhance the energy consumption and emissions in a methanol synthesis facility. The revision of the Clean Air Act by the U.S. EPA has added more stringent emission requirements to industrial plants and this has encouraged operators to move towards cleaner and more efficient catalytic processes. For example, the Good Neighbour Plan announced in March 2023 requires that power plants cut by half their ozone season NOx emissions by 2027, affecting 23 states. Moreover, the EPA has suggested more toxic emission standards on the use of some kinds of industrial boilers, which further constricted the regulations of industrial emissions. Such regulatory requirements encourage the operators to use more efficient and cleaner catalytic processes to meet the new standards. The high selectivity and thermal stability of ATR catalysts required are necessary to enable the use of different ratios of oxygen and steam feeds. The technology allows to adhere to the limits of emission and create methanol flexibly. Research by DOE shows that more than 20 percent of CO 2 can be eliminated by using ATR catalysts in plants, which has caused increased demand.

- Catalyst longevity and regeneration technologies: The U.S and EU sustainability policies on waste minimization and the circular economy force methanol producers to consider catalysts that feature a longer lifespan and the ability to be regenerated. Subsidy programs including the Department of Energy (DOE) have been provided to develop programs in research and development to enhance the lifetime and recyclability of catalysts to minimize hazardous wastes and raw material use. For example, the U.S. Department of Energy has given out to 14 projects up to USD 17 million aimed at decreasing the dependence on important metals by enhancing recovery, substitution, and recyclability. The efforts promote cleaner technologies, such as catalysts, by reducing the consumption number of raw materials and the amount of hazardous waste. Furthermore, within the FP7 NEXT-GEN-CAT program of the EU, nanostructured automotive catalysts allowing partial substitution of precious metals with cheaper transition metals, enhanced thermal and mechanical stability, and a complete life-cycle assessment of which spent catalysts can be recycled have been made. Recovery of precious metals as well as regeneration techniques to restore catalytic activity all help in projected growth in the demand of advanced catalysts by 2030.

Challenges

- High capital investment in cleaner production technologies: Methanol catalyst manufacturers are experiencing serious capital investment aspects in order to meet the ever-increasing requirements in environment regulations. For instance, in 2024, BASF invested a high double-digit million euros in the new Catalyst Development and Solids Processing Center in Ludwigshafen pools, necessary in the development of new catalyst technologies. These large-scale investments pose significant impediment to the smaller methanol producers who are willing to upgrade to next generation efficient catalyst systems. However, small-scale manufacturers are regularly unable to compete or grow because such large-scaled investments are usually not within their financial capacity. The expensive nature of equipment upgrading, pollution management and optimization of processes are hence a major obstacle to growth and innovation in the methanol catalyst market of methanol catalyst.

- Supply chain shocks to production stability: Supply chain vulnerabilities are a major threat to methanol catalyst suppliers specifically due to the reliance on metals such as copper, zinc and nickel. The WTO dispute case of export restrictions in China sheds light on the effect of export restrictions on rare earths and critical metals in causing a shortage of supplies in the world and delay, which were thus a major challenge to industries that used such materials. These supply limitations directly influenced the development and the growth of methanol catalyst through the slowed production and rising costs. This resulted in shocks in the world methanol catalyst market that deterred the prompt upgrading of the facilities and capacity expansion. Having to navigate intricate international trade policies and secure stable access to important metals has become a major concern among manufacturers looking to secure a consistent quality of products and satisfy the ever-increasing demand around the globe.

Methanol Catalyst Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 8.5 billion |

|

Forecast Year Market Size (2035) |

USD 15.2 billion |

|

Regional Scope |

|

Methanol Catalyst Market Segmentation:

Catalyst Type Segment Analysis

Copper-based segment is anticipated to grow with the highest revenue share of 41.6% by 2035, due to their high catalytic performances and low cost. These catalysts are extensively applied in the synthesis of methanol since they are highly selective and active, especially in transforming syngas and CO 2 into methanol. The U.S Department of energy points out the importance of copper in the development of sustainable chemical processes such as production of green methanol by hydrogenating CO2. The move towards copper-based catalysts is also speeded up by environmental policies such as the EU Green Deal, favouring low-carbon chemical production, which contributes to the strong development of the segment. The flexibility of these catalysts to renewable feedstock makes them the methanol catalyst market leaders in the face of increasing demand to produce eco-friendly methanol production.

