Collagen and HA-based Biomaterials Market Outlook:

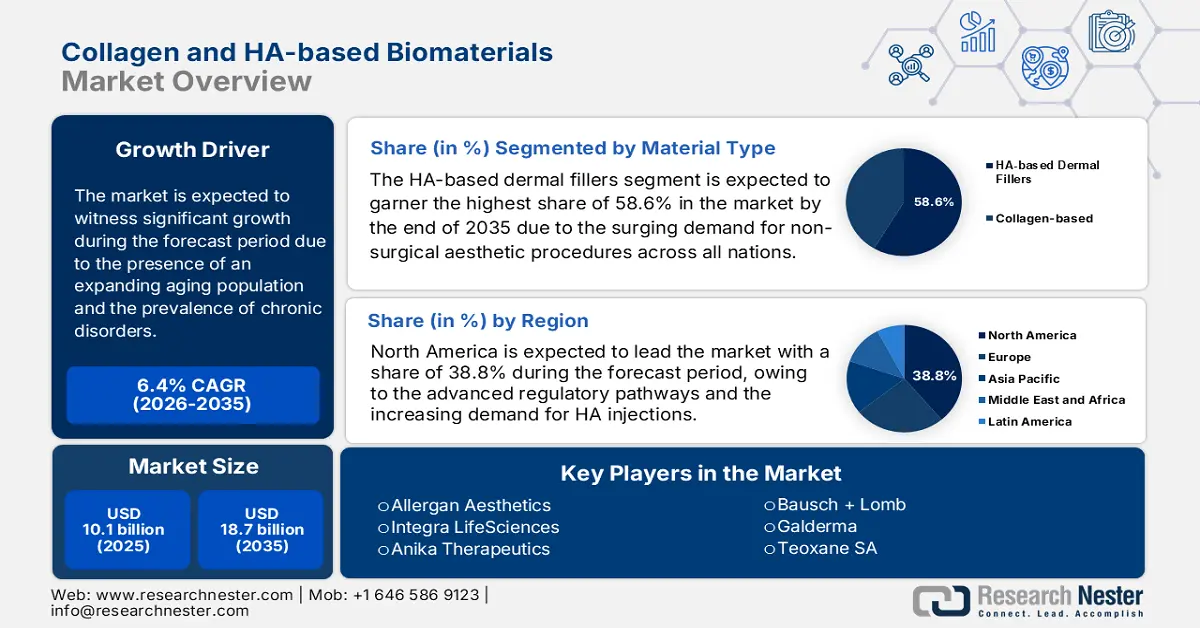

Collagen and HA-based Biomaterials Market was valued at USD 10.1 billion in 2025 and is projected to reach USD 18.7 billion by the end of 2035, rising at a CAGR of 6.4% during the forecast period, 2026 to 2035. In 2026, the industry size of collagen and HA-based biomaterials is assessed USD 10.7 billion.

The global market is significantly transforming, owing to the presence of an expanding aging population and the prevalence of chronic disorders. As evidence, the World Health Organization study in February 2025 depicts that over 1.1 billion people will be aged above 60, and this number is expected to rise, thereby increasing the demand for orthopedic and wound care needs. On the other hand, the report published by the NLM in October 2023 states that over 10.5 million individuals in the U.S. suffer from chronic wounds, with reliance on collagen-based dressings as a key treatment procedure.

This surging demand in terms of medical procedures, coupled with the rising prevalence of osteoarthritis, supports the collagen and HA-based biomaterials market growth. The WHO data in July 2023 states that 528 million U.S. adults have osteoarthritis, hence creating significant demand for HA-based viscosupplementation. Further, the research and development for biomaterials is robust and is largely channeled via public and non-profit funding mechanisms. The pharmaceutical R&D accelerates the shift of new collagen and HA biomaterials from laboratory research to clinical application by meeting the needs of the growing patient population.

