Auto Dealer Software Market Outlook:

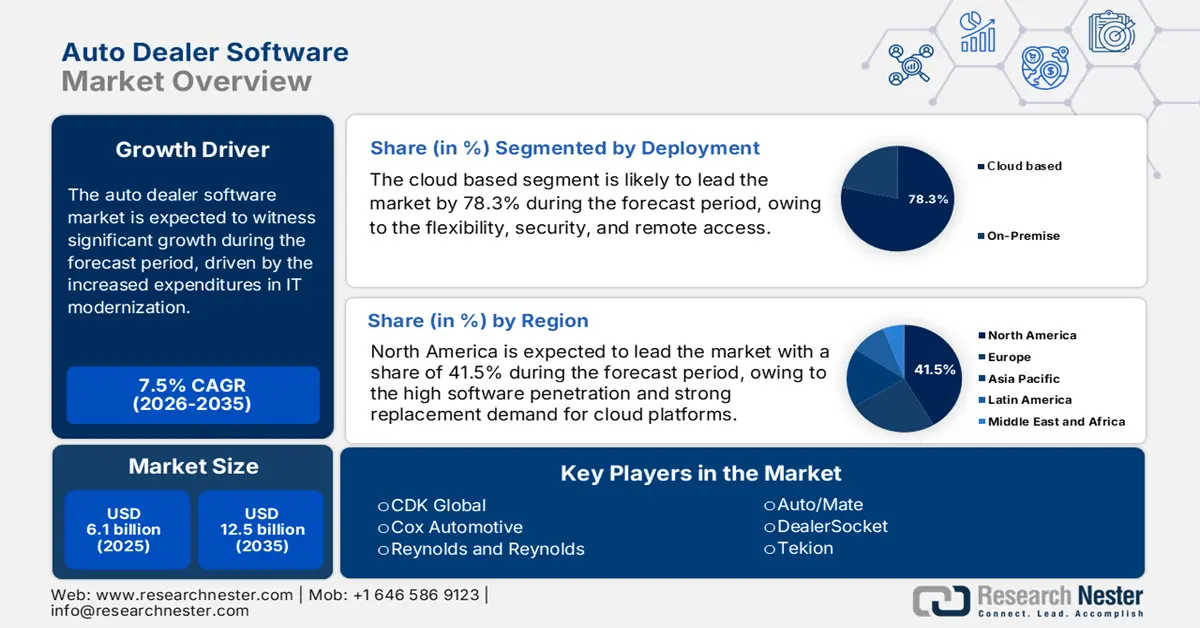

Auto Dealer Software Market size was valued at USD 6.1 billion in 2025 and is projected to reach USD 12.5 billion by the end of 2035, rising at a CAGR of 7.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of auto dealer software is assessed at USD 6.5 billion.

The auto dealer software market is defined by regulatory digital compliance requirements, expanding use of electronic vehicle records, and increased expenditures in IT modernization throughout the automotive retail sector. The National Highway Traffic Safety Administration report in March 2024 depicts that the U.S. federal datasets indicate that dealerships are operating in a progressively digitalized environment, and over 30 million annual vehicle recalls in 2023. This reinforces the need for automated compliance recall tracking workflows and integrated dealer information systems to minimize the administrative burden. Further, the Federal Trade Commission’s updated vehicle retailing guidelines emphasize transparent digital documentation and secure customer information handling, aligning with the need for the CRM integrated dealer software systems that maintain compliant audit trails.

Number of Vehicle Recalls Report

|

Year |

No. of Recalls |

Affected Population |

|

2019 |

880 |

38,597,607 |

|

2020 |

784 |

31,838,132 |

|

2021 |

987 |

28,879,611 |

|

2022 |

932 |

30,904,342 |

|

2023 |

894 |

34,862,036 |

Source: NHTSA March 2024

The auto dealer software market is also influenced by the improvements in the broadband and digital infrastructure, with the report from the Information Technology and Innovation Foundation data in December 2022 noting that 92% of U.S. people have access to the fixed high-speed broadband, enabling more dealers, mainly in rural areas, to adopt cloud-based platforms and online inventory tools. Further, the Bureau of Transportation Statistics highlights that many used vehicles are transferred yearly in the U.S., driving the need for automated appraisal inventory management and digital sales administration modules within the dealer software. These regulatory and operational pressures support a stronger B2B software procurement and replace legacy systems across franchised, independent, and multi-lot dealership groups.

