Customer Relationship Management Market Outlook:

Customer Relationship Management Market size was valued at USD 84.6 billion in 2025 and is projected to reach USD 339.6 billion by the end of 2035, rising at a CAGR of 14.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of customer relationship management is estimated at USD 97.3 billion.

The customer relationship management market is driven by the hyper-personalization of customer service, increasing digital-led infrastructure, and the rising use of AI. The main advantage of the CRM software increases the response time, reduces costs, and improves customer satisfaction in the industry. Organizations actively adopt this software in various departments such as customer service and support, and sales & marketing, further adopting AI to enhance the customer experience and feedback to have a strong customer trust. For instance, Accenture, a leading player in the market, announced the acquisition of Unlimited in April 2024, which is an award-winning integrated customer engagement agency. This move indicates a broader market trend where consultancies are surging their capabilities to implement and manage AI-enabled CRM systems for enterprise clients.

Further, according to the ServiceNow report in 2024, poor customer service could result in U.S. businesses losing up to USD 1.9 trillion in consumer spending. This is the main reason for companies to adopt CRM software. Further, the report also depicts that CRM adoption is high, and nearly 90% of mid-sized businesses are using a CRM system, which can lead to an ROI of USD 8.71 for every spent dollar. Nearly 73% of the companies use CRM software to boost their customer engagement and have a high bond to track their interactions. This data highlights that the CRM is no longer a optional tool but a vital infrastructure for revenue retention. Hence, investment is increasingly directed towards platforms that offer predictive analytics to identify and reduce the potential service failures before they impact customer loyalty.

Key Customer Relationship Management Market Insights Summary:

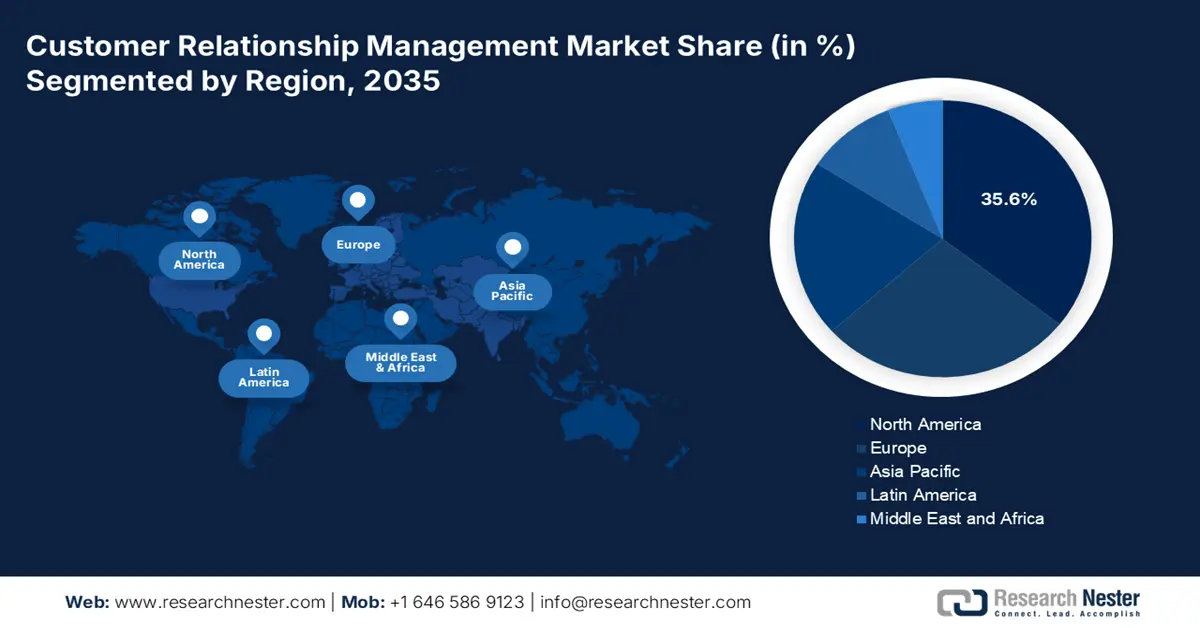

Regional Highlights:

- By 2035, North America is anticipated to secure a 35.6% share of the customer relationship management market, supported by the early adoption of AI and cloud technologies.