Key Collagen and HA based Biomaterials Market Insights Summary:

Regional Insights:

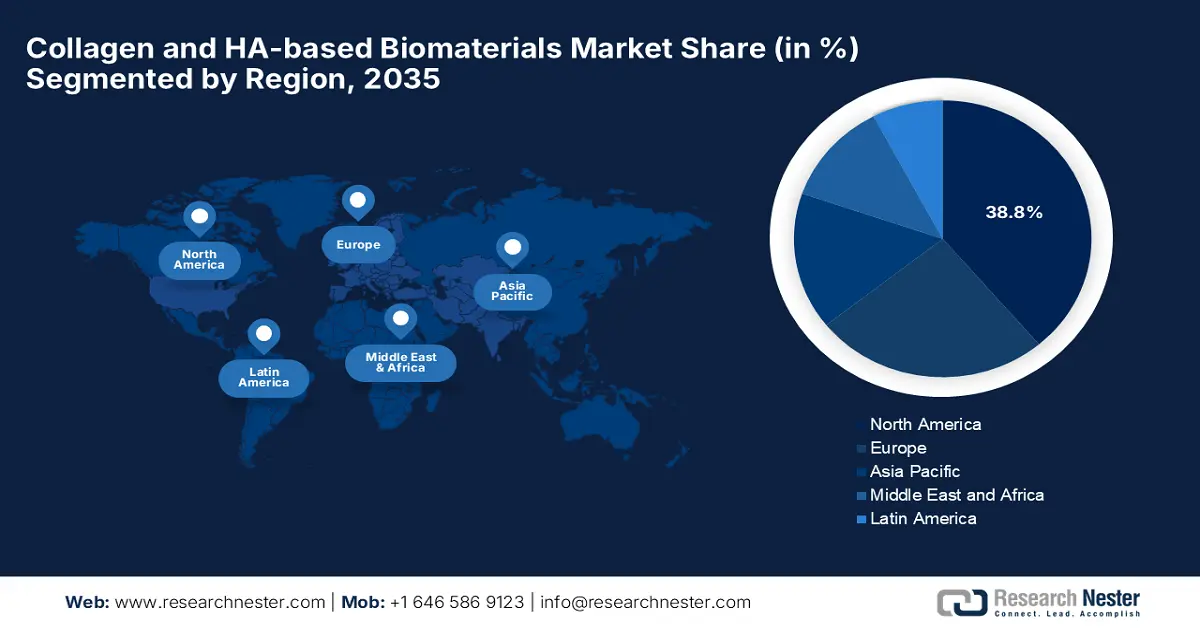

- North America collagen and HA-based biomaterials market is anticipated to command a 38.8% share by 2035, sustained by advanced regulatory frameworks and the growing adoption of HA injections.

- Asia Pacific region is poised to expand at a notable CAGR of 9.5% through 2026–2035, driven by the rapidly aging population and flourishing medical tourism sector.

Segment Insights:

- The hyaluronic acid segment is anticipated to capture the largest 58.6% share in the Collagen and HA-based Biomaterials Market by 2035, propelled by the surging preference for minimally invasive dermal fillers worldwide.

- The aesthetic medicine segment is projected to expand notably during 2026–2035, impelled by the rapid growth of the medical sector and rising demand for preventive aesthetic treatments among younger populations.

Key Growth Trends:

- Improvements in healthcare quality

- Growth in minimally invasive procedures

Major Challenges:

- Reimbursement barriers

- Mandatory clinical evidence

Key Players:Allergan Aesthetics (USA), Integra LifeSciences (USA), Anika Therapeutics (USA), Bausch + Lomb (USA), Galderma (Switzerland), Teoxane SA (Switzerland), Croma-Pharma GmbH (Austria), Laboratoires Vivacy (France), Gelita AG (Germany), BioPolymer GmbH & Co. KG (Germany), Seikagaku Corporation (Japan), LG Chem (South Korea), HUGEL Inc. (South Korea), Medytox Inc. (South Korea), CollPlant Biotechnologies (Israel), Q-Med (Sweden), Contipro Group (Czech Republic), CSL Limited (Australia), Advanced BioMatrix, Inc. (USA), Merz Aesthetics (Germany).

Global Collagen and HA based Biomaterials Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.1 billion

- 2026 Market Size: USD 10.7 billion

- Projected Market Size: USD 18.7 billion by 2035

- Growth Forecasts: 6.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, South Korea

- Emerging Countries: India, Brazil, Malaysia, Mexico, Italy

Last updated on : 24 October, 2025

Collagen and HA-based Biomaterials Market - Growth Drivers and Challenges

Growth Drivers

- Improvements in healthcare quality: The benefits offered by collagen and HA-based biomaterials are proven to be significant and affordable, thereby allowing the global leaders to make investments in this sector. As evidence, a recent report has found that collagen-based wound care appreciably reduced diabetic ulcer-associated hospitalizations, hence saving a significant amount yearly in the U.S. Moreover, the HA injections utilized for knee osteoarthritis reduced the surgery rates in a UK NHS trial.

