Syphilis Testing Market Outlook:

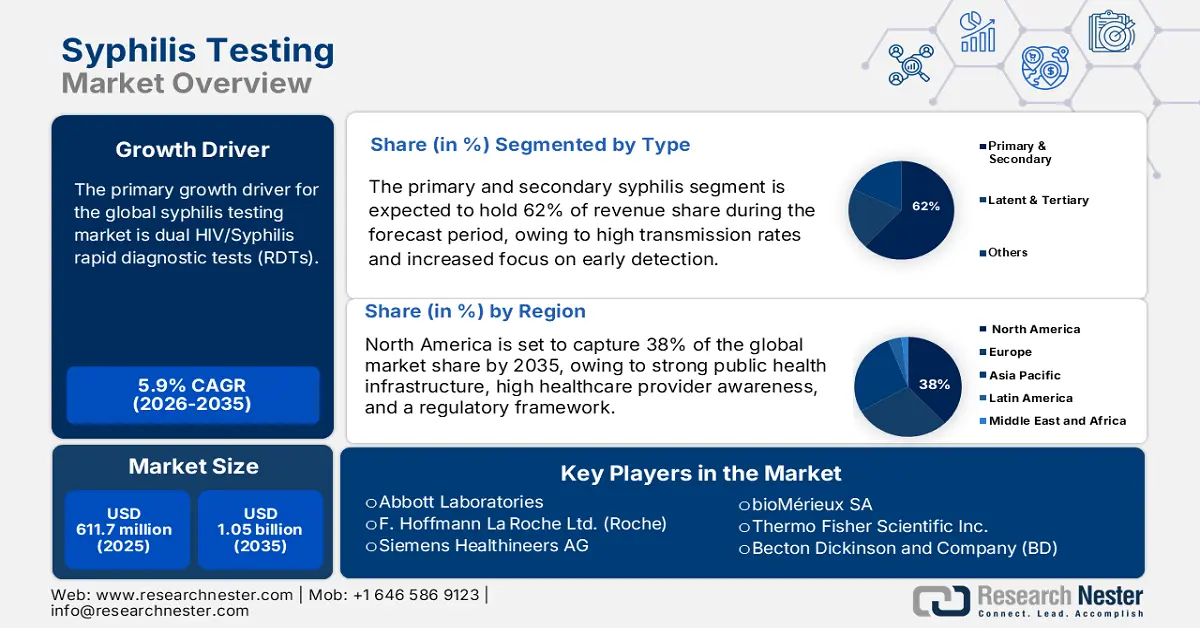

Syphilis Testing Market size was valued at USD 611.7 million in 2025 and is projected to reach USD 1.05 billion by the end of 2035, rising at a CAGR of 5.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of syphilis testing is estimated at USD 645.7 million.

Dual HIV/Syphilis rapid diagnostic tests (RDTs) are the primary growth driver of the market. They have been integrated into antenatal healthcare to improve testing for pregnant women. The World Health Organization (WHO) endorses these tests because they are cost-efficient and provide faster diagnosis at the point of care. As per a report by the FDA published in August 2024, syphilis cases went up by 80% in the U.S., continuing a decade-old trend of increase, between 2018 and 2022 (from 115,000 to over 207,000). These tests need to ensure quality and safety throughout the supply chains. Efforts toward expanding RDTs' scope to triple testing for HIV, HBV, and syphilis additionally support the streamlined delivery of diagnostics in resource-limited settings.

Moreover, the WHO endorsement and prequalification of multiplex RDT panels encourage international procurement and local manufacturing. This support strengthens global trade and improves access to syphilis testing tools worldwide. According to a report by NLM in August 2024, syphilis is endemic in the developing world and is mostly found among people who are poor and with limited access to health care, with over 60% of new diagnoses being reported from the low and middle-income countries. Additionally, WHO's recommendations for dual testing strengthen quality assurance concerning diagnosis, while supporting strategies in deployment at scale that reinforce the growth of supply chains and the capacity in environments with minimal resources.

