Pancreatic Elastase Testing Market Outlook:

Pancreatic Elastase Testing Market size was valued at USD 17.8 billion in 2025 and is projected to reach USD 36.9 billion by the end of 2035, rising at a CAGR of 7.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of the pancreatic elastase testing is estimated at USD 19.3 billion.

There has been an increased awareness and diagnosis of pancreatic insufficiency, particularly among patients with chronic pancreatitis, cystic fibrosis, and other gastrointestinal disorders, which are the key factors propelling growth in the pancreatic elastase testing industry. In this regard, the National Institute of Health in June 2023 revealed that acute pancreatitis leads to around 275,000 hospital admissions in a year, wherein 80% of cases are mild and a mortality rate of about 2%. It also stated that chronic pancreatitis affects 50 per 100,000 people, with an annual incidence of 5 to 12 per 100,000.

Furthermore, the growing focus on early detection and preventive healthcare is driving adoption in this field, especially in regions with expanding healthcare infrastructure. A study by the NIH in January 2025 observed that the ambulatory care cost breakdown for the cohort shows significant differences between the U.S. and Ireland. It further found that the U.S. is dominating at 81.41% of the total laboratory costs, wherein Ireland reported at 40.35%, and higher proportions in radiology and procedures.

Key Pancreatic Elastase Testing Market Insights Summary:

Regional Insights:

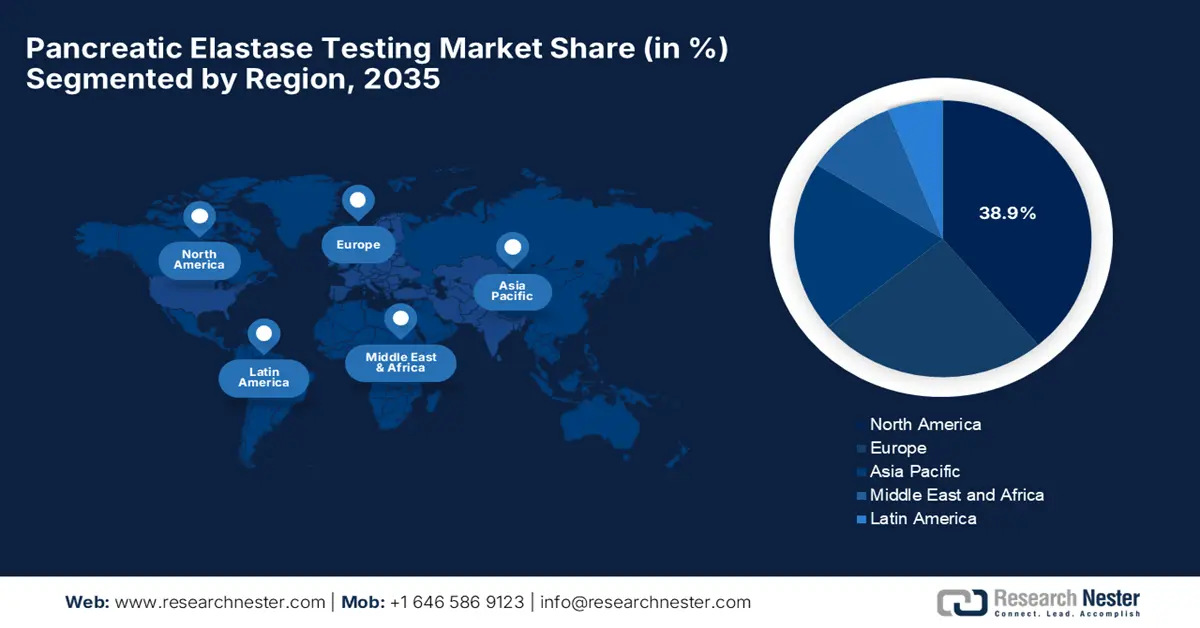

- By 2035, North America is anticipated to secure a 38.9% share of the Pancreatic Elastase Testing Market, propelled by rising gastrointestinal disease prevalence and expanding digital test access.