Key Auto Dealer Software Market Insights Summary:

Regional Highlights:

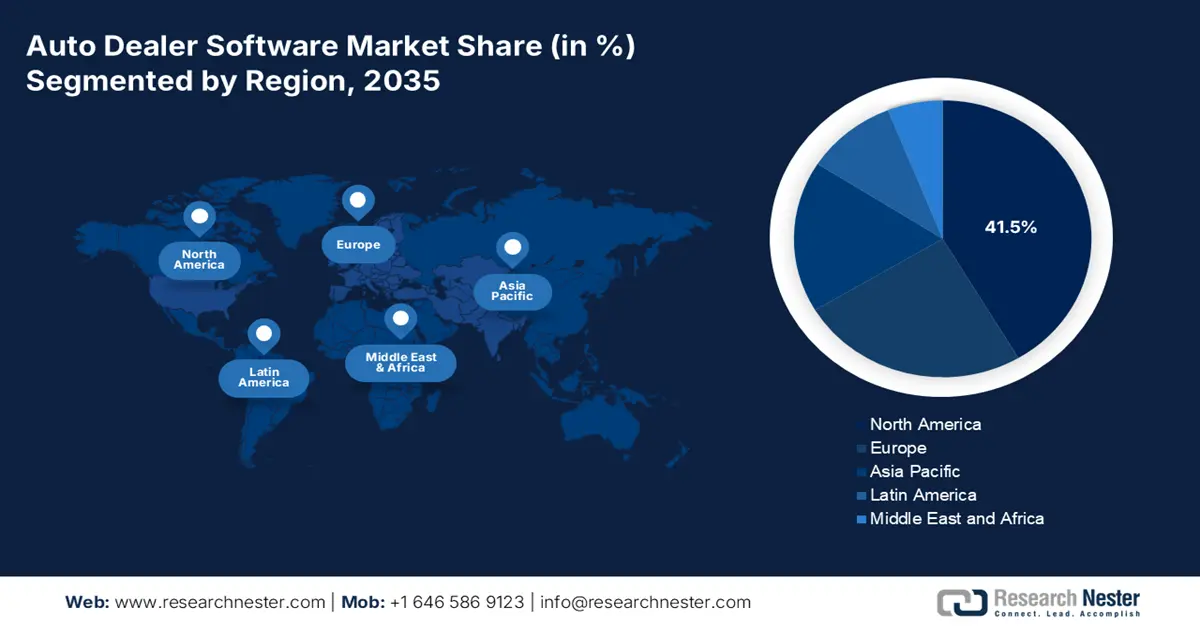

- North America is projected to dominate the auto dealer software market with a 41.5% share by 2035, underpinned by a mature dealership ecosystem and high cloud penetration reinforced by stringent regulatory compliance requirements and rising EV-related operational complexity.

- Asia Pacific is expected to emerge as the fastest-growing region, expanding at a CAGR of 12.1% during 2026–2035, as large-scale vehicle production, rapid digital adoption, and accelerating EV transition intensify demand for integrated, mobile-first dealership platforms supported by regulatory diversification.

Segment Insights:

- The cloud-based deployment segment in the auto dealer software market is anticipated to account for a 78.3% share by 2035, as dealerships increasingly favor scalable, subscription-driven platforms enhanced by centralized security frameworks and remote accessibility capabilities.

- The OEM-associated dealerships segment is forecast to maintain the largest share by 2035, owing to mandatory manufacturer integrations, enterprise-scale operations, and sustained franchise activity that necessitate complex, compliant software ecosystems.

Key Growth Trends:

- Government mandates for electric vehicle sales and infrastructure

- Growth of the used vehicle transactions

Major Challenges:

- High integration complexity and legacy systems

- Intense competition from incumbent all in one platforms

Key Players: CDK Global (U.S.), Cox Automotive (U.S.), Reynolds and Reynolds (U.S.), Auto/Mate (U.S.), DealerSocket (U.S.), Tekion (U.S.), VinSolutions (U.S.), SAP (Germany), Keyloop (UK), SERA (Germany), Incadea (Germany), AutoIT (Australia), MAM Software (UK), Softeam (Japan), AutoManage (U.S.), Gaurant (India), Mongoose (U.S.), Elva (Sweden), M5 (South Korea), Auto-Facts (Malaysia).

