Off-Grid Energy Storage Market Outlook:

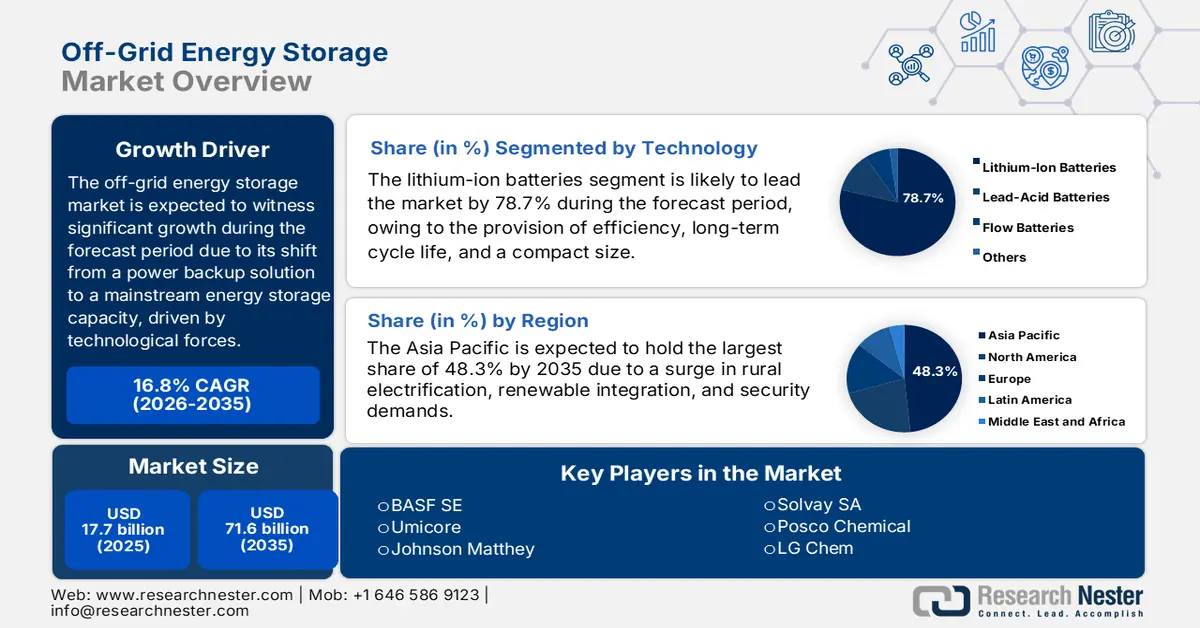

Off-Grid Energy Storage Market size was over USD 17.7 billion in 2025 and is estimated to reach USD 71.6 billion by the end of 2035, expanding at a CAGR of 16.8% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of off-grid energy storage is estimated at USD 20.6 billion.

The international off-grid energy storage market is undergoing a profound transformation, gradually shifting from a niche power backup solution to the mainstream pillar of global energy storage. This particular evolution is readily fueled by the convergence of technological, economic, and geopolitical forces that have prioritized cost parity, decarbonization, and energy security. According to an article published by the World Bank Group in June 2025, more than 450 million people currently lack access to reliable power, and 675 million reside without electricity. Therefore, countries have ramped up to meet nearly 2/3rd of international electricity needs by the end of 2035, along with over 73 million kilometers of power lines required to be provided by 2050. Besides, yearly investment in electricity generation across developing nations is projected to double by 2035, amounting to USD 630 million from USD 280 million, thereby making it suitable for the market’s upliftment.