- Growth in minimally invasive procedures: There is a sustained demand for minimally invasive surgeries across all nations. For instance, ASPS in 2025 proclaimed that in the U.S., the expenditure for HA dermal fillers averaged USD 715 per procedure. Simultaneously, South Korea’s government subsidized HA filler treatments to boost medical tourism. Therefore, these affordable plans are projected to expand consumer access, hence indicating a positive HA-based biomaterials market demand.

- Advancements in bioprocessing and recombinant technology: Technology advancements are providing high-purity, pathogen-free, and sustainable biomaterials in various applications. The traditional method of collagen derived from animals has various issues, such as variability and immunogenic risk. Recently, the FDA's October 2022 report stated that collagen alginate dressing has reduced the wound area by 79% in 12 weeks. This allows manufacturers to focus more on sensitive applications in ophthalmology and neurology, where purity is paramount.

Summary of Clinical Trials on Collagen and Hyaluronic Acid Biomaterials for Wound Healing

|

Year |

Trial ID / Source |

Biomaterial Type |

Study Design & Condition |

Main Clinical Findings |

|

2025 |

PMC12359144 |

Collagen-based matrix (Promogran; bovine collagen + oxidized regenerated cellulose) |

Multicenter wound-care evaluations for chronic ulcers |

Demonstrated reduction in MMP and enhanced granulation tissue formation in venous and diabetic ulcers |

|

2024 |

NCT04467736 |

Collagen + Hyaluronic acid scaffold |

Randomized controlled clinical study; post-alveolar ridge wound |

Reported comparable soft-tissue healing with less postoperative morbidity |

|

2022 |

PMC9496351 |

Collagen sponge (ovine tendon, Type I collagen) |

Pre-clinical and early human evaluation |

Non-toxic, high porosity (60–70%), reduced inflammation and exudate |

Source: NLM August 2025, Clinical Trials September 2024, NLM September 2022

Challenges

- Reimbursement barriers: The aspect of inadequate reimbursement and government-imposed price controls hampers the profitability of manufacturers involved in the collagen and HA-based biomaterials market. For instance, in 2023, BMG notified that in Germany, AMNOG law-imposed price reductions on HA-based osteoarthritis injections, limiting margins for the firms. Whereas the U.S. Medicaid is offering coverage for patients, thereby restricting access to a wider consumer base.

- Mandatory clinical evidence: This is yet another factor negatively influencing the upliftment of the collagen and HA-based biomaterials market in almost all nations. The EC in 2023 reported that in Europe, the frameworks demand five-year follow-up data for collagen scaffolds, thereby leading to a delayed product launch. Therefore, this makes it challenging for the manufacturers, exacerbating the current expenses. However, to address this, CollPlant provided real-world evidence from burn centers, hence accelerating approvals.

Collagen and HA-based Biomaterials Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.4% |

|

Base Year Market Size (2025) |

USD 10.1 billion |

|

Forecast Year Market Size (2035) |

USD 18.7 billion |

|

Regional Scope |

|

Collagen and HA-based Biomaterials Market Segmentation:

Material Type Segment Analysis

The hyaluronic acid segment is expected to garner the highest share of 58.6% in the collagen and HA-based biomaterials market by the end of 2035. This dominance is effectively attributed to the phenomenal demand for minimally invasive dermal fillers across the world. As evidence, the NLM study in December 2021 noted that the hyaluronic acid treatment has improvements in skin elasticity and turgor and also shows a 95% satisfaction rate from physicians and patients.

Application Segment Analysis

The aesthetic medicine segment is projected to grow at a considerable rate in the collagen and HA-based biomaterials market during the forecast period. The growth in the segment is subject to the booming medical sector, i.e., the NLM study in December 2024 depicts that the cumulative cost for knee replacement treatment ranges from USD 1,164 to USD 74,662 for hyaluronic acid. Furthermore, the surge in preventive aesthetics, such as early wrinkle obsession in young people, is allowing progressive revenue for manufacturers, hence denoting a positive segment outlook.