Global Auto Dealer Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.1 billion

- 2026 Market Size: USD 6.5 billion

- Projected Market Size: USD 12.5 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: India, South Korea, Indonesia, Vietnam, Thailand

Last updated on : 16 December, 2025

Auto Dealer Software Market - Growth Drivers and Challenges

Growth Drivers

- Government mandates for electric vehicle sales and infrastructure: The government spending and regulatory targets for EV adoption are the primary drivers in the auto dealer software market. The White House report in December 2023 states that the U.S. Bipartisan Infrastructure Law allocates USD 7.5 billion for EV charging infrastructure, creating a demand for software to manage EV-specific sales service and changing station scheduling. In Europe, the EU Fit for 55 package mandates a 55% reduction in CO2 from cars by 2030, based on the Council of European Union report in 2022, stimulating the EV supply to dealerships. Further, the software vendors must develop modules for EV battery health reporting, charging logistics, and integrating with the public grant programs to become essential for dealer compliance and customer education in this transition.

- Growth of the used vehicle transactions: The used vehicle market is expanding, driving demand for data-driven appraisal, reconditioning, and inventory management software. The SEC report in 2025 states that CarMax sold 789,050 used vehicles at retail February, 2025 creating a high volume administrative demand for automated workflows. The dealers rely on software to streamline inspection logs, pricing recommendations, paperwork, digitalization, and multi-lot inventory visibility. The governments are pushing for the digital recordkeeping in used vehicle transactions, including the odometer reporting compliance and emissions record traceability. As the used vehicle sales become more regulated, the dealership prioritizes for the platforms that ensure documentation accuracy, regulatory compliance, and faster turnaround times.

- Dealer consolidation and scale economics: The trend toward consolidation into large auto groups demands enterprise-grade software. These groups need platforms capable of centralized reporting, standardized operations across multiple brands and locations, and bulk purchasing management. These drivers move away from the single-store solutions toward scalable cloud-based systems that offer unified data views. For vendors, the strategic focus should be on the robust multi-rooftop management features, corporate-level business intelligence dashboards, and API ecosystems that allow groups to integrate their preferred third-party tools at scale, catering to the sectors' most influential and deep-pocketed buyers.

Challenges

- High integration complexity and legacy systems: Penetrating auto dealer software market requires seamless two-way integration with entrenched, often proprietary dealer management systems such as CDK Global and Reynolds and Reynolds. These legacy systems are deeply embedded in dealer workflows, and their owners often maintain walled gardens with high fees and complex APIs for third-party access. This creates a significant technical and financial barrier. For example, despite being cloud native, a vendor such as Tekion had to invest heavily in building robust, secure middleware to connect with these legacy backbones, a prerequisite for any functional sales or service module.

- Intense competition from incumbent all in one platforms: New suppliers provide best-in-class point solutions, such as an improved F&I menu system. However, they compete against the giants such as Cox Automotive and CDK Global that auto dealer software market integrated all-in-one suites. Dealers often prefer the perceived simplicity of a single vendor despite potential shortcomings in individual modules. This forces niche players to either partner with incumbents or spend disproportionately on sales and marketing to convince dealers of the ROI from a best-of-breed approach and the added integration work.

Auto Dealer Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 6.1 billion |

|

Forecast Year Market Size (2035) |

USD 12.5 billion |

|

Regional Scope |

|

Auto Dealer Software Market Segmentation:

Deployment Segment Analysis

Under the deployment, the cloud based are dominating and is expected to hold the share value of 78.3% by 2035. The segment is the most transformative trend in the auto dealer software market and is driven by the vital needs for flexibility, security, and remote access. This model eliminates large upfront capital expenditure on hardware and IT maintenance, allowing dealerships of all sizes to access enterprise-grade tools via a predictable subscription fee. The scalability of the cloud supports seamless integration of the new applications from digital retailing to AI analytics without disruptive system overhauls. A primary driver is the strong cybersecurity cloud providers invest heavily in advanced centralized security protocols that are often superior to what a single dealership can implement, a necessity as digital transactions and data storage increase. According to the Eurostat report in December 2023, the percentage of businesses that bought cloud computing in 2023 was 42.5 % reflecting a steady rise in the trend that encompasses the automotive retail sector.

