Broadcast Automation Software Market Outlook:

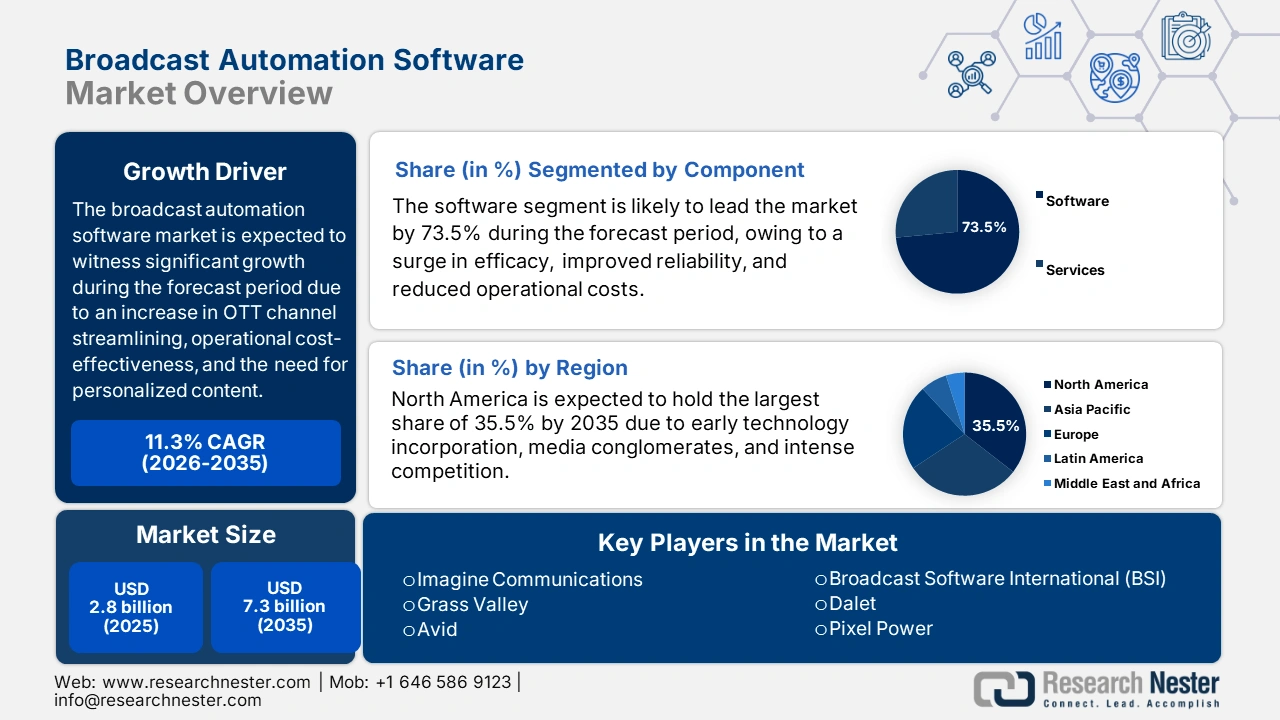

Broadcast Automation Software Market size was USD 2.8 billion in 2025 and is anticipated to reach USD 7.3 billion by the end of 2035, increasing at a CAGR of 11.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of broadcast automation software is assessed at USD 3.1 billion.

The international market is presently bolstering, owing to strategic shifts and industrial developments. These include the proliferation of streaming and OTT services, ROI pressure, operational cost efficiency, an increase in the consumer demand for personalized and high-quality content, along with cloud and IP-Native transition. According to an article published by NLM in May 2025, over 80% of executives in the consumer and retail space are expected to successfully leverage artificial intelligence (AI) automation, mainly for business processes, by the end of 2025. In addition, 88% of marketers have claimed that AI is readily utilized to manage customer personalization, thereby suitable for the market’s growth.

Moreover, the market’s evolution is further characterized by different transformative trends, such as the dominance of remote and distributed production, which is followed by the presence of software-defined and hyper-converged workflows, and a focus on compliance and security. According to an article published by NLM in March 2022, the adoption of a live selling strategy is considered the most effective for almost 27.9% of sellers. Besides, a rise in free-ad-supported streaming TV (FAST) channels is also positively impacting the market’s exposure. For instance, Solomon Partners, in one of its July 2025 articles, indicated that the global FAST market has been estimated to be valued at USD 8.0 billion as of 2023, which is projected to grow by 23% by the end of 2030, thus making it suitable for the market.