Activation Method Segment Analysis

The thermal activation segment is projected to grow at methanol catalyst market share of 40.8% over the forecast years. The method is known as high-temperature catalyst activation to improve the surface of the catalysts and catalytic efficiency, which are necessary to produce methanol stably. According to the U.S. Environmental Protection Agency (EPA), thermal activation/oxidation extends the life of catalysts and control of emissions, which enables manufacturers to meet the requirements of air quality standards. Large-scale industrial applications also demand thermal activation, which is more stable and more affordable, thus the need in both established and emerging methanol catalyst markets. Moreover, it can be used with changing feedstock mixtures and renewable reactions which also consolidates its methanol catalyst methanol catalyst market dominance.

Reaction Process Segment Analysis

By 2035, steam reforming segment is likely to grow substantially with the methanol catalyst market share of 39.2%, as the process remains the most preferred one because of high yields of methanol and its efficiency in the process. It is a process of reforming hydrocarbons using steam to generate syngas, which are then transformed using methanol catalyst to form methanol. The modernization of steam reforming to cut on emissions and energy consumption, which is in line with the clean air provisions and sustainability concerns. Its ability to process different feedstocks such as natural gas as well as biomass makes it an essential process during the energy transition. Constant innovation in catalyst design is still going on to optimize the performance of steam reforming to ensure the robust growth trend of this segment.

Our in-depth analysis of the methanol catalyst market includes the following segments:

| Segment | Subsegment |

|

Catalyst Type |

|

|

Reaction Process |

|

|

End use Application |

|

|

Activation Method |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Methanol Catalyst Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific methanol catalyst market is expected to be the dominant region with the largest revenue share of with 37.5% during the forecast years from 2026 to 2035, due to the increased industrialization and rising chemical manufacturing capacities. Government policies that promote clean energy and reduction of emission favor the emphasis on sustainable production in the region. In 2024, PAG increased USD 550 million to its initial fund of renewable energy investments, which includes investments in solar energy in Japan with the assistance of the entry of Mubadala into the clean energy market. Together with solar and renewable power, the Asia-Pacific region is also creating intense growth in the development of methanol catalyst as the cleaner fuel and green chemical production is on the rise. These trends highlight the commitment of the region in the context of the promotion of clean technologies and the achievement of high climate targets based on a diversified sustainable energy solution. The new environmental regulations that are in tandem with the international climate objectives encourage the use of new methanol catalyst which increase efficiency in production and reduce carbon footprints. The regional trade agreement encourages the growth of the supply chain to increase the imports and exports of catalysts. Programs that enhance research and development in catalysis also enhance the methanol catalyst market as the Asia Pacific is becoming a hub of critical innovation in methanol catalyst technologies.

By 2035, China’s methanol catalyst market is projected to lead the Asia Pacific region, attributed to the extensive governmental funding of clean technologies in chemistry. From example, the large-scale commercial wind power-biomass green methanol integrated demonstration project launched by Shanghai Electric in Jilin Province. The project will yield 250,000 tons of green methanol per year with an investment of CNY 5.6 billion (approximately USD 780 million), and this will demonstrate the willingness of China to develop green energy technologies. Stringent regulations on the environment by the Ministry of Ecology and Environment (MEE) compel manufacturers to use low-emission catalysts to achieve carbon neutrality under the set deadline of 2060. Moreover, the focus of China on the modernization of industrial-level activities contributes to a higher volume of production in terms of producing methanol as a catalyst, which increases the demand in catalysts. R&D initiatives supported by the government are aimed at increasing the efficiency and other characteristics of catalysts, facilitating the process of sustainable chemical production. This regulatory pressure coupled with funding and growth in the industrial sector entrenches China in the methanol catalyst market as a powerful force in the methanol catalyst market in the Asia-Pacific region.

