- Introduction

- Study Objective

- Scope of the report

- Market Taxonomy

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- Primary Research

- SPSS Approach

- Data Triangulation

- Client-specific Requirements and Tailored Solutions

- Executive Summary

- Competitive Landscape

- Competitive Intelligence

- Outcome: Actionable Insights

- Global Industry Overview

- Market Overview

- Global Demand Growth of Plant-based API (2020–2036)

- Demand Share by Region

- Regional Market Insights: Plant-Based API

- Top Import & Export Markets

- Comparative Overview of Plant-based and Synthetic API

- Comparative Assessment of Plant-based Molecules

- Application-wise Insights: Adoption, Trends, and Future Potential

- Competitive Landscape

- Major Buyers Of API: Purchasing Trends and Strategies

- Regional Synopsis

- Industry Supply Chain Analysis

- DROT

- Regulatory Framework

- Ongoing Technological Advancements

- Pice Benchmarking

- Patents Filed in The Industry

- Root Cause Analysis (RCA) for the Market

- Pestle Analysis

- Porter Five Forces Analysis

- Industry Risk Assessment

- Global Outlook and Projections

- Global Overview

- Market Value (USD Million), Volume (Thousand/Gram) Current and Future Projections, 2020-2036

- Increment $ Opportunity Assessment, 2020-2036

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), 2020-2036, By

- Molecule Type, Value (USD Million), Volume (Thousand/Gram)

- Alkaloids

- Phenolic Acids

- Terpenoids

- Lignin & Stilbenes

- Anthocyanin

- Flavonoids

- Others

- Form Type, Value (USD Million)

- Liquid

- Powder

- Granules

- Application, Value (USD Million)

- Oncology

- Cardiovascular

- Anti-inflammatory

- Pain Management

- Respiratory Disorders

- Diabetes

- Anti-viral / Anti-bacterial / Anti-fungal

- Others

- End-User, Value (USD Million)

- Pharmaceuticals

- Nutraceuticals

- Herbal Based Industries

- Others

- Regional Synopsis (USD Million) 2020-2036

- North America, Value (USD Million), Volume (Thousand/Gram)

- Europe, Value (USD Million), Volume (Thousand/Gram)

- Asia Pacific, Value (USD Million), Volume (Thousand/Gram)

- Latin America, Value (USD Million), Volume (Thousand/Gram)

- Middle East and Africa, Value (USD Million), Volume (Thousand/Gram)

- Molecule Type, Value (USD Million), Volume (Thousand/Gram)

- Global Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2020-2036

- Increment $ Opportunity Assessment, 2020-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2020-2036, By

- Molecule Type, Value (USD Million), Volume (Thousand/Gram)

- Alkaloids

- Phenolic Acids

- Terpenoids

- Lignin & Stilbenes

- Anthocyanin

- Flavonoids

- Others

- Form Type, Value (USD Million)

- Liquid

- Powder

- Granules

- Application, Value (USD Million)

- Oncology

- Cardiovascular

- Anti-inflammatory

- Pain Management

- Respiratory Disorders

- Diabetes

- Anti-viral / Anti-bacterial / Anti-fungal

- Others

- End-User, Value (USD Million)

- Pharmaceuticals

- Nutraceuticals

- Herbal Based Industries

- Others

- Country Level Analysis, Value (USD Million), Volume (Thousand/Gram)

- US

- Canada

- Molecule Type, Value (USD Million), Volume (Thousand/Gram)

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2020-2036

- Increment $ Opportunity Assessment, 2020-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2020-2036, By

- Molecule Type, Value (USD Million), Volume (Thousand/Gram)

- Alkaloids

- Phenolic Acids

- Terpenoids

- Lignin & Stilbenes

- Anthocyanin

- Flavonoids

- Others

- Form Type, Value (USD Million)

- Liquid

- Powder

- Granules

- Application, Value (USD Million)