End user Segment Analysis

The OEM associated dealerships are dealerships are projected to retain the largest share value in the end-user segment. The position is solidified by their contractual obligations, complex operations, and scale. These dealerships are mandated by the manufacturers to use specific software integrations for warranty processing, vehicle ordering, and certified pre-owned programs, creating a captive market for compliant DMS providers. Their operations are also more multifaceted, requiring software that manages high-volume new and used logistics. The scale of these operations is often part of larger auto groups, demands enterprise level software with the multi location management and consolidated reporting. Their dominance in the auto dealer software market spending is associated with the overall health of new vehicle sales. For example, the Hyundai industry report on the passenger vehicle industry in June 2024 depicts that the motor vehicle output contributed to 2.5% of real GDP growth in Q4 2023, indicating sustained economic activity at the franchise level that underlines software investment.

Function Segment Analysis

In the function segment, the service function is the primary profit engine for modern dealerships, making it the highest revenue software function. The software for this area manages the complete customer service lifecycle from the digital appointment scheduling and technician dispatch to complex repair orders, parts inventory lookup, and customer communications. The key drivers are the increasing technical complexity of vehicles, mainly with the rise of electric vehicles and advanced driver assistance systems that require specialized diagnostic software and technician training modules integrated into the workflow. Further, the software is vital for maximizing customer retention via automated service marketing and lifetime value management.

Our in-depth analysis of the auto dealer software market includes the following segments:

|

Segment |

Subsegments |

|

Deployment |

|

|

Application |

|

|

Function |

|

|

End user |

|

|

Vehicle Type |

|

|

Dealership Size |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Auto Dealer Software Market - Regional Analysis

North America Market Insights

North America is dominating the auto dealer software market and is projected to hold the share of 41.5% by 2035. The auto dealer software market is driven by a mature dealer network, high software penetration, and strong replacement demand for cloud platforms. The key drivers include robust data security compliance, notably with the U.S. FTC Safeguards Rule, and the need to manage the complex sales and service requirements of electric vehicles. Government spending, such as the U.S. Bipartisan Infrastructure Law’s on EV charging, is indirectly fueling the demand for the compliant integrated software. The trend is toward consolidation on unified AI-enabled platforms that manage omnichannel retail and leverage connected vehicle data for the predictive service, with dealerships prioritizing vendors that ensure regulatory adherence and ROI in a competitive, margin-sensitive environment.

The U.S. auto dealer software market is defined by the dual demands of regulatory compliance and managing technological vehicle shifts. A primary driver is the enforcement of the Federal Trade Commission’s updated safeguards Rule, compelling the dealerships to invest in software with a verifiable data security architecture. Further, the transition to electric vehicles, aided by federal initiatives such as the Bipartisan Infrastructure Law’s invest heavily in the charging network. Creating a demand for the EV-specific sales and service modules. This drives the consolidation toward unified cloud-based platforms that ensure compliance while integrating digital retail tools and connected vehicle data. The data from the An Economic Sense in August 2025 states that the private investment in software was a key contributor, increasing 3.3% GDP in Q2 2025, reflecting ongoing sector-wide digital investment that encompasses automotive retail systems.

The auto dealer software market in Canada is shaped by the national climate policy and data privacy law, creating a distinct demand environment. The federal government’s mandate for all new light-duty vehicle sales to be zero emission, pushing dealerships to adopt software capable of managing ZEV inventory federal purchase incentive program, and new service workflows. According to a Government of Canada study published in October 2025, there were 13,687 vehicle dealerships in Canada in 2024. This data shows the overall addressable auto dealer software market for DMS, CRM, inventory management systems, financial and insurance modules, and so on. Further, the demand operates within the framework of the Personal Information Protection and Electronic Documents Act, making data governance a core software feature. This results in a trend toward platforms that are both integrated with a larger ecosystem and localized for the regulations in Canada.