- Asia Pacific is projected to expand at a 13.5% CAGR from 2026–2035, underpinned by the rising retail and e-commerce sector, increasing digital transformation, and strong demand from small and medium-sized enterprises.

Segment Insights:

- The cloud sub-segment in the customer relationship management market is expected to command an 85.6% share by 2035, propelled by high scalability, cost-effectiveness, and enhanced innovation.

- By 2035, the enterprise sub-segment is set to retain a dominant revenue share, supported by the complex operational scale and strategic resources.

Key Growth Trends:

- AI and generative AI integration

- Expansion of remote and hybrid work models

Major Challenges:

- Unpredictable tariff and tax structures

- Digital infrastructure disparity

Key Players: Salesforce (USA), Microsoft (USA), Oracle (USA), SAP (Germany), Adobe (USA), HubSpot (USA), Zoho Corporation (India), ServiceNow (USA), Zendesk (USA), Freshworks (USA), Creatio (USA), SugarCRM (USA), Insightly (USA), PegaSystems (USA), IONOS (Germany), Odoo (Belgium), Sage Group (United Kingdom), Fujitsu (Japan), LG CNS (South Korea), NEC Corporation (Japan).

Global Customer Relationship Management Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 84.6 billion

- 2026 Market Size: USD 97.6 billion

- Projected Market Size: USD 339.6 billion by 2035

- Growth Forecasts: 14.9%

Key Regional Dynamics:

- Largest Region: North America (35.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, Brazil, South Korea, Indonesia, United Arab Emirates

Last updated on : 20 November, 2025

Customer Relationship Management Market - Growth Drivers and Challenges

Growth Drivers

- AI and generative AI integration: The fusion of AI is redefining the CRM from a record-keeping system into an autonomous productivity engine. These capabilities automate the content creation for marketing and service response, hence providing predictive sales scoring and offering actionable conversion summaries. This trend has increased the government-backed research; the NLM study in February 2024 has depicted that USD 800 million is invested in AI research, boosting innovation that directly feeds into enterprise software. Companies such as Salesforce and Microsoft are rapidly embedding these technologies to maintain competitiveness and making AI a baseline requirement rather than a differentiator. This initial investment guarantees that AI capabilities will continue to develop from innovative features into the fundamental operational framework of all top CRM platforms, radically changing customer contact models and workforce responsibilities.

- Expansion of remote and hybrid work models: The most permanent shift is the decentralization of workforces, which has significantly increased the use of cloud-based, mobile-based CRM systems. These platforms serve as the centralized digital headquarters for the sales and service teams, thereby enabling them to have seamless access to the most important customer data from any location. This change is the main reason for the increasing demand for mobile-first interfaces, deep integration with video conferencing tools, and collaborative features that are built-in, thus boosting the use of legacy and on-premise systems. In accordance with the U.S. Bureau of Labor Statistics, private-sector companies have adopted hybrid work, a structural change that has permanently embedded flexible, connected CRM tools as a vital enterprise infrastructure.

- Shift to industry-specific CRM solutions: The adoption of a generic CRM platform has been limited and industry-specific solutions have been customized for sectors such as healthcare, manufacturing, and finance. These specific systems are made with pre-built compliance frameworks and terminologies, reducing the implementation time and complexity. This driver is supported by the digitization of the public sector. For instance, the UK's £2.6 billion National Cyber Strategy by the government is mainly about securing sector-specific digital infrastructure, thus, the demand for compliant CRM tools in the industries that are critical is increasing. This focus compels CRM vendors to develop deep vertical expertise or risk irrelevance. Hence, a significant number of partnerships is increased among the CRM providers and industry-specific consultants to deliver these tailored solutions effectively.

Challenges

- Unpredictable tariff and tax structures: Volatile import duties and complex value-added tax systems create significant financial uncertainty. The automotive parts suppliers may find their profitability erased by a sudden tariff hike on raw materials. The World Trade Organization data states that the average tariffs have decreased, and their unpredictable application remains as a non-tariff constraint that transforms the supply chains and complicates long-term financial planning for new market entrants.