Key Broadcast Automation Software Market Insights Summary:

Regional Highlights:

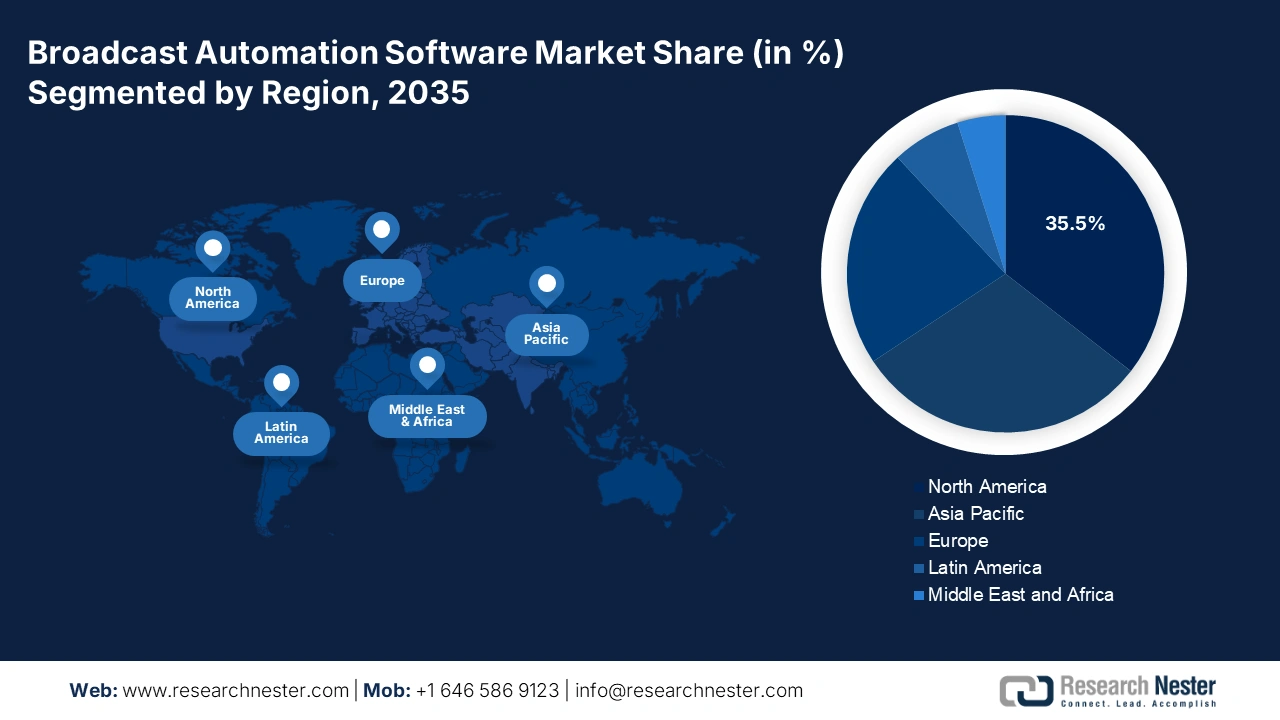

- North America is projected to hold the largest 35.5% share of the broadcast automation software market by 2035, impelled by early technology adoption, major media conglomerate concentration, and the surging prominence of FAST channels.

- Europe is anticipated to witness the fastest growth through 2026-2035, propelled by modernized regulatory mandates, adoption of DVB-I standards, and the digitalization of multi-platform content delivery.

Segment Insights:

- The software segment in the broadcast automation software market is projected to account for 73.5% share by 2035, propelled by its capability to automate repetitive tasks, enhance efficiency, and enable data-driven decision-making.

- The cloud segment is expected to secure the second-largest share by 2035, owing to its scalability, cost-effectiveness, and ability to support flexible, collaborative, and remote production workflows.

Key Growth Trends:

- Exponential growth of multi-platform content distribution

- Transition towards remote production models

Major Challenges:

- An increase in investment and ownership expense

- Integration complication with legacy facility

Key Players: Imagine Communications (U.S.), Grass Valley (U.S.), Avid (U.S.), Broadcast Software International (BSI) (U.S.), Dalet (France), Pixel Power (UK), Evertz (Canada), Ross Video (Canada), Harmonic Inc. (U.S.), PlayBox Technology (UK), Cinegy (Germany), Appear (Norway), Amagi (India), SeaChange International (U.S.), Vecima Networks (Canada), Synamedia (UK), MediaKind (UK), Sony Electronics (Japan), BroadStream (U.S.), AQ Broadcast (Malaysia).