APAC Market Insights

Asia Pacific is the fastest-growing auto dealer software market and is poised to grow at a CAGR of 12.1% during the forecast period 2026 to 2035. The market is driven by the dominant position in vehicle production and sales, rapid digitalization, and the stimulated shift toward EVs. The key growth includes the need for dealerships to manage increasingly complex EV inventories nd service inventories and service requirements, integrate online and offline sales channels, and comply with the diverse national regulations on emissions and data. A major trend is the demand for integrated cloud-based platforms that combine customer relationship management, inventory management, and digital retailing tools into a single system. The auto dealer software market is seeing a surge in the mobile-first solutions customized for the high smartphone penetration rates across Southeast Asia and India, allowing sales agents to manage customer interactions and vehicle data remotely.

China’s auto dealer software market is the largest and the most advanced in the APAC, and is propelled by the world's leading electric vehicle adoption rate, and is a fully integrated digital consumer ecosystem. The main driver is the need for the software to manage the complexities of selling and servicing EVs, including the battery lifecycle management and over-the-air update integration. The government policy is a critical accelerator. According to the People’s Republic of China report in September 2025, China has revealed a 2-year work plan to stabilize auto sector growth. The plan is expected to target sales of 32.3 million vehicles in 2025. This data highlights the rise in demand for management software in dealerships and compliance tracking. Further, the domestic market is dominated by local tech giants and specialized SaaS providers offering deeply customized solutions that integrate with platforms, to surge sales

India’s auto dealer software market is defined by an explosive growth potential and is driven by the rapid formalization and digitization of its massive automotive retail sector. The key demand stems from the need to organize fragmented used car inventories, streamline financing and insurance processes, and integrate with government digital infrastructure such as the VAHAN vehicle registry and FASTag electronic toll collection. The government of India’s Digital India initiative, led by the Ministry of Electronics and Information Technology, has created a foundation digital public infrastructure that enables software innovation. The data from the Ministry of Heavy Industries, December 2025, depicts that automotive is the key pillar in the Indian economy, highlighting the rising demand for automotive digital retailing in India.

Europe Market Insights

The Europe’s auto dealer software market is a dynamic landscape driven by the region’s transition to electric vehicles and heightened consumer expectations for digital retailing. The auto dealer software market is primarily fueled by the regulatory pushes for transparent vehicle history and emissions tracking, alongside dealers' need for integrated systems that manage online sales service booking and EV-specific operations such as battery health monitoring. A key trend is the consolidation of point solutions into comprehensive platforms that unify customer relationship management, inventory, and financial operations. For instance, the push for the digital single market in the EU promotes the software solutions that can seamlessly operate across borders. Further, the investment from the EU digital and green transition funds is stimulating innovation, with the broader automotive tech sector seeing significant growth in venture capital funding year-over-year.

Germany’s auto dealer software market is being transformed by its leadership in the premium automotive manufacturing and robust regulatory demands. The market is driven by the need to integrate the software with complex supply chains for electric vehicles and to comply with rigorous data security and consumer protection laws. The major trend is the adoption of advanced digital retailing tools that allow for detailed online configuration of high-value vehicles, directly linking customer orders to factory production. The digitalization of automotive services is a national priority, for instance, the German Federal Ministry for Economic Affairs and Climate Action reported in its 2023 digital strategy with significant allocation for business digitization initiatives, indirectly boosting sectors such as automotive retail technology.

The UK auto dealer software market is defined by a highly competitive retail environment and a strong independent dealer network. The growth is fueled by the consumer demand for a seamless online-to-offline car buying experience and the need for software to navigate the post Brexit regulatory changes in vehicle standards and the cross-border transactions. A recent innovation, such as the one announced in June 2025, Keyloop has announced the release of VEGA and VEGA.ai, two advanced business intelligence tools that can gather and understand data in real time from the company's portfolio of software products. Further, dealers may use these tools to assess important parts of business performance and determine how to optimize the customer and vehicle lifetime value while lowering expenses and increasing profits.

Key Auto Dealer Software Market Players:

- CDK Global (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cox Automotive (U.S.)