- Oncology

- Cardiovascular

- Anti-inflammatory

- Pain Management

- Respiratory Disorders

- Diabetes

- Anti-viral / Anti-bacterial / Anti-fungal

- Others

- End-User, Value (USD Million)

- Pharmaceuticals

- Nutraceuticals

- Herbal Based Industries

- Others

- Country Level Analysis, Value (USD Million), Volume (Thousand/Gram)

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Netherlands

- Switzerland

- Poland

- Belgium

- Rest of Europe

- Molecule Type, Value (USD Million), Volume (Thousand/Gram)

- Overview

- Asia-Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2020-2036

- Increment $ Opportunity Assessment, 2020-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2020-2036, By

- Molecule Type, Value (USD Million), Volume (Thousand/Gram)

- Alkaloids

- Phenolic Acids

- Terpenoids

- Lignin & Stilbenes

- Anthocyanin

- Flavonoids

- Others

- Form Type, Value (USD Million)

- Liquid

- Powder

- Granules

- Application, Value (USD Million)

- Oncology

- Cardiovascular

- Anti-inflammatory

- Pain Management

- Respiratory Disorders

- Diabetes

- Anti-viral / Anti-bacterial / Anti-fungal

- Others

- End-User, Value (USD Million)

- Pharmaceuticals

- Nutraceuticals

- Herbal Based Industries

- Others

- Country Level Analysis, Value (USD Million), Volume (Thousand/Gram)

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Taiwan

- Thailand

- Singapore

- Philippines

- Vietnam

- New Zealand

- Malaysia

- Rest of Asia Pacific

- Molecule Type, Value (USD Million), Volume (Thousand/Gram)

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2020-2036

- Increment $ Opportunity Assessment, 2020-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2020-2036, By

- Molecule Type, Value (USD Million), Volume (Thousand/Gram)

- Alkaloids

- Phenolic Acids

- Terpenoids

- Lignin & Stilbenes

- Anthocyanin

- Flavonoids

- Others

- Form Type, Value (USD Million)

- Liquid

- Powder

- Granules

- Application, Value (USD Million)

- Oncology

- Cardiovascular

- Anti-inflammatory

- Pain Management

- Respiratory Disorders

- Diabetes

- Anti-viral / Anti-bacterial / Anti-fungal

- Others

- End-User, Value (USD Million)

- Pharmaceuticals

- Nutraceuticals

- Herbal Based Industries

- Others

- Country Level Analysis, Value (USD Million), Volume (Thousand/Gram)

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Molecule Type, Value (USD Million), Volume (Thousand/Gram)

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2020-2036

- Increment $ Opportunity Assessment, 2020-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2020-2036, By

- Molecule Type, Value (USD Million), Volume (Thousand/Gram)

- Alkaloids

- Phenolic Acids

- Terpenoids

- Lignin & Stilbenes

- Anthocyanin

- Flavonoids

- Others

- Form Type, Value (USD Million)

- Liquid

- Powder

- Granules

- Application, Value (USD Million)

- Oncology

- Cardiovascular

- Anti-inflammatory

- Pain Management

- Respiratory Disorders

- Diabetes

- Anti-viral / Anti-bacterial / Anti-fungal

- Others

- End-User, Value (USD Million)

- Pharmaceuticals

- Nutraceuticals

- Herbal Based Industries

- Others

- Country Level Analysis, Value (USD Million), Volume (Thousand/Gram)

- Saudi Arabia

- UAE

- Israel

- Qatar

- Kuwait

- Oman

- South Africa

- Rest of Middle East & Africa

- Molecule Type, Value (USD Million), Volume (Thousand/Gram)