The methanol catalyst market in India is anticipated to experience a strong growth owing to the sustainability initiatives of the government and the growth of the industry. For example, the partnership of NTPC with the Indian Institute of Petroleum to create a catalyst to change the CO 2 of the flue gas of power plants fired with fossil fuels into methanol with more than 99% purity. In addition, NLC India is establishing a ₹4350 crore lignite-to-methanol plant, with a yearly capacity of 400,000 tonnes and will save 1000 crore of crude oil imports. These programs underscore the drive by India towards making energy and cleaner fuel technologies more sustainable. Market expansion is further boosted by increasing commercial demand of fuel, formaldehyde and DME. The emphasis by India on decreasing fossil fuel consumption acts as a catalyst to invest in green methanol production, which is adding to the demand of catalysts. Also, the cooperation of government agencies with players in the private sector can speed up the research of the improvements in the catalyst performance. All these make India a fast-growing methanol catalyst market in terms of methanol catalyst in Asia Pacific.

North America Market Insights

North America methanol catalyst market is set to experience a consistent growth, with a share of 22.5% between 2026 and 2035, stimulated by the rise in investments in clean energy and sustainable chemical production with government stimulation. For example, Saint-Gobain Ceramics is spending more than USD 40 million to construct a state-of-the-art catalyst carrier manufacturing plant in Wheatfield, New York. This growth by its subsidiary, Saint-Gobain NorPro, is to satisfy the growing requirement of the ceramic catalyst carriers in the energy production, refining, biofuels, and chemical manufacturing industries. The economic investment programs of the state and the locality, such as the New York State Excelsior Program of USD 1 million and likely the creation of about 30 full-time jobs when it comes to completion, support the project. Furthermore, the safety and environmental compliance programs help to develop the introduction of modern catalytic technologies, such as, the pollution prevention programs in North America encourage the use of modern catalytic technologies through implementation of strict environmental laws that minimize the emissions and waste products produced by industries. Such programs prompt industries to use advanced catalysts in order to achieve compliance and enhance sustainability performance. These efforts provide a catalytic solution that is cleaner and more efficient and leads to innovation through collaboration with the regulating bodies and industry stakeholders.

The U.S. methanol catalyst market is expected to dominate the North American region with the largest revenue share by 2035, owing to the robust government investment and regulation stimulus. In 2022, the U.S. government invested some USD 3 billion in promoting clean energy technologies, including catalytic processes to produce methanol, which is 22% larger than in 2020. Emission regulations are highly strict enforced by the Environmental Protection Agency (EPA), compelling manufacturers to consider more efficient, and environmentally-friendly catalysts, boosting demand in the methanol catalyst market. Moreover, the Occupational Safety and Health Administration (OSHA) promotes the chemical safety programs which enhance the catalysts production standards, in order to achieve sustainable development. The three elements of funding, regulation and safety programs place the U.S. methanol catalyst market in a position towards gradual growth, with an emphasis on innovations that will lower greenhouse gas emissions and enhance the efficiency of producing methanol.

The methanol catalyst market in Canada is likely to witness an upward trend over the projected years, mainly due to the government efforts on ensuring sustainability and development of clean energy. Government of Canada is stepping up investment in the innovation of the advanced manufacturing, allocating up to CAD 427 million (approximately USD, 300-350 million) in October 2023, to renew the advanced manufacturing cluster under Global Innovation Clusters to assist in scaling up advanced technology solutions in manufacturing. The Canadian Environmental Protection Act is a legislation that endorses the manufacture of low emission chemicals, which fosters the implementation of high level of catalytic technologies in the production of methanol. For instance, the Natural Resources Canada is funding the CO 2 Conversion to Methanol (Methanol+) project in Edmonton, Alberta under the leadership of Quantium Technologies Inc. The project, which is expected to cost a total of CAD 4.9 million (of which 3.15 million will be in the form of an EIP contribution) seek to validate the catalyst and process technologies to convert captured CO 2 and solar hydrogen to methanol. This pilot project is a lab-scale that is aimed to create methanol that is carbon-negative and in addition helps in training and employment. Federal initiatives aid in research of renewable methanol catalyst and safe disposal of chemical waste, which are expected to result in less environmental impact. Government-industry joint efforts can enhance the process of the development of effective catalysts in line with the Canadian climate objectives. These programs enhance the status of Canada as an emerging methanol catalyst market in the use of methanol catalyst in the greater North American chemical industry.

