Orthopedic Biomaterials Market Outlook:

Orthopedic Biomaterials Market size was over USD 24.19 billion in 2025 and is poised to exceed USD 50.32 billion by 2035, growing at over 7.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of orthopedic biomaterials is estimated at USD 25.84 billion.

The major factor attributed to the growth of the market is the rising prevalence of musculoskeletal diseases all over the world. Musculoskeletal diseases in a human usually affect the joints, bones, and muscles, and aid the development of other pain conditions and inflammatory diseases. Treatment of such musculoskeletal conditions requires orthopedic biomaterials for an effective healing process which in turn is expected to propel market expansion. As per the statistics shared by the World Health Organization (WHO) in 2022, approximately 1.71 billion people were affected by musculoskeletal conditions all over the world.

In addition to the aforementioned factors, other factors that are attributed to market growth is the rising chronic skeletal conditions among the global population which requires orthopedic biomaterials in the treatment process. Furthermore, the world has seen a surge in various kinds of orthopedic illnesses owing to the high engagement in a sedentary lifestyle and consumption of fatty and processed food items. Also, the burgeoning geriatric population which is more prone to various musculoskeletal ailments is considered to positively contribute to market expansion. In addition, the escalation in the number of trauma cases owing to injuries from accidents coupled with the increased number of sports injuries is also anticipated to bring lucrative growth opportunities for market expansion during the forecast period. Moreover, the growing demand for technologically advanced orthopedic biomaterials for treating various kinds of diseases is propelling the key player in the market to invest more in research and development activities. This factor is anticipated to impetus robust revenue generation in the upcoming years. Another factor that is anticipated to aid market growth is the rising number of orthopedic surgeries such as joint arthroplasty, joint reconstruction, and viscosupplementation which is expected to generate a demand for orthopedic biomaterials.

Key Orthopedic Biomaterials Market Insights Summary:

Regional Highlights:

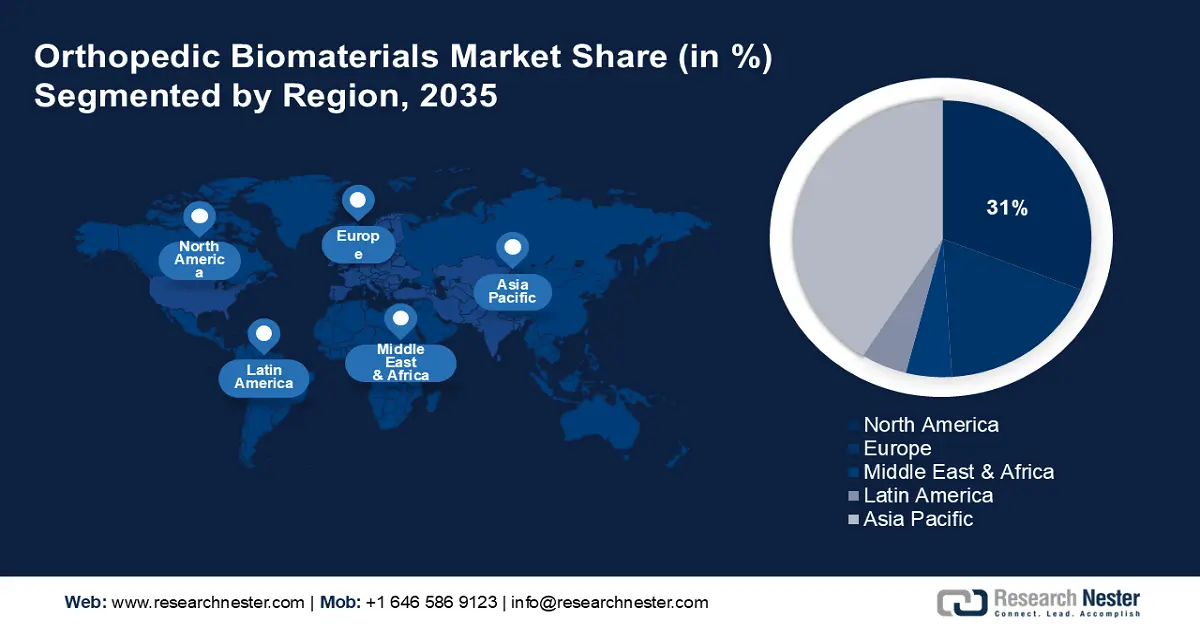

- The North America orthopedic biomaterials market is forecasted to secure a 31% share by 2035, driven by a large pool of patients with musculoskeletal diseases, rising R&D investments, and higher disposable incomes increasing adoption of advanced orthopedic biomaterials.