Key Syphilis Testing Market Insights Summary:

Regional Highlights:

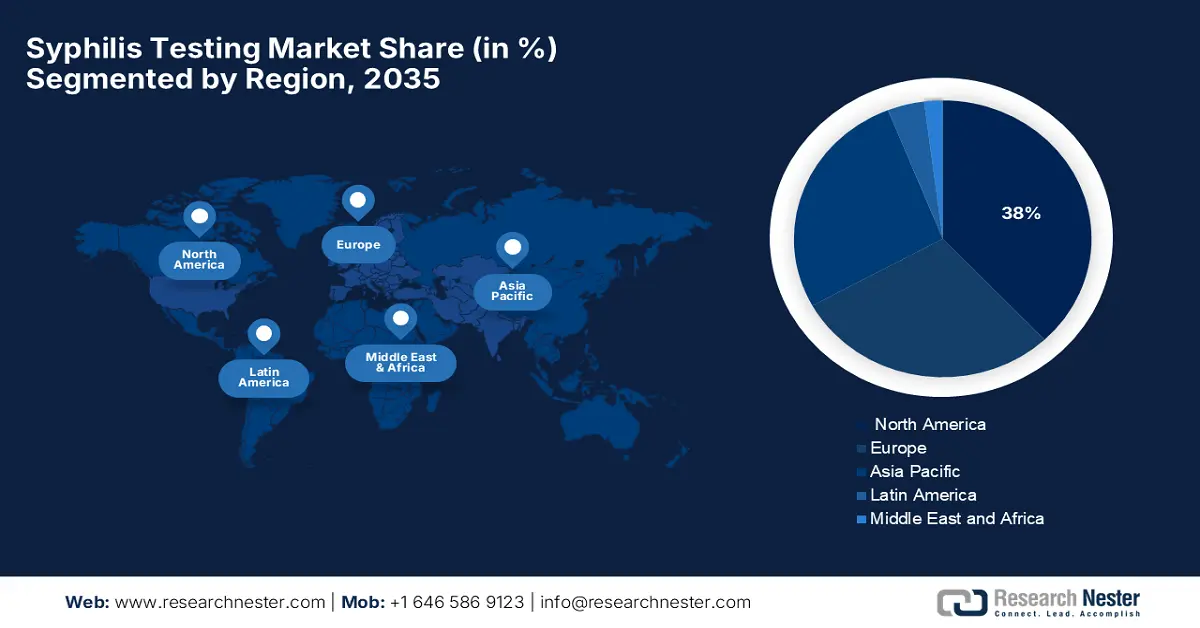

- North America syphilis testing market is projected to hold a 38% share by 2035 (driven by strong public health infrastructure, high healthcare provider awareness, and a regulatory framework).

- Asia Pacific is expected to witness the fastest growth by 2035 (owing to rising awareness, government initiatives, and expansion of healthcare infrastructure).

Segment Insights:

- Primary and secondary syphilis is projected to account for 62% share by 2035 in the syphilis testing market (propelled by high transmission rates and increased focus on early detection).

- Laboratory testing is anticipated to hold the second-largest share by 2035 (owing to its universal availability and high specificity).

Key Growth Trends:

- Integration of dual and multiplex rapid diagnostic tests (RDTs)

- Government-funded testing programs and screening guidelines

Major Challenges:

- High False-Positive Rates in Immunoassays

- Limited Access in Low-Resource Settings

Key Players: Abbott Laboratories (U.S.), F. Hoffmann‑La Roche Ltd. (Roche) (Switzerland), Siemens Healthineers AG (Germany), bioMérieux SA (France), Thermo Fisher Scientific Inc. (U.S.), Becton Dickinson and Company (BD) (U.S.), Danaher Corporation (U.S.), DiaSorin S.p.A. (Italy), Ortho Clinical Diagnostics (U.S.), QIAGEN N.V. (Netherlands), Meridian Bioscience, Inc. (U.S.), Creative Diagnostics (U.S.), Meril Life Sciences Pvt. Ltd. (India), Sekisui Diagnostics (Japan), Shenzhen New Industries Biomedical Eng. Co. (China).

Global Syphilis Testing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 611.7 million

- 2026 Market Size: USD 645.7 million

- Projected Market Size: USD 1.05 billion by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, United Kingdom, Canada

- Emerging Countries: China, India, Brazil, South Korea, Mexico

Last updated on : 8 September, 2025

Syphilis Testing Market - Growth Drivers and Challenges

Growth Drivers

- Integration of dual and multiplex rapid diagnostic tests (RDTs): The WHO recognition of dual HIV/syphilis RDTs and the latest triple tests (HIV, Hepatitis B, and Syphilis) has propelled uptake in low-resource and antenatal care settings. As per a report by WHO in July 2025, the WHO endorsement of dual HIV/syphilis RDTs and more recent triple tests such as the Determine Antenatal Care Panel, which simultaneously detects HIV, hepatitis B, and syphilis among pregnant women aged more than 12 years, has accelerated antenatal care adoption through simplified diagnostics, reducing turnaround time, and facilitating integrated disease control in low-resource environments.