Global Broadcast Automation Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.8 billion

- 2026 Market Size: USD 3.1 billion

- Projected Market Size: USD 7.3 billion by 2035

- Growth Forecasts: 11.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.5% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, United Kingdom, Germany, China, Japan

- Emerging Countries: India, South Korea, Indonesia, Brazil, Australia

Last updated on : 9 October, 2025

Broadcast Automation Software Market - Growth Drivers and Challenges

Growth Drivers

- Exponential growth of multi-platform content distribution: This particular distribution is essential for the market. It helps in extending a company’s reach to a wide and diversified customer base by meeting them on selective platforms and devices. Additionally, it enhances engagement and develops new revenue streams through different monetization models and fosters audience loyalty by providing content that is on-demand and flexible. According to an article published by NLM in March 2023, the Europe-based commission indicated that Apple’s competitive market for music streaming services has raised expenses by a charging fee of 30%, which is deliberately earned through rival applications.

- Transition towards remote production models: These models are crucial for the broadcast automation software market, owing to their ability to diminish expenses, enhance flexibility as well as efficiency, and provide great scalability for events such as live broadcasts. As stated in the June 2022 NLM article, an estimated 2.9% of the overall workforce in the U.S. and nearly 2% of that from Europe readily engaged in remote working. Besides, remote models tend to leverage technology, with the intention of centralizing operations so that companies can utilize a small on-site footprint to reduce travel costs and enter into a broad talent pool.

- Integration of automation: This is extremely important for the market and is suitable for optimizing efficacy by diminishing errors and streamlining repetitive tasks. This usually happens during live broadcasts, thereby enabling rapid content delivery across different platforms. Besides, automation deliberately supports content customization, generates on-demand highlights, and improves resource utilization, eventually resulting in low operational expenses, enhanced viewer experiences, and huge scalability, thus making it suitable for uplifting the overall market.

Digitalized Taxation Across Different Countries Driving the Broadcast Automation Software Market (2024)

|

Countries |

Tax Rate |

Global Valuation |

Regional Valuation |

|

Austria |

5% |

USD 801 million |

USD 27 million |

|

Canada |

3% |

USD 801 million |

USD 15 million |

|

France |

3% |

USD 801 million |

USD 27 million |

|

India |

6% |

- |

USD 1,198 |

|

UK |

2% |

USD 31 million |

USD 623 million |

Source: Tax Foundation Organization

Challenges

- An increase in investment and ownership expense: While automation successfully ensures long-lasting OpEx savings, the actual capital outlay for enterprise-based software, staff training, and integration services is substantial. For various broadcasters, particularly public and small-scale broadcasters with fixed budgets, this aspect creates a significant financial gap in the broadcast automation software market. Besides, the total cost of ownership (TCO), such as maintenance, cloud infrastructure, and ongoing licensing, can be effectively daunting. This frequently results in expanded ROI periods, thereby causing decision-makers to delay or scale back investments, and thus slowing the market penetration and replacement cycles for legal systems.

- Integration complication with legacy facility: The majority of broadcasters effectively operate in a hybrid environment of modernized IP-specific and legacy SDI hardware. Therefore, incorporating the newest software-based automation systems with these deep-rooted and usually proprietary legacy systems is considered a monumental technical challenge in the market. Additionally, this demand complicated the middleware, meticulous system, and customized API’s testing to offer frame-based synchronization and ensure signal stability. This, in turn, leads to expensive and prolonged implementation projects, along with operational disruptions.

Broadcast Automation Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.3% |

|

Base Year Market Size (2025) |

USD 2.8 billion |

|

Forecast Year Market Size (2035) |

USD 7.3 billion |

|

Regional Scope |

|

Broadcast Automation Software Market Segmentation:

Component Segment Analysis

The software segment in the broadcast automation software market is anticipated to garner the largest share of 73.5% by the end of 2035. The segment’s upliftment is effectively driven by its importance for enabling complicated scheduling, enhancing efficiency, optimizing reliability, diminishing operational expenses, and facilitating data-based decision-making by automating repetitive tasks, such as content playout and management. For instance, in January 2022, Broadcast Solutions, along with its branch, Broadcast Solutions Nordic, partnered with Seervision. The objective was to strengthen its position by offering overall solutions for joint customers, therefore making it suitable for the segment’s growth.

