Polycythemia Vera Treatment Market Outlook:

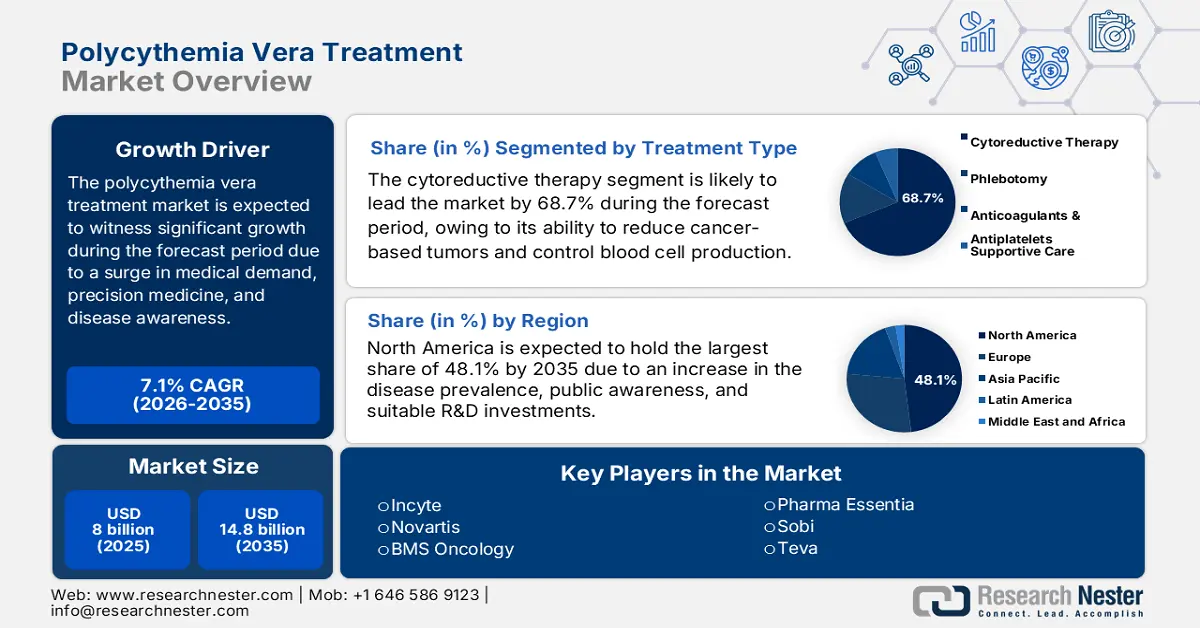

Polycythemia Vera Treatment Market size was USD 8 billion in 2025 and is expected to reach USD 14.8 billion by the end of 2035, increasing at a CAGR of 7.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of polycythemia vera treatment is evaluated at USD 8.5 billion.

The polycythemia vera treatment market is witnessing sustained growth, owing to factors such as innovation in the pipeline, an increase in unmet medical demand, expansion in treatment indications, a sudden shift towards precision medicine, the presence of an aging population, and optimized diagnostics and disease awareness. According to an article published by NLM in January 2023, there has been a year-on-year rise in healthcare expenditure as a part of the gross domestic product (GDP), which reached 17% in the U.S. and 10.2% in Australia. In addition, drug development is also a huge contributor to the market’s upliftment, which is estimated to account for USD 1.3 billion to produce new drugs in the market.

Moreover, the aspect of suitable reimbursement policies, tactical geographic expansion, advancements in drug delivery, and intense growth in digitalized health and telehealth are also boosting the overall polycythemia vera treatment market internationally. As per an article published by ASPE in April 2023, the telehealth utilization rate readily varied, ranging from 20.5% to 24.2%, with an average of 22% adults reporting the continuous implementation of telehealth. Besides, 28.3% of telehealth visits have been covered by Medicaid, and 26.85% by Medicare. Therefore, with the effective presence of health services, along with standard reimbursement policies, the market is continuously growing across different nations.