- Government-funded testing programs and screening guidelines: Nations are implementing free or subsidized STI testing, especially in epidemic groups. WHO and CDC recommended that early testing needs to be performed during antenatal visits, promoting demand for point-of-care testing and immunoassay diagnostics. As per a report by NLM in May 2024, over 1 million STIs are contracted every day worldwide, as well as over 38 million HIV/AIDS infected people. The nations are increasing free or subsidized STI testing, particularly in high-burden populations, while the WHO and CDC require early antenatal screening.

- Technological advancements in point-of-care diagnostics: Improvements in piercing diagnostic technologies have helped to enhance all aspects of immunoassay-based tests, including lateral flow and CLIA tests. These tests became more accurate and user-friendly with advancements, and these are now less dependent on the laboratory and provide on-site testing possibilities. Through this shift, patients can now receive quicker testing with health-care providers at the point of care, bypassing centralized laboratory sites. This improves the availability of on-site testing, especially in remote and resource-poor areas, as the diagnosis promotes treatment decisions.

Congenital Syphilis Testing and Treatment Gaps in the Market (2023)

|

State/Territory |

Total CS Cases |

No/Nontimely Testing (%) |

Late Seroconversion Identification (%) |

Inadequate Treatment (%) |

No/No Documented Treatment (%) |

Clinical Evidence Despite Adequate Treatment (%) |

|

Texas |

930 |

35.9 |

6.2 |

5.8 |

48.4 |

2.2 |

|

California |

512 |

57.4 |

4.1 |

19.5 |

14.6 |

1.2 |

|

Florida |

235 |

46.4 |

4.3 |

20.9 |

12.8 |

6.8 |

|

Georgia |

127 |

33.1 |

13.4 |

18.1 |

27.6 |

2.4 |

|

Louisiana |

109 |

25.7 |

13.8 |

24.8 |

28.4 |

3.7 |

|

New York |

67 |

41.8 |

9.0 |

14.9 |

10.4 |

6.0 |

|

Washington |

57 |

63.2 |

5.3 |

17.5 |

12.3 |

1.8 |

|

Maryland |

69 |

40.6 |

10.1 |

31.9 |

10.1 |

7.2 |

Source: CDC, November 2024

Challenges

- High False-Positive Rates in Immunoassays: Syphilis immunoassays have exhibited high false-positive rates in low-prevalence settings. This leads to unnecessary follow-up testing, causing increased patient anxiety and higher costs for the healthcare system. Such diagnostic inaccuracies undermine confidence in the reliability of these tests, discouraging healthcare providers from relying solely on immunoassays. Consequently, the adoption rate is hindered, posing a barrier to market growth and delaying the widespread implementation of these diagnostics in clinical and public health settings.

- Limited Access in Low-Resource Settings: Due to high costs, the need for specialized infrastructure, and a shortage of trained personnel, immunoassay-based diagnostics have limited adoption in low-resource settings. These barriers hinder early diagnosis and treatment in high-burden areas where accurate testing is most critical. Consequently, the market expansion remains focused on developed countries, with only limited growth elsewhere. Global expansion is thus stalled, largely unable to meet the disease burden faced by neglected populations, thus negatively impacting the market.

Syphilis Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 611.7 million |

|

Forecast Year Market Size (2035) |

USD 1.05 billion |

|

Regional Scope |

|

Syphilis Testing Market Segmentation:

Type Segment Analysis

The primary and secondary syphilis hold the highest market share with 62% in the type segment within the forecast period due to high transmission rates and increased focus on early detection. As per a report by the WHO in May 2025, untreated syphilis during pregnancy, or treatment that is late or with the wrong antibiotic, leads to 50% to 80% of poor birth outcomes. This is true worldwide, as syphilis in pregnancy can cause serious birth complications. Therefore, more monitoring, early screening, and targeted interventions in reproductive health services are needed.

Location of Testing Segment Analysis

Location testing is dominated by laboratory testing with the second-largest share in the market due to its universal availability, high specificity, and incorporation into regular clinical practice. Hospitals and diagnostic labs remain the primary locations for confirmatory syphilis testing, supported by government and insurance health programs. Laboratory tests enable thorough analysis, such as follow-up confirmatory tests, which are critical for clinical decisions. These advantages make lab testing the preferred choice in both private and public healthcare settings.