Europe Market Insights

Europe methanol catalyst market is expected to grow steadily at a revenue share of 26.1%, by 2035 stimulated by strict environmental laws and governmental investment to decrease industrial emissions and promote the development of the sustainable environment of chemical production. European Chemicals Agency (ECHA) imposes stringent chemical safety and emissions requirements that compel manufacturers to use superior catalysts that are more efficient and less hazardous to the environment. Furthermore, the Green Deal and the Circular Economy Action Plan of the European Union also encourage the innovation of catalytic technologies used to produce carbon-neutral methane.

In UK, commercialization of green methanol catalyst is encouraged by government initiatives, which are in line with its net-zero ambitions by 2050. For example, with a net-zero and sustainability net-zero research, the UK Catalysis Hub III was started with a 12.5 million investment by the Engineering and Physical Sciences Research Council (EPSRC). This project has gathered 46 universities in research in ensuring issues in the field of manufacturing, recycling and reduction of pollution, including the making of catalysts in the production of green methanol. The government of Germany is still at the forefront of catalyst innovation, which is supported by the Federal Ministry of Economic Affairs and Climate Action and geared towards greener chemical production.

Germany methanol catalyst market is expected to advance steadily as the country accelerates its transition toward low-carbon chemicals, sustainable fuels, and green hydrogen-based production pathways. Growing investment in clean methanol technologies, including renewable methanol and carbon-capture-integrated processes, is creating opportunities for high-efficiency, durable catalysts. Germany’s strong industrial base-spanning chemicals, automotive, and energy-continues to drive demand for methanol as a key feedstock, while ongoing modernization of chemical plants boosts the need for catalyst upgrades.

Key Methanol Catalyst Market Players:

- BASF SE (Germany)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Haldor Topsoe A/S (Denmark)

- Lummus Technology (U.S.)

- CRI Catalyst Company (U.S.)

- Clariant AG (Switzerland)

- Johnson Matthey (UK)

- W. R. Grace & Co. (U.S.)

- Synfuels China Technology Co., Ltd. (China)

- Albemarle Corporation (U.S.)

- KBR, Inc. (U.S.)

- Sinopec Catalyst Co., Ltd. (China)

- N.E. Chemcat Corporation (Japan)

- Mitsubishi Chemical Corporation (Japan)

- Sumitomo Chemical Co., Ltd. (Japan)

- Ube Industries, Ltd. (Japan)

- BASF SE is a leading global supplier of catalysts used in methanol synthesis, offering copper-zinc-alumina and other advanced formulations that deliver high activity, stability, and energy efficiency. The company’s catalysts support large-scale methanol plants, syngas optimization, and low-carbon production routes. Strategically, BASF invests heavily in R&D for sustainable chemical processes, including CO₂-to-methanol and green hydrogen integration. Its global production footprint and strong technical service network provide customers with process optimization and lifecycle support.

- Haldor Topsoe A/S is a technology leader in methanol production catalysts, offering a wide range of high-efficiency copper-based methanol synthesis catalysts, reforming catalysts, and complete process solutions. Its technologies support conventional syngas routes as well as renewable, low-carbon methanol production. Strategically, the company focuses on decarbonization, investing in Power-to-X solutions, carbon capture utilization, and green hydrogen–integrated methanol plants. Topsoe’s strong engineering services, plant design expertise, and global customer partnerships enhance its methanol catalyst market influence.