Key Polycythemia Vera Treatment Market Insights Summary:

Regional Highlights:

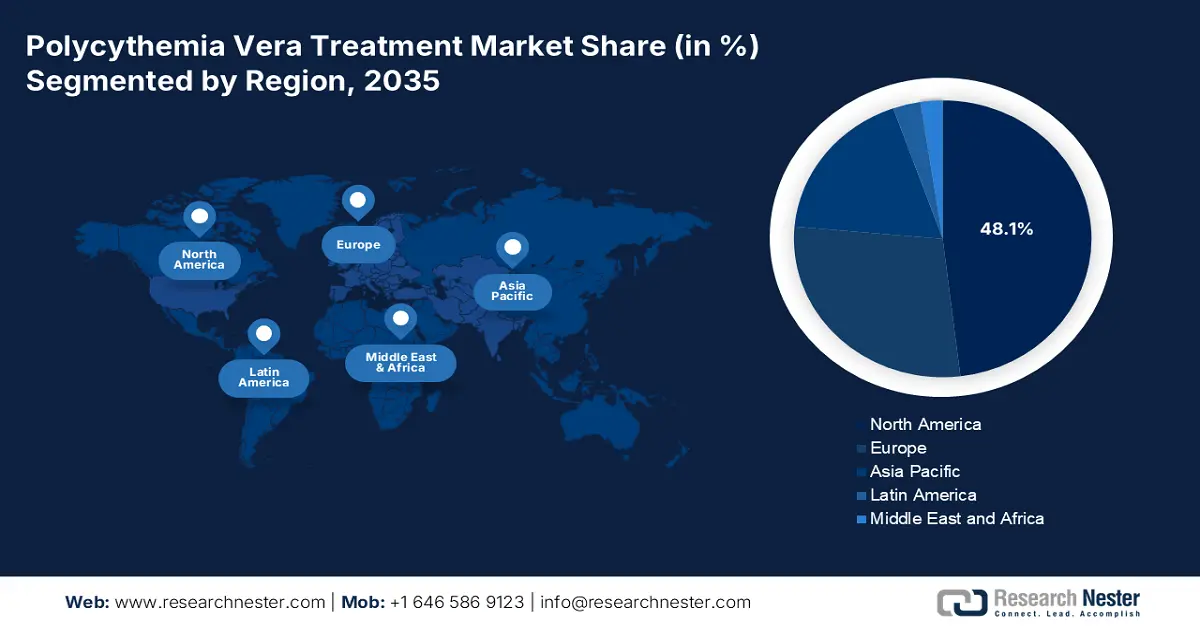

- North America is anticipated to dominate the polycythemia vera treatment market with a 48.1% share by 2035 as high disease awareness, strong diagnostic capabilities, and significant medical research investments strengthen therapeutic adoption and innovation.

- Asia Pacific is expected to emerge as the fastest-growing region driven by improving healthcare infrastructure, rising health expenditure, growing disease awareness, and demographic changes such as a rapidly aging population.

Segment Insights:

- The cytoreductive therapy segment is projected to secure a 68.7% share by 2035 in the polycythemia vera treatment market as its ability to reduce tumor volume and regulate elevated blood cell production drives strong clinical adoption supported by favorable survival outcomes from recent studies.

- The hospital pharmacies segment is expected to hold the second-largest share as the high cost and complex administration of interferon-based drugs, along with the need for continuous monitoring and procedures such as therapeutic phlebotomy, make hospital settings the preferred distribution channel.

Key Growth Trends:

- Expansion in first-line treatment

- Sudden shift towards targeted therapies

Major Challenges:

- Government negotiations and price controls

- Cost-sharing and patient affordability

Key Players: Novartis AG, Bristol Myers Squibb, PharmaEssentia Corp., CTI BioPharma, Teva Pharmaceutical Industries Ltd., Mylan N.V., Pfizer Inc., Sandoz International GmbH, Dr. Reddy's Laboratories Ltd., Hikma Pharmaceuticals PLC, Apotex Inc., Cipla Ltd., Glenmark Pharmaceuticals Ltd., MSD (Merck & Co., Inc.).

Global Polycythemia Vera Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8 billion

- 2026 Market Size: USD 8.5 billion

- Projected Market Size: USD 14.8 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48.1% Share by 2034)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, China, Japan

- Emerging Countries: India, Brazil, South Korea, Indonesia, Mexico

Last updated on : 26 September, 2025

Polycythemia Vera Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Expansion in first-line treatment: This particular treatment is frequently considered to be a part of the standard set of treatments, including surgery, which is followed by radiation and chemotherapy. In addition, it is accepted as one of the best treatments, which is positively impacting the polycythemia vera treatment market. In this regard, the September 2023 NLM article indicated that the first-line tyrosine kinase inhibitors (TKIs) therapy has been successful at a 66.2% rate. In addition, first-line platinum-specific chemotherapy has also been successful, with a rate of 43.1% and 48.6% by combining both pemetrexed and bevacizumab.