- Overview

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

- Legal Disclaimer

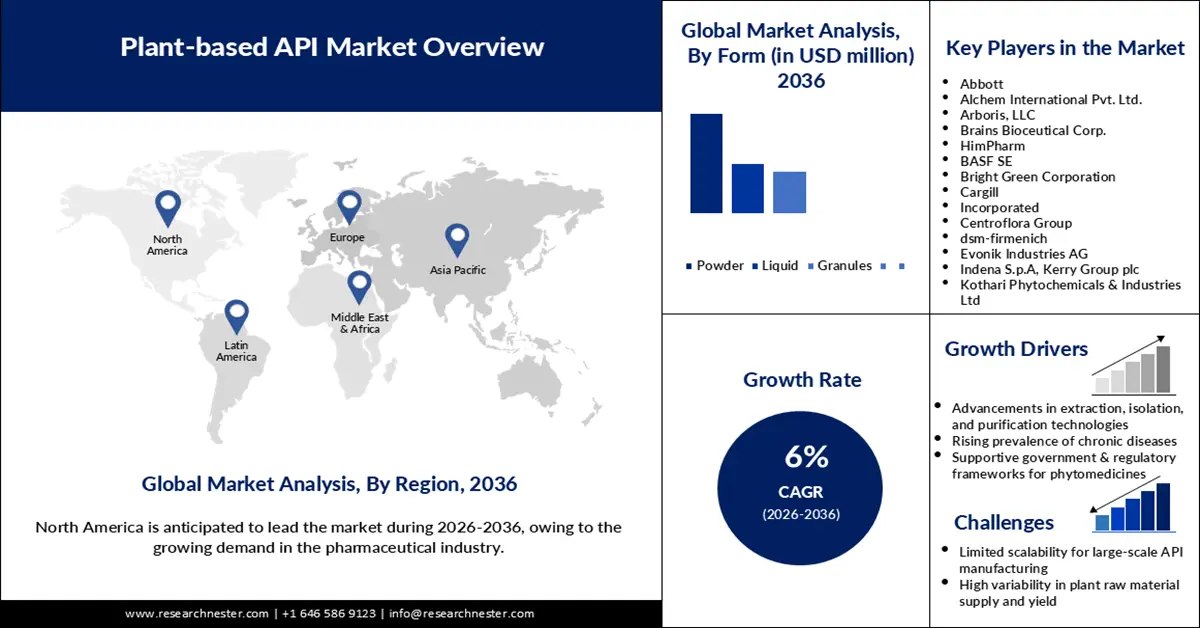

Plant-based API Market Outlook:

Plant-based API Market size was valued at USD 32.91 billion in 2025 and is projected to reach USD 63.84 billion by the end of 2036, rising at a CAGR of 6% during the forecast period, i.e., 2026-2036. In 2026, the industry size of plant-based API is estimated at USD 35.59 million.

The rising preferences for organic and herbal medications are fueling the market growth. Consumers globally are increasingly seeking plant-derived pharmaceutical products, driven by growing awareness of the side effects of synthetic drugs. Companies have also started to manufacture natural medications, nutraceutical products, and herbal supplements with the use of plant-based APIs, alternatives to synthetic drugs. For instance, in January 2023, Nutricia launched Fortimel Plant-Based Energy. The product was developed using a plant-based API and meets the growing nutritional needs of people.

The surging need for the pharmaceutical industry to enable sustainable and green manufacturing practices is also boosting the market growth. This type of need in the pharmaceutical sector is driven by the regulatory push. For instance, in December 2024, the World Health Organization released a call for action to foster sustainability in pharmaceutical production. As a result, the global pharmaceutical industry became obligated to sustainable packaging, manufacturing, distribution, and utilization of medical products to drive environmental benefits. The call for action also pushed for the integration of digital technologies and the initiation of public-private partnerships to foster environmentally-friendly innovation within the pharmaceutical sector. As a result, a steady adoption of the plant-based APIs can be noticed to alter the use of synthetic materials with organic compounds.