- Digital infrastructure disparity: The effectiveness of digital products and SaaS platforms depends on high-speed internet. A company that sells IoT solutions cannot operate in regions that have poor connectivity. A 2023 World Bank report has stated that some parts of sub-Saharan Africa have fixed broadband penetration and have below average, which limits the addressable market for data-intensive services and requires costly and modified infrastructure solutions.

Customer Relationship Management Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

14.9% |

|

Base Year Market Size (2025) |

USD 84.6 billion |

|

Forecast Year Market Size (2035) |

USD 339.6 billion |

|

Regional Scope |

|

Customer Relationship Management Market Segmentation:

Deployment Segment Analysis

The cloud sub-segment is dominating the segment and is expected to hold the share value of 85.6% by 2035. The segment is driven by factors such as high scalability, cost-effectiveness, and enhanced innovation. The Cloud solutions allow businesses to scale their operations seamlessly without any capital expenditure, which is a critical advantage in the digital economy. Almost 94% of firms are using cloud services to ensure cost management, workload optimization, and data portability, based on the SQ Magazine report released in July 2025. Furthermore, cloud platforms are the primary delivery vehicle for the latest technologies, including AI and machine learning, enabling features like predictive analytics and automated customer interactions that are difficult to replicate on-premises. The government demonstrates the wider use of cloud computing, which is used as a key component of modern business strategy.

Enterprise Size Segment Analysis

By 2035, the enterprise sub-segment is projected to maintain a dominant revenue share in the market and is driven by the complex operational scale and strategic resources. To combine the massive amounts of client data from different departments and marketplaces, these businesses need a robust and integrated CRM platform. The report from the Preprints data in October 2024 depicts that the adoption of CRM software in large enterprises has increased the lead rate by 25% to 40%. This data further highlights that the firms are actively increasing their adoption of a comprehensive suite from companies such as Salesforce and SAP, which offer advanced AI analytics, marketing automation, and customizability. Their status as the main source of income for enterprise-level CRM solutions is reinforced by the need for a single system to handle complex, high-value client relationships and sales pipelines.

Function Segment Analysis

Sales force automation is the holding the highest share value in the function segment in the customer relationship management market. The dominance is due to its direct impact on revenue generation and productivity. AI-powered insights, need for improved sales, and mobile accessibility are the key drivers of the segment. Modern sales force automation integrates AI to analyze consumer data, recommend next best actions, and prioritize leads to increase conversion rates. The shift to remote and hybrid work models has driven the demand for the first mobile-first SFA tools that empower the sales team to work efficiently from anywhere. Further, the executive totally relies on the SFA platform for real-time pipeline visibility and accurate forecasting, which is important for strategic planning and resource allocation. This strategic focus on empowering the sales force ensures SFA's continued financial dominance in the CRM landscape.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Deployment |

|

|

Function |

|

|

Enterprise Size |

|

|

Application |

|

|

End user |

|

|

Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Customer Relationship Management Market - Regional Analysis

North America Market Insights

The customer relationship management market in North America is dominating and is expected to hold the market share of 35.6% by 2035. The market is driven by the early adoption of AI and cloud technologies across the mature enterprises in the BFSI and tech sectors. Key drivers such as the strategic integration of gen AI for hyper-personalization and automation are a strong shift towards platform consolidation to break down the data silos and raise the demand for predictive analytics. Strong data privacy laws are pushing investments in secure, compliant CRM architectures. The region’s advanced digital infrastructure and the presence of the major vendors such as Microsoft and Salesforce create a synergistic environment, assuring a continued market expansion and innovation. This established ecosystem of technology providers and high-level enterprise users creates a self-reinforcing cycle of demand and advanced development, setting its long-term leadership.

The U.S. leads the North America customer relationship management market and is driven by the rising enterprise adoption, rapid digital transformation, and high e-commerce penetration. The mobile CRM solutions are expanding the business, seeking remote and real-time access to customer data. Integration of automation and AI in the CRM platforms provides predictive analytics, streamlines operations, and personalizes customer experience. The Key sectors contributing to growth include retail, BFSI, healthcare, and IT. Data privacy management tactics in CRM implementations are influenced by regulatory regulations like the CCPA. The substantial federal investment in the underlying digital infrastructure serves as a highlight of this expansion. The National Telecommunications and Information Administration report in April 2024 depicts that the BEAD Program provides USD 42.45 billion to expand access to affordable, reliable, high-speed Internet, which directly enables the reliable connectivity required for cloud CRM adoption.

