Online Coaching Software Market Outlook:

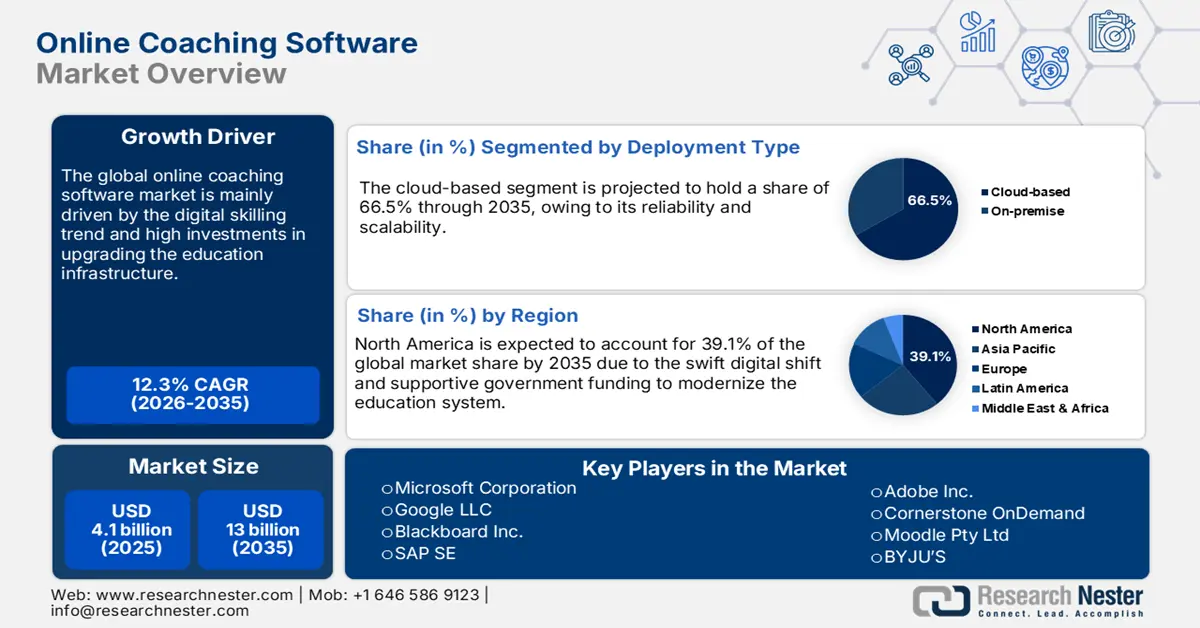

Online Coaching Software Market size was USD 4.1 billion in 2025 and is estimated to reach USD 13 billion by the end of 2035, expanding at a CAGR of 12.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of online coaching software is evaluated at USD 4.6 billion.

The market is primarily driven by rising internet accessibility and mobile connectivity. Due to rising global connectivity, coaching platforms record growth in sign-ups, live classes, video consumption, and mobile-first product usage, creating demand for mobile-optimized LMS, low-bandwidth features, payment integrations, and analytics tailored to large, distributed learner bases. According to data released by the Telecom Regulatory Authority of India (TRAI) in July 2025, the internet subscriber base in India expanded by 1.54% in FY 2024-25, increasing from 954.40 million in March 2024 to 969.10 million in March 2025.

This growth is largely fueled by a rise in broadband users, which went up from 924.07 million to 944.12 million, reflecting a 2.17% year-on-year increase. The steady rise in internet and broadband subscribers in India is expanding digital access, creating a larger pool of learners who can seamlessly adopt online coaching platforms. This growing connectivity propels demand for online coaching software, helping in wider reach, interactive learning, and scalable digital education solutions.

Key Online Coaching Software Market Insights Summary:

Regional Highlights:

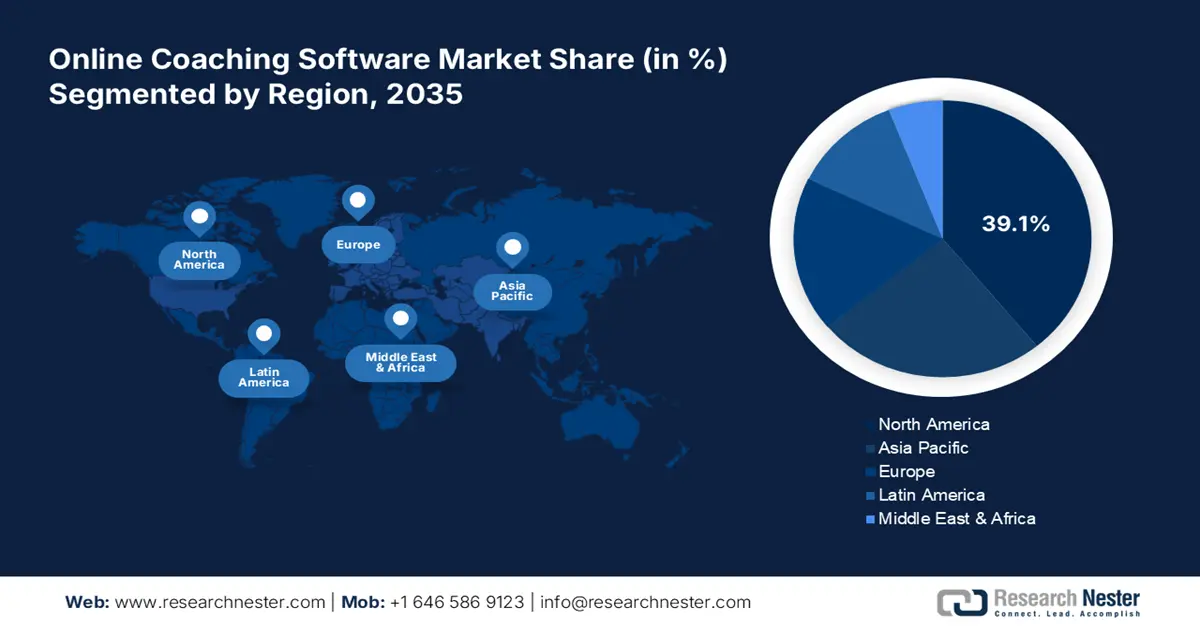

- North America online coaching software market is expected to secure a 39.1% share by 2035, supported by rising government ict investments and expanding digital learning ecosystems.

- The Asia pacific online coaching software market is projected to grow steadily through 2035 as digital transformation and expanding e-learning adoption fuel increasing demand for modern online coaching platforms.

Segment Insights:

- The cloud-based segment is projected to account for 66.5% of the online coaching software market share by 2035, uplifted by its scalability, cost advantages, and the rising government push for cloud-enabled digital learning infrastructure.

- The educational institutions segment is anticipated to hold a 40.1% share during 2026–2035, supported by the accelerating shift toward digital and hybrid learning environments facilitated by national digital education programs.

Key Growth Trends:

- Growing importance of online learning for upskilling and continuous learning

- Expansion of remote and hybrid work culture

Major Challenges:

- Limited IT infrastructure

- Inconsistent pricing models

Key Players: Google LLC (Google Classroom), Blackboard Inc., SAP SE (Litmos), Adobe Inc., Cornerstone OnDemand, Moodle Pty Ltd, BYJU’S, Docebo Inc., 360Learning, Class Technologies Inc., WizIQ, Fast Learning Co., Ltd., iTrainAsia Pte Ltd, Benesse Corporation, Recruit Co., Ltd. (Study Sapuri), Hitachi Solutions Ltd., Fujitsu Limited, NEC Corporation.

Global Online Coaching Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.41 billion

- 2026 Market Size: USD 7.78 billion

- Projected Market Size: USD 12.66 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, China, Japan

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 3 October, 2025

Online Coaching Software Market - Growth Drivers and Challenges

Growth Drivers

- Growing importance of online learning for upskilling and continuous learning: The rising demand for upskilling and constant learning is a major factor boosting the online coaching software market. The World Economic Forum in 2022 stated that a growing number of people are enrolling in online courses to keep pace with the shifting demands of today’s dynamic job market. This can be clearly understood from recent reports released by an American online open course provider, Coursera. According to the report, Coursera’s student registrations rose from 21 million in 2016 to 92 million in 2021, indicating how remote work and pandemic-driven shifts accelerated the adoption of online learning. Further, enrolments doubled in 2020 and went up to 32% in 2021, reaching 189 million, highlighting the widespread acceptance of digital education. This surge shows how professionals, students, and underserved communities are turning to online platforms for flexible, skill-focused learning, driving rapid growth in online coaching software adoption.

- Expansion of remote and hybrid work culture: The shift towards remote work and learning has heightened the need for flexible coaching solutions. Remote and hybrid work models require digital training and coaching tools. Software with virtual classroom features, asynchronous modules, and mobile access continues to gain adoption. The U.S. Bureau of Labor Statistics reports that in Q1 2024, approximately 35.5 million people worked remotely or from home for pay, representing a 5.1 million increase from the previous year. Remote workers represented 22.9% of the employed population, up from 19.6% in the same quarter of 2023. Additionally, with the emergence of the COVID-19 pandemic, the remote/hybrid work culture escalated. With remote and hybrid work becoming more common, the need for online learning and coaching solutions is anticipated to increase rapidly.

