Advanced Energy Storage Systems Market Outlook:

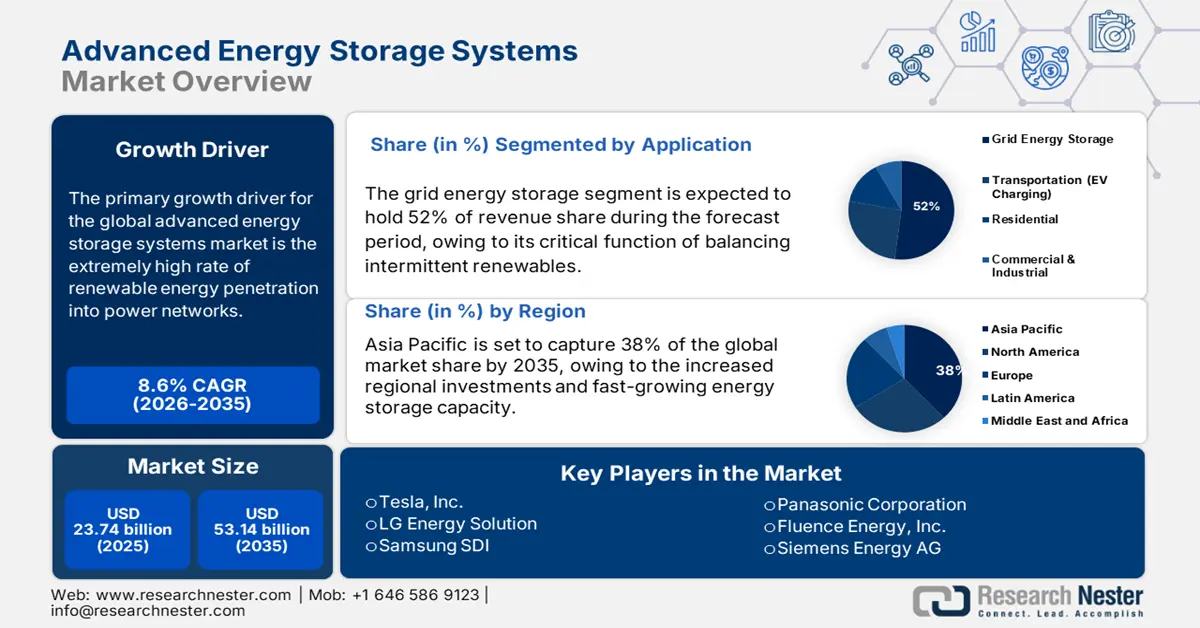

Advanced Energy Storage Systems Market size was valued at USD 23.74 billion in 2025 and is projected to reach USD 53.14 billion by the end of 2035, rising at a CAGR of 8.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of advanced energy storage systems is estimated at USD 25.72 billion.

The primary growth driver for the global advanced energy storage systems market is the rapid increase in renewable energy penetration into power networks. In 2024, about 90% of new electrical producing capacity in the U.S. came from renewable energy sources, with solar power making up 78% of this total. In September 2024, 1,786 megawatts (MW) of new solar electricity, equivalent to the producing capacity of a sizable coal-fired power plant, went into operation. Wind and solar contributed 2,626 MW and 18,635 MW, respectively, in 2024. Renewables accounted for approximately 21% of U.S. electricity generation in 2023, according to the EIA. This requires increasing storage capacity to ensure the balancing of intermittency and grid stability. The IEA estimated that it is anticipated that the proportion of renewable energy in the electrical sector will increase from 30% in 2023 to 46% in 2030.