Segment Insights:

- The polymer segment in the orthopedic biomaterials market is projected to capture a 34% share by 2035, driven by the rising use of polymers as bone cement and load-bearing surfaces.

- The orthopedic implants segment in the orthopedic biomaterials market is projected to achieve a substantial share by 2035, fueled by the rising number of keyhole orthopedic surgery and bone fractures.

Key Growth Trends:

- Growing Number of Orthopedic Surgeries Across the Globe

- Rising Prevalence of Injuries and Accidents

Major Challenges:

- High Cost Associated with Orthopedic Biomaterials

- Low Awareness Level About the Advantages

Key Players: Evonik Industries AG, Stryker Corporation, DePuy Synthes Inc., Zimmer Biomet Holdings Inc., Invibio Ltd., Koninklijke DSM N.V., Victrex Plc., Heraeus Holding GmbH, Exactech Inc., Collagen Matrix Inc.

Global Orthopedic Biomaterials Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 24.19 billion

- 2026 Market Size: USD 25.84 billion

- Projected Market Size: USD 50.32 billion by 2035

- Growth Forecasts: 7.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (31% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Orthopedic Biomaterials Market - Growth Drivers and Challenges

Growth Drivers

-

Growing Number of Orthopedic Surgeries Across the Globe – People nowadays are being diagnosed with numerous kinds of musculoskeletal diseases owing to unhealthy lifestyles and accidents with traumas and injuries. As a result, the demand for orthopedic biomaterials is anticipated to increase during the surgical procedures of the treatment process. Thus, a high number of orthopedic surgeries being performed is a positive indicator for market expansion during the forecast period. Recent statistics, it is revealed that approximately 5 million musculoskeletal system surgeries are performed every year in the United States region.

-

Rising Prevalence of Injuries and Accidents – People encounter different types of injuries every year. In such cases, orthopedic biomaterials are effective in treatment processes and enhance the healing process. Hence, the growing number of injuries is expected to increase the demand for orthopedic biomaterials and aid market growth in the upcoming years. The National Safety Council stated that in 2020, the United States experienced around 55.4 million injuries, out of which 200,955 were classified as preventable deaths.

-

Increasing Burden of Bone Diseases – To solve bone diseases, orthopedic biomaterials are effective in bone repair and fastening the healing processes. Therefore, the high number of cases of bone disorders is anticipated to bring in lucrative growth opportunities for market expansion. The National Library of Medicine published a report that calculated the prevalence of osteoporosis to be more than 200 million people across the world in 2019. It also has been calculated that the occurrence of osteoporosis in women around the world is more than 23% and in men around the world was found to be almost 11%.

-

Rapid Escalation in Number of Bone Fractures – For instance, in 2019, there were more than 175 million cases of fractures and approximately 450 million cases of acute or long-term symptoms of a fracture worldwide.

-

High Focus on Developing the Medical Devices Sector - The data revealed by the India Brand Equity Foundation (IBEF) stated that in FY20, the foreign investments in the Indian medical devices sector increased to USD 301 million from USD 151 million in FY19, which indicates a 98% increment.

Challenges

- High Cost Associated with Orthopedic Biomaterials – Orthopedic biomaterials are technologically advanced medical products with the integration of the latest features. As a result, the costs of these products subsequently increase the costs of the surgical procedure and treatment. This factor is anticipated to lower the adoption rate of orthopedic biomaterials among the population with middle and low-income and ultimately hamper market growth during the forecast period.