- Advancements in technology: Technological advancements, especially in AI, have enhanced the potential of online coaching software. AI integration in online coaching platforms enables personalized learning paths, real-time feedback, and efficient progress tracking, making coaching more effective and accessible. With rising advancements in technology, online coaching is not just limited to general educational coaching; instead, there are massive opportunities in specialized verticals such as wellness & mental health coaching, executive leadership, sports coaching, life coaching, subject-specific academic tutoring, language coaching, and many more. Moreover, as a large number of users are accessing services via smartphones, mobile-friendly coaching apps rather than full desktop platforms are an opportunity. This is especially effective in developing markets where mobile penetration is high and lightweight devices are more accessible than PCs.

Challenges

- Limited IT infrastructure: The lack of proper infrastructure in the budget-constrained markets is hampering the adoption of online coaching software systems. The poor network accessibility and inconsistent electricity limit the IT infrastructure growth in these markets, which directly affects the sales of online skilling platforms. The poor countries, schools in rural areas are not able to adopt digital tools owing to poor infrastructure and limited capital expenditure.

- Inconsistent pricing models: The improper pricing models are expected to limit the sales of online coaching software solutions in the coming years. The online coaching software solutions are priced based on the SaaS subscriptions. The high costs of online coaching software platforms often deter their adoption in price-sensitive markets. To overcome this issue, companies are focusing on the reprice or subsidize tactics. Competitive pricing marketing strategies are also expected to aid the market players in sustaining their position in the competitive landscape.

Online Coaching Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12.3% |

|

Base Year Market Size (2025) |

USD 4.1 billion |

|

Forecast Year Market Size (2035) |

USD 13 billion |

|

Regional Scope |

|

Online Coaching Software Market Segmentation:

Deployment Type Segment Analysis

The cloud-based segment is projected to capture 66.5% of the market share by 2035. The scalability, cost-effectiveness, and versatility are prime factors driving the sales of cloud-based online coaching software solutions. The increasing government investments in cloud platforms also contribute to segment growth. This model allows coaching platforms to deliver services across several devices and locations, accommodating the increasing demand for remote learning solutions. For instance, the Centre of Excellence in AI for Education received an investment of approximately USD 57.57 million under India's Union Budget FY26, which aims to enhance skills, personalize learning, and transform education through AI integration. Such initiatives highlight the government's commitment to encouraging digital education, thereby accelerating the adoption of cloud-based coaching platforms.

End user Segment Analysis

The educational institutions segment is anticipated to capture a 40.1% share during the forecast period, supported by the growing adoption of digital and hybrid learning models. Schools, colleges, and universities continue to integrate online tools alongside classroom teaching, a shift that gained momentum during the COVID-19 pandemic and remains high worldwide. In India, government initiatives such as PM eVidya and DIKSHA play a critical role in advancing digital education. PM eVidya unifies digital, online, and broadcast learning channels to grant wider access, while DIKSHA, the National Digital Infrastructure for Teachers, serves as a platform for teachers to access training content, create resources, and collaborate with the teacher community. These programs not only improve the quality of education but also encourage institutions to embrace online coaching software as a scalable and flexible solution. The demand is largely driven by the need for accessible, efficient, and measurable learning methods supported by digital infrastructure and policy efforts.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegment |

|

Deployment Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Online Coaching Software Market - Regional Analysis

North America Market Insights

The North America online coaching software market is estimated to hold 39.1% of the revenue share through 2035. This growth can be attributed to increasing government investment in ICT infrastructure and innovations in online coaching software solutions. The robust expansion of the digital learning ecosystem and rising public-private collaborations are expected to contribute significantly to overall market growth. Moreover, the easily accessible and affordable digital education is set to double the revenues of key players in the years ahead.

The U.S. online coaching software market is powered by significant investments by enterprises in upskilling and digital transformation initiatives aimed at improving AI education. In September 2025, more than 60 organizations pledged to support the White House's AI Education Executive Order, promising to provide resources such as funding, curricula, and professional development for K-12 students and educators. Additionally, Microsoft announced a USD 1.25 million investment through the Presidential AI Challenge to recognize and reward educators leading AI-powered learning. These efforts point out a national strategy to combine AI education across various educational levels, thereby fostering a skilled workforce adept in AI technologies. Such initiatives are propelling the demand for online coaching platforms that can deliver scalable, accessible, and effective AI training solutions.

The Canada market is expected to witness consistent growth due to robust digital transformation initiatives and major connectivity investments. Programs such as the federal Connect to Innovate and Ontario’s high-speed internet expansion recently invested USD 22 million to bring broadband access to 1,400 homes across 10 communities, and are supporting reliable internet access even in remote areas. Additionally, the International Trade Administration (ITA) states that the digital economy in Canada grew at a rate of 9% through 2025. Thus, these investments are directly promoting the adoption of online coaching platforms by increasing the user base, improving accessibility, and encouraging institutions and learners to leverage digital learning solutions in the country.