Application Segment Analysis

The sub-segment of diagnostic testing leads the application segment of the syphilis testing market with the highest revenue share. There were increases in rates of STIs worldwide, in demand for antenatal testing, and awareness of early detection. Diagnostic testing can accurately identify Treponema pallidum infections using immunoassays that have a high degree of specificity and sensitivity, allowing early treatment to prevent transmission. Its incorporation into routine healthcare workflows thus positions it as an essential function in the market with a leading market position.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Sub-segments |

|

Type |

|

|

Location of Testing |

|

|

Technology |

|

|

Product Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Syphilis Testing Market - Regional Analysis

North America Market Insights

The North America syphilis testing market is expected to hold the highest market share of 38% within the forecast period due to due to strong public health infrastructure, high healthcare provider awareness, and a regulatory framework. The market of North America has a decentralized yet cooperating public health system. The U.S. testing infrastructure is supported by organizations such as APHL and HRSA that enhance laboratory capacity and outreach. Successful partnerships between the government and nonprofits drive screening among underserved and high-risk populations.

The U.S. syphilis testing market is growing due to the CDC mandating routine syphilis screening, the rising reported incidence of syphilis, and affordable multiplex rapid diagnostic tests (RDTs). As per the December 2024 CMS report, the U.S. syphilis test market is driven by high national health expenditure at USD 4.9 trillion in 2023 alone. Such financial capability forms the basis of robust public health interventions, advanced diagnostics, and widespread testing availability. Significant investment ensures that syphilis testing remains a focus in STI prevention and control interventions.

The Canada syphilis testing market is growing due to the increased syphilis, provincial healthcare, and the federal response of the Public Health Agency of Canada. As per a report by NLM in January 2025, early congenital syphilis confirmed cases rose in the country by 127 times in 2022, at 32.7 per 100,000 live births. The highest rates were faced by Saskatchewan, Manitoba, Alberta, and Ontario. On the rise are infection rates in females of reproductive age, demanding mass and early screening for syphilis. These trends, thus, point towards the need for an increase in syphilis screening and public health interventions in Canada to quell the unfolding epidemic.

Asia Pacific Market Insights

The Asia Pacific syphilis testing market is expected to hold the fastest-growing market within the forecast period due to rising awareness and government initiatives, increasing prevalence of syphilis, and expansion of healthcare infrastructure. As per a report by Heliyon in March 2023, in the Asia Pacific, syphilis prevalence among men who have sex with men (MSM) varies widely and is estimated to be between 0.9% and 30.9%, among which many are co-infected with HIV. These upward trends are a matter of great concern, and they highlight the urgent need for encouraging and scaling tests and screenings for syphilis in the region.

The syphilis testing market is increasing in China due to the spread of acceptance of self-testing by men who have intimate relations with men. As per a study by NLM in December 2023, the National Syphilis Control Program (NSCP) significantly reduced early syphilis incidence from 21.1 to 8.8 per 100,000 and congenital syphilis from 63 to 4.1 per 1000,000, while the syphilis prevalence dropped markedly among MSM and female sex workers and remained under 1% among pregnant women. Key factors influencing uptake include openness about sexual orientation and lack of prior hospital-based testing. Reported harms were minimal, supporting broader adoption of self-testing methods.

The syphilis testing market in India is highly driven by rapid diagnostic testing (RDT), introduced under the Pan-India Package of Services, especially at PHCs and Ayushman Arogya Mandirs, helping expand access in rural areas. Meanwhile, large-scale HIV prevention programs such as Avahan have included point-of-care syphilis screening, improving detection among high-risk groups. Similarly, antenatal screening for syphilis, HIV, and hepatitis B has supported wider access and clinical acceptance in rural settings.

Europe Market Insights

The syphilis testing market in Europe is expected to hold a significant position in the market in the forecast period due to rising rates of STIs, government public health programs, and telemedicine and home testing kits. As per a report by ECDC in March 2024, there were 35,391 syphilis cases reported in 29 EU/EEA countries in 2022, with an 8.5 per 100,000 rate of notifications, a 34% increase from 2021, and a 41% rise. Increased cases, improved diagnostics, and public health activities are driving the European market, although complicated by barriers such as stigma and healthcare inequities.

In the UK, the syphilis testing market is expanding due to a sharp surge in reported syphilis cases, growing awareness, and screening programs for high-risk groups, with digital health tools and home testing kits that offer better accessibility and ensure privacy. As per a study by the UK Government published in September 2024, there were 9,513 registered infectious cases of syphilis in 2023: an increase of 9.4% compared to 2022. The infections rose sharply among heterosexual populations, with 29% among females and 17% among males, whereas GBMSM has continued to be the most affected group. The rising number of cases is pushing up the demand for testing, supported by targeted screening programs and digital health solutions, and increasing public awareness.