Synthetic graphite production in the United States grew from 259,000 metric tons (t) valued at $1.16 billion in 2021 to 319,000 t valued at $1.45 billion. Natural graphite imports and exports from the U.S. were 89,200 t and 9,500 t, respectively, up 68% and 10% from 2021. The United States imported 151,000 t of synthetic graphite and exported 38,700 t. The United States consumed 431,000 t of synthetic graphite and 79,700 t of natural graphite. An estimated 1.68 million metric tons (Mt) of natural graphite were produced worldwide. According to regional UN Comtrade data, in 2023, China exported about 11 million short tons of battery materials, packs, and components, or 58% of interregional trade, and imported nearly 12 million short tons of raw and processed battery minerals, or 44% of interregional trade.

Key Advanced Energy Storage Systems Market Insights Summary:

Regional Insights:

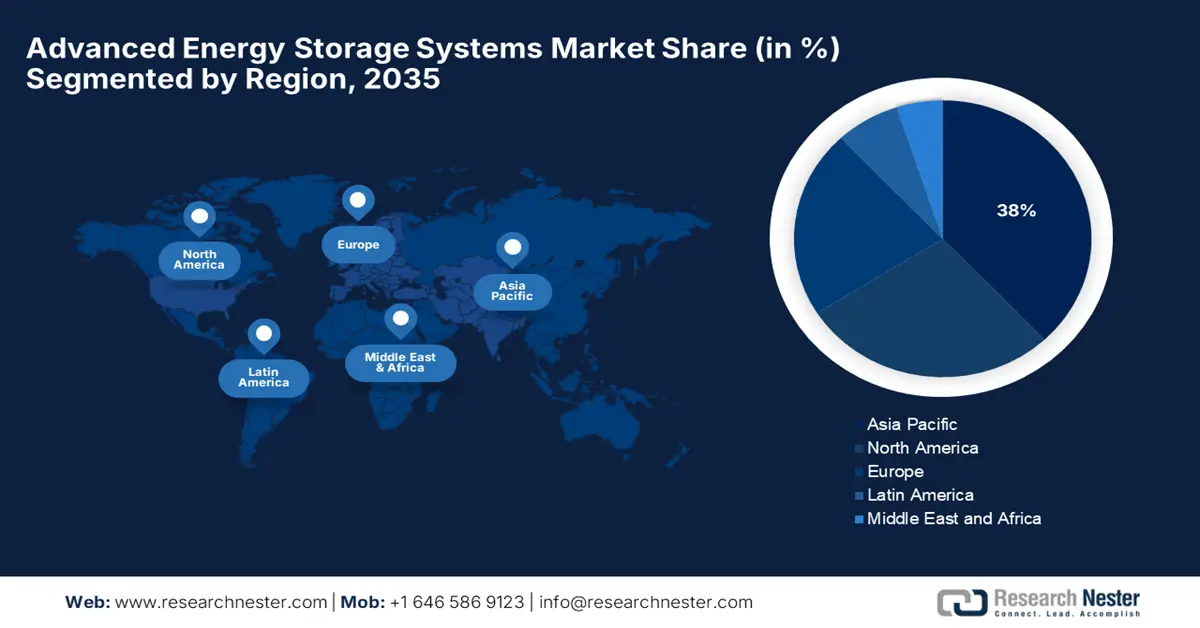

- The Asia Pacific Advanced Energy Storage Systems Market is expected to secure about 38% share by 2035, owing to increasing regional investments, expanding energy storage capacity, and supportive government initiatives promoting renewable integration.

- North America is forecasted to account for approximately 28% of the market share by 2035, impelled by robust policy frameworks, strong capital inflows, and accelerated grid modernization efforts.

Segment Insights:

- The Utilities segment in the Advanced Energy Storage Systems Market is projected to command a 54% revenue share by 2035, propelled by surging demand for utility-scale renewable integration and expanding grid modernization investments.

- The Grid Energy Storage segment is anticipated to capture a 52% share by 2035, supported by its essential role in stabilizing intermittent renewable sources and evolving regulatory frameworks encouraging scalable storage investment.