Furthermore, the lithium-iron-phosphate (LFP) chemistry dominance, the presence of energy and prosumer community models, modular and containerized systems standardization, predictive analysis and artificial intelligence-based energy management, along with stationary storage and mobility convergence, are also driving the off-grid energy storage market globally. As per an article published by the IEA Organization in 2023, LFP constitutes a 30% share, and 95% of this battery type are utilized for electric LVDs that specially focuses on vehicle production in China. Besides, Tesla caters to 15% of the share, which further increased from 20% to 30% as of 2022. Likewise, almost 85% of vehicles with LFP batteries are manufactured by Tesla, especially in China, with the remaining being manufactured in the U.S. Moreover, nearly 3% of electric cars with LFP batteries are manufactured in the U.S. as of 2022. Besides, the use of these batteries, along with low and high nickel for LDV, is also uplifting the off-grid energy storage market internationally.

Electric LDV Battery Capacity by Chemistry (2018-2022)

|

Year |

Low-Nickel |

High-Nickel |

LFP |

Other |

|

2018 |

11% |

78% |

7% |

4% |

|

2019 |

6% |

89% |

3% |

2% |

|

2020 |

5% |

87% |

6% |

3% |

|

2021 |

4% |

76% |

17% |

3% |

|

2022 |

4% |

66% |

27% |

3% |

Source: IEA Organization

Key Off-Grid Energy Storage Market Insights Summary:

Regional Highlights:

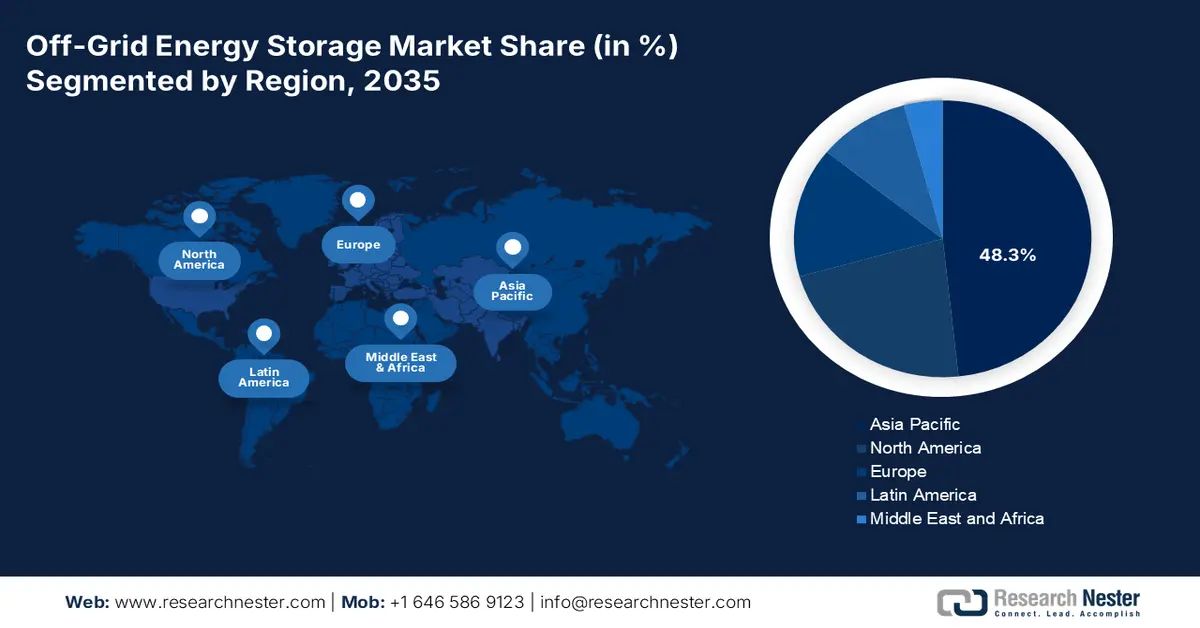

- By 2035, the Asia Pacific in the off-grid energy storage market is anticipated to secure a 48.3% share, supported by rising energy security demands, large-scale renewable integration, and extensive rural electrification.

- Europe is projected to remain the fastest-growing region through 2035, anchored by regulatory support, decarbonization initiatives, and strengthened energy-security imperatives.