- Sudden shift towards targeted therapies: These therapies are readily designed to operate by effectively exploiting differences between healthy cells and cancer cells, thereby positively driving the polycythemia vera treatment market internationally. According to an article published by Biochemical Pharmacology in October 2022, with the adoption of targeted therapy, HER2 amplification accounted for 28% of human breast tumors, which was correlated with a high risk of relapse and death. Besides, a 10-year randomization process, the disease-free survival rate was 69% for cohorts after receiving 2 years of trastuzumab, thus suitable for uplifting the market.

- Innovation in drug formulations: The aspect of drug formulation is gaining increased importance in modern medicine, which is further turning raw active ingredients into effective and combinable therapies, thus boosting the polycythemia vera treatment market. According to an article published by the MedRxiv Organization in February 2024, an overall 20,398 CTPs, which corresponds to 9,682 unique molecular entities for aiding 910 disease classes, have been readily defined by the WHO, thus denoting a huge growth opportunity for the overall market internationally.

Polycythemia Diagnosis Categories Driving the Market Demand (2023)

|

Category A |

Category B |

|

36 mL/kg of overall red blood cell mass in males and 32mL/kg among females |

Platelets of over 400,000 per microliters |

|

Arterial oxygen saturation more than or equal to 92% |

White blood cells of more than 12,000 per microliter |

|

Splenomegaly |

Leukocyte alkaline phosphatase (ALP) more than 100 U/L |

|

- |

Serum vitamin B12 more than 900 pg/mL or binding capacity more than 2200 pg/mL |

Source: NLM

Medical Treatment Boosting the Polycythemia Vera Treatment Market

|

Treatment Method |

Components |

|

Phlebotomy |

|

|

Low Dose Aspirin |

|

|

Treat aspirin refractory symptoms |

|

|

Cardiovascular health optimization |

|

Source: NLM

Challenges

- Government negotiations and price controls: The US Inflation Reduction Act (IRA) effectively represents a paradigm shift, which has permitted Medicare to successfully negotiate drug prices directly. For the polycythemia vera treatment market, a particular therapy chosen for negotiation is projected to experience a mandatory price, which is significantly below its market rate, thereby drastically diminishing the revenue potential. Besides, the Congressional Budget Office stated that this will effectively reduce federal spending, resulting loss of revenue for manufacturers.

- Cost-sharing and patient affordability: Even after achieving insurance coverage, co-insurance, and high deductibles can leave patients with disabling out-of-pocket expenses for special tier medications. This has led to non-adherence, worsened health outcomes, and prescription abandonment, thereby negatively impacting the polycythemia vera treatment market internationally. In addition, this harms patients, as well as undermines a drug’s real-world effectiveness and valuable story. However, to overcome this issue, manufacturers are recommended to fund ongoing patient assistance programs that can readily cover these expenses.

Polycythemia Vera Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 8 billion |

|

Forecast Year Market Size (2035) |

USD 14.8 billion |

|

Regional Scope |

|

Polycythemia Vera Treatment Market Segmentation:

Treatment Type Segment Analysis

The cytoreductive therapy segment in the polycythemia vera treatment market is anticipated to garner the largest share of 68.7% by the end of 2035. The segment’s growth is highly attributed to its ability to diminish cancer-based tumor volume and effectively control increased blood cell production. According to an article published by NLM in March 2024, a clinical study was conducted on 103 patients to evaluate the cytoreductive surgery, and the 90-day mortality rate was 2.9% and the 5-year overall survival rate was 36%, thus suitable for uplifting the segment’s growth.

Distribution Channel Segment Analysis

The distribution channel, the hospital pharmacies segment in the polycythemia vera treatment market is expected to account for the second-largest share during the projected timeline. The segment’s growth is highly driven by its specialty and the complicated nature of catering to therapeutics. Notable drugs, especially interferon formulations, are highly expensive and demand suitable administration protocols, which in turn have necessitated continuous monitoring by hematologists for adverse and efficacy events. Besides, crucial procedures, such as management of acute thrombotic complications and therapeutic phlebotomy, usually take place in hospital settings, thus denoting a huge growth opportunity for the overall market.