Key Growth Trends:

- Circular economy & innovation in recycling

- Growing electric vehicle (EV) adoption

Major Challenges:

- Supply chain dependency on critical minerals

- Insufficient grid integration infrastructure

Key Players: Tesla, Inc., LG Energy Solution, Samsung SDI, Panasonic Corporation, Fluence Energy, Inc., Siemens Energy AG, ABB Ltd, Johnson Controls International, Saft Groupe S.A., Redflow Limited, Exide Industries Limited, VARTA AG, Amita Technologies, NEC Energy Solutions, Hitachi Chemical Company, Ltd.

Global Advanced Energy Storage Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 23.74 billion

- 2026 Market Size: USD 25.72 billion

- Projected Market Size: USD 53.14 billion by 2035

- Growth Forecasts: 8.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 24 September, 2025

Advanced Energy Storage Systems Market - Growth Drivers and Challenges

Growth drivers

- Circular economy & innovation in recycling: Goals for recovering lithium from spent batteries include 50% by the end of 2027 and 80% by the end of 2031, and 90% by the end of 2027 and 95% by the end of 2031 for copper, cobalt, lead, and nickel. Public R&D funds have financed innovation in new recycling technologies, lowering manufacturing energy and raw‐material input per MWh. Cost savings and supply security driven by recycling stimulate next-generation storage demand for solutions integrated with second-life or recycled materials to facilitate corporate sustainability targets and allow scalable deployment into the energy sector.

- Growing electric vehicle (EV) adoption: The global movement towards electric vehicles has driven demand for advanced energy storage systems - in particular, lithium-ion batteries. The uptake of EVs is based on large-scale production of batteries, and related charging infrastructure development, and requires innovative solutions to develop batteries with more capacity, longer life, and lower cost, all in parallel. By 2025, widespread EV use could cut global CO2 emissions by 1.5 billion metric tons per year. EVs are more energy efficient than internal combustion engine (ICE) vehicles because they use 60-70% of the grid's electricity for movement, compared to ICE vehicles' 20-30%. As EVs penetrate our economy, that means battery storage demand will increase in both mobility and stationary applications.

- Grid modernization and stability need: Aging electrical grids and the increasing electricity demand create challenges for utilities to maintain their existing systems. Advanced energy storage technologies contribute to power generation by providing frequency regulation, voltage support, and load balancing. Energy storage also plays an important role in creating flexibility and resilience for the grid. The Infrastructure Investment and Jobs Act's $1.2 trillion infrastructure bill includes $65 billion for improvements to the electrical grid. The grid is an overdue investment that consists of more than 7,300 power plants, 160,000 miles of high-voltage power lines, and millions of low-voltage power lines. As a result of the blurring lines between providers and customers, national and local governments and utilities recognize the opportunity to invest in energy storage technologies as part of developing smart grids and catalyzing electrification efforts.

Emerging Trade Dynamics of Lithium Batteries and Lithium-Ion Batteries

Global lithium battery trade fell 7.2% in 2023 to $3.76 billion, down from $4.05 billion in 2022. In contrast, the lithium-ion battery trade surged 27.3%, rising from $98.1 billion in 2022 to $125 billion in 2023, highlighting robust demand for lithium-ion technology despite the broader lithium battery market’s decline.

Trade of Lithium Batteries in 2023

|

Exporting Country |

Trade Value (USD Million) |

Importing Country |

Trade Value (USD Million) |

|

China |

986 |

United States |

482 |

|

United States |

435 |

Germany |

293 |

|

Indonesia |

339 |

Mexico |

222 |

Source: OEC

Trade of Lithium-Ion Batteries in 2023

|

Exporting Country |

Trade Value (USD Million) |

Importing Country |

Trade Value (USD Million) |

|

China |

72.9 |

Germany |

26.9 |

|

Poland |

11.6 |

United States |

19.7 |

|

Hungary |

9.62 |

South Korea |

8.97 |

Source: OEC

Challenges

- Supply chain dependency on critical minerals: The advanced energy storage systems market is not subject to the high risk of dependence on a few countries for critical raw materials such as lithium, cobalt, and nickel. Due to geographic concentration, supply shortages and price fluctuations occur, hindering steady production and growth. Additionally, trade barriers and geopolitical conflicts can hamper procurement, delay a project, and increase costs, thereby reducing investment confidence and hindering global deployment of large-scale storage facilities.