- Between 2026 and 2035, the Asia Pacific region is expected to record the highest CAGR, underpinned by escalating healthcare spending and rapid advances in diagnostic infrastructure.

Segment Insights:

- By 2035, the exocrine pancreatic insufficiency segment is projected to command a 68.5% share in the Pancreatic Elastase Testing Market, spurred by heightened awareness of EPI as a comorbidity and growing diagnostic adoption.

- The ELISA kits segment is forecast to capture a 62.3% share by 2035, strengthened by its position as the gold standard for quantitative fecal elastase-1 measurement.

Key Growth Trends:

- Emergence of non-invasive diagnostic technologies

- Growing focus on preventive healthcare

Major Challenges:

- Strict regulatory compliance and delays in approval

Key Players: Abbott Laboratories, Bühlmann Laboratories AG, DiaSorin S.p.A., Thermo Fisher Scientific Inc., CerTest Biotec S.L., Meridian Bioscience, Inc., Quest Diagnostics Incorporated, Bio-Rad Laboratories, Inc., Siemens Healthineers AG, F. Hoffmann-La Roche Ltd, Immundiagnostik AG, DRG International, Inc., Cell Sciences, Inc., Alpha Laboratories Ltd.

Global Pancreatic Elastase Testing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.8 billion

- 2026 Market Size: USD 19.3 billion

- Projected Market Size: USD 36.9 billion by 2035

- Growth Forecasts: 7.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, China

- Emerging Countries: India, South Korea, Brazil, Australia, Singapore

Last updated on : 26 September, 2025

Pancreatic Elastase Testing Market - Growth Drivers and Challenges

Growth Drivers

- Emergence of non-invasive diagnostic technologies: This is the pivotal driving factor in the upliftment of the market since it offers a convenient, accurate alternative to invasive procedures. BIVDA in February 2021 noted that the new fPELA turbo assay will revolutionize pancreatic elastase testing by offering automated, flexible, and rapid analysis on most clinical chemistry platforms. Besides. It allows simultaneous testing with the fCAL turbo assay using the same CALEX extraction device, thereby positively influencing market growth.

- Growing focus on preventive healthcare: Healthcare systems across different nations are focusing on preventive care and early diagnosis of chronic conditions to reduce long-term complications and healthcare costs as well. This can be testified by the report from the PRECEDE Consortium in September 2024, which reported advancements in early detection and personalized care for high-risk individuals with pancreatic cancer, aiming to increase the 5-year survival rate from 13% to 50% through proper monitoring, screening methods, and risk management.

- Expanding healthcare infrastructure: Patients are gaining enhanced access to diagnostic facilities owing to the expanding healthcare expenditure, which is constantly driving business in the pancreatic elastase testing sector. In May 2025, Dr. D. Y. Patil Medical College, Pune, hosted the national conference Gastro Update of DYPMC: Pancreas Update 2025, in collaboration with the Indian Medical Association, which also inaugurated the DPU–Integrated Center for Pancreatic Diseases and attracted over 330 participants.

Ambulatory Care Cost Breakdown for Cystic Fibrosis 6-17-Year-Old Cohort in the U.S. and Ireland

|

Category |

U.S. (USD) |

% of Total (U.S.) |

Ireland (USD) |

% of Total (Ireland) |

|

Total Cost |

4,243.76 |

100.00% |

3,148.38 |

100.00% |

|

Laboratory |

3,454.75 |

81.41% |

1,270.26 |

40.35% |

|

Clinic Visit |

526.76 |

12.41% |

672.22 |

21.35% |

|

Radiology |

260.19 |

6.13% |

880.60 |

27.97% |

|

Procedures |

2.06 |

0.05% |

325.30 |

10.33% |

Source: NIH, 2025

Digestive Disease Statistics in the U.S. (2018-2022)

|

Category |

Statistic |

|

Adults with diagnosed ulcers |

14.8 million |

|

Percent of adults with diagnosed ulcers |

5.9% |

|

Physician office visits for digestive diseases |

35.4 million visits |

|

Emergency department visits for digestive diseases |

8.8 million visits |

Source: CDC

Challenges

- Strict regulatory compliance and delays in approval: Manufacturers face intricate regulatory compliance that is variable across various regions, which usually causes delays in the approval of the product and market access. Also, the variance in the results in the laboratories by using different ELISA kits due to the lack of standardization results in the governments refraining from incorporating tests in their national health programs, hence causing hindrance to market expansion.