Deployment Mode Segment Analysis

The cloud segment is expected to cater to the second-largest market share during the predicted timeline. The segment’s upliftment is extremely fueled by its provision of scalability to manage changing requirements and cost-efficacy by reducing physical facility expenses, flexibility to unveil and up-scale channels, optimize remote production, and streamline, along with collaborative workflows. In this regard, the February 2025 International Journal of Public Administration in the Digital Age article stated that with cloud computing, e-government services stand at 35% across developed nations and 15% in developing countries.

Enterprise Size Segment Analysis

The large enterprises segment in the market is expected to constitute the third-largest share by the end of the projected period. The segment’s development is attributed to the aspect of immense operational scalability, tactical imperatives, and significant capital reserves for international distribution and content supremacy. These readily manage complicated and vast media libraries, along with operating different simultaneous linear as well as digitalized channels, thereby making manual processes completely unfeasible. Besides, the primary drivers of the segment cater to gaining unparalleled operational efficacy, providing flawless and overall broadcast reliability.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Deployment Mode |

|

|

Enterprise Size |

|

|

Application |

|

|

End user |

|

|

Workflow |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Broadcast Automation Software Market - Regional Analysis

North America Market Insights

North America market is projected to account for the highest share of 35.5% by the end of 2035. The market’s growth in the region is attributed to the aspect of early technology adoption, an increase in the concentration of major media conglomerates. In addition, intense competition, content battles, and the explosive growth of FAST channels are also driving the market in the region. Besides, according to an article published by the Pew Research Organization in September 2025, half of the population in the U.S., which is 53% receives news from social media. In addition, 38% achieve news updates from Facebook, and 35% from YouTube, thereby making it suitable for the market’s upliftment.

U.S. market is growing effectively, owing to the aspect of massive investment in cloud-based production as well as playout to support direct-to-consumer platforms and FAST channels proliferation deliberately. As per the August 2022 NCSES Government article, the Broadband Equity, Access, and Deployment Program successfully authorized USD 42.4 billion for digitalized infrastructure investment by prioritizing underserved and unserved regions of the nation. Besides, digitalization has been observed in over 90% of businesses in the country, with increased focus on personal and financial information.

The market in Canada is also growing due to the tactical push for content diversity and technological sovereignty, which are readily fueled by both private and public broadcasters. In addition, the aspect of modernization of infrastructure to provide support to indigenous language and simultaneous bilingual content distribution, along with mandatory reforms, are also bolstering the market in the country. Meanwhile, in August 2024, the Minister of Public Services and Procurement declared an effectively new project to support 15 innovative manufacturing projects by providing USD 59 million, which is a huge growth opportunity for the market.

Europe Market Insights

Europe is projected to emerge as the fastest-growing region in the market during the forecast duration. The market’s development in the region is extremely fueled by modernized mandates, along with the region’s diversified and multi-lingual media ecosystem. Additionally, the continent’s shift to cutting-edge standards, such as DVB-I and a robust push from public service broadcasters to streamline and digitalize archives as well as multi-platform content delivery, are also uplifting the market in the region. As per the April 2025 IMF data report, artificial intelligence results in large productivity gains and accessibility to AI tools for 14% of low-skilled taxi drivers and 50% for software engineers, thus suitable for the market’s upliftment.

The broadcast automation software market in the UK is gaining increased traction, owing to rapid modernization of its production infrastructure, increased support from the government and industrial bodies, thereby regulating and promoting investments in communication-based infrastructure. According to the September 2025 Government UK article, the country’s AI ecosystem comprises over 5,800 AI-based organizations, denoting an 85% increase within 2 years. The revenue is currently valued at £23.9 billion, and the overall industry is valued at £11.8 billion, thereby making it suitable for the market to grow in the overall country.

Germany market is also gaining exposure due to its strong public broadcasting industry, as well as strict demand for broadcast archiving and reliability. In addition, the continuous and large-scale migration from SDI-based and analog infrastructure to IP and software-based systems is also boosting the market’s demand in the overall country. As stated in the 2025 GTAI data report, the country’s robotics and automation sector has projected a holistic surge in sales by 2%, along with a valuation of £ 16.5 billion as of 2024, which denotes an optimistic outlook for the overall market in the country.