- Insufficient grid integration infrastructure: Another huge growth inhibitor is the under-invested grid infrastructure needed to facilitate economic integration of mass-scale energy storage systems. Much of the world does not have digital controls, smart inverters, and transmission upgrades necessary to allow flexible, bi-directional power flow. This restricts storage capacity to offer grid balancing, peak shaving, and ancillary services at scale. Utilities have technical challenges in deploying storage beyond pilot schemes. In the absence of coordinated policy and investment in infrastructure, the sector is likely to be confronted by a lack of utilization of storage capacity, commercialization hold-up, and large-scale energy transition programs.

Advanced Energy Storage Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.6% |

|

Base Year Market Size (2025) |

USD 23.74 billion |

|

Forecast Year Market Size (2035) |

USD 53.14 billion |

|

Regional Scope |

|

Advanced Energy Storage Systems Market Segmentation:

End user Segment Analysis

The utilities segment in the advanced energy storage systems market is expected to dominate AESS revenue with a 54% share in 2035, driven by rising requirements of utility-scale renewable integration and grid modernization investments. Large-scale storage systems are highly demanded by utilities to stabilize grids and to provide ancillary services. In 2024, the U.S. utility-scale battery storage capacity surpassed 26 gigawatts (GW), as reported in the January 2025 Preliminary Monthly Electric Generator Inventory. In 2024, 10.4 GW of additional battery storage capacity was added by generators, making it the second-largest addition to generating capacity behind solar. Despite its rapid growth, battery storage capacity accounted for just 2% of the 1,230 GW of utility-scale power-producing capacity in the US in 2024. Further opportunities for utilities arise on account of increasing microgrid projects and investments in distributed energy resources, fueling market growth for storage.

Application Segment Analysis

Grid energy storage segment in the advanced energy storage systems market is expected to lead with a 52% revenue share in 2035, due to its critical function of balancing intermittent renewables. The International Energy Agency reports that over USD 20 billion was spent globally in 2022 on battery energy storage, with grid-scale deployment accounting for over 65% of total expenditures. Based on the current pipeline of projects and new capacity targets established by governments, battery energy storage investment reached another record high and exceeded USD 35 billion in 2023 after seeing strong growth in 2022. Grid-scale deployment is facilitated by shifting regulatory models, such as FERC Order 2222, which help in the growth of electric market participation and incentives for scalable storage investment. Further, the deepening penetration of electric vehicles and decentralized energy infrastructure necessitates advanced grid management capabilities that trigger the need for flexible high-capacity storage technologies.

Technology Segment Analysis

The lithium-ion battery market is expected to hold 46% of the installed capacity in 2035, owing to energy density, cost, and supply chain improvements. The United States Energy Information Administration envisages continuous enhancements in performance and manufacturing of lithium-ion batteries and thus continued application of lithium in all sectors. Over 90% of the demand for lithium-ion batteries each year comes from the energy sector. Flow batteries and pumped hydro are well verified yet bringing forth a curb along cost and locational requisites. There are emerging technologies, such as solid-state batteries and new thermal storage in the pipeline, that hold the promise of greater efficiency and safety that can redefine market forces in the next decade.

Our in-depth analysis of the global advanced energy storage systems market includes the following segments:

|

Segments |

Subsegments |

|

Technology |

|

|

Application |

|

|

End User |

|

|

Energy Capacity |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Advanced Energy Storage Systems Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific advanced energy storage systems market is also expected to hold a share of approximately 38% of the overall market by 2035 due to increased regional investments and fast-growing energy storage capacity. The rising government policies are streamlining the adoption of renewables as well as grid stabilization. Asia Pacific is leading the charging of utility, commercial, and residential programs for energy storage. Regional economies get established on low cost of production and long supply chains of battery components, which are positive factors for storage markets and technology development.