Pancreatic Elastase Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.9% |

|

Base Year Market Size (2025) |

USD 17.8 billion |

|

Forecast Year Market Size (2035) |

USD 36.9 billion |

|

Regional Scope |

|

Pancreatic Elastase Testing Market Segmentation:

Application Segment Analysis

Based on the application, the exocrine pancreatic insufficiency segment is projected to garner the largest revenue share of 68.5% in the pancreatic elastase testing market during the forecast timeline. The dominance of this segment is highly attributable to the significant unmet need and a growing awareness of API as a complication of other diseases. NIH in January 2023 revealed that Fecal Elastase-1 (FE-1) is used as a screening test to evaluate pancreatic insufficiency, particularly in diabetic patients. Also, 13% of diabetic patients had low FE-1 levels, indicating exocrine pancreatic insufficiency and the importance of fecal elastase testing in detecting pancreatic dysfunction.

Test Type Segment Analysis

In terms of test type, the ELISA kits segment is expected to attain a significant share of 62.3% in the pancreatic elastase testing market by the end of 2035. Their established role as the gold standard for quantitative fecal elastase-1 measurement is the key factor behind the leadership. For instance, in April 2025, Tecan Group announced the acquisition of certain assets related to key ELISA immunoassay products from Cisbio Bioassays SAS, which is a subsidiary of Revvity Inc. It also includes the manufacturing rights for four ELISA kits, two for in vitro diagnostics and two for research use.

End user Segment Analysis

Based on the end-user hospitals & diagnostic laboratories segment, it is anticipated to capture a considerable share of 55.8% in the pancreatic elastase testing market over the analyzed timeframe. The subtype’s growth is highly subject to its role as a primary hub for diagnostic workups. Also, patients with symptoms suggestive of EPI or with underlying risk factors such as chronic abdominal pain, steatorrhea, are typically referred to gastroenterologists based in hospitals or have samples sent to large diagnostic labs, hence a wider segment scope.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Test Type |

|

|

End user |

|

|

Form |

|

|

Product |

|

|

Sample Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pancreatic Elastase Testing Market - Regional Analysis

North America Market Insights

The pancreatic elastase testing market in North America is projected to register 38.9% of the share by 2035, owing to rising incidences of gastrointestinal disease and increasing digital test access. Various companies in the region are making strategic partnerships with public health agencies to accelerate the market uptake. In the U.S, the launch of home-based stool test kits is a major driving factor, wherein Geneoscopy in July 2025 reported U.S. FDA approval for an updated stool collection kit for its RNA-based colorectal cancer screening test, ColoSense, aiming to simplify at-home screening.

Canada in the pancreatic elastase testing industry is also set to witness staggering growth due to increased funding through provincial and federal initiatives. The government in the country is emphasizing early-stage diagnostic testing. For instance, in March 2025, Health Canada reported a bilateral agreement in collaboration with Quebec to invest a substantial USD 305 million in improving access to drugs for rare diseases. The funding will support early diagnosis, screening, and access to new and existing treatments as part of Quebec’s Action Plan on Rare Diseases, hence benefiting overall market growth.

Canada's National Strategy for Drugs for Rare Diseases (2023)

|

Funding Purpose |

Amount |

Duration |

Notes |

|

Total Investment in National Strategy |

Up to USD 1.5 billion |

Over 3 years |

To improve access and affordability of rare disease drugs |

|

To Provinces and Territories via Bilateral Agreements |

Up to USD 1.4 billion |

Part of USD 1.5 billion total |

For access to new/emerging drugs, existing drugs, early diagnosis, and screening |