The syphilis testing market growth in Germany is effectively attributed to its well-developed healthcare infrastructure and government-funded public health strategies for STI prevention and control. Sophisticated diagnostic methods, serologic and nucleic acid tests, improve detection precision. Disparities between healthcare in regions and social stigmatization of sexuality, however, present obstacles to uptake of testing. Even with such barriers, German interest in technological progress and the plethora of testing has only helped drive market growth further, with early diagnosis and efficient case management of syphilis.

Europe-Specific Market Based on Historical STI Diagnosis Trends by Age and Gender

|

Age Group (Years) |

2014 Cases |

2015 Cases |

2016 Cases |

2017 Cases |

2018 Cases |

2019 Cases |

Trend (IRR) |

Significance (p-value) |

|

Males |

||||||||

|

13-14 |

120 |

108 |

96 |

101 |

88 |

90 |

0.93 |

0.38 |

|

15-19 |

25,495 |

23,466 |

21,323 |

20,970 |

21,350 |

21,702 |

0.99 |

0.53 |

|

20-24 |

73,133 |

69,556 |

65,228 |

64,536 |

66,808 |

67,444 |

1.00 |

0.77 |

|

25-34 |

82,192 |

83,245 |

79,548 |

80,233 |

87,091 |

94,029 |

1.03 |

<0.001 |

|

35-44 |

31,271 |

31,698 |

29,808 |

30,532 |

34,126 |

38,353 |

1.05 |

<0.001 |

|

45-64 |

20,314 |

20,771 |

20,367 |

21,176 |

23,943 |

25,584 |

1.05 |

<0.001 |

|

65+ |

1,714 |

1,718 |

1,712 |

1,856 |

2,108 |

2,202 |

1.05 |

0.28 |

|

Females |

||||||||

|

13-14 |

1,070 |

806 |

615 |

605 |

610 |

586 |

0.91 |

<0.001 |

|

15-19 |

62,207 |

55,796 |

52,312 |

50,893 |

50,063 |

49,389 |

0.98 |

<0.001 |

|

20-24 |

79,061 |

74,543 |

73,198 |

73,747 |

76,702 |

79,843 |

1.03 |

<0.001 |

|

25-34 |

52,691 |

52,479 |

52,503 |

53,507 |

56,575 |

59,213 |

1.03 |

<0.001 |

|

35-44 |

15,125 |

14,736 |

14,962 |

15,069 |

15,905 |

16,891 |

1.03 |

0.04 |

|

45-64 |

8,471 |

8,307 |

8,351 |

8,354 |

8,837 |

9,208 |

1.02 |

0.55 |

|

65+ |

384 |

402 |

373 |

434 |

472 |

542 |

1.07 |

Source: RSPH, June 2022

Key Syphilis Testing Market Players:

- Abbott Laboratories (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- F. Hoffmann‑La Roche Ltd. (Roche) (Switzerland)

- Siemens Healthineers AG (Germany)

- bioMérieux SA (France)

- Thermo Fisher Scientific Inc. (U.S.)

- Becton Dickinson and Company (BD) (U.S.)

- Danaher Corporation (U.S.)

- DiaSorin S.p.A. (Italy)

- Ortho Clinical Diagnostics (U.S.)

- QIAGEN N.V. (Netherlands)

- Meridian Bioscience, Inc. (U.S.)

- Creative Diagnostics (U.S.)

- Meril Life Sciences Pvt. Ltd. (India)

- Sekisui Diagnostics (Japan)

- Shenzhen New Industries Biomedical Eng. Co. (China)

The market shows intense competition with dominant world players (Roche, Abbott, Siemens, bioMérieux) investing in assay automation, multiplex platforms, and innovation in rapid testing. In strategic growth, R&D, M&A (e.g., Roche's LumiraDx; Quidel-Chembio), and point-of-care expansions are supported. From a collaborative standpoint, partnerships are created to increase the extent of reach geographically and affordability. Emerging manufacturers from regional markets (India, Japan, China) now provide less expensive kits for APAC markets to further intensify market democratization.

Here is a list of key players operating in the global market:

Recent Developments

- In August 2024, NOWDiagnostics announced that its First To Know Syphilis Test can now be purchased nationwide, after receiving FDA approval for its authorization as over-the-counter usability.

- In October 2024, Labcorp announced a strategic agreement to become the exclusive U.S. distributor of the First to Know test for clinical settings and, starting in 2025, via their Labcorp OnDemand platform directly to patients.

- Report ID: 8073

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Syphilis Testing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.