Segment Insights:

- The lithium-ion batteries segment is expected to command a 78.7% share by 2035 in the off-grid energy storage market, fueled by its compact design, long cycle life, and high efficiency.

- The lithium iron phosphate segment is set to capture the second-largest share during 2026–2035, underpinned by its strong safety profile, economic stability, and extended operational life.

Key Growth Trends:

- Grid fragility and energy security

- Economic viability of renewable-plus-storage

Major Challenges:

- Critical mineral dependency and complex supply chain

- Lack of skilled labor and standardized regulations

Key Players: Albemarle Corporation (U.S.), Livent Corporation (U.S.), SQM (Chile), Ganfeng Lithium Group Co., Ltd. (China), Tianqi Lithium Corporation (China), Contemporary Amperex Technology Co., Limited (CATL) (China), BYD Company Ltd. (China), BASF SE (Germany), Umicore (Belgium), Johnson Matthey (U.K.), Solvay SA (Belgium), Posco Chemical (South Korea), LG Chem (South Korea), Samsung SDI (South Korea), Panasonic Holdings Corporation (Japan), Mitsubishi Chemical Group Corporation (Japan), 3M (U.S.), Targray Technology International Inc. (Canada), Ecopro BM Co., Ltd (South Korea), Sumitomo Chemical Co., Ltd. (Japan).

Global Off-Grid Energy Storage Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.7 billion

- 2026 Market Size: USD 20.6 billion

- Projected Market Size: USD 71.6 billion by 2035

- Growth Forecasts: 16.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48.3% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Japan, Germany, India

- Emerging Countries: Indonesia, Brazil, South Africa, Vietnam, Mexico

Last updated on : 8 December, 2025

Off-Grid Energy Storage Market - Growth Drivers and Challenges

Growth Drivers

- Grid fragility and energy security: The increase in weather severity and frequency, such as floods, storms, and wildfires, along with geopolitical instability, the centralized grid vulnerability has been exposed. This has made decentralized storage an essential investment for national security and business continuity, which is creating a positive impact on the off-grid energy storage market globally. According to an article published by the IEA Organization in September 2025, through the provision of grid connection, there have been almost 10,000 users and 7,500 generation projects to achieve the Dublin electricity network connection. Additionally, Tenne T, which is the Ditch transmission system operator, spent EUR 388 million in 2022 on grid congestion management, which is responsible for boosting the market’s exposure.

- Economic viability of renewable-plus-storage: The precipitous and continued decline in the Levelized Cost of Energy (LCOE) for wind and solar PV, along with falling battery prices, has readily made hybrid renewable-plus-storage systems the low-cost option. As per the October 2025 IEA Organization data report, the share of renewable energy in power generation accounts for 32% as of 2024, along with the share of VRE caters to 15%. Based on this, the renewable energy share is further projected to increase to 43% and 28% for VRE by the end of 2030. Therefore, the forecast net additions account for 4,605 GW, which denotes a positive outlook on the off-grid energy storage market globally. Therefore, the overall renewable capacity is expected to triple across different regions in the upcoming years, which is suitable for the off-grid energy storage market’s expansion.

- Electrification in remote sectors: The presence of developmental and government bank programs is aimed at offering electricity to people globally, which is a critical growth driver for the off-grid energy storage market. This is readily possible without accessibility, which has resulted in the increased adoption of solar mini-grids and solar-home systems with storage as the most sustainable and scalable option. Regarding this, the May 2024 World Bank Group Organization article indicated that utilities are required to provide accessibility to electricity to almost 700 million people, particularly in Sub-Saharan Africa. Besides, the 2025 IEA Organization data report stated that solar photovoltaic is projected to account for 80% of growth in the international renewable capacity by the end of 2030, which is also increasing the market’s demand.