Key Plant Based API Market Insights Summary:

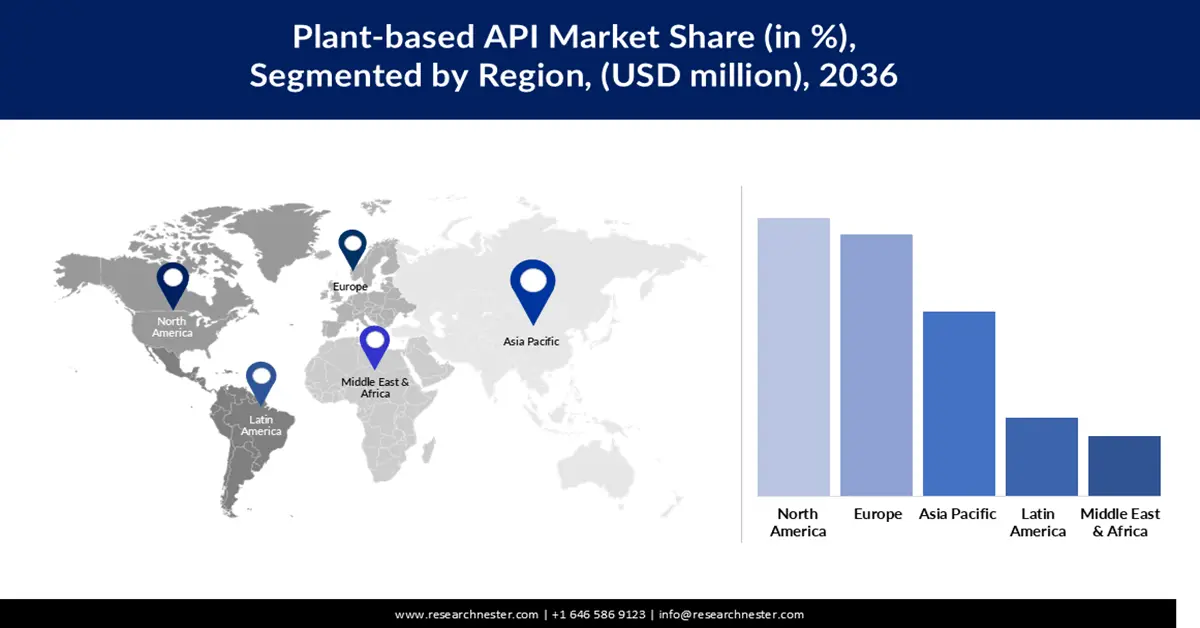

Regional Highlights:

- North America plant-based API market is anticipated to account for a 51% revenue share by 2036, owing to rising demand, technological advancements in extraction, and purification techniques.

- Europe market is projected to hold a 41.8% share by 2036, driven by environmental awareness, health consciousness, and an aging population.

Segment Insights:

- The alkaloids segment in the plant-based API market is anticipated to account for 50.5% share by 2036, owing to regulatory support for smoother integration into pharmaceutical portfolios.

- The powder segment is projected to capture a 69.6% revenue share during 2026–2036, driven by its stability, palatability, and ease of incorporation into pharmaceutical formulations.

Key Growth Trends:

- Advancements in extraction, isolation, and purification technologies

- Rising prevalence of chronic diseases

Major Challenges:

- Limited scalability for large-scale API manufacturing

- High variability in plant raw material supply and yield

Key Players: Roquette Freres SA, Company Overview, Business Strategy, Key Product Offerings, Financial Performance, Key Performance Indicators, Risk Analysis, Recent Development, Regional Presence, SWOT Analysis, EVONIK Industries, AG, Cargill, Inc., Novartis AG, Sanofi SA, Kothari Phytochemicals & Industries Ltd, Centroflora Group, Arboris, LLCs, BASF SE, GlaxoSmithKline, plc

Global Plant Based API Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 32.91 billion

- 2026 Market Size: USD 35.59 million

- Projected Market Size: USD 63.84 billion by 2036

- Growth Forecasts: 6% CAGR (2026-2036)

Key Regional Dynamics:

- Largest Region: North America (51% Share by 2036)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Indonesia, Mexico

Last updated on : 5 November, 2025

Plant-based API Market - Growth Drivers and Challenges

Growth Drivers

- Advancements in extraction, isolation, and purification technologies: Advancements in technologies used for solvent extraction and chromatography are likely to optimize the purity and yield of plant-based APIs in the upcoming business years. These are expected to provide the industry with the opportunity to boost consistency and address the issues of scalability. Strategic collaborations are also initiated by the technology companies globally to develop extraction, isolation, and purification technologies that can be adopted in the market to enhance sustainability.