|

To the Canadian Institutes of Health Research (CIHR) |

USD 32 million |

Over 5 years |

For rare disease research, diagnostic tools, and a clinical trial network |

|

To National Governance Structures (Health Canada Secretariat & Advisory Group) |

USD 16 million |

Over 3 years |

To support the implementation of the National Strategy |

Source: Health Canada

APAC Market Insights

The pancreatic elastase testing market in the Asia Pacific is projected to progress with the highest CAGR between 2026 and 2035, fueled by rising healthcare expenditure and the establishment of upgraded diagnostic infrastructure. In a plethora of countries, AI-powered diagnostic practices and tests based on stool analysis are considered to be the gold standard practice amongst healthcare practitioners. Additionally, the administrative bodies across the region’s countries are also giving preference to the early diagnosis and adoption of non-invasive testing for pancreatic diagnostics.

In India, the widespread expansion of private facilities for diagnosis in the country, schemes such as the National Health Policy, are emphasizing the early detection of chronic diseases, augmenting demand in the market. For instance, in May 2024, Cipla reported an additional investment of up to INR 26 crore (USD 3.13 million) in Achira Labs Private Limited through Optionally Convertible Preference Shares, in four tranches, which strengthens its position in the point-of-care (PoC) diagnostics space, supporting Achira’s efforts to develop and commercialize innovative medical test kits in the country.

Europe Market Insights

The pancreatic elastase testing market in Europe is predicted to register a notable share by the end of 2035 due to the presence of a robust framework for approvals and exponentially increasing digestive disorders. In May 2025, ALPCO reported that it had launched the Calprotectin Immunoturbidimetric Assay in Europe, which is an FDA-cleared assay, expanding its gastrointestinal diagnostic portfolio. The company also reported that the assay was certified in 2022 (IVDD), remarkably, assisting in diagnosing inflammatory bowel diseases such as Crohn’s disease and ulcerative colitis, with high sensitivity (90.5%) and specificity (93.4%).

The market in Switzerland is portraying steady growth, owing to increasing collaborations between major firms and advancements in diagnostic technologies. In October 2024, BÜHLMANN Laboratories AG announced that it had partnered with Beckman Coulter to distribute its BÜHLMANN fPELA turbo assay, an automated test for quantifying pancreatic elastase in stool samples, on Beckman Coulter’s clinical chemistry analyzers. Therefore, such moves enhance laboratory workflow efficiency by integrating pancreatic elastase testing into routine automated platforms, hence denoting a positive market outlook.

Key Pancreatic Elastase Testing Market Players:

- Abbott Laboratories

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bühlmann Laboratories AG

- DiaSorin S.p.A.

- Thermo Fisher Scientific Inc.

- CerTest Biotec S.L.

- Meridian Bioscience, Inc.

- Quest Diagnostics Incorporated

- Bio-Rad Laboratories, Inc.

- Siemens Healthineers AG

- F. Hoffmann-La Roche Ltd

- Immundiagnostik AG

- DRG International, Inc.

- Cell Sciences, Inc.

- Alpha Laboratories Ltd

- Sysmex Corporation

- PerkinElmer, Inc.

- Biopanda Reagents Ltd

- Randox Laboratories Ltd

- AccuBioTech Co., Ltd.

- Arlington Scientific, Inc.

The competitive landscape of the market for pancreatic elastase testing is rapidly evolving as established key players, healthcare giants, and new entrants are investing in novel medicines. Prominent organizations in the market are focused on developing new technologies and products that cater to the stringent regulatory norms and consumer demand. Besides, these firms are implementing numerous strategies, such as mergers and acquisitions, joint ventures, partnerships, and product launches, to enhance their product portfolio and strengthen their market position.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In July 2025, QuidelOrtho and BÜHLMANN Laboratories AG together declared the availability of the fCAL and fPELA turbo assays on QuidelOrtho’s VITROS Systems, which will assist in the diagnosis of IBD and pancreatic insufficiency.

- In April 2022, American Laboratory Products Company announced that it had merged with GeneProof, and the milestone combined ALPCO’s immunoassay expertise with GeneProof’s extensive molecular diagnostics portfolio, including over 70 CE-marked PCR tests distributed across multiple continents.

- Report ID: 4043

- Published Date: Sep 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pancreatic Elastase Testing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.