- Reynolds and Reynolds (U.S.)

- Auto/Mate (U.S.)

- DealerSocket (U.S.)

- Tekion (U.S.)

- VinSolutions (U.S.)

- SAP (Germany)

- Keyloop (UK)

- SERA (Germany)

- Incadea (Germany)

- AutoIT (Australia)

- MAM Software (UK)

- Softeam (Japan)

- AutoManage (U.S.)

- Gaurant (India)

- Mongoose (U.S.)

- Elva (Sweden)

- M5 (South Korea)

- Auto-Facts (Malaysia)

- CDK Global is a titan in the auto dealer software market and is providing a comprehensive dealer management system that serves as the central nervous system for thousands of dealerships. The company has significantly advanced its platform by integrating data from every department, such as sales, service, F&I, and CRM, into a unified cloud-based ecosystem. This integration ensures a real time inventory analytics, optimizing dealership operations and profitability in the highly competitive retail environment.

- Cox Automotive is a leading player that shapes the auto dealer software landscape via its vast portfolio of brands, including Dealertrack, Xtime, and VinSolutions. The company has made significant advancements by weaving these disparate software solutions into a connected retail ecosystem. This strategy ensures data from digital marketing inventory listing, deal structuring, and service scheduling flows seamlessly, enabling a frictionless omnichannel buying experience and providing dealers with a holistic view of the customer lifecycle.

- Reynolds and Reynolds is a foundational player in the auto dealer software sector, renowned for its deeply integrated ERA and DMS platforms customized for automotive retail. The company has advanced its auto dealer software market position by developing a closed-loop system that ensures data integrity and process control across the dealership. This approach guarantees that the information from the showroom service bay and back office is synchronized in real time, optimizing compliance, operational efficiency, and providing a single source of truth for franchise dealerships.

- Auto/Mate has carved a significant niche in the auto dealer software market by focusing mainly on the dealership DMS needs with a customer-centric model. The company has made advancements by offering a modern, user-friendly platform that prioritizes seamless integration with third-party vendors. This open architecture philosophy ensures dealers can access real-time data from their preferred F&I CRM and digital retailing tools, optimizing workflow efficiency and providing a cost-effective customization alternative to legacy systems.

- DealerSocket, now a part of Solera, is a major innovator in the auto dealer software market, unifying its CRM, DMS, and digital retailing solutions into a single platform. This company has significantly advanced dealership technology by using this integrated data to power AI-driven sales intelligence and automated marketing tools. This ensures real-time insights into customer behavior and sales pipeline health, optimizing lead conversion, service retention, and enabling a more personalized modern customer journey.

Here is a list of key players operating in the global auto dealer software market:

The global auto dealers software market is highly competitive and is dominated by the established U.S. players, such as the CDK and Reynolds, with strong regional players in Europe and the emerging innovators in the Asia Pacific. The landscape is being reshaped by a shift from the legacy on-premises system to cloud native platforms, with the key initiatives focused on integration and unification. Leading players are aggressively acquiring niche solutions to create unified end-to-end ecosystems. The strategic emphasis is now on data analytics, AI-driven insights, and omnichannel retailing to enhance the customer experience and dealership operational efficiency. For example, UnameIT announced the acquisition of Claire Automotive, a Dutch provider of work order management software for automotive companies. Competition also hinges on seamless integration with the OEM systems and third-party marketplaces, pushing vendors on seamless integration with OEM systems and third party marketplaces pushing the vendors more open, flexible architecture.

Corporate Landscape of the Auto Dealer Software Market:

Recent Developments

- In December 2025, FPT Software has announced its Smart Showroom Accelerator solution, which enables the auto dealers to turn data into decisions that inform and accelerate sales-to-conversion in real-time while building customer loyalty.

- In January 2025, Launch NY announced that it has committed up to USD 250,000 into Refraction, a technology startup that has developed e-commerce software for used automotive dealers.

- In August 2024, Salesforce launched Connected Vehicle, a new Automotive Cloud application that gives automakers a faster and easier way to build and deliver safer, more personalized driver experiences.

- Report ID: 8321

- Published Date: Dec 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Auto Dealer Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.