End user Segment Analysis

Hospitals and clinics are projected to hold a dominant share in the market. The segment is driven by the crucial role as a primary hub for a wide range of procedures using biomaterials for ophthalmic surgery and orthopedic injections for the treatment of complex wounds. Hospitals have integrated infrastructure, including specialized operating rooms and sterile processing, that are necessary for various surgical applications. Further, the high patient registration for conditions such as osteoarthritis ensures a consistent volume of procedures such as HA-based viscosupplementation, which are administered in outpatient clinical settings within these facilities.

Our in-depth analysis of the collagen and HA-based biomaterials market includes the following segments:

|

Segment |

Subsegments |

|

Material Type |

|

|

Application |

|

|

Product Form |

|

|

Source |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Collagen and HA-based Biomaterials Market - Regional Analysis

North America Market Insights

The North America collagen and HA-based biomaterials market is expected to hold the largest market share of 38.8% during the forecast tenure. The leadership of the region is effectively catering to the advanced regulatory pathways and the surging demand for HA injections. Based on this factor, the Breakthrough Device Program undertaken by the U.S. FDA accelerated the approvals for various HA and collagen products annually. Besides the presence of cross-border API trade, strengthens supply chains of HA products for Canada being drawn from GMP facilities in the U.S.

The U.S. is the dominating player in the regional market, highly fueled by the expanded volume of dermal filler procedures and Medicare spending. The CDC data in January 2024 depicts that osteoarthritis affects over 33 million U.S. adults, creating a sustained demand for the market. Further, the high volume of minimally invasive procedures drives the dermal filler segment. A primary trend is the shift towards intuitive, non-animal-derived, and recombinant biomaterials to meet the batch variability and enhance biocompatibility.

Canada is also growing in North America’s collagen and HA-based biomaterials market, rising rapidly. The growth in the country is significantly propelled by progressive budget allocations and mounting support from governing bodies. Reinforcing this trend, Galderma announced in January 2024 that it had received approval from Health Canada for Restylane SHAYPE, which is a hyaluronic acid injectable designed for temporary chin augmentation. These new launches shape the market in Canada and expand the role in advancing aesthetic biomaterial innovations.

Asia Pacific Market Insights

Asia Pacific collagen and HA-based biomaterials market is growing exponentially at a CAGR of 9.5% and is expected to have significant growth by the end of the forecast timeline. Key factors propelling growth in the region include the presence of rapidly aging populations and expanding medical tourism. Besides the progressive countries Japan, China, India, South Korea, and Malaysia, and their unique developmental approaches are positioning Asia Pacific as a key leader in this sector. The expanded patient populations, subsidies, and government grants further drive business in the market.

China is the global hub for the collagen and HA-based biomaterials market, which marked its position in the Asia Pacific with a significant regional revenue share. The market is witnessing such growth, highly fueled by the state-led government funding and domestic manufacturing capabilities. NMPA states that the country received funding under the Healthy China initiative 2030, reflecting the government’s strong commitment towards the sector. Besides, the domestic manufacturers are providing HA APIs, cutting costs, and hence are suitable for progressive market development.

India is unfolding appreciable expansion opportunities that allow to the grab of a regional market share during the forecast timeline. The crisis towards diabetic wound care, displaying 66 diabetic foot ulcers patients among 10,000 people with diabetes, is fostering a favorable business environment for this sector, based on the NLM study in June 2023. Besides, the National Biopharma Mission granted funds to accelerate domestic hyaluronic acid production, thereby reducing import dependency, hence creating a huge foundation for market expansion.

Europe Market Insights

The collagen and HA-based biomaterials market is witnessing rapid growth in Europe during the assessed time frame. This is majorly facilitated by the EU MDR reforms that are accelerating the clearances of hyaluronic acid or collagen products being approved yearly. Besides the nationwide rising aging population is further propelling growth in the region. As per the Eurostat data in February 2025, the EU population was projected to have 449.3 million individuals aged above 65 in 2024, which is 21.6% of the overall population.

Germany is at the forefront of contributing upliftment of the market in Europe. The country is driven by the robust medical device industry, high healthcare expenditure, and a rapidly aging demographic. As per the Destatis report in 2025, 4 million people are aged above 67, and this number is expected to rise, demanding advanced wound care, orthopedic, and aesthetic solutions that are using collagen and HA-based biomaterials. Further, strong R&D is continuing to boost the market.