Canada is experiencing significant growth in the customer relationship management market and is driven by the concerted national push for digital transformation and the need for robust data privacy compliance. The Canada Digital Adoption Program is the key catalyst providing direct financial support for small and medium-sized businesses to modernize their operations. According to the Made in CA data in January 2025, companies in Canada allocate 29% of their IT budgets to cloud computing, and moreover, 92% of companies use some form of cloud computing. This data highlights that a part of the budget is allocated to enabling CRM systems and related infrastructure, such as data storage, customer analytics, and integration tools. Further, the rising adoption rate demonstrates strong market readiness and technological maturity for advanced CRM solutions.

APAC Market Insights

Asia Pacific is considered the fastest-growing customer relationship management market and is projected to grow at a CAGR of 13.5% during the forecast period, 2026 to 2035. The market is experiencing rapid growth and is driven by the rising retail and e-commerce sector, increasing digital transformation, and strong demand from small and medium-sized enterprises. Countries such as India, China, South Korea, and Japan are surging the growth via investment in IT infrastructure, and digital customer engagement is robust. The adoption of cloud-based CRM solutions, mobile CRM platforms, and AI-driven analytics enhances the customer experience and improves operational efficiency. The BFSI and retail industries are key sectors aggressively leveraging CRM technology to gain a competitive advantage and elevate customer retention. CRM expansion is further supported by government digital initiatives and the region's growing internet and smartphone usage, underscoring APAC's strong growth potential as the fastest-growing worldwide CRM market through 2025.

China market is dominating the APAC market and is driven by the top players, and is rapidly evolving via deep integration with social media and mobile super apps. The growth is heavily propelled by the Digital China policy that prioritizes technological self-sufficiency and the adoption of cloud native, AI-powered enterprise software. A key differentiator is the seamless embedding of CRM functionalities within platforms such as Alipay and WeChat, enabling businesses to manage e-commerce and customer interaction within a single ecosystem. According to the TCS data in 2025, the China cloud infrastructure services expenditure increased by 21%, reflecting he strong digital infrastructure buildout, where most modern CRM platforms operate. This directly lowers adoption barriers for CRM software by improving reliability, scalability, and data storage capabilities for China enterprises.

India is experiencing an explosive growth due to the rapid digital transformation in the SME proliferation of affordable, and mobile-first cloud solutions. The government’s India Digital initiative is a monumental catalyst, where a unified digital infrastructure is created to leverage the CRM platforms. A prime example of the market growth in the country is the Aadhaar-enabled e-KYC process, allowing businesses to onboard customers seamlessly and integrate verified data directly into their CRM systems. The PIB data in September 2025 stated that UIDAI has recorded 221 crore Aadhaar authentication transactions, which is a 10% increase from August 2024. High demand for voice-enabled interfaces, UPI-based payment gateway, and bundling of CRM are the key trends for the customer relationship management market expansion.

Europe Market Insights

The customer relationship management market in the Europe is defined by a strong regulatory environment and a strong push for digital sovereignty that simultaneously shapes the market growth. The General Data Protection Regulation is the key driver pushing the vendors to design products with privacy by design and ensure robust data governance. The development of cloud solutions providers is enabling cross-border data flow, highlighting the emphasis landscape that CRM providers must navigate. This has spurred the development of sovereign cloud solutions and increased the demand for CRM platforms that can demonstrate full compliance. Key trends include the integration of AI for predictive analytics under the proposed EU AI Act, and a strong preference for industry-specific solutions in manufacturing and automotive sectors.