Drug Class Segment Analysis

The JAK inhibitors segment in the polycythemia vera treatment market is expected to account for the third-largest share by the end of the projected period. The segment’s development is highly fueled by its capability to provide treatment for different hematologic, inflammatory, and autoimmune diseases by effectively blocking particular intracellular signaling pathways and offering other mechanisms that conventional biologics. As per an article published by NLM in May 2022, the JAK structure comprises 7 domains, including JH-1 to JH-7, and four JAKs comprise the same domain, with an overall similarity rate of 48%, thus suitable for boosting the segment globally.

Our in-depth analysis of the polycythemia vera treatment market includes the following segments:

|

Segment |

Subsegments |

|

Treatment Type |

|

|

Distribution Channel |

|

|

Drug Class |

|

|

Disease Severity |

|

|

Line of Therapy |

|

|

Patient Population |

|

|

Route of Administration |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polycythemia Vera Treatment Market - Regional Analysis

North America Market Insights

North America in the polycythemia vera treatment market is anticipated to be the dominating region, garnering the highest share of 48.1% by the end of 2035. The market’s growth in the region is subject to an increase in disease prevalence, early diagnosis, high public awareness, effective R&D investments to ensure drug innovation, video display sourcing, and patient pool benefits. According to the January 202 Research America Organization data report, an estimated USD 161,766 investment has been made in the region of medical and health, while the federal government provided USD 61,475, followed by USD 16,814 from research and academic institutions, USD 2,986 from voluntary health associations, and USD 2,086 from the state government, thereby denoting a huge opportunity for the market in the region.

The polycythemia vera treatment market in the U.S. is growing significantly, owing to the increased disease prevalence, the strong presence of federal agency funding for blood and rare cancers, rapid implementation of innovative diagnostics, fast-track FDA clearances, and an expansion in Medicaid and Medicare coverage. As per an article published by NLM in April 2023, the disease readily affects 0.6 to 1.6 per million patients in the country. In addition, the Janus kinase-2 gene, which is involved in intracellular signaling, is effectively mutated across 905 of the disease cases, which is suitable for bolstering the market’s exposure.

The polycythemia vera treatment market in Canada is also growing due to the wide-ranging utilization of diagnostic tools, generous government funding, provincial and federal universal healthcare strategies, targeted administrative outlays for chronic conditions, and effective public health campaigns. As stated in the November 2024 Government of Canada report, approximately USD 1.4 billion has been provided to territories and provinces for three years to assist them in launching rare disease drugs, along with diagnostic and screening services, which will cater to lower the disease prevalence in the country, thus uplifting the market demand.

Video Displays 2023 Export and Import in North America

|

Countries |

Export |

Import |

|

Mexico |

USD 12.7 billion |

USD 2.8 billion |

|

U.S. |

USD 2.1 billion |

USD 17.3 billion |

|

Canada |

USD 160 million |

USD 1.4 billion |

|

Guatemala |

USD 7.7 million |

USD 1 billion |

|

Costa Rica |

USD 4 million |

USD 142 million |

|

El Salvador |

- |

USD 91 million |

Source: OEC

APAC Market Insights

Asia Pacific in the polycythemia vera treatment market is expected to emerge as the fastest-growing region within the projected timeline. The market’s development in the region is highly attributed to rapid optimization in health and medical facilities, an increase in health expenditure, rising awareness of the disease, a surge in the elderly population, expansion in digital health services, and government strategies. As per a data report published by the 2025 World Bank Organization, the 6.5% as of 2022 is the present health expenditure in terms of GDP, which is readily creating opportunities for the market to expand in the overall region.

The polycythemia vera treatment market in China is gaining increased traction, owing to a significant increase in government spending, the presence of a massive diagnosed patient population, the existence of public health campaigns, an increase in hospital-based specialist accessibility, and expansion in regional pharmaceutical manufacturing. According to an article published by NLM in September 2024, the Healthy China 2030 initiative has demonstrated a 25% decrease in out-of-pocket expenses. Besides, the WHO has suggested that the overall health spending in GDP should not be less than 5% and the out-of-pocket cost should range between 15% to 20%.

The polycythemia vera treatment market in India is also developing due to a rise in patient numbers, extensive growth in specialized health and medical infrastructure, growth in telehealth services, effective collaboration between foreign investments and government programs, and a boost in gas and liquid measuring instruments sourcing. As per the July 2025 MOHFW data report, the presence of eSanjeevani has been useful by serving 391,264,848 patients, followed by the availability of 223,143 providers, 133,205 AAMs operations, 17,423 operational hubs, and 694 online OPDs hostage. Therefore, the adoption of this particular platform as a telehealth service has resulted in a valuation of USD 391.2 million as of 2025, thus uplifting the market in the country.