France follows the regional collagen and HA-based biomaterials market with a commendable share by the end of 2035. The country is a home for fast-track approvals and government budget allocations, allowing the market to expand to build a strong market at a rapid pace. Besides the HAS notes that the fast-track approvals for 3D-printed collagen implants fundamentally shaped the merchandise. Simultaneously, the Silver Economy Plan made an investment in geriatric HA treatments, addressing millions of osteoarthritis cases, reflecting a positive market demand.

Key Collagen and HA-based Biomaterials Market Players

- Allergan Aesthetics (USA)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Integra LifeSciences (USA)

- Anika Therapeutics (USA)

- Bausch + Lomb (USA)

- Galderma (Switzerland)

- Teoxane SA (Switzerland)

- Croma-Pharma GmbH (Austria)

- Laboratoires Vivacy (France)

- Gelita AG (Germany)

- BioPolymer GmbH & Co. KG (Germany)

- Seikagaku Corporation (Japan)

- LG Chem (South Korea)

- HUGEL Inc. (South Korea)

- Medytox Inc. (South Korea)

- CollPlant Biotechnologies (Israel)

- Q-Med (Sweden)

- Contipro Group (Czech Republic)

- CSL Limited (Australia)

- Advanced BioMatrix, Inc. (USA)

- Merz Aesthetics (Germany)

Here is a list of key players operating in the global market:

The collagen and HA biomaterials market presents a highly consolidated landscape with dominating global leaders grabbing the highest market share. The giants based in the U.S. and Europe dominate through cost-optimized and branded products such as Juvederm and Restylane. Simultaneously, the manufacturers are adopting strategic initiatives and partnerships to expand the market. For example, in May 2023, GC Corporation agreed with Olympus Terumo Biomaterials Corporation to succeed businesses in the development, manufacturing, and sales of biomaterials such as Teruplug, Terudermis, and the dental product sales business. Key trends opted by the leading firms include vertical integration, niche specialization, and sustainable alternatives.

Corporate Landscape of the Collagen and HA-based Biomaterials Market:

Allergan Aesthetics is a global leader in medical aesthetics, which heavily focuses on the collagen and HA-based biomaterials market. The company leads the use of hyaluronic acid with its JUVÉDERM collection of dermal fillers that are designed to restore smooth wrinkles and volume. Apart from HA, the product portfolio includes regenerative technologies that stimulate the body’s own collagen production.

Integra LifeSciences is the leading innovator in regenerative medicine and specializes in surgical solutions within the collagen and HA-based biomaterials market. The company is well known for its proprietary collagen-based technologies, including the Integra Dermal Regeneration Template that is used in complex wound care and reconstructive surgery. Its product provides a scaffold for cellular integration and tissue regeneration, showing a strategic focus on leveraging biomaterials to repair and restore damaged tissue.

Anika Therapeutics specializes in using hyaluronic acid for therapeutic applications in orthopedics and aesthetics, driving the collagen and HA-based biomaterials market. The company advances in proprietary HA-based viscoelastic supplements such as CINGAL and MONOVISC, which is used for osteoarthritis pain management. The research and development expenses in 2024 was USD 25.6 million, driving growth in various fields.

Bausch + Lomb is a leading eye health company with expertise in the ophthalmic segment of the collagen and HA-based biomaterials market. Its strategic advancements is evident in its portfolio of HA-based viscoelastic products that are used in cataract and other ocular surgeries for delicate eye tissue protection. In Q3 2024, the total revenue earned was USD 1.196 billion, and it accelerated its advancements in advance contact lenses.

Galderma is a pure-play dermatology company with a strong strategic focus on the aesthetic and therapeutic segments of the Collagen and HA-based Biomaterials Market. The company has made advancements with its hyaluronic acid-based dermal fillers, most notably the RESTYLANE collection, which are engineered for precision and longevity. Further, the company’s integrated portfolio, which also includes technologies that support skin health and collagen integrity, demonstrates a holistic approach to dermatology through biomaterial science.

Recent Developments

- In October 2024, GeniPhys announced that the U.S. Patent and Trademark Office had issued a patent that expands the protection of its platform technology, Collymer, and the processing methods that support applications for material diversity.

- In September 2024, PACT secures £9 million in funding to accelerate revolutionary collagen-based biomaterials production. These intuitive, leather-like materials are expected to impact multiple industries significantly.

- Report ID: 7795

- Published Date: Oct 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Collagen and HA based Biomaterials Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.