- Rising prevalence of chronic diseases: The growing prevalence of chronic diseases, such as type 2 diabetes, cardiovascular disorders, cancer, and others, is expected to fuel the adoption of phytopharmaceutical products among the aging population. As reported by the World Health Organization in September 2025, around 19 million noncommunicable deaths took place due to cardiovascular diseases in 2021. During the same period, cancer, chronic respiratory diseases, and diabetes killed around 10 million, 4 million, and more than 2 million people, respectively. Plant-based APIs are the cornerstone of phytopharmaceuticals.

- Supportive government & regulatory frameworks for phytomedicines: Supportive government and regulatory frameworks promote standardization, safety, and commercialization. Clear guidelines for the approval, manufacturing, and quality control of botanical products reduce regulatory uncertainty and accelerate product launches. Many governments are introducing incentives, such as tax benefits, research grants, and fast-track approvals, to encourage pharmaceutical and biotech firms to invest in plant-derived APIs. Additionally, harmonized international standards and favorable intellectual property regulations facilitate global trade and technology transfer. These frameworks also emphasize sustainability and ethical sourcing, strengthening supply chain transparency. Overall, such supportive policies enhance investor confidence, expand market access, and help transform plant-based APIs from traditional remedies into clinically validated pharmaceutical ingredients.

Challenges

- Limited scalability for large-scale API manufacturing: For decades, pharmaceutical companies in Western countries have shifted API production to regions with lower labor and infrastructure costs to optimize profitability. The significant expenses associated with constructing and operating large-scale batch manufacturing facilities have driven this trend. However, this offshoring strategy poses a challenge for the production of plant-based APIs, as it limits local manufacturing capabilities and increases reliance on external supply chains. Consequently, Western manufacturers may face reduced profit margins and slower scalability due to higher production costs and dependency on imported raw materials.

- High variability in plant raw material supply and yield: High variability in plant raw material supply and yield is a common area of challenge for the plant-based API industry, which can disrupt the production process. The availability of plant raw materials, such as fruits, leaves, seeds, herbs, and roots required for the production of the plant-based APIs, often fluctuates in different regions. Geographical and seasonal variations, the impact of climate change, and environmental damage are the factors causing a lack of availability of the required raw materials in different regions.

Plant-based API Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2036 |

|

CAGR |

6% |

|

Base Year Market Size (2025) |

USD 32.91 billion |

|

Forecast Year Market Size (2036) |

USD 63.84 billion |

|

Regional Scope |

|

Plant-based API Market Segmentation:

Molecule Type Segment Analysis

The alkaloids segment is expected to account for a market share of 50.5% by 2036, owing to regulatory support for smoother integration into pharmaceutical portfolios. The molecule type has a long history of approval from regulators across different regions. It is even widely available in the global market. As revealed by the Government of Opium & Alkaloid factories in September 2025, alkaloid firms are engaged in the processing of the raw opium into pharmacopoeia-grade alkaloids to fulfill the demand of the pharmaceutical industry in India. Therefore, the demand for the molecule type is likely to accelerate with the expansion of the pharmaceutical industry in different regions. North America generated 49.1% of global pharmaceutical sales in 2021.

Form Segment Analysis

The powder segment is projected to acquire a revenue share of 69.6% between 2026 and 2036, as a consequence of the growing demand for the plant-based API in powder form in the pharmaceutical sector. The demand is driven by the stability, palatability, and easy incorporation characteristics of the API produced in powder form. The production of this type of API provides them with a longer shelf life, suitable for use in the formulation of tablets, capsules, and sachets. Organizations are actively investing in the production of plant-based APIs in powder form, influencing the future dominance of the segment by increasing the market accessibility of the product. For instance, in November 2023, Relsus introduced a premium line of plant-based protein powders in India, formulated using locally sourced ingredients. The company leveraged these materials to develop plant-based APIs in powder form, emphasizing sustainability, quality, and the use of regionally available resources to strengthen its local production capabilities.