China has the potential to deliver more than 50% of the market in the region by 2035, being driven by a grid storage capacity installation target by 2030. China's entire utility-scale wind and solar capacity reached 758 GW by the first quarter of 2024, although the China Electricity Council stated that the overall capacity, including distributed solar, was 1,120 GW. Wind and solar power currently make up 37% of the nation's total power capacity, up 8% from 2022. In 2024, it was expected to overtake coal power, which currently makes up 39% of the total. Through the 14th Five-Year Plan, the Chinese government has invested in research and development of energy storage technology as well as infrastructure. With China's vertically integrated supply chain offering the largest global production of lithium-ion batteries, China's homegrown vertically integrated supply chain ensures cost competitiveness and raw material access. Government emphasis on bulk energy storage to offset the variability of renewable energy supplies and peak load shaving is driving high-growth additions.

China Total Operating Solar Capacity Per Province, in 2023

|

Distributed solar |

Capacity (MW) |

Utility-scale solar |

Capacity (MW) |

|

Shandong |

40,988 |

Xinjiang |

38,020 |

|

Henan |

30,940 |

Qinghai |

27,708 |

|

Jiangsu |

29,469 |

Shanxi |

25,189 |

|

Zhejiang |

26,896 |

Inner Mongolia |

23,485 |

|

Hebei |

23,926 |

Ningxia |

21,302 |

Source: Global Energy Monitor

India is expected to capture approximately 15% of the Asia Pacific AESS market share by 2035, based on a particular renewable addition and energy storage requirements. The Central Electricity Authority's (CEA) National Electricity Plan (NEP) 2023 projects that in 2026-2027, the energy storage capacity required will be 82.37 GWh (47.65 GWh from PSP and 34.72 GWh from BESS). This demand is also anticipated to rise to 411.4 GWh in 2031-2032, with 175.18 GWh coming from PSP and 236.22 GWh from BESS. Due to the inclusion of more renewable energy in light of the net-zero emissions targets established for 2070, CEA has also predicted that by 2047, the need for energy storage will rise to 2380 GWh (540 GWh from PSP and 1840 GWh from BESS). Demand is also driven by growing rural electrification initiatives and industry-wide electrification campaigns.

North America Market Insights

North America advanced energy storage systems market is expected to have approximately 28% market share by 2035, driven by robust policy mandates and capital investment inflows in energy storage initiatives. Grid modernization, needs for renewable integration, and electrification of commercial and industrial sectors are the key drivers. The region's potential is expected to rise, driven by state-level renewable portfolio standards and federal incentives that improve project economics and reduce adoption cycles for utility and commercial markets.

The US is expected to lead in this area, controlling more than 75% of the North America market by 2035. Installation at the utility-scale is expected to increase at a CAGR of 20.3% during 2026-2035, driven by installations in California and Texas. FERC Order 2222 facilitates distributed energy resource integration, opening up commercial potential for demand response and grid services.

U.S. Utility-scale Electricity Generation by Source, Amount, and Share of Total in 2023