Challenges

- Critical mineral dependency and complex supply chain: The off-grid energy storage market’s dependency on lithium-ion technology has tethered its fortune to a geopolitically concentrated and volatile supply chain for severe minerals, such as graphite, nickel, cobalt, and lithium. Besides, the overall processing and supply is readily controlled by China, which creates significant and tactical vulnerabilities, along with price volatility. This particular reliability has unveiled critical risks, based on which project economics are derailed by cost fluctuations in raw materials as well as national security policies. In addition, developing diversified and alternative supply chains in Australia, Europe, and North America is slow and capital-intensive, and experiences strict permitting and environmental obstacles.

- Lack of skilled labor and standardized regulations: The absence of universally approved interconnection protocols, safety codes, and technical standards for the off-grid energy storage market has created a risky and fragmented landscape. This particular regulatory ambiguity results in expensive and extended permitting processes, discourages institutional investment, and increases liability for developers. Besides, across different regions, regulations are either outdated or non-existent for grid-tied rules, thereby failing to cater to the unique standalone system characteristics. Therefore, compounding this is a critical international shortage of skilled engineers and technicians trained to maintain, commission, install, and design these complicated and integrated systems, thus causing a hindrance in the market’s growth.

Off-Grid Energy Storage Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

16.8% |

|

Base Year Market Size (2025) |

USD 17.7 billion |

|

Forecast Year Market Size (2035) |

USD 71.6 billion |

|

Regional Scope |

|

Off-Grid Energy Storage Market Segmentation:

Technology Segment Analysis

The lithium-ion batteries segment, which is part of the technology, is anticipated to garner the largest share of 78.7% in the off-grid energy storage market by the end of 2035. The segment’s upliftment is primarily attributed to its provision of compact size, long cycle life, and increased efficiency. This, in turn, enables suitable and standard power from sources, such as solar, across remote locations. According to an article published by the IEA Organization in 2023, there has been a surge in lithium-ion batteries by nearly 65% as of 2022, denoting a rise from 330 GWh the previous year. This growth is possible, owing to an increase in electric passenger car sales, with the newest registrations constituting 55% of the share as of 2022. Therefore, with the continuous upliftment in this battery segment, there is a huge growth opportunity for the overall segment in the market internationally.

Battery Chemistry Segment Analysis

Based on battery chemistry, the lithium iron phosphate segment in the off-grid energy storage market is projected to account for the second-largest share during the forecast period. The segment’s growth is highly driven by the compelling safety trifecta, economic stability, and longevity that directly address the ultimate requirements of unattended and remote installations. Unlike Nickel Manganese Cobalt (NMC) variants, the olivine crystal structure of LFP offers outstanding chemical thermal stability, thereby deliberately diminishing the risk of fire and thermal runaway. This particular safety permits for less expensive and simpler battery management as well as housing systems. Moreover, the LFP chemistry provides a suitable long-lasting cycle life, which results in a low-cost storage facility, thereby denoting a positive outlook for the segment’s growth.

System Type Segment Analysis

By the end of 2035, the integrated solar-plus-storage systems, under the system type segment, are expected to cater to the third-largest share in the off-grid energy storage market. The development of these systems is highly fueled by the standard synergy between battery storage and solar generation, which readily solves the fundamental issues of renewables, transforming the variable solar output into a dispatchable and dependable 24/7 power source. Besides, when it comes to off-grid consumers, this particular integration is regarded as a complete turnkey solution that eliminates the performance and complexity risk of interfacing and sourcing separate components from various manufacturers. Furthermore, notable manufacturers design these systems as modular and pre-engineered units, frequently in containerized formats with the provision of guaranteed performance metrics, a single digitalized control platform, and unified power conversion.