Application Segment Analysis

The oncology segment is poised to hold a revenue share of 58.9% during the forecast period, on account of the growing prevalence of cancer. As reported by the World Health Organization in February 2024, the number of cancer cases is estimated to surpass 35 million in 2050, an increase of 77% from the projected 20 million in 2022. This indicates a growing need for oncological treatments in the upcoming business years, which can fuel the consumption of plant-based APIs as a source of active pharmaceutical ingredients. Increasing research and development can expand the application of plant-based API in the field of oncology.

Our in-depth analysis of the plant-based API includes the following segments:

|

Segments |

Subsegments |

|

Molecule Type |

|

|

Form |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Plant-based API Market - Regional Analysis

North America Market Insights

The plant-based API market is anticipated to account for a revenue share of 51% by the end of 2036, owing to the growing demand in the pharmaceutical industry. The growing consumer preference for organic and sustainable pharmaceutical products is encouraging drug manufacturers to adopt plant-based APIs. In North America, technological advancements, particularly in extraction and purification techniques, are further propelling this trend. These innovations are enhancing efficiency, yield, and consistency in API production. Consequently, the region is well-positioned to lead the development of advanced plant-based APIs and broaden their applications across various therapeutic areas.

The U.S is projected to emerge as an expanding market, at a CAGR of 5.6%, during the forecast period. The growing prevalence of chronic diseases is likely to fuel the consumption of plant-based APIs in the upcoming business years. As reported by the CDC Foundation in April 2025, around 194 million adults in the U.S. were victims of chronic diseases in 2023, a 7% increase from 2013. The U.S. is also expected to show leadership in the development of the advanced plant-based APIs, with growing innovation in manufacturing and extraction technologies.

Canada is likely to show dominance as an expanding market, owing to the rapid shift of consumers towards natural pharmaceutical products, influencing the biopharmaceutical suppliers to adopt organic API. Regulatory push for pharmaceutical and sustainable agricultural practices is also likely to boost the consumption of the plant-based APIs. For instance, in December 2022, Agriculture and Agri-Food Canada launched a consultation with the agriculture industry stakeholders, partners, and producers to promote sustainable agricultural practices. The use of sustainably produced plants of cannabis, turmeric, ginseng, and cinchona can promote circularity in the market.

Europe Market Insights

The Europe plant-based API market is projected to account for a revenue share of 41.8% by 2036, as a consequence of the growing environmental awareness and health consciousness among the regional population. In a survey conducted by the European Union in 2024, 78% of respondents agreed with the regular life and health issues caused by environmental damage. This is likely to influence pharmaceutical firms across the region to adopt plant-based APIs in production. Europe is facing issues with an aging population, influencing a growth in the prevalence of chronic diseases, which can lead to a boost in plant-based API consumption. Among the 449.3 million population of the region, around 21.6% was aged 65 years and older as of January 2024.

The plant-based API market in Germany can witness an expansion at a 7% CAGR from 2026 to 2036, attributed to the strong dominance of the phytopharmaceuticals sector of the country. Germany is extremely active in sustainable phytopharmaceutical cultivation, influencing a steady expansion of plant-based APIs in production. The robust expansion of the pharmaceutical industry is also expected to fuel the use of plant-based APIs, especially when the government is encouraging environmentally friendly practices. As disclosed by the Germany Trade & Invest in August 2024, Sanofi, the pharmaceutical giant in France, is keen to invest USD 1.5 billion to boost insulin production in Germany.

The UK is projected to exhibit significant growth in the market over the forecast period, driven by the rising prevalence of chronic diseases and the resulting increase in demand for plant-derived pharmaceutical ingredients. The growing incidence of chronic illnesses leading to higher mortality rates has further intensified the need for safer, natural, and sustainable treatment options. Consequently, this trend is accelerating the consumption of plant-based APIs across the country. According to The Health Foundation in July 2023, around 9.1 million people in the UK are likely to suffer from chronic diseases by 2040.