APAC Market Insights

Asia Pacific in the broadcast automation software market is predicted to account for a considerable share by the end of the projected period. The market’s upliftment in the region is highly driven by the presence of huge digitalization, a rise in disposable incomes, increased focus on exporting and importing computers, and government-based broadband extension. Besides, the rapid proliferation of localized and domestic OTT platforms, the continuous shift from analog to digitalized broadcasting, and effective investments in 5G facilities. As per an article published by the ASEAN Organization in 2022, regulations are being initiated to promote the harmonization of the newest 5G bands, such as 700 MHz, 1500 MHz, 2600 MHz, 3500 MHz, 4900 MHz, 26 GHz, 43 GHz, and 71 GHz, thereby suitable for bolstering the overall market.

The broadcast automation software market in China is effectively growing, owing to its massive localized audience, along with the presence of regional mandated need for media modernization and self-dependency. Besides, the National Radio and Television Administration (NRTA) has witnessed an increase in rapid consolidation and digitalization of provincial broadcasters, thus developing a huge scale. According to an article published by The People’s Republic of China in November 2023, the cloud computing market has expanded by 40.9% and reached 455 billion yuan (approximately USD 63.3 billion), which is positively impacting the market’s development.

The market in India is also growing due to low data expenses, along with an explosion of OTT platforms in regional languages that require scalable and cost-effective cloud automation. According to a data report published by the IBEF Organization in May 2025, there has been an increase in OTT years, accounting for 97 million paid subscriptions and 43 as subscribing households in 2023. This was followed by a further increase, with 110 and 50 in 2024, and it has been estimated that these numbers will also increase to 138 and 65 in the upcoming years. Therefore, this denotes a huge growth opportunity for the market in the overall country with increased exposure to OTT platforms.

Computers 2023 Export and Import in Asia

|

Countries |

Export |

Import |

|

China |

USD 158 billion |

USD 6.3 billion |

|

Vietnam |

USD 15.9 billion |

USD 1.3 billion |

|

Malaysia |

USA 5.1 billion |

USD 3.3 billion |

|

Singapore |

USD 3.6 billion |

USD 6.5 billion |

|

Thailand |

USD 2.9 billion |

USD 4.5 billion |

|

Japan |

USD 1.4 billion |

USD 12.5 billion |

|

India |

USD 244 million |

USD 8.3 billion |

|

South Korea |

USD716 million |

USD 4.3 billion |

Source: OEC

Key Broadcast Automation Software Market Players:

- Imagine Communications (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Grass Valley (U.S.)

- Avid (U.S.)

- Broadcast Software International (BSI) (U.S.)

- Dalet (France)

- Pixel Power (UK)

- Evertz (Canada)

- Ross Video (Canada)

- Harmonic Inc. (U.S.)

- PlayBox Technology (UK)

- Cinegy (Germany)

- Appear (Norway)

- Amagi (India)

- SeaChange International (U.S.)

- Vecima Networks (Canada)

- Synamedia (UK)

- MediaKind (UK)

- Sony Electronics (Japan)

- BroadStream (U.S.)

- AQ Broadcast (Malaysia)

The international broadcast automation software market is extremely fragmented and is characterized by intensified competition between established hardware-transitioning agile and vendors, along with cloud-native entrants. The dominant tactical approach is the ultimate pivot to subscription-based and flexible cloud and SaaS platforms, as has been observed with Harmonic’s VOS solutions and Grass Valley’s GV AMPP. This effective transition is highly fueled by the demand for OpEx models as well as scalability for OTT and FAST channels. Besides, notable players are aggressively adopting tactical acquisitions to extend geographic reach and consolidate capabilities, thereby making it suitable for the market globally.

Here is a list of key players operating in the market:

Recent Developments

- In October 2025, IBM and Anthropic declared their strategic partnership, with the intention of accelerating the creation of an enterprise-based AI by effectively infusing Anthropic’s Claude into IBM’s software portfolio to offer measurable productivity benefits.

- In October 2025, Rockwell Automation notified that it has recently expanded its collaboration with Avvale along with ESGeo, which will assist industrial organizations to effectively address increasing regulatory, investor, and social expectations regarding sustainability, especially in its operational technology.

- In February 2025, e& UAE successfully announced the introduction of innovative AI-based solutions, which are powered by Aleria to empower small and medium-sized businesses with progressive AI solutions in different sectors by incorporating the C-level executive AI platform

- Report ID: 3712

- Published Date: Oct 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.