Our in-depth analysis of the off-grid energy storage market includes the following segments:

|

Segment |

Subsegments |

|

Technology |

|

|

Battery Chemistry |

|

|

System Type |

|

|

Application |

|

|

End user |

|

|

Power Output |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Off-Grid Energy Storage Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the off-grid energy storage market is anticipated to garner the highest share of 48.3% by the end of 2035. The off-grid energy storage market’s upliftment in the region is highly attributed to energy security demands, renewable integration, and huge rural electrification. According to an article published by the Renewable Energy Asia Organization in December 2025, the region is projected to enhance its renewable energy capacity from 1,300 GW as of 2023 to an estimated 2,500 GW by the end of 2028. In addition, solar energy plays a pivotal role in this upliftment, which is poised to increase from 1,000 GW to 2,000 GW by the same year. Moreover, wind energy is also expected to grow from 300 GW to approximately 600 GW by the end of 2028. Besides, the provision of USD 1 trillion in the country’s renewable energy infrastructure is predicted to bolster the overall off-grid energy storage market’s exposure.

China in the off-grid energy storage market is growing significantly, owing to the presence of the international supply chain for lithium-ion batteries, along with a huge domestic push for renewable integration. As per the November 2025 Greenpeace Organization report, both solar and wind generated 1,730 TWh of electricity, denoting a 28.3% year-over-year (YoY) increase, as well as successfully supplied 22% of national power consumption. The additional 382.2 TWh YoY output surpassed the overall growth in electricity consumption. Therefore, based on all these, the overall country’s renewable generation has reached 2,890 TWh, catering to an estimated 40% of the power. Moreover, different cities in the country have escalated the energy-mix shift and effectively established a robust foundation for a renewable-based power system, which is responsible for boosting the off-grid energy storage market.

Solar Capacity Increase Targets Across Different Cities in China (2025)

|

City Name |

14th FYP Solar Additions Target (GW) |

Solar Capacity Added by H1 2025 (GW) |

Completion (%) |

|

Fujian |

3 |

13.9 |

462.6 |

|

Henan |

10 |

38.9 |

389.3 |

|

Chongqing |

1.2 |

4.5 |

371 |

|

Jiangsu |

18.2 |

66.9 |

368.3 |

|

Zhejiang |

12.8 |

44.7 |

348.3 |

|

Anhui |

14.3 |

40.1 |

280.1 |

|

Guangdong |

20 |

49.5 |

247.4 |

|

Hubei |

15 |

35.9 |

239 |

Source: Greenpeace Organization

India, in the off-grid energy storage market, is also growing due to declining technological expenses, acute demand, and unprecedented convergence policy. As per a report published by the RJ Wave Organization in July 2025, the country’s overall solar power capacity installation is recorded to be 107,9 GW. This readily comprises 82.3 GW ground-mounted solar plants, 17.6 GW grid-connected solar rooftop, 2.8 GW hybrid projects, and 4.9Gw off-grid solar. Additionally, solar energy has been the largest contributor to ensure capacity extension between 2024 and 2025, further adding 23.8 GW, which is a suitable increase from the previous year. Meanwhile, as stated in the April 2022 PIB Government article, there has the provision of direct investment, amounting to Rs. 45,000 crore in advanced chemistry cell battery storage-based manufacturing projects, which is creating an optimistic outlook for the overall market in the country.

Europe Market Insights

Europe in the off-grid energy storage market is predicted to emerge as the fastest-growing region during the forecast duration. The market’s development in the region is gradually developing, owing to regional regulatory support, decarbonization of remote areas and islands, and energy security imperatives. In addition, the REPowerEU plan and Green Deal have significantly catalyzed investment, intended to escalate energy independence from fossil fuels. As per an article published by the Europe Commission in July 2023, there has been the provision of €3.6 billion to 41 large-scale clean technological projects, which is projected to be financed through the regional innovation fund. Of these, decarbonization comprises 8 projects with €1.4 billion worth, along with €1.2 billion valuation for the industry hydrogen and electrification comprising 13 projects, thereby making it suitable for bolstering the market.