Top Causes of Death Per 100,000 Population in the United Kingdom of Great Britain and Northern Ireland 2021

|

Diseases |

Deaths per 100,000 population |

|

Alzheimer disease and other dementias |

128 |

|

COVID-19 |

103.8 |

|

Ischaemic heart disease |

103.7 |

|

Lower respiratory infections |

56.9 |

|

Stroke |

53.9 |

|

Chronic obstructive pulmonary disease |

53.8 |

|

Trachea, bronchus, lung cancers |

52 |

|

Colon and rectum cancers |

29.2 |

|

Breast cancer |

19.8 |

|

Prostate cancer |

19.8 |

Source: WHO

The development of the advanced plant tissue culture methods in the UK is also expected to fuel the production of plant-based APIs in more sustainable ways. Consumers are also seeking natural pharmaceutical products, influencing a growing consumption of the material in the years to come.

Asia Pacific Market Insights

The plant-based API market in the Asia Pacific is projected to experience a CAGR of 6.7% throughout the projection timeline, with the growing demand for functional food and nutraceutical products, driven by surging disposable income among the population. Potential consumers are becoming increasingly health-conscious and prone to lifestyle-based diseases across the region, leading them to adopt natural and functional products. Governments within the region are increasingly in the plant-based and cell-cultivated market, making access to funding for plant-based API production more convenient.

China is poised to acquire a remarkable plant-based API market share by 2036, due to the rapid modernization of pharmaceutical practices. Therefore, with the expansion of the pharmaceutical industry of the country, the demand for plant-based APIs is also likely to increase in the near future. As reported by the International Trade Administration in September 2025, China’s pharmaceutical market was valued at USD 282 billion in 2023 and is expected to reach a valuation of USD 298 billion by the end of 2025, an increase of 7.8%. The biological diversity in China is increasing the scope of using novel plants in the production of APIs.

India is set to emerge as a growing plant-based API market, owing to the presence of a vast number of brands, increasing the diversity of the APIs. Companies within the country are also involved in the development of plant-based APIs, contributing significantly to the advancement of the material. Government support can also be availed for the expansion of the market in India. For instance, as informed by the KNN India in April 2024, the Production-Linked Incentive (PLI) scheme of the government is aimed at bolstering the API production domestically to reduce dependence on China in drug development.

Key Plant-based API Market Players:

- Roquette Freres SA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- EVONIK Industries, AG

- Cargill, Inc.

- Novartis AG

- Sanofi SA

- Kothari Phytochemicals & Industries Ltd

- Centroflora Group

- Arboris, LLCs

- BASF SE

- GlaxoSmithKline, plc

Global leaders in the plant-based API market are solidifying their position through strategic initiatives, which are successfully ensuring the widespread of this methodology. Their effort to advance in new formulations and indications is encouraging other players to engage their resources. They are also investing in captivating novel synthesizing techniques to elevate the quality of the ingredients. For instance, in September 2024, Zydus Lifesciences acquired Sterling Biotech’s fermentation-based API business in a transaction of USD 9.5 million. The acquisition was intended to possess a complete array of offerings and a production site at Masa, Gujarat, strengthening its footprint in this sector. Such key players are:

Recent Developments

- In April 2024, Roquette launched the LYCAGEL hydroxypropyl pea starch excipient range at Vitafoods Europe 2024 as an addition to its plant-based softgel. The new API pipeline broadened the company’s scope of globalization in the field of vegetarian and vegan supplements.

- In October 2023, Evonik announced the commercial launch of plant-based squalene, PhytoSquene for parenteral drug delivery applications. The functions of these adjuvant components aim to reduce dependency on animal-derived materials while maintaining quality and purity.

- Report ID: 7136

- Published Date: Nov 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Plant Based API Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.