- Low Awareness Level About the Advantages

- Lack of Favorable Reimbursement Policies

Orthopedic Biomaterials Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.6% |

|

Base Year Market Size (2025) |

USD 24.19 billion |

|

Forecast Year Market Size (2035) |

USD 50.32 billion |

|

Regional Scope |

|

Orthopedic Biomaterials Market Segmentation:

Material Segment Analysis

The global orthopedic biomaterials market is segmented and analyzed for demand and supply by material into ceramics & bioactive glasses, polymers, metals, and calcium phosphate cements. Out of the four segments, the polymer segment is set to hold more than 34% orthopedic biomaterials market share by 2035. The major factor for segment growth is the rising use of polymers as bone cement and load-bearing surfaces for total joint arthroplasties. In addition, the easy availability of cost-effective polymers and biopolymers that are advantageous for various uses in ortho biologics and bio-resorbable tissue fixation is expected to surge the demands of polymer-based orthopedic biomaterial globally and impetus segment growth. Furthermore, the advantages offered by polymers such as high flexibility, enhanced strength, and increased durability are also expected to expand their application use and help in expanding the segment size.

Application Segment Analysis

The global orthopedic biomaterials market is also segmented and analyzed for demand and supply by application into joint reconstruction, bio-resorbable tissue fixation, ortho biologics, viscosupplementation, orthopedic implants, and others. Amongst these segments, orthopedic implants segment is poised to hold substantial orthopedic implants market share by 2035. The major factor for segment growth is the rising number of keyhole orthopedic surgery across the world coupled with the increased prevalence of bone fractures. For instance, it has been calculated that in the United States, almost 2 million fractures occur every year. Furthermore, the rising number of bone diseases such as osteoporosis, osteopenia, osteoarthritis, osteomyelitis, and rapid escalation of musculoskeletal conditions is anticipated to fuel revenue generation and drive segment growth during the forecast period.

Our in-depth analysis of the global market includes the following segments:

|

By Material |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Orthopedic Biomaterials Market Regional Analysis:

APAC Market Insights

North American region is anticipated to account for more than 31% orthopedic biomaterials market share by the end of 2035. Factors that are anticipated to create a positive outlook for market growth during the forecast period are the presence of a large pool of patients diagnosed with various kinds of musculoskeletal diseases and bone disorders who need orthopedic biomaterials for faster treatment procedures. In addition, the rising investments in the research and development activities by the major key player operating in the market for developing advanced and better orthopedic biomaterials are also anticipated to fuel market growth in the region. Furthermore, Rising disposable income has resulted in increased spending capacity, which is predicted to motivate Americans to adopt advanced medical devices such as orthopedic biomaterials and is It is expected to bring revenue raising opportunities.

North American Market Insights

North American region is anticipated to account for more than 31% orthopedic biomaterials market share by the end of 2035. Factors that are anticipated to create a positive outlook for market growth during the forecast period are the presence of a large pool of patients diagnosed with various kinds of musculoskeletal diseases and bone disorders who need orthopedic biomaterials for faster treatment procedures. In addition, the rising investments in the research and development activities by the major key player operating in the market for developing advanced and better orthopedic biomaterials are also anticipated to fuel market growth in the region. Furthermore, Rising disposable income has resulted in increased spending capacity, which is predicted to motivate Americans to adopt advanced medical devices such as orthopedic biomaterials and is It is expected to bring revenue raising opportunities.

Europe Market Insights

In orthopedic biomaterials market, Europe region is estimated to capture significant share by the end of 2035.The rising focus on health and fitness along with the availability of a high number of medical care settings to receive treatment is considered to be a factor driving market growth during the forecast period. Other factors include the presence of a high number of hospitals and a high number of inpatients and outpatients visiting the hospitals along with the availability of favorable reimbursement policies. The increased number of bone fractures along with injuries, accidents, and traumas among the European people is also estimated to generate the demand for orthopedic biomaterials and expand the market size.

Orthopedic Biomaterials Market Players:

- Evonik Industries AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Stryker Corporation

- DePuy Synthes Inc.

- Zimmer Biomet Holdings Inc.

- Invibio Ltd.

- Koninklijke DSM N.V.

- Victrex Plc.

- Heraeus Holding GmbH

- Exactech Inc.

- Collagen Matrix Inc.

Recent Developments

-

Evonik Industries AG has launched the latest osteoconductive Polyether Ether Ketone (PEEK), which is an effective biomaterial that is expected to improve the fusion between bone and an implant.

-

Stryker Corporation has developed the newest Citrelock Tendon Fixation Device System that provides surgeons a differentiated design owing to the tendon thread with a resorbable technology. It also has unique chemical and mechanical properties for orthopedic surgical applications.

- Report ID: 3547

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Orthopedic Biomaterials Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.