Germany in the off-grid energy storage market is gaining increased traction, owing to leadership in the Mittelstand engineering, robust policy support, and unparalleled industrial base. In addition, domestic agricultural operations are seeking to ensure meeting stringent climate targets and operational continuity, along with the decarbonization of energy-based sectors are also driving the market’s growth. According to the 2025 Federal Ministry for Economic Affairs and Energy article, there has been a surge in large-scale rooftop PV installations, along with ground-based PV installations of 750 kW. Besides, as per an article published by the ITA in August 2025, the country aims a target for 80% of its overall electricity supply to derive from renewables by the end of 2030, and has already gained 59% as of 2024, thereby suitable for bolstering the market.

Italy, in the off-grid energy storage market, is also developing due to the presence of remote mountain and agricultural communities, as well as huge off-grid potential across non-interconnected islands. As stated in a report published by the Europe Parliament in April 2022, the country’s Recovery and Resilience Plan has allocated 37.5% to witness the green transition. In addition, this funding takes into account climate measures and proposals, which are included in 5 out of 6 missions. Moreover, according to the January 2024 ITA report, the country significantly consumed 4.5% less energy as of 2022, accounting for 149,175 kilotons. In addition, energy consumed in 2022 originated from 37.6% of natural gas, 35.7% from petroleum and oil products, 18.5% from renewables, 5% from coal, 2.5% from imported electricity, and 0.8% from non-renewable waste, thereby creating an optimistic outlook for the overall market.

North America Market Insights

North America in the off-grid energy storage market is projected to witness considerable growth by the end of the stipulated period. The market’s growth in the region is highly propelled by a transition from pure backup solutions to revenue-based and optimized assets for decarbonization and resilience. According to an article published by the EIA Government in January 2024, the battery storage capacity in the U.S. increased by 89% as of 2024. In addition, presently, developers have made an expansion in battery capacity to over 30 GW, denoting an energy capacity that exceeds landfill gas, wood and wood waste, geothermal, and petroleum liquids. Besides, California comprises the maximum installed battery storage capacity, with 7.3 GW, which is followed by 3.2 GW in Texas, which has created an optimistic outlook for the market within the region.

The U.S. in the off-grid energy storage market is gaining increased exposure, owing to chemical industry strategies, federal spending, and the presence of relevant governmental programs impacting storage chemistry. As stated in an article published by the U.S. Department of Energy (DOE) in November 2022, the Biden-Harris Administration declared almost USD 74 million in funding for 10 projects to make advancements in processes and technologies for electric battery reuse and recycling. Besides, with an increase in the demand for crucial battery minerals, including graphite and lithium, predicted to surge by almost 4,000% in the upcoming decade, this newest round of funding readily supports the reuse and recycling segment of the domestic battery supply chain. Therefore, with such a generous funding opportunity by the country’s government, there is a huge growth opportunity for the overall market.

The off-grid energy storage market in Canada is also growing due to indigenous energy and remote community sovereignty, strict carbon pricing and climate policy, severe mining and infrastructure sector decarbonization, federal funding, technological leadership, and grid resilience and modernization. As per an article published by the Transportation Research Interdisciplinary Perspectives in November 2024, the country’s government has readily introduced a proposal to boost the climate plan, comprising the launch of a CAD 15 per ton of carbon dioxide equivalent greenhouse gas (GHG) emission fee between 2023 and 2030. Besides, the livestock and agriculture industry in the country, excluding emissions from fertilizer manufacturing or fossil fuel utilization, significantly contributes to 10% of the nation’s GHG emissions. Moreover, as per the December 2024 Government of Canada article, the GI Smart Grid Program, addresses innovative goals for climate change and clean growth by investing USD 100 million for utility-based projects, thus driving the market’s growth.

Key Off-Grid Energy Storage Market Players:

- Albemarle Corporation (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Livent Corporation (U.S.)

- SQM (Chile)

- Ganfeng Lithium Group Co., Ltd. (China)

- Tianqi Lithium Corporation (China)

- Contemporary Amperex Technology Co., Limited (CATL) (China)

- BYD Company Ltd. (China)

- BASF SE (Germany)

- Umicore (Belgium)

- Johnson Matthey (U.K.)