Germany is been driven by the unwavering emphasis on data security, deep vertical integration, and engineering precision. Robust data protection standards and strict enforcement of the GDPR make compliance a non-negotiable feature for any CRM solutions. This is particularly critical for the Mittelstand, which is the small and medium-sized enterprises that form the backbone of the economy. The Federal Statistical Office data states that businesses in the nation are actively investing more in software and database systems, and have reported a considerable increase in 2022 that reflects the demand for digital tools like CRM. The market is further defined by a preference for on-premise or cloud deployments, a high demand for CRM features that are integrated with Industrial IoT for smart firms, and the growing adoption of AI-driven analytics to improve the lifecycle management for B2B customers.

The UK market is defined by the leading financial services and tech companies with its active approach to data regulation. The growth of the market is mainly led by the use of AI and cloud technologies. The European Parliament data in April 2024 has indicated that the country's AI sector reached over £21 billion in 2022, which is the main source of direct demand for AI-powered CRM functionalities such as predictive sales analytics and automated customer service. Among the key trends the global SaaS giants and agile local players show a strong interest in composable and open CRM architectures, and a focus on solutions that ensure seamless data transfer under new international adequacy agreements.

Key Customer Relationship Management Market Players:

- Salesforce (USA)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft (USA)

- Oracle (USA)

- SAP (Germany)

- Adobe (USA)

- HubSpot (USA)

- Zoho Corporation (India)

- ServiceNow (USA)

- Zendesk (USA)

- Freshworks (USA)

- Creatio (USA)

- SugarCRM (USA)

- Insightly (USA)

- PegaSystems (USA)

- IONOS (Germany)

- Odoo (Belgium)

- Sage Group (United Kingdom)

- Fujitsu (Japan)

- LG CNS (South Korea)

- NEC Corporation (Japan)

- Salesforce is leading in the customer relationship management market is the dominant leader which is renowned for its comprehensive cloud-based ecosystem. Their strategic initiative focuses on using artificial intelligence via Einstein GPT to embed gen AI across service, sales, and marketing clouds. As per the 2025 annual report, the company has earned USD 37.9 billion in revenue, and further, the company states that 90% of the Fortune 500 businesses are Salesforce customers.

- Microsoft is an active and strong player in the market and is deeply embedding its Dynamics 365 platform within its broader technology stack. Its key strategic initiative is seamless integration of Microsoft Cloud, including Azure, Office 365, and Teams. As a result, an integrated environment is created where CRM data improves teamwork and production.

- Oracle establishes a strong presence in the customer relationship management market mainly by targeting large enterprises with complex needs. Its strategic initiative centers on convergence, which offers a unified fusion Cloud CX suite that integrates CRM, ERP, and Human Capital Management on a single platform model. As per the Oracle 2025 annual report states that total revenue earned is USD 14.9 billion, which is up 12%.

- SAP holds a unique position in the customer relationship management market and is focusing on its core strength. The primary strategic initiative is to incorporate its CRM solution in the SAP business suite. This makes sure the customer relationship data is linked with real-time operational, supply chain, and financial data. By providing this seamless integration, SAP enables businesses to move beyond departmental CRM.

- Adobe has carved a distinct niche in the market with its Adobe Experience Cloud, which is often considered as the Experience Platform rather than traditional CRM. Its strategic initiative revolves around unifying data and content.

Here is a list of key players operating in the global market:

The customer relationship management market is very competitive and is dominated by the U.S. giants such as Microsoft, Oracle, and Salesforce. These industry players compete by providing broad, AI-driven platforms that include analytics, sales, marketing, and customer service. Their key strategic initiatives, such as mergers and acquisitions, expand their ecosystem. For instance, in August 2025, SuperOffice acquired the leading i-Centrum to build a stronger relationship with its customers in Europe. Companies mainly focus on vertical-specific solutions, cost-effectiveness, and user-friendly interfaces. The general trend is a rush to acquire long-term company contracts by offering a scalable, unified, and intelligent customer data platform.

Corporate Landscape of the Market:

Recent Developments

- In October 2025, Salesforce expanded its partnership with OpenAI, establishing a new generation of employee and consumer experiences powered by Salesforce’s Agentforce 360 and OpenAI frontier models.

- In July 2025, Meon announced the launch of Meon Customer Relationship Management Software, which is customized to the unique needs of Indian businesses. The launch aims to streamline lead management, marketing campaigns, customer support, and sales automation.

- Report ID: 8255

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.