APAC Market Insights

The Asia Pacific online coaching software market is projected to expand throughout the anticipated period. The digital transformation, e-learning expansion, and rise in government ICT investments are expected to open lucrative doors for the online coaching software companies. China, India, Japan, and South Korea are anticipated to lead the sales of online coaching software solutions owing to supportive IT policies and modernizing education infrastructure. Thus, the Asia Pacific is emerging as a win-win market for online coaching software producers.

The India market is increasing at a remarkable pace, fueled by strong government-led initiatives and demand for upskilling/reskilling courses to sustain in the competitive market. For instance, the Ministry of Electronics & Information Technology (MeitY) initiated FutureSkills PRIME, which saw registrations of more than 18.56 lakh candidates for upskilling and reskilling, with 3.37 lakh completing courses as of July 2024. This large-scale mobilization of both learners and platforms points out the strong demand for digital skills training in new technologies such as AI. Consequently, online coaching software providers are profiting from increased adoption of LMS platforms, assessment tools, progress tracking, and certificate management, creating significant growth opportunities in India’s digital education ecosystem.

Supportive government funding and digital educational programs are estimated to drive the sales of online coaching software platforms in China. Smart Education Pilot Zone program and the aggressive investment in AI and cloud computing by the Ministry of Industry and Information Technology (MIIT) are set to accelerate innovations in the digital upskilling solutions. The digital literacy initiatives in both rural and urban areas are anticipated to uplift the demand for AI-driven coaching software platforms.

Europe Market Insights

Europe online coaching software market is expected to expand rapidly, pushed by the European Union's Digital Education Action Plan. This initiative promotes collaboration among EU member states to improve digital education, focusing on personalized and flexible learning models. Additionally, the EU's Digital Europe Program has assigned €1.3 billion for 2025-2027 to develop digital skills, AI, and cybersecurity, directly enabling the development and adoption of online coaching platforms across the continent.

In the UK, the online coaching software market is likely to witness significant growth due to government-oriented initiatives promoting advancement. The government's USD 219.30 million TechFirst program, introduced in June 2025, is a classic example. This initiative aims to integrate digital and AI education into classrooms and communities, granting 1 million secondary school students opportunities to develop tech and AI skills. Furthermore, the Digital Inclusion Innovation Fund is supporting local community efforts to increase digital participation, thereby expanding access to online coaching resources nationwide.

The online coaching software market in Germany is expected to register rapid growth by the end of 2035, driven by the government's commitment to digital education, including initiatives to enhance digital infrastructure and support digital skills among educators and students. These steps are part of a broader strategy to modernize the education system and proliferate digital tools effectively in the market in Germany. Such investments are creating a widely supportive environment for the growth and adoption of online coaching platforms across the country.

Key Players in the Online Coaching Software Market:

- Microsoft Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Google LLC (Google Classroom)

- Blackboard Inc.

- SAP SE (Litmos)

- Adobe Inc.

- Cornerstone OnDemand

- Moodle Pty Ltd

- BYJU’S

- Docebo Inc.

- 360Learning

- Class Technologies Inc.

- WizIQ

- Fast Learning Co., Ltd.

- iTrainAsia Pte Ltd

- Benesse Corporation

- Recruit Co., Ltd. (Study Sapuri)

- Hitachi Solutions, Ltd.

- Fujitsu Limited

- NEC Corporation

- Benesse Corporation

The market is represented by the presence of dominant players and an increasing number of new companies. The startups are focused on the production of innovative solutions to stand out in the crowd. The industry giants are employing several organic and inorganic marketing strategies to boost their revenue shares. New product launches, technological innovations, mergers & acquisitions, partnerships & collaborations, and regional expansion are some of them. The digital marketing and customization tactics are also poised to offer high-earning opportunities to the online coaching software manufacturers in the coming years

Recent Developments

- In March 2025, Fujitsu partnered with Macquarie University to tackle the growing shortage of machine learning engineers. As part of this collaboration, a new micro-credentials course will provide students with hands-on experience using Fujitsu’s AutoML technology, enabling them to build AI models more quickly and efficiently.

- In February 2025, Adobe teamed up with California State University to strengthen students’ AI literacy and creative abilities. Through this new initiative, CSU students from all disciplines will gain exposure to AI tools and develop digital creative skills. The program builds on Adobe’s established collaboration with the CSU system, which has already seen over 300 Student Ambassadors lead workshops, join events, and take part in professional development with Adobe to enhance career readiness.

- Report ID: 3628

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Online Coaching Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.