- Lummus Technology is a major provider of methanol production process technologies and catalysts through its proprietary methanol synthesis platforms. Known for its engineering and modular plant designs, Lummus offers catalysts suited for high-efficiency methanol conversion and optimized syngas operations. Strategically, the company expands by licensing advanced methanol technologies and forming partnerships that integrate renewable feedstocks and carbon-reduction pathways. Its strong presence in petrochemicals, refining, and process plant design enables seamless deployment of methanol units worldwide.

- CRI Catalyst Company, part of the Shell group, specializes in high-performance methanol synthesis catalysts and related syngas conversion technologies. Its copper-based catalysts are widely used in large-scale methanol plants for their durability, thermal stability, and high productivity. Strategically, CRI focuses on developing catalysts that support cleaner fuels, CO₂-to-methanol conversion, and low-carbon chemical pathways. The company benefits from Shell’s global network, which enables strong technical support and integration with advanced energy systems.

- Clariant AG is a leading supplier of methanol synthesis catalysts known for high selectivity, long life, and strong resistance to sintering. Its MegaMax® catalyst series is widely used in methanol plants worldwide, providing consistent performance under demanding conditions. Strategically, Clariant invests in innovation focused on sustainability, including catalysts tailored for low-carbon methanol, CO₂-recycling, and green hydrogen applications. The company’s global manufacturing reach and technical service teams help optimize plant operations for efficiency and lower environmental impact.

Below is the list of some prominent players operating in the global methanol catalyst market:

The global methanol catalyst market is highly competitive with major players trying to increase the efficiency of their catalysts, minimize environmental damage, and meet the increasing needs of green methanol production. Such companies as BASF SE, Haldor Topsoe A/S, and Clariant AG are on the frontline, investing much on research and development in order to innovate and enhance formulations of catalysts. Strategic efforts involve merging and acquisition including the purchase of Johnson Matthey by Honeywell international with an aim of venturing into less emitting fuel like sustainable methanol and aviation fuel. Likewise, joint ventures and agreements are common, with firms such as Albemarle Corporation and KBR, Inc. collaborating to come up with the latest catalysts to develop methanol production. Such strategic positions will help the companies to stay on the competitive advantage in the fast-developing methanol catalyst market.

Corporate Landscape Methanol Catalyst Market:

Recent Developments

- In April 2025, Clariant started a MegaMax 900 catalyst of ethanol to methanol in the e-methanol facility at European energy in Kasso, Denmark. This plant is one of the first and largest commercial e-methanol plants globally, generating on an annual basis, up to 42,000 tons of green methanol using biogenic CO2 and green hydrogen. MegaMax 900 catalyst offers high activity, stability as well as selectivity under low temperature and pressure to enhance sustainability and economics of green methanol production.

- In March 2025, Mitsubishi gas chemical company (MGC) began the construction of a methanol demonstration plant at its Mizushima Plant. The plant will be using a variety of gases such as CO2 and industrial by-product gases with a yearly production capacity of 100 tons. This project supports the determinations of Japan to recycle carbon and to reduce the greenhouse gases. The mobile plant is expected to set to test the methanol production technology on by-product gases of steel manufacturing mixed with hydrogen as a means to support the vision of MGC of a sustainable resource-recycling society with methanol.

- In January 2024, BASF partnered with Envision Energy to create e-methanol technologies. BASF offers high-end SYNSPIRE catalysts oriented towards high-efficiency green methanol manufacturing by using CO2 and renewable hydrogen. The concept of envision incorporates the AIoT-enabled energy management in order to streamline the process efficiency in line with the availability of renewable energy. The collaborative project involves the establishment of a demonstration plant in Inner Mongolia, China, aimed at going into commercial in 2025. The collaboration will promote the progress of the sustainable fuel alternatives, as it will be possible to optimize the processes dynamically and reduce the amount of carbon emission considerably.

- Report ID: 8283

- Published Date: Dec 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Methanol Catalyst Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.