Gas and Liquid Flow Measuring Instruments 2023 Export and Import in the Asia Pacific

|

Countries |

Export |

Import |

|

China |

USD 3.2 billion |

USD 2.5 billion |

|

Japan |

USD 1.5 billion |

USD 655 million |

|

Malaysia |

USD 533 million |

USD 265 million |

|

Singapore |

USD 386 million |

USD 518 million |

|

South Korea |

USD 456 million |

USD 797 million |

|

Thailand |

USD 339 million |

USD 267 million |

|

India |

USD 296 million |

USD 565 million |

|

Vietnam |

USD 70.2 million |

USD 143 million |

Source: OEC, August 2025

Europe Market Insights

Europe in the polycythemia vera treatment market is anticipated to account for a considerable share by the end of the forecast duration. The market’s exposure in the region is highly fueled by the presence of strict healthcare regulations, proactive national screening programs, government-based incentives, an increase in healthcare spending, and technological convergence. As per an article published by NLM in August 2024, the Artificial Intelligence (AI) Act in the overall region readily prohibits unacceptable risks, failing to overcome leads to EUR 35 million or 7% of yearly turnover for organizations as a penalty. Therefore, with the existence of stringent reforms, the market will experience growth in the region.

The polycythemia vera treatment market in Germany is gaining increased exposure, owing to a strong pharmaceutical industry, which is backed by state-funded clinical programs and government investments, increased per capita healthcare spending, advanced reimbursement policies, and robust biotech facility and research funding. As per a data report published by the ITA in August 2025, the gross value of the healthcare sector in the country was USD 496 billion as pf 2024, which readily corresponds to 11.5% of the overall country’s economy. Additionally, with more USD 172 billion through international sales, healthcare contributed 8.1% to the country’s exports, thus suitable for the market growth.

The polycythemia vera treatment market in France is also growing due to a rise in budget allocation for the treatment, active support from the Ministry of Solidarity and Health and French National Authority for Health (HAS) for reimbursement reforms, expansion in public awareness campaigns, enhanced focus on personalized medicine, and innovative therapies adoption. According to the May 2025 NLM article, 100% of the population is under the statutory health insurance coverage, and 96% of people also carry private complementary insurance. Besides, the healthcare spending was at 12.2% of GDP over the past five years, which is considered one of the highest spending rates in the whole of Europe.

Key Polycythemia Vera Treatment Market Players:

- Incyte Corporation (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novartis AG (Switzerland)

- Bristol Myers Squibb (U.S.)

- PharmaEssentia Corp. (Taiwan)

- CTI BioPharma (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Mylan N.V. (U.S.)

- Pfizer Inc. (U.S.)

- Sandoz International GmbH (Germany)

- Dr. Reddy's Laboratories Ltd. (India)

- Hikma Pharmaceuticals PLC (UK)

- Apotex Inc. (Canada)

- Cipla Ltd. (India)

- Glenmark Pharmaceuticals Ltd. (India)

- MSD (Merck & Co., Inc.) (U.S.)

The global polycythemia vera treatment market is effectively dominated by a handful of notable players, accounting for significant market share through proprietary patented therapies, especially in the case of JAK inhibitors. Besides, Novartis AG and Incyte Corporation are currently leading the market, highly fueled by the commercialization success of ruxolitinib. Meanwhile, tactical approaches are effectively focused on R&D for cutting-edge therapies, label expansions, along with geographic extension into emerging economies. Moreover, organizations are readily engaging with high-risk-sharing deals with payers and boosting patient support programs to combat price pressure and ensure market accessibility, thus suitable for the polycythemia vera treatment market internationally.

Here is a list of key players operating in the global market:

Recent Developments

- In August 2024, Merck notified the initiation of Shorespan-007, noting a crucial Phase 3 clinical trial for evaluating bomedemstat, which is an investigational orally available lysine-specific demethylase 1 (LSD1) inhibitor, for aiding patients with essential thrombocythemia.

- In June 2024, Agios Pharmaceuticals, Inc. stated the international Phase 3 ENERGIZE-T study of mitapivat in adults with transfusion-dependent (TD) alpha- or beta-thalassemia successfully gained its initial endpoint of transfusion reduction response.

- Report ID: 5256

- Published Date: Sep 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polycythemia Vera Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.