|

Energy source |

Billion kWh |

Share of total |

|

Total - all sources |

4,178 |

|

|

Fossil fuels (total) |

2,505 |

60.0% |

|

Natural gas |

1,802 |

43.1% |

|

Coal |

675 |

16.2% |

|

Petroleum (total) |

16 |

0.4% |

|

Petroleum liquids |

12 |

0.3% |

|

Petroleum coke |

5 |

0.1% |

|

Other gases3 |

11 |

0.3% |

|

Nuclear |

775 |

18.6% |

|

Renewables (total) |

894 |

21.4% |

|

Wind |

425 |

10.2% |

|

Hydropower |

240 |

5.7% |

|

Solar (total) |

165 |

3.9% |

|

Photovoltaic |

162 |

3.9% |

|

Solar thermal |

3 |

0.1% |

|

Biomass (total) |

47 |

1.1% |

|

Wood |

31 |

0.8% |

|

Landfill gas |

8 |

0.2% |

|

Municipal solid waste (biogenic) |

6 |

0.1% |

|

Other biomass waste |

2 |

0.1% |

|

Geothermal |

16 |

0.4% |

|

Pumped storage hydropower |

-6 |

-0.1% |

|

Other sources |

10 |

0.2% |

Source: U.S. Energy Information Administration

Canada is expected to likely maintain around 25% of the North American AESS market share by 2035, underpinned by provincial spending every year. Canada's hydroelectric foundation provides a second renewable footprint with energy storage systems performing grid balancing and peak load management. Ontario, Quebec, and Alberta lead deployment with a doubling of battery storage capacity by 2030 forecasted. Canadian policy stimulus for low-carbon industrial processes and grid resiliency, and cross-border U.S. energy trade, underpins sustained market development.

Europe Market Insights

Climate policies and renewables policies are expected to constitute about 22% market share in Europe by 2035. In the EU's electrical system, where the proportion of renewable energy is predicted to reach roughly 69% by 2030 and 80% by 2050, system flexibility is especially necessary. In all EU nations, the need for flexibility in the electrical system will grow significantly, rising from 11% in 2021 to 24% (288 TWh) of the total power consumption in 2030 and 30% (2,189 TWh) by 2050. Storage has incentives within the framework of the European Green Deal and the Fit for 55 legislative packages to accept renewable variability and carbon emission reduction across different member states.

Key Advanced Energy Storage Systems Market Players:

- Tesla, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- LG Energy Solution

- Samsung SDI

- Panasonic Corporation

- Fluence Energy, Inc.

- Siemens Energy AG

- ABB Ltd

- Johnson Controls International

- Saft Groupe S.A.

- Redflow Limited

- Exide Industries Limited

- VARTA AG

- Amita Technologies

- NEC Energy Solutions

- Hitachi Chemical Company, Ltd.

The Advanced Energy Storage Systems market is highly competitive, driven by a blend of technological innovation, manufacturing scale, and strategic alliances. U.S. companies like Tesla and Fluence leverage cutting-edge battery technology and expansive project portfolios to secure market leadership. South Korean giants LG Energy Solution and Samsung SDI dominate with robust supply chains and innovation in lithium-ion chemistries. European players such as Siemens and ABB excel in grid-scale integration and renewables support. Japanese firms Panasonic, NEC Energy Solutions, and Hitachi Chemical focus on improving energy density, battery management, and sustainability through R&D. Indian and Malaysian companies target cost efficiency and regional penetration. Across the board, strategic investments in raw material security, recycling, and expansion of production capacities underpin market growth and resilience.

Top Global Manufacturers List for the Advanced Energy Storage Systems Market

Recent Developments

- In January 2023, Tesla, Inc. announced a USD 3.6 billion investment to expand its Nevada Gigafactory dedicated to advanced energy storage systems. Supported by funding from the U.S. Department of Energy’s Grid Modernization Initiative, the expansion aims to increase battery module production capacity by 40% by 2027. This move addresses the surging global demand for grid-scale energy storage solutions to support renewable energy integration and electric vehicle infrastructure, especially across North America and Europe.

- In December 2020, Siemens Energy unveiled a partnership with the European Investment Bank to deploy a €350 million fund focused on developing next-generation advanced energy storage systems across the EU. The initiative targets large-scale deployment in Germany, France, and Spain, aiming to double energy storage capacity by 2030. The fund supports the EU’s Green Deal objectives to enhance grid reliability and accelerate decarbonization efforts.

- Report ID: 8120

- Published Date: Sep 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.