- Solvay SA (Belgium)

- Posco Chemical (South Korea)

- LG Chem (South Korea)

- Samsung SDI (South Korea)

- Panasonic Holdings Corporation (Japan)

- Mitsubishi Chemical Group Corporation (Japan)

- 3M (U.S.)

- Targray Technology International Inc. (Canada)

- Ecopro BM Co., Ltd (South Korea)

- Sumitomo Chemical Co., Ltd. (Japan)

- Albemarle Corporation is one of the international leaders in lithium production and a foundational supplier of battery-grade lithium compounds, crucial for manufacturing lithium-ion batteries. The organization’s standard investments in refining sustainable and capacity extraction technologies directly support the security and scalability of the international energy storage supply chain. Besides, as per its 2024 annual report, the organization generated revenue, which is based on prices ranging between USD 1,661 to USD 3,020 per metric ton, along with an estimated USD 364 per metric ton for operating costs.

- Livent Corporation specializes in high-purity lithium compounds and is also considered a notable producer of lithium hydroxide, which is an essential precursor for the high-nickel cathode chemistries utilized in innovative and long-life storage batteries. The company’s focus on long-lasting supply agreements and integrated operations with major battery manufacturers ensures quality and consistent material flow for the industry.

- SQM is regarded as the world’s low-cost lithium producer from South America’s brine resources. It offers substantial volumes of lithium hydroxide and carbonate, which help stabilize input costs for battery manufacturers. The organization’s continuous expansion projects are essential to cater to the forecasted exponential growth in the requirement for energy storage materials. Besides, as stated in its June 2025 annual report, the organization generated USD 4,529 million in overall sales, followed by USD 404 million in net income.

- Ganfeng Lithium Group Co., Ltd. is regarded as the vertically integrated giant that controls a significant portion of the international lithium supply chain from refining and mining to battery component manufacturing. Its strong expansion and dominance, comprising investments in lithium projects, makes it a crucial force in determining the pricing and availability of notable raw materials for off-grid energy storage systems.

- Tianqi Lithium Corporation is a major shareholder in the global premier lithium asset and exerts considerable influence over the international lithium market through its control of high-quality spodumene concentrate. The organization’s integrated lithium chemicals production is essential for supplying battery giga factories that readily produce cells for the storage industry.

Here is a list of key players operating in the global off-grid energy storage market:

The global off-grid energy storage market is readily bifurcated between integrated battery producers and upstream chemical specialists, which has exerted significant control over the supply chain. Competition centers on establishing circular economies through recycling, developing cost and performance-based cathode materials, and securing critical mineral resources. Notable strategies include strong vertical integration through massive capital spending and mining in local Gigafactory supply chains, along with huge research and development investment in cutting-edge solid-state sodium chemistries. Besides, in December 2025, RWE significantly powered ahead with the existence of its largest storage project in the UK, Pembroke Battery Storage, by initiating the circa £200 million development, which denotes a positive impact on the off-grid energy storage market.

Corporate Landscape of the Off-Grid Energy Storage Market:

Recent Developments

- In December 2025, PowerBank Corporation announced the successful execution of equipment procurement deals for 15 late-stage distributed solar and energy storage projects throughout New York state by wholly owned subsidiaries.

- In May 2025, ABB declared the introduction of its latest Battery Energy Storage Systems-as-a-Service (BESS-as-a-Service), which is a zero-CapEx solution, specifically designed to escalate the transition to cost-effective, resilient, and clean energy.

- In May 2024, Sungrow ensured a tactical partnership with Larsen & Toubro, with the intention of supplying 160MW/760MWh energy storage systems and 165MW PV inverters for AMAALA.

- Report ID: 8286

- Published Date: Dec 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Off-Grid Energy Storage Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.